EGS Biweekly Global Business Newsletter Issue 74, Tuesday, January 24, 2023

Edited and curated by: William (Bill) Edwards, CFE, CEO of Edwards Global Services, Inc. (EGS)

In this issue we reference a number of country, regional and global surveys and articles that seem to say 2023 might be a better year economically than first thought. China’s reopening might help global growth but not global inflation. And the privately held Subway® chain founded in 1965 and with 37,000 locations in almost 100 countries appears up for sale.

The mission of this newsletter is to use trusted global and regional information sources to update our 1,400+ readers in 20+ countries on key global and local trends that can impact the success of their businesses at home and abroad.

To receive this biweekly newsletter that is read by over 1,400 people in 20 countries, click here:

https://bit.ly/geowizardsignup

First, A Few Words of Wisdom From Others

“Success is not accident. It is hard work, perseverance, learning, studying, sacrifice, and most of all, love of what you are doing.”, Pele

“The best way to predict the future is to create it.”, Abraham Lincoln.

“The only sustainable competitive advantage is the speed with which we learn.”, Peter Senge

Highlights in issue #74:

- Brand Global News Section: Amrest KFC®, Subway®, Taco Bell®

NOTE: Bolded headlines in this newsletter are live links where the article is available without a paid subscription.

Interesting Data and Studies

“What the Experts See Coming in 2023 – In this, our fourth year of Prediction Consensus (now part of our more comprehensive 2023 Global Forecast Series), we’ve learned a few things about the universe of predictions, experts, outlooks, and forecasts. Experts are reasonably good at predicting the future one year out, though they are also in a strong position to help shape the future through their influential thought leadership and actions. Situations can and will flare up in unexpected ways, which can have knock-on effects on the whole system (e.g. COVID-19, Ukraine invasion). Visual Capitalist, January 11. 2023

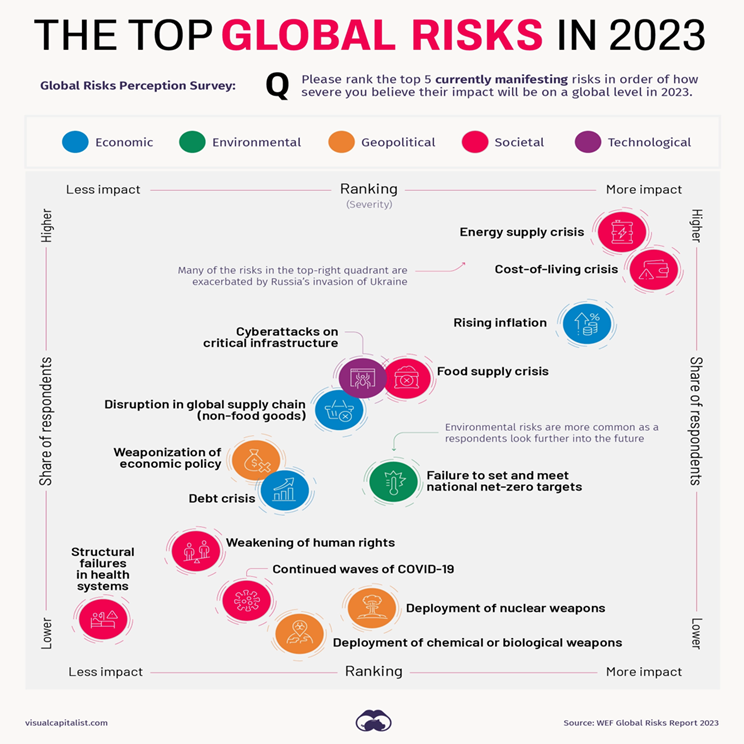

“The Biggest Global Risks of 2023 – The profile of risks facing the world is evolving constantly. Events like last year’s invasion of Ukraine can send shockwaves through the system, radically shifting perceptions of what the biggest risks facing humanity are. Today’s graphic summarizes findings from the Global Risks Report, an annual publication produced by the World Economic Forum (WEF). It provides an overview of the most pressing global risks that the world is facing, as identified by experts and decision-makers. These risks are grouped into five general categories: economic, environmental, geopolitical, societal, and technological.”, Visual Capitalist / World Economic Forum, January 13, 2023

“Global Unemployment to Steady Despite Economic Slowdown, Says International Labour Organization – The U.N. agency sees the first episode of stagflation since the 1970s, but no similar surge in unemployment. Unemployment will stay mostly stable around the world this year and next despite a sharp economic slowdown, reflecting a shortage of workers in rich countries among other factors, the International Labour Organization said Monday.”, The Wall Street Journal, January 16, 2023

“PwC’s 26th Annual Global CEO Survey – Winning today’s race while running tomorrow’s. Evolve or die, say 4,410 chief executives in our 2023 CEO Survey. But are they spending enough time on business reinvention? Many tell us no. Forty percent of global CEOs think their organization will no longer be economically viable in ten years’ time, if it continues on its current course…..Most of those CEOs feel it’s critically important for them to reinvent their businesses for the future.”, PWC, January 16, 2023

“Fake Meat Was Supposed to Save the World. It Became Just Another Fad – Beyond Meat and Impossible Foods wanted to upend the world’s $1 trillion meat industry. But plant-based meat is turning out to be a flop. Ever since founding Beyond Meat Inc. in 2009 with the then fantastical idea of making meat without animals, Ethan Brown has been giving the equivalent of one extremely long TED Talk. But Big Meat is still alive and well. After Beyond went public in 2019—at the time the most successful major initial public offering since the 2008 financial crisis—competitors rushed into the space, followed by a categorywide pandemic surge. Since then the industry has plunged.”, Bloomberg, January 18, 2023

Global Supply Chain, Energy, Commodities, Inflation & Trade Issues

“The Dipping Cost of Shipping – A little over one year ago, congestion at America’s West Coast ports were making headlines, and the global cost of shipping containers had reached record highs. Today, shipping costs have come back down to Earth, with some routes approaching pre-pandemic levels. The graphic above, using data from Freightos, shows just how dramatically costs have fallen in a short amount of time. The Freightos Baltic Index (FBX)—a widely recognized benchmark for global freight rates—has fallen 80% since its peak in late 2021.”, Visual Capitalist, January 23, 2023

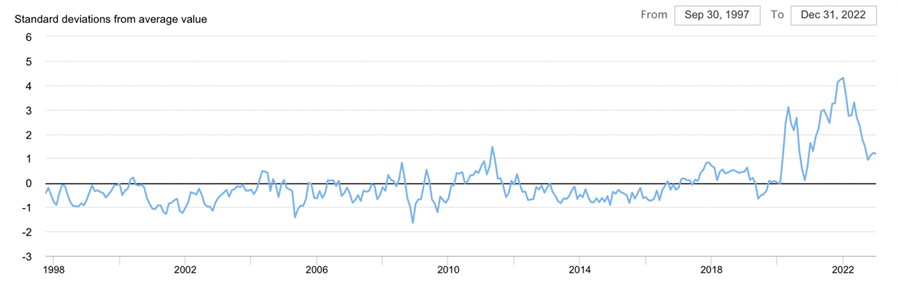

“Global Supply Chain Pressure Index (GSCPI) – Global supply chain pressures decreased moderately in December, disrupting the upward trend seen over the previous two months. The largest contributing factors to supply chain pressures were rises in Korean delivery times and Taiwanese inventories, but these were more than offset by smaller negative contributions over a larger set of factors. The GSCPI’s recent movements suggest that developments in Asia are slowing down the index’s return to normal historical levels.”, Federal Reserve Bank of New York, January 17, 2023

Global & Regional Travel Updates

“EU delays new entry rules requiring fingerprints until autumn – Rene Vihalem, chairman of the EES programme management board, told a meeting of the EU’s large-scale IT projects committee that a revised timetable would be published in March but that ports and airports should be equipped for the system to launch by the end of the year. Under the scheme, all arrivals from outside the European Union will have four fingerprints scanned and a photograph taken. The data will be captured on the first entry to the bloc and verified on subsequent visits. Holidaymakers had been told to expect long delays, especially at British ports — where border controls are juxtaposed with French immigration formalities carried out on UK land — because of difficulties of capturing passengers’ data from inside their cars. There are also concerns of long queues at the Eurotunnel terminal in Folkestone.”, The Times of London, January 7, 2023

“Airlines Resurrect Ancient Jumbo Jets to Meet First and Business-Class Demand – The fuel-inefficient 747 and A380 are being resurrected, thanks to their large numbers of premium seats. As global air travel comes roaring back from its pandemic-induced slump, airlines are racing to provide enough capacity, particularly for premium tickets on the long-haul flights enjoying a stronger-than-expected rebound. The surge has created a surprise bottleneck for some carriers, which are finding that many of their new-generation aircraft outfitted with enough business and first-class berths are either late for delivery or still awaiting regulatory approval. So carriers have been forced to revive a venerable plane model that looked consigned to the scrap heap even before the Covid‑19 outbreak: the four-engine dinosaur.”, Bloomberg, January 11, 2023

“Airlines face hurdles to cashing in on China re-opening – U.S. and European airlines will benefit from pent-up demand for travel to China after its recent border reopening, but route approvals, fresh COVID-19 testing rules and not enough large aircraft remain barriers to rising sales, analysts and industry officials say. Travel is returning to China, the world’s largest outbound tourism market worth $255 billion in 2019, after the country ended mandatory quarantines on Jan. 8. Airfares from China are now 160% higher than before the pandemic, data from travel firm ForwardKeys shows, due to limited supply.”, Reuters, January 17, 2023

“American Airlines To Restart Nonstop Dallas/Fort Worth-Shanghai Flights – China has finally reopened to the rest of the world, and international air travel demand to the country has already surged. However, due to conflicting capacity restrictions and geopolitical tensions, most US airline schedules have taken some time to adapt to the sudden demand. One carrier making such adjustments is American Airlines, which has now announced the resumption of flights to Shanghai. The last time American Airlines operated non-stop flight services between Dallas-Fort Worth International Airport and Shanghai Pudong International Airport was in March 2020, when it was suspended due to the impending pandemic.”, Simply Flying, January 9, 2023

Country & Regional Updates

Australia

“ASX off to the best start in at least 30 years – The Australian sharemarket has posted its second-best start to a year in at least three decades as optimism grows inflation will peak lower than the Reserve Bank’s 8 per cent forecast for the December quarter. Westpac chief economist Bill Evans tipped inflation data on Wednesday would show annual price rises peaked at 7.4 per cent and would slow to 3.7 per cent this year – well below the RBA’s 4.7 per cent forecast.”, Australian Financial Review, January 23, 2023

Canada

“Inflation rate eases to 6.3% in December as Bank of Canada considers new rate hike – Canada’s inflation rate eased in December alongside a steep drop in gasoline prices, an encouraging sign for the Bank of Canada as it considers further increases in interest rates. It was the latest in a string of promising developments for inflation. The U.S. rate is continuing to fall, while prices for many resources – such as lumber and natural gas – have dropped. Companies in several industries have reported that supply chain disruptions – a key factor in recently driving up prices – are improving, too.”, The Globe and Mail, January 19, 2023

China

“China’s Reopening Is the Boost the Flagging World Economy Needs – The easing of Covid restrictions will unleash pent-up demand for commodities, consumer goods and travel. Around the world, economies that rely on tourism and commodities are set to receive a shot from China’s sudden reopening, as consumers unleash some of the 5.6 trillion yuan ($836 billion) in excess savings they built up during the pandemic. Demand for air travel, hotels and spots at foreign schools and universities will light up as Chinese pack their bags for international travel for the first time since Covid-19 struck.”, Bloomberg, January 18, 2023

“China’s Economy Fails To Meet Government Target, Expanding 3% In 2022 – Although the data showed a marked slowdown in economic activity, it was slightly better than estimates including the World Bank’s earlier forecast of 2.7%. Officials expressed a note of optimism by saying that the economy held up under pressure from a volatile international environment as well as the difficult task to reform and maintain stability domestically. Now that China is reopening to the world, the top leadership is also voicing more support for the private sector. Officials are easing their crackdown on the property sector by providing fresh credit and allowing extensions in debt repayments, which sparked a recent rally in the shares of real estate developers. Another major source of growth, namely the internet sector, is also finding a more friendly regulatory environment as well.”, Forbes, January 17, 2023

“China’s population falls in historic shift – First decline in 60 years set to have long-term consequences for domestic and global economies. China’s population fell in 2022 for the first time in decades in a historic shift that is expected to have long-term consequences for the domestic and global economies. The world’s most populous country has long been a crucial source of labour and demand, fuelling growth in China and the world. ‘This is a truly historic turning point, an onset of a long-term and irreversible population decline,’ said Wang Feng, an expert on Chinese demographic change at the University of California, Irvine.”, The Financial Times, January 16, 2023

European Union

“Eurozone set to avoid recession this year as economists’ gloom lifts – Sharp about-turn in sentiment comes as IMF indicates it will upgrade its global economic forecasts. The eurozone will avoid a recession this year according to a widely-watched survey of economists which illustrates the sharp about-turn in global economic sentiment in the past couple of weeks. The upgrade comes after officials and business leaders at this week’s annual World Economic Forum in Davos also embraced a more upbeat outlook, and the IMF signalled that it would soon upgrade its forecasts for global growth.”, The Financial Times, January 22, 2023

“Europe may avoid recession in 2023, economic chiefs say – Economic officials from the European Union on Monday offered a rosier vision for the bloc’s economic future, with the latest data showing Europe may avoid a recession that had been predicted several months ago. EU Economic Commissioner Paolo Gentiloni said that although the bloc’s economic situation ‘is still uncertain … we had some encouraging news. We managed to reduce our energy dependence, energy prices went down significantly and inflation peaked last year in Europe,’ Gentiloni said ahead of monthly talks with eurozone finance ministers in Brussels. ‘So, there is a chance to avoid a deep recession and maybe to enter a more limited, shallow contraction,’ he added.”, Deutsche Welle, January 16, 2023

Germany

“German investors turn positive as recession fears wane – German investor sentiment turned positive for the first time since Russia’s invasion of Ukraine in January, in a further sign that the downturn in Europe’s biggest economy may not be as sharp as feared. The ZEW Institute’s indicator of investors’ expectations of the outlook for the coming six months, a closely watched measure of economic confidence, rose for the fourth successive month to 16.9, from minus 23.3 in December. The reading was well above the minus 15 forecast in a Reuters poll of economists.”, The Financial Times, January 17, 2023

Latin America

“Brazil and Argentina eye a common currency similar to the euro, with Latin American nations invited to join – Argentina and Brazil are in the preliminary stages of renewing discussions on forming a common currency for financial and commercial transactions, reviving an often-discussed plan that would face numerous political and economic hurdles. South America’s two largest economies have considered options to coordinate their currencies for decades, often to counter the influence of the dollar in the region. The persistent macroeconomic imbalances of both countries, together with recurrent political obstacles to the idea, has resulted in little practical progress.”, Fortune, January 22, 2023

India

“Apple wants to manufacture 25% of its iPhones in India, minister says – Piyush Goyal, India’s minister of commerce and industry, called Apple ‘another success story’ as he talked up the business credentials of the world’s fifth-largest economy. ‘They’re [Apple] already at about 5-7% of their manufacturing in India. If I am not mistaken, they are targeting to go up to 25% of their manufacturing,’ Goyal said at a conference. Last year, Apple began assembling its flagship iPhone 14 in India. It was the first time the tech giant, based in Cupertino, California, produced its latest model in India so close to its launch. Apple has been manufacturing iPhones in India since 2017, but these were usually older models.”, CVNBC, January 23, 2023

Malaysia

“Malaysia Records Trade Surplus for 25th Consecutive Year – Malaysia registered a trade surplus for a 25th consecutive year in 2022, with exports to major markets, including China and ASEAN countries, setting records boosted by global inflation. – Exports rose 25% to MYR 1.55 trillion ($355.1 billion) last year, according to the Ministry of International Trade and Industry, lifted by shipments of electrical and electronic products, petroleum, liquefied natural gas and palm oil.”, Bloomberg, January 18, 2023

United Kingdom

“From the markets to falling energy prices: 10 reasons to be cheerful about the economy – The FTSE is close to record highs, inflation is on the wane, and interest rates are close to peaking — just some of the reasons to give the country hope. Many business leaders have been quietly sharing an increased sense of optimism, which increased last week after Friday’s data showed that the UK economy had avoided the recession that many had predicted. Upbeat trading statements from Marks & Spencer and Sainsbury’s showed that shoppers kept spending during Christmas, despite the cost of living crisis.

The stock market soared, with the FTSE 100 ending the week within a whisker of its all-time high — 5 per cent up already in 2023, just 13 days in…..While 2023 may be difficult, there are reasons to be cheerful.”, The Times of London, January 14, 2023

United States

“A drop in chicken prices gives operators something to cluck about – Current costs and supply are favorable, giving chicken concepts a reason to celebrate after steady price increases. But the year ahead may bring changes. Jim Bitticks, president and COO of Los Angeles-based Dave’s Hot Chicken, gets positively jubilant when he talks about the current price of chicken. ‘We use jumbo chicken tenders,’ he said of Dave’s menu. ‘Six months ago, they were over $3 a pound, but now they’re holding steady at 98 cents. They’ve been dropping in price since October.’ David Maloni, foodservice supply chain analyst and president of Datum FS, agrees that chicken breast prices have fallen drastically over the last six months, as have wings. But, he cautioned, prices are at their bottom and will move higher over the next six months.”, Restaurant Business, January 11, 2023

Brand & Franchising News

“AmRest sells its KFC restaurant business in Russia for 100 mln euro – Madrid-based restaurant operator AmRest said on Tuesday it agreed to sell its KFC restaurant business in Russia for at least 100 million euros ($104.48 million) to Russian restaurant and entertainment company Almira. AmRest follows hundreds of Western companies which have either withdrawn, sold or closed down operations in Russia since the invasion of Ukraine in February. Before the Ukrainian crisis, Russia was one of the main markets for the restaurant operator.”, Reuters, December 7, 2022. Compliments of Jason Gehrke, The Franchise Advisory Centre, Brisbane

“Subway Explores Sale That Could Value Sandwich Chain at More Than $10 Billion – Biggest restaurant chain by U.S. locations is in the midst of a turnaround – Sandwich chain Subway has retained advisers to explore a sale of the closely held company, according to people familiar with the situation. The process, which is in the early stages, is expected to attract potential corporate buyers and private-equity firms, and could value Subway at more than $10 billion, the people said. Still, it is possible there won’t be a sale or other deal.”, The Wall Street Journal, January 11, 2023

“The Next Wave of On-Demand Restaurant Delivery – Successful ghost kitchen models are learning from the successes, and pitfalls, of predecessors. Many startups across varying industries, eager to disrupt, often make a lot of mistakes out of the gate, the restaurant space is no different, however, here, the main blunder made by some of these startups was not understanding the business of hospitality from the get-go…..CEO and cofounder of OOMI Digital Kitchen, Markus Pineyro….is an example of one operator who has sat back, watched the model launch, and took copious notes. He attributes his patience and good timing to what he believes will be the winning ghost kitchen strategy.”, QSR Magazine, January 6, 2023

“Taco Bell (Canada) to open 200 new locations in partnership with Redberry Restaurants – This will more than double the franchises’ existing Canadian location count and will establish Redberry’s position as the largest franchisee in the country. This is what restless creativity looks and feels like in (Canada). The restaurant company currently owns and operates 14 locations across Ontario. The plan to build 200 new locations will take place over an eight-year period.”, Franchiseinfo.ca, January 16, 2023

To receive this biweekly newsletter, click here : https://bit.ly/geowizardsignup

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, economic development and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing environment. Our GlobalTeam™ covering 25+ countries provides us with updates about what is happening in their specific countries.

To sign up for our biweekly newsletter click here: https://bit.ly/geowizardsignup

During four-decades in international business, William (Bill) Edwards has played a leadership role in the global growth of more than 40 brands. He is widely recognized as an International Problem Solver, Strategist, Advisor and a specialist on global cultures. His career covers international operations, executive and entrepreneurial experience in the energy, technology, licensing, management consulting and retail sectors. He has been a technical specialist, manager, brand senior executive and country president. As a Global Advisor, he now shares his experiences and wisdom with senior executives to help them successfully navigate the complex international company growth landscape. To take your business global successfully, contact Bill Edwards at bedwards@edwardsglobal.com or +1 949 224 3896.

Download our latest chart ranking 40+ countries as places to do business at this link: