EGS Biweekly Global Business Newsletter Issue 68, Tuesday, November 1, 2022

Edited and curated by: William (Bill) Edwards, CFE, CEO of Edwards Global Services, Inc. (EGS)

In this issue, the sudden reversal of the global chip shortage, global consumer spending declines, air fares are high, natural gas prices decline, fossil fuel demand might peak this decade, Euromonitor makes its 2023 economic predictions and McKinsey says we may be seeing a ‘New Dawn’ for global economies.

To receive this biweekly newsletter that is read by 1,450 people in 20 countries, click here : https://bit.ly/geowizardsignup

First, A Few Words of Wisdom From Others

“It always seems impossible until it’s done.”, Nelson Mandela

“Victory is sweetest when you’ve known defeat.”, Malcolm S. Forbes

“Fortune befriends the bold.”, Emily Dickinson

Highlights in issue #68:

- A New Era Dawns – McKinsey & Co.

- Brand Global News Section: Dominos® Pizza China, Guzman y Gomez®, Happy Joe’s Pizza & Ice Cream®, KFC®, Xponential Fitness®

NOTE: Bolded headlines in this newsletter are live links where the article is available without a subscription.

Interesting Data and Studies

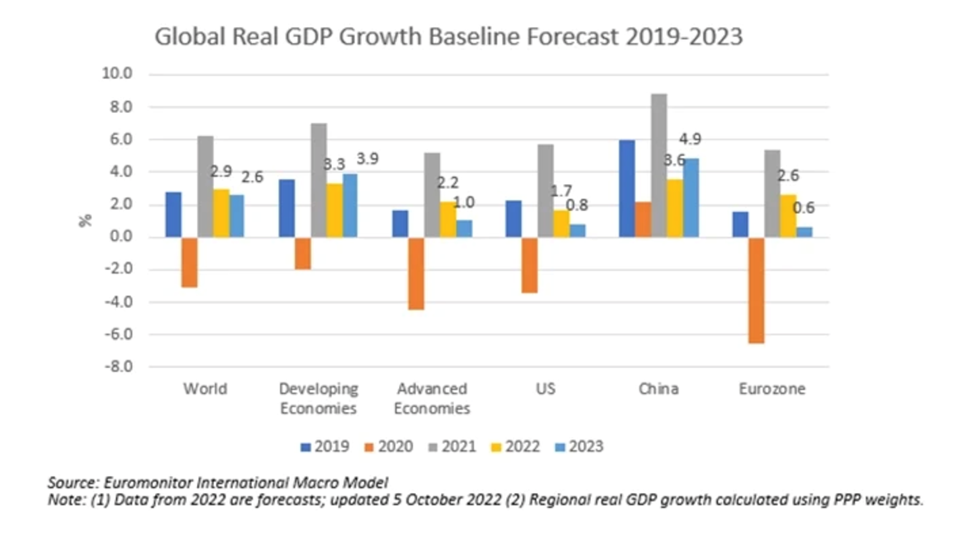

“Euromonitor’s Q4 Global Economic Forecast Predicts Worsening Conditions – Global real GDP growth is expected to decline from 6.2% in 2021 to 2.9% in 2022 and 2.6% in 2023, 0.1 and 0.3 percentage points lower than our predictions made in Q3 2022, respectively. Global inflation will peak at 9.0% in 2022 before it recedes somewhat in 2023.”, Euromonitor, October 24, 2022

“A New Era Dawns – With a growing US-China rift, pandemic-induced supply-chain breakdown and war-induced energy crisis unfolding alongside demographic aging, it’s arguably a cliché to say humanity is entering a new era. That said, a paper from the McKinsey Global Institute details a compelling case for why the world is likely going through something akin to major step changes of the 20th century, including World War II, the 1970s oil crisis and the breakup of the Soviet empire in 1989-92, which powerfully shaped socio-economic outcomes in following decades.”, Bloomberg and McKinsey & Co., October 26, 2022

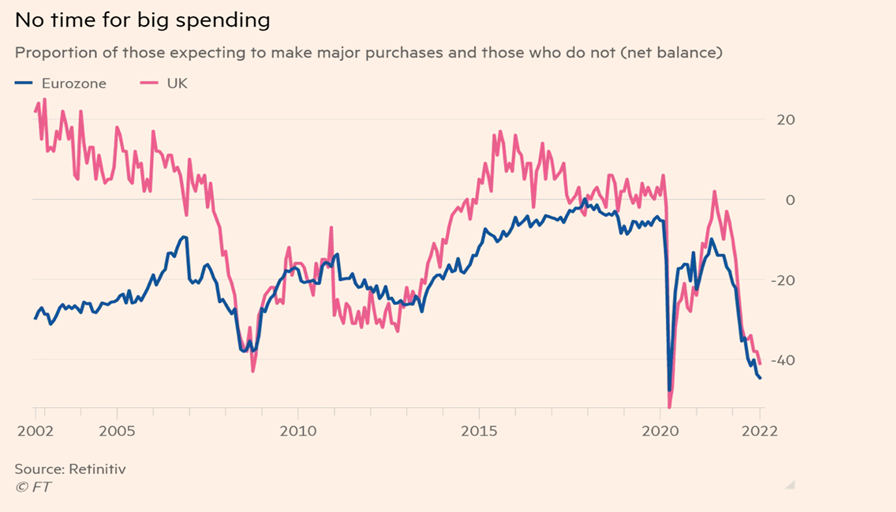

“European consumers cut back on discretionary spending – Shoppers postpone big purchases and reduce leisure outlays as cost of living crisis bites. European consumers’ intentions of spending on major goods, such as cars and houses, are at their lowest levels for two decades, excluding the early months of the pandemic.”, The Financial Times, October 29, 2022

Global Supply Chain, Energy, Commodities, Inflation & Trade Issues

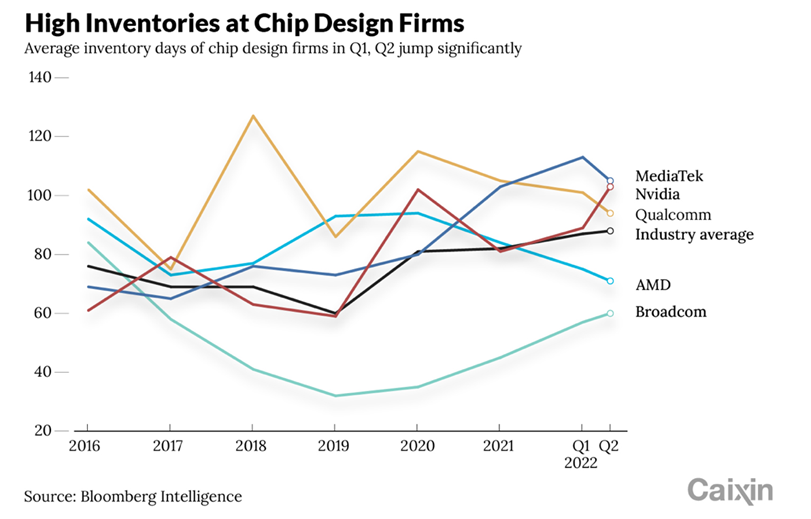

“The Sudden Reversal of the Global Chip Shortage – Remember the global semiconductor shortage a few months ago? It’s over. Now quickly shrinking demand for consumer electronics is causing canceled orders and unsold stockpiles at makers of integrated circuits including Taiwan Semiconductor Manufacturing Co. (TSMC), Advanced Micro Devices Inc. (AMD) and Nvidia. It’s a stark contrast with the disruptions that chip shortages caused for makers of autos, smartphones, computers and other goods relying on the advanced electronic devices.”, Caixin Global, October 20, 2022

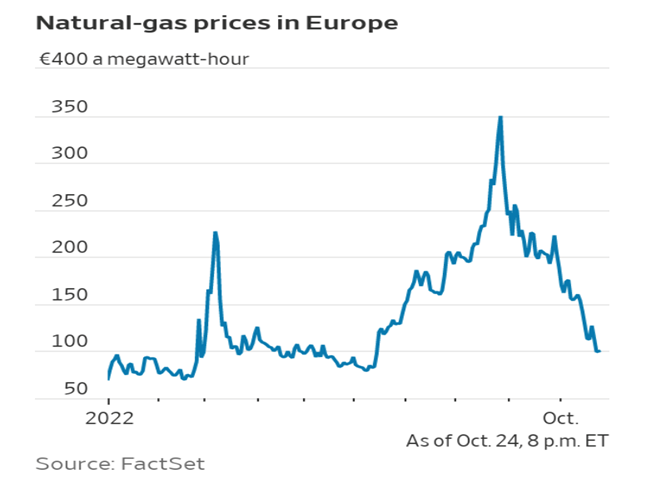

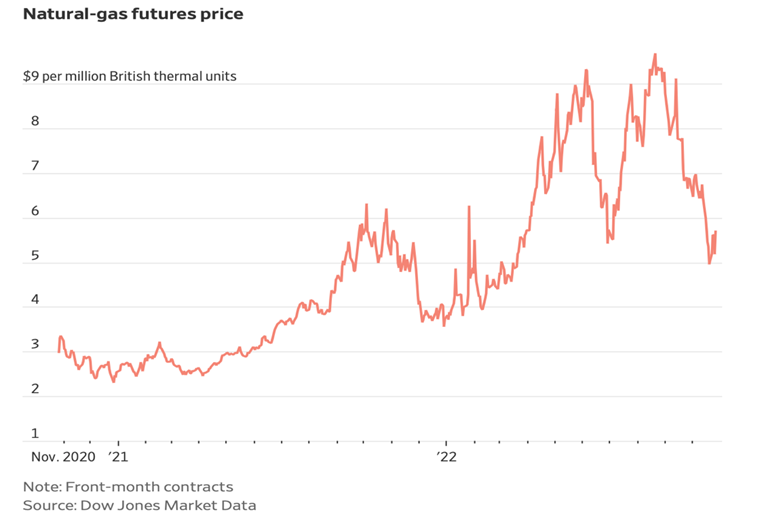

“Europe, Once Fearing Gas Rationing This Winter, Has a Glut – Prices for natural gas have tumbled more than 70% from their late-August high, thanks in part to a burst of warm weather. The comfortable position Europe finds itself in could be temporary. Starting next week, seasonal forecasts will be able to show with some accuracy how winter weather will affect storage.”, The Wall Street Journal, October 26, 2022

“(US) Natural-Gas Prices Have Plunged Into Autumn – A big driver of inflation is down about 40% in two months as U.S. inventories have swelled since air-conditioning season ended. The decline is due to warm autumn weather, record domestic production and gas-storage facilities that have filled up fast since the end of air-conditioning season. Now, one of the big drivers of inflation costs roughly the same as it did a year ago.”, The Wall Street Journal, October 30, 2022

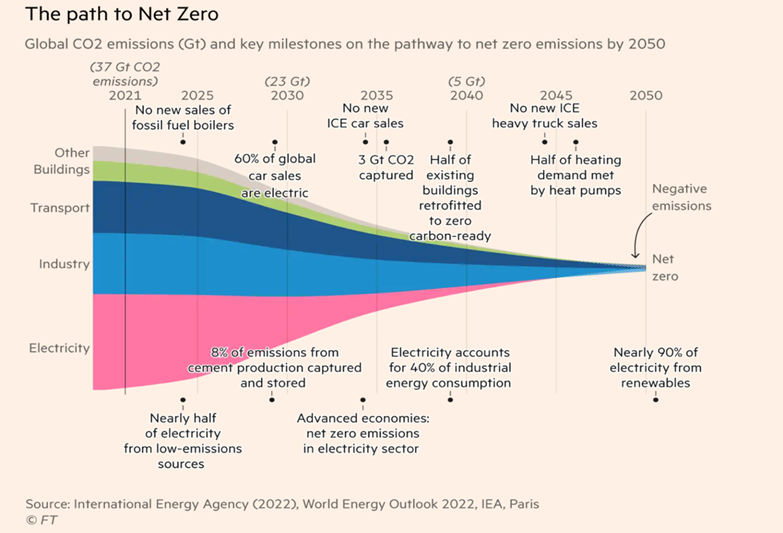

“IEA forecasts fossil fuel demand will peak this decade – World is approaching a ‘pivotal moment’ and ‘golden age of gas’ is coming to an end. The International Energy Agency has said Russia’s invasion of Ukraine will accelerate a peak in the world’s consumption of fossil fuels, with gas demand now expected to join oil and coal in topping out near the end of this decade.”, The Financial Times, October 27, 2022

Global & Regional Travel Updates

“Why Airfares Have Risen Five Times Faster Than The Overall Inflation Rate – Airline ticket prices have climbed much faster than overall inflation during the pandemic recovery due to several factors. The industry ground to a virtual standstill in the earliest days of the pandemic and recovery was initially slow. Russia’s war in Ukraine has driven up fuel costs substantially and, in recent months, an extraordinarily strong rebound in travel demand has collided with massive challenges to supply, including labor shortages, aircraft delivery delays and other issues.”, Forbes, October 14, 2022

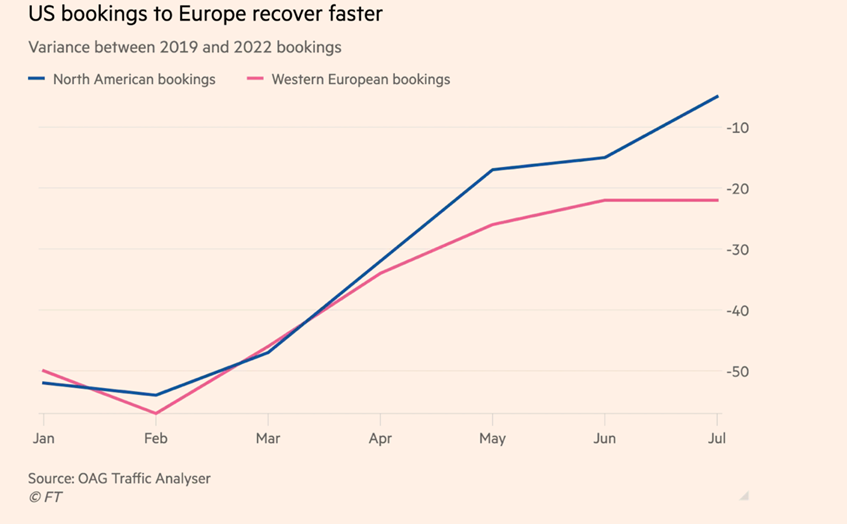

“Transatlantic travel soars as Americans make most of strong dollar – Virgin boss says UK holidays are ‘on sale’ for US tourists. Transatlantic travel is booming, driving airline revenue as Americans armed with a strong US dollar fly to Europe and the UK.”, The Financial Times, October 22, 2022

Country & Regional Updates

Southeast Asia

“Southeast Asia’s top digital economies expected to hit $200 billion in 2022 – The milestone comes three years ahead of earlier projections and is a 20% increase from last year’s $161 billion in gross merchandize value (GMV). An earlier report in 2016 estimated the internet economy in the region’s six major countries will close in on $200 billion in GMV by 2025. The six major economies covered in the report are: Indonesia, Malaysia, the Philippines, Singapore, Thailand, and Vietnam.”, CNBC, October 26, 2022

Australia

“Australia to cut economic growth forecasts on lower consumer spending – Australia’s economic growth is expected to slow sharply next financial year as rising inflation curbs household consumption, according to new forecasts to be unveiled by Treasurer Jim Chalmers in Tuesday’s budget. Budget papers are set to show gross domestic product (GDP) for fiscal 2023-2024 will be downgraded to 1.5% from the 2.5% forecast in April. GDP is also due to be downgraded to 3.25% from 3.5% for 2022-2023, according to draft figures from the Treasury.”, Reuters, October 24, 2022

