EGS Biweekly Global Business Newsletter Issue 78, Tuesday, March 21, 2023

Edited and curated by: William (Bill) Edwards, CFE, CEO of Edwards Global Services, Inc. (EGS)

Introduction: This issue’s quotes are all about banking over the past 250 years. Global business travel is almost back to pre-COVID levels. The world’s happiest country survey is out. European economies limp into 2023 but it could have been worse. U.S. inventories fall and small business confidence improves.

The mission of this newsletter is to use trusted global and regional information sources to update our 1,400+ readers in 20+ countries on key global and local trends that can impact the success of their businesses at home and abroad.

To receive this biweekly newsletter that is read by over 1,400 people in 20 countries, click here:

https://bit.ly/geowizardsignup

First, A Few Words of Wisdom From Others

“If you owe the bank $100 that’s your problem. If you owe the bank $100 million, that’s the bank’s problem.”, J. Paul Getty, Founder, Getty Oil

“Banking is a very good business if you don’t do anything dumb.”, Warren Buffett,

Chairman and CEO, Berkshire Hathaway

“I sincerely believe that banking establishments are more dangerous than standing armies.”, Thomas Jefferson

Highlights in issue #78:

- Brand Global News Section: Carl’s Jr®, Chick-Fil-A®, Restauramt Group (UK), Strong Pilates®, Subway®, Sweetgreen®, Wendys®

NOTE: Bolded headlines in this newsletter are live links where the article is available without a paid subscription.

Interesting Data and Studies

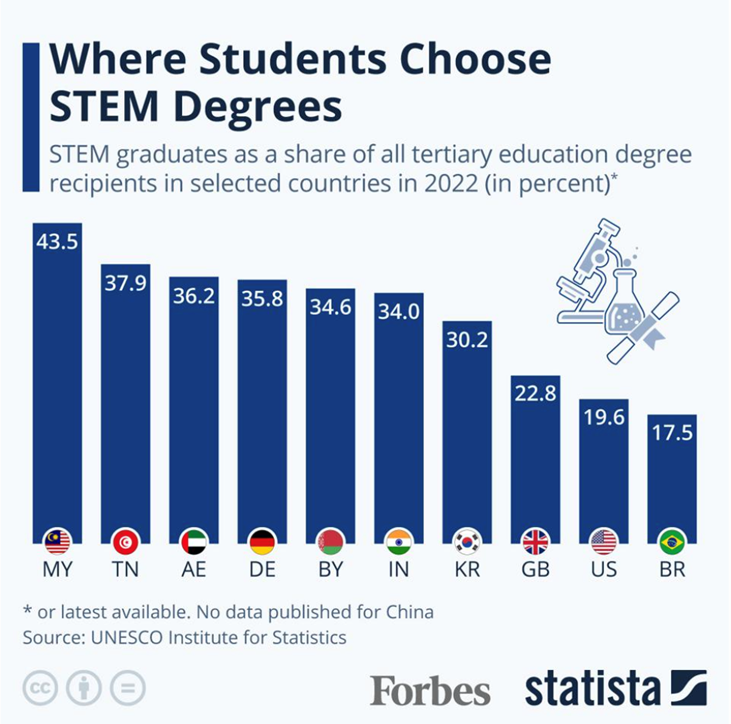

“Where Students Choose STEM Degrees – Many countries have tried to bolster enrollment in STEM to aid important growth industries like medtech, digital services, mobility or computer sciences. However, countries have had varying success, as data from UNESCO shows. In general, countries that have managed to produce a higher share of STEM graduates than elsewhere are more likely to be found in the Arab world, in Eastern Europe and also in East Asia. Using the latest available data from 2020 through 2022, Malaysia saw the highest share of STEM graduates in all tertiary education degree recipients at 43.5%.”, Forbes, March 10, 2023

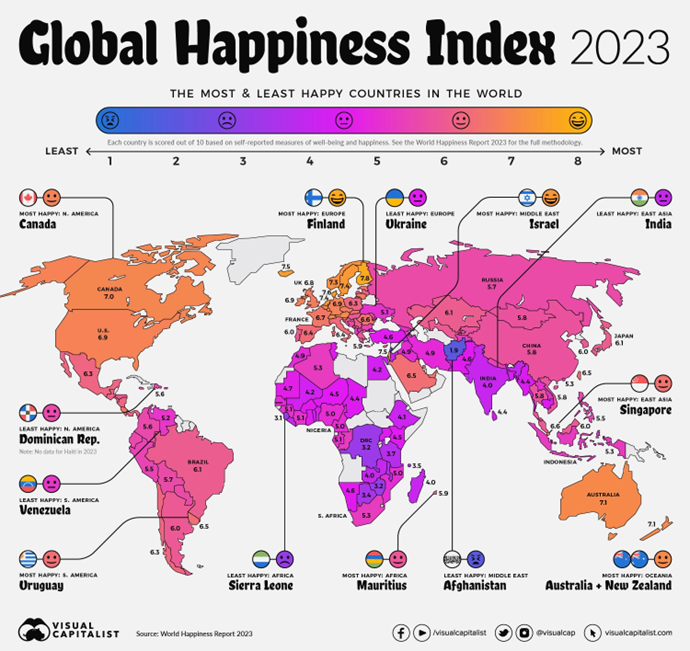

“The World’s Happiest Countries in 2023 – Released today!! Are wealth and prosperity legitimate measures of happiness? How about safety and health outcomes? In the West, we view democracy as a key component to happiness, yet there are countries under authoritarian rule that score high in the Happiness Index. The map above is a global snapshot of life satisfaction around the world. It utilizes the World Happiness Report—an annual survey of how satisfied citizens are worldwide—to map out the world’s happiest and least happy countries. To create the index the map is based on, researchers simply asked people how satisfied they are with their lives. While there may be no perfect measure of happiness around the world, the report is a robust and transparent attempt to understand happiness at the global level.”, Visual Capitalist / World Happiness Report, March 20, 2023

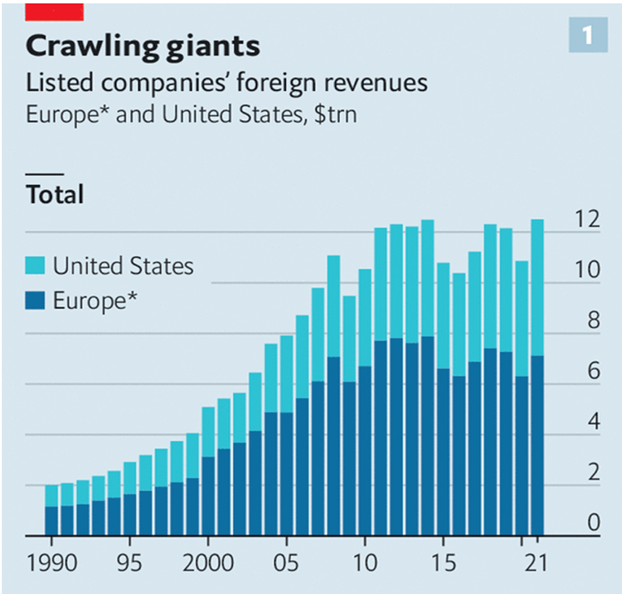

“Are Western companies becoming less global? Operating as a multinational company has always involved difficulties, from co-ordinating across time zones to navigating a patchwork of regulatory regimes. The latest strains on globalised commerce—wrought by geopolitical tensions and rising protectionism—raise tricky questions for the corporate giants of the West that have been among globalisation’s biggest beneficiaries. Since 2010 the foreign sales of listed American and European companies have grown by a meagre 2% per year, down from 8% in the 2000s and 10% in the 1990s. American firms may have a quarter fewer foreign subsidiaries than a decade ago, on average, but the drop was more than offset by the number of them with a presence abroad.”, The Economist, March 16, 2023

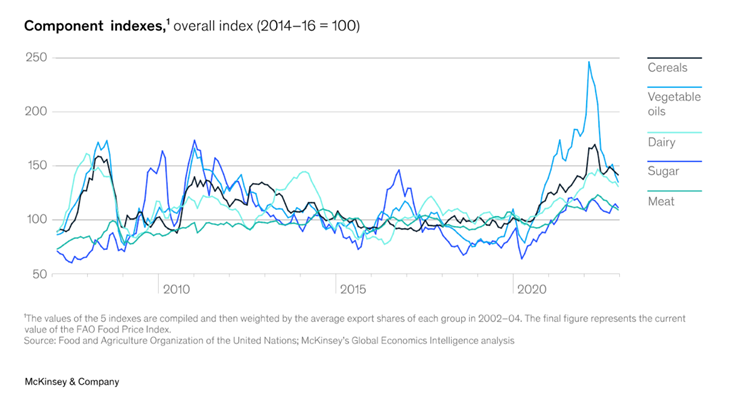

Global Supply Chain, Energy, Commodities, Inflation & Trade Issues

“Global Economics Intelligence executive summary, February 2023 – Some economic indicators strengthen amid persisting inflation and investor uncertainty; central banks keep to a tightening course. In the United States, positive retail sales totals and outsize jobs growth suggest a stronger business environment in early 2023. In China, the purchasing managers’ index (PMI) for manufacturing, a key leading indicator, reached 52.6 in February, the highest reading in more than a decade. The nonmanufacturing PMI for China rose to 56.3 on higher services and construction activity in an economy awakening from the “zero-COVID” closures. In the eurozone, services growth pushed the composite PMI (for manufacturing and services) above the expansion line of 50 with a reading of 50.3 in January; the indicator then advanced to 52.6 in February, the highest mark recorded since May 2022.”, McKinsey, February 2023

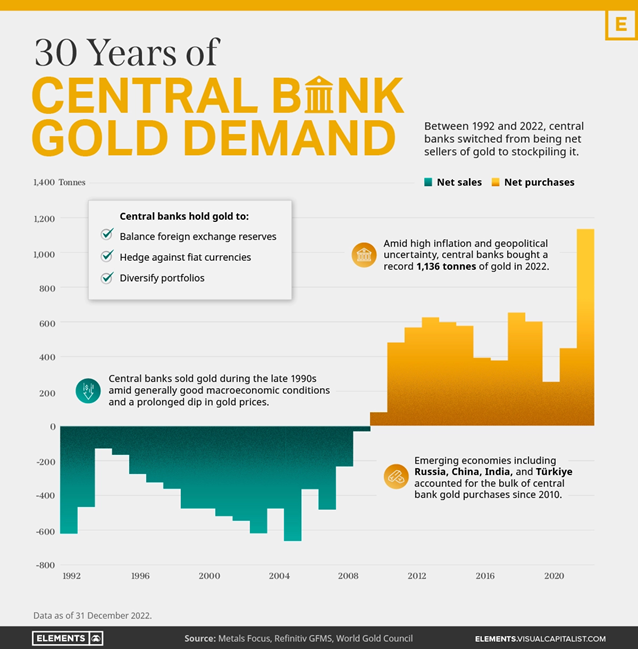

“Charted: 30 Years of Central Bank Gold Demand – Did you know that nearly one-fifth of all the gold ever mined is held by central banks? Besides investors and jewelry consumers, central banks are a major source of gold demand. In fact, in 2022, central banks snapped up gold at the fastest pace since 1967. However, the record gold purchases of 2022 are in stark contrast to the 1990s and early 2000s, when central banks were net sellers of gold. The above infographic uses data from the World Gold Council to show 30 years of central bank gold demand, highlighting how official attitudes toward gold have changed in the last 30 years.”, Visual Capitalist, March 15, 2023

Global & Regional Travel Updates

“IATA Reports January Traffic At 84% Of 2019 Level – In its latest air passenger traffic report released yesterday, IATA said that January 2023 traffic increased by 67% compared to January last year. t’s not news that domestic traffic remained strong, with many nations already operating at pre-pandemic levels. The relaxing of travel restrictions in China is now starting to translate into airline passengers, which helped domestic RPKs to rise by 32.7% in January compared to the same month last year.”, Simple Flying, March 9, 2023

“Singapore Snatches Back ‘World’s Best Airport’ Crown From Qatar – Singapore’s Changi has regained its title as the world’s best airport, after losing its long-held crown to Qatar for two years running during the height of pandemic travel restrictions. The Asian hub edged Doha’s Hamad International Airport into second place, with Tokyo’s Haneda Airport bagging third, in the Skytrax World Airport Awards 2023. The US was conspicuous by its absence in the top 10. Paris Charles de Gaulle was Europe’s top performer, up one spot to fifth place, while Seattle-Tacoma International Airport was the highest ranked North American airport, languishing in 18th position — but an improvement from 27th place last year.”, Bloomberg, March 15, 2023

Country & Regional Updates

Argentina

“Argentina’s inflation rate soars past 100%, its worst in over 30 years – Annual rate of 102.5% is denting purchasing power, savings, economic growth and government’s chances in elections next year. In Argentina’s markets, shops and homes, the impact of rising prices is being felt keenly as one of the highest inflation rates in the world stretches people’s wallets. With inflation so high, prices change almost weekly.”, The Guardian, March 15, 2023

China

“Economy Rebounds but Further Acceleration Needed – The National Bureau of Statistics’ (NBS) release of February’s data gives us our first glimpse of how quickly the economy might rebound in 2023. Last year, GDP only grew by 3 percent, as the authorities implemented policies to stop the spread of the pandemic. This year, the government is targeting growth of around 5 percent. The increase in industrial value added was disappointing. It had risen by 2.8 percent in the fourth quarter of 2022 and by 3.8 percent last year. However, the growth in service production was encouraging given that it had fallen by 0.1 percent last year and by 0.9 percent in the fourth quarter.”, Yicai Global, March 17, 2023

“China to Resume Issuing Range of Visas to Foreigners – China will resume issuing various types of visas to tourists and other foreign travelers from Wednesday, as the country lifts some of the last Covid restrictions that have hampered cross-border travel for the past three years. According to the Chinese foreign ministry, the move includes allowing foreigners with visas issued before March 28, 2020, which are still valid, to enter China.”, Caixin Global, March 14, 2023

Eurozone & European Union Countries

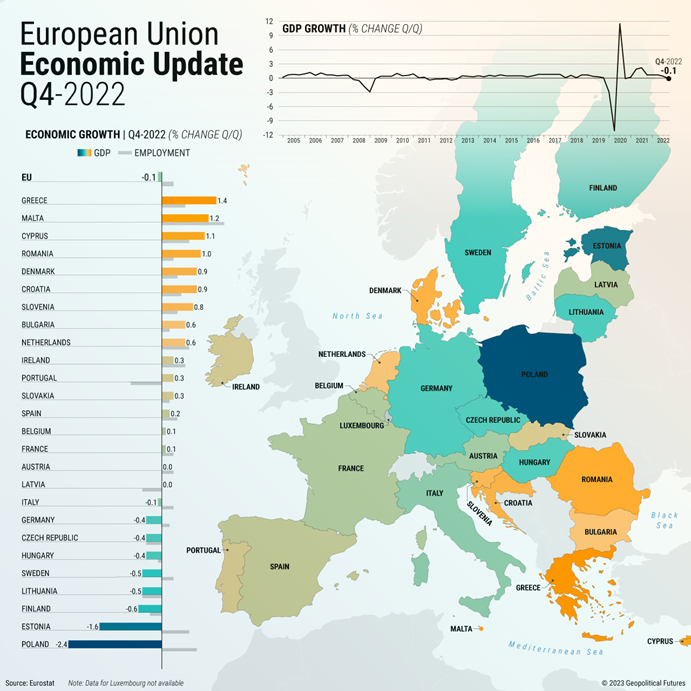

“European Economies Limp into 2023. It could have been worse – The European Union’s economy shrank slightly in the final quarter of 2022. It could have been worse. Most countries tolerated the sharp rise in energy prices without a major hit to growth. Employment also climbed slightly in both the eurozone and the EU. It remains to be seen how well Europe will withstand monetary tightening, the war, and warning signs in the banking sector, among other things, in 2023.”, Geopolitical Futures, March 17, 2023

India

“Air India Confident on Funding for World’s Biggest Aircraft Deal – Indian carrier placed order for 470 jets from Boeing. Air India Ltd. is in talks with banks to help fund its recently announced record aircraft order, benefitting from the support of new owner Tata Sons Ltd., the carrier’s chief executive officer said. ‘We have the backing of Tata Sons, so there is financing available for these aircraft,’ CEO Campbell Wilson said in an interview with Bloomberg News on the sidelines of the CAPA India Aviation Summit in New Delhi on Monday.”, Bloomberg, March 20, 2023

Indonesia

“Indonesia sets aside $455 million to subsidise electric motorcycle sales – Indonesia will allocate 7 trillion rupiah ($455.88 million) in state funds to subsidise electric motorcycle sales through 2024, officials said on Monday, as it pushes mass adoption of EVs with the aim of attracting investment in the domestic industry. The government will also announce incentives for electric cars on April 1, said senior cabinet minister Luhut Pandjaitan said. Finance Minister Sri Mulyani Indrawati said the subsidies will cover sales of 800,000 new electric motorcycles and the conversion of 200,000 combustion engine motorcycles.”, Reuters, March 20, 2023

Japan

“Japan/eggs: mayonnaise crisis highlights food price pressures – Bird flu has led to shortages of household staple, hitting manufacturers, retailers and consumers. Japan has culled about 15mn birds, as it deals with its worst-ever outbreak of bird flu. As a result, wholesale prices of eggs in February almost doubled. The shortages are widely felt. Convenience stores including 7-Eleven have suspended the sale of some egg-related products. Ingredient prices for food companies are rising across the board. The biggest problem is with mayonnaise. Egg yolks are a key ingredient of this staple Japanese condiment. Manufacturers including the largest, Kewpie and Ajinomoto, will raise prices by up to 21 per cent from April.”, The Financial Times, March 10, 2023

New Zealand

“How franchisors supported franchisees after Gabrielle – The Anniversary Day floods and Cyclone Gabrielle turned summer from a happy and relaxed time into a period of danger, despair and stress for many people, small business owners included. One touching story came from The Coffee Club, which had a new franchisee in Napier hit by the floods just 11 days after opening. The new café was closed for 8 days, then had to start all over again. The franchisor flew two staff down to help, and also encouraged suppliers to donate free product to help the franchisees get back on their feet. The franchisee said, ‘No, there are people worse off than us,’ and made up 150 lunch bags using the donated product to give to the volunteers helping the worst affected.”, Franchise New Zealand magazine, March 20, 2023. Compliments of Simon Lord, Publisher

United Kingdom

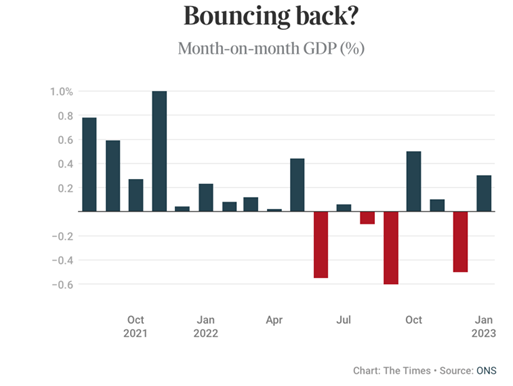

“UK economy returns to growth in January – Month-on-month gross domestic product rose 0.3 per cent during the month, according to data from the Office for National Statistics (ONS). City economists had forecast a 0.1 per cent rise. In the three months to January, however, growth was flat and the economy remains 0.2 per cent below its pre-pandemic size, adding pressure on Jeremy Hunt to spur growth in next week’s budget. It also adds to the challenge facing the chancellor to meet his target to get government debt falling as a share of GDP. The country is the only one among its G7 peers that has not yet recovered its pre-pandemic size.”, The Times Of London, March 10, 2023

“Doctors Are Quitting Britain’s NHS for a Career in Business – Newly-qualified medics are switching to management consultancy. Unions blame poor pay and conditions in the health system. A poll published by the British Medical Association at the end of last year found that 2-in-5 junior doctors plan to leave the NHS once they’re offered another job, while 79% “often think about leaving the NHS.” Pay, deteriorating conditions and increasing workloads were the main gripes, according to the survey. Of those actively planning a new career, the most popular option was management consulting, with the pharmaceutical sector also a key destination.”, Bloomberg, March 13, 2023

United States

“U.S. business inventories fall for first time in nearly two years – Business inventories dropped 0.1%, the Commerce Department said on Wednesday. That was the first decline and also the weakest reading since April 2021 and followed a 0.3% gain in December. Economists polled by Reuters had expected inventories, a key component of gross domestic product, would be unchanged. Inventories increased 11.1% on a year-on-year basis in January.”, Reuters, March 15, 2023

“U.S. small business confidence improves further in February – The National Federation of Independent Business (NFIB) said its Small Business Optimism Index increased 0.6 point to 90.9 last month. Still, it was the 14th straight month that the index was below the 49-year average of 98. Forty-seven percent of owners reported job openings that were hard to fill, up 2 points from January, with workers scarce for both skilled and unskilled positions.”, Reuters, March 15, 2023

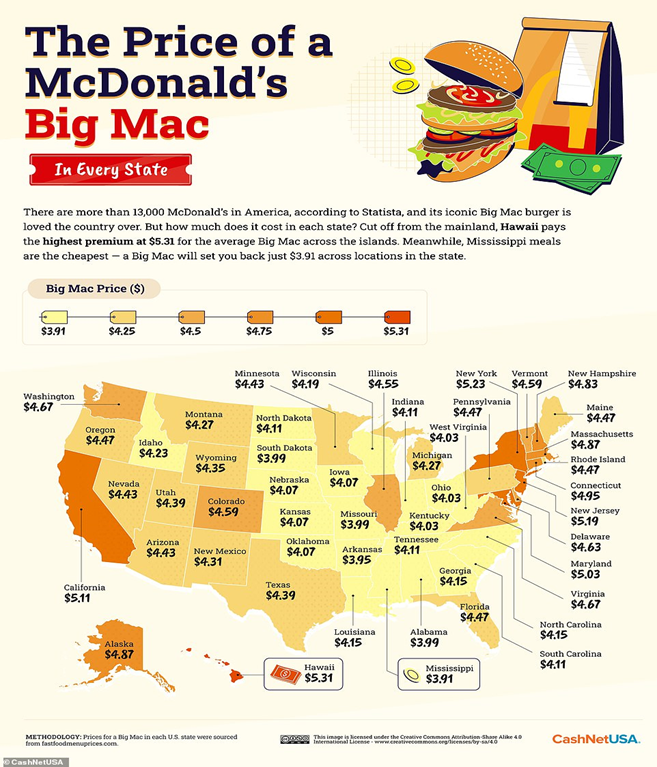

“How inflation has upped the price of your Big Mac: State-by-state breakdown reveals the staggering difference in cost for a McDonald’s. A Big Mac in Hawaii will set you back $5.31, which is the most expensive in America, according to data sourced by CashNetUSA. The same burger in Mississippi is available for just $3.91 and priced at $3.95 in Arkansas and $3.99 in Missouri, South Dakota and Alabama. The average cost of a Big Mac in the US is $4.40 which is among the cheapest in 76 countries.”, The Daily Mail, March 19, 2023

Brand & Franchising News

“2023 State of the (U.S.) Restaurant Industry – A new normal takes hold. Many restaurant owners have a growth mindset for 2023. Nearly 3 in 4 operators say business conditions are already close to normal—a new, more positive normal—or are well on the path, and the focus is on sustaining growth in the coming year. While the headwinds of 2022 will carry over into 2023, consumers’ desire for the restaurant experience is as strong as ever and will play a critical role in the industry’s recovery.”, National Restaurant Association, February 28, 2023

“US burger giant Carl’s Jr. instructs Christie & Co to find franchise partners for UK debut – In 2021, BigHospitality revealed that the 1,000 plus strong brand was looking to enter the UK market for first time following its success in mainland Europe. Carl’s Jr. initially looked to find a master franchisee, but it is now looking to partner with multiple ‘ambitious’ hospitality entrepreneurs/investment groups who can open at least 20 restaurants in their respective region, in the next few years, ideally with extensive restaurant experience and the financial capability.”, Bighospitality UK, March 15, 2023

“Chick-Fil-A Is Investing $1 Billion In International Markets – Chick-fil-A is booming in the United States. QSR reported that the famed maker of chicken sandwiches was the third-biggest fast food restaurant in America by sales as of 2021. Chick-fil-A’s sales are particularly striking when you consider that the chain has under 3,000 locations in the US. As CEO Andrew Cathy recently told The Wall Street Journal, the company plans to spend $1 billion to establish a presence abroad in the coming years. Chick-fil-A’s previous attempts to expand internationally have largely fallen flat.”, The Tasting Table, March 19, 2023

“Restaurant Group (UK) to close 35 underperforming outlets – The operator of the Wagamama and Frankie & Benny’s restaurant chains has announced plans to exit from about 35 uneconomic restaurants in its leisure division as it seeks to whittle down its least successful businesses. The Restaurant Group (TRG) announced the move alongside a three-year plan to reduce debt and improve margins in what was widely regarded as a riposte aimed at Oasis Management Company, an activist investor with a 6.5 per cent stake.”, The Times of London, March 8, 2023

“STRONG Pilates secures Singapore as it looks to Canada, the US – Only four months after announcing plans to enter the UK market, fitness brand STRONG Pilates has added another region to its global footprint as it looks to roll out 11 locations across Singapore over the next three years. The foray into Singapore is part of the Melbourne-based company’s bullish ambitions to launch into three new global markets this year, with plans for the remaining two – Canada and the US – currently in the works.”, Business News Australia, March 20, 2023

“Your Sweetgreen Salads May Soon Be Delivered By Flying Robots – Only 16 years after the first restaurant premiered in Washington D.C. …. Sweetgreen has become a nationwide chain, and a growing one at that. In fact, according to QSR, the restaurant chain, who reached 150 locations in 2021, announced in 2022 that it had set its sights on reaching 1,000 by 2030. This week, Zipline announced in a press release that it was collaborating with Sweetgreen and healthcare companies on a new delivery method that will bring food and prescription medicines to people’s homes in a faster and more convenient fashion — and in a more sustainable manner.”, Tasting Table, March 17, 2023

“Advent International joins list of suitors for sandwich chain Subway – Buyout firm Advent International is among a list of firms that remain in contention to buy sandwich chain Subway, Sky News reported on Monday. The firm joins rival bidders including Goldman Sachs’ asset management arm, Bain Capital, TDR Capital – the joint owner of Asda – and TPG, according to the report. Advent had previously invested in entertainment retailer HMV and currently has investments in companies such as Laird International and McAfee Corp, among others.”, Reuters, March 13, 2023

“US fast food chain Wendy’s to launch ‘hundreds’ of restaurants in Australia – Speaking exclusively to the Australian Financial Review, Wendy’s chief development officer Abigail Pringle said she was convinced there was an appetite for the chain’s signature burgers, fries and frosty desserts Down Under. ‘We believe Australia is a lucrative market for long-term growth,’ Ms Pringle told the publication.”, News.com.au, February 27, 2023. Compliments of Jason Gehrke, Franchise Advisory Centre, Brisbane

“9 Iconic (U.S.) Restaurant Chains That Are Struggling – Your favorite restaurants of the past are closing one by one. These iconic restaurant chains, among others, are struggling to regain customers against an avalanche of difficulties. The stalwart legacy restaurants of the past are in worse shape than ever before thanks to long-term financial woes, changing customer tastes, and low post-pandemic recovery efforts. Soon, some of the classic restaurants you grew up on could be a thing of the past. So if you want to relive the glory days of fast-casual dining (or grab a low-cost deli sandwich), grab a high-top table before it’s too late.”, Eat This, Not That!, March 17, 2023

To receive this biweekly newsletter, click here : https://bit.ly/geowizardsignup

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, economic development and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing environment. Our GlobalTeam™ on the ground covering 25+ countries provides us with updates about what is actually happening in their specific countries.

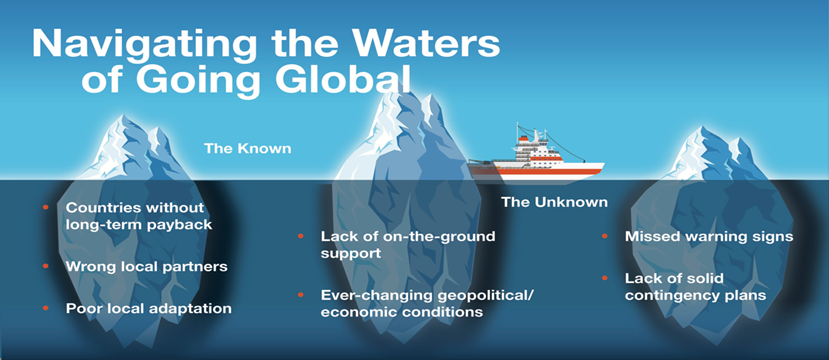

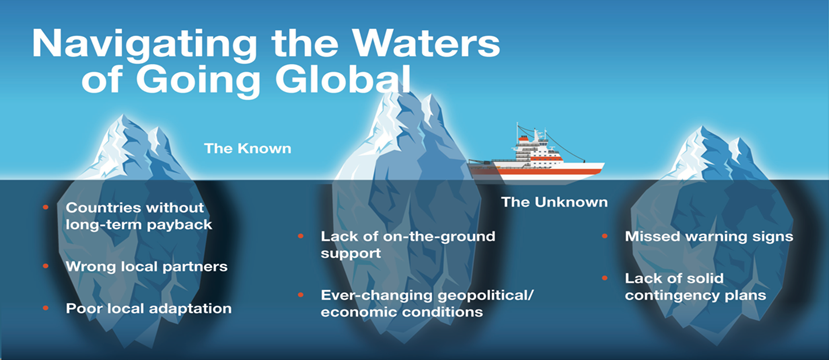

Over 4 decades William (Bill) Edwards has steered more than 40 brands successfully through the complexities of Going Global. Problem-solver, strategist, visionary and trusted Global Advisor, Bill Edwards sees what others don’t. Now he’s sharing this unmatched experience and wisdom with select senior executives traversing the complex international growth landscape.

For a complimentary 30 minute consultation on how to take your business global successfully, contact Bill Edwards at bedwards@edwardsglobal.com or +1 949 224 3896.

Download our latest chart ranking 40+ countries as places to do business at this link:

Our latest GlobalVue™ 40 country ranking

EGS Biweekly Global Business Newsletter Issue 77, Tuesday, March 7, 2023

Edited and curated by: William (Bill) Edwards, CFE, CEO of Edwards Global Services, Inc. (EGS)

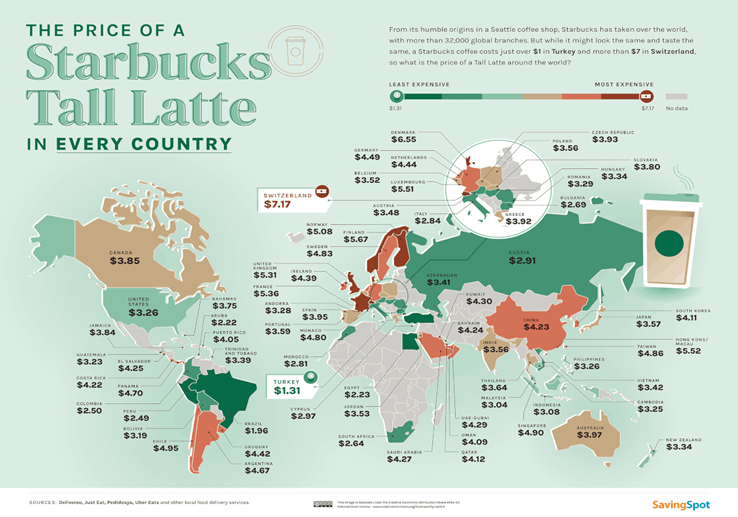

Introduction: Prices – both up and down – once again highlight our biweekly global business update newsletter. From what a Starbuck’s coffee costs around the world to higher hotel rates due to recovering travel to dropping shipping container costs to a 34% salary increase for Delta Airlines pilots. Interesting AI analyses. And the strange McDonald’s® menu items to be found around the world.

The mission of this newsletter is to use trusted global and regional information sources to update our 1,400+ readers in 20+ countries on key global and local trends that can impact the success of their businesses at home and abroad.

To receive this biweekly newsletter that is read by over 1,400 people in 20 countries, click here:

https://bit.ly/geowizardsignup

First, A Few Words of Wisdom From Others

“The difference between the possible and the impossible lies in a person’s determination.”, Tommy Lasorda

“When you’re good at something you’ll tell everyone. When you’re great at something, they’ll tell you.”, Walter Payton

“There is only one way to succeed in anything….and that is to give it everything.”, Vince Lombardi

Highlights in issue #77:

- Brand Global News Section: Appleby’s®, Chili’s®, F45®, Gelatissimo®, McDonalds® and Starbucks®

NOTE: Bolded headlines in this newsletter are live links where the article is available without a paid subscription.

Interesting Data and Studies

“The Price of Starbucks Coffee, by Country – In 1971, three former students from the University of San Francisco set up the first Starbucks at Seattle’s Pike Place Market, selling fresh roasted coffee beans, teas, and spices from around the world. This was a relatively humble beginning for what is now the largest coffeehouse chain in the world. Today, Starbucks boasts 32,000 stores across 80 countries, second only to McDonald’s in the fast-food chain business. And like McDonald’s, the price of a coffee at Starbucks varies wildly depending on the country you’re in. This map made by SavingSpot has the answer to which country has the most and least expensive Starbucks coffee…”, Visual Capitalist / SavingSpot, February 24, 2023

“Black swans, gray rhinos, and silver linings: Anticipating geopolitical risks (and openings) – The global order still reels from disruptions related to the war in Ukraine, including those in energy, food security, supply chains, and more. A central concern among global CEOs who speak with us is whether and how they will contend with additional geopolitical ruptures when they occur. The imperative to lift one’s gaze and look around the corner has become key to strategy and performance—scenario planning is squarely back.”, McKinsey & Co., February 24, 2023

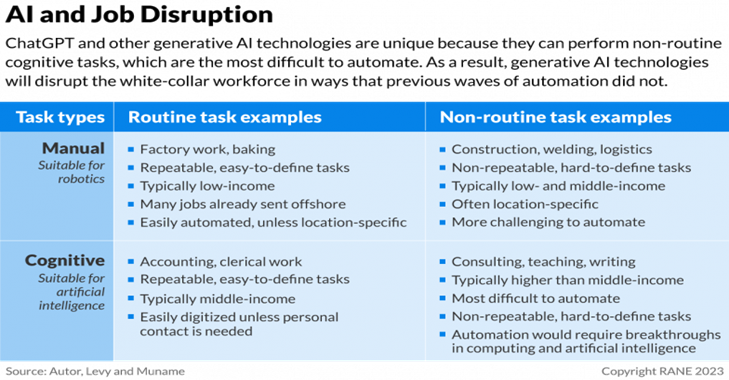

“The Rise of ChatGPT and the Future of White-Collar Jobs – Since its release on Nov. 30, 2022, an artificial intelligence (AI) chatbot called ChatGPT has taken the world by storm with its ability to provide in-depth answers to a variety of questions and seemingly hold meaningful conversations. The seeming leaps and bounds that ChatGPT represents in the field of AI are refueling age-old fears about the impact of new technologies on the job market, fears that date back perhaps most memorably to the early 19th-century Luddite movement.”, RANE Stratfor Worldview, March 2, 2023

“KPMG Global Study Confirms Trusting AI Remains A Major Employee Confidence Gap – Artificial intelligence (AI) is increasingly used to invent new products and services, enhance productivity, improve decision making and reduce costs, including automating administrative tasks and improving cyber security. However, integrating AI into the everyday workplace still creates challenges, especially without a clear policy and communication process to ensure employees trust the technology methods, approaches, and societal reasons for deploying the new practices and solutions. AI poses unique challenges in employee minds, including the big question – Can they trust the technology?”, Forbes, February 25, 2023

Global Supply Chain, Energy, Commodities, Inflation & Trade Issues

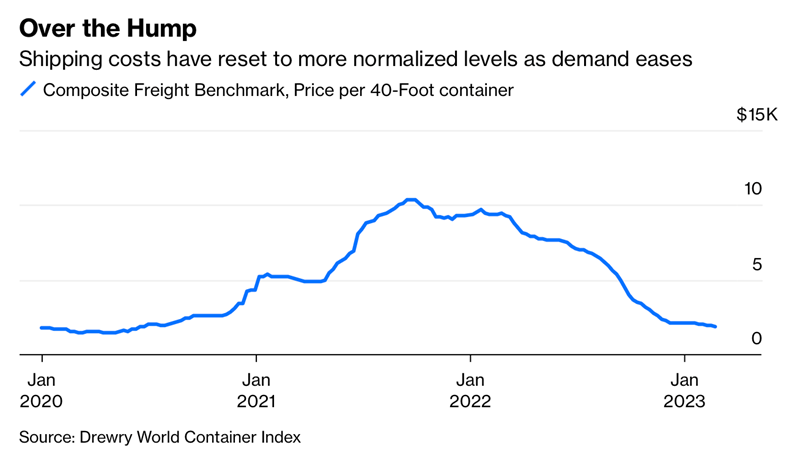

“How a Global Shortage Turned Into a Shipping Container Glut – Facing slack demand, low order volumes and rising materials costs, China’s globally dominant container-manufacturing industry is slashing output. Less than two years ago, authorities exhorted companies to dramatically increase production in response to logistics disruptions caused by the pandemic. The Taicang factory in eastern China’s Jiangsu province has cut more than 80% of its capacity and stopped hiring. Chinese factories build more than 96% of the world’s dry cargo containers and 100% of the world’s refrigerated containers, according to U.K. maritime consultancy Drewry.”, Caixin Global, March 2, 2023

“Supply Chains Aren’t Fixed, But They’re Getting There – Problems remain, but complaints of missing parts, delivery delays and gluts of half-finished products are becoming rarer. While companies that produce memory chips used in phones and PCs are cutting production as they grapple with a historic plunge in demand, manufacturers continue to struggle to get enough of the microprocessors that enable the injection of software into a wide range of industrial products….But complaints of missing parts, delivery delays and gluts of half-finished products are becoming rarer. Overall, running an assembly line feels less and less like a random game of whack-a-mole.”, Bloomberg, February 24, 2023

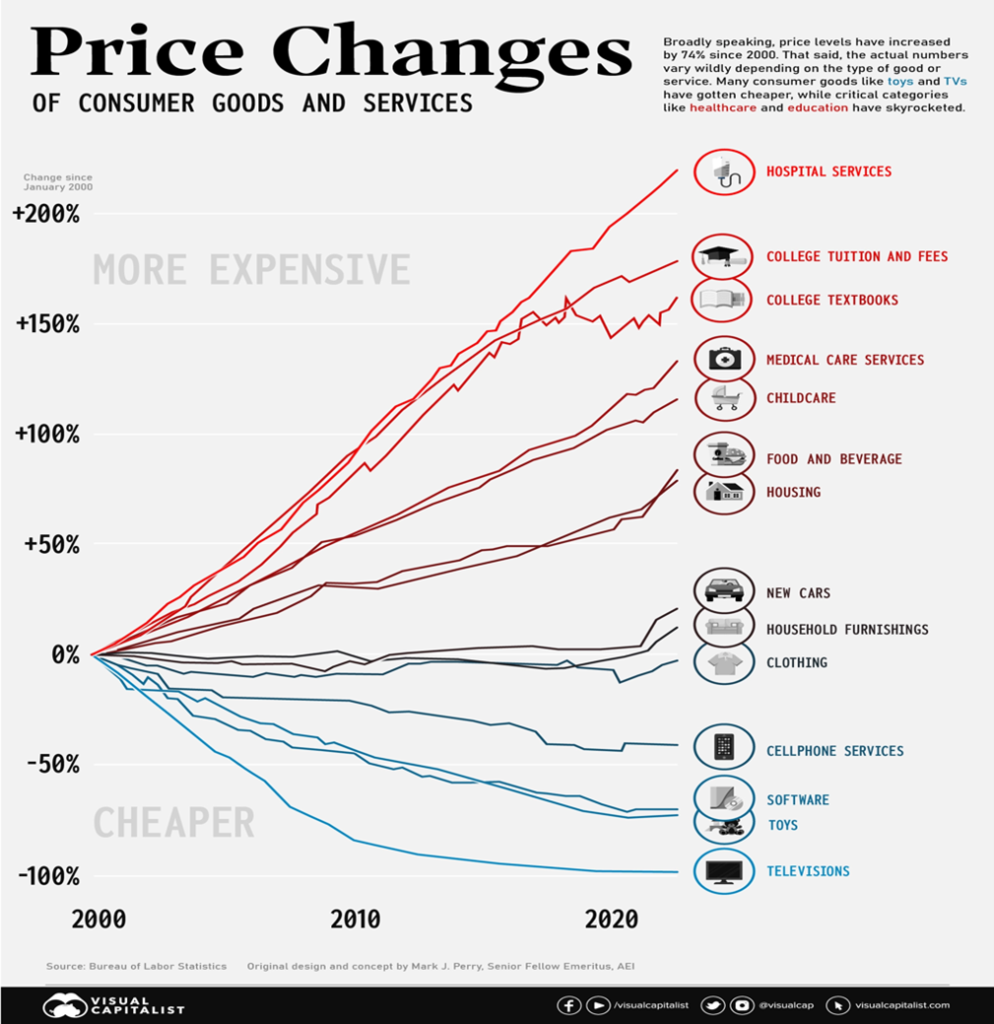

“Consumer Price Inflation, by Type of Good or Service (2000-2022) – The Consumer Price Index (CPI) provides a steady indication of how inflation is affecting the economy. This big picture number is useful for policymakers and professionals in the financial sector, but most people experience inflation at the cash register or checkout screen. Since the start of the 21st century, U.S. consumers have seen a divergence of price movements across various categories. Nowhere is this better illustrated than on this chart concept thought up by AEI’s Mark J. Perry. It’s sometimes referred to as the “chart of the century” because it provides such a clear and impactful jump-off point to discuss a number of economic forces.: Visual Capitalist, February 22, 2023

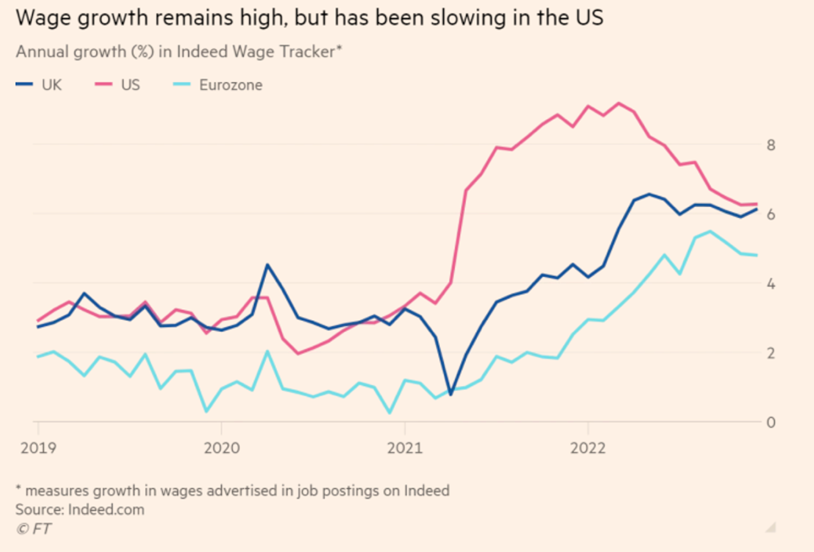

“Global economy: will higher wages prolong inflation? Price growth remains stubbornly high and central bankers worry that pay settlements will keep it that way. Whether the world’s workers can press home their demands for better pay is the single biggest question facing central bankers around the world this year as they fight to curb the rates at which prices are rising. ‘Even after energy and pandemic factors fade . . . wage inflation will be a primary driver of price inflation over the next several years,’ Philip Lane, chief economist at the European Central Bank, warned in November.”, The Financial Times, February 28, 2023

Global & Regional Travel Updates

“Travel demand fuels a boom in Asia Pacific — in hotel rates. Finding a great hotel deal may be harder than ever before. Finding a great hotel deal may be harder than ever before. Hotel rates are at an “all-time high,” Alan Watts, Hilton’s Asia-Pacific president, told “Squawk Box Asia” on Thursday. Rates are being fueled by travel demand that is like “a feast … to offset the famine,” he said, referencing the pandemic. According to earnings reports, Hilton’s average daily rates increased by 8% in the fourth quarter of 2022, compared with the same period in 2019. Similarly, Marriott and IHG hiked prices by 13%, while Hyatt had a 14% daily rate increase.”, CNBC, March 5, 2023

“Delta Pilots Ratify Contract With Massive 34% Salary Hike – Roughly 78% of Delta’s 15,000 pilots, represented by the Air Line Pilots Association (ALPA), voted to ratify the new contract, which includes over $7 billion in cumulative increases through December 2026. Delta’s pilots get an immediate raise of at least 18%, with another 5% after one year, 4% after two years and 4% after three years, according to a contract seen by Forbes.”, Forbes, March 1, 2023

“Qantas to Hire 8,500 Workers Over Decade to Reverse Covid Cuts – Roles include pilots, engineers and cabin crew, airline says Expansion underscores aviation’s post-Covid growth trajectory. With potentially more than 300 new aircraft arriving in the next 10 years, Qantas also plans to open an engineering academy to help maintain the fleet, it said Friday.”, Bloomberg, March 2, 2023

Country & Regional Updates

Australia

“Australia’s economy grows 0.5% in December quarter powered by household and government spending – The country’s GDP grew by 2.7% through the year, marking the fifth consecutive quarterly rise in GDP. Consumer spending and government expenditure were the driving forces behind the 0.4% increase in overall consumption, with the retail, hospitality and transportation industries seeing the most significant gains. Meanwhile, the export sector experienced 1.1% growth, mainly thanks to a surge in demand for travel services and the continued interest from foreign markets in Australia’s coal and mineral ores.”, Proactive, March 2, 2023

Canada

“Bank of Canada expected to hold rates steady in face of conflicting economic signals – After eight consecutive rate increases, central bank officials believe they’ve done enough to get inflation back under control. The pace of consumer price growth remains well above the bank’s target. But there are increasing, if conflicted, signs that higher borrowing costs are having their intended effect: slowing the economy and weighing on price growth. In January, Bank of Canada Governor Tiff Macklem announced a “conditional pause” to further rate hikes, teeing up the March 8 rate decision as a turning point for monetary policy.”, The Globe & Mail, March 5, 2023

China

“Here’s how much economists expect China s GDP to grow this year – The Chinese government is widely expected to announce on Sunday a GDP growth target of around or above 5% for the year. The average estimate among economists is slightly higher, at 5.21%, according to CNBC analysis. China’s latest factory data marked the highest reading in nearly eleven years, indicating further recovery ahead.”, CNBC, March 1, 2023. Compliments of Paul Jones, Jones & Co., Toronto

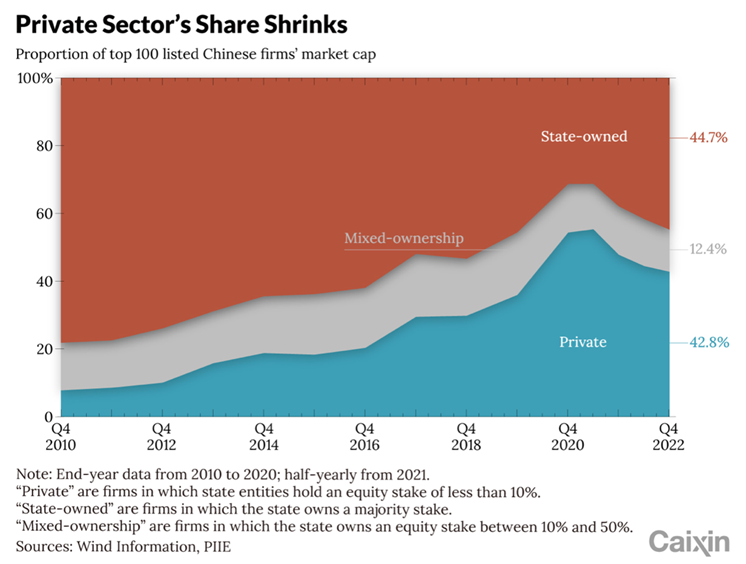

“Private Sector’s Shrinking Share of China’s Top Stocks – The share of private enterprises in the total market capitalization of China’s top 100 listed firms has suffered an unbroken decline since peaking in mid-2021, according to new research by U.S. think tank the Peterson Institute for International Economics (PIIE). As of the end of 2022, companies less than 10% state-owned comprised 42.8% of the total market cap of China’s top 100 listed firms, down 1.7 percentage points in six months, data compiled by PIIE researchers Tianlei Huang and Nicolas Véron show.”, Caixin Global, February 22, 2023

Egypt

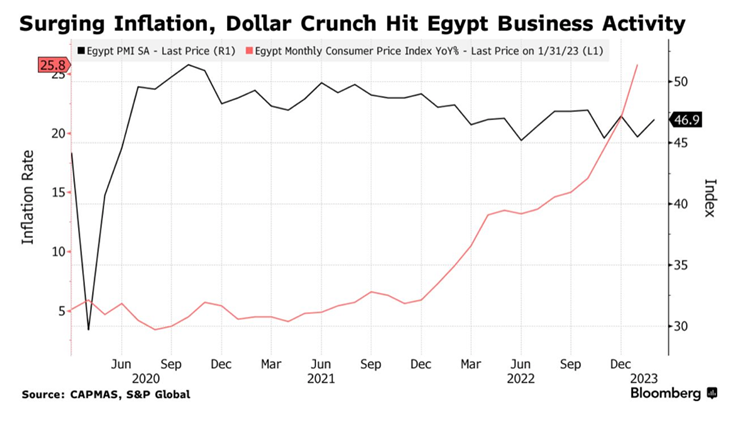

“Dollar Woes, Inflation Batter Egyptian Firms’ Hopes for 2023 – Activity in Egypt’s non-oil economy contracted for a 27th month, with businesses seeing little prospect that high inflation and foreign-currency shortages will ease this year, a survey showed. The Purchasing Managers’ Index compiled by S&P Global, which measures the performance of the private sector, rose to 46.9 in February from 45.5 the month before, yet remained well below the 50 mark that separates growth from decline.”, Bloomberg, March 5, 2023

Eurozone & European Union Countries

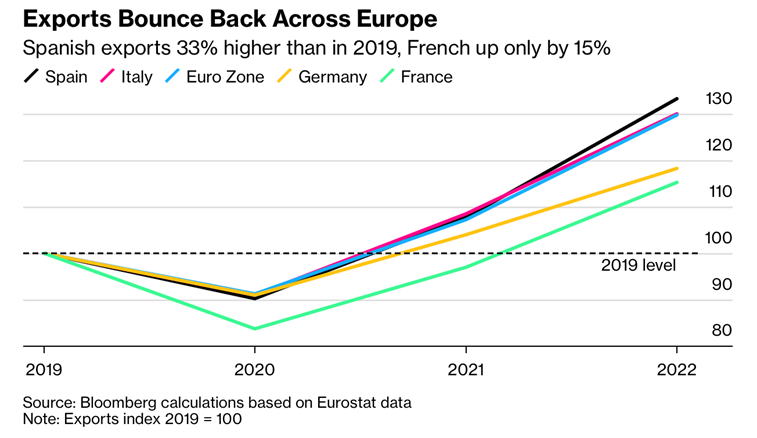

“Europe’s Top Economies Lag Behind on Pandemic Export Rebound – Cross-border trade in all European Union countries is now above pre-pandemic levels. Yet a closer look reveals that Germany’s exports in 2022 were only 18% above those in 2019 and France trailed even more with a mere 15%. That compares with a euro-area average of 30%. Within the 20-member currency bloc, Slovenia, Latvia and Greece lead the export recovery, all showing increases higher than 60% versus the pre-pandemic period.”, Bloomberg, February 23, 2023

Indonesia

“Pay attention to Indonesia. It will help determine the future of Asia – It’s hard to think of another country as big and important as Indonesia that is so completely ignored by the American public. With a population of 274 million, it is the fourth-largest country in the world, the third-most populous democracy, and the most populous Muslim-majority country. It is the world’s largest producer of nickel and could become the second-largest producer of cobalt. It dominates one of the world’s most strategically important waterways — the Straits of Malacca, linking the Indian Ocean and the Pacific Ocean. Most of China’s energy supplies pass through the Straits.”, Washington Post, February 20, 2023

“Nickel Shows Indonesia How to Escape the Middle Income Trap – The success of its strategy to boost investment in smelting has encouraged the government to expand the idea to other industries. The goal is to double per-capita GDP to $10,000 by 2045, which would bring Indonesia close to the World Bank’s high-income threshold. At the same time, the shift would create new centers of growth outside Java, its richest and most populated island.”, Bloomberg, February 24, 2023

Peru

“Country Announces Public-Private Partnerships to Boost Economic Activity – The Peruvian minister of production announced the launch of more than 30 public-private partnerships, collectively worth more than $9 billion, in a bid to boost the economy….The projects are in a variety of sectors including road maintenance, energy and sanitation. The first two months of 2023 saw economically disruptive protests as Peruvians demanded early elections and the release of former left-wing President Pedro Castillo, who was impeached and detained on Dec. 7, 2022, following a coup attempt. Peru was the fastest growing economy in South America over the past decade, with an annual average of 5.9% gross domestic product growth.”, RANE Stratfor Worldview, March 1, 2023

Russia

“Over 1,000 Companies Have Curtailed Operations in Russia—But Some Remain – Since the invasion of Ukraine began, we have been tracking the responses of well over 1,200 companies, and counting. Originally a simple “withdraw” vs. “remain” list, our list of companies now consists of five categories—graded on a school-style letter grade scale of A-F for the completeness of withdrawal. The list below is updated continuously by Jeffrey Sonnenfeld and his team of experts, research fellows, and students at the Yale Chief Executive Leadership Institute to reflect new announcements from companies in as close to real time as possible.”, Yale School of Management, March 2, 2023

Spain

“Spain’s February jobless rises 0.1% from January to 2.91 million – The number of people registering as jobless in Spain rose by 0.1% in February from a month earlier, or by 2,618 people, leaving a total of 2.91 million people out of work, data from the Labour Ministry showed on Thursday. The number of unemployed people was the lowest registered in a month of February since 2008, the ministry said, adding that the data reflected ‘a trend of stability in the labour market’. Meanwhile, consumer prices in Spain rose 6.1% year-on-year in February – a faster pace than the 5.9% during the 12 months to January – preliminary data from the National Statistics Institute (INE) showed on Tuesday.”, Reuters, March 2, 2023

Thailand

“Thai economy seen growing 3% to 4% this year, inflation to fall – Thailand’s economy is seen growing between 3%-4% this year as it follows a sustained recovery path despite a global slowdown, with tourism and private consumption key drivers, the central bank said on Tuesday. Headline inflation, above target at 5.02% in January, should return to within the targeted 1%-3% in the second half of 2023, the Bank of Thailand said, citing a speech on Monday by its governor, Sethaput Suthiwartnarueput.”, Reuters, February 28, 2023

United Kingdom

“World’s Largest Four-Day Work Week Trial Finds Few Are Going Back – And about one in six employees in the study said no amount of money would convince them to return to five days a week. The study involved 61 organizations and about 2,900 workers who voluntarily adopted truncated work weeks from June to December 2022. Only three organizations decided to pause the experiment, and two are still considering shorter hours, data released Tuesday showed. The rest were convinced by revenue gains, drops in turnover and lower levels of worker burnout that four is the new five when it comes to work days.”, Bloomberg, February 20, 2023

“HSBC to halve space for head office – HSBC told staff that it may yet remain at its tower in Canary Wharf, with renovations. HSBC moved into the tower, owned by Qatar’s sovereign wealth fund, in 2002. Its lease expires in early 2027. HSBC’s mooted departure from Canary Wharf echoes law firm Clifford Chance, which is ditching 700,000 sq ft of space in a Canary Wharf tower for a City office less than half the size. The enduring popularity of remote working is forcing Canary Wharf Group, the site’s owner, to offset the fall in office workers by attracting more families and tourists. Chief executive Shobi Khan is seeking to diversify away from banks and law firms, by building lab space to attract companies in life sciences.”, The Times of London, February 21, 2023

United States

“Brisk Sales Are Powering Restaurant Stocks – High inflation hasn’t prevented chains from thriving. The restaurant industry usually fares well when labor and food costs rise gradually, and attracting customers with lower prices becomes easier. Even though inflation has remained stubbornly high of late, that hasn’t prevented restaurant companies—and their stocks—from thriving. Shares of restaurant chains have been among this year’s stronger performers, after lagging behind in early 2022. Restaurants haven’t been immune to rising labor and food costs, but prices at grocery stores have actually risen more quickly than on restaurant menus over the past year, driving more traffic to restaurants.”, The Wall Street Journal, March 1, 2023

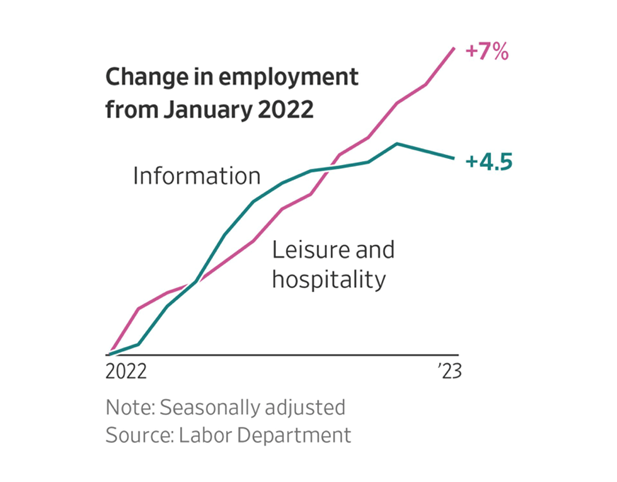

“Bars, Hotels and Restaurants Become the Economy’s Fastest-Growing Employers – Hospitality companies revive their hiring after pandemic cuts, offsetting slower growth in tech jobs. The leisure-and-hospitality industry is rebuilding its workforce after cutting back during the pandemic’s early days. In contrast, companies focused on providing business and tech-related services have slowed their growth in recent months. Because the hospitality industry includes a larger number of private-sector jobs than the tech and information sectors, the shift in hiring patterns has helped keep the U.S. unemployment rate at a 53-year low and the overall job market tight.”, The Wall Street Journal, March 5, 2023

Brand & Franchising News

“Applebee’s Is Closing Even More Locations Nationwide – Applebee’s parent company Dine Brands anticipates that the chain will have between 10 and 20 fewer restaurants in its roster when 2023 comes to a close, Restaurant Business Magazine reported. This would be an even larger decrease in store count for Applebee’s than in 2022, when it ended the year with nine fewer stores after closing 13 and opening four new locations.”, Eat This, Not That!, March 3, 2023

“How Chili’s Is Prepping for Tough Times, Starting With the Fries – Rising costs and a shortage of workers are pushing the Southwest-style restaurant chain to do more with less. When Kevin Hochman became CEO last June of the company that owns Chili’s Bar & Grill, amid a labor shortage and escalating costs, he started looking for bottlenecks in the kitchen. When he started the new job last year, inflation was spiking, and the economy was blinking early warnings of a slowdown. In the months since, he has trimmed menu offerings, raised prices and streamlined kitchen procedures.”, The Wall Street Journal, March 4, 2023

“Take a Crack at These Breakfast Franchise Opportunities – Breakfast is a multibillion-dollar opportunity for entrepreneurs. Gen-Zers – adults born between 1993 and 2003 – consistently buy breakfast through third-party delivery services. In fact, two-thirds of Gen-Zers buy breakfast outside the home at least once a week, according to food manufacturer J.M. Smucker Co. But is owning a breakfast franchise a wise investment? If the success of American icons like Denny’s and IHOP are any indication, breakfast franchises are a hit in any community. Here are 13 breakfast franchise opportunities to consider in 2023.”, FranchiseWire, February 27, 2023

“Multiple F45 Training gyms collapse, equipment up for sale on Facebook Marketplace – A popular Aussie gym franchise has suffered an epic fall from grace with staff laid off, mass resignations from board members and its share price staying stubbornly low. And now it’s emerged that a number of stores have gone into liquidation in the past several months while gym equipment is being sold incredibly cheaply online in a sign of the business struggling to stay afloat. F45 Training – which known for its functional high intensity interval training (HIIT) classes that takes place in 45 minutes – was at first an Australian success story after hitting the New York Stock Exchange in 2021 and raking in $500 million on the first day.”, News.com.au, February 22. 2023. Compliments of Jason Gerhrke, Managing Director, Franchise Advisory Centre, Brisbane

“Gelatissimo opens stores in Thailand, Singapore, Hawaii – Australian gelato chain Gelatissimo has opened five new stores – including in Thailand and Singapore – taking its international store network to 70. One store has opened in Sunny Laguna in Phuket, Thailand, another in Hawaii’s Royal Hawaiian Center at Waikiki and a third at Jewel Changi Airport in Singapore. In Australia, the company opened stores in Rhodes, NSW, and Highpoint, Victoria.”, Inside Retail, February 22, 2023

“Strange McDonald’s menu items around the world – The fast-food place has created menu items that fall in line with a foreign country’s culture. McDonald’s doesn’t operate like a regular fast-food corporation. With over 38,000 locations in over 100 countries, the chain prides itself on two things — uniformity and cultural awareness. The latter is evident in its menus in other countries, whether it’s replacing the famous Big Mac with a pork burger in Thailand or offering a larger variety of vegetarian options in India. Here is a look at unique menu items specific to other countries.”, Deseret News, February 18, 2023

“Starbuck’s China: Big opportunities inject shot of caffeine into smaller cities – Popular chains bank on lower costs, ties with customers for rapid expansion. Starbucks entered the Chinese market 24 years ago and, beginning in January, consumers in the downtown area of Suihua, Heilongjiang province, can also enjoy Starbucks beverages as the coffee chain has opened its first store in the smaller city. The move into lower-tier Chinese cities signals the rapid expansion from top on-premise coffee chain players to grab more consumers at better costs, said an industry expert.}, China Daily, February 21, 2023. Compliments of Paul Jones, Jones & Co., Toronto

To receive this biweekly newsletter, click here : https://bit.ly/geowizardsignup

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, economic development and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing environment. Our GlobalTeam™ on the ground covering 25+ countries provides us with updates about what is actually happening in their specific countries.

To sign up for our biweekly newsletter click here: https://bit.ly/geowizardsignup

Over 4 decades William (Bill) Edwards has steered more than 40 brands successfully through the complexities of Going Global. Problem-solver, strategist, visionary and trusted Global Advisor, Bill Edwards sees what others don’t. Now he’s sharing this unmatched experience and wisdom with select senior executives traversing the complex international growth landscape.

For a free 30 minute consultation on how to take your business global successfully, contact Bill Edwards at bedwards@edwardsglobal.com or +1 949 224 3896.

Download our latest chart ranking 40+ countries as places to do business at this link:

Our latest GlobalVue™ 40 country ranking