EGS Biweekly Global Business Newsletter Issue 100, Tuesday, January 23, 2023

Edited and curated by: William (Bill) Edwards, CFE, CEO of Edwards Global Services, Inc. (EGS)

Introduction: Welcome to the 100th edition of my biweekly global business update newsletter. It started on March 30th, 2020, as a report to companies we were helping take their brands into new countries. International travel had stopped due to COVID. But the companies wanted to know what was going on in countries where they already had operations and/or were in negotiations with potential partners in a country.

My team and I added to the information sources we were already monitoring to eventually daily monitor 40 publications. And we expanded our communication with the more than 20 Country Associates who helped us find partners for our clients. 100 biweekly editions later more than 1,400 people in more than 20 countries read this diverse report that watches countries, business sectors and trends that impact global business.

This issue continues to look at trends and events that impact the ability of companies to expand their business into new countries successfully. Thanks to our readers for your time to read this newsletter and for your input.

To receive this currently free biweekly newsletter every other Tuesday in your email, click here: https://bit.ly/geowizardsignup

The mission of this newsletter is to use trusted global and regional information sources to update our global readers on key global and local trends that can impact the success of their businesses at home and abroad.

NOTE: We subscribe to about 40 international information sources to keep our readers up to date on the world’s business. Some of the information sources that we provide links to require a paid subscription for our readers to access.

First, A Few Words of Wisdom From Others For These Times

“There is no such thing as a normal period of history. Normality is a fiction of economic textbooks.”, Joan Robinson

“Opportunities multiply as they are seized.”, Sun Tzu

“Don’t judge each day by the harvest you reap, but by the seeds you plant.”, Robert Louis Stevenson

Highlights in issue #100:

- Brand Global News Section: Burger King®, Jimmy Johns®, and Papa Johns®

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Interesting Data, Articles and Studies

Research across many sources yielded the topics above on what will impact doing business around the world in 2024. Perhaps the most important is the fact that 64 countries will see elections this year covering 49% of the world’s population and 50% of the world’s Gross Domestic Product (GDP). Elections have consequences. Elections often mean changes in economic policies which impact a company’s ability to do business in a country. From a presentation by William (Bill) Edwards to the 4th Annual Growth & Scale Summit – AI Transformation on January 18, 2024, at the University of California, Irvine’s Beall Applied Innovation Center put on by the Executive Next Practices Institute. (https://enpinstitute.com)

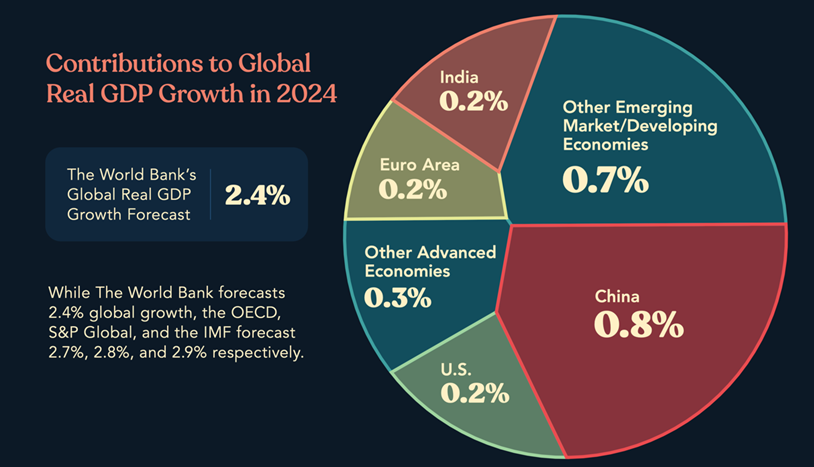

“Global Economic Prospects – Global growth is set to slow further this year, amid the lagged and ongoing effects of tight monetary policy, restrictive financial conditions, and feeble global trade and investment. Downside risks to the outlook include an escalation of the recent conflict in the Middle East and associated commodity market disruptions, financial stress amid elevated debt and high borrowing costs, persistent inflation, weaker-than-expected activity in China, trade fragmentation, and climate-related disasters.”, The World Bank and Visual Capitalist, January 2024

“Davos 2024: Global elite gather against WEF’s most complex backdrop so far – A challenging global economic picture, with shifting interest rate policies and rising debt, will also confront the central bankers, financiers and business leaders attending. Geopolitical risks have mounted around the globe in recent years, with Russia’s war in Ukraine and Israel’s war with Hamas militants, and the recent related impact on shipping in the Red Sea. China, meanwhile, has been increasing military pressure to assert sovereignty claims over Taiwan.”, Reuters, January 11, 2024

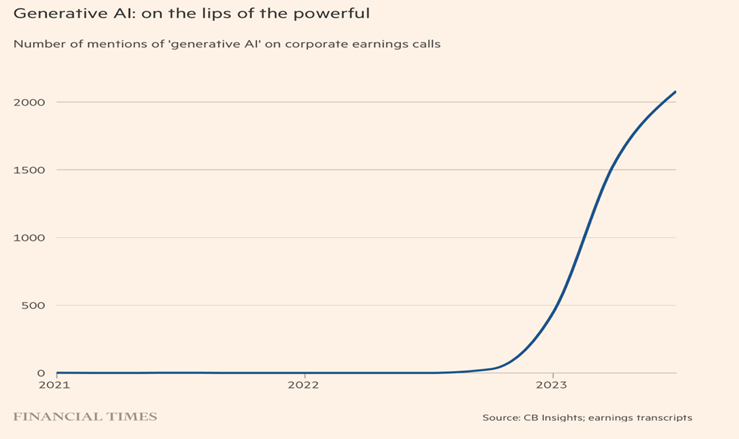

“Amazon CEO Andy Jassy says AI is both the biggest risk and biggest opportunity facing companies in 2024 – Companies around the world are all facing an interesting dilemma in 2024, according to Amazon CEO Andy Jassy: their biggest problems and solutions might be one and the same. ‘The opportunity and risk is pretty similar in that there is this wildly transformative, disruptive technology in generative AI that you can’t get through any conversation without talking about,’ Jassy says. At a dinner in Davos, Switzerland, on Thursday, Jassy told Fortune CEO Alan Murray that prior to the pandemic, companies were largely moving to modernize their preexisting technology to innovate and lower costs.”, Fortune, January 18, 2024

“Confidence improves as CEOs wait for takeoff – The Q4 Vistage CEO Confidence Index rose 6 points to reach 82.0 — the fifth time in six quarters — and while optimism is improving, the historical lows of economic confidence show that takeoff is still delayed. Despite healthy GDP in 2023, CEOs’ concerns regarding the current and future economy stay within ranges not seen since the waning days of the Great Recession in 2008. Compared to Q4 2022, both expectations for the next 12 months and a review of last year are well above the lows hit in Q2 2022, yet still well below the norm established during the rising economic tide of the 2010s.”, Vistage, January 2024

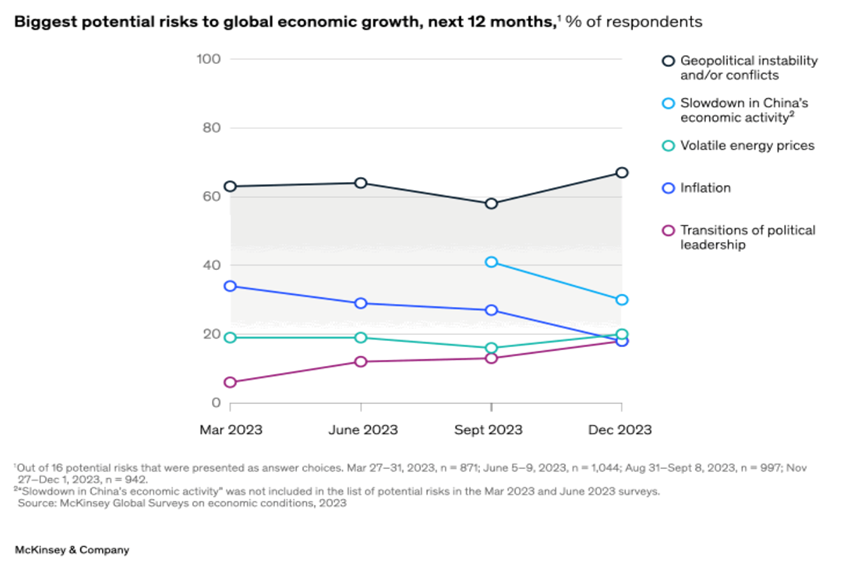

“Geopolitical conflicts loom large – Geopolitical instability has risen as a potential threat to global growth for 2024, cited by 67 percent of executives in a recent McKinsey Global Survey. Concerns about transitions of political leadership also rose, senior partner Sven Smit and colleagues find. Fears about inflation, meanwhile, have continued to recede, dropping from more than 30 percent in March 2023 to less than 20 percent at the end of the year.”, McKinsey & Co., January 16, 2024

“Life in a New Normal: Navigating our way into an uncertain future – Ever since the pandemic began, pundits have been trying to predict the glide path for returning to normal, with “normal” implicitly defined by the way things were in the before times. The problem is the way of life we knew—socially, culturally, economically—has irrevocably changed. It’s impossible to go through a major collective event, such as the pandemic, without having alterations to the way we view…For investors and business owners, this has made the intervening years exceedingly treacherous to navigate. The rules seemed to have changed overnight about how consumers purchase, how (and where) employees want to work, and how suppliers want to do business. Millions of decisions, large and small, had to be renegotiated not just once, but many times.”, Franchising.com, December 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global Supply Chain, Energy, Commodities, Inflation & Trade Issues

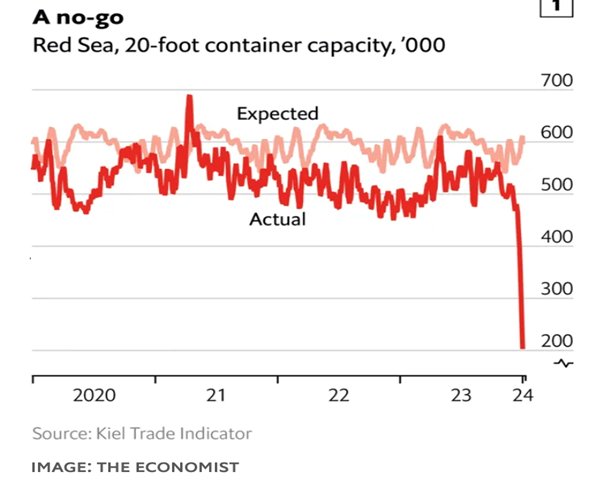

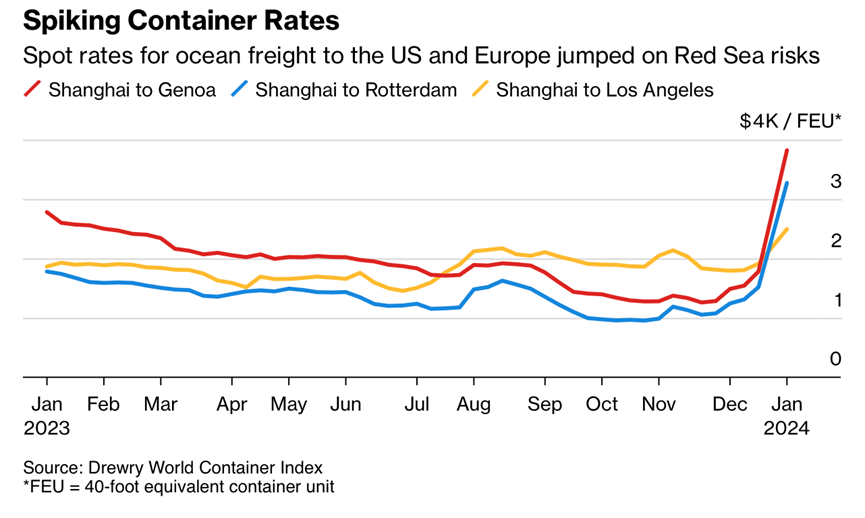

“Tracking ships in the Red Sea – More than 200 container ships travelled through the Red Sea and the Suez Canal between January 4th and 11th last year. During the same week in 2024 only 122 dared to make the journey. Container firms accounting for 95% of the capacity that usually sail the Suez have suspended services in the area. A few energy firms, such as BP and Equinor, have also temporarily stopped using the canal. By January only 200,000 standard containers were passing through the waterway per day, compared with around 450,000 in December 2022—the lowest point of the pandemic. Instead of sailing through the Red Sea, ships travelling between Asia and Europe are now being re-routed around Africa and the Cape of Good Hope.”, The Economist, January 18, 2024

“Ocean Premiums Rocket – The Red Sea Crisis and its Ripple Effects on Global Shipping. The Red Sea crisis is unleashing unprecedented challenges on the global shipping industry, notably marked by a staggering surge in ocean freight rates. Major shipping companies are diverting vessels due to the looming threat of Houthi attacks, leading to an abrupt spike in rates. Logistics managers are quoting rates as high as $10,000 per 40-foot container, a stark contrast to last week’s rates of $1,900 to $2,400. The rerouting of 158 vessels, carrying over $105 billion worth of cargo, intensifies strains on the supply chain.”, Alba Wheels Up, January 18, 2024

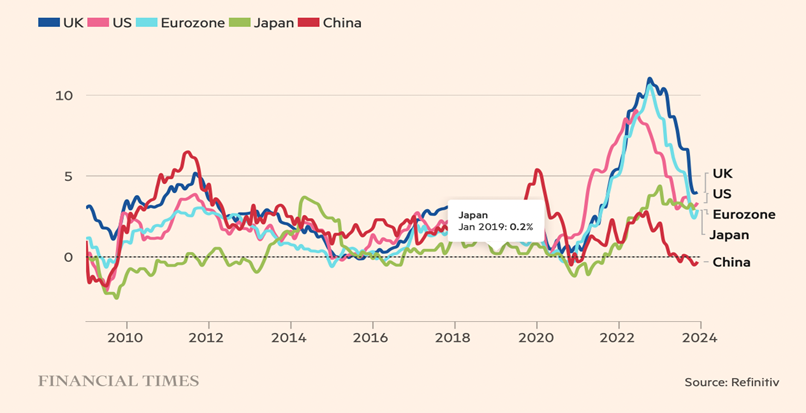

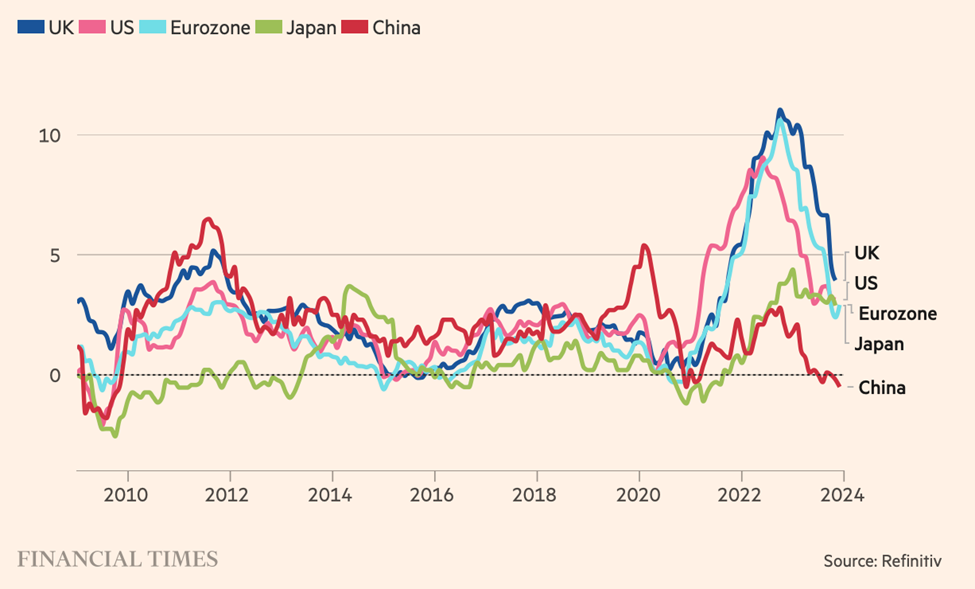

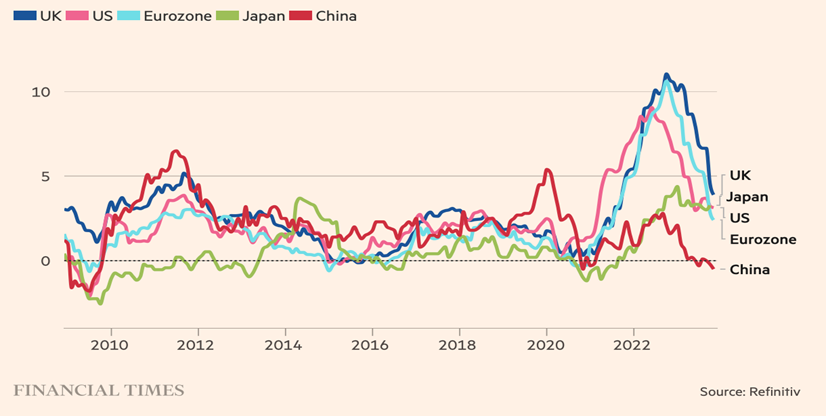

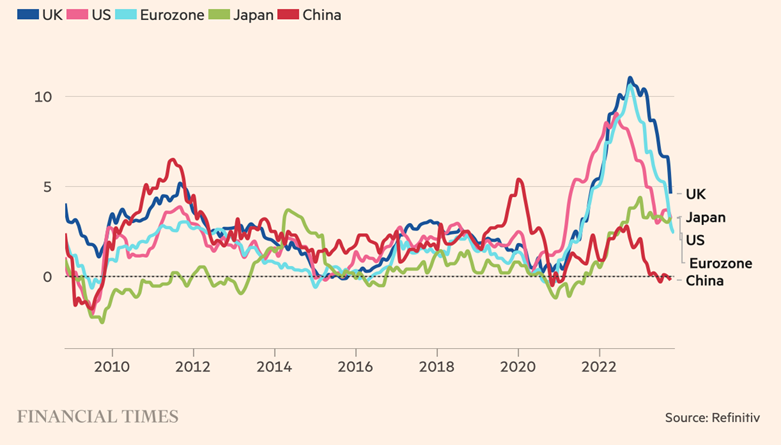

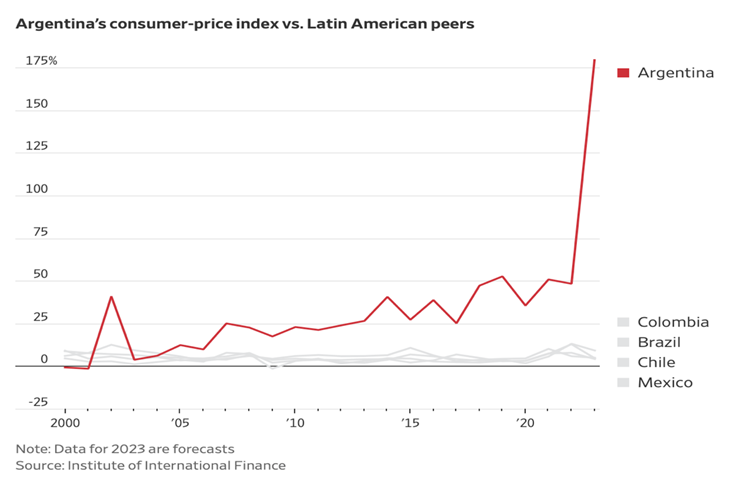

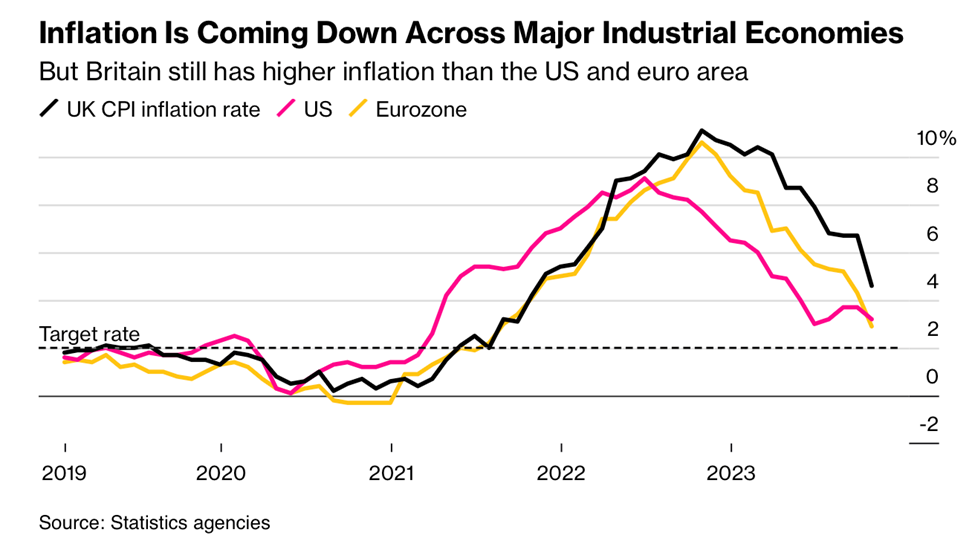

Annual % change in consumer price index

“Global Inflation Tracker – Inflation is easing from the multi-decade highs reached in many countries following Russia’s full-scale invasion of Ukraine. The latest figures for most of the world’s largest economies show the wholesale food and energy prices that soared during 2022 are now falling back.”, The Financial Times, January 16, 2024

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Country & Regional Updates

Australia

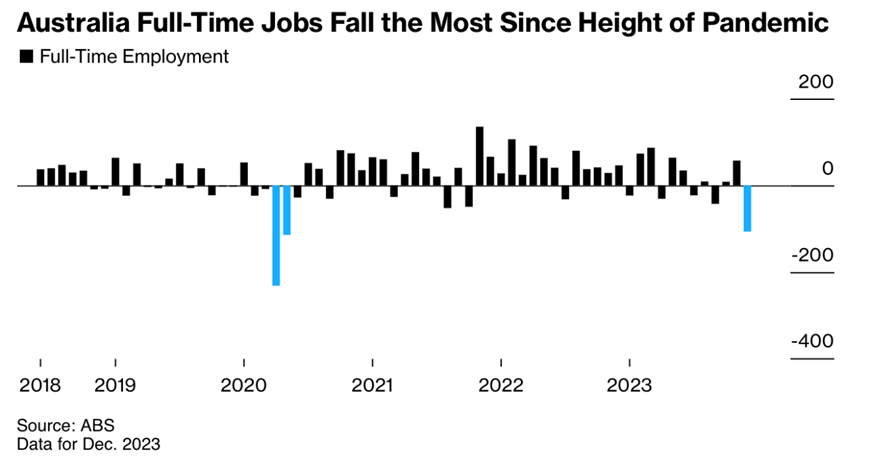

“Jobs Slump: Australia Briefing – Employment tumbled in December, boosting the odds of the Reserve Bank of Australia pivoting to monetary easing. The economy shed 65,100 roles, an unexpected outcome led by the biggest monthly drop in full-time employment since the height of pandemic, government data showed.”, Bloomberg, January 19, 2024

Canada

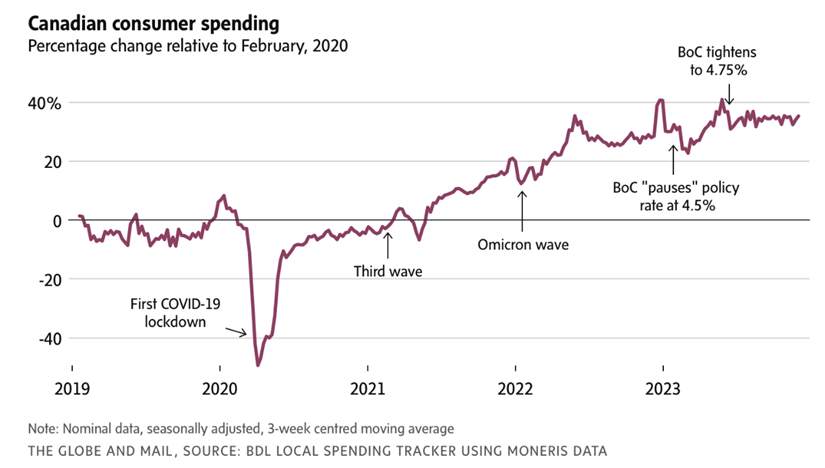

“Experts predict what’s to come for housing, jobs, wages, interest rates and more – Economists, academics, investors and business leaders pick a chart that highlights an issue that will be important to watch in 2024. After a year of surprising resilience in the face of high interest rates, Canada’s economy enters 2024 in an uneasy state. The Globe and Mail reached out to dozens of experts, including economists, academics, investors and business leaders, and asked them to each pick a chart that highlights an issue that will be important to watch in 2024 and explain why….”, The Globe and Mail, January 14, 2024

China

“China orders indebted local governments to halt some infrastructure projects-sources – China has instructed heavily indebted local governments to delay or halt some state-funded infrastructure projects, three people with knowledge of the situation said, as Beijing struggles to contain debt risks even as it tries to stimulate the economy. Increasing its efforts to manage $13 trillion in municipal debt, the State Council in recent weeks issued a directive to local governments and state banks to delay or halt construction on projects with less than half the planned investment completed in 12 regions across the country, the sources said.”, Reuters, January 19, 2024

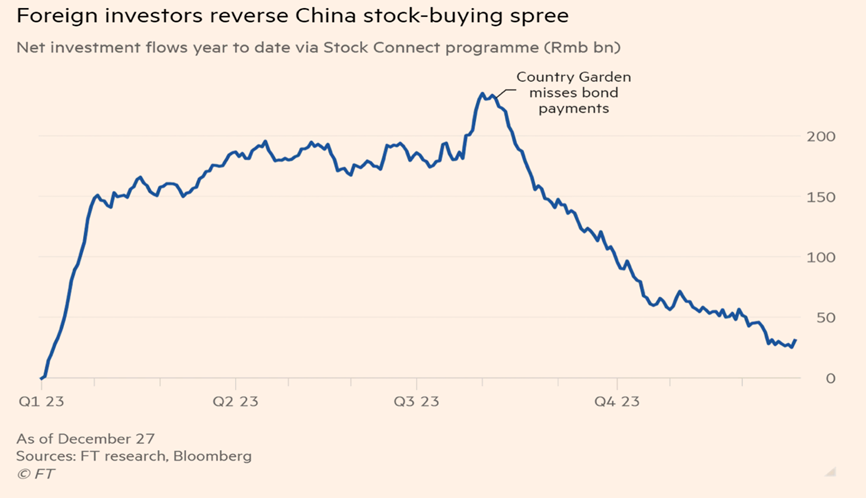

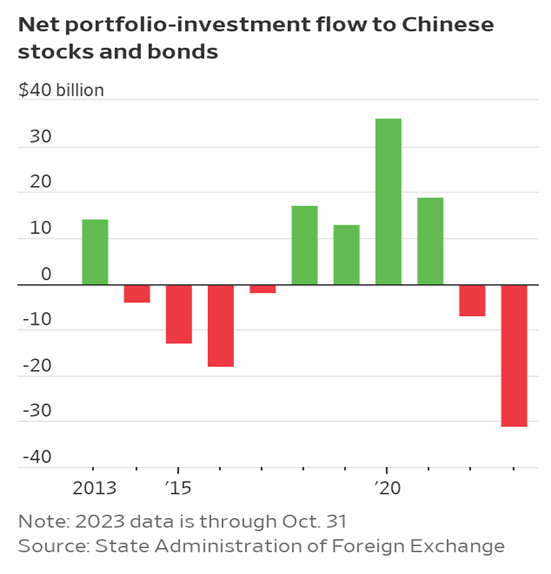

“Chinese stock rout accelerates as foreign investors sell out – Fall in Hong Kong and Chinese indices defies many Wall Street banks’ hopes of rebound after last year’s losses. International investors “just threw in the towel” after a speech by Premier Li Qiang at Davos on Tuesday lacked any hint of new government measures to boost the economy or financial markets, said the head of trading at one investment bank in Hong Kong. Foreign investors, who by the end of 2023 had sold about 90 per cent of the $33bn of Chinese stocks they had purchased earlier in the year, have continued selling this year. Year-to-date outflows more than doubled on Wednesday after Beijing confirmed China’s annual growth was the slowest in decades and revealed the country’s population decline had accelerated in 2023.”, The Financial Times, January 18, 2024

European Union & Eurozone

“Too early to say inflation is defeated, warns ECB – Many traders think the ECB will start loosening its policy in March and will deliver rate reductions of 125 to 150 basis points over the next 12 months. The deposit rate stands at 4 per cent, the highest point since the central bank was created in 1998. Rapidly declining inflation and poor economic growth have fuelled expectations for interest rate cuts. Carsten Brzeski, global head of macro at ING, the Dutch bank, said: “The European Central Bank (ECB) is more cautious about the growth outlook, but far from relaxed about inflation.”, The Times of London, January 15, 2024

“EV Sales Run Out of Juice in Europe as Germans Tighten Belts – Steep drop in electric sales in Germany was main factor in sending EU sales down for the first time in 16 months. Germany’s new-car market went into a free fall in December, led by a near halving of new electric-vehicle sales, pulling the sale of new EVs in the broader European Union down for the first time since early 2020. Automotive executives in Germany have been warning about an approaching cliff in EV sales for months, blaming the impending gloom on a combination of high manufacturing costs at home and a government decision to end incentives for consumers.”, The Wall Street Journal, January 18, 2024

India

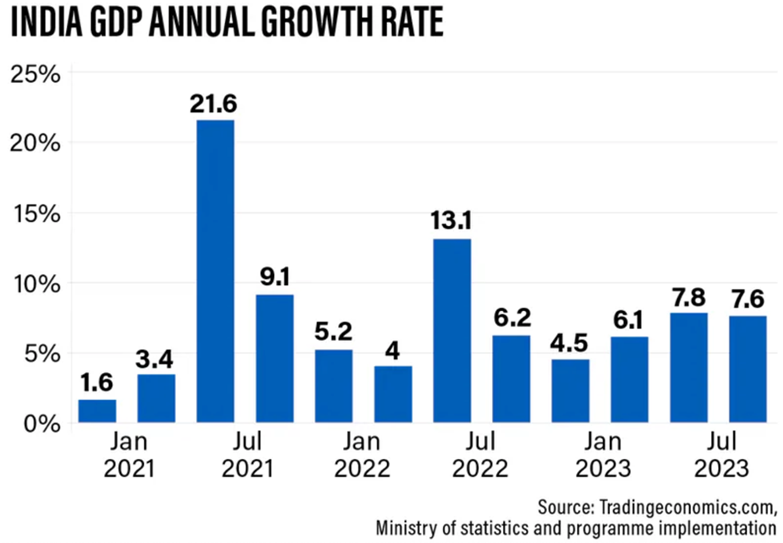

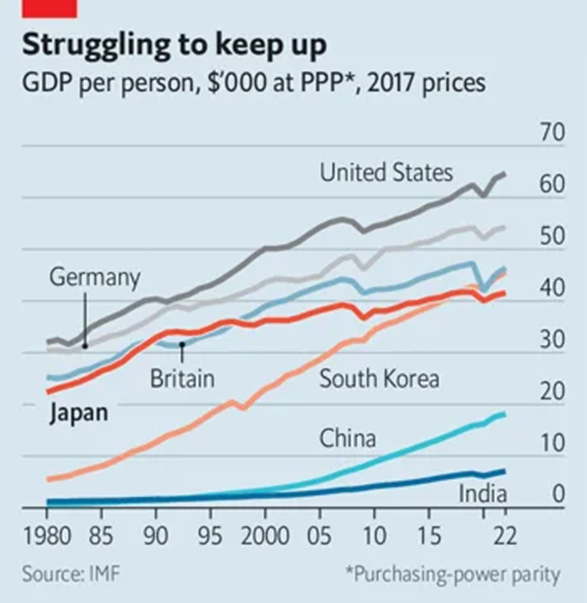

“Why India Isn’t the New China – The country’s population surpassed China’s last year. But India’s path forward is likely to look very different from its neighbor’s. There are plenty of reasons for optimism. The country’s population surpassed China’s last year. More than half of Indians are under 25. And at current growth rates, it could become the world’s third-largest economy in less than a decade, having recently overtaken the U.K., its old colonial ruler, for the no. 5 spot. While its labor resources are, in theory, plentiful, a host of barriers still make it difficult to connect workers with employers. Only a third of India’s female working-age population was in the labor force in fiscal year 2022. India’s love-hate relationship with trade is another problem”, Wall Street Journal, January 17, 2024

“India takes investment spotlight while risks weigh in China – Suntory CEO – Japanese drinks maker Suntory is prioritising expansion in India while taking a cautious stance on business in China, especially given concerns over spy laws recently used to detain foreign workers, Chief Executive Takeshi Niinami said in an interview. Suntory is looking for local partners in India to expand its drinks and nutrition businesses, he said, although in China, which he acknowledged is still an attractive market, he cannot justify sending in international staff for an investment push in the current environment.”, The Daily Mail, January 19, 2024

Middle East

“The Middle East faces economic chaos – Escalating conflict threatens to tip several countries over the brink. Just over 100 days after Hamas’s brutal attack on Israel started a war in Gaza, the conflict is still escalating. On January 11th America and Britain started attacking Houthi strongholds in Yemen, after months of Houthi missile strikes on ships in the Red Sea. Five days later Israel fired its biggest targeted barrage yet into Lebanon. Its target is Hizbullah, a militant group backed by Iran. A full-blown regional war has so far been avoided, largely because neither Iran nor America wants one. Yet the conflict’s economic consequences are already vast.”, The Economist, January 18, 2024

Singapore

“Singapore seeks expanded governance framework for generative AI – Looking to balance user security with innovation, Singapore wants feedback on proposed updated to the country’s existing artificial intelligence governance framework. Singapore has released a draft governance framework on generative artificial intelligence (GenAI) that it says is necessary to address emerging issues, including incident reporting and content provenance. The proposed model builds on the country’s existing AI governance framework, which was first released in 2019 and last updated in 2020.”, ZD Net, January 14, 2024

United Kingdom

“British retail sales fell more than expected in run-up to Christmas – Figures raise risk that UK fell into technical recession at the end of 2023. The decline was much steeper than the 0.5 per cent fall forecast by economists polled by Reuters, and was the largest monthly fall since January 2021, when coronavirus restrictions hit sales. The fall was driven in part by people doing their Christmas shopping early, particularly during the Black Friday sale period in November, the ONS said. Economists also blamed high prices and borrowing costs for damping consumer confidence and spending power.”, The Economist, January 19, 2024

United States

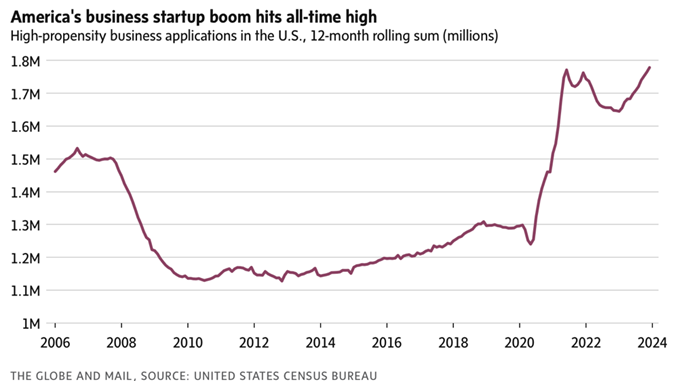

“America’s economy is creating new businesses at a feverish pace – If the Great Recession put U.S. entrepreneurship into a deep freeze, the COVID-19 pandemic lit a fire under American self-starters, and the boom in business creation that began in 2020 has kicked into overdrive. December marked the fastest 12-month stretch of startup activity on record, based on the number of what the U.S. Census Bureau calls “high-propensity business applications.” It’s the latest sign that America’s economic engine continues to defy expectations of a slowdown.”, The Globe and Mail, January 18, 2024

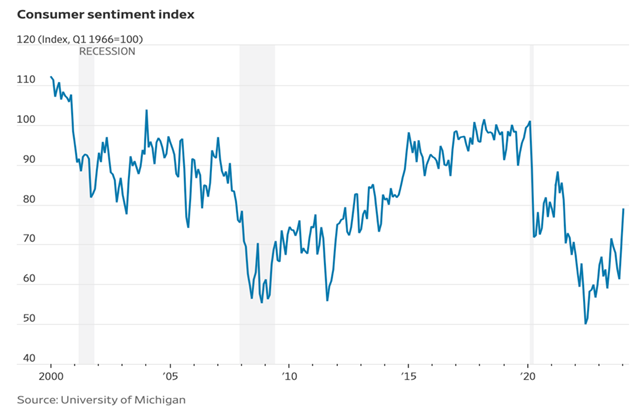

“Americans Are Suddenly a Lot More Upbeat About the Economy – Consumer sentiment gauge posted the largest two-month gain since 1991. Consumer sentiment surged 29% since November, the biggest two-month increase since 1991, the University of Michigan said Friday, adding to gauges showing improving moods. The pickup in sentiment was broad-based, spanning consumers of different age, income, education and geography.”, The Wall Street Journal, January 19, 2024

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Brand & Franchising News

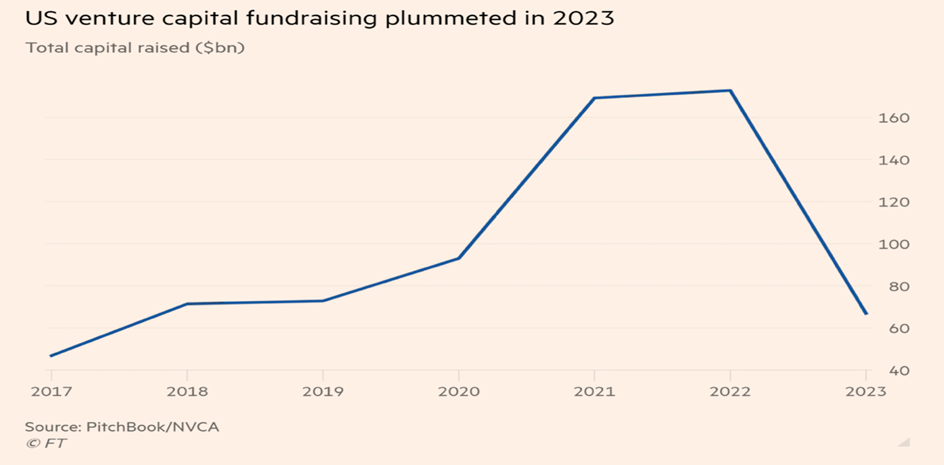

“Commanding a Premium Franchise Sale in a Cautious 2024 Private Equity Investment Climate – Perfect market timing is difficult to pull off, but excellent preparation and building a valuable business in the first place is much more under your control. The valuation of private equity exits in 2023 has seen a significant drop compared to the boom in 2021. This shift requires franchise owners to recalibrate their strategies when considering a sale. To attract premium offers, businesses need to stand out with unique value propositions and robust operational efficiencies.”, Entrepreneur magazine, January 19, 2024

“Inspire Brands to Take Jimmy John’s Global – The sandwich fast casual signed deals to grow in Canada and Latin America. Jimmy John’s is now set to grow in Canada and Latin America. The former will expand through a partnership with Foodtastic, a franchisor that oversees north of 1,100 locations through a collection of brands, including Pita Pit and Freshii, and $1.1 billion in sales. The Latin America deal comes via Franquicias Internacionales, a group based in El Salvador whose portfolio expands from F&B to digital media and logistics.”, QSR Magazine, January 2024

“Burger King parent company to buy out largest franchisee to modernize stores – Restaurant Brands International Inc. announced Tuesday that it would purchase the issued and outstanding shares of Burger King franchisee Carrols Restaurant Group Inc. for $9.55 per share at a value of approximately $1 billion. Carrols is the largest Burger King franchisee in the country, operating 1,022 Burger King restaurants in 23 states and 60 Popeyes locations. Restaurant Brands said that it will invest $500 million to renovate approximately 600 restaurants that were acquired in the transaction.”, People Magazine, January 18, 2024

“Giant pizza chain Papa John’s to shut up to 100 locations – The family favourite global pizza chain said it will “strategically close low-performing locations” in a bid to boost profits. A family favourite pizza chain is to shut scores of locations across the UK this year in a fresh wave of closures as restaurants battle high costs and fewer visitors. Dozens of Papa John’s branches will close for good, according to The Sun. It comes after the chain, which operates 524 locations in the UK, told investors it anticipates “additional strategic restaurant closures of low-performing restaurants” in a bid to boost profits.”, News.com.au, January 9, 2024

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

To receive this biweekly newsletter, click here : https://bit.ly/geowizardsignup

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, the franchise sector, economic development, and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing environment. Our GlobalTeam™ on the ground covering 25+ countries provides us with updates about what is actually happening in their specific countries.

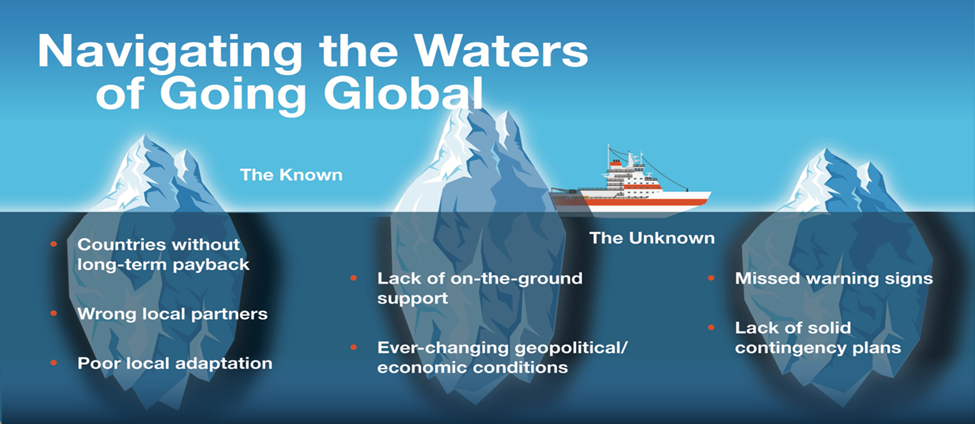

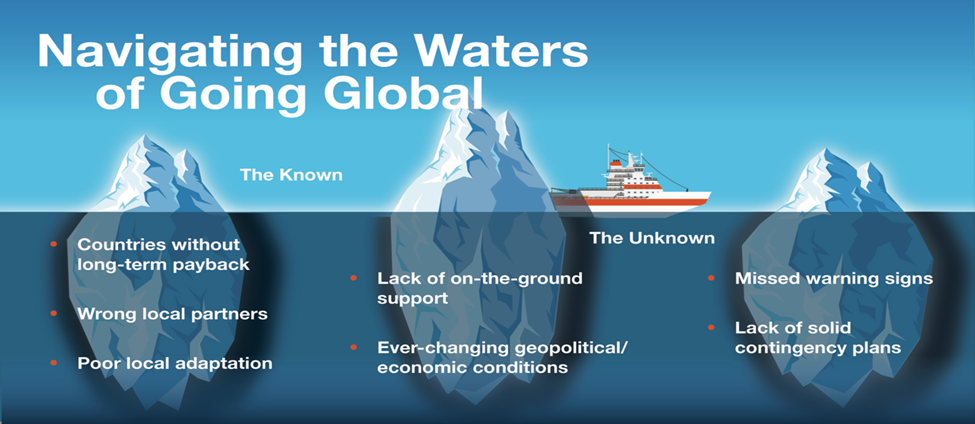

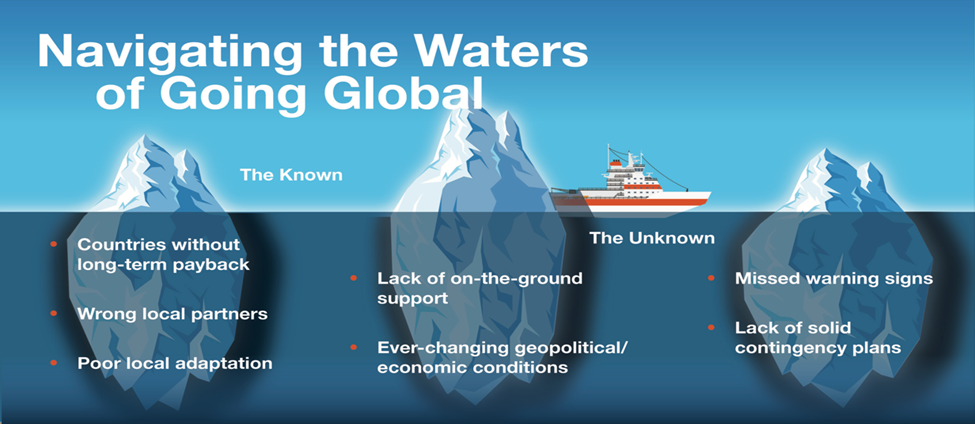

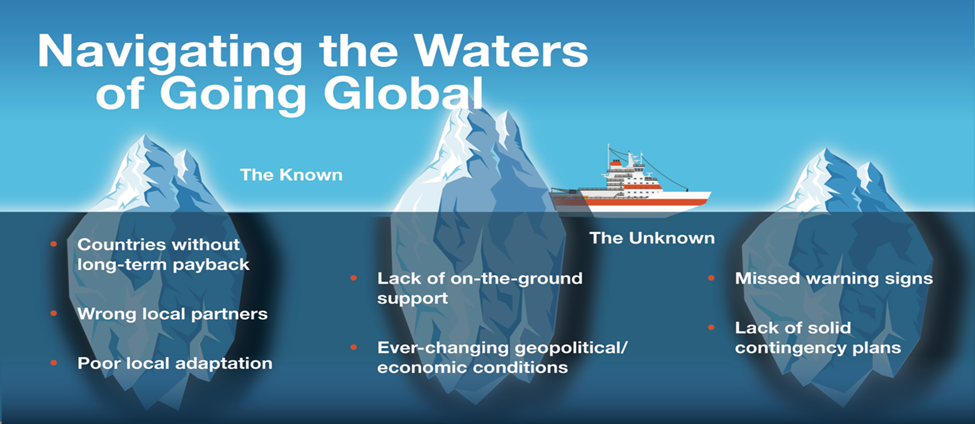

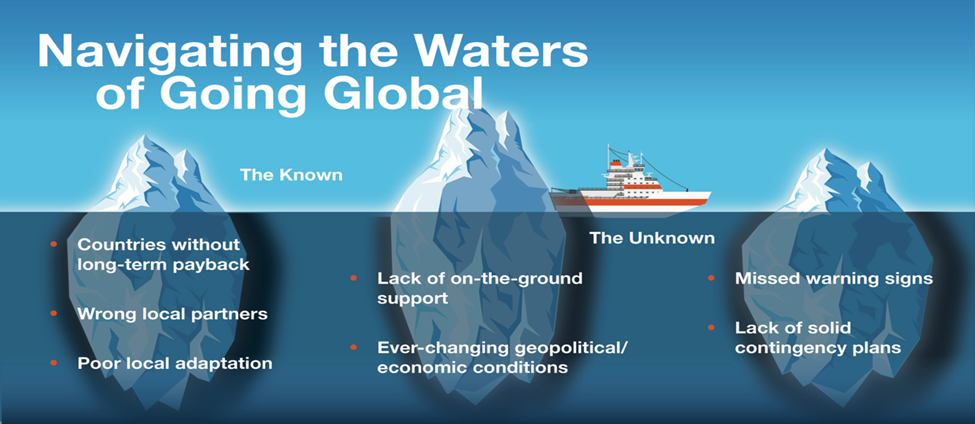

William “Bill” Edwards: Global Advisor Is Uniquely Qualified to Steer Sr. Executives Successfully Through the Complex Waters of Going Global. With four decades of successful international business experience spanning virtually every corner of the world and many business sectors, Bill Edwards understands the global business landscape like no other. He has been a County Master Franchisee in five countries in Asia, Europe and the Middle East; the Senior VP for a franchisor operating in 15 countries and a full-service consultant since 2001 taking 40 franchisors global.

For a complimentary 30-minute consultation on how to take your business global successfully, contact Bill Edwards at bedwards@edwardsglobal.com or +1 949 224 3896.

And download our latest chart ranking 40+ countries as places to do business at this link:Our latest GlobalVue™ 40 country ranking

EGS Biweekly Global Business Newsletter Issue 99, Tuesday, January 9, 2023

Edited and curated by: William (Bill) Edwards, CFE, CEO of Edwards Global Services, Inc. (EGS)

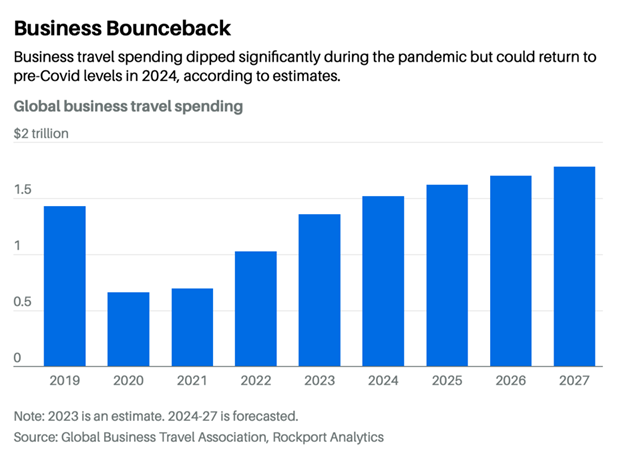

Introduction: In this issue, we look back at 2023 and forward with lots of different projections for 2024. Global shipping disrupted. Global markets had their best year since before the pandemic. Where will the Chinese economy go in 2024. U.S. oil and gas exports fuel the world’s demand. India continues to grow at a high level. The U.S. dollar finished 2023 down. The U.S. economy leads other developed countries in 2023.

The mission of this newsletter is to use trusted global and regional information sources to update our 1,400+ readers in 20+ countries on key global and local trends that can impact the success of their businesses at home and abroad.

NOTE: Some of the sources that we provide links to require a paid subscription to access. We subscribe to 40 international information sources to keep our readers up to date on the world’s business.

To receive this biweekly newsletter that is read by over 1,400 people in 20 countries, click here: https://bit.ly/geowizardsignup

First, A Few Words of Wisdom From Others For These Times

“Every time you tear a leaf off a calendar, you present a new place for new ideas.”, Charles Kettering

“The new year stands before us, like a chapter in a book, waiting to be written.”, Melody Beattie

““Be at war with your vices, at peace with your neighbors, and let every new year find you a better man.”, Benjamin Franklin

Highlights in issue #99:

- Brand Global News Section: Chick Fil A®, Dominos® and McDonalds®

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Interesting Data, Articles and Studies

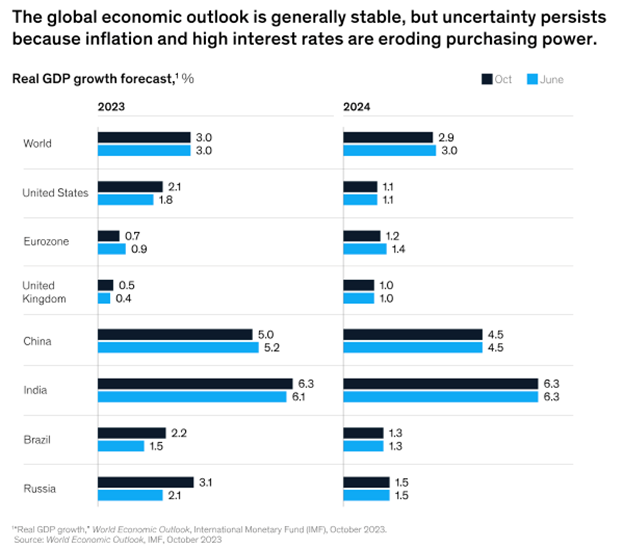

“These Are the Five Potential Trouble Spots That Could Knock the Global Economy Off Course. US unemployment claims in the US, business confidence in Germany, bond yields in Japan. What investors and executives need to be watching in 2024. The global economy was tested in 2023 as it rarely has been before: inflation and the most aggressive monetary tightening campaign in decades, wars in Europe and the Middle East, a festering real estate crisis in China and the deepening rivalry between Washington and Beijing, which is forcing companies to rethink supply chains and security. The International Monetary Fund forecasts global growth of 2.9% in 2024, a whisker below last year. With two wars raging and some 40 national elections on the calendar, political developments will shape the year, especially as Donald Trump makes a go at winning back the presidency. But crucial economic stress points could upend the benign outlook.”, Bloomberg, January 3, 2024

“Six things to watch in 2024 global economy, from tax cuts to AI – The Israel-Hamas war could broaden, and many developing countries are on a path to crisis. Six things to watch in 2024 global economy, from tax cuts to AI. The Israel-Hamas war could broaden, and many developing countries are on a path to crisis. Central banks start to cut interest rates. A developing-country debt crisis. Pre-election tax cuts. A deepening US-China cold war. The unstoppable rise of generative AI. Rising oil prices.”, The Guardian, January 2, 2024

“Ten business trends for 2024, and forecasts for 15 industries – Geopolitics will again loom large in 2024, as us-China tensions mount and the wars in Ukraine and Gaza rumble on. Inflation will fall and interest rates level off; supply-chain kinks will ease, along with commodity prices. But global gdp will grow by only 2.2% amid lacklustre expansions in rich countries. Developing economies will do better, though China will lose corporate investment to competitors. Companies will face new environmental rules and perhaps a global minimum tax rate.”, The Economist, November 13, 2024

“Global stock markets record best year since 2019 – S&P 500 ends 2023 just shy of record as investors bet interest rates have peaked. The MSCI World index, a broad gauge of global developed market equities, has surged by 16 per cent since late October and is up 22 per cent this year — its best performance for four years. That has largely been fuelled by Wall Street’s benchmark S&P 500 index, which has risen 14 per cent since October and 24 per cent on the year, ending the last trading day of 2023 just shy of its all-time record. The gains have been driven by a dramatic shift in interest rate expectations following a slew of recent data showing inflation falling faster than expected in western economies.”, The Financial Times, December 30, 2024

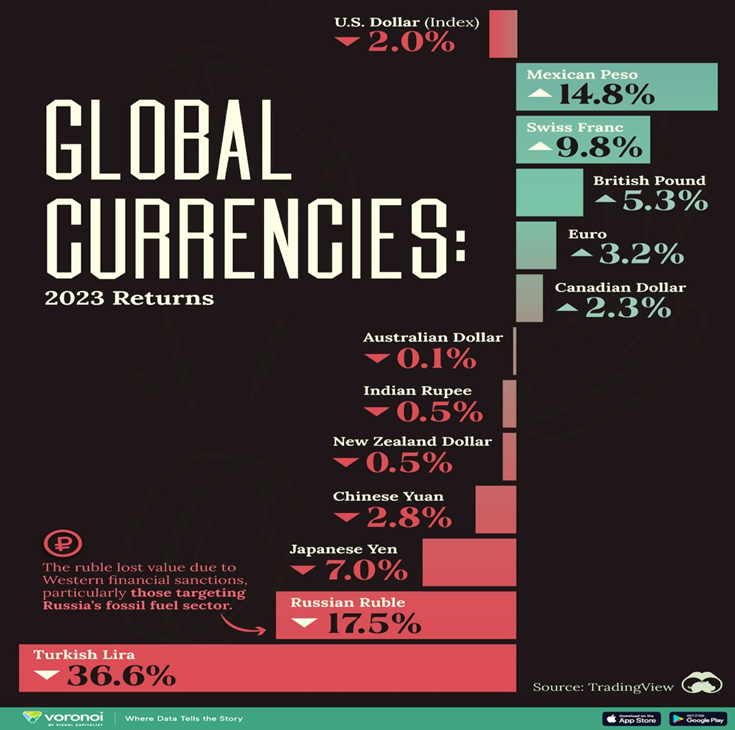

“How Major Currencies Performed in 2023 – The U.S. Dollar Index peaked in fall 2022, the highest it had been in nearly two decades, rising in response to aggressive interest rate hikes. The index measures the value of the U.S. dollar against a basket of major currencies from six countries. A gain indicates the dollar is appreciating against the basket and vice-versa. The euro is the biggest component on the index and thus sways the index value and return.”, Visual Capitalist, January 4, 2024

“The top tech trends to watch in 2024 – CES, the consumer electronics show in Las Vegas, will offer a first look at the ways our relationship with tech could change this year. If the last two years proved that generative artificial intelligence and large language models aren’t going anywhere, 2024 will be year they get embedded into products you may actually want to buy. CES, one of the largest technology trade shows in the world, will host thousands of engineers, entrepreneurs, dealmakers and tech companies in Nevada, all eager to share their visions of what’s next. And yes, AI looms larger over the show than ever before — though it’s not the only thing attendees will be talking about.”, The Washington Post, January 8, 2024

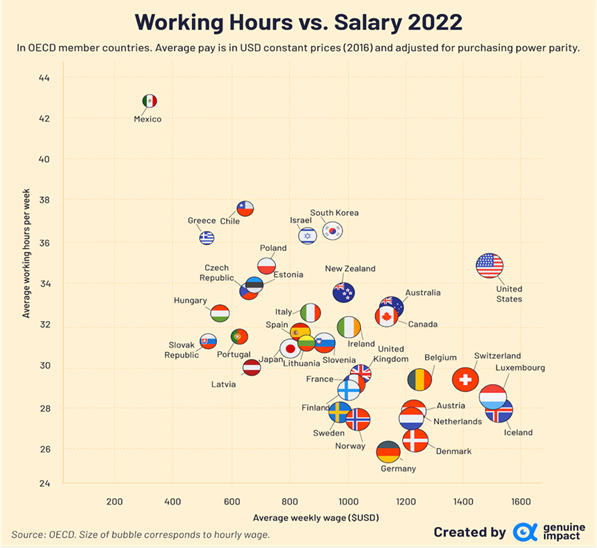

“Will AI enable a three-day workweek? Certain billionaires think so, but some experts disagree. Some of the world’s most successful business leaders, including Bill Gates and Jamie Dimon, have recently suggested that advancements in artificial intelligence will cut the workweek down to just three or three and a half days. Others aren’t so convinced. In a November episode of the What Now? With Trevor Noah podcast the former Microsoft chief executive described a world where machines do most of the labour, while humans earn a comfortable living working three days a week.”, The Globe and Mail, January 8, 2024

Global Supply Chain, Energy, Commodities, Inflation & Trade Issues

“2024 Supply Chain Risk Report – Which geopolitical instability should you be watching? What materials will supply chain managers be fighting over? And what is the top risk your supply network will 100% guaranteed face in 2024. Everstream’s 2024 outlook is based on our comprehensive database of supply chain disruptions and how those impact our clients. The report includes a countdown, risk scores, and extensive data for each of 2024’s Top 5 most likely events.”, Evergreen Analytics, January 4, 2024

“Spot Container Shipping Rates Soar 173% on Red Sea Threats – Suez traffic is down 28% in past 10 days, IMF PortWatch says Risk of congestion rises heading into Chinese Lunar New Year. The spot rate for shipping goods in a 40-foot container from Asia to northern Europe now tops $4,000, a 173% jump from just before the diversions started in mid-December, Freightos.com, a cargo booking and payment platform, said late Wednesday. The cost for goods from Asia to the Mediterranean increased to $5,175, Freightos said, adding that some carriers have announced prices above $6,000 for this route starting in mid-January. Rates from Asia to North America’s East Coast have risen 55% to $3,900 for a 40-foot container.”, Bloomberg, January 4, 2024

Annual % change in consumer price index

“Global Inflation Tracker – Inflation is easing from the multi-decade highs reached in many countries following Russia’s full-scale invasion of Ukraine. The rise in energy prices was the main driver of inflation in many countries, even before Russia invaded Ukraine. Daily data show how the pressure has intensified on the back of a conflict that has forced Europe to search for alternative gas supplies. However, wholesale prices continue to ease as a result of weakening global demand and European gas storage facilities being filled close to capacity.”, The Financial Times, January 5, 2-24

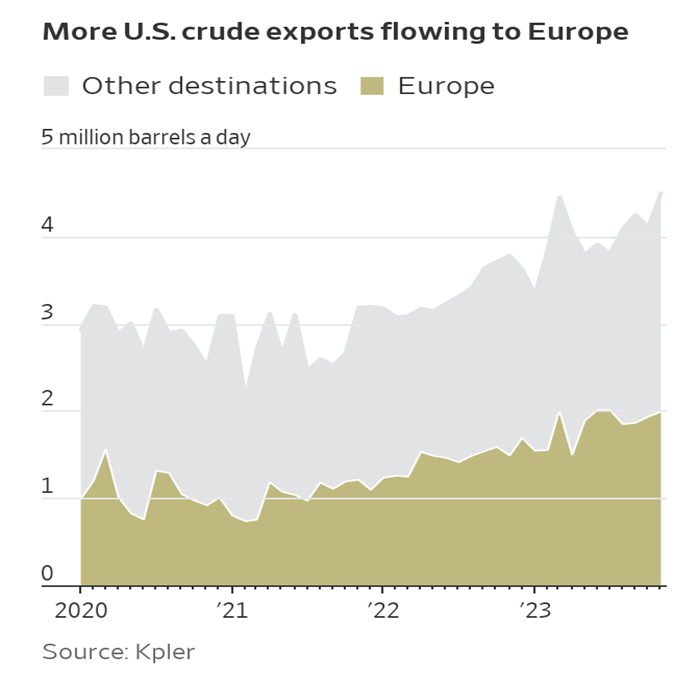

“(U,S.) Shale Is Keeping the World Awash With Oil as Conflicts Abound – The shipping crisis in the Red Sea is expected to raise consumer prices. But it has had little impact on energy prices, largely because of surging supplies from U.S. frackers. That is largely because of record production of U.S. fossil fuels. Shippers in November moved more oil out of the U.S. than what was produced in Iraq, OPEC’s second-largest member, at a record 4.5 million barrels a day. Likewise, U.S. exports of liquefied natural gas, or LNG, are set to hit a record in December, according to market intelligence firm Kpler.”, The Wall Street Journal, January 1, 2024

Global & Regional Travel Updates

“SAFEST PLACES TO TRAVEL 2024 – What makes a safe place to travel?It sounds like an easy question, but the definition of a safe destination has changed over time. According to our research, a safe place was originally a place that’s largely free from terrorist activity. Then it became a place that was safe from disease outbreaks. Now it’s a place where all types of people can move about freely without discrimination or harassment. As definitions of a safe destination have evolved, so too have the world’s safest places. Are there places where people can move about freely, stay disease-free, and be sheltered from severe weather events?”, Berkshire Hathaway Travel Protection, September 2024

“The World’s Most On-Time Airlines in 2023 – Aviation analytics firm Cirium ranked the punctuality of different airlines around the world—and the winner may surprise you. The list, derived from over 600 real-time flight information sources, features the expected names, to be sure (Delta received Cirium’s Platinum Award for global operational excellence for the third year in a row), but reveals some wild card winners as well. Avianca Airlines, a low-cost carrier based in Colombia, was ranked the most punctual global airline of 2023 with 85.73% of its flights arriving within 15 minutes of its scheduled gate arrival.”, CNN Traveler, January 2, 2024

Country & Regional Updates

BRICS Countries

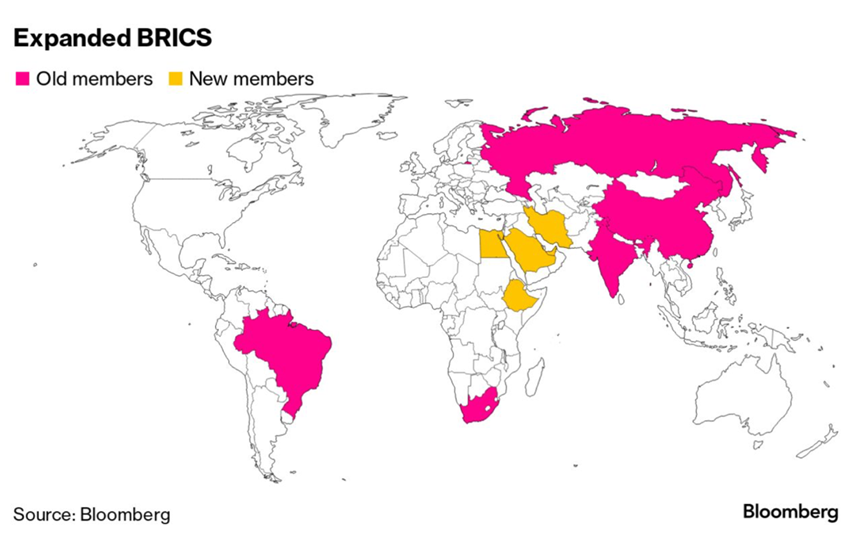

“How BRICS Doubled in Size – The BRICS group of emerging-market nations — the acronym stands for Brazil, Russia, India, China and South Africa — has gone from a slogan dreamed up at an investment bank two decades ago to a real-world club that controls a multilateral lender. It doubled in size at the start of 2024, pairing some of the planet’s largest energy producers with some of the biggest consumers among developing countries and potentially enhancing the group’s economic clout in a US-dominated world. Saudi Arabia, Iran, the United Arab Emirates, Ethiopia and Egypt accepted invitations to join starting on Jan. 1.”, Bloomberg, January 4, 2024

China

“Foreign investors unwind $33bn bet on China growth rebound – Almost 90% of money that flowed into Chinese stocks in 2023 has left amid concern about economy. Since peaking at Rmb235bn ($33bn) in August, net foreign investment in China-listed shares this year has dropped 87 per cent to just Rmb30.7bn, according to Financial Times calculations based on data from Hong Kong’s Stock Connect trading scheme. ‘The confidence issue goes beyond real estate, although real estate is key,’ said Wang Qi, chief investment officer for wealth management at UOB Kay Hian in Hong Kong. ‘I’m referring to consumer confidence, business confidence and investor confidence — both from domestic and foreign investors.’”, The Financial Times, December 27, 2023

European Union & Eurozone

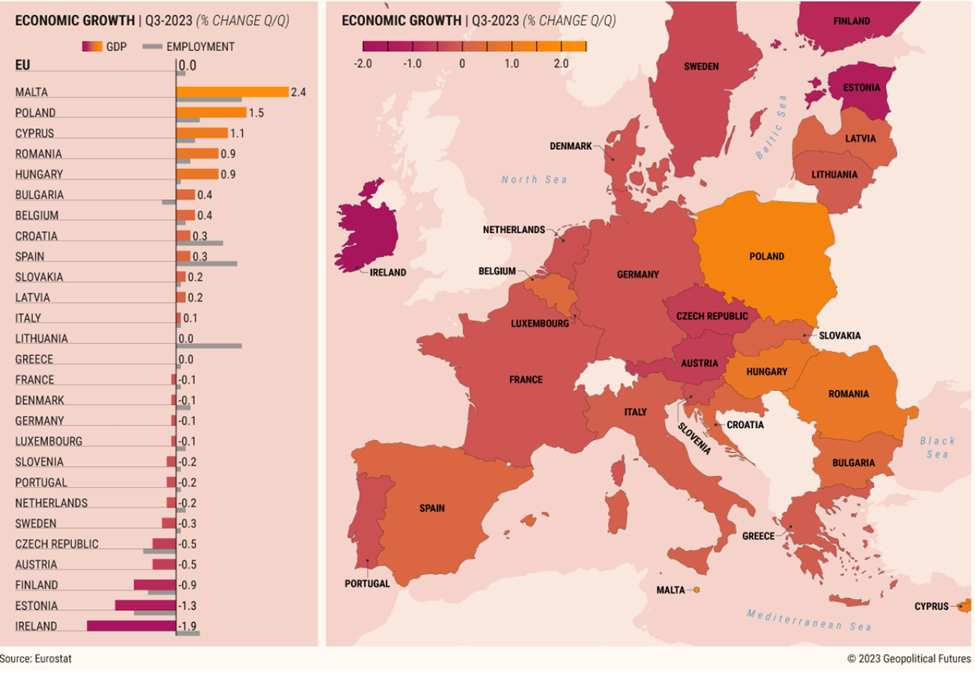

“EU Economy Is Stable but Stagnant – High and volatile energy costs continue to hold back growth. In the third quarter of 2023, seasonally adjusted gross domestic product remained stable in the European Union compared with the previous quarter, and employment ticked up slightly. Stabilization aside, the EU still faces growth challenges. European industry is unlikely to reach pre-pandemic growth rates anytime soon, as volatile energy prices continue to restrain industrial activity and create distributional conflicts within countries and the bloc as a whole.”, Geopolitical Futures, December 29, 2024

Germany

“German inflation rises to 3.8% in blow to rate-cut hopes – Energy subsidy phaseout pushes up prices in EU’s largest economy ahead of closely watched eurozone figures. The reduction of government subsidies on gas, electricity and food that began last year has triggered a re-acceleration of annual inflation in much of Europe. German energy prices rose 4.1 per cent in the year to December, a reversal from a 4.5 per cent annual decline a month earlier.”, The Financial Times, January 4, 2024

India

“Will India emerge as a global economic powerhouse in 2024? – While there is overall optimism, some economists are sounding a note of caution on the world’s fifth largest economy. Against a backdrop of global economic volatility, coupled with food and oil supply shocks keeping inflation elevated, some may wonder whether India’s growth momentum will continue in 2024. The country, which overtook China to become the world’s most populous nation in 2023 with more than 1.4 billion people, is set to benefit from its young demographic and rising middle class incomes, economists say.”, The National news, December 31, 2024

South Korea

“South Korea Unveils Steps Aimed at Suppressing Inflation Quickly – Authorities to prevent price rigging, freeze utility costs Inflation fight comes ahead of parliamentary elections. The government plans to freeze public utility charges, bolster monitoring of potential price rigging and make it mandatory for businesses to disclose if they are reducing packaged volumes of their products during the first six months of 2024, according to a statement Thursday from the Finance Ministry. The government will also provide about 11 trillion won ($8.4 billion) in support for energy vouchers, food discounts and other programs that could help lower consumer prices, it said.”, Bloomberg, January 3, 2024

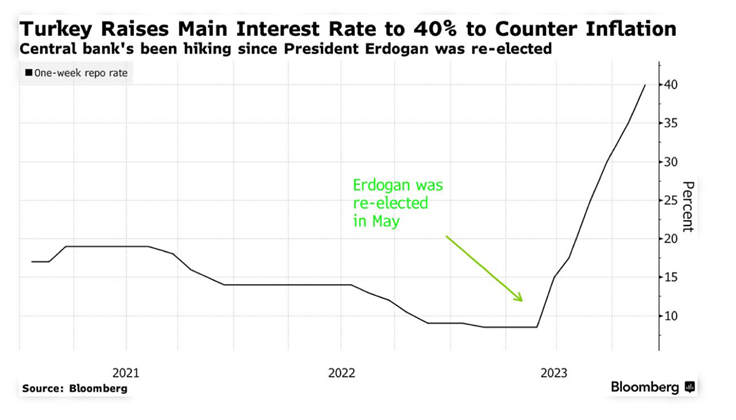

Turkey

“Turkish inflation climbs to nearly 65%, with more rises expected – Inflation in the country rose to 64.8% on an annual basis in December, an acceleration from 62% in November. This was slightly below expectations of economists polled by Reuters of 65.1%. Month-on-month inflation cooled to 2.9% from 3.3%. Inflation has been back on the rise since June, but market watchers say this cycle should hit its peak by mid-2024. Murat Ulgen, HSBC’s global head of emerging markets research, said Turkish bonds are in favor among EM investors who see a peak in inflation and stabilizing currency ahead.”, CNBC, January 3, 2024

United Kingdom

“Eight reasons to be cheerful about UK economy – Deutsche Bank predicts falling inflation will mean tax cuts before election. The chancellor is set to benefit from lower inflation, the possibility of interest rate cuts and a reduction in the Bank of England’s bond holdings, all of which will help to reduce the estimated borrowing bill compared with forecasts made by the Office for Budget Responsibility in November.”, The Times of London, January 2, 2024

United States

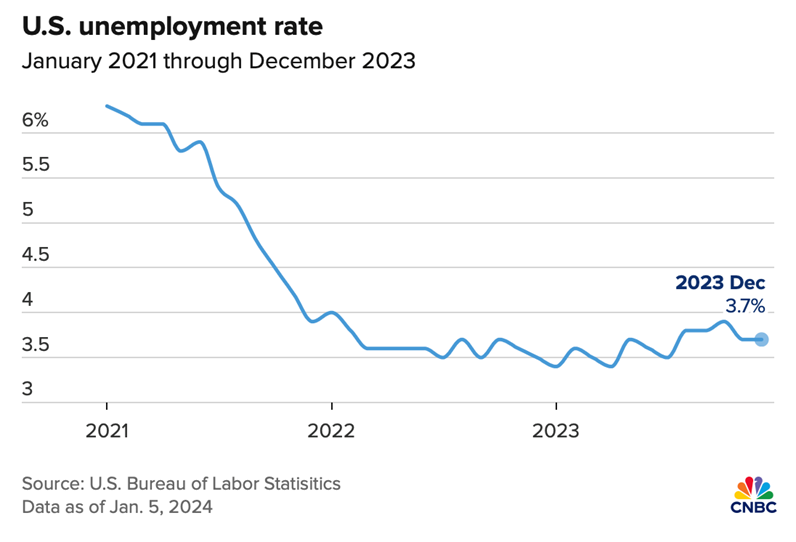

“The 2023 U.S. economy, in a dozen charts – The U.S. labor market ended the year strong, creating more than 200,000 jobs in the last month of the year and nearly 2.7 million jobs in all of 2023, when seasonally adjusted. Consumer spending remained robust throughout the year, with bright spots in travel and entertainment. There were some trouble areas for consumers, however, with mortgage rates high and existing home sales low.”, CNBC, January 7, 2024

“US venture capital fundraising hits a 6-year low – A 60% decline in 2023 from the year before sends a gloomy signal to funders and the start-ups that rely on them. Globally, in 2023 venture investors raised the lowest level of capital since 2015. The sharp decline ratchets up pressure on start-ups, which have endured a funding drought over the past 18 months.”, The Financial Times, January 5, 2024

Brand & Franchising News

“Chick-fil-A prices surge in recent years, report says – Chick-fil-A prices up 21% in the last two years, data shows. Newsweek compiled data from Food Truck Empire, which said the chicken chain first increased prices for its classic chicken sandwich by 15% in 2022, and a menu-wide 6% increase in January 2023. So what is the cause? Rising costs of ingredients, packaging and transportation due to inflation added to supply disruptions, Aaron Anderson, the CEO and founder of franchise consulting firm Axxeum Partners, told Newsweek.”, Fox Business, January 3, 2024

“Domino’s Pizza expands China franchise with 10 new stores – DPC Dash reaches a milestone with openings in Xiamen, Yangzhou, and other mainland cities. DPC Dash Ltd., Domino’s Pizza’s exclusive franchise operator in China, Hong Kong and Macau, has opened 10 new stores in eight new cities as part of its strategy for expansion. Currently, DPC Dash has opened a combined 175 new stores, leading to over 761 stores in over 29 cities in the Chinese mainland.”, Retail Asia, January 2, 2024

“McDonalds China and Cainiao partner on RFID chips to improve supply chain efficiencies. A trial project of the RFID technology helped reduce the time needed for stocktaking each day from 1 hour to 15 minutes for restaurants. The deal between McDonald’s China and Cainiao comes as the logistics firm prepares for an initial public offering in Hong Kong. Apart from deploying RFID technology to improve efficiency in inventory and logistics, McDonald’s and Cainiao will also explore digitisation and automation technologies in the supply chain, Cainiao said.”, South China Morning Post, January 5, 2024. Compliments of Paul Jones, Jones & Co., Toronto

“Why McDonald’s Ultimately Flopped In Bolivia – If you’ve recently visited the Tibet of the Americas, then you may have noticed there are no golden arches to be seen. That’s because McDonald’s pulled out of Bolivia in 2002, only a few years after it tried to launch in the country. McDonald’s withdrawal from the region marked a rare failure for the company. Locals were going to the thousands of street vendors — largely made up of indigenous women – for their fix of burgers rather than the fast food chain. This led to poor year-on-year sales that caused the restaurant to shut its doors in the country. Part of the blame can be placed on a move away from American influence in the early 2000s to focus on Bolivia’s marginalized natives.”, The Daily Meal, December 30, 2024

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

To receive this biweekly newsletter, click here : https://bit.ly/geowizardsignup

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, the franchise sector, economic development and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing environment. Our GlobalTeam™ on the ground covering 25+ countries provides us with updates about what is actually happening in their specific countries.

William “Bill” Edwards: Global Advisor Is Uniquely Qualified to Steer Sr. Executives Successfully Through the Complex Waters of Going Global. With four decades of successful international business experience spanning virtually every corner of the world and many business sectors, Bill Edwards understands the global business landscape like no other. He has been a County Master Franchisee in five countries in Asia, Europe and the Middle East; the Senior VP for a franchisor operating in 15 countries and a full-service consultant taking 40 franchisors global.

For a complimentary 30-minute consultation on how to take your business global successfully, contact Bill Edwards at bedwards@edwardsglobal.com or +1 949 224 3896.

And download our latest chart ranking 40+ countries as places to do business at this link:

Our latest GlobalVue™ 40 country ranking

EGS Biweekly Global Business Newsletter Issue 98, Tuesday, December 26, 2023

Edited and curated by: William (Bill) Edwards, CFE, CEO of Edwards Global Services, Inc. (EGS)

Introduction: In this issue, my latest article, “Doing Global Business In These Times”, which global economy did best in 2023, the most used AI tools in 2023, the best and worst global airports, how KFC became Japan’s preferred Christmas food (really!), Turkey raises its interest rates to 42.5%, McDonalds’ new brand and the USA is seeing the lowest inflation in years.

The mission of this newsletter is to use trusted global and regional information sources to update our 1,400+ readers in 20+ countries on key global and local trends that can impact the success of their businesses at home and abroad.

NOTE: Some of the sources that we provide links to require a paid subscription to access. We subscribe to 40 international information sources to keep our readers up to date on the world’s business.

To receive this biweekly newsletter that is read by over 1,400 people in 20 countries, click here: https://bit.ly/geowizardsignup

First, A Few Words of Wisdom From Others For These Times

“Cheers to another year and another chance to get it right.”, Oprah Winfrey

“You will either step forward into growth or you will step back into safety.”, Abraham Maslow

“Year’s end is neither an end nor a beginning but a going on, with all the wisdom that experience can instill in us.”, Hal Borland

Highlights in issue #98:

- Brand Global News Section: CosMc’s®, Greggs®, KFC®, Luckin Coffee®, Tim Hortons® and YUM China

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Interesting Data, Articles and Studies

“Doing Global Business in These Times – Doing business cross border has significantly changed due to the pandemic. This article looks at changes in doing global business in recent years from a practitioner’s perspective, specific trends and factors that impact successful brand entry into a new country and how several countries where you might take your business are expected to do economically in 2024. What has changed and what is the picture for doing cross border business in 2024? Below are some factors to keep in mind when planning your 2024 new country marketing budget.”, Momentum Magazine, December 15, 2023. This article is by your newsletter editor, William (Bill) Edwards

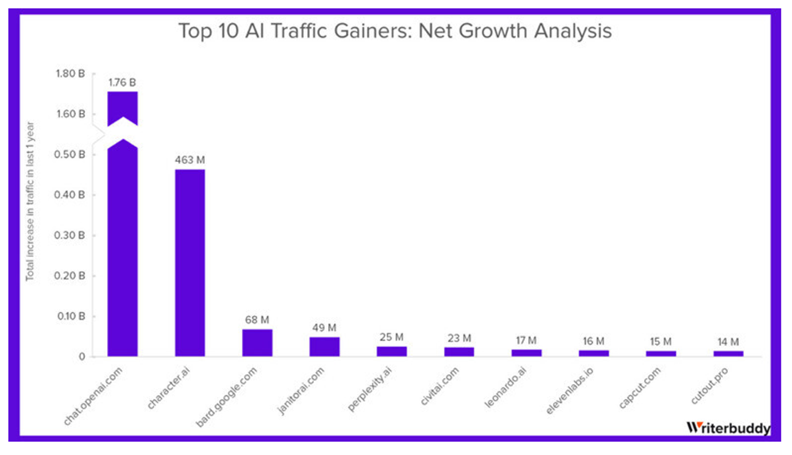

“Here Are The Most Used AI Tools Of 2023 – Artificial intelligence was all the rage in 2023. From writing assistants to generative media tools, hundreds of millions — scratch that, billions — of users have incorporated artificial intelligence into their workflows in unprecedented ways…..the top 50 AI tools generated 24.3 billion visits between September 2022 and August 2023, with traffic increasing by an average of 236.3 million visits per month.”, Slash Gear, December 23, 2023

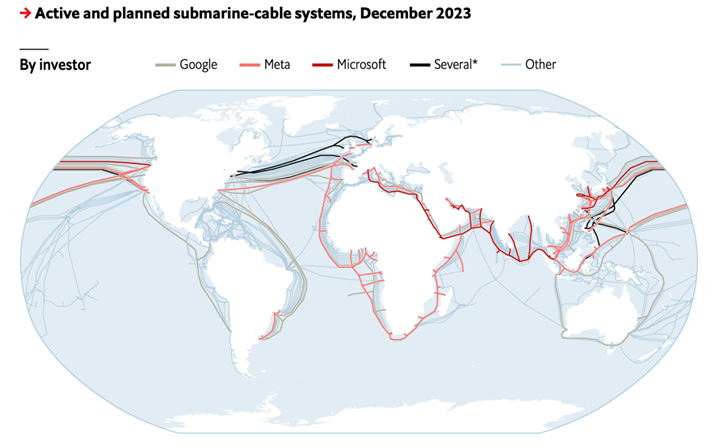

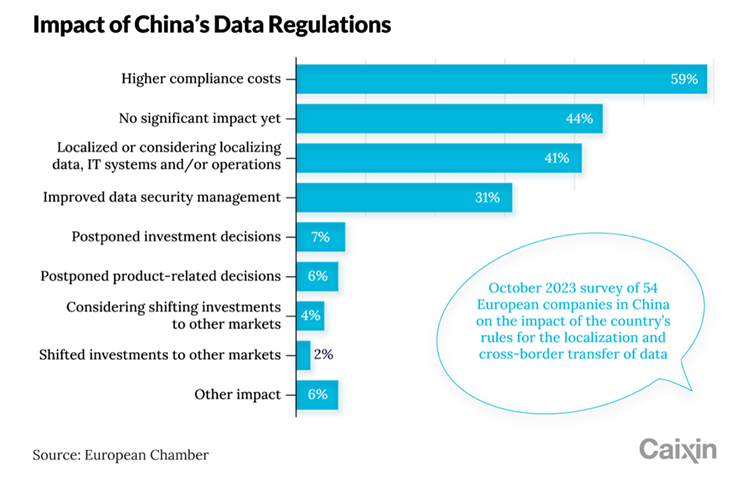

“Big tech and geopolitics are reshaping the internet’s plumbing – Data cables are turning into economic and strategic assets. Submarine cables used to be seen as the internet’s dull plumbing. Now giants of the data economy, such as Amazon, Google, Meta and Microsoft, are asserting more control over the flow of data, even as tensions between China and America risk splintering the world’s digital infrastructure. The result is to turn undersea cables into prized economic and strategic assets.”, The Economist magazine, December 20, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global Supply Chain, Energy, Commodities, Inflation & Trade Issues

Annual % change in consumer price index

“Global Inflation Tracker – Inflation is easing from the multi-decade highs reached in many countries following Russia’s full-scale invasion of Ukraine. The latest figures for most of the world’s largest economies show the wholesale food and energy prices that soared during 2022 are now falling back.”, The Financial Times, December 11, 2023

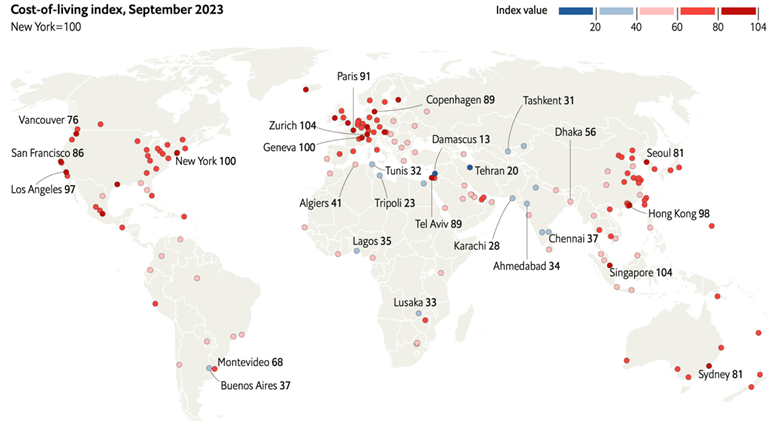

“These are the world’s most expensive cities – EIU’s cost-of-living index shows where prices are highest. Tied in first place this year were Singapore and Zurich. Western European cities, including Copenhagen, Dublin and Vienna, take around half of the top 20 spots. The three biggest climbers were Santiago de Querétaro and Aguascalientes in Mexico, and Costa Rica’s capital, San José. Beijing was one of four Chinese cities among the ten biggest decliners in the ranking.”, The Economist, November 29, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global & Regional Travel Updates

“The World’s Best and Worst Airports for 2023 Offer Plenty of Surprises – According to an annual ranking by AirHelp, US airports continue to miss the mark—as do hubs in many of the most-visited cities around the world. The results say that the world’s best airport is Oman’s Muscat International. In second and third place, respectively, are Brazil’s Recife-Guararapes International Airport and South Africa’s Cape Town International Airport. Japan and Brazil generally dominate in airport performance, with each counting three locations on the Top 10 list of best global airports. Of US hubs, only three made it onto the world’s Top 50 list: Minneapolis-St. Paul International (No. 13), Seattle-Tacoma International (No. 34) and Detroit Metropolitan Airport Wayne County (No. 38). European airports didn’t do much better, with just nine making it into the Top 50 best airport experiences of the world, according to AirHelp. Bilbao Airport in northern Spain took the No. 1 spot in Europe.”, Bloomberg, December 19, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Country & Regional Updates

Argentina

“Milei Unveils Broad Reforms to Liberalize Argentina Economy – Plan will face opposition in congress and from labor unions Measures come after deep budget cuts, sharp peso devaluation. President Javier Milei announced sweeping reforms to reduce the hand of the state in Argentina’s economy, including steps to privatize companies, facilitate exports and end price controls, in a bold political move that’s likely to face pushback in congress and courts.The libertarian leader listed 30 initial points of his plan in a televised address Wednesday night, adding they’re part of a broader package containing over 300 measures. He presented the all-around reforms as an attempt to free Argentines from the “oppression” of the state and its bureaucrats, in line with his campaign pledges.”, Bloomberg, December 20, 2023

China

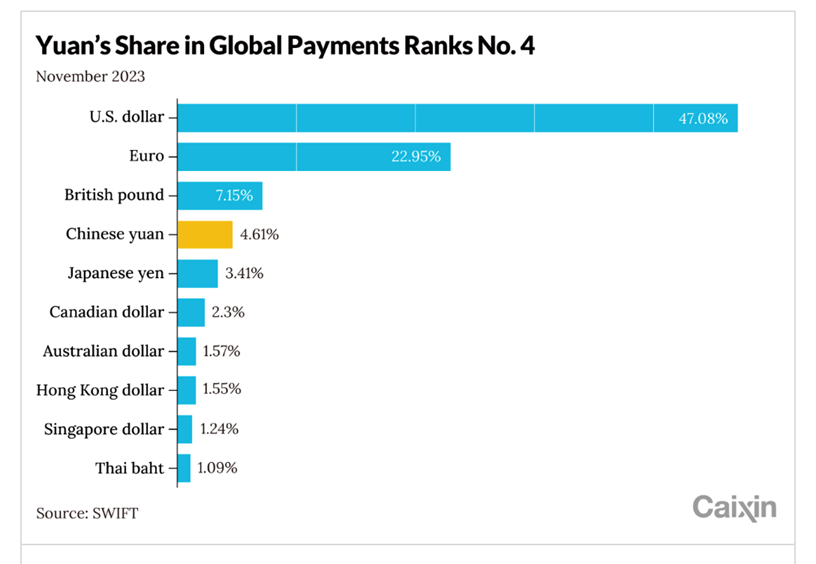

“China’s Yuan Overtakes Yen to Rank Fourth for Global Payments – The yuan overtook the Japanese yen to become the fourth-most used currency by value in global payments for the first time in almost two years, according to a monthly tracker of the Chinese currency released by the Society for Worldwide Interbank Financial Telecommunication (SWIFT).”, Caixin Global, December 22, 2023

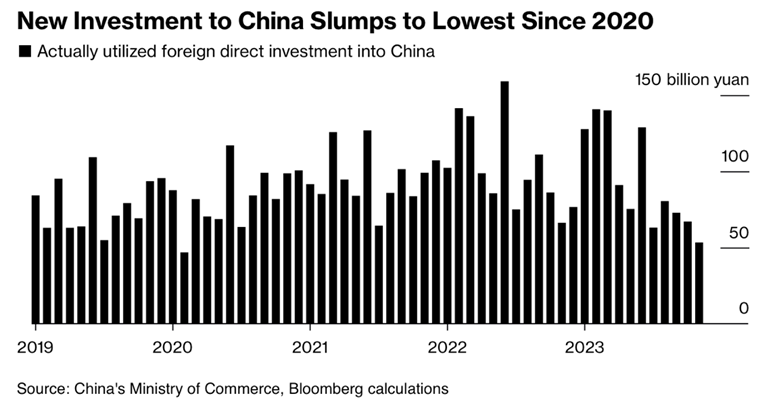

“China’s Foreign Direct Investment Drops to Near Four-Year Low – A measure of foreign investment into China fell to the lowest in nearly four years in November, underlining how geopolitical tensions and a slowing economy have combined to convince foreign companies to slow their expansion. New actually utilized foreign capital received by the country was 53.3 billion yuan ($7.5 billion) last month, down 19.5% from a year earlier, according to Bloomberg calculations based on data published by the Ministry of Commerce on Thursday. That’s the worst number since February 2020, when the Covid-19 pandemic first hit.”, Bloomberg, December 21, 2023

Greece

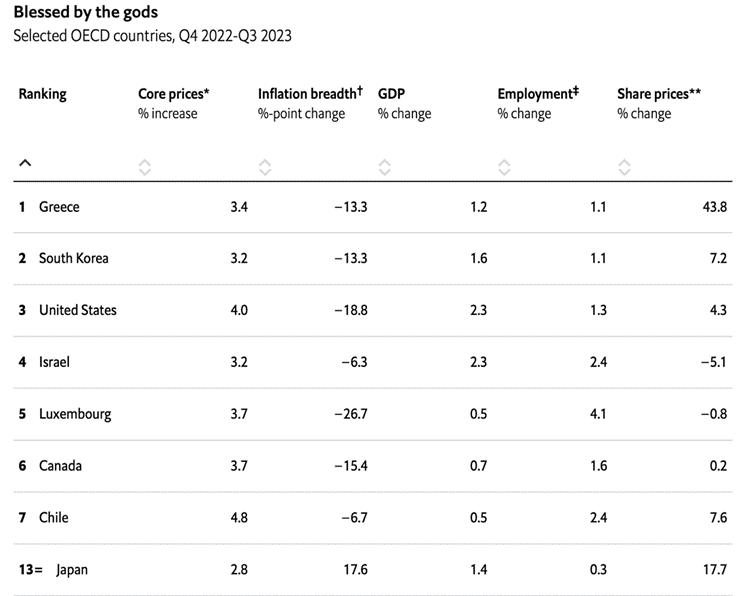

“Which economy did best in 2023? – Another unlikely triumph. The Economist has compiled data on five indicators—inflation, “inflation breadth”, gdp, jobs and stockmarket performance—for 35 mostly rich countries. We have ranked them according to how well they have done on these measures, creating an overall score. The table shows the rankings, and some surprising results. Top of the charts, for the second year running, is Greece—a remarkable result for an economy that was until recently a byword for mismanagement. Aside from South Korea, many of the other standout performers are in the Americas.”, The Economist, December 17, 2023

Japan

“How KFC Became Japan’s Hallmark Christmas Food – Ah, Christmas food. Maybe you go for a large, typical spread of roast this and roast that with various vegetables and sauces, rolls, and apple pie. Or maybe you live in Japan and queue up outside of a KFC waiting for a deluxe Christmas meal pack of crispy fried chicken like your artery-clogging parents before you. Hold on, you say: “Folks eat KFC for Christmas in Japan?” Yes, indeed. Feel free to peruse a Japanese-language KFC Christmas menu online; it doesn’t matter if you don’t read Japanese because everything has a picture.”, Grunge, December 20, 2023

South Korea

“S.Korea banks pledge $1.5 bln for small businesses amid push to share profits – South Korea’s commercial banks will provide 2 trillion won ($1.53 billion) to support small businesses, the organisation representing the lenders said on Thursday, amid political and regulatory pressure to share more of their profits with society. The Korea Federation of Banks, which represents 23 financial institutions including Kookmin Bank and Woori Bank, said of the total, 1.6 trillion won will be used as cash refund for interest payments borrowers made, to help them cope with the rising costs of living as interest rates climb.”, The Daily Mail (UK), December 20, 2023

Turkey

“Turkey raises rates to 42.5%, nearing end of cycle – Some analysts said one more rate hike was on the cards after seven straight months of tightening. The central bank has lifted its one-week repo rate by 3,400 basis points since June, when President Tayyip Erdogan appointed former Wall Street banker Hafize Gaye Erkan as its governor to conduct a sharp pivot toward more orthodox policies. It had raised rates by 500 basis points in each of the last three months but last month said tightening would soon end.”, The Daily Mail (UK), December 21, 2023

United Kingdom

“UK economy on brink of recession after growth falls – Gross domestic product revised down to -0.1% in the third quarter. The downgrades mean that the economy has expanded by 0.3 per cent so far this year, down from economists’ projections of 0.6 per cent, and the economy overall is 1.4 per cent larger than pre-pandemic levels.”, The Times of London, December 22, 2023

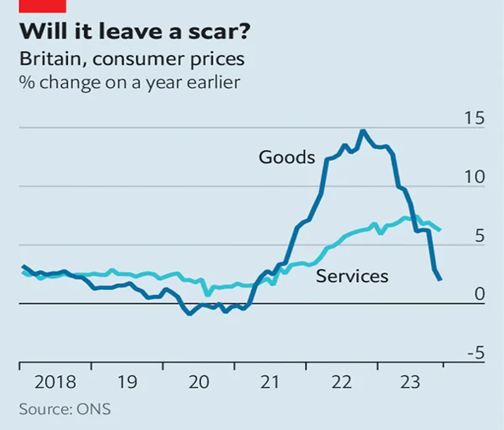

“Britain’s cost-of-living squeeze will leave an enduring mark – Britons are going to the discounters more and going out less. Those habits may stick. The worst of Britain’s most sustained period of high inflation since the 1970s is coming to an end. The headline rate of consumer-price inflation in November fell to an annual pace of 3.9%, its lowest reading in more than two years. Such a prolonged squeeze is likely to reshape consumer behaviour. The most persistent shifts will probably be in food. Along with energy, food was a major cause of the spike in goods prices in 2021 and 2022….. Unlike energy bills, food prices are still rising at a fast clip. They were up by 9.2% in the year to November.”, The Economist, December 22, 2023

United States

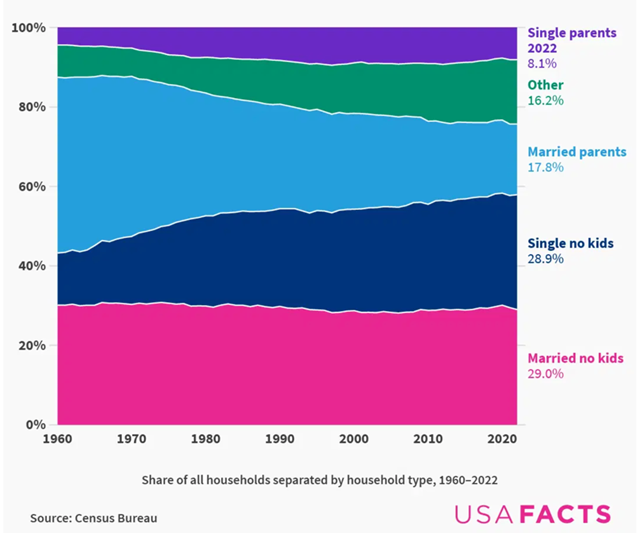

“How has the structure of American households changed over time? In 2022, more than half of American households were childless: 29% were married households without children, and 28.9% were single households without kids. More than a quarter of households included parents — 17.8% were married households, while 8.1% were single-parent households. In 1960, households with married parents represented over 44% of all American households, while slightly over 13% were single with no children. Today, that’s inverted — in 2022, single people living alone and married couples without children outnumbered married-parent households.”, Voronoi – USA Facts, December 12, 2023

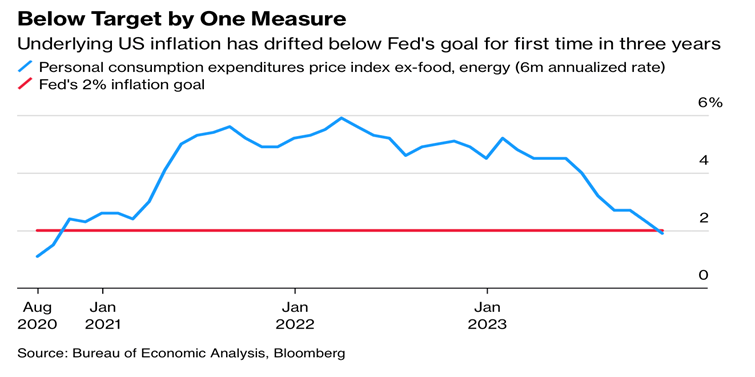

“The US Inflation Fight Approaches Victory – The US Federal Reserve’s preferred gauge of underlying inflation barely rose last month and—by one measure—even trailed the policymaker’s 2% target. That marks the first time in three years the Fed has achieved its definition of price stability after waging war on inflation triggered by the pandemic, Russia’s war on Ukraine and various other things. Americans can now look ahead to a likely reduction in interest rates next year and more affordability of almost everything (though savers may grumble).”, Bloomberg, December 23, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Brand & Franchising News

“East Lothian Greggs: ‘Huge milestone’ as 500th franchise shop opens in Monktonhall outside Edinburgh – The new shop is a partnership between Greggs and the UK’s largest independent forecourt operator MFG. The landmark opening comes one year after Greggs launched their 400th shop and is one of 71 franchised units that opened in 2023, with these locations now accounting for approximately 20 per cent of the retailer’s total estate.”, Edinburgh Evening News, December 15, 2023

“Yum China’s CEO on Chinese consumers’ incredible hunger for foreign brands – On a recent episode of Fortune’s Leadership Next podcast, co-host Alan Murray talks with Joey Wat, CEO of Yum China. The company, which is listed on both the New York and Hong Kong stock exchanges, was spun off from Yum! in 2016. Wat, who started working at age 9 in a factory in Hong Kong, oversees 14,000 stores across brands including KFC, Pizza Hut, Taco Bell, Little Sheep, and Huang Ji Huang. About 90% of the restaurants are company-owned, with just 10% run by franchisees. In 2024, Yum China will open more than four new stores per day.”, Fortune, December 20, 2023

“Luckin Coffee (China) in dispute with Thai company over trademark – China’s Luckin Coffee might be facing overseas trademark infringement compensation after a Thai group reportedly filed for 10 billion baht (US$290 million) compensation. Thailand’s 50R Group formally submitted a lawsuit to the local court requesting China’s Luckin Coffee compensate for economic losses. China’s Luckin Coffee, founded in 2017, said in August last year that the Thai stores bearing the same name were counterfeit.”, Shine.cn, December 12, 2023. Compliments of Paul Jones, Jones & Co., Toronto

“Canadian coffee chain Tim Hortons to open 150 outlets in Korea within 5 years – Tim Hortons has decided to enter the Korean market, which has a vibrant coffee market where coffee consumptions per person is almost threefold the global average, the company said in a statement. Korea will be the seventh Asian country to have a Tim Hortons shop following China, India, Pakistan, Thailand, Singapore and the Philippines, it said. The Ontario-based coffee chain, founded in Canada in 1964, currently operates more than 5,700 stores in 17 countries around the world, including the United States and China.”, The Korea Times, December 12, 2023. Compliments of Stephen Armstrong, MAPLE U.S.-Canada Business Council, Irvine, California

“A Trip to CosMc’s, McDonald’s New Space-Themed Takeout Chain – Expect sweet drinks—and plenty of quality time in the car—in the first few days for the new offshoot. The space-themed brand is the fast-food giant’s first new U.S. restaurant concept in its more than 60-year history, designed to deliver a beverage-heavy menu through takeout-focused locations built with multiple drive-throughs.”, The Wall Street Journal, December 12, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

To receive this biweekly newsletter, click here : https://bit.ly/geowizardsignup

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, the franchise sector, economic development and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing environment. Our GlobalTeam™ on the ground covering 25+ countries provides us with updates about what is actually happening in their specific countries.

William “Bill” Edwards: Global Advisor Is Uniquely Qualified to Steer Sr. Executives Successfully Through the Complex Waters of Going Global. With four decades of successful international business experience spanning virtually every corner of the world and many business sectors, Bill Edwards understands the global business landscape like no other. He has been a County Master Franchisee in five countries in Asia, Europe and the Middle East; the Senior VP for a franchisor operating in 15 countries and a full-service consultant taking 40 franchisors global.

For a complimentary 30-minute consultation on how to take your business global successfully, contact Bill Edwards at bedwards@edwardsglobal.com or +1 949 224 3896.

And download our latest chart ranking 40+ countries as places to do business at this link:

Our latest GlobalVue™ 40 country ranking

EGS Biweekly Global Business Newsletter Issue 97, Tuesday, December 12, 2023

Edited and curated by: William (Bill) Edwards, CFE, CEO of Edwards Global Services, Inc. (EGS)

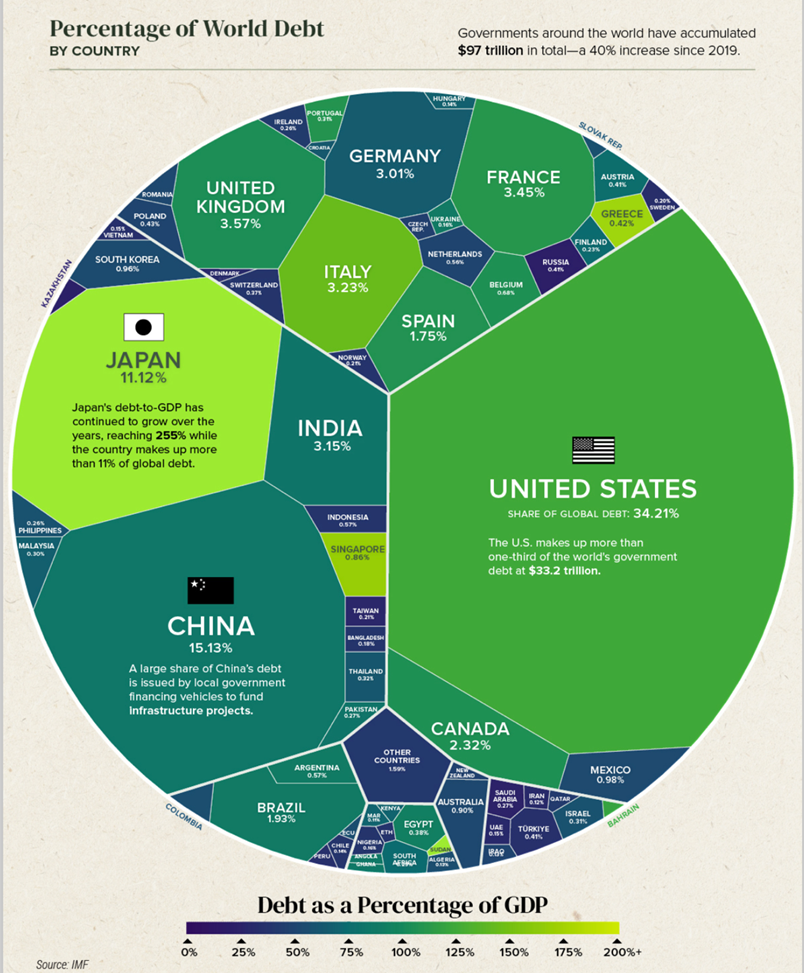

Introduction: In this issue, global government debt is at $97 trillion. Analysts are mixed in how they see economies in 2024. The European Union proposes the first government rules for AI. Global airfares are expected to stabilize in 2024. And McDonalds® plans to open 9,000 more restaurants worldwide. And dairies take 1st steps to tackle planet-warming cow burps.

The mission of this newsletter is to use trusted global and regional information sources to update our 1,400+ readers in 20+ countries on key global and local trends that can impact the success of their businesses at home and abroad.

NOTE: Some of the sources that we provide links to require a paid subscription to access. We subscribe to 40 international information sources to keep our readers up to date on the world’s business.

To receive this biweekly newsletter that is read by over 1,400 people in 20 countries, click here: https://bit.ly/geowizardsignup

First, A Few Words of Wisdom From Others For These Times

“No one who achieves success does so without acknowledging the help of others.” – Alfred North Whitehead.

“Accept challenges so that you may feel the exhilaration of victory.” – General George S. Patten.

“You must do the things you think you cannot do.” – Eleanor Roosevelt

Highlights in issue #97:

- Brand Global News Section: 7-Eleven®, Joe and the Juice®, KFC® and McDonalds®

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Interesting Data and Studies

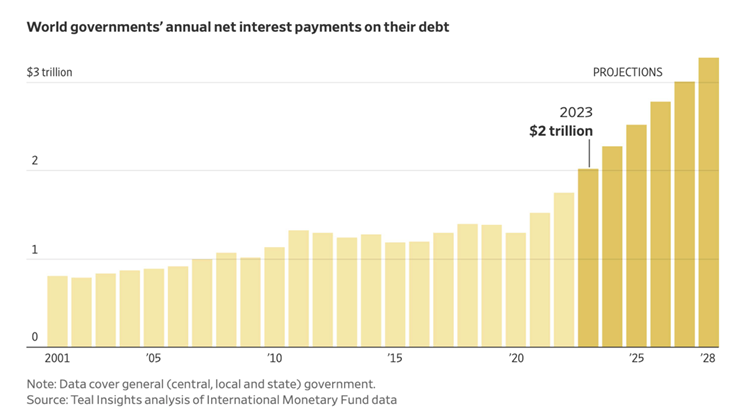

“Global government debt is projected to hit $97.1 trillion this year, a 40% increase since 2019 – During the COVID-19 pandemic, governments introduced sweeping financial measures to support the job market and prevent a wave of bankruptcies. However, this has exposed vulnerabilities as higher interest rates are amplifying borrowing costs. This graphic shows global debt by country in 2023, based on projections from the International Monetary Fund (IMF).”, Visual Capitalist, December 5, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global Supply Chain, Energy, Commodities, Inflation & Trade Issues

Annual % change in consumer price index

“Global Inflation Tracker – Inflation is easing from the multi-decade highs reached in many countries following Russia’s full-scale invasion of Ukraine. The latest figures for most of the world’s largest economies show the wholesale food and energy prices that soared during 2022 are now falling back.”, The Financial Times, December 11, 2023

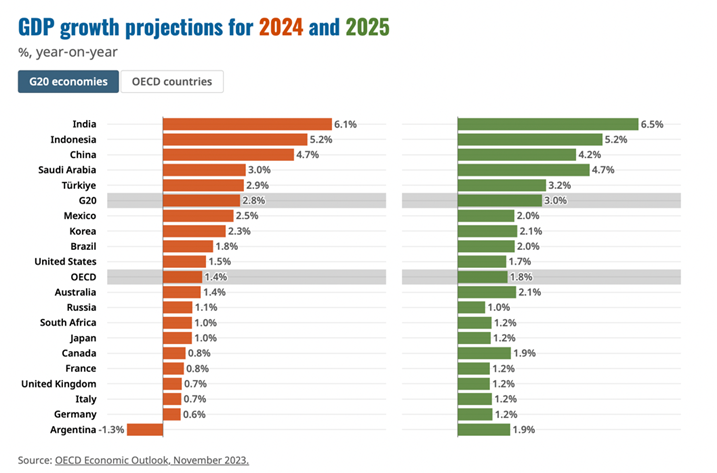

“Restoring Growth – OECD Economic Outlook November 2023 – The global economy continues to confront the challenges of inflation and low growth prospects. GDP growth has been stronger than expected so far in 2023, but is now moderating on the back of tighter financial conditions, weak trade growth and lower business and consumer confidence. Global growth is projected to be 2.9% in 2023, and weaken to 2.7% in 2024. As inflation abates further and real incomes strengthen, the world economy is projected to grow by 3% in 2025. Global growth remains highly dependent on fast-growing Asian economies. On the upside, growth could also be stronger if households spend more of the excess savings accumulated during the pandemic.”, OECD, November 2023

“Global trade to contract by 5% in 2023, UN body says – Global trade is set to contract by 5% in 2023 compared to last year, the United Nations trade body said on Monday, with an overall pessimistic forecast for 2024. In its Global Trade Update, the United Nations Conference on Trade and Development (UNCTAD) projected that commerce this year would amount to approximately $30.7 trillion. Trade in goods is expected to contract by nearly $2 trillion in 2023, or 8%, but services trade should increase by about $500 billion, or 7%, according to the U.N. body.”, Reuters, December 11, 2023

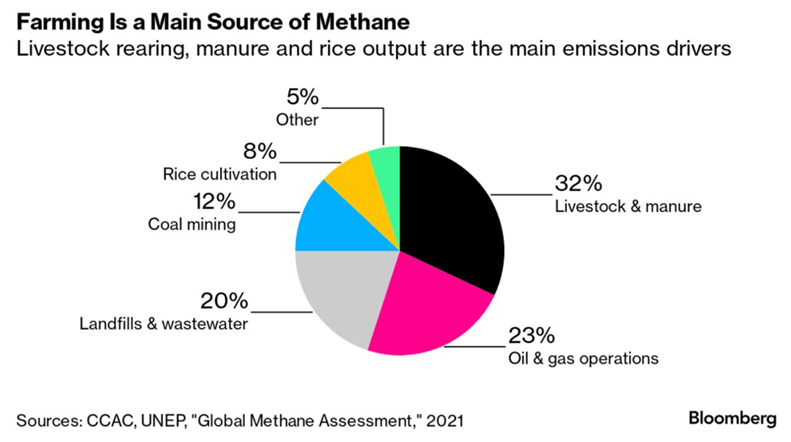

“Dairy Giants Take First Steps to Tackle Planet-Warming Cow Burps – Six of the world’s biggest dairy producers pledged to publicly say how much methane they emit as part of efforts to address livestock’s huge environmental footprint. Agriculture emits about 40% of all methane, a potent gas with 80 times the warming power of carbon dioxide. The majority of that comes from livestock, whether belched from the stomach or through manure. While the focus has been on tackling the problem in the energy sector — such as leaks from oil wells — addressing it in farming has so far proven elusive.”, Bloomberg, December 8, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global & Regional Travel Updates

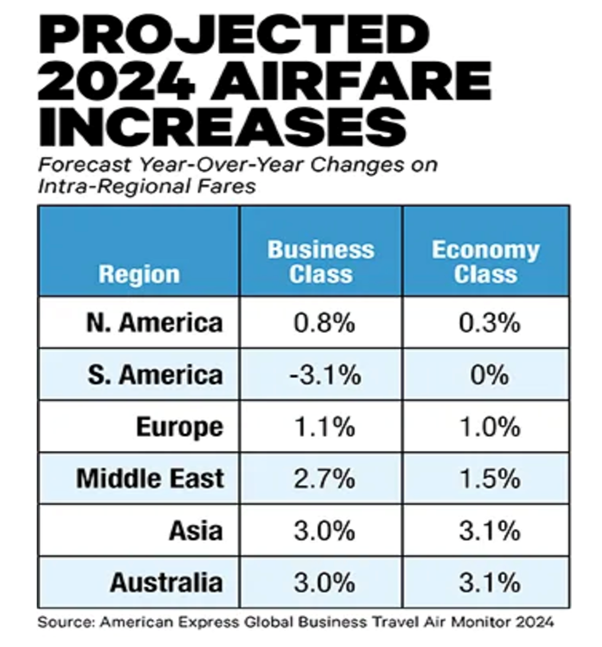

“Amex GBT Projects 2024 Global Airfares to Stabilize – 2024 economy- and business-class airfares throughout the world are projected to stabilize, “with prices falling on some routes,” according to a new American Express Global Business Travel forecast, released Wednesday. Business-class fare projections from North America to other regions are mixed….. Most economy-class fares from North America are expected to decline.”, Business Travel News, December 6, 2023

“Indonesia eyes visa waivers for 20 countries, including US, China, India – The government will finalise the list of countries included in the provision within one month, according to a statement. Minister Sandiaga Uno said the president had instructed the government to consider the visa waiver as a means of boosting the economy, tourism visits and investment.”, Reuters, December 7, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Country & Regional Updates

Argentina

“Argentina prepares for Milei to start shock therapy – Argentina’s financial markets were on tenterhooks on Monday to see if new President Javier Milei would immediately launch into his promised economic shock therapy by devaluing the peso. The radical economist took office on Sunday with a warning in his inaugural speech that he had no alternative to a sharp, painful fiscal shock to fix the country’s “titanic” challenges. Milei has promised deep cuts to public spending but his task looks daunting, with inflation nearing 200%, recession looming and payments ramping up while Argentina’s reserves are depleted.”, Reuters, December 11, 2023

China

“Wall Street Puts a ‘Sell’ on Its China Holdings – Institutional investments in the nation have plunged as its economy slows and property market craters; ‘a bit of an awakening’. The amount of money that institutional investors have in Chinese stocks and bonds has declined by more than $31 billion this year, through October, the biggest net outflow since China joined the World Trade Organization in 2001, official Chinese data show.”, The Wall Street Journal, December 7, 2023

“China’s deflation worsens as economic pressures mount – Consumer price data comes after policymakers pledge to step up fiscal and monetary support. China’s consumer prices fell 0.5 per cent year on year in November, the sharpest decline in three years as the world’s second-largest economy grapples with worsening deflation. Consumer prices dropped by more than the 0.2 per cent decline forecast by a Bloomberg survey of economists and exceeded October’s fall of 0.2 per cent. Producer prices, which are measured at factory gates and heavily driven by the cost of commodities and raw materials, dropped by 3 per cent and have remained in negative territory for the past year.”, The Financial Times, December 9, 2023

European Union

“Europe seals world’s first set of rules regulating artificial intelligence – The deal requires ChatGPT and general purpose AI systems (GPAI) to comply with transparency obligations before they are put on the market. The proposals lay the groundwork for the Artificial Intelligence Act, which will be voted on by the European Parliament and Council next year and will come into effect in 2025. The legislation, if passed, would be the world’s first comprehensive rules to regulate the use of artificial intelligence, paving the way for legal oversight of AI technology.”, Fox Business, December 9, 2023

India

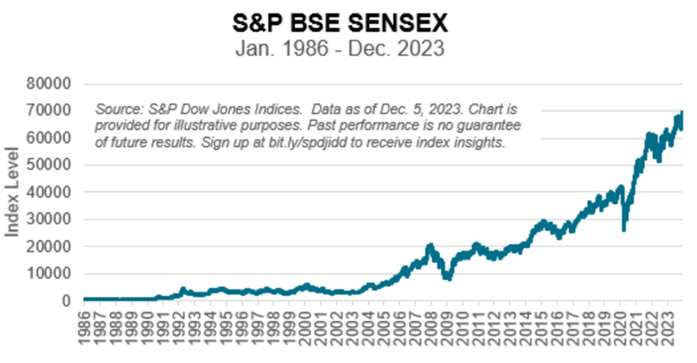

“India’s stock market tops $4 trillion in value as investors buy into world’s fastest growing big economy – The S&P BSE Sensex, India’s benchmark equity index, is up more than 7% in just the past month and has gained 14.3% for the year-to-date as investors seek exposure to the world’s most populous nation and fifth biggest economy. The MSCI China index, in dollar terms, has dropped 13.6%, while the MSCI World Index is up 16.1% over the same period, boosted by an 18.5% gain for the S&P 500 in the U.S. ‘It’s been a fantastic decade for Indian blue chips, with the Sensex hitting a new all-time high in 9 of the past 10 years, for a cumulative total of 243 times,’ noted Benedek Vörös, director, index investment strategy at S&P Dow Jones Indices.”, Market Watch, December 7, 2023

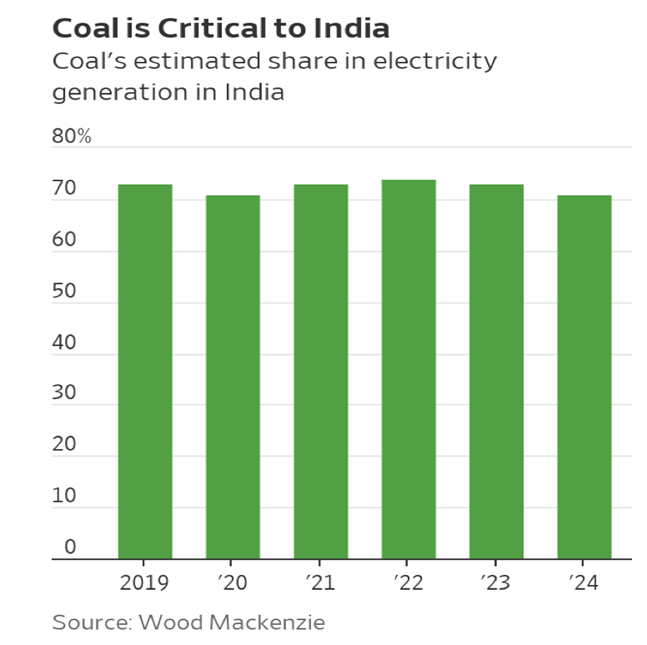

“What India Needs to Ditch Coal – India, along with China, has opted out of the Global Renewables and Energy Efficiency pledge at the COP28 climate conference in Dubai—which included a commitment to curtail investment in new coal power. Coal currently meets nearly three-quarters of India’s growing energy needs. Moreover higher electricity capacity will, ironically, be key to survival in its increasingly hot weather as air conditioning needs rise. So what does India really need to shift decisively toward low carbon power? For one, money—much of it from the developed world.”, The Wall Street Journal. December 11, 2023

The Philippines

“Peso Set to Ride Remittance Wave on Philippine Holiday Spending – The Philippine peso has outperformed its Asian peers this year and a seasonal pick-up in overseas remittances ahead of Christmas will likely extend the gains.

Remittances are a key pillar of the nation’s economy, which typically receives the highest cash transfers in the last month of the year as workers send money home for holiday spending. The inflows have helped strengthen the currency in all but three Decembers in the last 10 years, data compiled by Bloomberg show.”, Bloomberg, December 10, 2023

Turkey

“Türkiye logs 5.9% Q3 GDP growth, sets eye on disinflation – Türkiye’s economy expanded by a more-than-expected 5.9% year-over-year in the third quarter, driven primarily by solid household spending, the official data showed Thursday. The country’s gross domestic product (GDP) thus grew slightly above the market expectations, hovering around 5.6%, data by the Turkish Statistical Institute (TurkStat) showed. ‘As envisaged in our program, we are moving toward a more balanced composition in growth,’ Treasury and Finance Minister Mehmet Şimşek said as he commented on the figures.”, Daily Sabah, November 30, 2023

United Kingdom

“Interest rates won’t be cut until 2026, predicts CBI – Business lobby group forecast based on inflation not hitting Bank of England’s 2% target until second half of 2025. In its latest outlook on the UK economy, the CBI said the base rate will stay at 5.25 per cent for at least two more years, despite rising market speculation that rates will be cut next year. The forecast is based on projections showing that consumer price inflation will not reach the Bank’s 2 per cent target until the third quarter of 2025. Rate-setters on the monetary policy committee — including Andrew Bailey, the Bank’s governor — have pushed back against traders’ expectations and warned that no monetary easing is imminent, despite inflation falling to a two-year low of 4.6 per cent in October. The Times of London, December 8, 2023

“UK economy showing ‘signs of life’ as eurozone heads towards recession – A closely watched index of private sector activity in the UK returned to growth in November after three months of decline. But in the single currency bloc business continued to struggle – leaving it on the brink of recession. The updates came as an influential ‘hawk’ at the European Central Bank said she believes further interest rate hikes can be taken off the table following the ‘remarkable’ fall in inflation. Isabel Schnabel fuelled speculation that rates in Europe and the UK will be cut in the first half of next year.”, The Daily Mail, December 5, 2023

United States

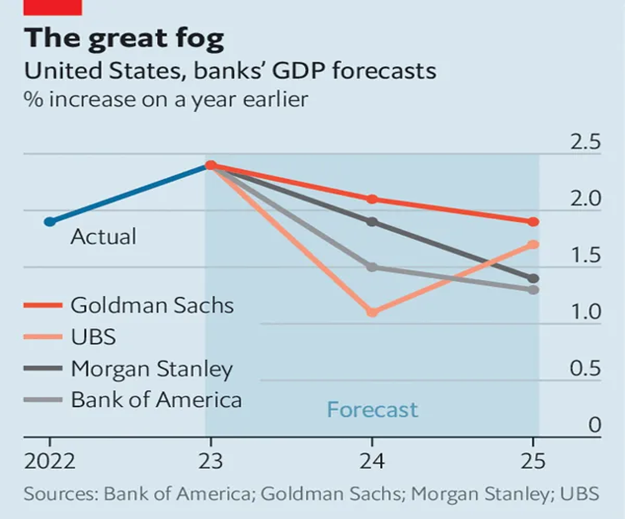

“(U.S.) Stock analysts who got it wrong last year predict a soft landing in 2024 – What a difference a year makes. Heading into 2023, stock forecasters were predicting an imminent recession triggered by high interests would torpedo financial markets. As we head into 2024, by contrast, Wall Street expects a soft landing for the U.S. economy to power the market to record highs. Most strategists also expect the Federal Reserve to turn the page on its rate-hiking offensive and for the S&P 500 to grind higher in the new year. Like most New Year’s resolutions, however, stock forecasts often end up bowing to reality. That imminent recession analysts predicted last year? It never materialized. Instead, the economy continues to grow; inflation is easing and equities are cruising toward year-end having booked double-digit gains.”, CBS News, December 8, 2023

“Market pros are all over the map when it comes to 2024 forecasts – Investment banks and asset managers have wildly varying stock market and currency calls for 2024, reflecting deep division over whether the U.S. economy will enter a long-heralded recession and drag the world with it. The lack of consensus among forecasters is a stark contrast to a year ago, when most predicted a U.S. recession and rapid rate cuts that failed to materialize. The world’s largest economy expanded by 5.2 per cent in the third quarter of this year.”, The Globe and Mail, December 8, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Brand & Franchising News

“From one 7-Eleven store to a $1.71 billion payday – The 7-Eleven Australia convenience store business, which began with one store in the Melbourne suburb of Oakleigh in 1977, has been sold by the Withers and Barlow families in a $1.71 billion payday. It has been acquired by the Japanese parent group Seven-Eleven Japan, which plans to step up expansion in Australia of a business with 752 outlets selling snacks, drinks, coffee and fuel. It has a market share of about 32 per cent in convenience store merchandise. The new owners are aiming to open around 35 stores annually. The Japanese group owns the 7-Eleven global licence and already collects licence fees from the Australian business, which has been owned by the two families since 1976.”, Australian Financial Review, November 30, 2023

“Private Equity Firm to Acquire Majority Ownership in Joe & the Juice – The 360-unit beverage chain wants to expand worldwide, including a new franchise program. Private equity firm General Atlantic announced Monday that it will acquire a majority interest in Joe & the Juice, a growing beverage chain with stores around the world. General Atlantic, which initially made a minority investment in October 2016, has three priorities for Joe & the Juice: accelerate expansion in international markets, capitalize on customer demand, and build digital channels.”, QSR Magazine, November 14, 2023

“Retail Food Group acquires Beefy’s Pies in major business deal – An Aussie award winning pie company has been sold to a major food and beverage group for $10 million. With stores in Gympie, Brisbane and on the Sunshine Coast, Beefy’s Famous Aussie Pies is an institution for many visitors to the southeast Queensland region. RFG CEO Matt Marshall said there was a number of appealing factors for acquiring Beefy’s, including its loyal customer base and its ability to foster a passionate business model since it opened its first store in 1997.”, News.com.au, November 30, 2023. Compliments of Jason Gehrke, The Franchise Advisory Centre, Brisbane

“Yum’s KFC division agrees to acquire more than 200 KFC restaurants in the UK and Ireland from franchisee EG Group – The deal “represents a significant opportunity to accelerate KFC’s growth strategy in the large and growing UK and Ireland chicken market, with high average unit volumes and robust margins,” the companies said in a joint statement. No financial terms were disclosed, but the deal is expected to close by the end of the first half of 2024.”, Market Watch, December 6, 2023

“McDonald’s Targets 50,000 Restaurants in Expansion Blitz – Most new stores will be in international licensed markets. The chain currently has more than 41,000 restaurants and already committed to opening an extra 2,000 by the end of this year. The new target highlights the burger giant’s stepped-up ambitions as it looks for its next leg of growth.”, Bloomberg, December 6, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

To receive this biweekly newsletter, click here : https://bit.ly/geowizardsignup

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, the franchise sector, economic development and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing environment. Our GlobalTeam™ on the ground covering 25+ countries provides us with updates about what is actually happening in their specific countries.

William “Bill” Edwards: Global Advisor Is Uniquely Qualified to Steer Sr. Executives Successfully Through the Complex Waters of Going Global. With four decades of successful international business experience spanning virtually every corner of the world and many business sectors, Bill Edwards understands the global business landscape like no other. He has been a County Master Franchisee in five countries in Asia, Europe and the Middle East; the Senior VP for a franchisor operating in 15 countries and a full-service consultant taking 40 franchisors global.

For a complimentary 30-minute consultation on how to take your business global successfully, contact Bill Edwards at bedwards@edwardsglobal.com or +1 949 224 3896.

And download our latest chart ranking 40+ countries as places to do business at this link:

Our latest GlobalVue™ 40 country ranking

EGS Biweekly Global Business Newsletter Issue 96, Tuesday, November 28, 2023

Edited and curated by: William (Bill) Edwards, CFE, CEO of Edwards Global Services, Inc. (EGS)

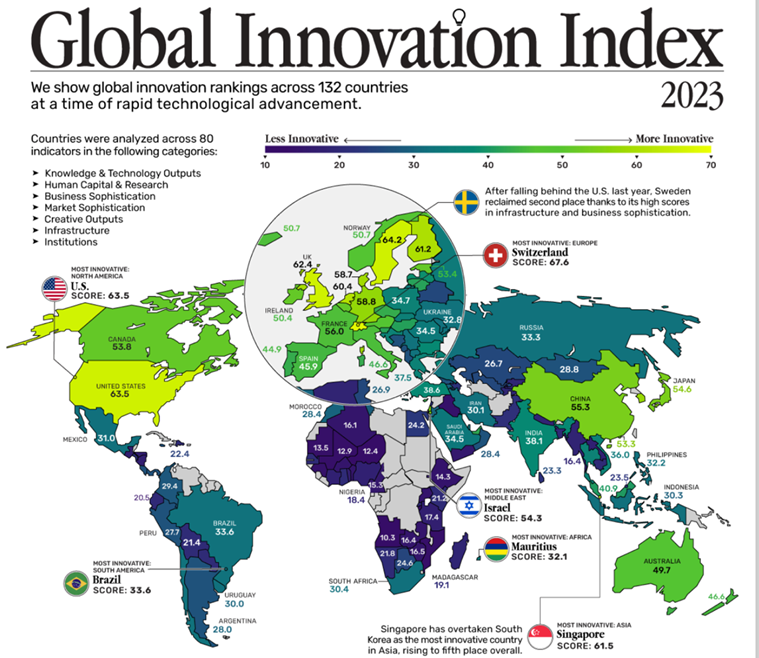

Introduction: In this issue, each day 70 million people visit McDonald’s 40,000 restaurants worldwide. The hours we work each week vary widely by country. Switzerland, Sweden, the United States, the United Kingdom, and Singapore lead the Global Innovation Index this year. And governments are expected to spend $2 trillion on interest on their debt this year.

The mission of this newsletter is to use trusted global and regional information sources to update our 1,400+ readers in 20+ countries on key global and local trends that can impact the success of their businesses at home and abroad.

NOTE: Some of the sources that we provide links to require a paid subscription to access. We subscribe to 40 international information sources to keep our readers up to date on the world’s business.

To receive this biweekly newsletter that is read by over 1,400 people in 20 countries, click here: https://bit.ly/geowizardsignup

First, A Few Words of Wisdom From Others For These Times

“Every problem is a gift — without problems we would not grow.”, Tony Robbins, motivational speaker and writer

“Only those who will risk going too far can possibly find out how far one can go.”, T.S. Eliot

“The journey of a thousand miles begins with a single step.”, Lao Tzu, Chinese Taoist philosopher

Highlights in issue #96: