EGS Biweekly Global Business Newsletter Issue 70, Tuesday, November 29, 2022

Edited and curated by: William (Bill) Edwards, CFE, CEO of Edwards Global Services, Inc. (EGS)

China begins to loosen Zero COVID travel Well so much for China relaxing zero COVID rules. Fall out needs to be watched closely for global impact. Mixed signals on global and country inflation and growth. McDonald’s reopens in the Ukraine, sort of. Who knew the Airbus 380 would come back into service so fast post pandemic? A look at the world’s most livable cities and the cost of gasoline worldwide.

To receive this biweekly newsletter that is read by over 1,400 people in 20 countries, click here:

https://bit.ly/geowizardsignup

First, A Few Words of Wisdom From Others

“The miracle of gratitude is that it shifts your perception to such an extent that it changes the world you see.”, Dr. Robert Holden

“Whether you think you can, or you think you can’t, you’re right.”, Henry Ford

“Success is the sum of small efforts, repeated day in and day out.”, Robert Collier

Highlights in issue #70:

- Brand Global News Section: California Pizza Kitchen®, Dominos®, FATB Brands, Nando’s®, Taco Bell®, Tim Horton’s®, Title Boxing® and Wendy’s®

NOTE: Bolded headlines in this newsletter are live links where the article is available without a subscription.

Interesting Data and Studies

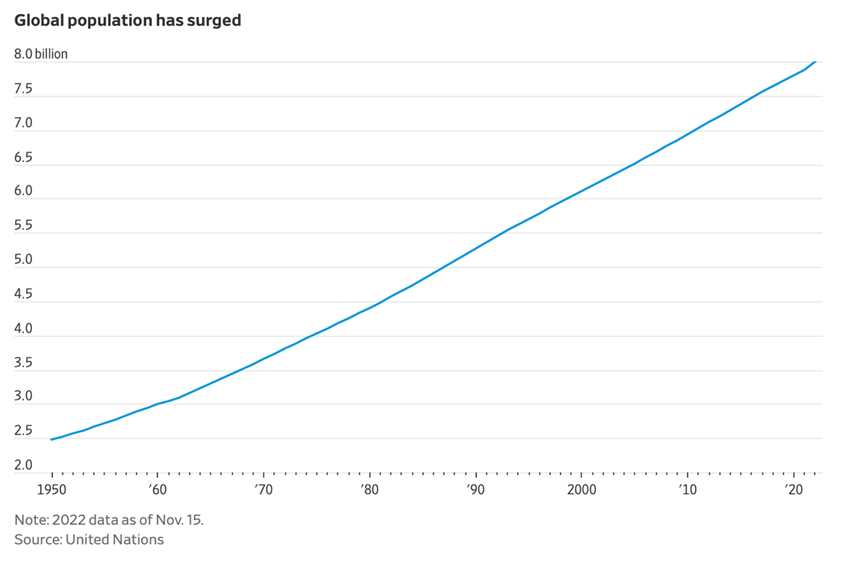

“World Population Hits 8 Billion, U.N. Says – The planet reached the milestone about a year later than expected because of the Covid-19 pandemic. U.N. officials said the milestone was an indicator of humanity’s achievements in medicine, nutrition, public health and personal hygiene. The world’s population has grown rapidly since 1900 largely thanks to soaring birthrates in some regions and healthcare advancements, according to the U.N.”, The Wall Street Journal, November 15, 2022

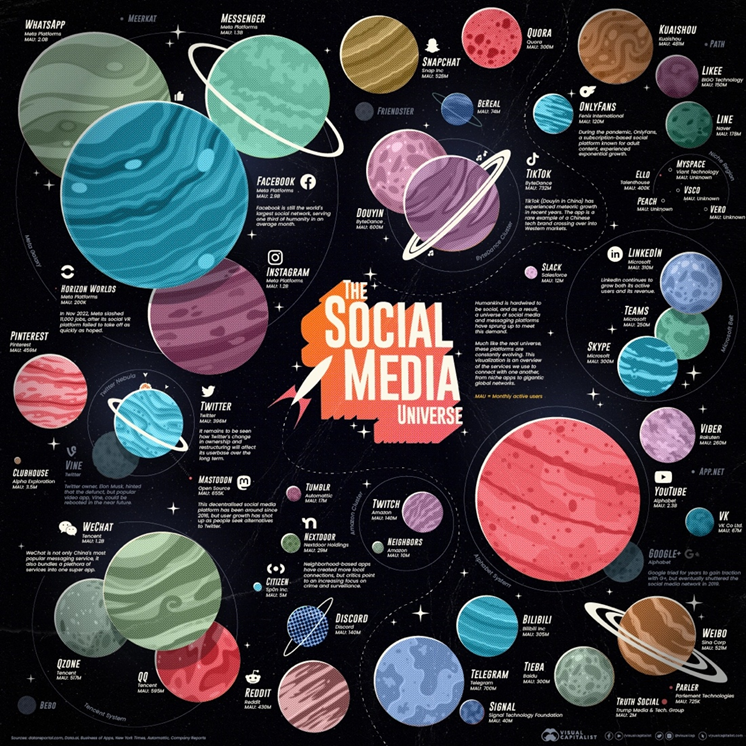

“Visualizing the World’s Top Social Media and Messaging Apps – In 2022, the social universe is looking more crowded than in previous years. The scale of Meta’s platforms still dominate thanks to their global reach, but there are a number of smaller networks fighting for market share. Here’s a look at popular platforms, organized from largest to smallest active userbase…..”, Visual Capitalist, November 18, 2022

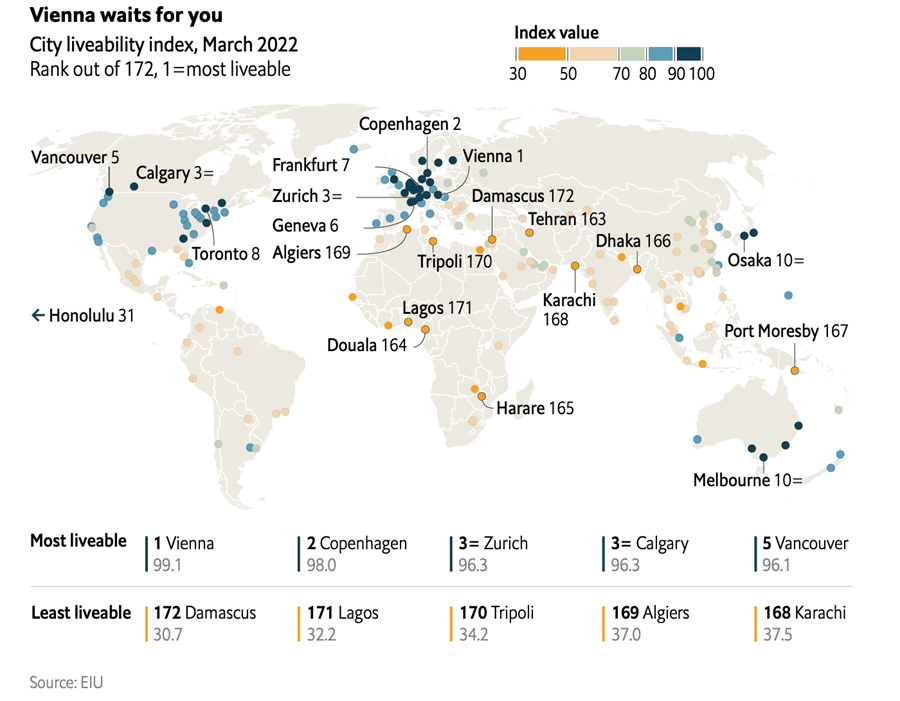

“The world’s most liveable cities – Life is getting back to normal, if not quite everywhere. For the third time in the past five years, Vienna has come top of the EIU’s ranking. Originally designed as a tool to help companies assign hardship allowances as part of expatriates’ relocation packages, the EIU’s (Economist Intelligence Unit) index rates living conditions in 172 cities (up from 140 last year) based on more than 30 factors. These are grouped into five categories: stability, health care, culture and environment, education and infrastructure.”, The Economist, June 22, 2022

Global Supply Chain, Energy, Commodities, Inflation & Trade Issues

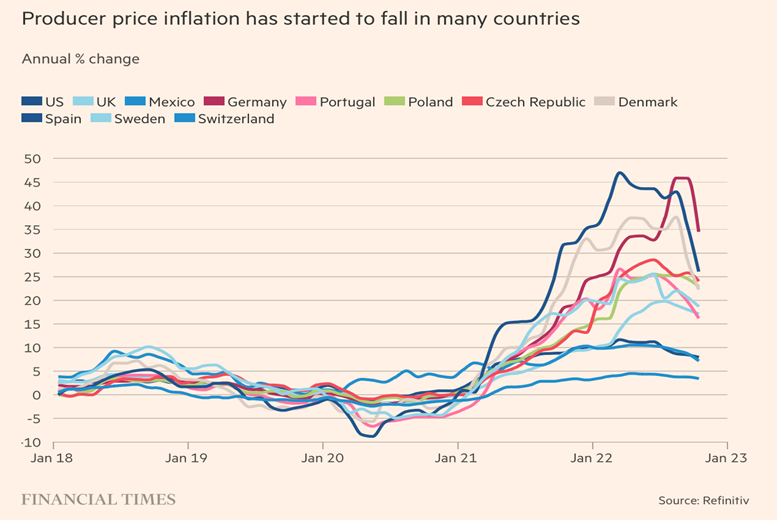

“Global inflation likely to have peaked, key data indicators suggest – Factory gate prices, shipping rates and expectations suggest headline price growth will slow. According to economists, the figures suggest that price pressures on global supply chains are easing, making it likely that headline inflation will fall from the historically high rates that hit household finances and business activity in recent months.”, The Financial Times, November 27, 2022

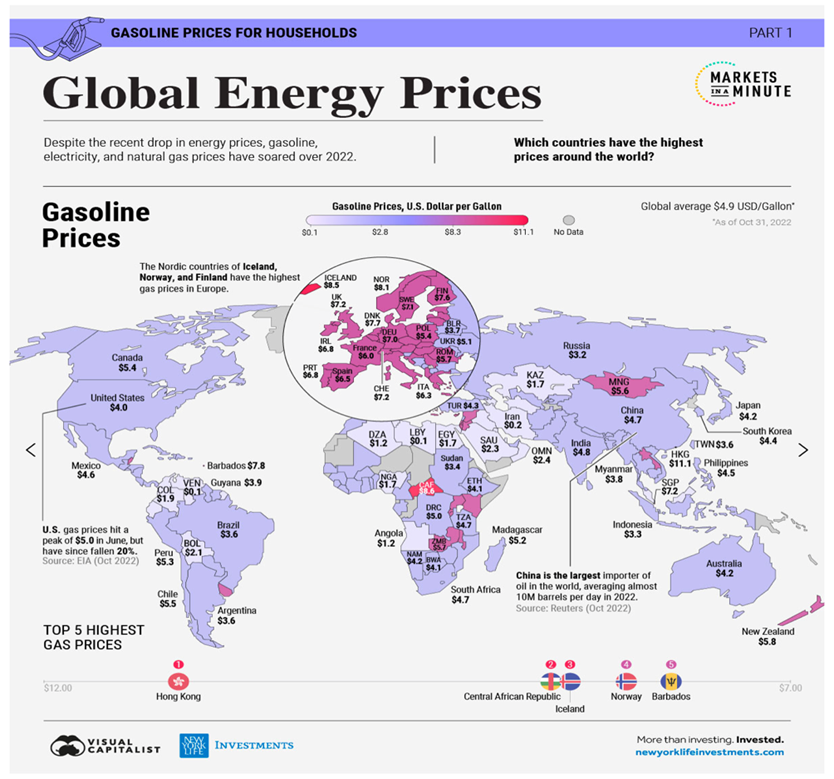

“Global Energy Prices, by Country in 2022 – For some countries, energy prices hit historic levels in 2022. Gasoline, electricity, and natural gas prices skyrocketed as Russia’s invasion of Ukraine ruptured global energy supply chains. Households and businesses are facing higher energy bills amid extreme price volatility. Uncertainty surrounding the war looms large, and winter heating costs are projected to soar.”, Visual Capitalist and New York Life, November 17, 2022

Global & Regional Travel Updates

“The world’s biggest plane is back – Here’s why – Covid nearly killed the popular Airbus A380, but now the double-decker plane is making a comeback. But the A380’s days were numbered, even before Covid. Airlines got their passenger predictions wrong. Demand for air travel post pandemic has recovered so fast that carriers cannot get their hands on enough jets to satisfy it. Global supply chain snarl-ups and shortages of everything from microchips to labour that have delayed production of new long-haul jets have made matters worse.”, The Times of London, November 18, 2022

“Japan to Welcome Cruise Ships Back after More than 2 Years – Japan will once again welcome cruise ships back to the country for the first time since the pandemic began. The country, which captured the world’s attention at the start of the pandemic with the outbreak of COVID-19 on the Diamond Princess ship, will now look to lift a more than 2 1/2-year ban on international cruise ships, The Associated Press reported.”, Travel and Leisure, November 17, 2022

Country & Regional Updates

Asia

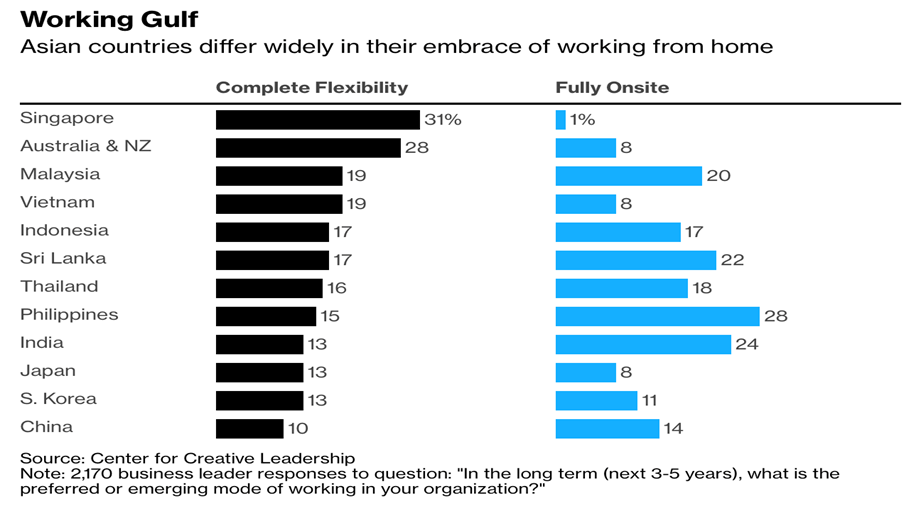

“Asia Embraces Work from Home But Bosses Say No to Four-Day Week – A survey found that remote work is likely here to stay. Attitudes about work from home vary across the region. The number of Asian businesses expecting employees to spend their entire working life operating from an office has plummeted during the pandemic, in a pivot to hybrid working that looks here to stay. Though over half of companies in Asia expected their staff to work in the office full time before the pandemic, the number has now fallen to 13%, according to a questionnaire conducted by the Center for Creative Leadership, a US-based education nonprofit.”, Bloomberg, November 18, 2022

China

“Chinese lenders to pump $162bn of credit into property developers – Injection is most direct move yet by Beijing to counter a real estate crisis. ‘The move is unprecedented,’ said Yan Yuejin, research director of E-house China Research and Development Institute in Shanghai. Yan said the rare disclosure of the loan details by Chinese commercial banks indicated authorities want to shore up confidence.”, The Financial Times, November 24, 2022

“Will Unrest In China Spook Markets? China has been hit by twin shocks. First of all the rate of COVID infections has spiked dramatically higher, pushing above levels seen at the last peak and this suggests that China following its very strict COVID policy we’ll have to lock down further and greater parts of its economy. The second shock which many did not expect, is the reaction of ordinary Chinese to the COVID shutdowns. There have been riots and unrest reported across China and this is relatively unusual.”, Forbes, November 27, 2022

Czech Republic

“Prague Christmas market returns after COVID but with fewer lights – Thousands of people poured into Prague’s medieval Old Town Square at the weekend for the lighting of a 25-metre (80-foot) Christmas tree and the reopening of the annual market after a two-year COVID-19 shutdown, but the energy crisis meant fewer lights than usual. The market, which is popular with Czechs and foreign tourists alike thanks to its mulled wine, sausages, sweets and gifts, was set up with more energy-efficient bulbs to both save money and send a seasonal message of energy efficiency.”, Reuters, November 27, 2022

European Union

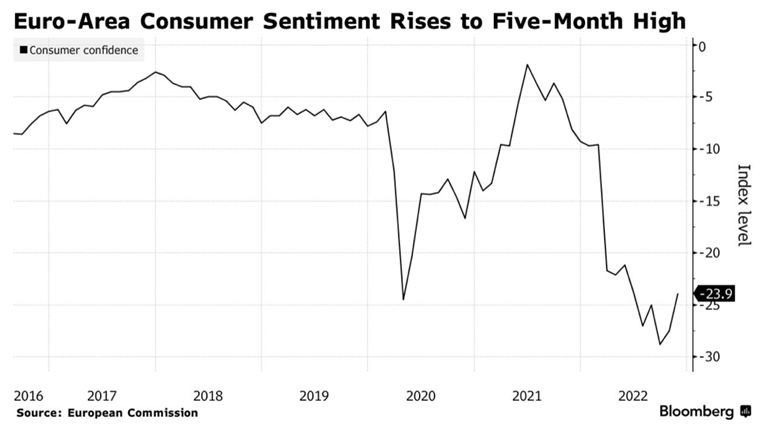

“Euro-Area Consumer Confidence Increases to 5-Month High – Consumer sentiment in the euro area rose to a five-month high, a sign of resilience among households at a time when the region is probably in recession. The gauge of confidence increased to -23.9 in November, according to the European Commission. The (European) Commission observed that consumer confidence still ‘remains at a very low level, well below its long-term average.’”, Bloomberg, November 22, 2022

Germany

“German manufacturing PMI rises for first time since outbreak of Ukraine war – Activity in Europe’s largest manufacturing economy improved in November for the first time since Russia’s invasion of Ukraine, according to a closely-watched business survey. The manufacturing purchasing managers index compiled by S&P Global rose to 46.7 from 45.1 in October……The comparable index for the services sector also improved surprisingly, leading the composite PMI to rebound to 46.4 from 45.1.”, Investing.com, November 23, 2022

Thailand

“Tourism revival likely boosted Thailand’s GDP growth in Q3 – Thailand’s economy grew at its fastest pace in more than a year last quarter, boosted by a rebound in tourism and private consumption, but the outlook was clouded by risks of a global economic slowdown, a Reuters poll predicted. Growth in Southeast Asia’s second-largest economy was estimated at 4.5% year-on-year in the third quarter, according to the median forecast of 13 economists polled on Nov. 11-16, up from 2.5% growth in the previous quarter.”, Reuters, November 16, 2022

Ukraine

“The McDonalds restaurant has resumed work in Khmelnytskyi (Ukraine) – ‘In accordance with the enhanced safety regulations, during the air raid alert, the facilities will be closed to allow employees and patrons to move to the nearest shelter. In doing so, the team will promptly issue pre-paid orders while halting production processes and turning off equipment before closing. The restaurant will resume work approximately one hour after the alarm is canceled: this time is needed to turn on and set up the equipment and to prepare the employees for work.”, Epravda, November 17, 2022. Translation and article compliments of Paul Jones, Jones & Co., Toronto

United Kingdom

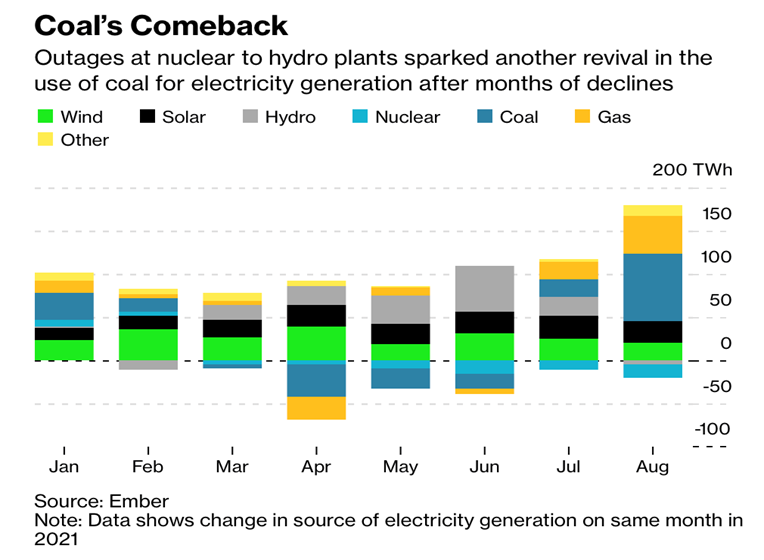

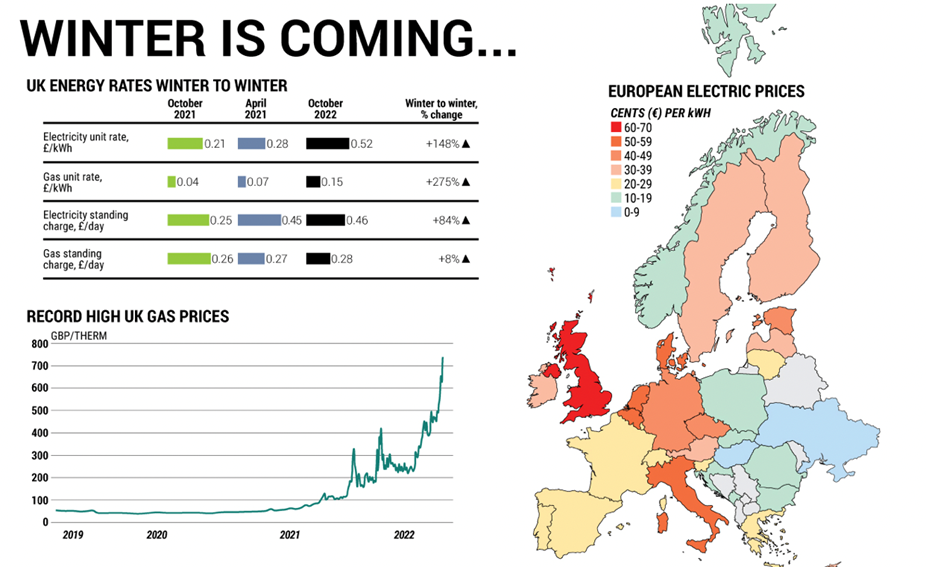

“UK doubles coal imports to head off winter energy crisis – The increasing use of coal-generated power in the UK comes after years of the country shifting to cleaner electricity from gas-fired power plants and renewables, but is deemed vital as Russian president Vladimir Putin crimps gas supplies to Europe. Figures from Kpler, a commodity analytics firm, show that last month more than 560,000 tonnes of coal came into British ports, compared to the 291,089 tonnes that arrived in October 2021, a 93 per cent increase.”, The Times of London, November 27, 2022

United States

“Black Friday Traffic Up 2.9% As Shoppers Return To Stores – The foot traffic to non-indoor mall locations, including lifestyle centers, open-air malls, neighborhood centers, and stand-alones, increased by 4.7%. ‘The strong traffic numbers for Black Friday show that shoppers are returning to stores and enjoying the socialization the holiday brings,’ said Brian Field, global leader of retail consulting and analytics at Sensormatic Solutions.”, Forbes, November 26, 2022

Brand & Franchising News

“Why the (US) Pet Industry Is a Recession-Resistant Franchise Sector – More than 23 million American households — nearly 1 in 5 nationwide — adopted a pet during the pandemic, according to the ASPCA. The pet market grew 14% in 2021— an increase over the 10% growth the industry experienced in 2020. The industry is evolving to meet the needs of modern pet ownership, resulting in a shift toward more convenient and tech-forward services, as well as more sustainable and environmentally friendly products.”, Franchising.com, November 27, 2022

“California Pizza Kitchen Announces Franchise Opening in Costa Rica – This newest CPK franchise builds on a momentous year for the brand, which opened new restaurants in Canada, India, and Chile earlier this year. CPK’s latest franchise location will be owned and operated by Byron Mora Porras, Chairman of Conceptos Gastronomicos, part of a larger company that currently operates restaurants and retail stores in eleven countries throughout Central and South America.”, Franchising.com, November 18, 2022

“Domino’s is building a fleet of GM Chevy Bolt EVs for the future of pizza delivery – Domino’s will roll out 800 custom-branded 2023 Chevy Bolt electric vehicles at locations across the U.S. in the coming months. The pizza chain restaurant has previously set a goal of net-zero carbon emissions by 2050, and CEO Russell Weiner said optimizing how it delivers pizza is key.”, CNBC, November 26, 2022

“FAT Brands reaches new milestone with 100th store opening this year. FAT Brands, the global franchising company that owns restaurants including Johnny Rockets, Fatburger, Round Table Pizza, Twin Peaks and 13 other concepts, announced that it has opened a record-breaking 100 new franchised locations so far this year and is poised for further growth, with approximately 25 additional stores slated to open by year-end. This is the first year since the company’s inception in 2017 that it has surpassed 100 openings in a year.”, VF Franchising, November 24, 2022

“Nando’s (UK) defies costs to serve up recovery – Pre-tax losses fell to £99.5 million compared with £241.8 million in the previous year. However, like many other businesses, the chain has been saddled with costs stemming from high inflation and global supply chain disruption, forestalling a return to profitability. The company’s wage bill increased from £243 million last year to £363 million. Rob Papps, chief executive, ……said: ‘The 2022 financial year saw a significant bounceback in customer demand following a return to eating out since the peak of the pandemic.’”, The Times of London, November 28, 2022

“What Does The Taco Bell Menu Look Like In India? In 2010, according to QSR, Taco Bell opened its first outlet in India, and in the 12 years since then, millions of people on the subcontinent have eaten tacos, burritos, and other specialties, adapted or invented for the market. There’s no beef at Taco Bell India.”, The Daily Meal, November 17, 2022

“Tim Hortons teams up with Alibaba to woo Chinese coffee drinkers – The operator of Canadian coffee chain Tim Hortons in China said on Thursday it had forged a two-year partnership with Alibaba Group’s (9988.HK) grocery chain that will see the two launch co-branded products. E-commerce giant Alibaba’s Freshippo will begin sales next month at its stores, of which it has more than 300, as well as through its official app, it said in a statement. Products will include drinks such as Velvet Cocoa Coffee.”, Reuters, November 17, 2022. Compliments of Paul Jones, Jones & Co., Toronto

“TITLE Boxing Club Announces International Deal Across Nine Countries – The nine countries being added to TITLE Boxing Club’s roster are: Bangladesh, Cambodia, Indonesia, Nepal, New Zealand, Philippines, Singapore, South Korea and Thailand.”, Franchising.com, November 18, 2022

“Burger chain Wendy’s cooks up plans for Ireland – The Dublin, Ohio-headquartered company announced on Monday that it plans to continue its expansion into the European market following on from the success of its return to the UK in 2021. Wendy’s, which has around 7,000 restaurants worldwide, currently owns 25 in the UK, ten of which are operated by the main company behind the brand and 15 of which are franchised out. The chain said that it is seeking ‘well-established franchisee candidates in Ireland that have strong operations experienced, local development expertise, ambition to grow quickly and a proven track record of growing brands in Ireland.’”, The Irish Times, November 28, 2022

To receive this biweekly newsletter, click here : https://bit.ly/geowizardsignup

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, economic development and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing environment. Our GlobalTeam™ covering 25+ countries provides us with updates about what is happening in their specific countries.

To sign up for our biweekly newsletter click here: https://bit.ly/geowizardsignup

William (Bill) Edwards has a four-decade career successfully accelerating the growth of more than 40 brands worldwide. He has directed projects on-site in Alaska, Asia, Europe and the Middle and Near East and has lived in China, the Czech Republic, Hong Kong, Indonesia, Iran and Turkey. Edwards Global Services, Inc. (EGS) provides a complete International solution for companies Going Global. From initial global market research and country prioritization, to developing new international markets, providing in-country operations support and problem solving around the world. EGS has twice received the U.S. President’s Award for Export Excellence. For advice on doing business successfully across 40+ countries, contact Bill Edwards at bedwards@edwardsglobal.com or +1 949 224 3896.

Download our latest chart ranking 40+ countries as places to do business at this link:Our latest GlobalVue™ 40 country ranking

EGS Biweekly Global Business Newsletter Issue 69, Tuesday, November 15, 2022

Edited and curated by: William (Bill) Edwards, CFE, CEO of Edwards Global Services, Inc. (EGS)

China begins to loosen Zero COVID travel quarantine, coal not going away just yet, China and the USA have half the world’s wealth, India’s coming decade of growth, US back to pre-COVID air travel, coffee bean prices are falling, 2 billion trees to be planted in Brazil and the dominant global marketing trends for 2023.

To receive this biweekly newsletter that is read by over 1,400 people in 20 countries, click here:

https://bit.ly/geowizardsignup

First, A Few Words of Wisdom From Others

“Nothing is impossible, the word itself says ‘I’m possible’“., Audrey Hepburn

“Wisdom comes from experience. Experience is often a result of lack of wisdom.”, Terry Pratchett

“The pessimist sees difficulty in every opportunity. The optimist sees opportunity in every difficulty.”, Winston Churchill

Highlights in issue #69:

- Brand Global News Section: Dunkin®, Carl’s Jr.®, Jolibee®, Kinderdance®, Tim Hortons® and Wetzel’s Pretzels®

NOTE: Bolded headlines in this newsletter are live links where the article is available without a subscription.

Interesting Data and Studies

“Battle of the Biggest – Today we look at who really has the world’s biggest economy……..But how to measure comparative sizes when countries have different currencies? A popular way to get around fluctuating exchange rates is to use a method called purchasing power parity, which accounts for the cheaper prices of goods and services in poorer countries. PPP, as it’s known, accounts for the bigger punch that $1 packs in, say, Laos than it does in the US. It’s not unlike looking at “real” GDP, which strips out the impact of inflation to look at the underlying state of the economy.”, Bloomberg, November 8, 2022

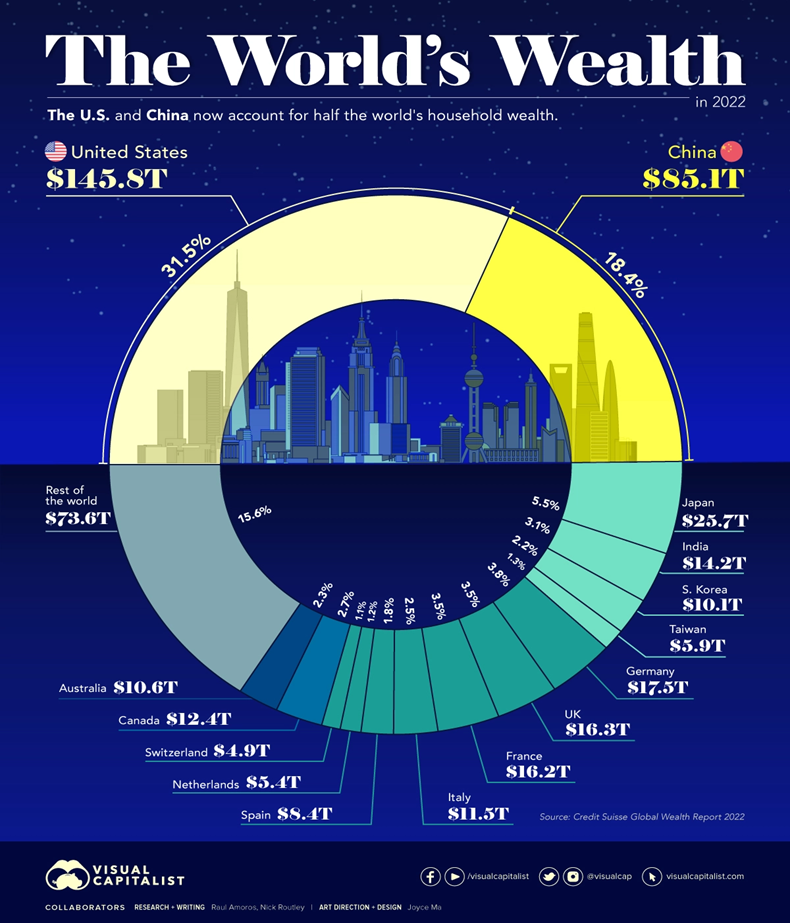

“The U.S. and China Account for Half the World’s Household Wealth – Measures like GDP are commonly used to understand the overall wealth and size of the economy. While looking at economic output on an annual basis is useful, there are other metrics to consider when evaluating the wealth of a nation. This visual utilizes data from Credit Suisse’s annual Global Wealth Report to break down the latest estimates for household wealth by country.”, Visual Capitalist / Credit Suisse, November 9, 2022

Global Supply Chain, Energy, Commodities, Inflation & Trade Issues

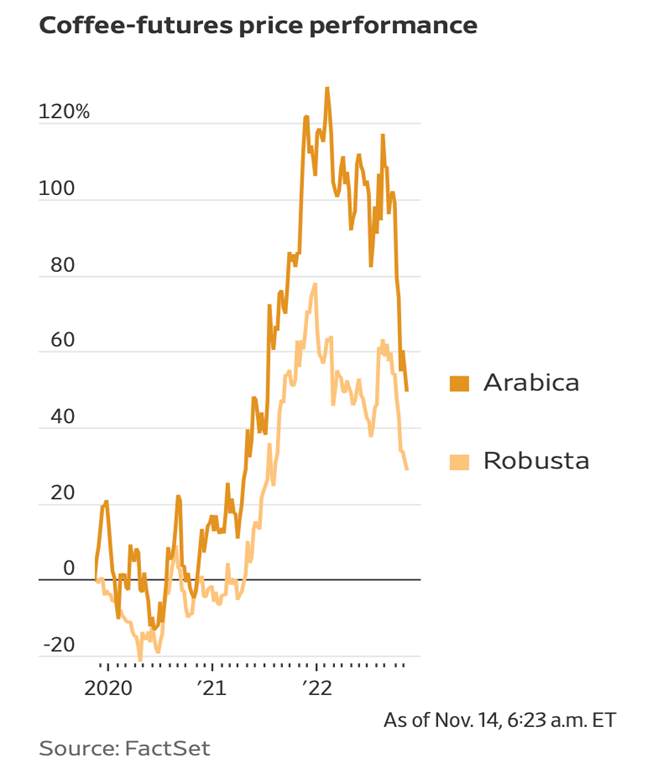

“Coffee Market Goes Cold as Brazilian Weather Normalizes – Futures prices have plunged since August, with coffee-growing conditions bouncing back from last season’s drought and frost. Wet weather in farming areas such as Brazil and Indonesia is raising the prospect of a good crop and bigger coffee supply, sending prices down. Arabica coffee futures have shed 22% in the past month.”, The Wall Street Journal, November 14, 2022

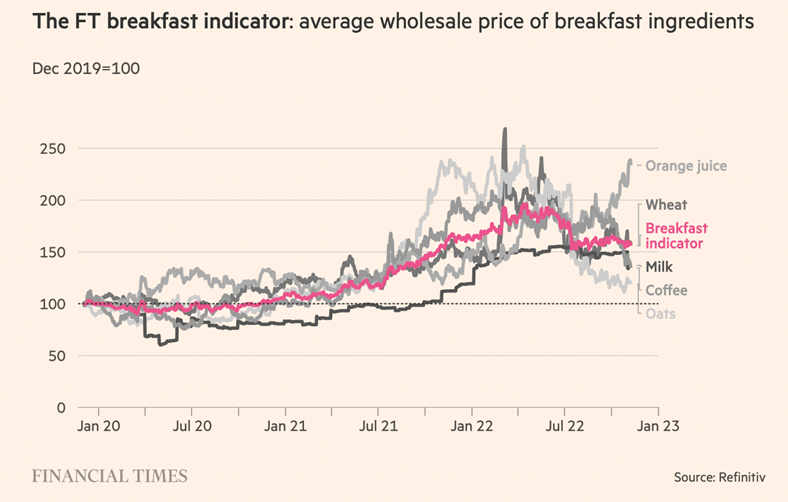

“Global inflation tracker: see how your country compares on rising prices –Russia’s invasion of Ukraine has increased prices for everything from energy to wheat, adding to the inflationary pressures affecting major economies of the world including the US, UK, Germany and France.”, The Financial Times, November 10, 2022

“Coal Was Meant to Be History. Instead, Its Use Is Soaring – The demise of the dirtiest fossil fuel has been delayed as power shortages and the war in Ukraine drive consumption, while China and India construct new plants. Prices of exported coal have skyrocketed to records and futures contracts suggest they’ll remain at historic highs for years to come.”, Bloomberg, November 4, 2022

Global & Regional Travel Updates

“These are the top 10 airlines in the world for 2022 – Airline-ranking company Skytrax ranked the world’s best carriers, and not a single U.S. airline made it to the top 10. Delta Airlines did rank in the 24th spot and earned the title of the best airline in North America—a result backed up by this year’s travelers satisfaction survey from The Points Guy.”, CNBC, November 10, 2022

“Americans Have Spent $11 Billion More on Domestic Flights This Year Than They Did in 2019 – Domestic flight prices in October alone were 24 percent higher than pre-pandemic levels. Through October 17, U.S. travelers spent a total of $76 billion on domestic flights, compared to $65 billion in 2019.”, Conde Nast Traveler, November 11, 2022

“WH Smith sales take off with return of global travel – WH Smith has reinstated dividend payments after reporting that the rebound in global travel had propelled it to the highest sales figures in 15 years. The group beat market expectations with a headline pre-tax profit of £61 million for the year to the end of August, against a £104 million loss last year, on sales of £1.4 billion. The company said it would pay a final dividend of 9.1p per share after suspending dividends during the pandemic.”, The Times of London, November 11, 2022

Country & Regional Updates

Brazil

“2 Billion New Trees (in Brazil): Suzano, Santander Launch Massive Planting Push in Brazil – An area the size of Switzerland, made of protected trees. The world’s largest pulp producer is among six companies aiming to plant millions of hectares of trees in Brazil, financed by the sale of carbon offsets.”, Bloomberg, November 12, 2022

China

“China Loosens ‘Zero-Covid’ Controls on Quarantine, Inbound Flights – China ended its “circuit breaker” mechanism for inbound flights and shortened the quarantine period for overseas travelers in an effort to “optimize” the country’s Covid-19 response, health authorities announced Friday. Travelers arriving in the country now must submit to five days of centralized quarantine plus three days of home confinement, rather than seven days of centralized isolation and three days of observation at home, according to the Joint Prevention and Control Mechanism of the State Council.”, Caixin Global, November 11, 2022

“Why Is China’s Youth Unemployment So High? This year’s cohort of college graduates has been facing China’s toughest job market in recent memory. Nearly one in every five young Chinese urbanites was unemployed in July, a record since data began to be released at the start of 2018. Their chances of finding a job have been hit by a perfect storm of economic disruption and uncertainty.”, Caixin Global, November 11, 2022

“Yum China Net profit in the third quarter increased by 98 percent to US 206 million with a total of 239 net new stores – In terms of the number of stores, a total of 239 new stores were added in the quarter, mainly driven by the development of the KFC and Pizza Hut brands, bringing the total number of stores to 12,409 as of September 30, 2022.”, Caijing Network, November 2, 2022. Compliments of Paul Jones, Jones & Co., Toronto

India

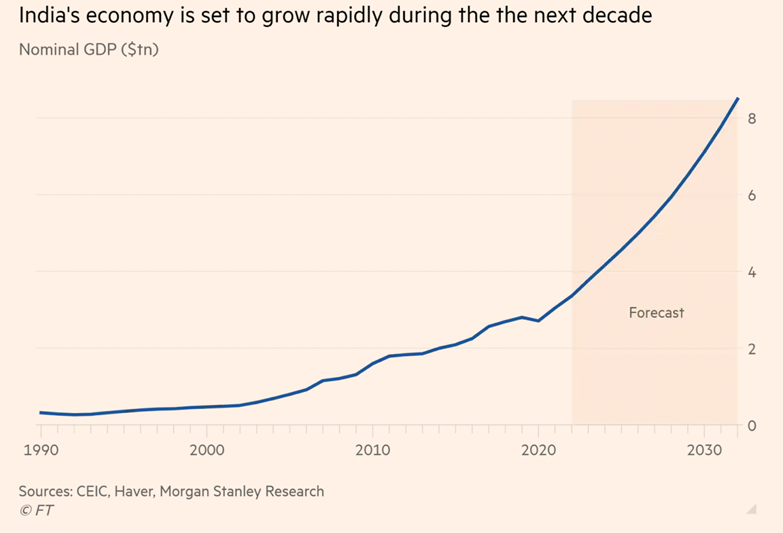

“India’s coming decade of outperformance – The country will provide a compelling opportunity in a world starved of growth. We forecast that India will be the third-largest economy by 2027, with its GDP more than doubling from the current $3.4tn to $8.5tn over the next 10 years. Incrementally, India will add more than $400bn to its GDP every year, a scale that is only surpassed by the US and China.”, The Financial Times, November 8, 2022

Malaysia

“Malaysia posts fastest economic growth in over a year, outlook clouded – Malaysia grows 14.2% y/y in Q3, beating forecasts. Central bank expects 2022 growth to surpass govt projections. Outlook clouded by risk of global slowdown.”, Reuters, November 11, 2022

The Philippines

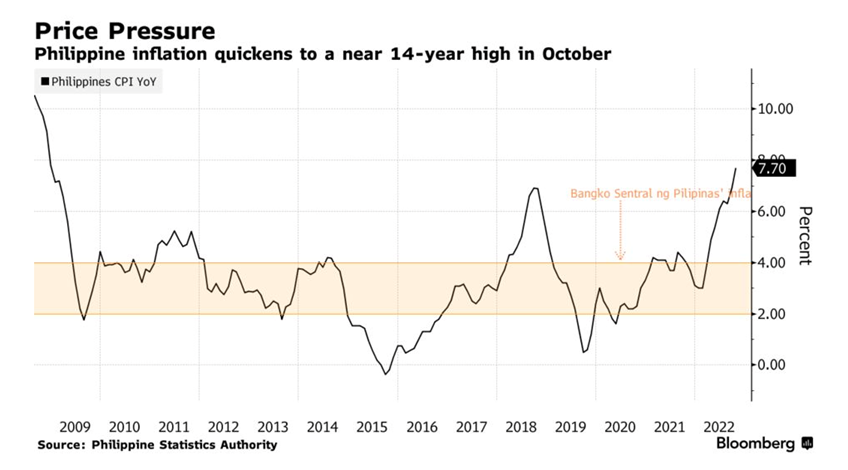

“Philippines Is Open to Matching More Fed Hikes to Tame Inflation – The Philippines central bank may keep on matching the Federal Reserve’s next rate increases should domestic inflation continue to quicken, according to Governor Felipe Medalla. Medalla’s comments came after the Philippines reported the fastest inflation in almost 14 years last month and a day after the governor announced that the monetary authority will match this week’s 75-basis-point hike at the Nov. 17 meeting.”, Bloomberg, November 4, 2022

United Kingdom

“Inflation ‘very possibly’ peaking – Is global inflation nearing its peak? Kristalina Georgieva, the head of the International Monetary Fund, has dared to say it might be. Georgieva believes the united action of central banks around the world to raise interest rates could be starting to push down on consumer price rises, which have surged to double-digit highs in the UK and elsewhere.”, The Times of London, November 7, 2022

“UK Energy Costs Are Through the Roof – A price cap is set to expire in April. Following the downfall of another prime minister and the British pound’s collapse to its lowest level ever against the dollar, the U.K. urgently needs to tackle energy prices. In June, regulatory body Ofgem reported that more than 2.3 million British households are behind on their electricity bills and 1.9 million are behind on gas bills. Both figures are some 70 percent higher than at the end of 2020.”, Geopolitical Futures, October 28, 2022

United States

“US Air-Passenger Traffic Tops Pre-Pandemic Levels of 2019 – Just over 15 million people went through Transportation Security Administration security portals in the past seven days, about 39,000 more than in 2019, or an increase of less than 1%, according to TSA data. The uptick comes in a traditionally slack period for travel. The recent volume is still well below the 18 million people a week who flew during peaks in the summer of 2019.”, Bloomberg, November 1, 2022

“Visualizing America’s Most Popular Fast Food Chains – Fast food is big business in America. From national chains to regional specialties, the industry was worth $331.4 billion as of June 2022. Which fast food brands are currently dominating this space? This graphic by Truman Du uses data from Quick Service Restaurant (QSR) Magazine to show the most popular fast food chains across America.”, Visual Capitalist / QSR Magazine, October 28, 2022

Brand & Franchising News

“MUMBO-fication: Multi-branding grows across international borders – It is becoming increasingly common to find multi-brand franchisees of foreign brands worldwide. This may be at the local or regional level, country level, or even a multi-country level. This is a major trend we see in the U.S. and increasingly in EU countries. These franchisees are often referred to as MUMBOs: multi-unit, multi-brand operators.”, Franchising.com, November 13, 2022. This article is by William Edwards, Editor of this newsletter

“Boost Juice (Australia) and EFG (Cambodia) sign agreement to bring Boost to Cambodia – EFG is committed to open 20 Boost locations within five years in Cambodia. The agreement also covers future store openings in Laos and Myanmar. Stores are expected to be located in airports, shopping malls and gas stations tapping into Asian needs for Grab & Go, Convenience Retail and a healthy daily beverage trend.”, Franchising.com, November 13, 2022

“Carl’s Jr. Signs Deal to Grow in Switzerland – CKE Restaurants Holdings, Inc. announced a franchise agreement with Spycher Burger Gang AG to develop Carl’s Jr. restaurants in Switzerland. Spycher will open restaurants across Switzerland in key cities including Zurich, Basel, Bern, and Lucerne.”, QSR Magazine, November 9, 2022

“Jollibee And Dunkin’ Are Breaking Up Their Partnership Overseas – This partnership, between Dunkin’ and Jollibee Food Corp., planned to expand the donut empire within southeast Asia, with a focus on China. Jollibee hoped to open more than 1,500 Dunkin’ locations, per The Philippine Star, but unfortunately, this expansion proved to be more difficult than anyone expected. In early November 2022, Jollibee and Dunkin’ announced that they would be ending their partnership.”, Mashed, November 10, 2022

“Kinderdance® A Top Kids Franchise Soars In Romania – Franchise owner Dana Iancu and her team of instructors are offering Kinderdance programs to children in Romania. Kinderdance programs are designed to be an integral part of a child’s school day and afterschool schedule.”, Franchising.com, November 2, 2022

“The next generation of ghost kitchens is stepping out from the shadows – Ghost kitchens and virtual brands in a post-pandemic world will favor more flexible, transparent business models from industry veterans like Reef and Nextbite, to newcomers like Oomi and Meal Outpost.”, Nation’s Restaurant News, October 31, 2022

“Papa Murphy’s® Owner MTY Foods to Buy Wetzel’s Pretzels® – The Canadian brand collector continues its U.S. shopping spree with its second deal this year, following an earlier acquisition of Famous Dave’s. The Canadian brand collector, which made its name through the ownership of dozens of mall-based concepts north of the border, on Tuesday announced the acquisition of the 350-unit Wetzel’s Pretzels for $207 million in cash.”, Restaurant Business, November 2, 2022

“Restaurant Brands profit, sales gain as Tim Hortons® looks to expand lunch, dinner offerings – Tim Hortons® has been adding lunch and dinner items to its menu, such as wraps and bowls, and such items are now included in 10 per cent of its transactions, which helped to drive sales momentum for the chain in the third quarter.”, The Globe and Mail, November 3, 2022

Articles & Studies For Today And Tomorrow

The Dominant Global Marketing Trends of 2023 – The world around us continues to change rapidly and drastically. With this change comes new and exciting opportunities for brands to connect with their customers. Global marketing teams are bracing for leaner budgets going into 2023. As budgets are tightening, marketing teams everywhere are finding that they need to optimize the campaigns that they can run and ensure that every dollar spent can make the most impact.”, Marcom Central, September 19, 2022. Compliments of Steve Dobbins, Founder and CEO of the Dobbins Group

“Unilever to extend four-day working week trial to Australia – Move follows successful New Zealand pilot scheme during which company reported happier and more engaged staff. Unilever is to extend its trial of a four-day working week to 500 employees in Australia after a successful 18-month pilot in New Zealand, becoming the largest company yet to offer a vote of confidence in the shorter schedule. Placid Jover, chief talent officer at the UK-based maker of Dove soap and Hellmann’s mayonnaise, said positive results from paying about 80 staff full salaries for four rather than five-day weeks in New Zealand had prompted the extension.”, The Financial Times, November 1, 2022

To receive this biweekly newsletter, click here : https://bit.ly/geowizardsignup

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, economic development and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing environment. Our GlobalTeam™ covering 25+ countries provides us with updates about what is happening in their specific countries.

To sign up for our biweekly newsletter click here: https://bit.ly/geowizardsignup

William (Bill) Edwards has a four-decade career successfully accelerating the growth of more than 40 brands worldwide. He has directed projects on-site in Alaska, Asia, Europe and the Middle and Near East and has lived in China, the Czech Republic, Hong Kong, Indonesia, Iran and Turkey. Edwards Global Services, Inc. (EGS) provides a complete International solution for companies Going Global. From initial global market research and country prioritization, to developing new international markets, providing in-country operations support and problem solving around the world. EGS has twice received the U.S. President’s Award for Export Excellence. For advice on doing business successfully across 40+ countries, contact Bill Edwards at bedwards@edwardsglobal.com or +1 949 224 3896.

Download our latest chart ranking 40+ countries as places to do business at this link:

Our latest GlobalVue™ 40 country ranking