Global Business Predictions for 2019

Despite global trade fears, new investment projects and new business development around world in 2019 will continue to be tied to a country’s Gross Domestic Product (GDP) growth. Generally, the higher the annual GDP growth rate in country, the more new investment is being made in an economy.

While the International Monetary Fund (IMF) believes global growth will slow a bit to about 3.7% in 2019, there remain several countries where the annual GDP growth rate will exceed 5%, including China, India, Indonesia, the Philippines and Vietnam. These high annual GDP growth countries have rapidly growing middle classes that need high growth rates to ensure there are sufficient jobs for the young consumer.

Argentina – “IMF support and fiscal reforms have pleased financial markets, but high interest rates are slowing domestic consumption and the economy is expected to have GDP growth of less than 2% in 2019. The second half of 2019 will be the time to begin looking at this market again.” Robert Jones, Chief International Officer, EGS

Brazil – Although the recent election of new President Jair Bolsonaro is somewhat of a wild card, he is expected to push fiscal reforms during his first year signaling a very positive message to the market, attracting domestic and foreign investors. Pro-business policies are expected to stimulate the economy and generate 2.4% GDP growth in 2019, creating new opportunities for foreign brands.

Canada – A GDP growth rate of 1.7% due to lower oil prices, new employment laws and regulations plus high business taxes will keep new brand investment and development down in this country in 2019.

Chile – Continued strong domestic demand and solid fiscal discipline should result in a GDP growth rate of 3.4% in 2019, making Chile a solid prospect for foreign brands.

China – Trade tensions with the U.S. and EU, as well as Chinese government controls and barriers, have increased the foreign investment difficulty factor in this market. GDP is expected to slow to 6.3% in 2019 as the government attempts to establish a more sustainable level of growth for the long-term. This ‘low’ GDP growth relative to recent years may be tied to lower consumer spending for the first time in almost 30 years

India – Although higher oil costs are a drag on the economy, GDP growth is expected to exceed 7% in 2019. This is slightly down form 2018. If the government implements regulatory and economic reforms, which it has announced it will do, the business climate could improve for foreign companies in 2019.

Indonesia – Strong domestic demand is expected to sustain a GDP growth rate of 5.2% in 2019. Foreign brand investment will continue due to the rapidly growing middle class consumer base. The presidential election needs watching for its impact on consumer confidence.

Italy – A higher fiscal deficit and disagreement with the EU regarding the new government’s budget have resulted in an estimated GDP of 1.2% in 2019; however, American brands are popular in this market and there is a demand despite the economy’s challenges.

Japan – Manufacturing has recently slowed somewhat and varying oil prices are a negative, but increasing domestic demand should maintain a GDP growth rate of 1.1% in 2019. This relatively low annual GDP growth rate is still good for this economy

Middle East – “The Middle East (Saudi Arabia, United Arab Emirates, Kuwait, Qatar, Oman and Bahrain), has experienced an economic contraction over the past several years with lower oil prices. Nevertheless, the restaurant segment continues to be strong. Retail is highly competitive and the B2B and B2C sectors offer limited opportunity for compelling new investment opportunities.” Paul Cairnie, CEO, World Franchise Associates.

Peru – Consumer spending is up, the government is pro-business growth, and increased export growth supports a prediction of 4% GDP growth for 2019, providing a solid opportunity for new investors.

Philippines – With an expected GDP growth rate of 6% in 2019, a fast-growing middle class consumer base, and a robust new investment environment, this country will continue to see continued new international brand entry this coming year.

Poland – Although the country’s very strong growth is expected to moderate somewhat in 2019, the current estimate of 3.6% is one of the European Union’s highest economic growth rates. This market offers solid opportunities for foreign franchisors, but market analysis and selection of the correct partner are keys for success.

Saudi Arabia – The 2019 GDP growth rate is expected to be an anemic 2% in 2019. Low oil prices, little new local investment plus fallout from recent legal issues, mean little new foreign investment in 2019.

Singapore – Weaker manufacturing will be offset by stronger consumer demand, with a 2.9% GDP growth rate estimated for 2019. Anti-immigrant legislation has made finding service workers difficult and choice retail space is priced at a premium.

South Africa – With a new government, the country could have an estimated GDP growth rate of 1.7% due to a program of fiscal stimulus. But security and rule of law challenges remain in a country with a huge middle class consumer upside.

Spain – Although 2019 annual GDP growth is expected to slow down from 2.7% in 2018, the pace of new development should continue to be high, especially in the food and beverage sector, in 2019. Retail rents are the price level before the 2008 recession.

Thailand – “As a center for global tourism, Thailand supports more international brands than its own population could support. It is also an excellent showcase of brands and proof-of-concept for the region. The Thai international brand market is crowded and tightly focused on selected urban areas. But there is a subset of strong, risk tolerant and qualified investors willing to invest in well-established American brands.” Greg Wong, Senior Commercial Officer, U.S. Commercial Service, Bangkok.

United Kingdom – “The United Kingdom is open for business, but until the details of what Brexit is going to look like have been confirmed, there will continue to be uncertainty in the marketplace. There are, however, still many good opportunities for the brave!” Iain Martin, The Franchising Centre, London.

Vietnam – This market continues to have strong retail sales and has benefitted from factories relocating from China. GDP growth of 6.6% is expected in 2019. American brands are highly desired in this market.

Projected 2019 GDP growth rates for this article are from the ‘Economist’ magazine.

William Edwards is CEO of Edwards Global Services (EGS). Contact him at bedwards@edwardsglobal.com or on +1 949 224 3896. With 45 years’ experience as a leader in international operations, business development and franchising, William “Bill” Edwards helps clients worldwide navigate the complex and often turbulent global business landscape. EGS provides a complete International Operations and Development Solution for Franchisors. From the initial global market research and country prioritization, to developing new international markets and providing operational support around the world, EGS offers the complete solution based on:

- Experience as Franchisors, International Licensees, Franchisees and Consultants working with 30+ U.S. franchise brands across 40 countries

- Knowledge across Food & Beverage, Retail and Service sectors and diverse cultures

- An operations and development team in over 40 countries experienced in finding,

- qualifying, signing, starting up, growing and fixing intentional licensees

- Trademarked processes and services based on decades of problem-solving experience

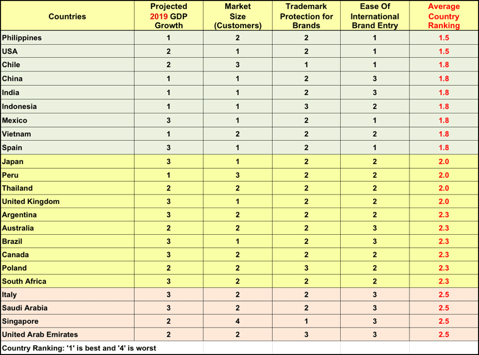

The EGS GlobalVue™ Country Ranking for Selected Countries in 2019

This blog is adapted from an article to appear this month in ‘Franchise Update’ magazine.

The Fastest 2 Minutes in International Franchising

Our GlobalTeam™ of highly experienced international specialists in the USA and on the ground in 32 countries contributed to this summary of today’s world business opportunities. Countries to watch for excellent business development opportunities in 2017: the Philippines, the UAE, Spain and Poland.

| Asia | China Japan Malaysia The Philippines Thailand Viet Nam |

Consumer economy growing at over 8% per year Corporations are seeking consumer investments Political and currency unrest Many new US international businesses opening Starting a comeback from post-coup recession 6%+ GDP growth, USA franchises desired |

| Americas | Argentina Brazil Canada Chile Colombia Mexico Peru USA |

Dramatic change, new government, improving economy Economy, stalled, inflation up, government problems New tax-focused government Government regulations increased Uneven growth, low new investment Post US election new investment stoppage New pro-business government, US brand friendly Renewed business confidence: lower taxes, regulations |

| Europe | Ireland Germany Poland Russia Spain Turkey United Kingdom |

Good GDP growth, slow to see new investment Difficult to find investors for foreign brands Highest EU GDP growth Not now!!! Recovery speeding up, heavy new investment Political unrest and terrorism = no new investment BREXIT & election fallout slowing new investment |

| Middle East | Egypt Saudi Arabia United Arab Emirates |

Security and hard currency problems Difficult to get new businesses open once built New US brands entering, strong new investment |

| Elsewhere | Australia India New Zealand South Africa |

Challenge to find investors for foreign brands Challenge to find licensees who follow system Few consumers, but pro foreign brands High unemployment (25%), low new investment |

A Global Franchising Update for Selected Countries

Our company, Edwards Global Services, Inc., is honored to work with some of the very best U.S. franchisors to take them global.

We closely monitor consumer spending in over 50 countries as consumers are the target market for the U.S. franchise brands we represent. Often media reports look at a country’s economy from the macro or 30,000 foot perspective. We look at a country’s economic activity from about 50 feet: what is the consumer doing and are they spending?

Here are a few updates on our clients’ recent and planned international openings, plus, an update on a ‘new’ or ‘reawakened’ market: Argentina.

Argentina – For decades, this European-style country has experienced political and economic challenges. After only a few months in power, Argentina’s new government has already taken significant steps to address the country’s economic problems. Argentine President Mauricio Macri has removed export taxes for agricultural products, slowed the printing of pesos, abolished most currency controls, and taken steps to remove subsidies on electricity, food and natural gas.

He has removed export tariffs on beef, soybeans, wheat, and corn, giving exporters greater leeway to sell their products abroad. Macri also plans to eliminate subsidies on electricity, food, and natural gas, thereby reversing the inefficiencies that have burdened Argentina’s economy in previous years. (“Argentina’s New President Lays the Groundwork for a Better Economy”, Stratfor, January 19, 2016)

Argentina was a strong franchise market in the past, and we are beginning to see interest by U.S. franchisors in re-entering this large, well educated, and sophisticated market in Latin America.

Italy – While Italy is considered a slow growing market in the European Union, with significant economic challenges, there are opportunities for new consumer brands in certain sectors. Burgers are one of those sectors. Just over a year ago, Fuddruckers® burger brand opened its first European location in Milan, Italy. Today there are two locations in Milan and a new location in Warsaw, Poland. Europe loves Fuddruckers’ burgers and wings!

Near Milan, Italy

Japan – This is generally considered a slow growth country that has been slow for several decades. That is not true in the consumer sector, and certainly not in the burger sector, where several U.S. brands have entered recently to challenge McDonald’s 3,000 unit monopoly. Carl’s Jr.® recently announced the opening of its first restaurant in Tokyo. In this photo, Ned Lyerle, President of CKE Restaurants International, is on the right, along with our company’s Japan Associate, Ichiro (Roy) Fujita.

Carl’s Jr.®

Philippines – In December 2015 it was announced that Denny’s® has signed a license agreement with the Bistro Group, who also is the Philippines licensee for TGI Friday’s® and Buffalo Wild Wings®. The first Denny’s® restaurant in the Philippines will open in Manila in mid-2016. The Philippine economy is expected to grow at 6.5% in 2016. U.S. food franchise brands are greatly desired.

Poland – This is the one country in Europe where GDP growth did not turn negative between 2008-2012. This year the country’s economy is expected to grow at 3.1%, the highest in the European Union. This is driven almost entirely by consumer spending.

International Dairy Queen entered Europe last year. This 75-year old brand, with 6,500 stores in 28 countries, now has three stores in Warsaw. Yes, the iconic Blizzard® is present in Poland and selling well, even in the winter!

International Dairy Queen

Turkey – Two years ago, Build-A-Bear Workshop®, the world’s largest children’s entertainment retail brand, opened its first store in Istanbul. Today there are three stores in Istanbul and one in Ankara. Turkish families love to spend money on their kids and Build-A-Bear Workshop® helps!

Build-A-Bear Workshop®

United Arab Emirates – The UAE continues to see annual Gross Domestic Product (GDP) growth in excess of 3% per year. Dubai is the center of tourism and financial business in the region. New U.S. food brands are continuing to enter this lucrative market.

In December 2015, Denny’s® opened its first restaurants in the Middle East in Dubai. In this picture are John Miller, the CEO of Denny’s®, and Steve Dunn, The Denny’s® Global Chief Development Officer.

Denny’s®

Vietnam – With a GDP annual growth rate of over 6% and a very fast growing middle class consumer market, Vietnam is one of the top developing markets in Asia. U.S. franchise brands are highly desired. Recently our company finalized the country license for PJ’s Coffee of New Orleans® to open 10 or more high end coffee shops in Vietnam over the next 5-7 years. Vietnamese are very big coffee drinkers and love the social aspects of meeting for coffee and pastries with their friends.

The Fastest 2 Minutes in International Franchising

Our GlobalTeam™ of highly experienced international specialists on the ground in 32 countries contributed to the following brief summary of the franchise world opportunities for 1st quarter 2016. Countries to watch for franchise opportunities in 2016: Argentina, the Philippines, the UAE, Spain, Poland and Peru.

| Asia | China Japan Malaysia The Philippines Thailand Viet Nam |

Consumer economy growing at 8.2% per year Only large corporations are investing in new projects Political unrest, declining Foreign Direct Investment Many new US F&B brands opening 4% GDP growth expected in 2016 6.5% GDP growth, prefer US franchise brands |

| Americas | Argentina Brazil Canada Chile Colombia Mexico Peru USA |

Dramatic change, new positive government Economy is stalled, inflation climbing, political uncertainty Declining investment in F&B, tax focused new government 3.7% GDP growth for 2016. Government regulations? Show me the money and where it came from Mexico City, Monterrey and Cancun booming Lima is a city of cranes and new foreign franchises US$15/hour minimum wage kills margins. Election year |

| Europe | Ireland Germany Poland Russia Spain Turkey United Kingdom |

GDP growth of 3.5% projected for 2016 Difficult to find investors/risk takers for new foreign brands 3%+ GDP growth for 2016. Slow new franchise investment Not now 2.7% GDP growth for 2016. Recovery speeding up Political unrest leading to drop in new project investment 2.2% GDP growth, but normal investment analysis paralysis |

| Middle East | Egypt Saudi Arabia Dubai |

Pent-up consumer demand, high growth, iffy security Challenges to get new businesses open due to regulations New building push, large expat influx, airport & airline soaring |

| Elsewhere | Australia India South Africa |

GDP growth of 2.5% but falling commodity exports. Jobs iffy? Not another country, another universe. But opportunities. Low growth, high unemployment (25%), low new investment |

The Fastest 2 Minutes in International Business

Our GlobalTeam™ of highly experienced international project managers – on the ground in 32 countries – contributed to the following brief summary of the franchise world opportunities for 4th quarter 2015.

| Asia | China Japan Malaysia Mongolia The Philippines Thailand Viet Nam |

Watch the consumer economy not the overall GDP growth. Large corporations are investing in new consumer projects. Ringgit drop of 25% against the US$ plus political unrest. US pizza and coffee franchises flourishing. Seriously. Middle class buying power accelerating. Stable politics. Military dictatorships often are stable. US sailors on shore leave, 6%+ GDP growth. |

| Americas | Argentina Brazil Canada Chile Colombia Mexico Peru USA |

You still get paid in soybeans, if at all. Economy is stalled, inflation climbing, corruption rife. Tim Horton’s and Burger King are now one??? New President negative on business. Investment stopped. Show me the money and where it came from. Mexico City, Monterrey and Cancun booming. Lima is a city of cranes and new foreign F&B brands. US$15/hour minimum wage means no margins, less jobs. |

| Europe | Ireland Germany Poland Russia Spain Turkey United Kingdom |

GDP growth of 3.5% projected for 2016. Difficult to find investors/risk takers for new foreign brands. 3.5% GDP growth for 2015 is the highest in the EU. Foreign brands with US$ denominated rents are closed GDP growth for 2016 estimated to be 2.6%. Political unrest leading to drop in new project investment. 2.4% GDP growth, but normal investment analysis paralysis. |

| Middle East | Egypt Saudi Arabia Dubai |

Pent up consumer demand, high growth but scary security. Challenges to get new businesses open due to regulations. New building push, large expat influx, airport & airline soaring. |

| Elsewhere | Australia India South Africa |

GDP growth of 2.6% but falling commodity exports. Jobs iffy? Not another country, another universe. Low growth, high unemployment (25%), low new investment |