EGS Biweekly Global Business Newsletter Issue 80, Tuesday, April 18, 2023

Edited and curated by: William (Bill) Edwards, CFE, CEO of Edwards Global Services, Inc. (EGS)

Introduction: In this issue, are we approaching the end of the central bank interest rate increases? There is a natural gas surplus due to increased U.S. LNG shipments and conservation post Ukraine invasion. Delta has already sold 75% of its seats for summer travel. Inflation continues to fall except for sugar. And the global future lies with electric cars ready or not!

The mission of this newsletter is to use trusted global and regional information sources to update our 1,400+ readers in 20+ countries on key global and local trends that can impact the success of their businesses at home and abroad.

To receive this biweekly newsletter that is read by over 1,400 people in 20 countries, click here:

First, A Few Words of Wisdom From Others

“Europe was created by history. America was created by philosophy.”, Margaret Thatcher

“To understand Europe, you have to be a genius – or French.”, Madeleine Albright

“You can’t go back and change the beginning, but you can start where you are and change the ending.”, C. S. Lewis

Highlights in issue #80:

- Brand Global News Section: Burger King®, Chick-Fil-A®, Papa Johns® and Subway

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Interesting Data and Studies

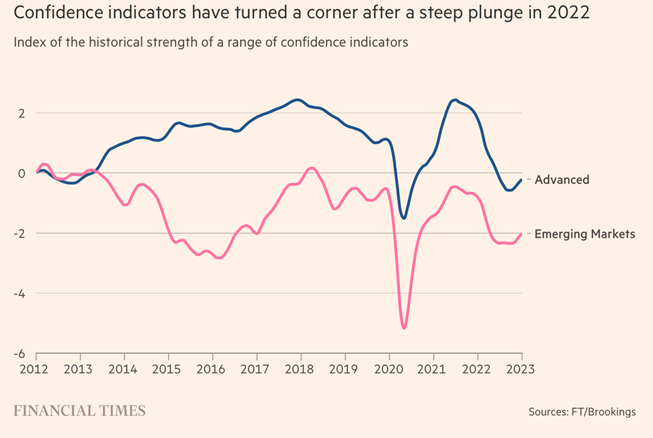

“Global economy fends off geopolitical and banking threats – China, US, eurozone, India and UK well-placed to avoid slowdown going into IMF-World Bank spring meetings. The world’s leading economies are showing surprising resilience despite facing a perilous moment, according to research for the Financial Times that suggests the global economy may avoid a sharp slowdown this year. China, the US, the eurozone, India and the UK are all growing faster than had been expected late last year, the latest edition of the twice-yearly Brookings-FT tracking index found, with consumer and business confidence rising after a rocky end to 2022.”, The Financial Times, April 9, 2023

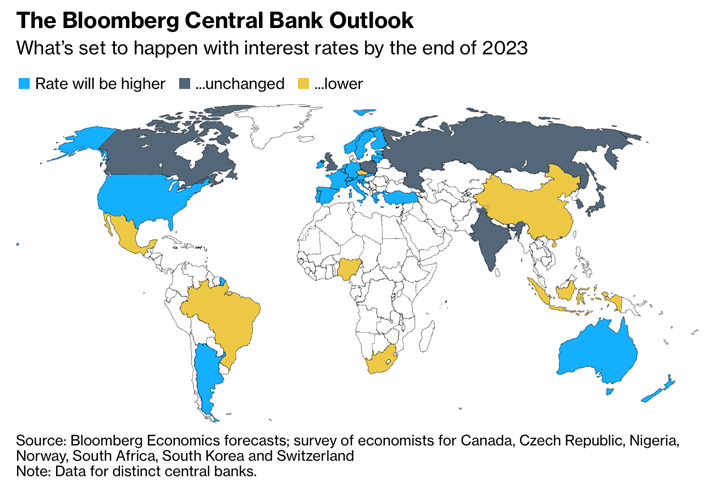

“End May Be in Sight for Global Rate-Hike Cycle as Fed Nears Peak – Quarterly outlook on what to expect from monetary policy. One more Fed hike and a pause could herald pivot by peers. Most global central banks may be either close to a peak or already done with interest-rate hiking, auguring a hiatus before possible monetary loosening comes into view.”, Bloomberg, April 9, 2023

“Intelligence for Sanctions Compliance – International sanctions and trade restrictions are growing in scope and complexity, not least in response to Russia’s invasion of Ukraine. Compliance with such laws can require insights into third-parties that cannot be achieved with automated screening or desktop research. For situations of heightened risk, an investigative approach that goes beyond the public record is recommended.”, Enquirisk, April 10, 2023

Editor’s Note: this site and company offer unusual insight into the all-important but often murky area of sanctions that companies need to know about when doing business on a global basis

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global Supply Chain, Energy, Commodities, Inflation & Trade Issues

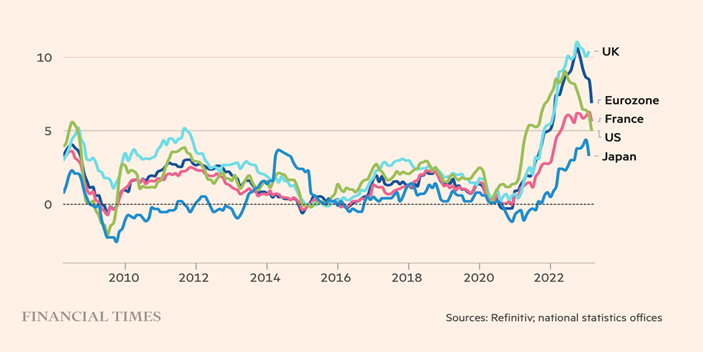

“Global inflation tracker – Inflation has started to show signs of easing from the multi-decade highs reached in many countries following Russia’s full-scale invasion of Ukraine. The latest figures for most of the world’s largest economies still make for worrying reading, with price pressures remaining high as the war in Ukraine continues to keep energy and food prices elevated. But in some countries pressures have eased and energy and food wholesale prices have declined. Economist and investors also expect inflationary levels to stabilise in the next few years.”, The Financial Times, April 12, 2023

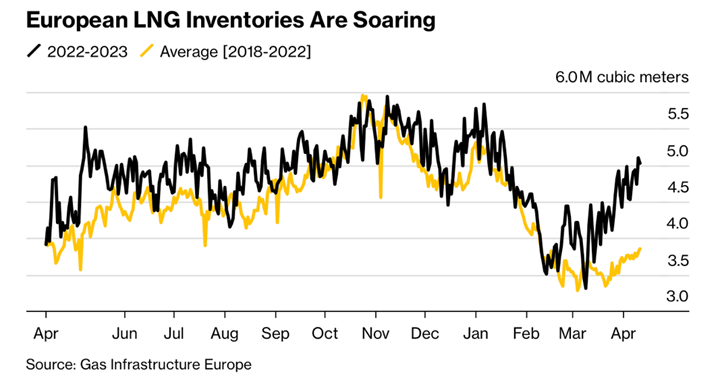

“World Gas Supply Shifts From Shortage to Glut With Demand Muted – Europe is reaching storage milestones weeks earlier than usual. Analysts uncertain over how long gas supply glut will last. The world is becoming awash with natural gas, pushing prices lower and creating an overabundance of the fuel in both Europe and Asia — at least for the next few weeks…… inventories are filling up from South Korea to Spain, a result of mostly mild winter weather and efforts to reduce consumption. Tankers filled with liquefied natural gas — a stopgap in replacing lost Russian pipeline flows — now often struggle to find a home, spending weeks idling at sea.”, Bloomberg, April 15, 2023

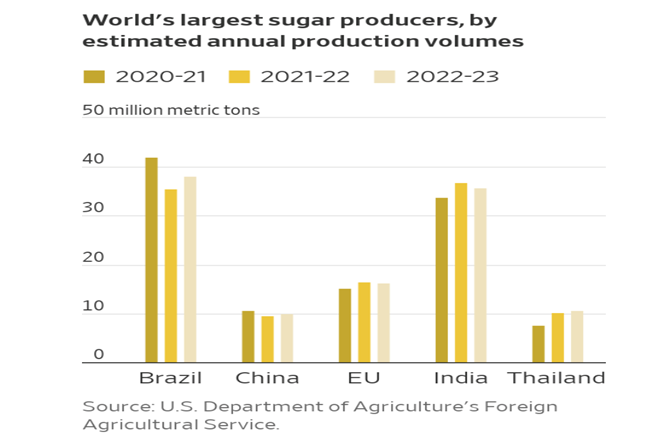

“Sugar Prices Bubble Up to Highest Since 2012 – The surge could lead to costlier sweet foods and drinks. Bad weather in India, China and Thailand has hit sugar production in all three countries, just as China’s economy has begun to reopen following the end of coronavirus lockdowns. Winners from the rally include Brazilian farmers, who are on track for a solid crop. Losers could include both food companies and consumers.”, The Wall Street Journal, April 14, 2023

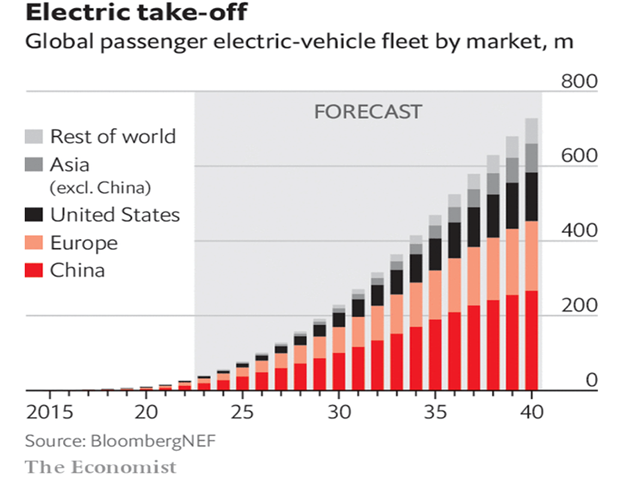

“The future lies with electric vehicles – The car industry is electrifying rapidly and irrevocably. A draft law approved by the European Union in February may mean a total ban on new ice cars by 2035 (though Germany has won an exception for cars using carbon-neutral synthetic fuels). Governments and cities are cracking down on carbon and other emissions that affect local air quality. China is demanding that 20% of cars must be (electric) by 2025.”, The Economist, April 14, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global & Regional Travel Updates

“Delta’s International Flights Are Already 75% Booked for Summer Travel – Want to fly Delta this summer? The increased demand follows a record March in which consumer demand ‘was well ahead of pre-pandemic levels,’ Delta president Glen Hauenstein said in an earnings call this week reviewed by Travel + Leisure. As a result, Delta is growing its international capacity this summer, and flying its largest-ever Transatlantic summer schedule (including new flights to London, increased service to Paris, and beyond).”, Travel & Leisure, April 14, 2023

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Country & Regional Updates

Australia

“May rate rise on the cards after strong jobs numbers – Overall consumer spending appears to be coming off the boil following 10 Reserve Bank interest rate increases and the inflationary squeeze on household incomes. But the 53,000-strong job surge in March, reported yesterday, brings a May rate rise back onto the table, reported Michael Read, following the central bank’s pause this month. If so, that would come exactly a week before the May 9 federal budget. Amid the loss of tech and consulting jobs, the red-hot labour market has been one of the big surprises of the pandemic recovery.”, Australia Financial Review, April 13, 2023

Canada

“Companies turn to baristas, free food and socializing to lure employees back to the office – Manulife’s chief executive Roy Gori says a complete overhaul of the company’s nearly 100-year-old office building, as well as pro-actively listening to employee feedback on their hybrid arrangement, has already paid off. ‘We’re not seeing any decrease in productivity,’ Mr. Gori says over lunch in the company’s renovated second floor cafeteria. “If anything, I think we’re going to see – and probably already are seeing – productivity improve because people are now being more purposeful with their time.”, The Globe And Mail, April 11, 2023

China

“Chinese Exports Surge as Trade With Russia and Southeast Asia Jumps – Shipments to Russia more than doubled in March from a year earlier. Outbound shipments from China soared 14.8% in March from a year earlier, data from China’s customs bureau showed Thursday, reversing the 6.8% decline recorded during the first two months of 2023 and ending a nearly half-year string of such drops stretching back to October.”, The Wall Street Journal, April 13, 2023

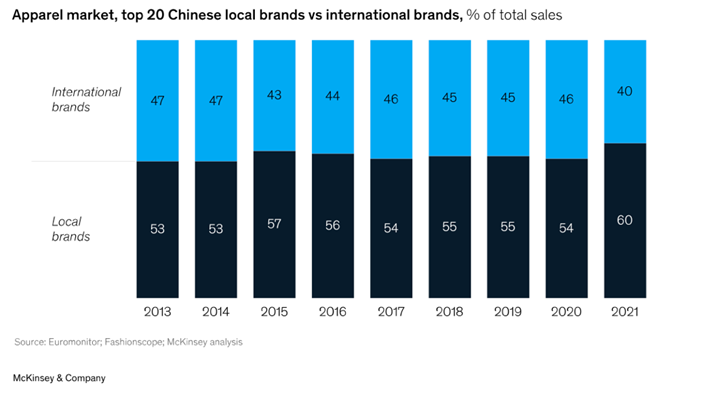

“Winning in China Top priorities for global apparel and fashion brands – The apparel, fashion, and luxury market in China continues to be one of the largest and most dynamic in the world. After a difficult 2022, the industry is likely to resume double-digit growth, fueled in part by a rising middle class. However, for multinational companies, doing business in China is getting harder. According to the National Bureau of Statistics, the China Consumer Confidence Index fell by 28 percent from October 2021 to October 2022, dampening consumer spending.2 Chinese champions are increasingly outpacing their global peers, and many are adopting a more agile operating model and supply chain to enable greater responsiveness to changing consumer preferences.”, McKinsey, March 30, 2023. Compliments of Paul Jones, Jones & Co., Toronto

India

“India’s plan to export its wildly successful digital payments system – After starting cross-border payments with Singapore, India is now setting up more international partnerships. The country’s biometric ID system, Aadhaar, already has takers in developing countries in Africa and Southeast Asia that are seeking digital sovereignty. With wider adoption of its unified payments interface, India’s digital stack is now positioned as a ‘benign’ alternative to international networks like Swift.”, Rest Of World, April 10, 2023

Japan

“Japan to Drop COVID-19 Testing, Vaccination Protocols Next Month — What to Know: ‘All border measures to prevent the spread of COVID-19 will be lifted on May 8, 2023,’ the Japan National Tourism Organization announced. Currently, all travelers heading to Japan are required to show either proof of three doses of a COVID-19 vaccine or proof of a negative test conducted within 72 hours of departure, according to the Japan National Tourism Organization.”, Travel & Leisure, April 7, 2023

Turkey

“Turkey to make inaugural deliveries from big Black Sea gas discovery – Turkish Petroleum, the state oil and gas company, will on Thursday flip the switch on the Sakarya gasfield development, roughly three years after making the find, according to its chief executive, Melih Han Bilgin.”, The Financial Times, April 16, 2023

United Kingdom

“Big firms a lot more confident about the future – Confidence among finance chiefs at the UK’s biggest companies has seen its sharpest rise since 2020. The Deloitte survey of chief financial officers showed sentiment rebounded as their concerns about energy prices and Brexit problems eased. There were 25% more chief financial officers feeling better about the future than worse, compared to 17% more feeling the opposite three months ago. Not since the Covid vaccine rollout has there been such a swing in confidence.”, BBC News, April 16, 2023

“No recession — but growth to be subdued, forecasters warn – The forecasting group expects the gross domestic product (GDP) measure of output to rise by 0.2 per cent. This reflects a significant upgrade from the 0.7 per cent decline expected in its January forecast. Output is then expected to rise by 1.9 per cent next year and 2.3 per cent in 2025. Inflation will begin to decline quickly because prices this year are compared with already high prices last year, and household bills are set to drop from July once households benefit from the sharp decline in natural gas prices over winter, the EY Item Club said.”, The Times of London, April 17, 2023

United States

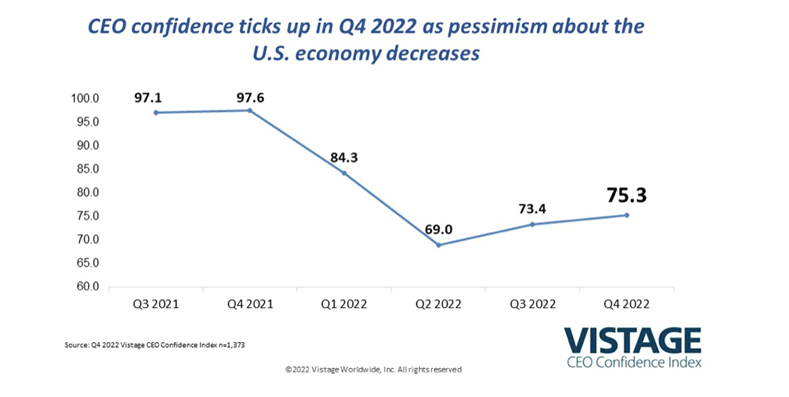

“The Q4 2022 Vistage CEO Confidence Index rose 1.9 points in Q4 to reach 75.3, which is the fourth lowest reading since the Great Recession. Looking across the six core components of the Index, the shifts in CEOs’ responses between improved, stayed the same and worsened largely offset each other. While plans for increased hiring in the year ahead rose, that improving sentiment was tempered by confidence in the economy remaining near historic lows.”, Vistage, January 5, 2023

“Homebuilder sentiment jumps to highest level since September – Confidence among builders in the U.S. housing market increased more than expected in April as declining mortgage rates and low inventory helped drive demand higher for new homes. The National Association of Home Builders/Wells Fargo Housing Market Index, which measures the pulse of the single-family housing market, rose one point to 45, the highest reading since September.”, Fox Business, April 17, 2023

“Small businesses are less optimistic about the future, survey finds – The National Federation of Independent Businesses released survey results showing their small business optimism index decreased in March, ‘marking the 15th consecutive month below the 49-year average of 98.’ “Small business owners are cynical about future economic conditions,” NFIB Chief Economist Bill Dunkelberg said. ‘Hiring plans fell to their lowest level since May 2020, but strong consumer spending has kept Main Street alive and supported strong labor demand.’”, Washington Examiner, April 12, 2023

Brand & Franchising News

“Burger King is selling more Whoppers than ever before in early days of its U.S. turnaround – Seven months after Burger King unveiled a strategy to revive its U.S. business, the chain is selling more Whoppers than ever before. Burger King U.S. President Tom Curtis told CNBC that preliminary improvements to restaurant operations and new marketing campaigns are already boosting sales and customer satisfaction, although it’s still early innings.”, CNBC, April 5, 2023

“Chick-fil-A Has the Country’s ‘Slowest Drive-Thru,’ But It’s Still Bringing in Major Profits – The chicken chain brought in $18.8 billion in U.S. sales last year, marking consistent upward growth since 2019, according to the brand’s Franchise Disclosure Document released earlier this week. But Chick-fil-A also ranked last for speed of service, according to The 2022 QSR Drive-Thru Report, with the average transaction taking 325.47 seconds (for reference, Taco Bell ranked number one at 221.99 seconds).”, Entrepreneur magazine, April 7, 2023

“Papa Johns Plots Global Domination – QSR Magazine reports that Papa Johns has announced, in partnership with PJP Investments Group, plans to open a whopping 650 new restaurants in India by 2033. That’s a lot of stores. According to Papa Johns’ filings, as of 2019 the chain consisted of 3,142 locations in the United States and 5,395 restaurants worldwide. The new locations in India would account for 11% of all Papa Johns units—which is wild, considering the restaurant operates in 49 other countries.”, The Takeout, April 4, 2023

“Subway Sale Process Heats Up as Bidders Head to Second Round – The first pool of bids were lodged in March, and several interested parties have already been thrown out by the company’s advisers for offering too little, the people said. Subway is aiming for a valuation of $10 billion or more. More than 10 possible suitors, including some big names in private equity, are conducting due diligence that should draw to a close by the end of this month, the people added. Final bids will likely be due around then and a buyer could emerge by the end of May, the people said.”, The Wall Street Journal, April 13, 2023

To receive this biweekly newsletter, click here : https://bit.ly/geowizardsignup

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, economic development and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing environment. Our GlobalTeam™ on the ground covering 25+ countries provides us with updates about what is actually happening in their specific countries.

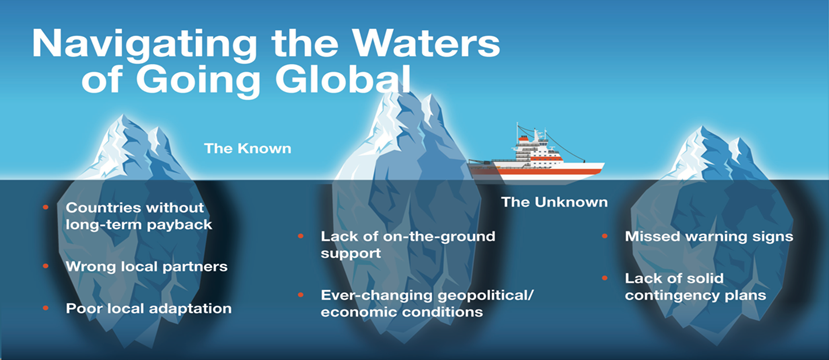

William “Bill” Edwards: Global Advisor Is Uniquely Qualified to Steer Sr. Executives Successfully Through the Complex Waters of Going Global.

With four decades of successful international business experience spanning virtually every corner of the world and many business sectors, Bill Edwards understands the global business landscape like no other. He has been a County Master Franchisee in five countries in Asia, Europe and the Middle East; the Senior VP for a franchisor operating in 15 countries and a full-service consultant taking 40 franchisors global.

For a complimentary 30 minute consultation on how to take your business global successfully, contact Bill Edwards at bedwards@edwardsglobal.com or +1 949 224 3896.

Download our latest chart ranking 40+ countries as places to do business at this link: