EGS Biweekly Global Business Newsletter Issue 78, Tuesday, March 21, 2023

Edited and curated by: William (Bill) Edwards, CFE, CEO of Edwards Global Services, Inc. (EGS)

Introduction: This issue’s quotes are all about banking over the past 250 years. Global business travel is almost back to pre-COVID levels. The world’s happiest country survey is out. European economies limp into 2023 but it could have been worse. U.S. inventories fall and small business confidence improves.

The mission of this newsletter is to use trusted global and regional information sources to update our 1,400+ readers in 20+ countries on key global and local trends that can impact the success of their businesses at home and abroad.

To receive this biweekly newsletter that is read by over 1,400 people in 20 countries, click here:

https://bit.ly/geowizardsignup

First, A Few Words of Wisdom From Others

“If you owe the bank $100 that’s your problem. If you owe the bank $100 million, that’s the bank’s problem.”, J. Paul Getty, Founder, Getty Oil

“Banking is a very good business if you don’t do anything dumb.”, Warren Buffett,

Chairman and CEO, Berkshire Hathaway

“I sincerely believe that banking establishments are more dangerous than standing armies.”, Thomas Jefferson

Highlights in issue #78:

- Brand Global News Section: Carl’s Jr®, Chick-Fil-A®, Restauramt Group (UK), Strong Pilates®, Subway®, Sweetgreen®, Wendys®

NOTE: Bolded headlines in this newsletter are live links where the article is available without a paid subscription.

Interesting Data and Studies

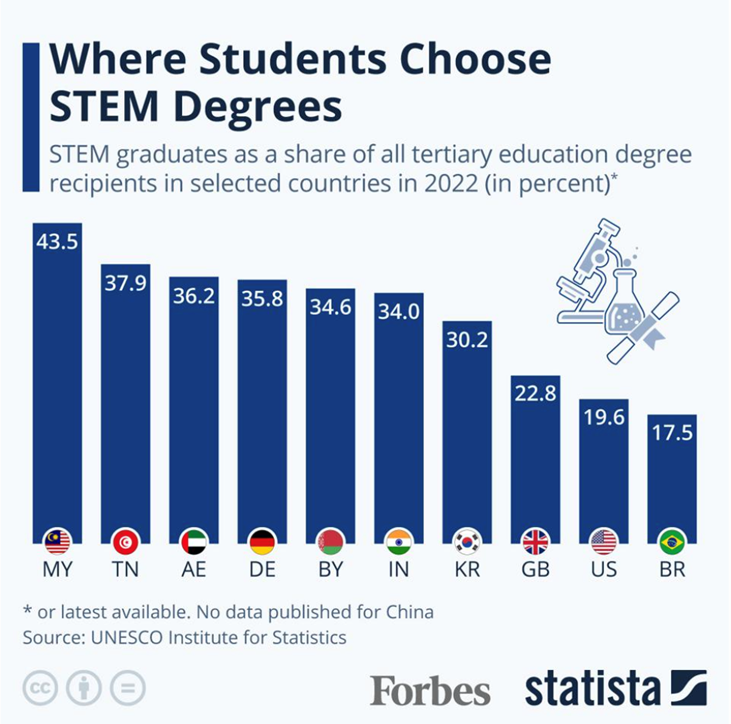

“Where Students Choose STEM Degrees – Many countries have tried to bolster enrollment in STEM to aid important growth industries like medtech, digital services, mobility or computer sciences. However, countries have had varying success, as data from UNESCO shows. In general, countries that have managed to produce a higher share of STEM graduates than elsewhere are more likely to be found in the Arab world, in Eastern Europe and also in East Asia. Using the latest available data from 2020 through 2022, Malaysia saw the highest share of STEM graduates in all tertiary education degree recipients at 43.5%.”, Forbes, March 10, 2023