Brazil

“Lula wins Brazil presidential election in historic comeback – Lula won 50.83 per cent of the vote versus 49.17 for Bolsonaro after a cliffhanger three-hour count, followed by millions across the country on television and online.’, The Financial Times, October 31, 2022

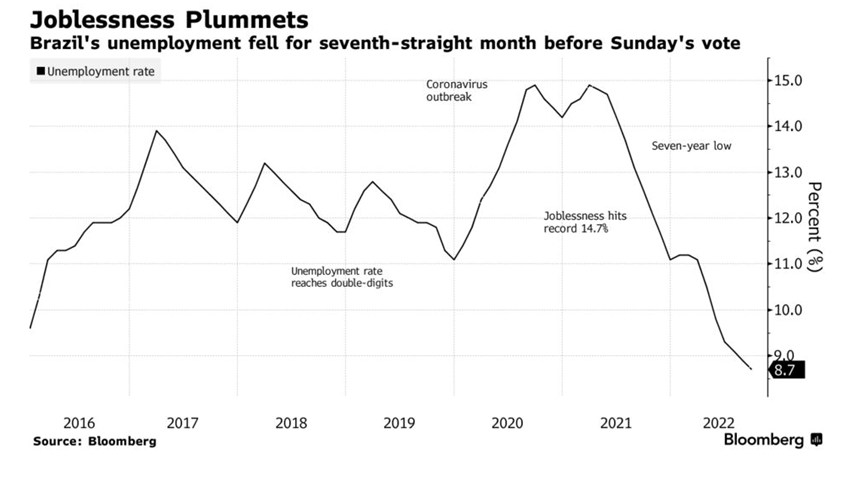

“Brazil Unemployment Hits New Seven-Year Low Before Presidential Runoff Vote – Jobless rate at 8.7% in three months through Sept.; est. 8.7% Brazilians head to the polls on Sunday with Lula leading polls. Brazil’s unemployment rate declined for the seventh-straight month to the lowest level since 2015, signaling the job market continued to improve ahead of Sunday’s presidential runoff.”, Bloomberg, October 27, 2022

Canada

“Bank of Canada raises interest rate for sixth time in a row, but signals campaign nearing end – The central bank raised its benchmark rate by 0.5 percentage points, its sixth consecutive hike since March. The move was smaller than financial markets were expecting, but still brings the policy rate to 3.75 per cent, its highest level since early 2008. Bank Governor Tiff Macklem told a news conference that further rate hikes are needed to get inflation, currently running near a four-decade high, under control.”, The Globe and Mail, October 27, 2022

China

“US companies’ sales forecasts drop to 10-year low in AmCham Shanghai’s 2022 poll, as zero-Covid rules upend operations – The number of companies expecting annual revenue growth plunged by 29 percentage points to 47 per cent this year, from 82.2 per cent in 2021. The annual AmCham Shanghai survey, featuring 307 respondents this year, was a stark contrast to the optimism found in the 2021 poll.”, South China Morning Post, October 28, 2022

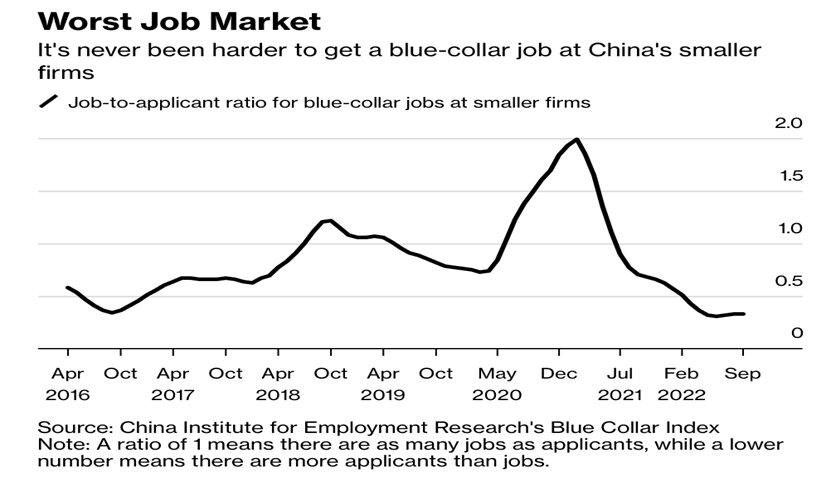

“Hiring at China’s Small Firms Fails to Pick Up from Record Low – Situation for blue-collar jobs near the worst since 2016. Jobs that declined most are related to property, construction. The ‘Blue Collar’ Job Index for small and medium-sized businesses, which are mostly in manufacturing and services, showed little improvement in the third quarter after hitting an all-time low of 0.3 in June, according to the Beijing-based China Institute for Employment Research. That means there’s more than three times as many applicants as there are jobs available.”, Bloomberg, October 27, 2022

India

“India economic outlook, October 2022 – India will likely post a 6.8%–7.1% growth during FY22–23, provided global uncertainties and inflation don’t weigh on domestic demand and investment sentiment in the near term. The purchasing managers’ index (PMI) suggests that economic activity stayed strong in July and August. Input cost inflation also fell to the lowest in 2022 due to falling commodity prices, including the lower prices of aluminum and steel.”, Deloitte, October 21, 2022

Japan

“Japan unleashes $200bn stimulus – The Japanese government on Friday unveiled Y29.1tn ($197bn) in fresh spending to ease the impact on consumers of soaring commodity prices and a falling yen, while the Bank of Japan stuck by its ultra-loose policy. Japan’s inflation rate, at 3 per cent in September, is much lower than price rises in the US and Europe.”, The Financial Times, October 28, 2022

Spain

“Economic Slowdown Starts to Weigh on Spain’s Stellar Job Market – Spain created fewer jobs in third quarter that during the same periods in the two previous years, a first sign that the job market is cooling after an impressive post-pandemic recovery. Unemployment rose slightly to 12.7% in the July to September period, according to data released by the statistics institute on Thursday.”, Bloomberg, October 27, 2022

United Kingdom

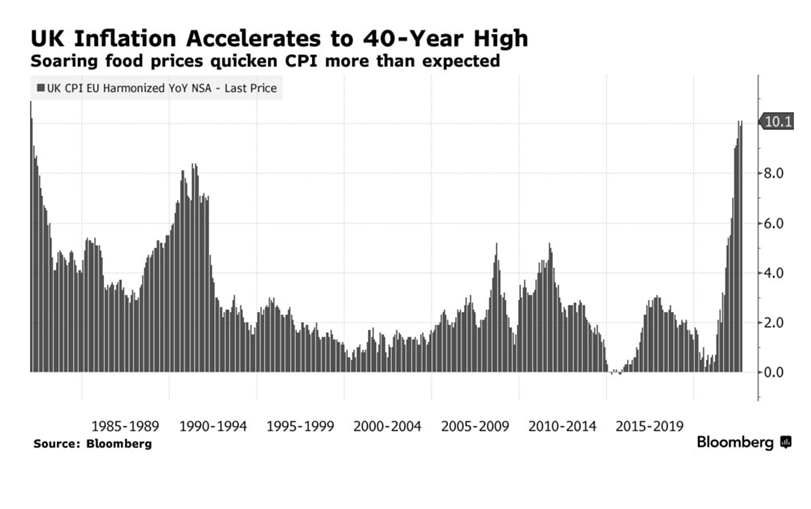

“UK Inflation May Hit 15% Without Further Energy Support – Backtracking on aid plan exposes households to surge in prices Government’s fiscal plan will have a big impact on economy. “The key question for the 2023 inflation outlook now relates to the energy price guarantee,” said James Smith, an economist at ING, who estimated that Hunt’s decision could add up to 3 percentage points to the headline inflation rate from April onwards.”, Bloomberg, October 20, 2022

United States

“Americans in Gallup poll say holiday spending will rise to 2019 level – The Gallup poll released Thursday shows Americans plan to spend an average of $932 on gifts this season, close to the $942 that the survey giant recorded in 2019. Pollsters found 37 percent of Americans plan to spend at least $1,000 on Christmas gifts this year, while 20 percent plan to spend between $500 and $999. Only 3 percent said they plan to spend less than $100, in line with previous years.”, The Hill, October 27, 2022

“U.S. economy grows in third quarter, reversing a six-month slump – Latest GDP report shows the economy expanded at an annual rate of 2.6 percent, even though many signs point to slowdown. Even though consumers bought fewer goods, they continued to spend on health care, which helped lift the reading on GDP, which sums up goods and services produced in the U.S. economy. The biggest boost, though, came from a narrowing trade deficit, with American retailers importing fewer items and exporting more goods as well as services, such as travel.”, The Washington Post, October 27, 2022

Brand News

“Three year revenue nearly doubled Domino s Pizza China s replicable economic model to build a broad moat – As the exclusive master franchisee of the world-renowned pizza brand Domino’s Pizza in Mainland China, Hong Kong Special Administrative Region of China and Macau Special Administrative Region of China, Domino’s Pizza China’s growth rate is impressive: as of June 30, 2022, it has 12 These cities quickly exceeded 500 directly-operated stores, while the number of stores in 2019 was 268.”, EEO.com.cn, October 21, 2022. Compliments of Paul Jones, Jones & Co., Toronto

“This Aussie food business is valued at A$1.5b as sport stars, super giant invest – Superannuation giant Aware Super and a syndicate of elite Australian athletes have backed Mexican food chain Guzman y Gomez in a share sale which values the company at $1.5 billion. Guzman y Gomez founder Steven Marks said the investments were a testament of the group’s recent past performance and plans for the future. “We’re well positioned to build and bring even more [Guzman y Gomez eateries] to life here in Australia and globally,” he said.”, Brisbane Times, October 19, 2022. Compliments of Jason Gehrke, The Franchise Advisory Centre, Brisbane

“Happy Joe’s to Increase Footprint by Over 50% with Monumental Master Franchise Agreement – Happy Joe’s CEO Tom Sacco announced this year that the popular family-centric concept has signed a master franchise agreement with H.J. Happy Joe’s for Restaurants L.L.C. to grow the brand abroad and open multiple new restaurants throughout the Middle East and North Africa. Led by Master Franchisee Ahmed Elbatran, the group will develop or sub-franchise at least 25 Happy Joe’s restaurants across Bahrain, Egypt, Jordan, Kuwait, Morocco, Qatar, Saudi Arabia and the U.A.E. over the next 10 years.”, Franchising.com, October 29, 2022

“Xponential Fitness Signs Master Franchise Agreement in Kuwait – Xponential Fitness, Inc. announced today it has signed a Master Franchise Agreement in Kuwait for its brands Rumble, Club Pilates, StretchLab and CycleBar. The deal, signed with Kuwait Real Estate Company, Aqarat, will result in the opening of a minimum of eight studios early in the initial 10-year term of the agreement. The Master Franchisee for Xponential in Kuwait is the publicly traded real estate development company, Aqarat, a prominent developer and manager of commercial, residential and hospitality properties in Kuwait and the Middle East, as well as Europe and the United States.”, Franchising.com, October 29, 2022

“KFC Owner Yum Exits Russia, Sells Business to Local Franchisee – Yum! Brands Inc., owner of the KFC fast-food chain, is exiting Russia and selling the business there to Smart Service Ltd., which is operated by one of the company’s existing KFC franchisees there. The new owner will be responsible for rebranding the restaurants to non-Yum concepts and retaining the company’s employees, the company said in a statement Monday. Yum said that after the transaction, it will cease having any corporate presence in Russia.”, Bloomberg, October 25, 2022

Articles & Studies For Today And Tomorrow

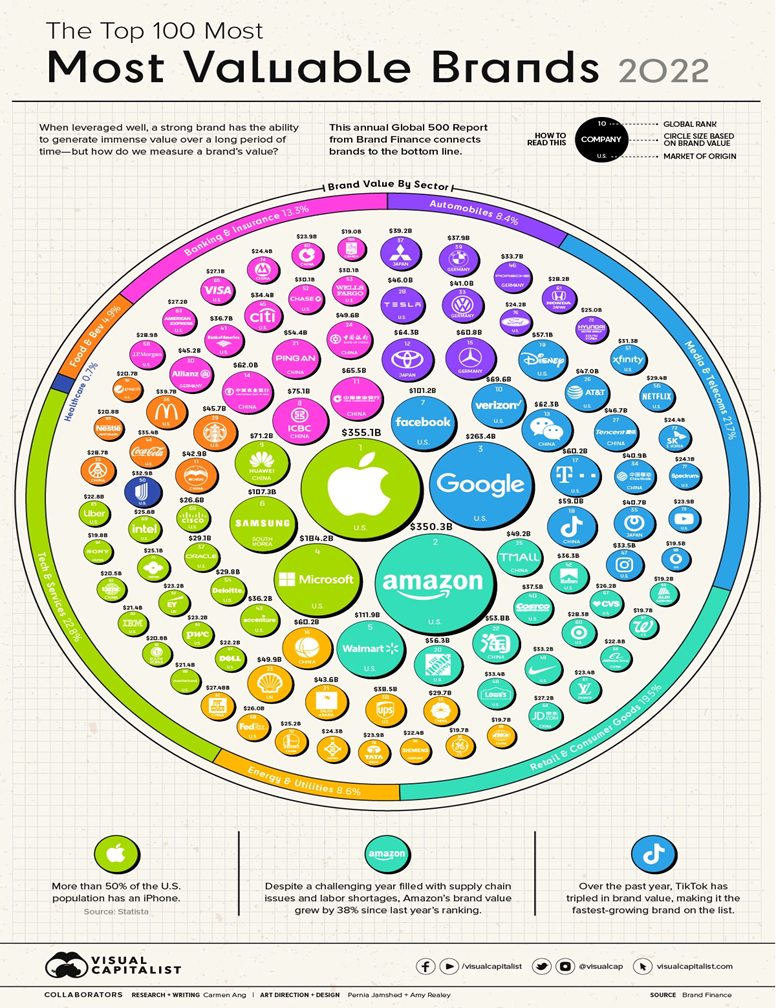

“The Top 100 Most Valuable Brands in 2022 – Given the allusive nature of brands, determining a brand’s financial value is a difficult task. Despite a brand’s intangibility, it’s hard to deny just how effective a strong one can be at boosting a company’s bottom line. With this in mind, Brand Finance takes on the challenge of identifying the world’s most valuable brands in the world in its annual Global 500 Report. The graphic above, using data from the latest edition of the report, highlights the top 100 most valuable brands in 2022.”, Visual Capitalist / Brand Finance, October 27, 2022

To receive this biweekly newsletter, click here : https://bit.ly/geowizardsignup

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, economic development and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing environment. Our GlobalTeam™ covering 25+ countries provides us with updates about what is happening in their specific countries.

To sign up for our biweekly newsletter click here: https://bit.ly/geowizardsignup

William (Bill) Edwards has a four-decade career successfully accelerating the international growth of more than 40 brands worldwide. He has directed projects on-site in Alaska, Asia, Europe and the Middle and Near East and has lived in China, the Czech Republic, Hong Kong, Indonesia, Iran and Turkey. Edwards Global Services, Inc. (EGS) provides a complete International solution for companies Going Global. From initial global market research and country prioritization, to developing new international markets, providing in-country operations support and problem solving around the world. EGS has twice received the U.S. President’s Award for Export Excellence. For advice on doing business successfully across 40+ countries, contact Bill Edwards at bedwards@edwardsglobal.com or +1 949 224 3896.

Download our latest chart ranking 40+ countries as places to do business at this link: