An Update on the Coronavirus Impact on Doing Business in China Today

Bill Edwards, CEO of EGS, has been doing business in China for 37 years, starting with living in China from late 1982 through mid 1985. Our company opened an office in Beijing in 2014. Our company is currently helping four U.S. brand enter the Mainland China market. Needless to say, things right now are different than ever before

Here are some recent headlines and analysis that define what is going on in China today:

As of this date, all flights from the US to China and most to Hong Kong have stopped. Business meetings stopped 2+ weeks ago. The Chinese are learning to work remotely.

“China Passenger Car Association said sales fell to just 4,909 units in the first 16 days of February, from 59,930 in the same period in 2019”, South China Morning Post (SCMP), 022120

“China app downloads surge due to coronavirus outbreak Deadly epidemic has left tens of millions of people confined to their homes”, Financial Times 021920

“Coronavirus a boon for China’s tech-savvy supermarkets as homebound customers switch to online grocery orders”, SCMP 022120

Burger King®, Dairy Queen®, KFC, McDonald’s® and Starbucks® closed a total of over 7,500 stores in China in late January or early February.

“McDonald’s has implemented contactless pickup and delivery of Big Macs, fries and other menu items across the China. Customers order remotely and employees seal the meals in bags and put them in a special spot for pickup without human contact.” Reuters 021820

Some feedback from business contacts in China:

“We have been inside our Beijing home for over a month. Only one adult is allowed out every other day. Our temperature is checked by a guard on the way our and on the way back in. Our 8-year-old daughter has not been to school in a month and we have run out of videos for her. Our local grocery store now comes to our housing compound.”, Our company’s Managing Director for Greater China based in Beijing.

“Thanks so much for the nice email and your concerns, Bill. The Coronavirus has essentially stopped inbound/outbound movement and that’s not good for business. All of our staff are doing fine and no one so far has been affected. Many of us try to work remotely as much as possible and avoid crowds, subways, and restaurants.” Message from the Managing Partner of a Shanghai legal firm. 022220

But things are starting to change:

“China’s biggest factories are offering bonuses and the government has laid on planes, trains and buses to ferry people back to work.” Financial Times 022520

“Apple reopens more than half its retail stores in China after coronavirus closures. Apple’s store website shows 29 of 42 locations are opening”. SCMP 022520

With over 37 years of experience of doing business in China, I’m happy to discuss these business ramifications and solutions. I keep my thumb on pulse of the Chinese business market, monitoring daily changes and trends, and have insight on how you can protect and grow your brand in this critical market. Contact me directly at bedwards@edwardsglobal.com or on +1 949 375 1896

Traveling On Business In China And The Great China Firewall

What do Dropbox, Southwest Airlines, Box.com, Google, Facebook, LinkedIn, Gmail and the New York Times have in common?

Their websites are all blocked in Mainland China. This means no Google mail and no access to cloud based files for many of the standard sources we in the West use today. However, WeTransfer seems to work fine for file transfer. Microsoft Outlook also works, most of the time.

No google.com, but yahoo.com is available. Southwest Airlines? Who knew they were a problem? In Hong Kong and Taiwan none of these websites are blocked.

Often before a Western website will fully load there is a delay as the Great China Firewall decides if the content is forbidden. If there has been an article that is negative to China you can also expect ‘The Economist’, the ‘Wall Street Journal’ and ‘Financial Times’ websites to be blocked. Usually this is only for a few days.

I have just returned from two weeks in Taipei, Shanghai, Wuhan, Chengdu and Hong Kong on business for three of the US franchises that our company represents around the world.

The good news is that high speed bandwidth Internet is available in major cities in Mainland China. And there is typically no charge for Internet at the major hotel chains. That is not the case in the USA where several large hotel chains still charge high prices for Internet access. And in the USA the bandwidth at such hotels can be ‘iffy’.

The Great China Firewall is alive and prospering. But manageable.

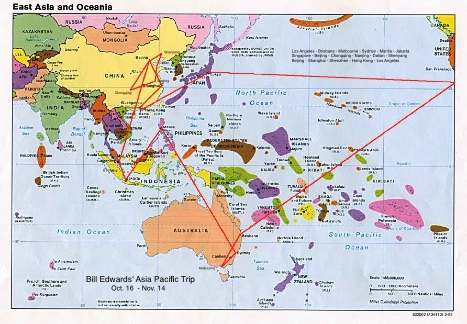

Bill’s Fall 2013 Asia Pacific Trip

From mid-October through mid-November I traveled approximately 20,000 air miles (see map) visiting 5 countries and 13 cites in Australia, Philippines, Indonesia, Singapore, China and Japan. The purpose of this trip was to meet with companies who were interested in acquiring licenses for U.S. franchise brands our company represents.

Australia had just gone through a national election that saw the pro-business party sweep into power. Everyone was very excited about the potential for growth over the next couple of years. The Philippines is seeing high growth and strongly desires U.S. brands, especially in the food sector. Indonesia continues to see good consumer spending growth despite some nationalistic moves by the government ahead of major elections in 2014. Singapore has recovered from the recession but is having some challenges with imported labor. All of these remain good places to take established U.S. franchise brands.

Singapore’s immigration challenges are interesting. For decades Singapore welcomed immigrants to help grow the economy to one of the most advanced in the world. Low wage workers are needed but citizens are becoming nervous about the influx of migrant workers. (Source: Stratford, ‘Singapore’s Immigration Dilemma’, 12/12/2013)

China is experiencing huge changes in 2013 associated with the once-a-decade Beijing government leadership changes. My trip to China this time was focused more on “2nd tier” cities such as Chongqing, Nanjing, Dalian and Shenyang. While these are cities with large populations – Chongqing officially has over 30 million people – they are often considered second class to Beijing, Shanghai, Guangzhou and Shenzhen. The 2nd tier cities are where the central government is focusing investment to raise the standard of living and to keep the population happy.

One of the very interesting trends now in the Philippines, Indonesia and China is the consumer’s focus on food quality and safety. Fast middle class consumer growth has far outstripped the countries ability to produce safe food locally. This seems to be a higher concern than prices. Especially for the new middle class young families with children.

A good sign on this concern is that US-based Smithfield Foods, a huge producer of pork, was recently bought by China’s Shuanghui International. And the UK-based Weetabix cereal was bought in 2012 by China’s Bright Food. (Source: Forbes, ‘Global Small Business Blog’, 12/20/13)