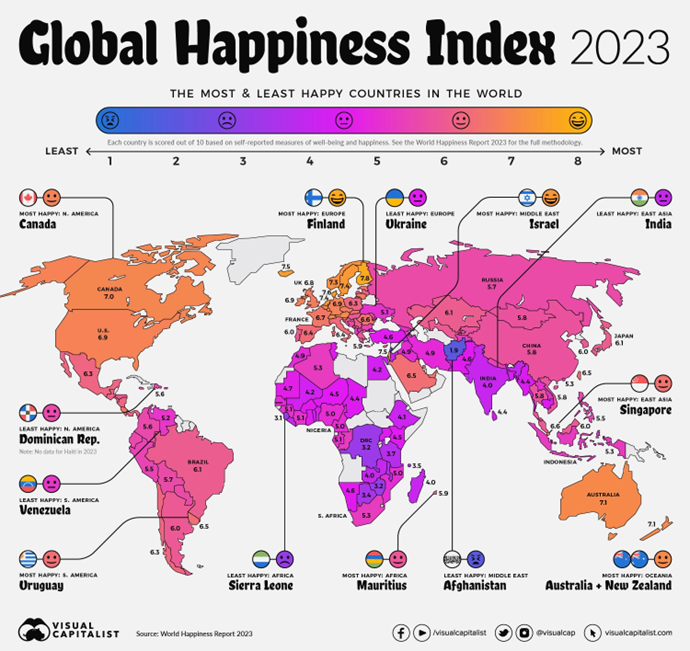

“The World’s Happiest Countries in 2023 – Released today!! Are wealth and prosperity legitimate measures of happiness? How about safety and health outcomes? In the West, we view democracy as a key component to happiness, yet there are countries under authoritarian rule that score high in the Happiness Index. The map above is a global snapshot of life satisfaction around the world. It utilizes the World Happiness Report—an annual survey of how satisfied citizens are worldwide—to map out the world’s happiest and least happy countries. To create the index the map is based on, researchers simply asked people how satisfied they are with their lives. While there may be no perfect measure of happiness around the world, the report is a robust and transparent attempt to understand happiness at the global level.”, Visual Capitalist / World Happiness Report, March 20, 2023

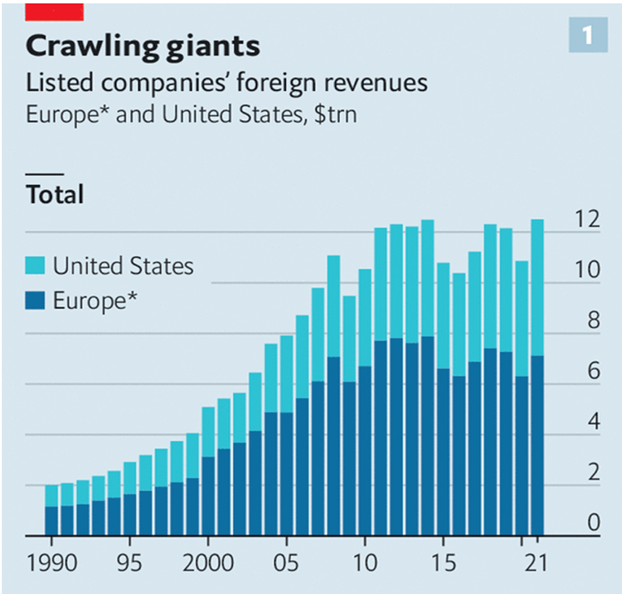

“Are Western companies becoming less global? Operating as a multinational company has always involved difficulties, from co-ordinating across time zones to navigating a patchwork of regulatory regimes. The latest strains on globalised commerce—wrought by geopolitical tensions and rising protectionism—raise tricky questions for the corporate giants of the West that have been among globalisation’s biggest beneficiaries. Since 2010 the foreign sales of listed American and European companies have grown by a meagre 2% per year, down from 8% in the 2000s and 10% in the 1990s. American firms may have a quarter fewer foreign subsidiaries than a decade ago, on average, but the drop was more than offset by the number of them with a presence abroad.”, The Economist, March 16, 2023

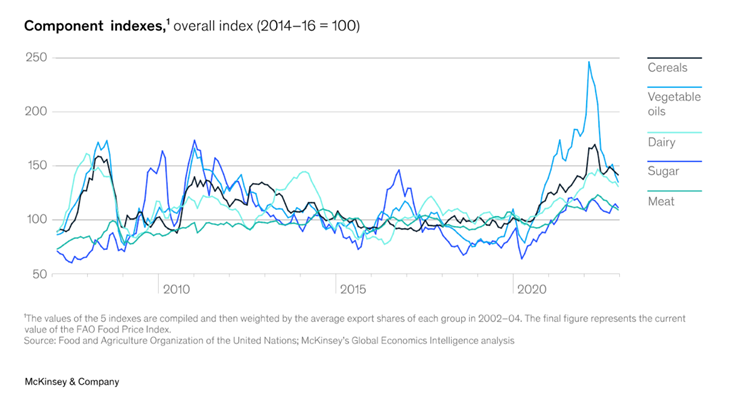

Global Supply Chain, Energy, Commodities, Inflation & Trade Issues

“Global Economics Intelligence executive summary, February 2023 – Some economic indicators strengthen amid persisting inflation and investor uncertainty; central banks keep to a tightening course. In the United States, positive retail sales totals and outsize jobs growth suggest a stronger business environment in early 2023. In China, the purchasing managers’ index (PMI) for manufacturing, a key leading indicator, reached 52.6 in February, the highest reading in more than a decade. The nonmanufacturing PMI for China rose to 56.3 on higher services and construction activity in an economy awakening from the “zero-COVID” closures. In the eurozone, services growth pushed the composite PMI (for manufacturing and services) above the expansion line of 50 with a reading of 50.3 in January; the indicator then advanced to 52.6 in February, the highest mark recorded since May 2022.”, McKinsey, February 2023

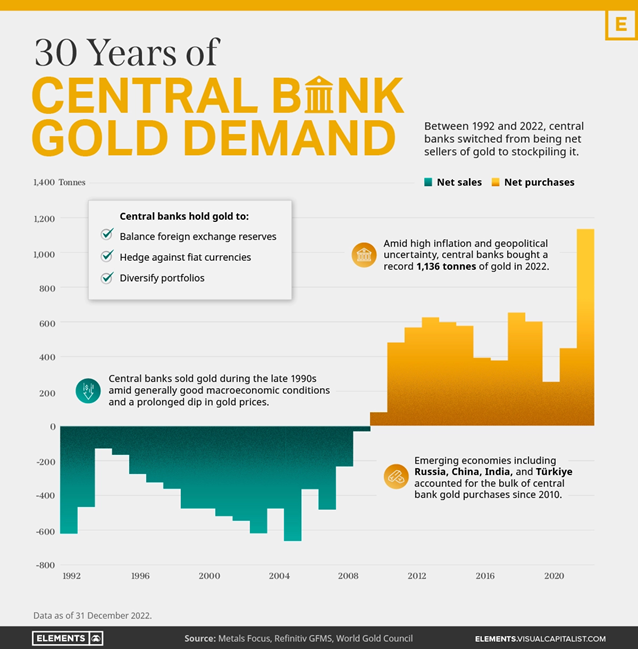

“Charted: 30 Years of Central Bank Gold Demand – Did you know that nearly one-fifth of all the gold ever mined is held by central banks? Besides investors and jewelry consumers, central banks are a major source of gold demand. In fact, in 2022, central banks snapped up gold at the fastest pace since 1967. However, the record gold purchases of 2022 are in stark contrast to the 1990s and early 2000s, when central banks were net sellers of gold. The above infographic uses data from the World Gold Council to show 30 years of central bank gold demand, highlighting how official attitudes toward gold have changed in the last 30 years.”, Visual Capitalist, March 15, 2023

Global & Regional Travel Updates

“IATA Reports January Traffic At 84% Of 2019 Level – In its latest air passenger traffic report released yesterday, IATA said that January 2023 traffic increased by 67% compared to January last year. t’s not news that domestic traffic remained strong, with many nations already operating at pre-pandemic levels. The relaxing of travel restrictions in China is now starting to translate into airline passengers, which helped domestic RPKs to rise by 32.7% in January compared to the same month last year.”, Simple Flying, March 9, 2023

“Singapore Snatches Back ‘World’s Best Airport’ Crown From Qatar – Singapore’s Changi has regained its title as the world’s best airport, after losing its long-held crown to Qatar for two years running during the height of pandemic travel restrictions. The Asian hub edged Doha’s Hamad International Airport into second place, with Tokyo’s Haneda Airport bagging third, in the Skytrax World Airport Awards 2023. The US was conspicuous by its absence in the top 10. Paris Charles de Gaulle was Europe’s top performer, up one spot to fifth place, while Seattle-Tacoma International Airport was the highest ranked North American airport, languishing in 18th position — but an improvement from 27th place last year.”, Bloomberg, March 15, 2023

Country & Regional Updates

Argentina

“Argentina’s inflation rate soars past 100%, its worst in over 30 years – Annual rate of 102.5% is denting purchasing power, savings, economic growth and government’s chances in elections next year. In Argentina’s markets, shops and homes, the impact of rising prices is being felt keenly as one of the highest inflation rates in the world stretches people’s wallets. With inflation so high, prices change almost weekly.”, The Guardian, March 15, 2023

China

“Economy Rebounds but Further Acceleration Needed – The National Bureau of Statistics’ (NBS) release of February’s data gives us our first glimpse of how quickly the economy might rebound in 2023. Last year, GDP only grew by 3 percent, as the authorities implemented policies to stop the spread of the pandemic. This year, the government is targeting growth of around 5 percent. The increase in industrial value added was disappointing. It had risen by 2.8 percent in the fourth quarter of 2022 and by 3.8 percent last year. However, the growth in service production was encouraging given that it had fallen by 0.1 percent last year and by 0.9 percent in the fourth quarter.”, Yicai Global, March 17, 2023

“China to Resume Issuing Range of Visas to Foreigners – China will resume issuing various types of visas to tourists and other foreign travelers from Wednesday, as the country lifts some of the last Covid restrictions that have hampered cross-border travel for the past three years. According to the Chinese foreign ministry, the move includes allowing foreigners with visas issued before March 28, 2020, which are still valid, to enter China.”, Caixin Global, March 14, 2023

Eurozone & European Union Countries

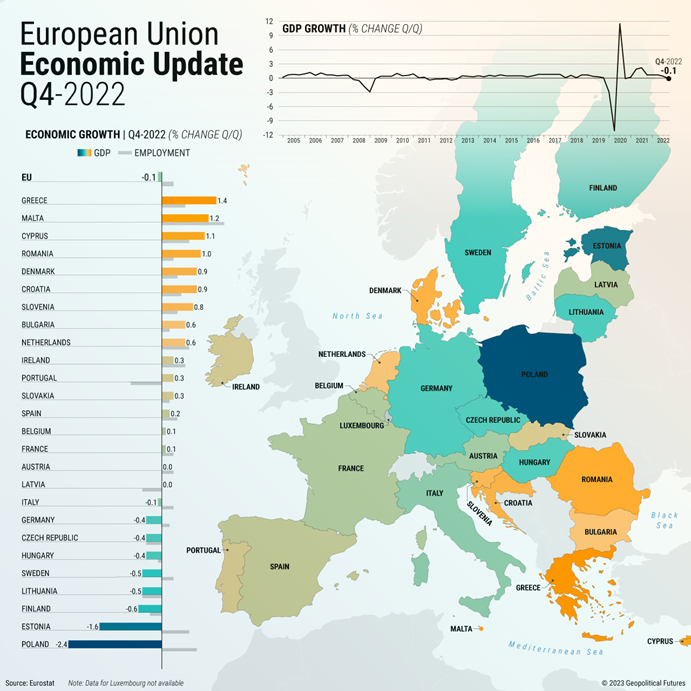

“European Economies Limp into 2023. It could have been worse – The European Union’s economy shrank slightly in the final quarter of 2022. It could have been worse. Most countries tolerated the sharp rise in energy prices without a major hit to growth. Employment also climbed slightly in both the eurozone and the EU. It remains to be seen how well Europe will withstand monetary tightening, the war, and warning signs in the banking sector, among other things, in 2023.”, Geopolitical Futures, March 17, 2023

India

“Air India Confident on Funding for World’s Biggest Aircraft Deal – Indian carrier placed order for 470 jets from Boeing. Air India Ltd. is in talks with banks to help fund its recently announced record aircraft order, benefitting from the support of new owner Tata Sons Ltd., the carrier’s chief executive officer said. ‘We have the backing of Tata Sons, so there is financing available for these aircraft,’ CEO Campbell Wilson said in an interview with Bloomberg News on the sidelines of the CAPA India Aviation Summit in New Delhi on Monday.”, Bloomberg, March 20, 2023

Indonesia

“Indonesia sets aside $455 million to subsidise electric motorcycle sales – Indonesia will allocate 7 trillion rupiah ($455.88 million) in state funds to subsidise electric motorcycle sales through 2024, officials said on Monday, as it pushes mass adoption of EVs with the aim of attracting investment in the domestic industry. The government will also announce incentives for electric cars on April 1, said senior cabinet minister Luhut Pandjaitan said. Finance Minister Sri Mulyani Indrawati said the subsidies will cover sales of 800,000 new electric motorcycles and the conversion of 200,000 combustion engine motorcycles.”, Reuters, March 20, 2023

Japan

“Japan/eggs: mayonnaise crisis highlights food price pressures – Bird flu has led to shortages of household staple, hitting manufacturers, retailers and consumers. Japan has culled about 15mn birds, as it deals with its worst-ever outbreak of bird flu. As a result, wholesale prices of eggs in February almost doubled. The shortages are widely felt. Convenience stores including 7-Eleven have suspended the sale of some egg-related products. Ingredient prices for food companies are rising across the board. The biggest problem is with mayonnaise. Egg yolks are a key ingredient of this staple Japanese condiment. Manufacturers including the largest, Kewpie and Ajinomoto, will raise prices by up to 21 per cent from April.”, The Financial Times, March 10, 2023

New Zealand

“How franchisors supported franchisees after Gabrielle – The Anniversary Day floods and Cyclone Gabrielle turned summer from a happy and relaxed time into a period of danger, despair and stress for many people, small business owners included. One touching story came from The Coffee Club, which had a new franchisee in Napier hit by the floods just 11 days after opening. The new café was closed for 8 days, then had to start all over again. The franchisor flew two staff down to help, and also encouraged suppliers to donate free product to help the franchisees get back on their feet. The franchisee said, ‘No, there are people worse off than us,’ and made up 150 lunch bags using the donated product to give to the volunteers helping the worst affected.”, Franchise New Zealand magazine, March 20, 2023. Compliments of Simon Lord, Publisher

United Kingdom

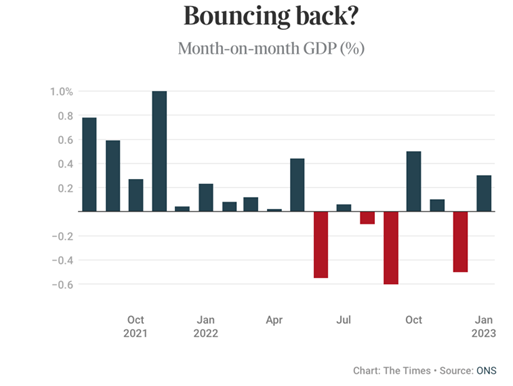

“UK economy returns to growth in January – Month-on-month gross domestic product rose 0.3 per cent during the month, according to data from the Office for National Statistics (ONS). City economists had forecast a 0.1 per cent rise. In the three months to January, however, growth was flat and the economy remains 0.2 per cent below its pre-pandemic size, adding pressure on Jeremy Hunt to spur growth in next week’s budget. It also adds to the challenge facing the chancellor to meet his target to get government debt falling as a share of GDP. The country is the only one among its G7 peers that has not yet recovered its pre-pandemic size.”, The Times Of London, March 10, 2023

“Doctors Are Quitting Britain’s NHS for a Career in Business – Newly-qualified medics are switching to management consultancy. Unions blame poor pay and conditions in the health system. A poll published by the British Medical Association at the end of last year found that 2-in-5 junior doctors plan to leave the NHS once they’re offered another job, while 79% “often think about leaving the NHS.” Pay, deteriorating conditions and increasing workloads were the main gripes, according to the survey. Of those actively planning a new career, the most popular option was management consulting, with the pharmaceutical sector also a key destination.”, Bloomberg, March 13, 2023

United States

“U.S. business inventories fall for first time in nearly two years – Business inventories dropped 0.1%, the Commerce Department said on Wednesday. That was the first decline and also the weakest reading since April 2021 and followed a 0.3% gain in December. Economists polled by Reuters had expected inventories, a key component of gross domestic product, would be unchanged. Inventories increased 11.1% on a year-on-year basis in January.”, Reuters, March 15, 2023

“U.S. small business confidence improves further in February – The National Federation of Independent Business (NFIB) said its Small Business Optimism Index increased 0.6 point to 90.9 last month. Still, it was the 14th straight month that the index was below the 49-year average of 98. Forty-seven percent of owners reported job openings that were hard to fill, up 2 points from January, with workers scarce for both skilled and unskilled positions.”, Reuters, March 15, 2023

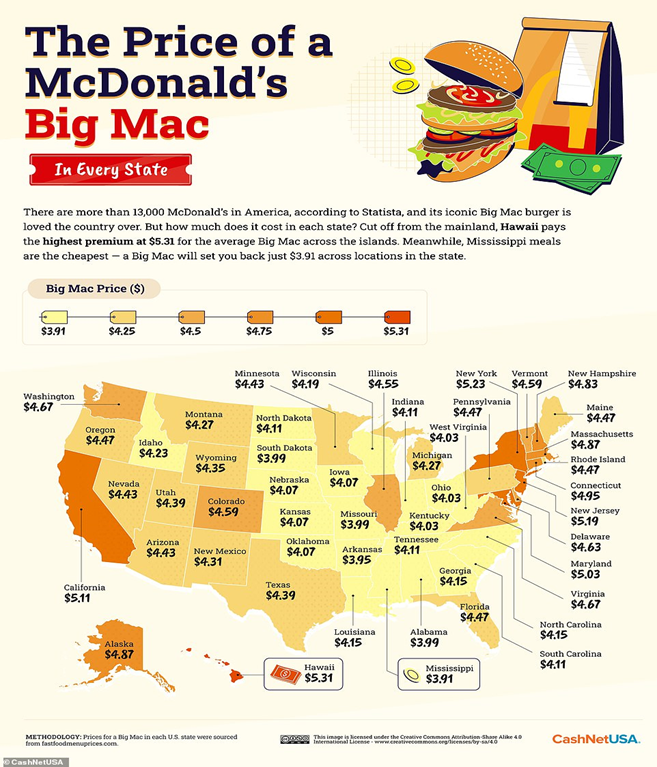

“How inflation has upped the price of your Big Mac: State-by-state breakdown reveals the staggering difference in cost for a McDonald’s. A Big Mac in Hawaii will set you back $5.31, which is the most expensive in America, according to data sourced by CashNetUSA. The same burger in Mississippi is available for just $3.91 and priced at $3.95 in Arkansas and $3.99 in Missouri, South Dakota and Alabama. The average cost of a Big Mac in the US is $4.40 which is among the cheapest in 76 countries.”, The Daily Mail, March 19, 2023

Brand & Franchising News

“2023 State of the (U.S.) Restaurant Industry – A new normal takes hold. Many restaurant owners have a growth mindset for 2023. Nearly 3 in 4 operators say business conditions are already close to normal—a new, more positive normal—or are well on the path, and the focus is on sustaining growth in the coming year. While the headwinds of 2022 will carry over into 2023, consumers’ desire for the restaurant experience is as strong as ever and will play a critical role in the industry’s recovery.”, National Restaurant Association, February 28, 2023

“US burger giant Carl’s Jr. instructs Christie & Co to find franchise partners for UK debut – In 2021, BigHospitality revealed that the 1,000 plus strong brand was looking to enter the UK market for first time following its success in mainland Europe. Carl’s Jr. initially looked to find a master franchisee, but it is now looking to partner with multiple ‘ambitious’ hospitality entrepreneurs/investment groups who can open at least 20 restaurants in their respective region, in the next few years, ideally with extensive restaurant experience and the financial capability.”, Bighospitality UK, March 15, 2023

“Chick-Fil-A Is Investing $1 Billion In International Markets – Chick-fil-A is booming in the United States. QSR reported that the famed maker of chicken sandwiches was the third-biggest fast food restaurant in America by sales as of 2021. Chick-fil-A’s sales are particularly striking when you consider that the chain has under 3,000 locations in the US. As CEO Andrew Cathy recently told The Wall Street Journal, the company plans to spend $1 billion to establish a presence abroad in the coming years. Chick-fil-A’s previous attempts to expand internationally have largely fallen flat.”, The Tasting Table, March 19, 2023

“Restaurant Group (UK) to close 35 underperforming outlets – The operator of the Wagamama and Frankie & Benny’s restaurant chains has announced plans to exit from about 35 uneconomic restaurants in its leisure division as it seeks to whittle down its least successful businesses. The Restaurant Group (TRG) announced the move alongside a three-year plan to reduce debt and improve margins in what was widely regarded as a riposte aimed at Oasis Management Company, an activist investor with a 6.5 per cent stake.”, The Times of London, March 8, 2023

“STRONG Pilates secures Singapore as it looks to Canada, the US – Only four months after announcing plans to enter the UK market, fitness brand STRONG Pilates has added another region to its global footprint as it looks to roll out 11 locations across Singapore over the next three years. The foray into Singapore is part of the Melbourne-based company’s bullish ambitions to launch into three new global markets this year, with plans for the remaining two – Canada and the US – currently in the works.”, Business News Australia, March 20, 2023

“Your Sweetgreen Salads May Soon Be Delivered By Flying Robots – Only 16 years after the first restaurant premiered in Washington D.C. …. Sweetgreen has become a nationwide chain, and a growing one at that. In fact, according to QSR, the restaurant chain, who reached 150 locations in 2021, announced in 2022 that it had set its sights on reaching 1,000 by 2030. This week, Zipline announced in a press release that it was collaborating with Sweetgreen and healthcare companies on a new delivery method that will bring food and prescription medicines to people’s homes in a faster and more convenient fashion — and in a more sustainable manner.”, Tasting Table, March 17, 2023

“Advent International joins list of suitors for sandwich chain Subway – Buyout firm Advent International is among a list of firms that remain in contention to buy sandwich chain Subway, Sky News reported on Monday. The firm joins rival bidders including Goldman Sachs’ asset management arm, Bain Capital, TDR Capital – the joint owner of Asda – and TPG, according to the report. Advent had previously invested in entertainment retailer HMV and currently has investments in companies such as Laird International and McAfee Corp, among others.”, Reuters, March 13, 2023

“US fast food chain Wendy’s to launch ‘hundreds’ of restaurants in Australia – Speaking exclusively to the Australian Financial Review, Wendy’s chief development officer Abigail Pringle said she was convinced there was an appetite for the chain’s signature burgers, fries and frosty desserts Down Under. ‘We believe Australia is a lucrative market for long-term growth,’ Ms Pringle told the publication.”, News.com.au, February 27, 2023. Compliments of Jason Gehrke, Franchise Advisory Centre, Brisbane

“9 Iconic (U.S.) Restaurant Chains That Are Struggling – Your favorite restaurants of the past are closing one by one. These iconic restaurant chains, among others, are struggling to regain customers against an avalanche of difficulties. The stalwart legacy restaurants of the past are in worse shape than ever before thanks to long-term financial woes, changing customer tastes, and low post-pandemic recovery efforts. Soon, some of the classic restaurants you grew up on could be a thing of the past. So if you want to relive the glory days of fast-casual dining (or grab a low-cost deli sandwich), grab a high-top table before it’s too late.”, Eat This, Not That!, March 17, 2023

To receive this biweekly newsletter, click here : https://bit.ly/geowizardsignup

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, economic development and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing environment. Our GlobalTeam™ on the ground covering 25+ countries provides us with updates about what is actually happening in their specific countries.

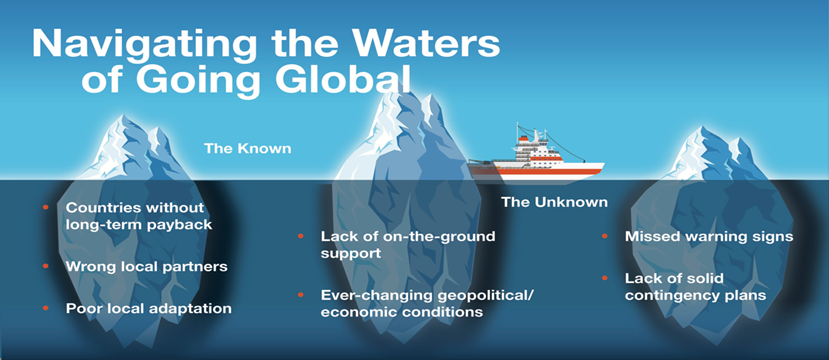

Over 4 decades William (Bill) Edwards has steered more than 40 brands successfully through the complexities of Going Global. Problem-solver, strategist, visionary and trusted Global Advisor, Bill Edwards sees what others don’t. Now he’s sharing this unmatched experience and wisdom with select senior executives traversing the complex international growth landscape.

For a complimentary 30 minute consultation on how to take your business global successfully, contact Bill Edwards at bedwards@edwardsglobal.com or +1 949 224 3896.

Download our latest chart ranking 40+ countries as places to do business at this link: