EGS Biweekly Global Business Newsletter Issue 101, Tuesday, February 6, 2024

Edited and curated by: William (Bill) Edwards, CFE, CEO of Edwards Global Services, Inc. (EGS)

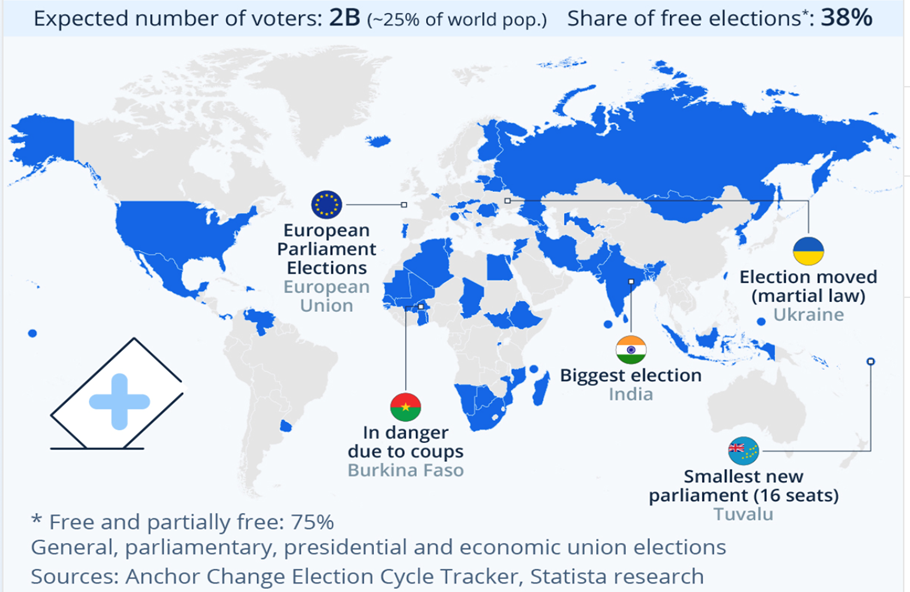

Introduction: This year 64 countries covering 49% of the world’s population and 57% of the world’s GDP will have elections that will impact global business. The European Union is about to finalize their Artificial Intelligence Act. Has the world passed ‘Peak Child’? Growth of established Western brandcd continues in China. Red Sea challenges grow.

To receive this currently free biweekly newsletter every other Tuesday in your email, click here: https://bit.ly/geowizardsignup

The mission of this newsletter is to use trusted global and regional information sources to update our global readers on key global and local trends that can impact the success of their businesses at home and abroad.

NOTE: We subscribe to about 40 international information sources to keep our readers up to date on the world’s business. Some of the information sources that we provide links to require a paid subscription for our readers to access.

First, A Few Words of Wisdom From Others For These Times

“A people free to choose will always choose peace”, President Ronald Reagan

“Time is what we want most, but what we use worst.”, William Penn

“Even if you’re on the right track, you’ll get run over if you just sit there.”, Will Rogers

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Highlights in issue #101:

The World Has Passed ‘Peak Child’

EU Artificial Intelligence Act

Why US small businesses will lead in AI investments in 2024

Big businesses take more space in London

Big Brands Are Playing the Long Game in China

(U.K.) Business confidence at its highest for January in eight years

Brand Global News Section: Body Shop®, Pizza Inn®, School of Rock®, Starbucks® and STRONG Pilates®

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Interesting Data, Articles and Studies

2024 will see elections in 64 countries covering 49% of world’s population and 57% of the world’s GDP. These elections have the potential for major changes to economic policies in major business countries. Statista, January 2024

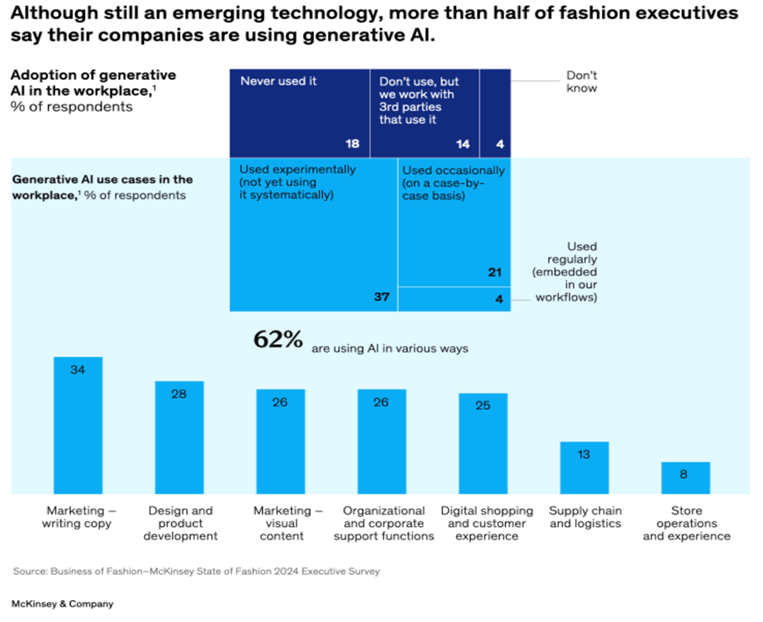

“Gen AI is so hot right now – The fashion industry has witnessed its share of ephemeral tech buzz, trends that disappear before they start. Generative AI, though, could have some staying power. Seventy-three percent of recently surveyed global fashion executives indicate generative AI will be a key priority for their businesses in the coming year, senior partner Achim Berg and colleagues note. And 62 percent of fashion leaders say their companies already use the technology, in areas such as online shopping assistance and writing product descriptions.”, McKinsey & Co., February 1, 2024

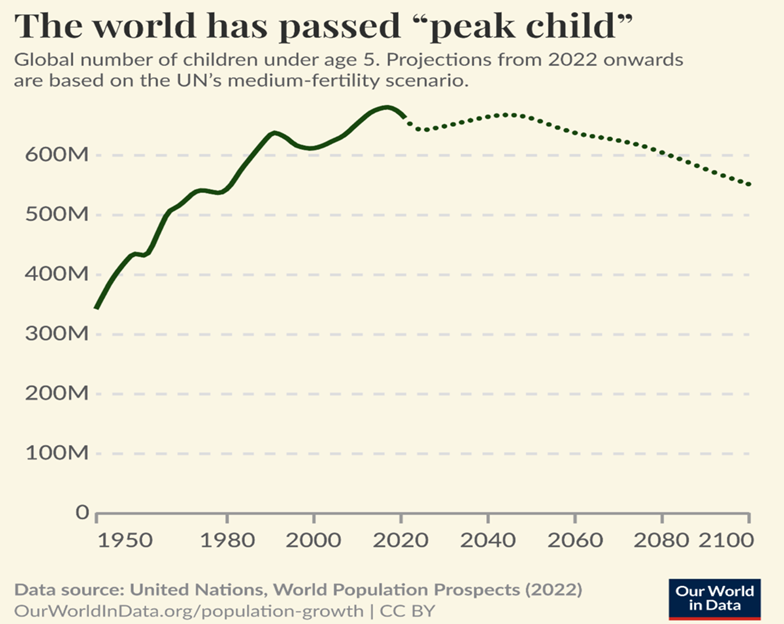

“The World Has Passed ‘Peak Child’ – Hans Rosling famously coined the term “peak child” for the moment in global demographic history when the number of children stops increasing. According to UN data, the world has now passed “peak child,” which is defined as the number of children under the age of five. The chart shows the UN’s historical estimates and projections of the global number of children under five. It estimates that the number of under-fives in the world peaked in 2017. Demographers expect a decades-long plateau before a more rapid decline in the second half of the century.”, Our World In Data, February 2, 2024

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

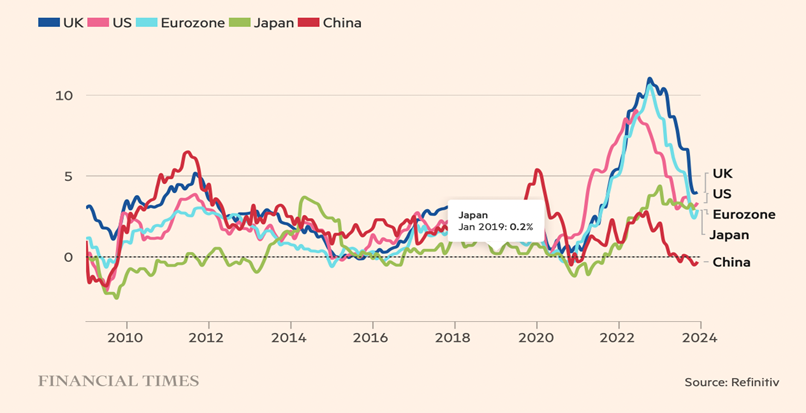

Global Supply Chain, Energy, Commodities, Inflation & Trade Issues

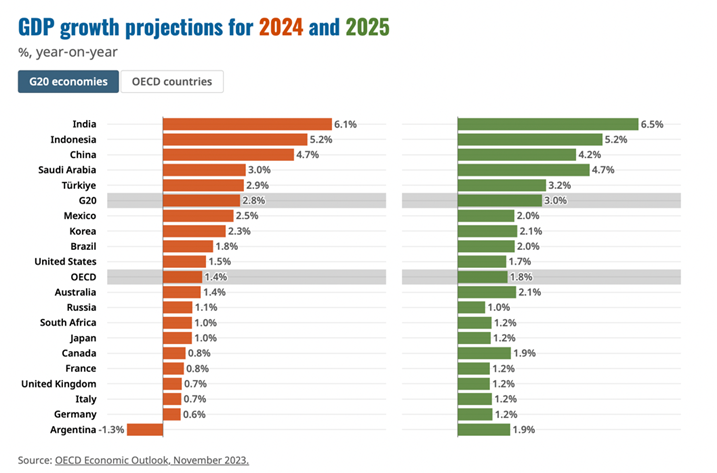

“Falling US inflation opens door to rate cuts within months, says OECD – Price pressures in UK forecast to be highest among G7 nations over next two years. The OECD’s interim outlook, published on Monday, predicted US inflation of just 2.2 per cent in 2024 and 2 per cent in 2025 — among the lowest rates in the G7. The Paris-based organisation said that only in Italy would price growth be less this year.”, The Financial Times, February 5, 2024

“Central bankers gear up for interest rate cuts – Policymakers may need to reduce the cost of credit sooner than they convey. Milton Friedman believed the “long and variable lags” of active monetary policy made its goal of hitting an inflation target essentially unachievable. Central bankers invoked these flaws earlier in this cycle to allay fears of runaway inflation, by claiming that their rate rises would eventually come to tame it. Now that price growth has fallen rapidly, they could end up contradicting themselves by being too slow to cut rates. Caution is understandable. Central bankers fear that inflation could bounce back. Wage growth is still high by historic standards.”, The Financial Times, February 1, 2024

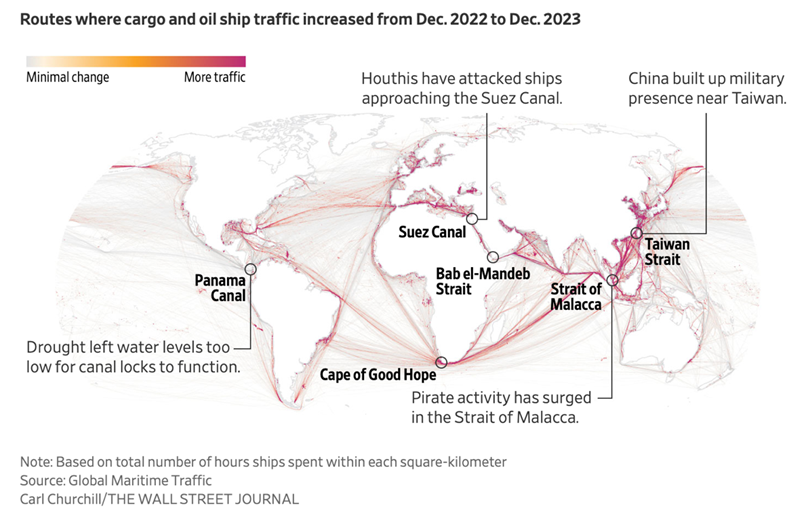

“On the High Seas, a Pillar of Global Trade Is Under Attack – Security crises from Red Sea to Black Sea pose a troubling question: How much has freedom of navigation been an anomaly? The modern economy rests on a rule so old that hardly anybody alive can remember a time before it: Ships of any nation may sail the high seas. Suddenly, that pillar of the international order shows signs of buckling.”, The Wall Street Journal, February 1, 2024

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Country & Regional Updates

Asia

“Factories in developing Asia may have seen the worst of manufacturing slump – South Korea’s S&P manufacturing PMI recorded a first expansionary reading since June 2022. Similar readings for Vietnam, Indonesia, the combined ASEAN, Taiwan, Malaysia and Thailand also saw improvements in January from December. In its January forecast, the International Monetary Fund said it expects emerging economies in Asia to grow 5.2% this year — a 0.4 percentage point upgrade from its forecast in October. The IMF upped its global economic growth projection to 3.1% in 2024 due to the greater-than-expected resilience of the U.S. and several large developing economies as well as fiscal support in China.”, CNBC, February 1, 2024

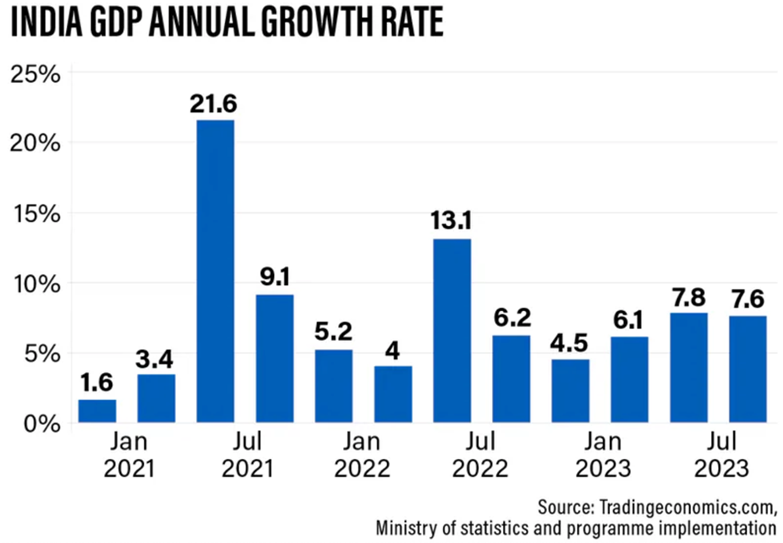

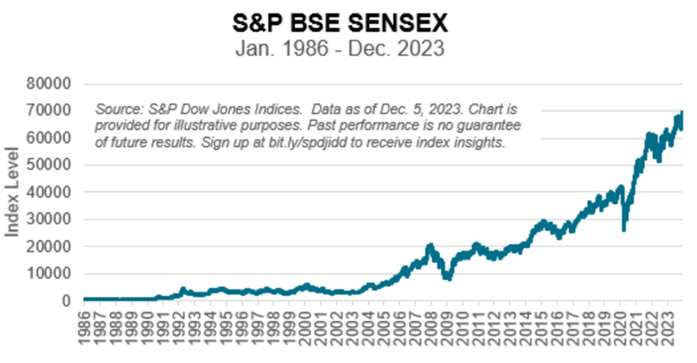

“IMF ups emerging Asia growth forecast, warns of China property risks but says India is a bright spot – IMF expects emerging economies in Asia to grow at 5.2% in 2024, a 0.4 percentage point upgrade from its forecast in October. It also estimates China’s economy will grow 4.6% in 2024, or 0.4 percentage point higher than the IMF’s forecast in October. Growth in India will remain strong at 6.5% in both 2024 and 2025, according to the IMF, on resilient domestic demand. The IMF also lifted its global growth forecast on the unexpected strength of the U.S. economy and fiscal support measures in China. It expects 3.1%, global growth this year, up 0.2 percentage point from its October projection, followed by a 3.2% expansion in 2025.”, CNBC, January 30, 2024

Brazil

“Volkswagen Investing $1.8 Billion in Brazil – Betting on Hybrids Carmaker plans flex, hybrids and electric models by 2028 Resources to be directed to all of brand’s factories in Brazil. The German carmaker, which wants to boost its profits in the region, announced the initiative a week after General Motors Co. disclosed plans to invest 7 billion reais in Brazil through 2028.”, Bloomberg, February 1, 2024

China

“‘Uninvestable’: China’s $2tn stock rout leaves investors scarred – Some global fund managers fear government efforts to stabilise the market are too little, too late. Chinese authorities’ promise of “forceful” measures last week was their most vocal attempt yet to halt a stock market sell-off that has wiped out almost $2tn in value. For many investors at a Goldman Sachs conference in Hong Kong, that vow was too little, too late. More than 40 per cent of those surveyed while attending a session on Chinese equities held by the US bank on Wednesday said they believed the country was ‘uninvestable’”., The Financial Times. February 2, 2024

“Big Brands Are Playing the Long Game in China – Apple, Mondelez and Procter & Gamble are bullish on consumer spending growth in China despite recent economic turmoil there. For years, the world’s biggest companies poured into China, enticed by the promise of generating hefty revenue from a growing class of consumers. China is now grappling with significant youth unemployment, dour economic forecasts and the collapse of what was once the country’s largest property developer. While U.S. executives have lamented weaker demand for some consumer products in China during earnings calls in recent weeks, a breakup is unlikely soon.”, The Wall Street Journal, February 4, 2024. Compliments of Paul Jones, Jones & Co., Toronto

European Union & Eurozone

“EU Artificial Intelligence Act — Final Form Legislation Endorsed by Member States – The long-awaited proposed AI Act, once enacted, will be a comprehensive cross-sectoral regulatory framework for artificial intelligence (AI). Its aim is to regulate the development and use of AI by providing a framework of obligations for parties involved across the entire AI supply chain. As with the General Data Protection Regulation (GDPR), the EU is seeking, through its first-mover advantage, to set the new global standard for AI regulation.”, Faegre Drinker, February 5, 2024

India

“India Cuts Tariffs to Entice More iPhone Manufacturing – Country lowering import taxes on smartphone components Move set to make assembly in India more cost-effective. ndia is reducing import taxes on several mobile-device components to boost smartphone production, a boon for companies like Apple Inc. that are increasingly considering the country as a global manufacturing base. Modi is trying to make India an electronics manufacturing powerhouse, luring global brands such as Apple away from China. At the same time, he’s trying to build an ecosystem of domestic suppliers to ensure India grabs a larger part of the value chain instead of being just an assembly location.”, Bloomberg, January 31, 2024

South Korea

“South Korea’s Exports Get off to Strong Start in 2024 – Exports from Asia’s fourth-largest economy rose 18.0% in January from a year earlier. January’s result marked a fourth consecutive month of expansion in exports for South Korea—the latest of a series of signs pointing to a recovery in global trade. Shipments grew at a stronger-than-expected pace, handily beating the median forecast from 11 economists polled by The Wall Street Journal for a 16.8% rise.”, The Wall Street Journal. January 31, 2024

Saudi Arabia

“Saudi Arabia Unveils Initiatives to Attract Global Investors and Entrepreneurs – In a strategic move to entice global investors and skilled professionals, Saudi Arabia has taken significant steps, opening its sectors to public-private partnerships, implementing new regulations for foreign companies, and launching the regional headquarters program. As part of its ambitious Vision 2030, the kingdom aims to host 480 global company headquarters by the end of the decade.”, Franchise Talk, January 22, 2024

Turkey

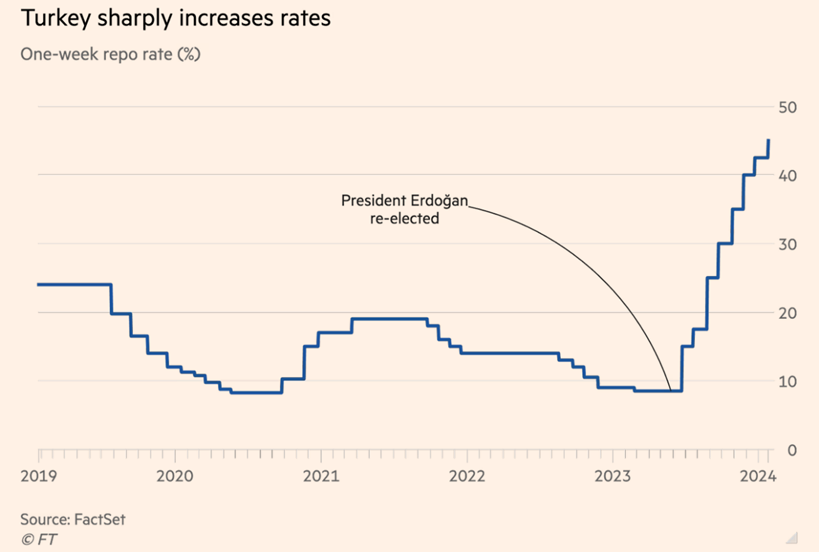

“Turkey still must shake off its inflation addiction – A target of low double-digit percentage price growth will do. Turkey’s devastating earthquakes one year ago horrified the nation. The disaster brought a shake-up in economic policy as well. Soaring annual price inflation, over 50 per cent, forced President Recep Tayyip Erdoğan to deal with the inflationary scourge — embracing economic orthodoxy in the form of higher interest rates.”, The Financial Times – February 5, 2024

United Kingdom

“Big businesses take more space in London – The number of companies looking for new offices in London is at its highest level in a decade, with leasing agents working to find 12 million sq ft of space for their clients. About 80 per cent of companies in the market for a new office are looking for either the same amount of space or more, Knight Frank found. However, there is a shortage of the most modern, eco-friendly office blocks that corporate renters are demanding. As such, companies are battling it out for high-end offices, rents for which are increasing quickly.”, The Times of London, January 30, 2024

“UK Border Checks on Food Begin on Brexit’s 4th Anniversary – Starting Wednesday, which marks the fourth anniversary of Brexit, health certificates will be required for medium- to high-risk foods, such as eggs for hatching, milk, cheese, fish and meat. It’s the latest stage of Britain’s split from the European Union. All this is coming just as the UK’s sticky consumer price inflation rate was finally coming down. Government officials are confident the introduction of paperwork checks will go smoothly, ahead of further physical checks to be introduced starting in April.”, Bloomberg, January 31, 2024

“(U.K.) Business confidence at its highest for January in eight years – Widespread anticipation of several interest rate cuts by the Bank of England this year has bolstered business confidence. Inflation is expected to continue its descent in the first half of this year, with several economic consultancies projecting that the rate will be back to the Bank of England’s 2 per cent target by April from its present level of 4 per cent.”, The Times of London, January 25, 2-24

United States

“Small Businesses Upbeat About 2024 Performance, Says Goldman Sachs Survey – While fundamental optimism is spreading, access to capital and high interest rates is stressing out Main Street and Wall Street. Of the 1,459 businesses that responded to the most recent 10,000 Small Businesses Voices survey from Goldman’s small business unit, 75 percent were positive about their financial prospects for the year, according to a summary released by the investment bank. The upbeat views contrast with respondents’ concerns and challenges: 71 percent said inflationary pressures increased for their businesses over the past three months, and 77 percent remain concerned about their ability to access capital.”, INC., February 2, 2024

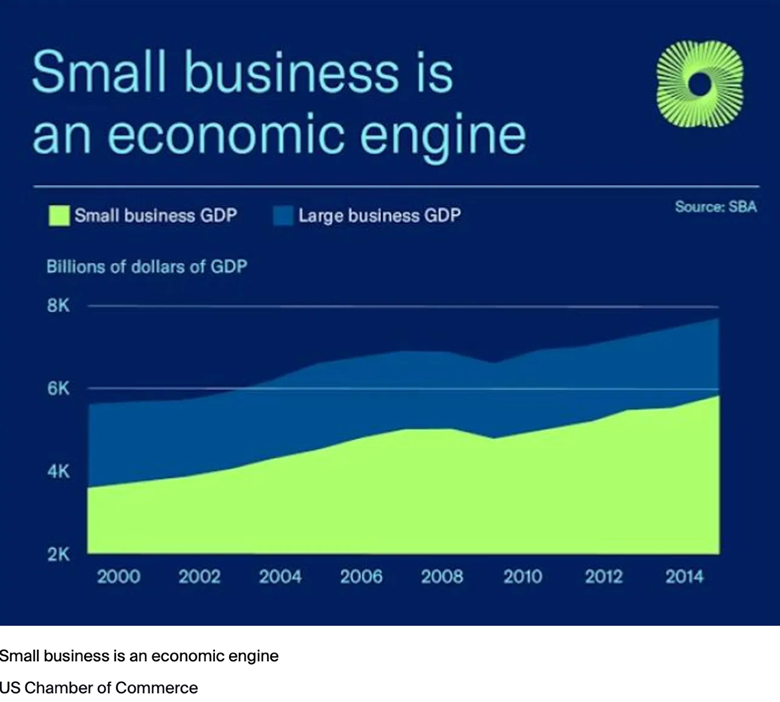

“Why US small businesses will lead in AI investments in 2024 – A new survey of US small business owners finds that 60% seek to improve productivity and communications by allocating bigger budgets to new technologies like artificial intelligence. Small businesses employ nearly half of the entire American workforce and represent 43.5% of America’s GDP. They are a critical part of our economic ecosystem, where big businesses and small businesses are vendors, employees, partners, and customers to each other.”, ZDNET, February 2, 2024

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Brand & Franchising News

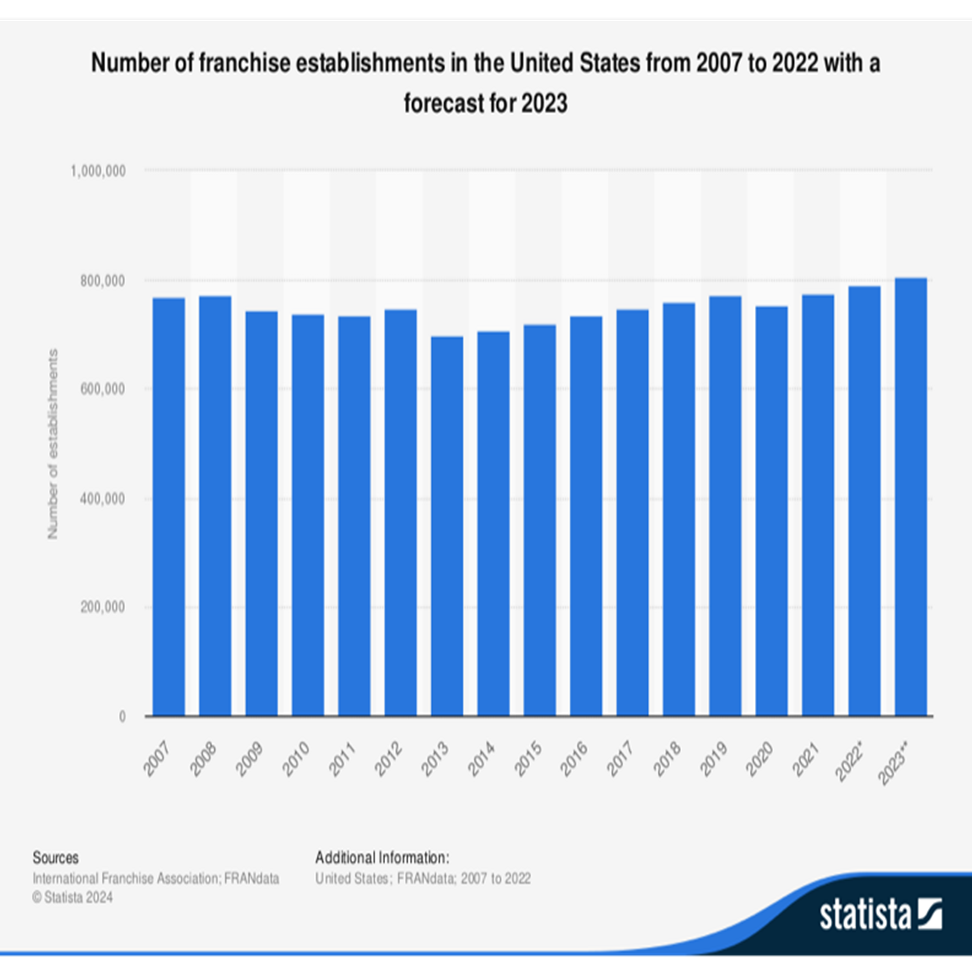

From a recent study by the International Franchise Association and FRANdata

“Under New Ownership, The Body Shop Is Shedding Most European and Some Asian Business – Financial terms of the deal, which includes both physical and digital operations, were not disclosed. The part of the activity effected equals to about 14 percent of The Body Shop’s business worldwide. The sale does not impact its global head franchise partners, which operate on a country or territory level, but some sub-franchise partners are to be included in the sale.”, WWD, February 1, 2024

“Pizza Inn and New Franchise Partner Team Up to Bring 50 New Locations to Saudi Arabia – Pizza Inn today announced a major franchise agreement with Blessings Basket Company for Serving Food to substantially expand its footprint in the Kingdom of Saudi Arabia. The 50-unit deal will kick off with the opening of the first two locations in January 2024.”, Franchising.com, February 4, 2023

“School of Rock Awards Master Franchise Agreement for Four New Countries – School of Rock announced today that Matias Puga Hamilton, School of Rock’s Latin America master franchisee, is set to double his portfolio with the brand with 13 new locations throughout Argentina, Bolivia, Ecuador and Uruguay. Beginning with a primary focus on Argentinian development, Matias Puga Hamilton awarded his first sub-franchise rights for a new School of Rock location in Buenos Aires’ northern suburbs, specifically in the Nordelta area. Sub-franchisees Roberto Sambrizzi and Fernando Tuer aim to open the school in April 2024.”, Franchising.com, February 4, 2024

“STRONG Pilates Launches in Japan – STRONG Pilate has announced the appointment of STRONG Pilates Japan (SPJ) as its master franchisee partner. Established by Chair and CEO, John B. Boardman, with extensive experience and success in the fitness market in Japan, SPJ plans to roll out 50 studios in Japan over the next 5 years.”, Franchising.com, February 4, 2024

“Starbucks stores on Chinese mainland exceed 7,000 – During a conference call on Wednesday, Belinda Wong, chairperson and CEO of Starbucks China, said that in January 2024, the company had achieved a milestone in the Chinese mainland market by surpassing 7,000 stores, while adding that Starbucks is dedicated to reaching its goal of 9,000 mainland stores by 2025. The year 2024 marks the 25th anniversary of Starbucks entering the Chinese mainland market. Wong said Starbucks will accelerate its expansion into more communities, aiming to provide high-quality coffee and the unique Starbucks experience to a broader range of Chinese customers.”, Shine.cn, January 31, 2024. Compliments of Paul Jones, Jones & Co., Toronto

This issue we are sharing an interesting franchise sector a book written by Gary Prenevost, a long-time franchise industry thought leader long-time relationship partner of ours has just been picked for USA Today’s top 10 business books to help you scale in 2024. The ‘Unstoppable Franchisee’ addresses several core operational challenges and is entirely focused on helping existing franchisees take their business to the next level. The book made the USA top 10 list and highly suggest you recommend this book to your franchisees to read as part of their growth plans in 2024.

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

To receive this biweekly newsletter, click here : https://bit.ly/geowizardsignup

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, the franchise sector, economic development, and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing environment. Our GlobalTeam™ on the ground covering 25+ countries provides us with updates about what is actually happening in their specific countries.

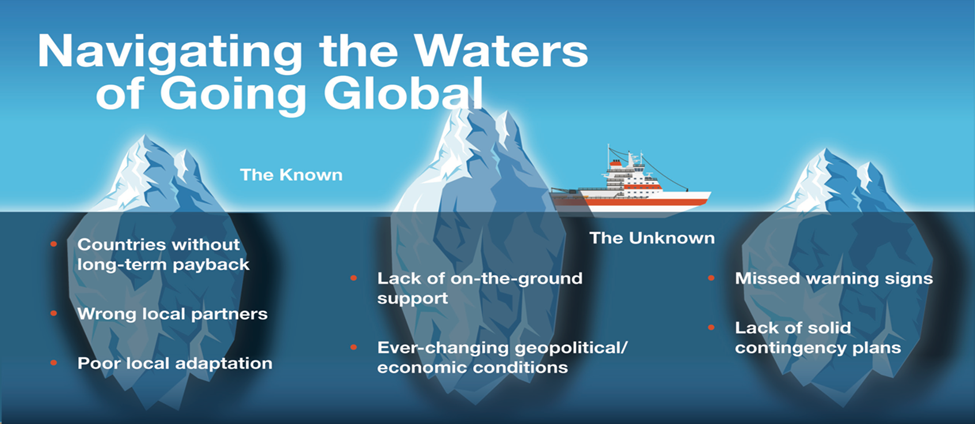

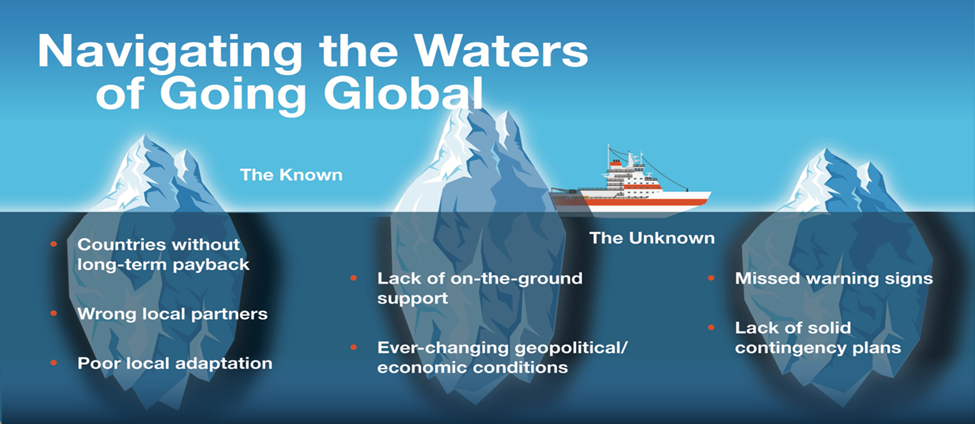

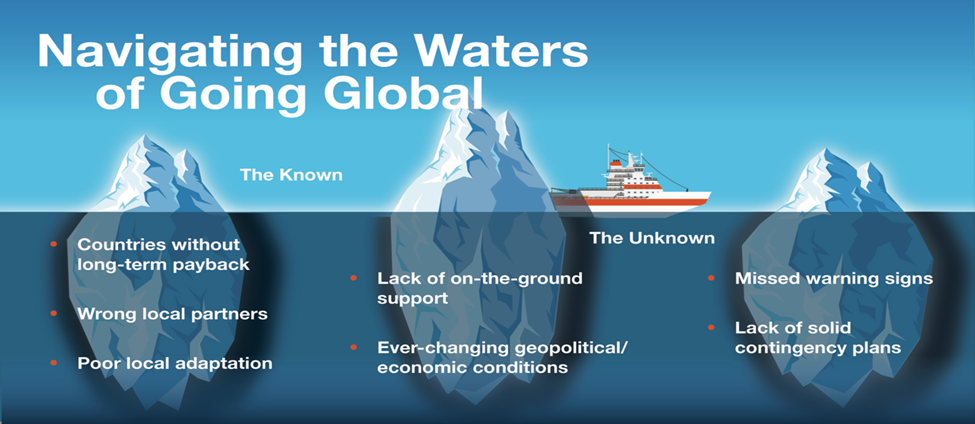

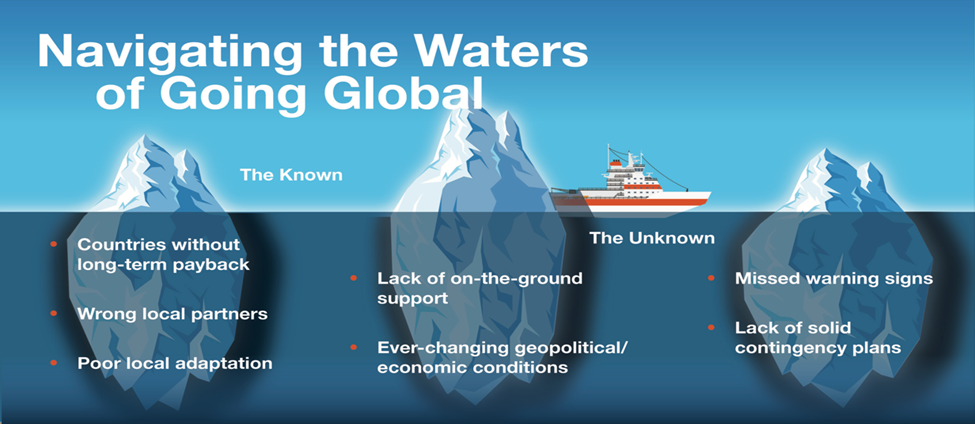

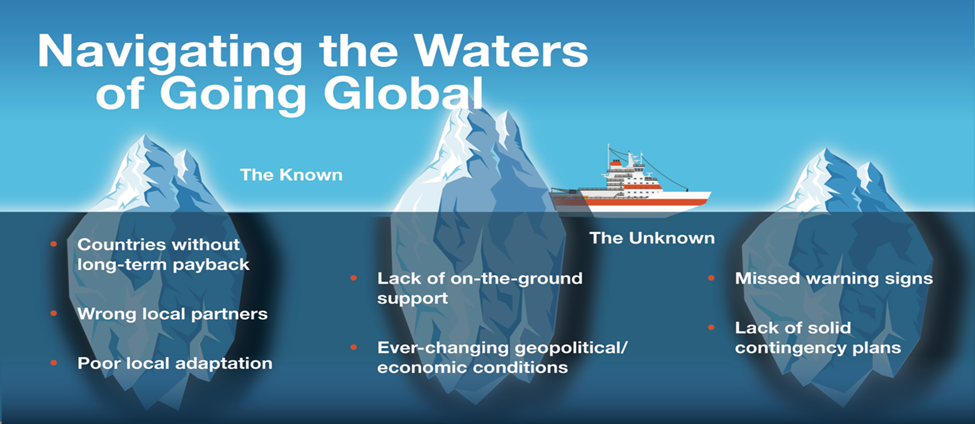

William “Bill” Edwards: Global Advisor Is Uniquely Qualified to Steer Sr. Executives Successfully Through the Complex Waters of Going Global. With four decades of successful international business experience spanning virtually every corner of the world and many business sectors, Bill Edwards understands the global business landscape like no other. He has been a County Master Franchisee in five countries in Asia, Europe and the Middle East; the Senior VP for a franchisor operating in 15 countries and a full-service consultant since 2001 taking 40 franchisors global.

For a complimentary 30-minute consultation on how to take your business global successfully, contact Bill Edwards at bedwards@edwardsglobal.com or +1 949 224 3896.

And download our latest chart ranking 40+ countries as places to do business at this link:

Our latest GlobalVue™ 40 country ranking

EGS Biweekly Global Business Newsletter Issue 100, Tuesday, January 23, 2023

Edited and curated by: William (Bill) Edwards, CFE, CEO of Edwards Global Services, Inc. (EGS)

Introduction: Welcome to the 100th edition of my biweekly global business update newsletter. It started on March 30th, 2020, as a report to companies we were helping take their brands into new countries. International travel had stopped due to COVID. But the companies wanted to know what was going on in countries where they already had operations and/or were in negotiations with potential partners in a country.

My team and I added to the information sources we were already monitoring to eventually daily monitor 40 publications. And we expanded our communication with the more than 20 Country Associates who helped us find partners for our clients. 100 biweekly editions later more than 1,400 people in more than 20 countries read this diverse report that watches countries, business sectors and trends that impact global business.

This issue continues to look at trends and events that impact the ability of companies to expand their business into new countries successfully. Thanks to our readers for your time to read this newsletter and for your input.

To receive this currently free biweekly newsletter every other Tuesday in your email, click here: https://bit.ly/geowizardsignup

The mission of this newsletter is to use trusted global and regional information sources to update our global readers on key global and local trends that can impact the success of their businesses at home and abroad.

NOTE: We subscribe to about 40 international information sources to keep our readers up to date on the world’s business. Some of the information sources that we provide links to require a paid subscription for our readers to access.

First, A Few Words of Wisdom From Others For These Times

“There is no such thing as a normal period of history. Normality is a fiction of economic textbooks.”, Joan Robinson

“Opportunities multiply as they are seized.”, Sun Tzu

“Don’t judge each day by the harvest you reap, but by the seeds you plant.”, Robert Louis Stevenson

Highlights in issue #100:

- Brand Global News Section: Burger King®, Jimmy Johns®, and Papa Johns®

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Interesting Data, Articles and Studies

Research across many sources yielded the topics above on what will impact doing business around the world in 2024. Perhaps the most important is the fact that 64 countries will see elections this year covering 49% of the world’s population and 50% of the world’s Gross Domestic Product (GDP). Elections have consequences. Elections often mean changes in economic policies which impact a company’s ability to do business in a country. From a presentation by William (Bill) Edwards to the 4th Annual Growth & Scale Summit – AI Transformation on January 18, 2024, at the University of California, Irvine’s Beall Applied Innovation Center put on by the Executive Next Practices Institute. (https://enpinstitute.com)

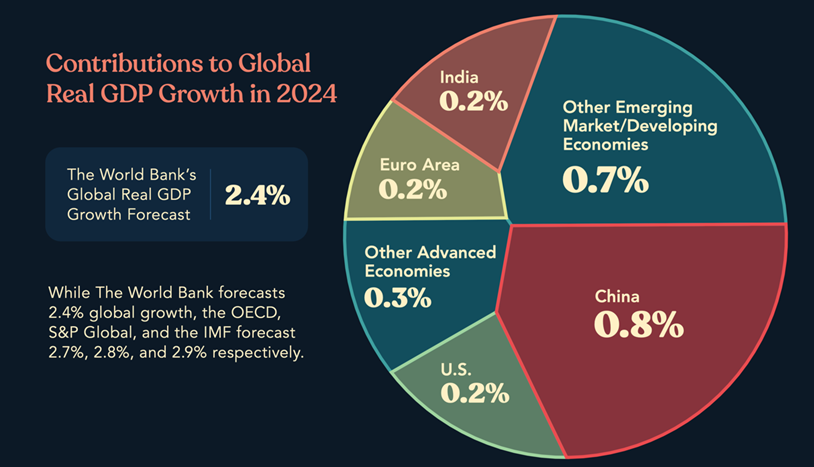

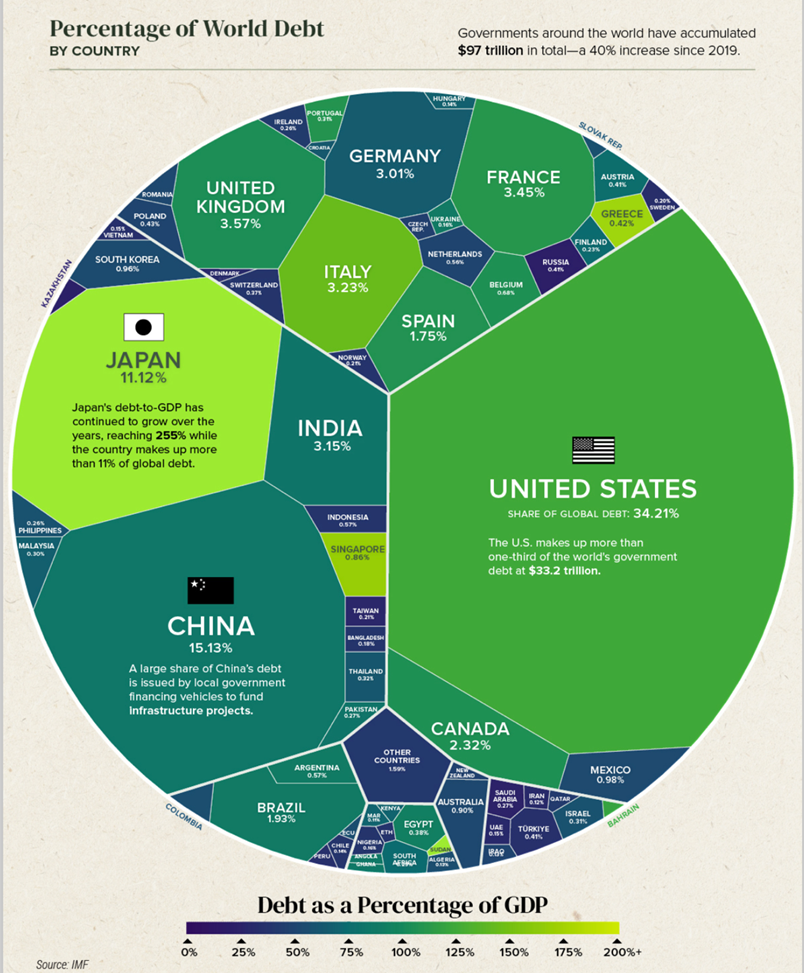

“Global Economic Prospects – Global growth is set to slow further this year, amid the lagged and ongoing effects of tight monetary policy, restrictive financial conditions, and feeble global trade and investment. Downside risks to the outlook include an escalation of the recent conflict in the Middle East and associated commodity market disruptions, financial stress amid elevated debt and high borrowing costs, persistent inflation, weaker-than-expected activity in China, trade fragmentation, and climate-related disasters.”, The World Bank and Visual Capitalist, January 2024

“Davos 2024: Global elite gather against WEF’s most complex backdrop so far – A challenging global economic picture, with shifting interest rate policies and rising debt, will also confront the central bankers, financiers and business leaders attending. Geopolitical risks have mounted around the globe in recent years, with Russia’s war in Ukraine and Israel’s war with Hamas militants, and the recent related impact on shipping in the Red Sea. China, meanwhile, has been increasing military pressure to assert sovereignty claims over Taiwan.”, Reuters, January 11, 2024

“Amazon CEO Andy Jassy says AI is both the biggest risk and biggest opportunity facing companies in 2024 – Companies around the world are all facing an interesting dilemma in 2024, according to Amazon CEO Andy Jassy: their biggest problems and solutions might be one and the same. ‘The opportunity and risk is pretty similar in that there is this wildly transformative, disruptive technology in generative AI that you can’t get through any conversation without talking about,’ Jassy says. At a dinner in Davos, Switzerland, on Thursday, Jassy told Fortune CEO Alan Murray that prior to the pandemic, companies were largely moving to modernize their preexisting technology to innovate and lower costs.”, Fortune, January 18, 2024

“Confidence improves as CEOs wait for takeoff – The Q4 Vistage CEO Confidence Index rose 6 points to reach 82.0 — the fifth time in six quarters — and while optimism is improving, the historical lows of economic confidence show that takeoff is still delayed. Despite healthy GDP in 2023, CEOs’ concerns regarding the current and future economy stay within ranges not seen since the waning days of the Great Recession in 2008. Compared to Q4 2022, both expectations for the next 12 months and a review of last year are well above the lows hit in Q2 2022, yet still well below the norm established during the rising economic tide of the 2010s.”, Vistage, January 2024

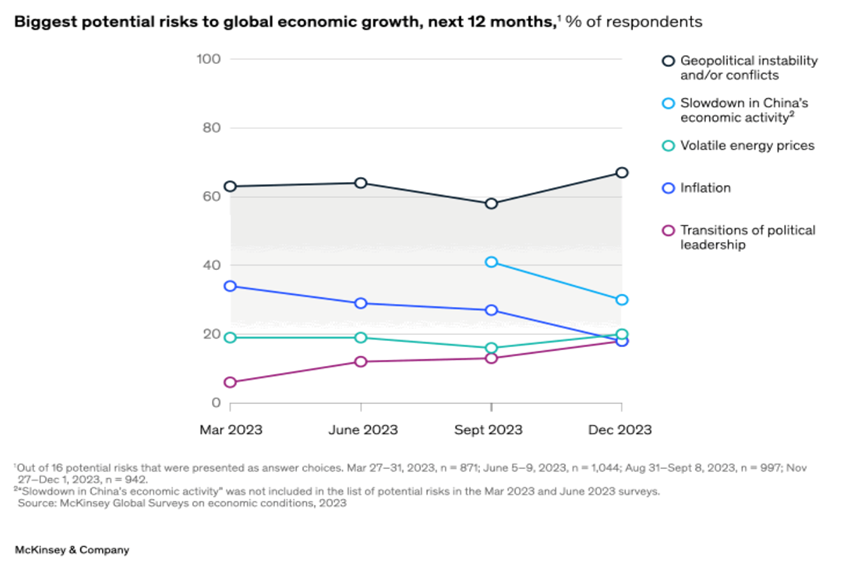

“Geopolitical conflicts loom large – Geopolitical instability has risen as a potential threat to global growth for 2024, cited by 67 percent of executives in a recent McKinsey Global Survey. Concerns about transitions of political leadership also rose, senior partner Sven Smit and colleagues find. Fears about inflation, meanwhile, have continued to recede, dropping from more than 30 percent in March 2023 to less than 20 percent at the end of the year.”, McKinsey & Co., January 16, 2024

“Life in a New Normal: Navigating our way into an uncertain future – Ever since the pandemic began, pundits have been trying to predict the glide path for returning to normal, with “normal” implicitly defined by the way things were in the before times. The problem is the way of life we knew—socially, culturally, economically—has irrevocably changed. It’s impossible to go through a major collective event, such as the pandemic, without having alterations to the way we view…For investors and business owners, this has made the intervening years exceedingly treacherous to navigate. The rules seemed to have changed overnight about how consumers purchase, how (and where) employees want to work, and how suppliers want to do business. Millions of decisions, large and small, had to be renegotiated not just once, but many times.”, Franchising.com, December 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global Supply Chain, Energy, Commodities, Inflation & Trade Issues

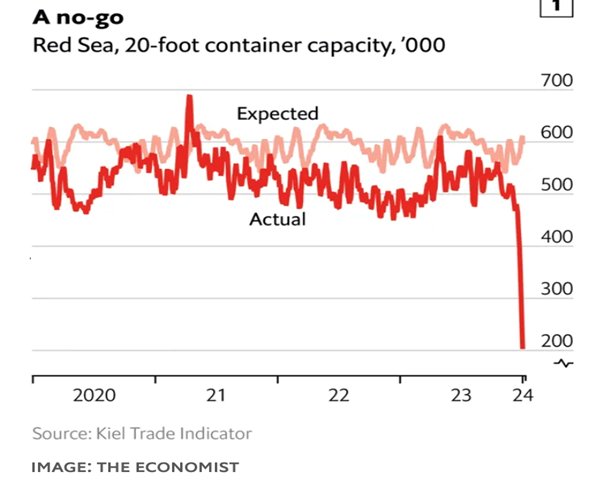

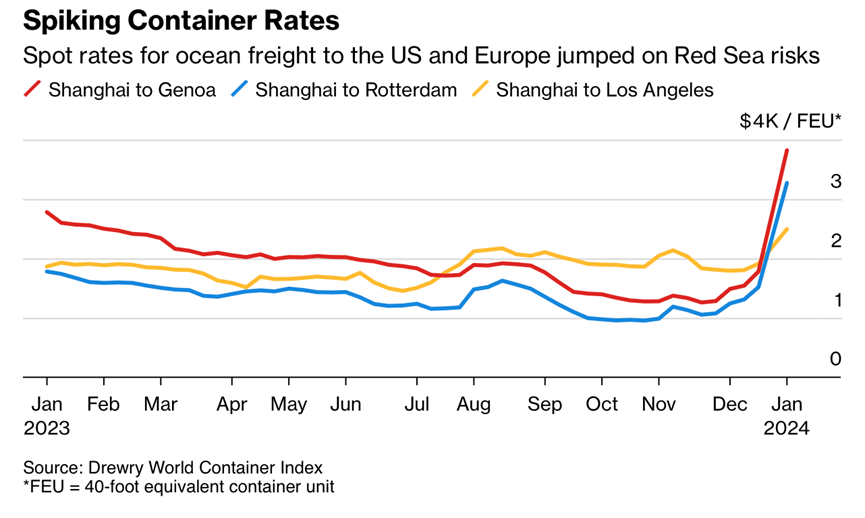

“Tracking ships in the Red Sea – More than 200 container ships travelled through the Red Sea and the Suez Canal between January 4th and 11th last year. During the same week in 2024 only 122 dared to make the journey. Container firms accounting for 95% of the capacity that usually sail the Suez have suspended services in the area. A few energy firms, such as BP and Equinor, have also temporarily stopped using the canal. By January only 200,000 standard containers were passing through the waterway per day, compared with around 450,000 in December 2022—the lowest point of the pandemic. Instead of sailing through the Red Sea, ships travelling between Asia and Europe are now being re-routed around Africa and the Cape of Good Hope.”, The Economist, January 18, 2024

“Ocean Premiums Rocket – The Red Sea Crisis and its Ripple Effects on Global Shipping. The Red Sea crisis is unleashing unprecedented challenges on the global shipping industry, notably marked by a staggering surge in ocean freight rates. Major shipping companies are diverting vessels due to the looming threat of Houthi attacks, leading to an abrupt spike in rates. Logistics managers are quoting rates as high as $10,000 per 40-foot container, a stark contrast to last week’s rates of $1,900 to $2,400. The rerouting of 158 vessels, carrying over $105 billion worth of cargo, intensifies strains on the supply chain.”, Alba Wheels Up, January 18, 2024

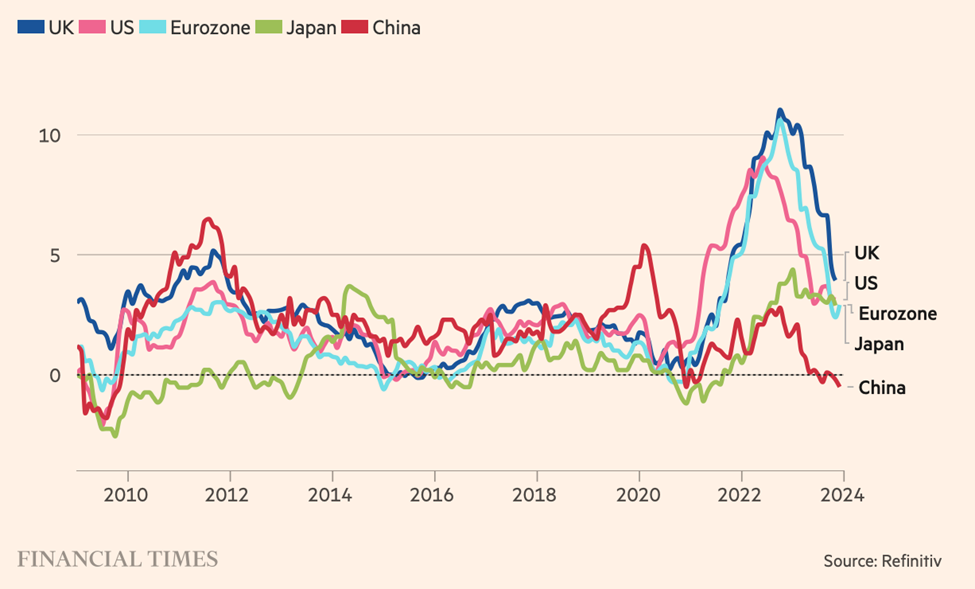

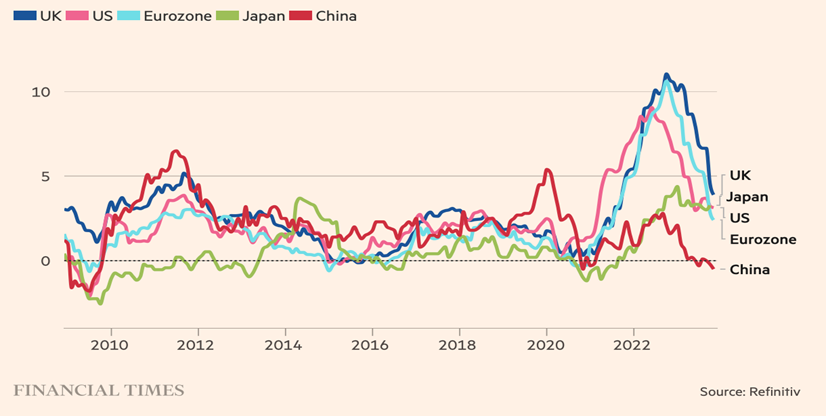

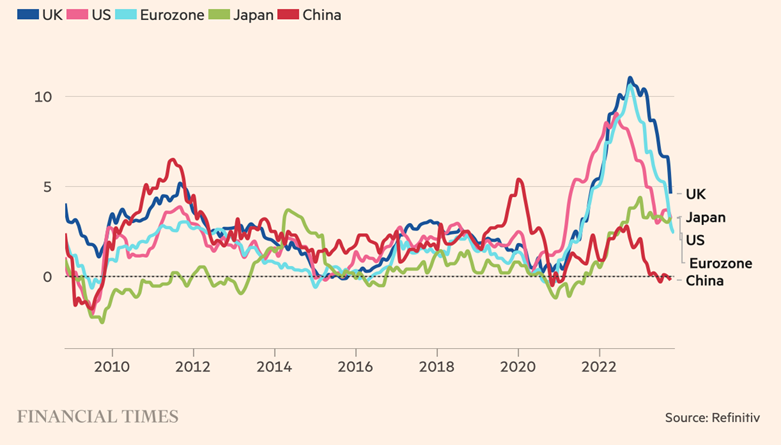

Annual % change in consumer price index

“Global Inflation Tracker – Inflation is easing from the multi-decade highs reached in many countries following Russia’s full-scale invasion of Ukraine. The latest figures for most of the world’s largest economies show the wholesale food and energy prices that soared during 2022 are now falling back.”, The Financial Times, January 16, 2024

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Country & Regional Updates

Australia

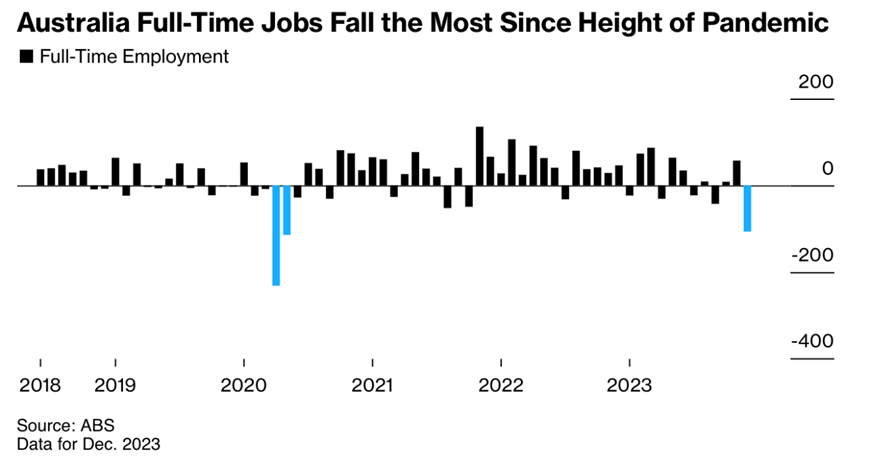

“Jobs Slump: Australia Briefing – Employment tumbled in December, boosting the odds of the Reserve Bank of Australia pivoting to monetary easing. The economy shed 65,100 roles, an unexpected outcome led by the biggest monthly drop in full-time employment since the height of pandemic, government data showed.”, Bloomberg, January 19, 2024

Canada

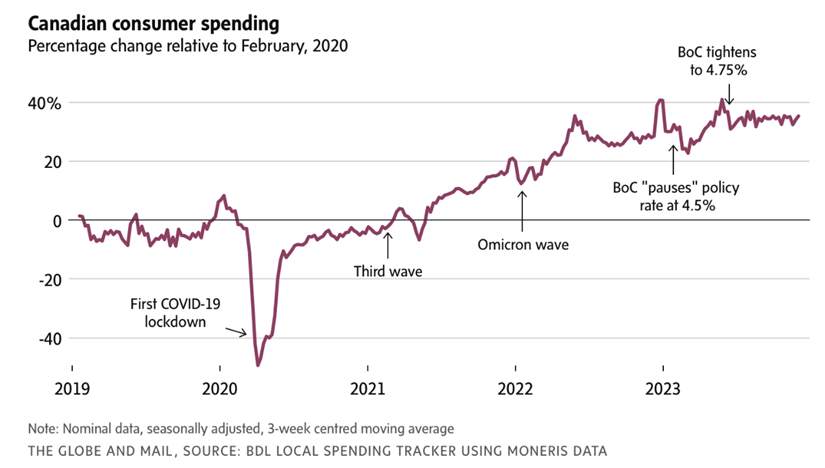

“Experts predict what’s to come for housing, jobs, wages, interest rates and more – Economists, academics, investors and business leaders pick a chart that highlights an issue that will be important to watch in 2024. After a year of surprising resilience in the face of high interest rates, Canada’s economy enters 2024 in an uneasy state. The Globe and Mail reached out to dozens of experts, including economists, academics, investors and business leaders, and asked them to each pick a chart that highlights an issue that will be important to watch in 2024 and explain why….”, The Globe and Mail, January 14, 2024

China

“China orders indebted local governments to halt some infrastructure projects-sources – China has instructed heavily indebted local governments to delay or halt some state-funded infrastructure projects, three people with knowledge of the situation said, as Beijing struggles to contain debt risks even as it tries to stimulate the economy. Increasing its efforts to manage $13 trillion in municipal debt, the State Council in recent weeks issued a directive to local governments and state banks to delay or halt construction on projects with less than half the planned investment completed in 12 regions across the country, the sources said.”, Reuters, January 19, 2024

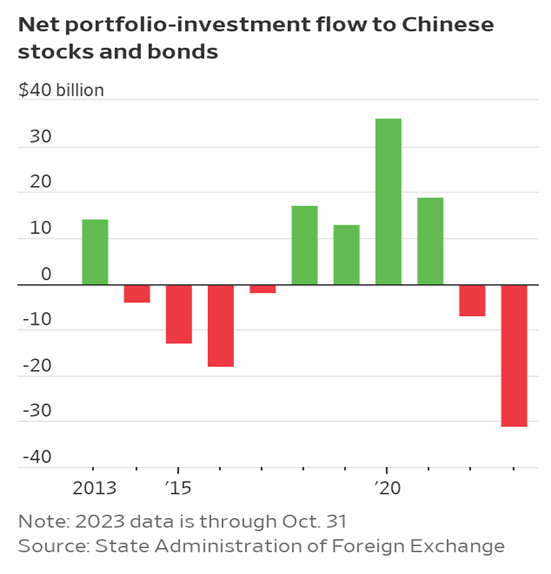

“Chinese stock rout accelerates as foreign investors sell out – Fall in Hong Kong and Chinese indices defies many Wall Street banks’ hopes of rebound after last year’s losses. International investors “just threw in the towel” after a speech by Premier Li Qiang at Davos on Tuesday lacked any hint of new government measures to boost the economy or financial markets, said the head of trading at one investment bank in Hong Kong. Foreign investors, who by the end of 2023 had sold about 90 per cent of the $33bn of Chinese stocks they had purchased earlier in the year, have continued selling this year. Year-to-date outflows more than doubled on Wednesday after Beijing confirmed China’s annual growth was the slowest in decades and revealed the country’s population decline had accelerated in 2023.”, The Financial Times, January 18, 2024

European Union & Eurozone

“Too early to say inflation is defeated, warns ECB – Many traders think the ECB will start loosening its policy in March and will deliver rate reductions of 125 to 150 basis points over the next 12 months. The deposit rate stands at 4 per cent, the highest point since the central bank was created in 1998. Rapidly declining inflation and poor economic growth have fuelled expectations for interest rate cuts. Carsten Brzeski, global head of macro at ING, the Dutch bank, said: “The European Central Bank (ECB) is more cautious about the growth outlook, but far from relaxed about inflation.”, The Times of London, January 15, 2024

“EV Sales Run Out of Juice in Europe as Germans Tighten Belts – Steep drop in electric sales in Germany was main factor in sending EU sales down for the first time in 16 months. Germany’s new-car market went into a free fall in December, led by a near halving of new electric-vehicle sales, pulling the sale of new EVs in the broader European Union down for the first time since early 2020. Automotive executives in Germany have been warning about an approaching cliff in EV sales for months, blaming the impending gloom on a combination of high manufacturing costs at home and a government decision to end incentives for consumers.”, The Wall Street Journal, January 18, 2024

India

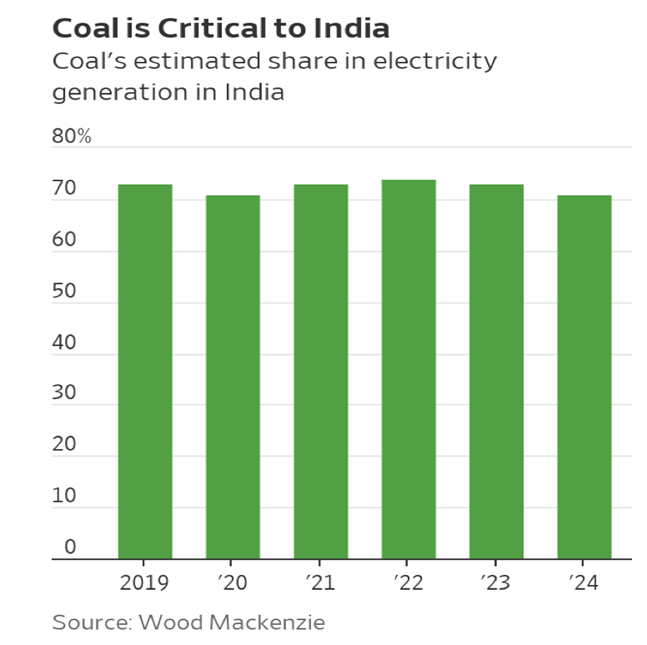

“Why India Isn’t the New China – The country’s population surpassed China’s last year. But India’s path forward is likely to look very different from its neighbor’s. There are plenty of reasons for optimism. The country’s population surpassed China’s last year. More than half of Indians are under 25. And at current growth rates, it could become the world’s third-largest economy in less than a decade, having recently overtaken the U.K., its old colonial ruler, for the no. 5 spot. While its labor resources are, in theory, plentiful, a host of barriers still make it difficult to connect workers with employers. Only a third of India’s female working-age population was in the labor force in fiscal year 2022. India’s love-hate relationship with trade is another problem”, Wall Street Journal, January 17, 2024

“India takes investment spotlight while risks weigh in China – Suntory CEO – Japanese drinks maker Suntory is prioritising expansion in India while taking a cautious stance on business in China, especially given concerns over spy laws recently used to detain foreign workers, Chief Executive Takeshi Niinami said in an interview. Suntory is looking for local partners in India to expand its drinks and nutrition businesses, he said, although in China, which he acknowledged is still an attractive market, he cannot justify sending in international staff for an investment push in the current environment.”, The Daily Mail, January 19, 2024

Middle East

“The Middle East faces economic chaos – Escalating conflict threatens to tip several countries over the brink. Just over 100 days after Hamas’s brutal attack on Israel started a war in Gaza, the conflict is still escalating. On January 11th America and Britain started attacking Houthi strongholds in Yemen, after months of Houthi missile strikes on ships in the Red Sea. Five days later Israel fired its biggest targeted barrage yet into Lebanon. Its target is Hizbullah, a militant group backed by Iran. A full-blown regional war has so far been avoided, largely because neither Iran nor America wants one. Yet the conflict’s economic consequences are already vast.”, The Economist, January 18, 2024

Singapore

“Singapore seeks expanded governance framework for generative AI – Looking to balance user security with innovation, Singapore wants feedback on proposed updated to the country’s existing artificial intelligence governance framework. Singapore has released a draft governance framework on generative artificial intelligence (GenAI) that it says is necessary to address emerging issues, including incident reporting and content provenance. The proposed model builds on the country’s existing AI governance framework, which was first released in 2019 and last updated in 2020.”, ZD Net, January 14, 2024

United Kingdom

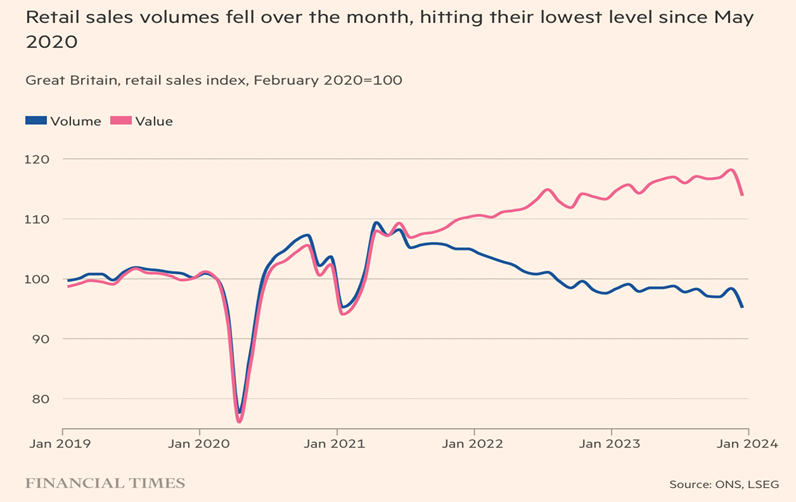

“British retail sales fell more than expected in run-up to Christmas – Figures raise risk that UK fell into technical recession at the end of 2023. The decline was much steeper than the 0.5 per cent fall forecast by economists polled by Reuters, and was the largest monthly fall since January 2021, when coronavirus restrictions hit sales. The fall was driven in part by people doing their Christmas shopping early, particularly during the Black Friday sale period in November, the ONS said. Economists also blamed high prices and borrowing costs for damping consumer confidence and spending power.”, The Economist, January 19, 2024

United States

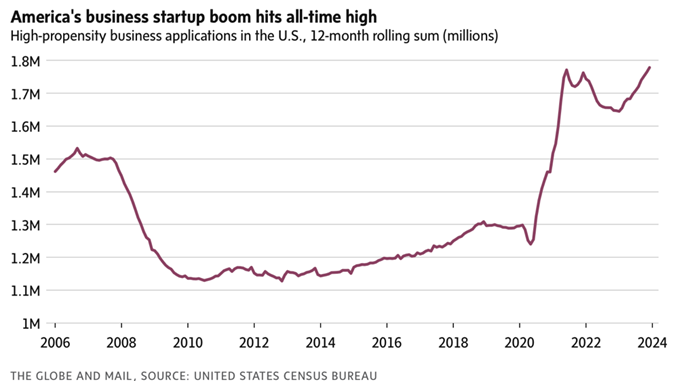

“America’s economy is creating new businesses at a feverish pace – If the Great Recession put U.S. entrepreneurship into a deep freeze, the COVID-19 pandemic lit a fire under American self-starters, and the boom in business creation that began in 2020 has kicked into overdrive. December marked the fastest 12-month stretch of startup activity on record, based on the number of what the U.S. Census Bureau calls “high-propensity business applications.” It’s the latest sign that America’s economic engine continues to defy expectations of a slowdown.”, The Globe and Mail, January 18, 2024

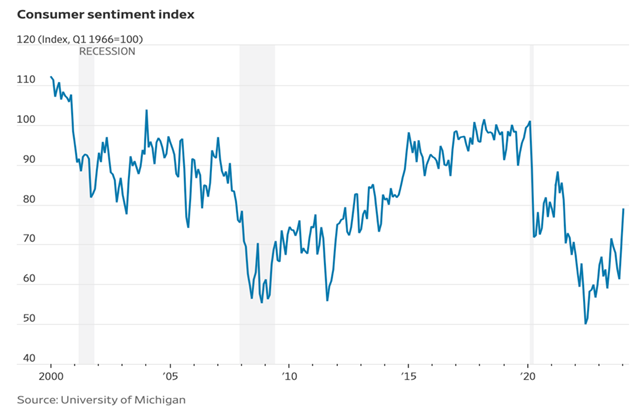

“Americans Are Suddenly a Lot More Upbeat About the Economy – Consumer sentiment gauge posted the largest two-month gain since 1991. Consumer sentiment surged 29% since November, the biggest two-month increase since 1991, the University of Michigan said Friday, adding to gauges showing improving moods. The pickup in sentiment was broad-based, spanning consumers of different age, income, education and geography.”, The Wall Street Journal, January 19, 2024

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Brand & Franchising News

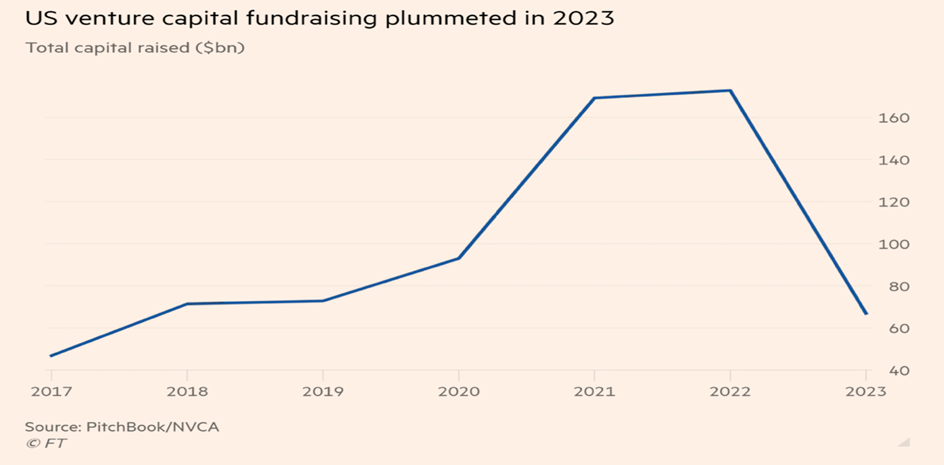

“Commanding a Premium Franchise Sale in a Cautious 2024 Private Equity Investment Climate – Perfect market timing is difficult to pull off, but excellent preparation and building a valuable business in the first place is much more under your control. The valuation of private equity exits in 2023 has seen a significant drop compared to the boom in 2021. This shift requires franchise owners to recalibrate their strategies when considering a sale. To attract premium offers, businesses need to stand out with unique value propositions and robust operational efficiencies.”, Entrepreneur magazine, January 19, 2024

“Inspire Brands to Take Jimmy John’s Global – The sandwich fast casual signed deals to grow in Canada and Latin America. Jimmy John’s is now set to grow in Canada and Latin America. The former will expand through a partnership with Foodtastic, a franchisor that oversees north of 1,100 locations through a collection of brands, including Pita Pit and Freshii, and $1.1 billion in sales. The Latin America deal comes via Franquicias Internacionales, a group based in El Salvador whose portfolio expands from F&B to digital media and logistics.”, QSR Magazine, January 2024

“Burger King parent company to buy out largest franchisee to modernize stores – Restaurant Brands International Inc. announced Tuesday that it would purchase the issued and outstanding shares of Burger King franchisee Carrols Restaurant Group Inc. for $9.55 per share at a value of approximately $1 billion. Carrols is the largest Burger King franchisee in the country, operating 1,022 Burger King restaurants in 23 states and 60 Popeyes locations. Restaurant Brands said that it will invest $500 million to renovate approximately 600 restaurants that were acquired in the transaction.”, People Magazine, January 18, 2024

“Giant pizza chain Papa John’s to shut up to 100 locations – The family favourite global pizza chain said it will “strategically close low-performing locations” in a bid to boost profits. A family favourite pizza chain is to shut scores of locations across the UK this year in a fresh wave of closures as restaurants battle high costs and fewer visitors. Dozens of Papa John’s branches will close for good, according to The Sun. It comes after the chain, which operates 524 locations in the UK, told investors it anticipates “additional strategic restaurant closures of low-performing restaurants” in a bid to boost profits.”, News.com.au, January 9, 2024

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

To receive this biweekly newsletter, click here : https://bit.ly/geowizardsignup

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, the franchise sector, economic development, and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing environment. Our GlobalTeam™ on the ground covering 25+ countries provides us with updates about what is actually happening in their specific countries.

William “Bill” Edwards: Global Advisor Is Uniquely Qualified to Steer Sr. Executives Successfully Through the Complex Waters of Going Global. With four decades of successful international business experience spanning virtually every corner of the world and many business sectors, Bill Edwards understands the global business landscape like no other. He has been a County Master Franchisee in five countries in Asia, Europe and the Middle East; the Senior VP for a franchisor operating in 15 countries and a full-service consultant since 2001 taking 40 franchisors global.

For a complimentary 30-minute consultation on how to take your business global successfully, contact Bill Edwards at bedwards@edwardsglobal.com or +1 949 224 3896.

And download our latest chart ranking 40+ countries as places to do business at this link:Our latest GlobalVue™ 40 country ranking

EGS Biweekly Global Business Newsletter Issue 99, Tuesday, January 9, 2023

Edited and curated by: William (Bill) Edwards, CFE, CEO of Edwards Global Services, Inc. (EGS)

Introduction: In this issue, we look back at 2023 and forward with lots of different projections for 2024. Global shipping disrupted. Global markets had their best year since before the pandemic. Where will the Chinese economy go in 2024. U.S. oil and gas exports fuel the world’s demand. India continues to grow at a high level. The U.S. dollar finished 2023 down. The U.S. economy leads other developed countries in 2023.

The mission of this newsletter is to use trusted global and regional information sources to update our 1,400+ readers in 20+ countries on key global and local trends that can impact the success of their businesses at home and abroad.

NOTE: Some of the sources that we provide links to require a paid subscription to access. We subscribe to 40 international information sources to keep our readers up to date on the world’s business.

To receive this biweekly newsletter that is read by over 1,400 people in 20 countries, click here: https://bit.ly/geowizardsignup

First, A Few Words of Wisdom From Others For These Times

“Every time you tear a leaf off a calendar, you present a new place for new ideas.”, Charles Kettering

“The new year stands before us, like a chapter in a book, waiting to be written.”, Melody Beattie

““Be at war with your vices, at peace with your neighbors, and let every new year find you a better man.”, Benjamin Franklin

Highlights in issue #99:

- Brand Global News Section: Chick Fil A®, Dominos® and McDonalds®

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Interesting Data, Articles and Studies

“These Are the Five Potential Trouble Spots That Could Knock the Global Economy Off Course. US unemployment claims in the US, business confidence in Germany, bond yields in Japan. What investors and executives need to be watching in 2024. The global economy was tested in 2023 as it rarely has been before: inflation and the most aggressive monetary tightening campaign in decades, wars in Europe and the Middle East, a festering real estate crisis in China and the deepening rivalry between Washington and Beijing, which is forcing companies to rethink supply chains and security. The International Monetary Fund forecasts global growth of 2.9% in 2024, a whisker below last year. With two wars raging and some 40 national elections on the calendar, political developments will shape the year, especially as Donald Trump makes a go at winning back the presidency. But crucial economic stress points could upend the benign outlook.”, Bloomberg, January 3, 2024

“Six things to watch in 2024 global economy, from tax cuts to AI – The Israel-Hamas war could broaden, and many developing countries are on a path to crisis. Six things to watch in 2024 global economy, from tax cuts to AI. The Israel-Hamas war could broaden, and many developing countries are on a path to crisis. Central banks start to cut interest rates. A developing-country debt crisis. Pre-election tax cuts. A deepening US-China cold war. The unstoppable rise of generative AI. Rising oil prices.”, The Guardian, January 2, 2024

“Ten business trends for 2024, and forecasts for 15 industries – Geopolitics will again loom large in 2024, as us-China tensions mount and the wars in Ukraine and Gaza rumble on. Inflation will fall and interest rates level off; supply-chain kinks will ease, along with commodity prices. But global gdp will grow by only 2.2% amid lacklustre expansions in rich countries. Developing economies will do better, though China will lose corporate investment to competitors. Companies will face new environmental rules and perhaps a global minimum tax rate.”, The Economist, November 13, 2024

“Global stock markets record best year since 2019 – S&P 500 ends 2023 just shy of record as investors bet interest rates have peaked. The MSCI World index, a broad gauge of global developed market equities, has surged by 16 per cent since late October and is up 22 per cent this year — its best performance for four years. That has largely been fuelled by Wall Street’s benchmark S&P 500 index, which has risen 14 per cent since October and 24 per cent on the year, ending the last trading day of 2023 just shy of its all-time record. The gains have been driven by a dramatic shift in interest rate expectations following a slew of recent data showing inflation falling faster than expected in western economies.”, The Financial Times, December 30, 2024

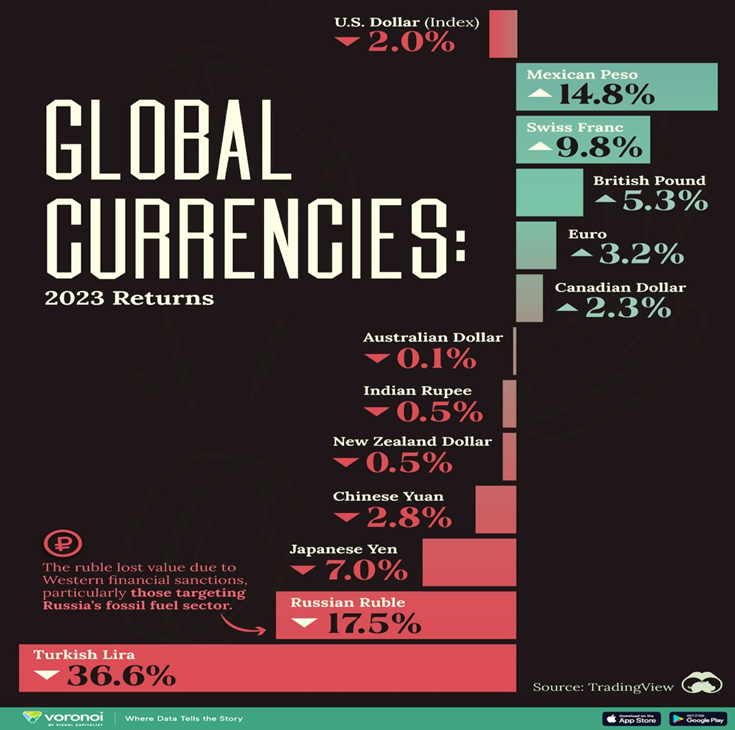

“How Major Currencies Performed in 2023 – The U.S. Dollar Index peaked in fall 2022, the highest it had been in nearly two decades, rising in response to aggressive interest rate hikes. The index measures the value of the U.S. dollar against a basket of major currencies from six countries. A gain indicates the dollar is appreciating against the basket and vice-versa. The euro is the biggest component on the index and thus sways the index value and return.”, Visual Capitalist, January 4, 2024

“The top tech trends to watch in 2024 – CES, the consumer electronics show in Las Vegas, will offer a first look at the ways our relationship with tech could change this year. If the last two years proved that generative artificial intelligence and large language models aren’t going anywhere, 2024 will be year they get embedded into products you may actually want to buy. CES, one of the largest technology trade shows in the world, will host thousands of engineers, entrepreneurs, dealmakers and tech companies in Nevada, all eager to share their visions of what’s next. And yes, AI looms larger over the show than ever before — though it’s not the only thing attendees will be talking about.”, The Washington Post, January 8, 2024

“Will AI enable a three-day workweek? Certain billionaires think so, but some experts disagree. Some of the world’s most successful business leaders, including Bill Gates and Jamie Dimon, have recently suggested that advancements in artificial intelligence will cut the workweek down to just three or three and a half days. Others aren’t so convinced. In a November episode of the What Now? With Trevor Noah podcast the former Microsoft chief executive described a world where machines do most of the labour, while humans earn a comfortable living working three days a week.”, The Globe and Mail, January 8, 2024

Global Supply Chain, Energy, Commodities, Inflation & Trade Issues

“2024 Supply Chain Risk Report – Which geopolitical instability should you be watching? What materials will supply chain managers be fighting over? And what is the top risk your supply network will 100% guaranteed face in 2024. Everstream’s 2024 outlook is based on our comprehensive database of supply chain disruptions and how those impact our clients. The report includes a countdown, risk scores, and extensive data for each of 2024’s Top 5 most likely events.”, Evergreen Analytics, January 4, 2024

“Spot Container Shipping Rates Soar 173% on Red Sea Threats – Suez traffic is down 28% in past 10 days, IMF PortWatch says Risk of congestion rises heading into Chinese Lunar New Year. The spot rate for shipping goods in a 40-foot container from Asia to northern Europe now tops $4,000, a 173% jump from just before the diversions started in mid-December, Freightos.com, a cargo booking and payment platform, said late Wednesday. The cost for goods from Asia to the Mediterranean increased to $5,175, Freightos said, adding that some carriers have announced prices above $6,000 for this route starting in mid-January. Rates from Asia to North America’s East Coast have risen 55% to $3,900 for a 40-foot container.”, Bloomberg, January 4, 2024

Annual % change in consumer price index

“Global Inflation Tracker – Inflation is easing from the multi-decade highs reached in many countries following Russia’s full-scale invasion of Ukraine. The rise in energy prices was the main driver of inflation in many countries, even before Russia invaded Ukraine. Daily data show how the pressure has intensified on the back of a conflict that has forced Europe to search for alternative gas supplies. However, wholesale prices continue to ease as a result of weakening global demand and European gas storage facilities being filled close to capacity.”, The Financial Times, January 5, 2-24

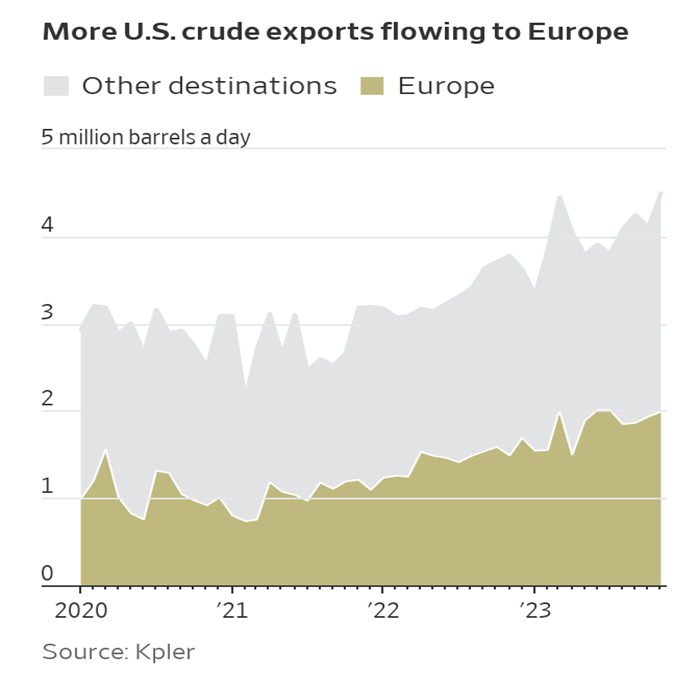

“(U,S.) Shale Is Keeping the World Awash With Oil as Conflicts Abound – The shipping crisis in the Red Sea is expected to raise consumer prices. But it has had little impact on energy prices, largely because of surging supplies from U.S. frackers. That is largely because of record production of U.S. fossil fuels. Shippers in November moved more oil out of the U.S. than what was produced in Iraq, OPEC’s second-largest member, at a record 4.5 million barrels a day. Likewise, U.S. exports of liquefied natural gas, or LNG, are set to hit a record in December, according to market intelligence firm Kpler.”, The Wall Street Journal, January 1, 2024

Global & Regional Travel Updates

“SAFEST PLACES TO TRAVEL 2024 – What makes a safe place to travel?It sounds like an easy question, but the definition of a safe destination has changed over time. According to our research, a safe place was originally a place that’s largely free from terrorist activity. Then it became a place that was safe from disease outbreaks. Now it’s a place where all types of people can move about freely without discrimination or harassment. As definitions of a safe destination have evolved, so too have the world’s safest places. Are there places where people can move about freely, stay disease-free, and be sheltered from severe weather events?”, Berkshire Hathaway Travel Protection, September 2024

“The World’s Most On-Time Airlines in 2023 – Aviation analytics firm Cirium ranked the punctuality of different airlines around the world—and the winner may surprise you. The list, derived from over 600 real-time flight information sources, features the expected names, to be sure (Delta received Cirium’s Platinum Award for global operational excellence for the third year in a row), but reveals some wild card winners as well. Avianca Airlines, a low-cost carrier based in Colombia, was ranked the most punctual global airline of 2023 with 85.73% of its flights arriving within 15 minutes of its scheduled gate arrival.”, CNN Traveler, January 2, 2024

Country & Regional Updates

BRICS Countries

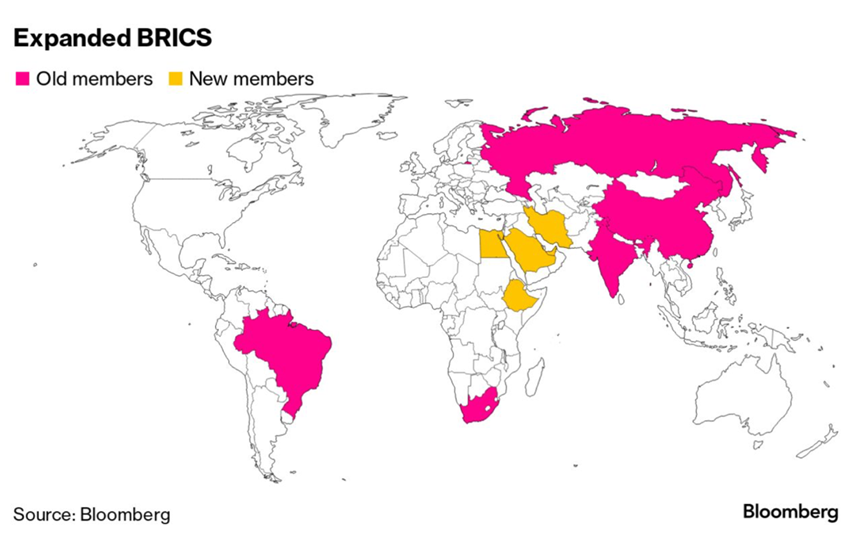

“How BRICS Doubled in Size – The BRICS group of emerging-market nations — the acronym stands for Brazil, Russia, India, China and South Africa — has gone from a slogan dreamed up at an investment bank two decades ago to a real-world club that controls a multilateral lender. It doubled in size at the start of 2024, pairing some of the planet’s largest energy producers with some of the biggest consumers among developing countries and potentially enhancing the group’s economic clout in a US-dominated world. Saudi Arabia, Iran, the United Arab Emirates, Ethiopia and Egypt accepted invitations to join starting on Jan. 1.”, Bloomberg, January 4, 2024

China

“Foreign investors unwind $33bn bet on China growth rebound – Almost 90% of money that flowed into Chinese stocks in 2023 has left amid concern about economy. Since peaking at Rmb235bn ($33bn) in August, net foreign investment in China-listed shares this year has dropped 87 per cent to just Rmb30.7bn, according to Financial Times calculations based on data from Hong Kong’s Stock Connect trading scheme. ‘The confidence issue goes beyond real estate, although real estate is key,’ said Wang Qi, chief investment officer for wealth management at UOB Kay Hian in Hong Kong. ‘I’m referring to consumer confidence, business confidence and investor confidence — both from domestic and foreign investors.’”, The Financial Times, December 27, 2023

European Union & Eurozone

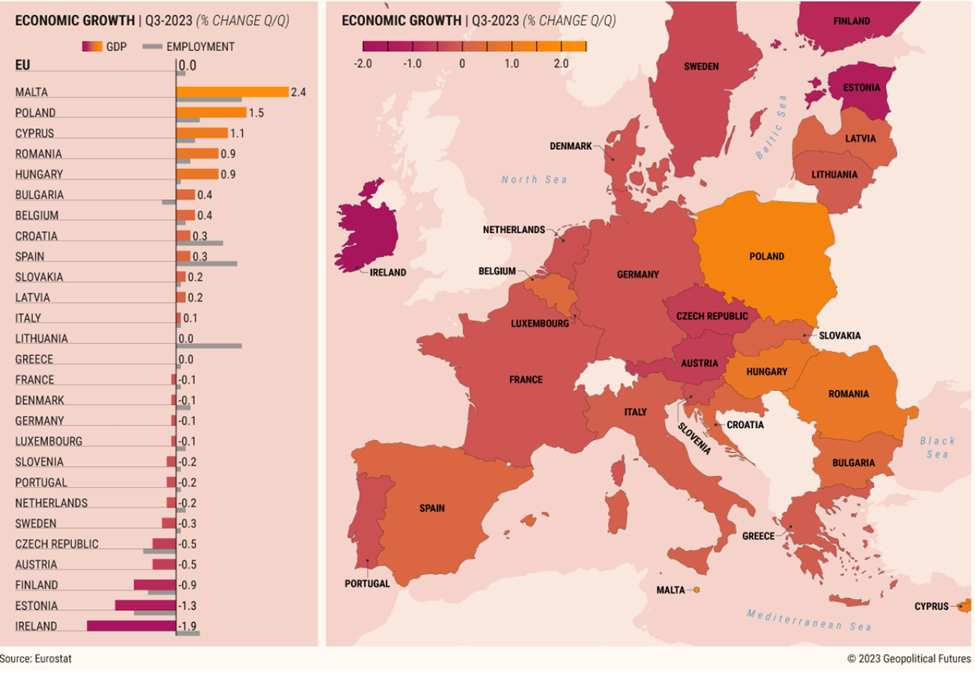

“EU Economy Is Stable but Stagnant – High and volatile energy costs continue to hold back growth. In the third quarter of 2023, seasonally adjusted gross domestic product remained stable in the European Union compared with the previous quarter, and employment ticked up slightly. Stabilization aside, the EU still faces growth challenges. European industry is unlikely to reach pre-pandemic growth rates anytime soon, as volatile energy prices continue to restrain industrial activity and create distributional conflicts within countries and the bloc as a whole.”, Geopolitical Futures, December 29, 2024

Germany

“German inflation rises to 3.8% in blow to rate-cut hopes – Energy subsidy phaseout pushes up prices in EU’s largest economy ahead of closely watched eurozone figures. The reduction of government subsidies on gas, electricity and food that began last year has triggered a re-acceleration of annual inflation in much of Europe. German energy prices rose 4.1 per cent in the year to December, a reversal from a 4.5 per cent annual decline a month earlier.”, The Financial Times, January 4, 2024

India

“Will India emerge as a global economic powerhouse in 2024? – While there is overall optimism, some economists are sounding a note of caution on the world’s fifth largest economy. Against a backdrop of global economic volatility, coupled with food and oil supply shocks keeping inflation elevated, some may wonder whether India’s growth momentum will continue in 2024. The country, which overtook China to become the world’s most populous nation in 2023 with more than 1.4 billion people, is set to benefit from its young demographic and rising middle class incomes, economists say.”, The National news, December 31, 2024

South Korea

“South Korea Unveils Steps Aimed at Suppressing Inflation Quickly – Authorities to prevent price rigging, freeze utility costs Inflation fight comes ahead of parliamentary elections. The government plans to freeze public utility charges, bolster monitoring of potential price rigging and make it mandatory for businesses to disclose if they are reducing packaged volumes of their products during the first six months of 2024, according to a statement Thursday from the Finance Ministry. The government will also provide about 11 trillion won ($8.4 billion) in support for energy vouchers, food discounts and other programs that could help lower consumer prices, it said.”, Bloomberg, January 3, 2024

Turkey

“Turkish inflation climbs to nearly 65%, with more rises expected – Inflation in the country rose to 64.8% on an annual basis in December, an acceleration from 62% in November. This was slightly below expectations of economists polled by Reuters of 65.1%. Month-on-month inflation cooled to 2.9% from 3.3%. Inflation has been back on the rise since June, but market watchers say this cycle should hit its peak by mid-2024. Murat Ulgen, HSBC’s global head of emerging markets research, said Turkish bonds are in favor among EM investors who see a peak in inflation and stabilizing currency ahead.”, CNBC, January 3, 2024

United Kingdom

“Eight reasons to be cheerful about UK economy – Deutsche Bank predicts falling inflation will mean tax cuts before election. The chancellor is set to benefit from lower inflation, the possibility of interest rate cuts and a reduction in the Bank of England’s bond holdings, all of which will help to reduce the estimated borrowing bill compared with forecasts made by the Office for Budget Responsibility in November.”, The Times of London, January 2, 2024

United States

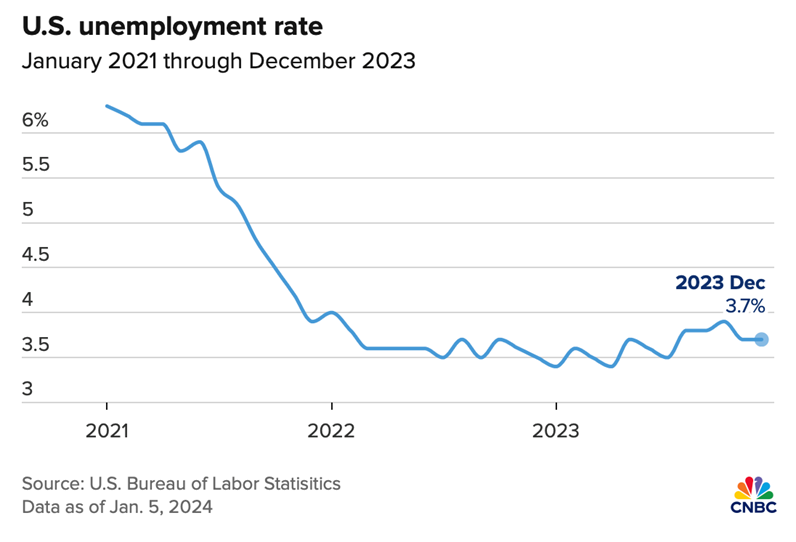

“The 2023 U.S. economy, in a dozen charts – The U.S. labor market ended the year strong, creating more than 200,000 jobs in the last month of the year and nearly 2.7 million jobs in all of 2023, when seasonally adjusted. Consumer spending remained robust throughout the year, with bright spots in travel and entertainment. There were some trouble areas for consumers, however, with mortgage rates high and existing home sales low.”, CNBC, January 7, 2024

“US venture capital fundraising hits a 6-year low – A 60% decline in 2023 from the year before sends a gloomy signal to funders and the start-ups that rely on them. Globally, in 2023 venture investors raised the lowest level of capital since 2015. The sharp decline ratchets up pressure on start-ups, which have endured a funding drought over the past 18 months.”, The Financial Times, January 5, 2024

Brand & Franchising News

“Chick-fil-A prices surge in recent years, report says – Chick-fil-A prices up 21% in the last two years, data shows. Newsweek compiled data from Food Truck Empire, which said the chicken chain first increased prices for its classic chicken sandwich by 15% in 2022, and a menu-wide 6% increase in January 2023. So what is the cause? Rising costs of ingredients, packaging and transportation due to inflation added to supply disruptions, Aaron Anderson, the CEO and founder of franchise consulting firm Axxeum Partners, told Newsweek.”, Fox Business, January 3, 2024

“Domino’s Pizza expands China franchise with 10 new stores – DPC Dash reaches a milestone with openings in Xiamen, Yangzhou, and other mainland cities. DPC Dash Ltd., Domino’s Pizza’s exclusive franchise operator in China, Hong Kong and Macau, has opened 10 new stores in eight new cities as part of its strategy for expansion. Currently, DPC Dash has opened a combined 175 new stores, leading to over 761 stores in over 29 cities in the Chinese mainland.”, Retail Asia, January 2, 2024

“McDonalds China and Cainiao partner on RFID chips to improve supply chain efficiencies. A trial project of the RFID technology helped reduce the time needed for stocktaking each day from 1 hour to 15 minutes for restaurants. The deal between McDonald’s China and Cainiao comes as the logistics firm prepares for an initial public offering in Hong Kong. Apart from deploying RFID technology to improve efficiency in inventory and logistics, McDonald’s and Cainiao will also explore digitisation and automation technologies in the supply chain, Cainiao said.”, South China Morning Post, January 5, 2024. Compliments of Paul Jones, Jones & Co., Toronto

“Why McDonald’s Ultimately Flopped In Bolivia – If you’ve recently visited the Tibet of the Americas, then you may have noticed there are no golden arches to be seen. That’s because McDonald’s pulled out of Bolivia in 2002, only a few years after it tried to launch in the country. McDonald’s withdrawal from the region marked a rare failure for the company. Locals were going to the thousands of street vendors — largely made up of indigenous women – for their fix of burgers rather than the fast food chain. This led to poor year-on-year sales that caused the restaurant to shut its doors in the country. Part of the blame can be placed on a move away from American influence in the early 2000s to focus on Bolivia’s marginalized natives.”, The Daily Meal, December 30, 2024

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

To receive this biweekly newsletter, click here : https://bit.ly/geowizardsignup

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, the franchise sector, economic development and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing environment. Our GlobalTeam™ on the ground covering 25+ countries provides us with updates about what is actually happening in their specific countries.

William “Bill” Edwards: Global Advisor Is Uniquely Qualified to Steer Sr. Executives Successfully Through the Complex Waters of Going Global. With four decades of successful international business experience spanning virtually every corner of the world and many business sectors, Bill Edwards understands the global business landscape like no other. He has been a County Master Franchisee in five countries in Asia, Europe and the Middle East; the Senior VP for a franchisor operating in 15 countries and a full-service consultant taking 40 franchisors global.

For a complimentary 30-minute consultation on how to take your business global successfully, contact Bill Edwards at bedwards@edwardsglobal.com or +1 949 224 3896.

And download our latest chart ranking 40+ countries as places to do business at this link:

Our latest GlobalVue™ 40 country ranking

EGS Biweekly Global Business Newsletter Issue 98, Tuesday, December 26, 2023

Edited and curated by: William (Bill) Edwards, CFE, CEO of Edwards Global Services, Inc. (EGS)

Introduction: In this issue, my latest article, “Doing Global Business In These Times”, which global economy did best in 2023, the most used AI tools in 2023, the best and worst global airports, how KFC became Japan’s preferred Christmas food (really!), Turkey raises its interest rates to 42.5%, McDonalds’ new brand and the USA is seeing the lowest inflation in years.

The mission of this newsletter is to use trusted global and regional information sources to update our 1,400+ readers in 20+ countries on key global and local trends that can impact the success of their businesses at home and abroad.

NOTE: Some of the sources that we provide links to require a paid subscription to access. We subscribe to 40 international information sources to keep our readers up to date on the world’s business.

To receive this biweekly newsletter that is read by over 1,400 people in 20 countries, click here: https://bit.ly/geowizardsignup

First, A Few Words of Wisdom From Others For These Times

“Cheers to another year and another chance to get it right.”, Oprah Winfrey

“You will either step forward into growth or you will step back into safety.”, Abraham Maslow

“Year’s end is neither an end nor a beginning but a going on, with all the wisdom that experience can instill in us.”, Hal Borland

Highlights in issue #98:

- Brand Global News Section: CosMc’s®, Greggs®, KFC®, Luckin Coffee®, Tim Hortons® and YUM China

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Interesting Data, Articles and Studies

“Doing Global Business in These Times – Doing business cross border has significantly changed due to the pandemic. This article looks at changes in doing global business in recent years from a practitioner’s perspective, specific trends and factors that impact successful brand entry into a new country and how several countries where you might take your business are expected to do economically in 2024. What has changed and what is the picture for doing cross border business in 2024? Below are some factors to keep in mind when planning your 2024 new country marketing budget.”, Momentum Magazine, December 15, 2023. This article is by your newsletter editor, William (Bill) Edwards

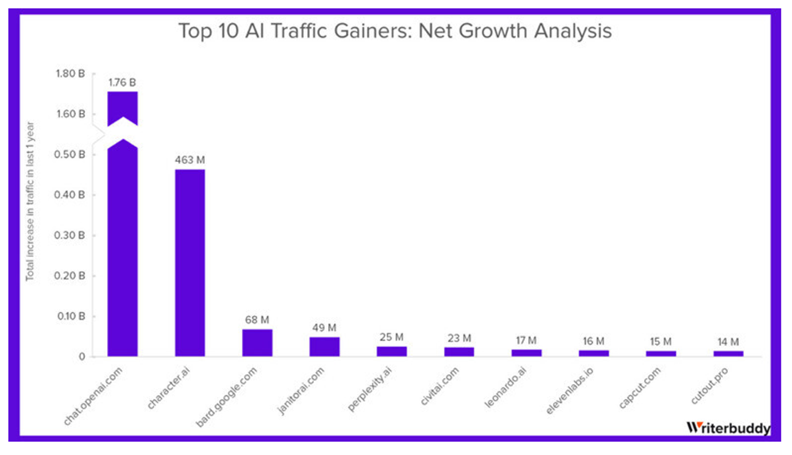

“Here Are The Most Used AI Tools Of 2023 – Artificial intelligence was all the rage in 2023. From writing assistants to generative media tools, hundreds of millions — scratch that, billions — of users have incorporated artificial intelligence into their workflows in unprecedented ways…..the top 50 AI tools generated 24.3 billion visits between September 2022 and August 2023, with traffic increasing by an average of 236.3 million visits per month.”, Slash Gear, December 23, 2023

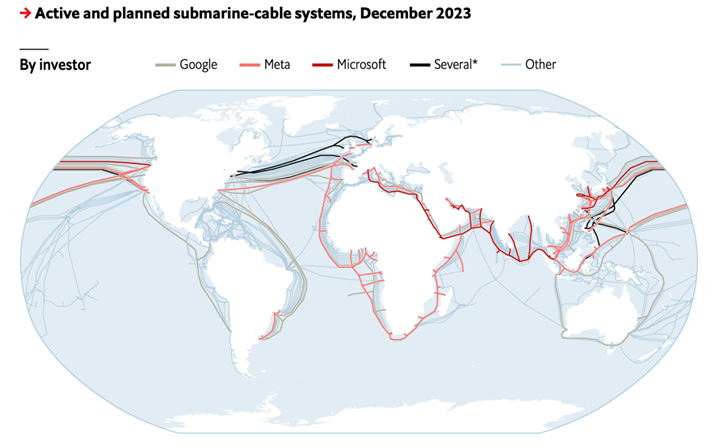

“Big tech and geopolitics are reshaping the internet’s plumbing – Data cables are turning into economic and strategic assets. Submarine cables used to be seen as the internet’s dull plumbing. Now giants of the data economy, such as Amazon, Google, Meta and Microsoft, are asserting more control over the flow of data, even as tensions between China and America risk splintering the world’s digital infrastructure. The result is to turn undersea cables into prized economic and strategic assets.”, The Economist magazine, December 20, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global Supply Chain, Energy, Commodities, Inflation & Trade Issues

Annual % change in consumer price index

“Global Inflation Tracker – Inflation is easing from the multi-decade highs reached in many countries following Russia’s full-scale invasion of Ukraine. The latest figures for most of the world’s largest economies show the wholesale food and energy prices that soared during 2022 are now falling back.”, The Financial Times, December 11, 2023

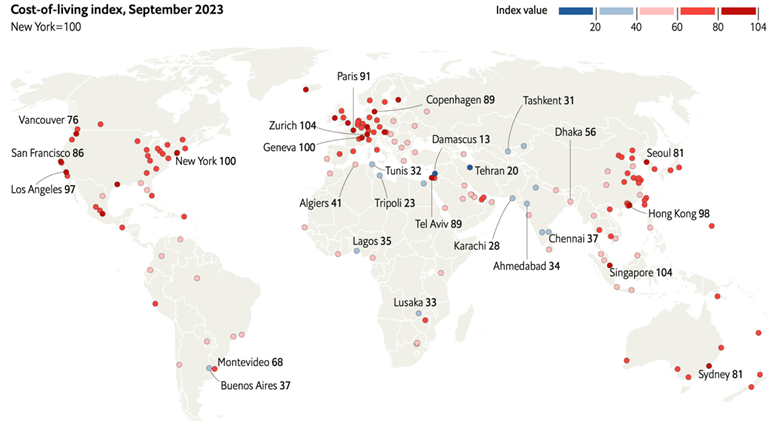

“These are the world’s most expensive cities – EIU’s cost-of-living index shows where prices are highest. Tied in first place this year were Singapore and Zurich. Western European cities, including Copenhagen, Dublin and Vienna, take around half of the top 20 spots. The three biggest climbers were Santiago de Querétaro and Aguascalientes in Mexico, and Costa Rica’s capital, San José. Beijing was one of four Chinese cities among the ten biggest decliners in the ranking.”, The Economist, November 29, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global & Regional Travel Updates

“The World’s Best and Worst Airports for 2023 Offer Plenty of Surprises – According to an annual ranking by AirHelp, US airports continue to miss the mark—as do hubs in many of the most-visited cities around the world. The results say that the world’s best airport is Oman’s Muscat International. In second and third place, respectively, are Brazil’s Recife-Guararapes International Airport and South Africa’s Cape Town International Airport. Japan and Brazil generally dominate in airport performance, with each counting three locations on the Top 10 list of best global airports. Of US hubs, only three made it onto the world’s Top 50 list: Minneapolis-St. Paul International (No. 13), Seattle-Tacoma International (No. 34) and Detroit Metropolitan Airport Wayne County (No. 38). European airports didn’t do much better, with just nine making it into the Top 50 best airport experiences of the world, according to AirHelp. Bilbao Airport in northern Spain took the No. 1 spot in Europe.”, Bloomberg, December 19, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Country & Regional Updates

Argentina

“Milei Unveils Broad Reforms to Liberalize Argentina Economy – Plan will face opposition in congress and from labor unions Measures come after deep budget cuts, sharp peso devaluation. President Javier Milei announced sweeping reforms to reduce the hand of the state in Argentina’s economy, including steps to privatize companies, facilitate exports and end price controls, in a bold political move that’s likely to face pushback in congress and courts.The libertarian leader listed 30 initial points of his plan in a televised address Wednesday night, adding they’re part of a broader package containing over 300 measures. He presented the all-around reforms as an attempt to free Argentines from the “oppression” of the state and its bureaucrats, in line with his campaign pledges.”, Bloomberg, December 20, 2023

China

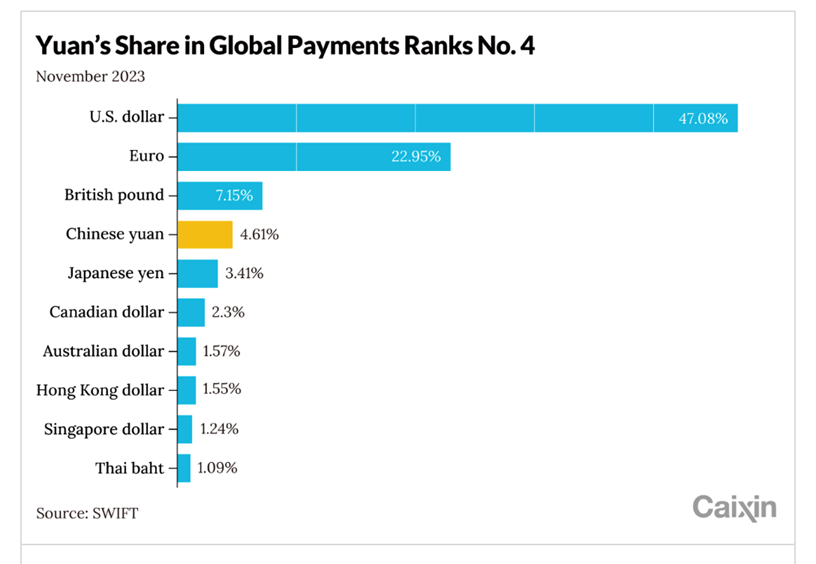

“China’s Yuan Overtakes Yen to Rank Fourth for Global Payments – The yuan overtook the Japanese yen to become the fourth-most used currency by value in global payments for the first time in almost two years, according to a monthly tracker of the Chinese currency released by the Society for Worldwide Interbank Financial Telecommunication (SWIFT).”, Caixin Global, December 22, 2023

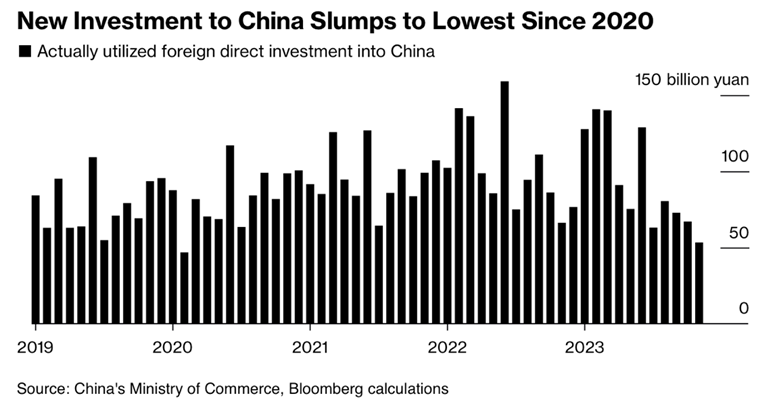

“China’s Foreign Direct Investment Drops to Near Four-Year Low – A measure of foreign investment into China fell to the lowest in nearly four years in November, underlining how geopolitical tensions and a slowing economy have combined to convince foreign companies to slow their expansion. New actually utilized foreign capital received by the country was 53.3 billion yuan ($7.5 billion) last month, down 19.5% from a year earlier, according to Bloomberg calculations based on data published by the Ministry of Commerce on Thursday. That’s the worst number since February 2020, when the Covid-19 pandemic first hit.”, Bloomberg, December 21, 2023

Greece

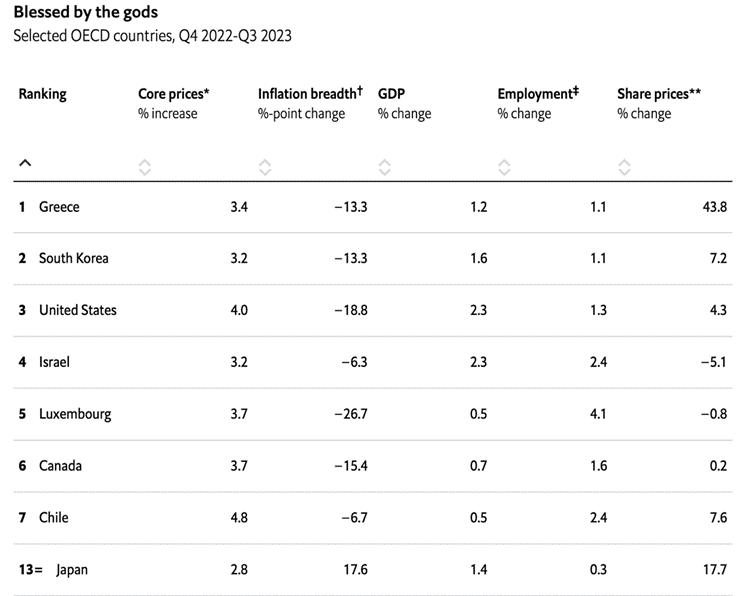

“Which economy did best in 2023? – Another unlikely triumph. The Economist has compiled data on five indicators—inflation, “inflation breadth”, gdp, jobs and stockmarket performance—for 35 mostly rich countries. We have ranked them according to how well they have done on these measures, creating an overall score. The table shows the rankings, and some surprising results. Top of the charts, for the second year running, is Greece—a remarkable result for an economy that was until recently a byword for mismanagement. Aside from South Korea, many of the other standout performers are in the Americas.”, The Economist, December 17, 2023

Japan

“How KFC Became Japan’s Hallmark Christmas Food – Ah, Christmas food. Maybe you go for a large, typical spread of roast this and roast that with various vegetables and sauces, rolls, and apple pie. Or maybe you live in Japan and queue up outside of a KFC waiting for a deluxe Christmas meal pack of crispy fried chicken like your artery-clogging parents before you. Hold on, you say: “Folks eat KFC for Christmas in Japan?” Yes, indeed. Feel free to peruse a Japanese-language KFC Christmas menu online; it doesn’t matter if you don’t read Japanese because everything has a picture.”, Grunge, December 20, 2023

South Korea

“S.Korea banks pledge $1.5 bln for small businesses amid push to share profits – South Korea’s commercial banks will provide 2 trillion won ($1.53 billion) to support small businesses, the organisation representing the lenders said on Thursday, amid political and regulatory pressure to share more of their profits with society. The Korea Federation of Banks, which represents 23 financial institutions including Kookmin Bank and Woori Bank, said of the total, 1.6 trillion won will be used as cash refund for interest payments borrowers made, to help them cope with the rising costs of living as interest rates climb.”, The Daily Mail (UK), December 20, 2023

Turkey

“Turkey raises rates to 42.5%, nearing end of cycle – Some analysts said one more rate hike was on the cards after seven straight months of tightening. The central bank has lifted its one-week repo rate by 3,400 basis points since June, when President Tayyip Erdogan appointed former Wall Street banker Hafize Gaye Erkan as its governor to conduct a sharp pivot toward more orthodox policies. It had raised rates by 500 basis points in each of the last three months but last month said tightening would soon end.”, The Daily Mail (UK), December 21, 2023

United Kingdom

“UK economy on brink of recession after growth falls – Gross domestic product revised down to -0.1% in the third quarter. The downgrades mean that the economy has expanded by 0.3 per cent so far this year, down from economists’ projections of 0.6 per cent, and the economy overall is 1.4 per cent larger than pre-pandemic levels.”, The Times of London, December 22, 2023

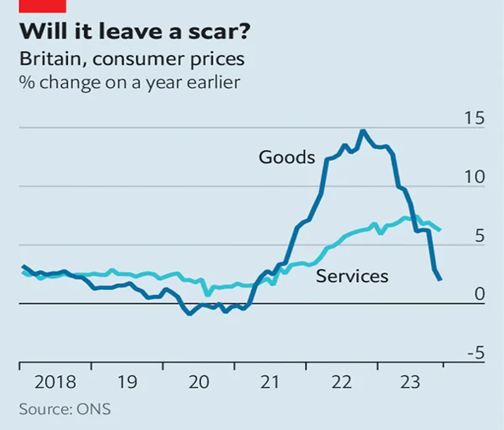

“Britain’s cost-of-living squeeze will leave an enduring mark – Britons are going to the discounters more and going out less. Those habits may stick. The worst of Britain’s most sustained period of high inflation since the 1970s is coming to an end. The headline rate of consumer-price inflation in November fell to an annual pace of 3.9%, its lowest reading in more than two years. Such a prolonged squeeze is likely to reshape consumer behaviour. The most persistent shifts will probably be in food. Along with energy, food was a major cause of the spike in goods prices in 2021 and 2022….. Unlike energy bills, food prices are still rising at a fast clip. They were up by 9.2% in the year to November.”, The Economist, December 22, 2023

United States

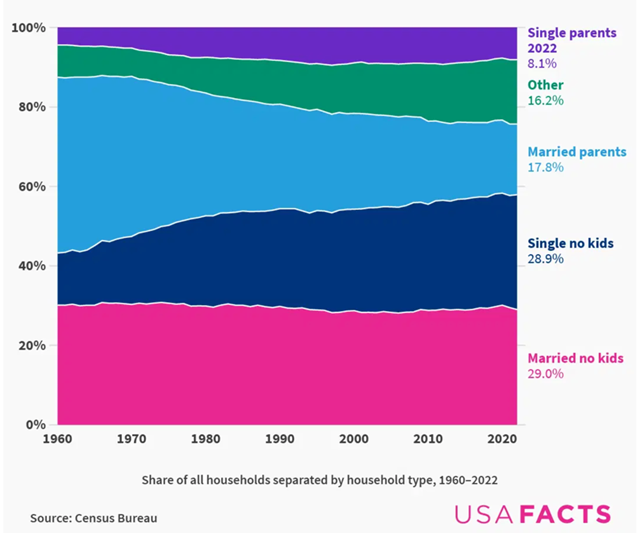

“How has the structure of American households changed over time? In 2022, more than half of American households were childless: 29% were married households without children, and 28.9% were single households without kids. More than a quarter of households included parents — 17.8% were married households, while 8.1% were single-parent households. In 1960, households with married parents represented over 44% of all American households, while slightly over 13% were single with no children. Today, that’s inverted — in 2022, single people living alone and married couples without children outnumbered married-parent households.”, Voronoi – USA Facts, December 12, 2023

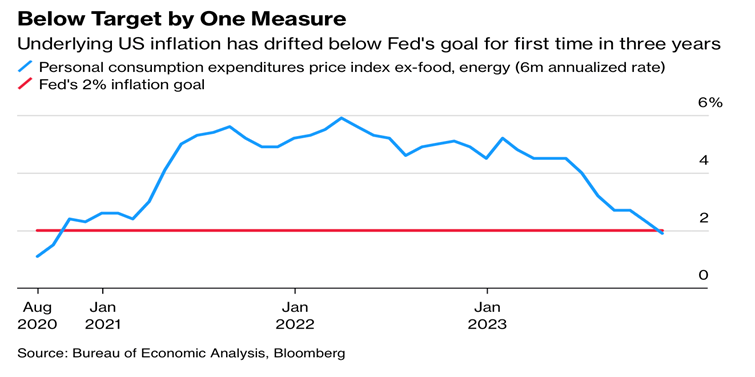

“The US Inflation Fight Approaches Victory – The US Federal Reserve’s preferred gauge of underlying inflation barely rose last month and—by one measure—even trailed the policymaker’s 2% target. That marks the first time in three years the Fed has achieved its definition of price stability after waging war on inflation triggered by the pandemic, Russia’s war on Ukraine and various other things. Americans can now look ahead to a likely reduction in interest rates next year and more affordability of almost everything (though savers may grumble).”, Bloomberg, December 23, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Brand & Franchising News

“East Lothian Greggs: ‘Huge milestone’ as 500th franchise shop opens in Monktonhall outside Edinburgh – The new shop is a partnership between Greggs and the UK’s largest independent forecourt operator MFG. The landmark opening comes one year after Greggs launched their 400th shop and is one of 71 franchised units that opened in 2023, with these locations now accounting for approximately 20 per cent of the retailer’s total estate.”, Edinburgh Evening News, December 15, 2023

“Yum China’s CEO on Chinese consumers’ incredible hunger for foreign brands – On a recent episode of Fortune’s Leadership Next podcast, co-host Alan Murray talks with Joey Wat, CEO of Yum China. The company, which is listed on both the New York and Hong Kong stock exchanges, was spun off from Yum! in 2016. Wat, who started working at age 9 in a factory in Hong Kong, oversees 14,000 stores across brands including KFC, Pizza Hut, Taco Bell, Little Sheep, and Huang Ji Huang. About 90% of the restaurants are company-owned, with just 10% run by franchisees. In 2024, Yum China will open more than four new stores per day.”, Fortune, December 20, 2023

“Luckin Coffee (China) in dispute with Thai company over trademark – China’s Luckin Coffee might be facing overseas trademark infringement compensation after a Thai group reportedly filed for 10 billion baht (US$290 million) compensation. Thailand’s 50R Group formally submitted a lawsuit to the local court requesting China’s Luckin Coffee compensate for economic losses. China’s Luckin Coffee, founded in 2017, said in August last year that the Thai stores bearing the same name were counterfeit.”, Shine.cn, December 12, 2023. Compliments of Paul Jones, Jones & Co., Toronto

“Canadian coffee chain Tim Hortons to open 150 outlets in Korea within 5 years – Tim Hortons has decided to enter the Korean market, which has a vibrant coffee market where coffee consumptions per person is almost threefold the global average, the company said in a statement. Korea will be the seventh Asian country to have a Tim Hortons shop following China, India, Pakistan, Thailand, Singapore and the Philippines, it said. The Ontario-based coffee chain, founded in Canada in 1964, currently operates more than 5,700 stores in 17 countries around the world, including the United States and China.”, The Korea Times, December 12, 2023. Compliments of Stephen Armstrong, MAPLE U.S.-Canada Business Council, Irvine, California

“A Trip to CosMc’s, McDonald’s New Space-Themed Takeout Chain – Expect sweet drinks—and plenty of quality time in the car—in the first few days for the new offshoot. The space-themed brand is the fast-food giant’s first new U.S. restaurant concept in its more than 60-year history, designed to deliver a beverage-heavy menu through takeout-focused locations built with multiple drive-throughs.”, The Wall Street Journal, December 12, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

To receive this biweekly newsletter, click here : https://bit.ly/geowizardsignup

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, the franchise sector, economic development and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing environment. Our GlobalTeam™ on the ground covering 25+ countries provides us with updates about what is actually happening in their specific countries.

William “Bill” Edwards: Global Advisor Is Uniquely Qualified to Steer Sr. Executives Successfully Through the Complex Waters of Going Global. With four decades of successful international business experience spanning virtually every corner of the world and many business sectors, Bill Edwards understands the global business landscape like no other. He has been a County Master Franchisee in five countries in Asia, Europe and the Middle East; the Senior VP for a franchisor operating in 15 countries and a full-service consultant taking 40 franchisors global.

For a complimentary 30-minute consultation on how to take your business global successfully, contact Bill Edwards at bedwards@edwardsglobal.com or +1 949 224 3896.

And download our latest chart ranking 40+ countries as places to do business at this link:

Our latest GlobalVue™ 40 country ranking

EGS Biweekly Global Business Newsletter Issue 97, Tuesday, December 12, 2023

Edited and curated by: William (Bill) Edwards, CFE, CEO of Edwards Global Services, Inc. (EGS)