EGS Biweekly Global Business Newsletter Issue 66, Tuesday, October 4, 2022

Edited and curated by: William (Bill) Edwards, CFE, CEO of Edwards Global Services, Inc. (EGS)

We say goodbye to Queen Elizabeth II. Chinese consumers get frugal, China’s energy imports decline and Starbucks will add 3,000 more stores in China. The war weighs down European Union country economies. And a new study says 90% of franchised businesses in the USA are negatively impacted by inflation.

To receive this biweekly newsletter that is read by 1,450 people in 20 countries, click here : https://bit.ly/geowizardsignup

First, A Few Words of Wisdom From Others

“Some people dream of success, while other people get up. Every morning and make it happen.”, Wayne Huizenga

“Success is walking from failure to failure with no loss of enthusiasm.”, Winston Churchill

“Remain a lifelong student. Don’t lose that curiosity.”, Indra Nooyi

HiiHighlights in issue #66:

- Brand Global News Section: Chipolte®, Dave & Buster’s®, Pokeworks®, Tommy Car Wash Systems®, Tous les Jours® and Wayback Burgers®

NOTE: Bolded headlines in this newsletter are live links where the article is freely available

Interesting Data and Studies

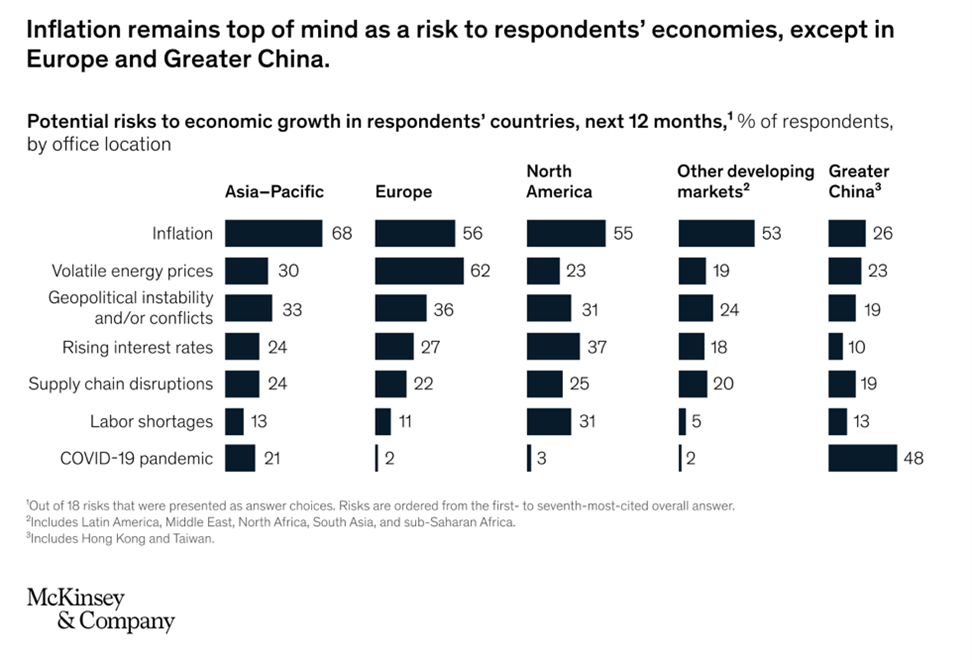

“Economic conditions outlook, September 2022 – In stormy weather, survey respondents maintain realism about the global economy. While geopolitical conflicts and inflation remain top of mind, concerns about energy volatility predominate in Europe. In September, respondents in most regions cite inflation as the main risk to growth in their home economies for the second quarter, according to the latest McKinsey Global Survey on economic conditions.1 Geopolitical instability and conflicts remain a top concern as well, most often cited as the greatest risk to global growth over the next 12 months.”, McKinsey & Co., September 29, 2022

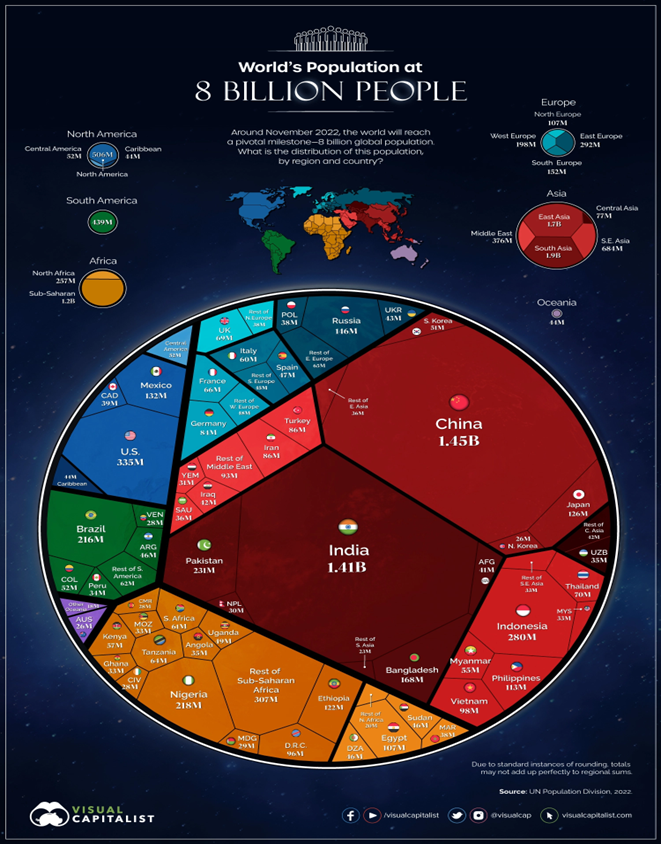

“The World’s Population at 8 Billion – At some point in late 2022, the eight billionth human being will enter the world, ushering in a new milestone for humanity.In just 48 years, the world population has doubled in size, jumping from four to eight billion. Of course, humans are not equally spread throughout the planet, and countries take all shapes and sizes. The visualizations in this article aim to build context on how the eight billion people are distributed around the world.”, Visual Capitalist / UN Population Division 2022

Global Supply Chain, Energy, Commodities, Inflation & Trade Issues

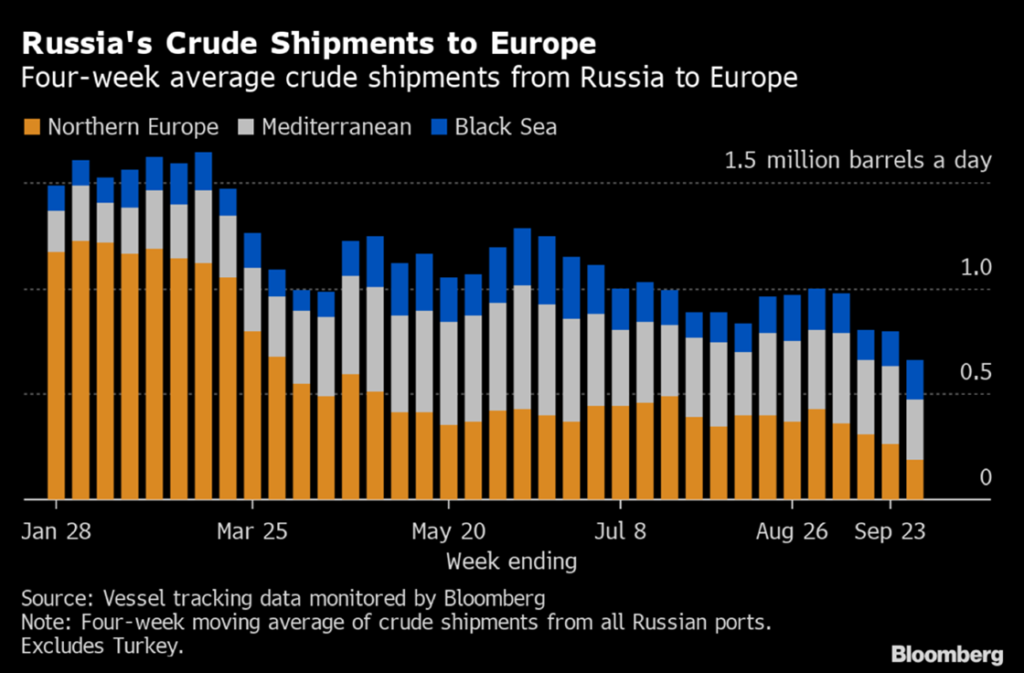

“Europe Turns Its Back on Russian Crude as Sanctions Draw Closer – Shipments to Europe are down 60%. The European market for Russia’s seaborne crude is drying up as sanctions draw nearer, and the country’s Asian customers aren’t picking up the slack like they once were. With just over two months until a European Union ban on seaborne crude imports comes into effect, shipments to the bloc plus the UK are down by about 60% from where they were before Moscow’s troops invaded Ukraine.”, Bloomberg, October 3, 2022

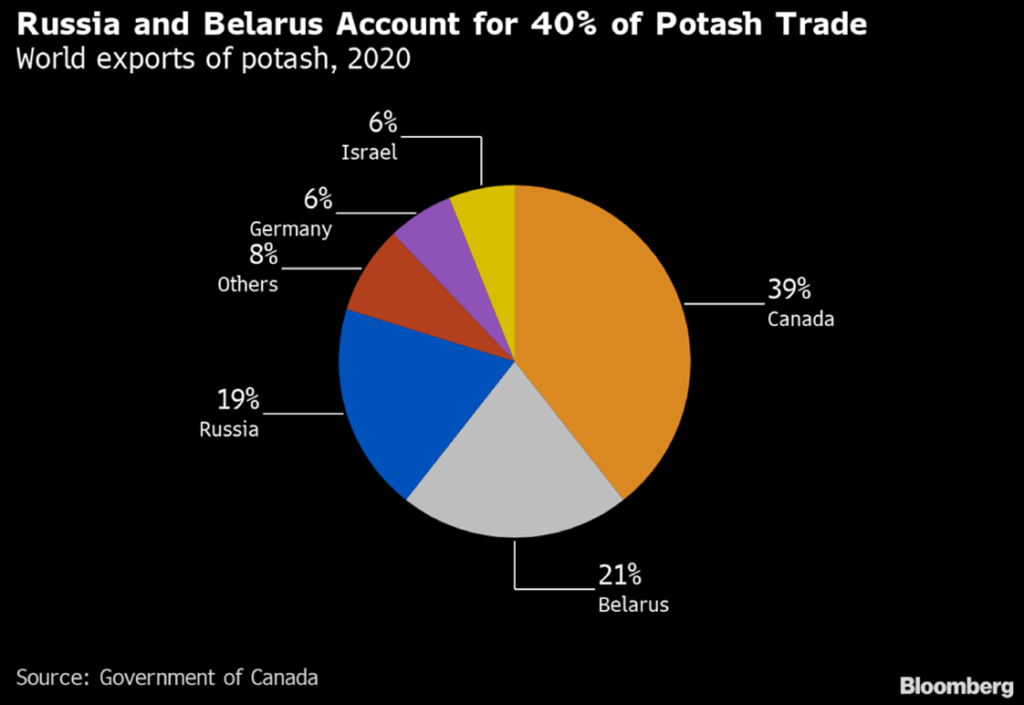

“India’s Potash Demand Languishes as World Reels From High Prices – Supplies from Russia, Belarus have been cut off amid sanctions Price talks will begin soon with companies in Russia, Canada – India, one of the world’s biggest potash importers, is facing demand destruction due to high prices and the loss of critical supplies from Belarus and Russia. Potash consumption will probably fall to 3 million tons in the year through March 2023 from 5 million a year earlier……Farmers have been using less of it to grow crops like rice, wheat and sugar.”, Bloomberg, September 27, 2022

“Oil Heads for First Quarterly Loss Since 2020. OPEC Expected to Cut Output. Crude oil prices are set for a quarterly loss for the first time in more than two years as global economic concerns outweigh the prospect of lower production. Brent crude , the international benchmark, was down 1.0% at $86.30 in morning trading and down 21% over the last three months. West Texas Intermediate , the U.S. standard, was down 0.9% at $80.50, down 24% over a three-month period. The last time the price of oil fell over a quarter was March 2020, although prices remain substantially elevated since their pandemic-driven lows. The potential for output cuts from the Organization of Petroleum Exporting Countries and its allies at their upcoming October meeting could support oil prices.”, Barron’s, September 30, 2022

Global & Regional Travel Updates

“Hong Kong-Los Angeles Business Class Fares Hit $13,000 in Rush to Fly – Travel to and from Hong Kong is easier now that hotel quarantine has ended. It is also more expensive. A business class ticket between Hong Kong and Los Angeles leaving Friday and returning on Oct. 7 cost HK$102,270 ($13,029) Monday with Cathay Pacific Airways Ltd., the only carrier offering the nonstop service in the wake of the pandemic. That’s more than double the HK$44,499 fare for the same flight next year.”, Bloomberg, September 26, 2022

Country & Regional Updates

Australia

“More than one in three Aussies would quit if they couldn’t work from home – Researchers from the National Bureau of Economic Research in the US found Australians worked an average of two days a week at home at the time of the surveys, higher than the survey average across 27 countries of 1.5 days. They found Australian employers on average wanted workers to have just one day working from home, while employees on average would like to work remotely two days a week. And if their employer required them to return to the office full-time, 35 per cent of Australians said they would quit or immediately start looking for a new job that allows working from home.”, Brisbane Times, September 18, 2022

Canada

“Canadian economy is slowing, but still eking out growth – Real (inflation-adjusted) gross domestic product rose 0.1 per cent in July, stronger than a previous estimate of a 0.1-per-cent drop, Statistics Canada said in a report on Thursday. In a preliminary estimate, the agency said growth was essentially unchanged in August……GDP is on track to grow at an annualized pace of about 1 per cent in the third quarter. That is considerably slower than growth of 3.1 per cent in the first quarter and 3.3 per cent in the second, along with the Bank of Canada’s forecast of 2-per-cent growth.”, The Globe & Mail, September 29, 2022

“COVID-19 air travel restrictions lifted in Canada – All COVID-19 restrictions for air travel are officially gone as of Oct. 1, with ArriveCan no longer being used for public health checks. Masks are now optional on flights.”, Global News, October 1, 2022

China

“Microsoft plans 1 000 new jobs in China despite slowing economy and widespread tech layoffs – The US technology giant says it will grow its workforce in China to over 10,000 next year, up from roughly 9,000 currently. Microsoft’s announcement comes amid a spate of lay-offs among some of the largest technology companies operating in China.”, South China Morning Post, September 22, 2022. Compliments of Paul Jones, Jones & Co., Toronto

“Starbucks opens 6 000th store in Chinese mainland – Starbucks Tuesday celebrated its 6,000th store in the Chinese mainland, located in downtown Shanghai. Shanghai thus became the first city in the world to have 1,000 Starbucks stores. In 2018, Starbucks announced it would have 6,000 stores on the Chinese mainland by the end of its fiscal year in September 2022. Starbucks opened its first store on the Chinese mainland in January 1999 in Beijing.”, Shine.cn, September 27, 2022. Compliments of Paul Jones, Jones & Co., Toronto

European Union

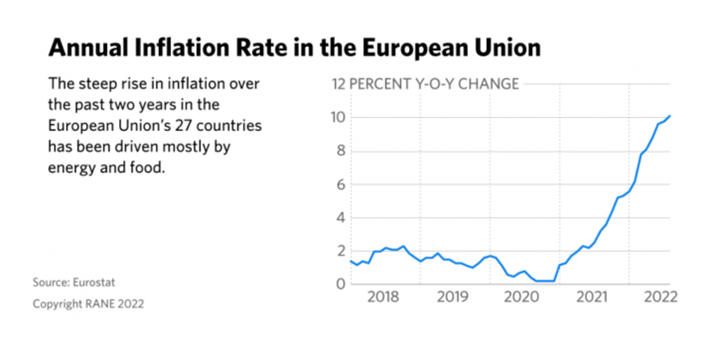

“A Slowing Economy Raises Social and Political Risks – A combination of high inflation, high energy prices, lingering geopolitical uncertainty and monetary tightening will slow economic activity in Europe during the quarter and increase social and political risks. Inflation will remain high in Europe, driven primarily by pervasively high energy prices.”, RANE/Worldview, September 28, 2022

Germany

“Berlin Introduces Debt-Financed Natural Gas Price Cap – The German government set out a 200 billion euro ($196 billion) debt-financed special fund to implement a natural gas price cap aimed at shielding German consumers and energy companies from soaring gas prices, Politico reported Sept. 29. Under the plan, which will run until March 2024, the government will use the fund to pay natural gas importers the difference between the cap and what importers pay for gas on the global market.”, RANE/Worldview, October 3, 2022

“New German COVID-19 rules come into force as infections rise in colder months – Germany has modified rules on mask-wearing and hygiene as it prepares for a rise in COVID-19 cases. But not all restrictions have been tightened — and not everyone is satisfied. Health Minister Karl Lauterbach called the new rules strict compared with other European countries but said Germany was being “not smarter but more cautious” in its approach.”, Deutsche Welle, October 1, 2022

India

“India Jobless Rate Drops to Four-Year Low Before Festival Season – India’s unemployment rate dropped to the lowest in more than four years in September, buoyed by a strong rise in new jobs, according to a private research firm. The jobless rate sharply fell to 6.43%, data from the Centre for Monitoring Indian Economy Pvt. showed. The reading is the lowest since August 2018 and compares with a one-year high of 8.3% in August.”, Bloomberg, October 3, 2022

Middle East

“Trade and security ties are knitting Israel into its region – Former enemies drawing closer, offering hope of a more stable and prosperous Middle East. For the first time since its creation in 1948, Israel has a warm peace with an Arab country, not just the formal, often frosty ones with Egypt and Jordan, its immediate neighbours. The accords are underpinning a realignment of trade, diplomacy and security arrangements in the Gulf. They are largely economic, built on the hope that trade can bring peace and restore the Middle East to its historic role as the crossroads of the world’s trade, linking Asia and Europe through the Silk Road and Africa through the Incense Road.”, The Economist, September 22, 2022

Pakistan

“How worried should we be about Pakistan’s economy? Concerns are rising again over the health of Pakistan’s economy as foreign reserves run low, the local currency weakens and inflation stands at decades-high levels despite the resumption of an International Monetary Fund funding programme in August. But then Pakistan was hit by major floods in late August that killed more than 1,500 people and caused billions of dollars worth of damage, heaping even more pressure on its finances. The biggest worries centre around Pakistan’s ability to pay for imports such as energy and food and to meet sovereign debt obligations abroad.”, Reuters, September 30, 2022

South East Asia

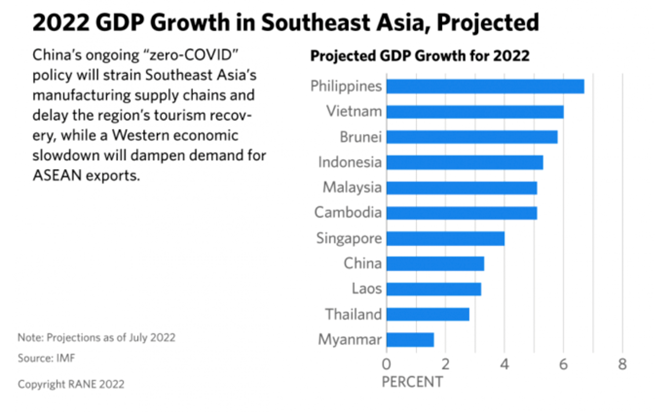

“Southeast Asian Economic Recovery Will Lag – Continued Chinese lockdowns and weaker consumer demand in the West will strain budgets and limit economic growth in Southeast Asia…… monetary policy tightening and looming recessions in the United States and the European Union will reduce demand, which will negatively impact Southeast Asian exports.”, RANE/Worldview, September 28, 2022

Thailand

“Thailand to Eliminate All Pandemic-related Travel Restrictions This Week – Thailand will drop the last of its remaining pandemic-related travel rules this week as the country ends its nationwide COVID-19 Emergency Decree. Starting Oct. 1, the Southeast Asian country will no longer require travelers to show proof of vaccination or proof of a negative test to enter.”, Travel & Leisure, September 26, 2022

United Kingdom

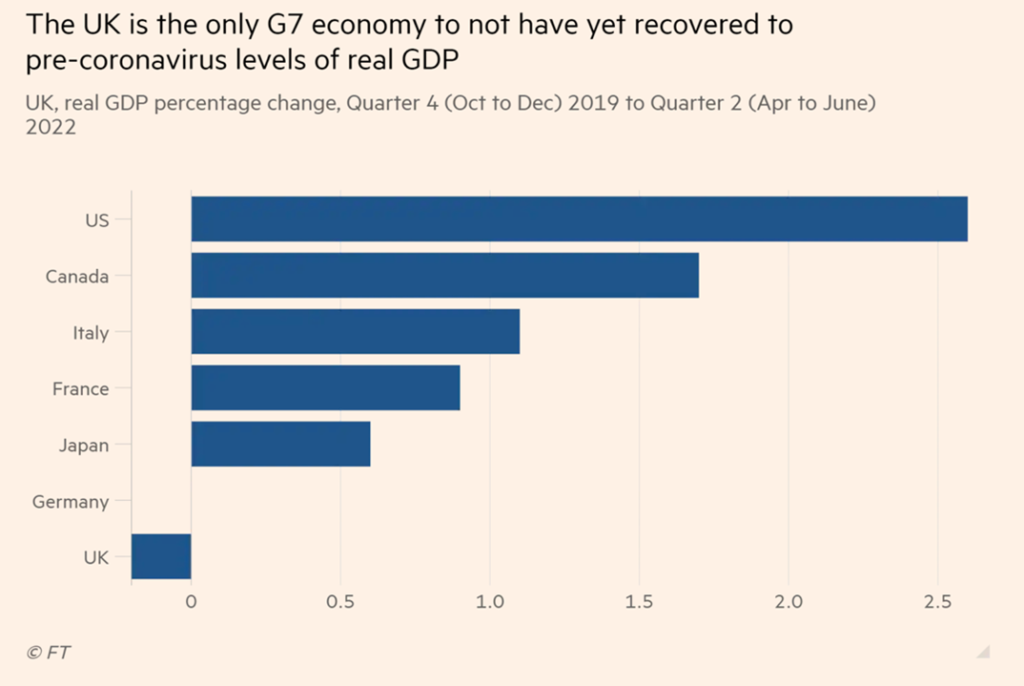

“UK remains only G7 economy to languish below pre-pandemic levels – GDP stuck 0.2% below final quarter of 2019, but latest growth data now positive. Office for National Statistics figures released on Friday showed that UK gross domestic product for the three months to June this year remained 0.2 per cent below the level it reached in the final quarter of 2019. By contrast with the UK’s failure to return to pre-pandemic levels, the eurozone economy reached 1.8 per cent above 2019 levels in the second quarter. The US had recovered to pre-pandemic levels by the start of last year.”, The Financial Times, September 30, 2022

“Why ‘digital literacy’ is now a workplace non-negotiable – Digital literacy used to mean being able to send an email or type using a word-processing programme. It was a skill largely required of knowledge workers – people who might use specific software at work, and need to be fluent in how to use it accordingly. Now, digital literacy means having the skills to thrive in a society where communication and access to information are increasingly done via digital technologies, such as online platforms and mobile devices. Today, digital literacy is no longer a functional proposition, it’s a mindset. In the modern workplace, there is a greater expectation for employees to nimbly adopt whatever technology comes with their job as well as adapt to ever-changing tools and approaches.”, BBC News, September 25, 2022

United States

“Vast Majority Of Manufacturers Plan Price Increases In 2023 – The poll of 150 manufacturing CEOs surveyed in late August found that nearly half of companies (45%) had passed on the costs of inflation to customers today, while 38% said they had avoided doing so and 17% said their companies absorbed the costs despite the financial hit. Those price increases had an impact. More than half (55%) said they had lost customers over the past year due to price increases, while nearly one in five (19%) have cut their workforce to keep costs in line.”, Forbes, September 28, 2020

“US Business Equipment Orders Rise by Most Since Start of Year – Capital goods orders ex-defense, aircraft rose 1.3% in August Overall durable goods bookings fell on softer plane orders. Orders for business equipment at US factories rose in August by the most since the start of the year, reflecting broad advances across categories, including machinery and computers, even as interest rates rise. The value of core capital goods orders, a proxy for investment in equipment that excludes aircraft and military hardware, increased 1.3% last month.”, Bloomberg, September 27, 2022

Brand News

“Franchise Times Top 500 Ranks the Largest Brands in Franchising – With many of the measures meant to slow down the coronavirus pandemic coming to an end and a sense of normalcy returning, 2021 marked a rebound year for hundreds of franchises. Those comebacks are reflected across the Franchise Times Top 500, the annual ranking of the largest U.S.-based franchise systems by worldwide sales.”, Franchise Times,

“Chipotle is moving its tortilla robot to a real restaurant – Chipotle’s tortilla-making robot will soon help out in a restaurant you can visit. The chain has unveiled a slew of technology updates that include moving the Miso Robotics-made Chippy robot to a real restaurant. The machine will start cooking tortilla chips in a Fountain Valley, California location in October. The chain is also piloting AI that tells kitchen staff what to cook.”, Engadget, September 27, 2022

“Dave and Buster’s to Open 11 Units Across KSA, UAE, and Egypt – Announces international franchise partnership with Abdul Mohsen Al Hokair Holding Group. The Brand will begin its expansion with sites in the Kingdom of Saudi Arabia, followed by the United Arab Emirates and Egypt.”, Company press releases, September 14, 2022

“Pokeworks Continues Global Growth with Talabat Partnership in the Middle East – In the first phase, Pokeworks expects to open 10 delivery-only locations in the UAE, Kuwait, and Bahrain over the next 3 years, starting with Dubai in 2023. Talabat is part of Germany’s Delivery Hero, which operates a network of online food delivery companies worldwide.”, September 30, 2022

“Tommy Car Wash Systems and Tommy’s Express Car Wash set their Sights on Development in Canada – U.S.-based car wash franchise, Tommy’s Express, announced earlier this year it will break ground on its first international franchise location in Ontario, Canada in Q4 2022. As front runners in the car wash industry, the brand is continuing to focus on expansion in Canada by exhibiting at the Convenience U CARWACS Show taking place September 13th – 14th at the Toronto Congress Centre.”, Franchising.com, September 13, 2022

“French-Asian Bakery Tous les Jours Makes U.S. Franchise Push – Tous les Jours means “every day” in French, and the French-Asian bakery-café chain hopes to make its artisan pastries, gourmet cakes and freshly baked bread an everyday habit in its push in the United States. With more than 70 cafes stateside, 1,631 worldwide and $697 million in system sales in 2021, Tous les Jours debuts on the Franchise Times Top 500 this year at No. 122. Franchise Times, September 2022

“Wayback Burgers Signs New Master Franchisee in the Dominican Republic – Wayback Burgers has announced a new master franchise agreement with Farhiell Exil to bring the U.S. burger concept to the Caribbean. Under the agreement, Exil will open eight Wayback restaurants across the Dominican Republic within the next 8 years. The first opening is planned for Santo Domingo, the nation’s capital, in early 2023.”, Franchising.com, September 27, 2022

Articles & Studies For Today And Tomorrow

“Unit-Level Economics for Franchise Businesses – After working with more than 900 franchise brands, we’ve (FranConnect) found that a common practice is working together with their franchisees to improve their unit-level economics – not only their top-level sales but also their bottom line. If you’re not doing this today, you will have trouble selling franchises in the future. Unit-level economics is a means by which franchisors and franchisees identify, measure, track, and manage the performance of their businesses at individual unit levels.”, FranConnect on Franchising.com, September 30, 2022

To receive this biweekly newsletter, click here : https://bit.ly/geowizardsignup

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, economic development and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing environment. Our GlobalTeam™ covering 40 countries provides us with updates about what is happening in their specific countries.

To sign up for our biweekly newsletter click here: https://bit.ly/geowizardsignup

William (Bill) Edwards has a four-decade career successfully accelerating the international growth of more than 40 brands worldwide. He has directed projects on-site in Alaska, Asia, Europe and the Middle and Near East and has lived in China, the Czech Republic, Hong Kong, Indonesia, Iran and Turkey. Edwards Global Services, Inc. (EGS) provides a complete International solution for companies Going Global. From initial global market research and country prioritization, to developing new international markets, providing in-country operations support and problem solving around the world. EGS has twice received the U.S. President’s Award for Export Excellence. For advice on doing business successfully across 40+ countries, contact Bill Edwards at bedwards@edwardsglobal.com or +1 949 224 3896.

Download our latest chart ranking 40+ countries as places to do business at this link: