EGS Biweekly Global Business Newsletter Issue 65, Tuesday, September 20, 2022

Edited and curated by: William (Bill) Edwards, CFE, CEO of Edwards Global Services, Inc. (EGS)

We say goodbye to Queen Elizabeth II. Chinese consumers get frugal, China’s energy imports decline and Starbucks will add 3,000 more stores in China. The war weighs down European Union country economies. And a new study says 90% of franchised businesses in the USA are negatively impacted by inflation.

To receive this biweekly newsletter that is read by 1,450 people in 20 countries, click here : https://bit.ly/geowizardsignup

First, A Few Words of Wisdom From Others

“What you think, you become. What you feel, you attract. What you imagine, you create.”, Buddha

“The way I see it, if you want the rainbow, you gotta put up with the rain.”, Dolly Parton

“Perpetual optimism is a force multiplier.”, Colin Powell

Highlights in issue #65:

- Brand Global News Section: Hard Rock Café®, KFC®, Nandos®, Starbucks®, Tim Hortons®, TGI Fridays®, Wendy’s®

NOTE: Bolded headlines in this newsletter are live links where the article is freely available

The Passing of Queen Elizabeth II

“Queen Elizabeth II – The long reign of Queen Elizabeth II was marked by her strong sense of duty and her determination to dedicate her life to her throne and to her people. She became for many the one constant point in a rapidly changing world as British influence declined, society changed beyond recognition and the role of the monarchy itself came into question. Her success in maintaining the monarchy through such turbulent times was even more remarkable given that, at the time of her birth, no-one could have foreseen that the throne would be her destiny.”, BBC News, September 8, 2022

“Elizabeth II: an appreciation by Simon Schama – The UK’s longest-serving monarch was so much more than a head of state — she was quintessential Britain.

Interesting Data and Studies

“New International Franchise Association Report Shows Inflation is Negatively Impacting 90% of Franchised Businesses. The most impacted sectors include lodging (90%), quick-services restaurants (83%), and child-related services (61%), which report a substantial increase. 89% of (franchised) units have had to raise their prices of goods and services to absorb cost increases. 64% of respondents reported lower earnings due to rising prices, with quick-service restaurants, retail stores, and the beauty-related industry being the top three industries to feel the impact on their bottom line. The most significant cost increases are driven by rising fuel prices, increases in labor cost and inventory costs. 60% of franchisees expect increases in cost to get worse in near future. 92% of franchisees with 11+ units say growth is constrained by labor issues.”, The International Franchise Association, September 15, 2022

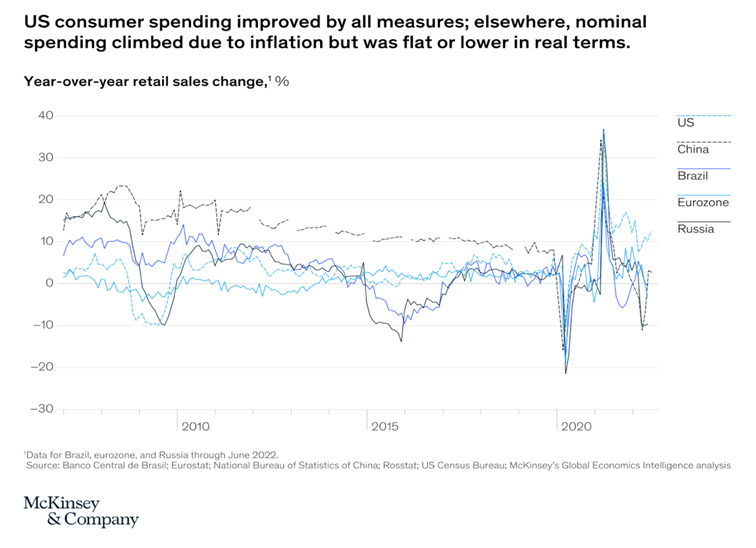

“Growth moderates globally in an inflationary environment – High inflation is eroding household budgets, leading to a decline in consumer sentiment and, outside the United States, static or declining retail sales in real terms. Production is flattening under persisting supply chain pressures, high input costs, and softening demand. Investor uncertainty over rising interest rates is roiling financial markets. GDP growth in China was 2.5% in the first half of 2022 but slowed to 0.4% in the second quarter, with output constrained by pandemic restrictions, softer external demand, and the financially troubled real-estate sector. In the eurozone, GDP growth outpaced expectations at 0.6% in the second quarter and 1.1% for the first half.”, McKinsey & Co., September 9, 2022

Global Supply Chain, Energy, Commodities, Inflation & Trade Issues

“UN FAO’s global food prices fall for fifth month in a row – The index fell to 138 in August and is now lower than it was before Russia’s invasion of Ukraine. The countries were both major exporters of crops including sunflower oil, corn and wheat. The UN’s Food and Agricultural Organisation says July’s UN backed deal to re-open Ukrainian ports has eased cereal and vegetable oil prices.”, BBC News, September 2, 2022

Global & Regional Travel Updates

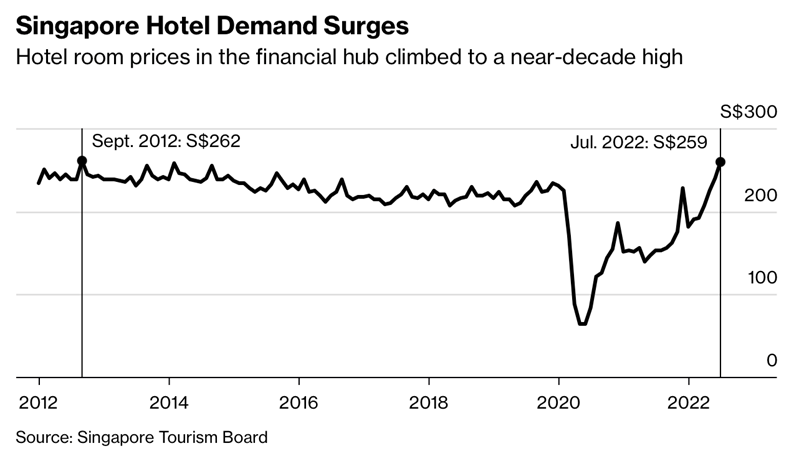

“Singapore opens up to travellers – During the pandemic Singapore’s national carrier, Singapore Airlines, was so short of business that it sold locals dining spots on board a grounded double-decker A380 plane. Between 2019 and 2021 passenger numbers at Changi airport, the main air hub, plunged by 96%. But since the government began loosening border restrictions late last year, tourists have started returning. This summer traffic at Changi reached 50% of pre-pandemic levels.”, The Economist, September 13, 2022

Country & Regional Updates

Asia

“Casino Suppliers Quit Macau for Resurgent Singapore, Philippines – Companies move staff, inventory out of city as slump continues. Casino revenue collapses on Covid policies, China crackdown. Suppliers of slot machines, baccarat table systems and other casino equipment are moving out of Macau to more welcoming markets, evidence of the damage China’s Covid Zero policy has wrought on the formerly bustling gambling hub.”, September 5, 2022

Australia

“Australia’s Jobless Rate Climbs for First Time in 10 Months – Australian unemployment unexpectedly rose in August, the first increase in 10 months, a result that supports the Reserve Bank’s signal of a potential shift to smaller interest-rate increases. The jobless rate’s rise to 3.5% came even as employment advanced by 33,500, the Australian Bureau of Statistics said Thursday. That was slightly below economists’ estimates for a 35,000 increase.”, Bloomberg, September 14, 2022

Canada

“Prices at Toronto restaurants to soar by up to 15% — as industry deals with ‘anything but normal’ situation. Higher prices are on the menu as inflation drives up operating costs, while industry continues to see closures. Half of restaurants were operating at a loss or just breaking even as of July 2022 — typically one of the busiest months of the year, the report found. As a result of higher costs, more than a third of full-service restaurant operators plan to raise their prices by more than seven per cent, and many between 10 and 15 per cent.”, Toronto Star, September 15, 2022

China

“China’s Economy Beats Expectations in a Range of Areas – New Chinese data showed better-than-expected results for August in a swath of sectors, all while Covid cases finally began to fall, giving hope of a rebound or at least stabilization in an economy beleaguered all year. Compared with the previous month, improvements were seen in retail sales, industrial production, fixed-asset investment, and unemployment….(Retail) Sales leapt to 5.4% year-on-year, compared to July’s 2.7%, and well above consensus forecast of 3.4%.”, Barron’s, September 16, 2022

“Frugal is the new cool for young Chinese as economy falters – Before the pandemic, Doris Fu imagined a different future for herself and her family: new car, bigger apartment, fine dining on weekends and holidays on tropical islands. Instead, the 39-year old Shanghai marketing consultant is one of many Chinese in their 20s and 30s cutting spending and saving cash where they can, rattled by China’s coronavirus lockdowns, high youth unemployment and a faltering property market. This new frugality, amplified by social media influencers touting low-cost lifestyles and sharing money-saving tips, is a threat to the world’s second-largest economy, which narrowly avoided contraction in the second quarter. Consumer spending accounts for more than half of China’s GDP.”, Reuters, September 18, 2022

“China’s plunging energy imports confound expectations – A revival would cause problems—and not just for Europe. With the price of fuels surging, the collapse in Chinese purchases of natural gas and other forms of energy has been an unexpected boon to countries around the world. Arrivals of seaborne liquefied natural gas (lng) have declined most markedly. China remains the largest lng importer in the world but, between January and August, imports dropped by a fifth compared with the same period last year. That shortfall, at roughly 14bn cubic metres, is roughly equivalent to the entire annual lng imports of Britain.”, The Economist, September 15, 2022

European Union

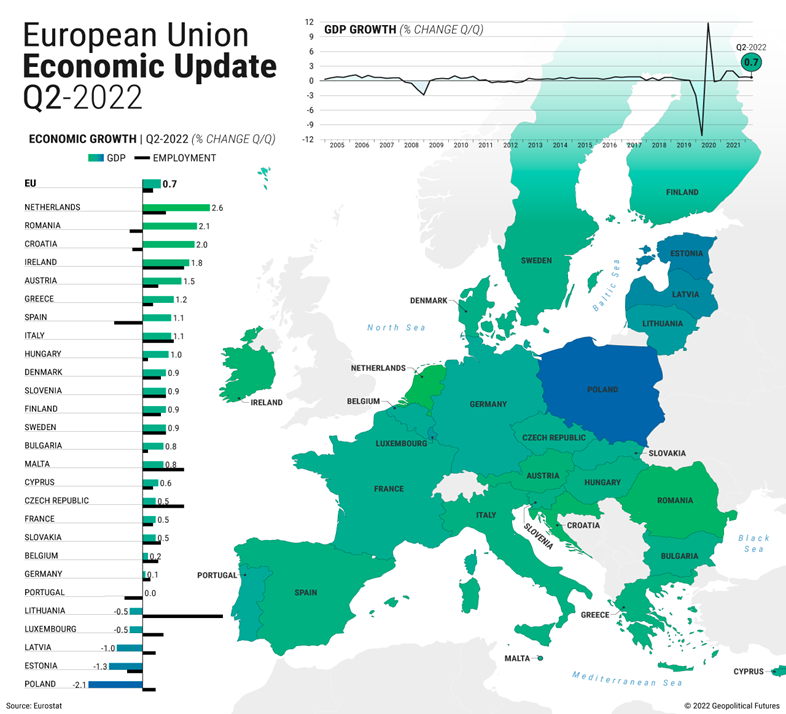

“Ukraine War Weighs Down European Economies – The countries closest to the war in Ukraine saw their economies shrink in the second quarter. Europe is bearing the brunt of the economic war raging between Russia and the West. On the whole, European economies grew in the second quarter of the year, driven by household consumption and government spending. However, the countries closest to the Russia-Ukraine war, such as Poland and the Baltic states, saw their economies shrink for a variety of reasons.”, Geopolitical Futures, September 16, 2022

India

“93% Indians Used At Least One Mode Of Digital Payment In Last Year – Digital payments are rising rapidly in the country and more and more Indians are adopting the cashless payment method. According to a survey commissioned by Mastercard, 93% of Indians are likely to have used at least one mode of digital payment in the past year.

Indian consumers are among those who are most open to digital payments methods in the Asia-Pacific region, Mint reported citing the survey. Compared to Indians, only Chinese consumers are more open to digital payments (98%).”, INC42, September 19, 2022

“Travel Etiquette: 10 Things to Consider When You Visit India – Saying that India is vast is an understatement. Its population of 1.38 billion ascribes to many different religions and beliefs. People are spread across 28 states and eight union territories; they communicate in hundreds of languages and local dialects and practice diverse cultural norms. The myriad cultural and religious differences, and the contrast between the urban and rural areas, mean there are a lot of dos and don’ts in order to be respectful and considerate of the local people and their customs.”, Fodor’s Travel, September 14, 2022

Italy

“Italy’s Draghi presents new aid package – Italy approved an aid package worth some 14 billion euros ($14 billion) on Friday to shield firms and families from surging energy costs,….The latest measures come on top of some 52 billion euros already budgeted since January to soften the energy crisis in Italy. They will be funded by higher value added tax revenues as a result of rising electricity and gas bills and by adjustments elsewhere in the state budget, without resorting to extra borrowing which had been requested by some parties.”, Reuters, September 16, 2022

Switzerland

“Swiss to dial down thermostats in government buildings – Swiss bureaucrats will need to dress warmly this winter after the government decided public buildings would be heated to no more than 20 degrees Celsius (68°F) to save energy. The measures agreed by the cabinet on Friday cover federal office buildings and universities and military properties. They aim to save 6-10% of the energy used to heat federal buildings.”, Reuters, September 16, 2022

United Kingdom

“Kentucky Fried Crisis: How surging chicken costs hit Nando’s and KFC – The rising cost of chicken is turning customers away, while farmers are leaving their sheds empty. The Office for National Statistics said last week that the price tag for chicken in shops had jumped by 14.9 per cent on average over the past year. The Producer Price Index, which measures the cost of goods for factories, showed that imported chicken and red meat from the EU had shot up 69 per cent. Feed prices for livestock were up 61 per cent, and fresh red meat and poultry was 21 per cent higher.”, The Times of London, August 21, 2022

“Pound hits new 37-year low as retail sales slide – The larger-than-expected drop in sales volumes of 1.6% prompted fresh concerns over the state of the economy. Sales across all retail sectors fell in August as households cut back in the face of rising prices. One analyst suggested the figures showed the UK is already in recession. Sterling fell more than 1% against the dollar to $1.1351 at one point, its lowest since 1985, following the release of the retail sales figures. The pound recovered later to climb above $1.14.”, BBC News, September 16, 2022

United States

“Women are reentering the workplace, but employers will have to do more for them to stick around – Last month, U.S. women saw a major gain in labor force participation, with the proportion of women in the workforce between the ages of 25 and 54 finally rising to a pre-pandemic level of almost 75%. But researchers say such celebration is premature if structures aren’t put in place to ensure women stay in the workforce. Fewer than 30% of women say they feel included in the workplace, according to a recent report from Bain & Company. This poses a major retention risk, considering a lack of belonging is one of the top reasons employees say they’d leave a company.”, Fortune, September 15, 2022

“Small business revenue doubles, but profits are flat – Seventy-five percent of U.S. small business owners say they are being impacted by inflationary pressures— prompting them to modify their practices in order to grow, according to a new study……’47% of all small business respondents reported that inflation is impacting their labor market by pushing them to accommodate and compensate for higher health care, enriched employee benefits and more frequent pay raises,’ said Brett Sussman, VP head of sales & marketing for Kabbage from American Express.”, Yahoo! Finance, September 14, 2022

Brand News

“Hard Rock CEO makes $100M employee wage investment: We wanted to ‘really thank them’ – Reporting that the Hard Rock brand “has been doing very well this year,” (Hard Rock International Chairman Jim) Allen announced an initiative Tuesday to thank the company’s line employees with a $100 million investment to raise starting wages for half of its U.S. workforce at company-managed hotel, café and casino locations nationwide.”, Fox Business, September 16, 2022

“Starbucks Plans to Add 3 000 Stores in China by 2025 – In the next three years, Starbucks China aims to accelerate its development potential through six growth engines and a series of major investments. By 2025, the total number of Starbucks stores in China is targeted to reach 9,000, while the number of employees will increase by 35,000, totaling more than 95,000.”, Pan Daily, September 14, 2022. Compliments of Paul Jones, Jones & Co., Toronto

“Starbucks (USA) to revamp stores to speed service, boost morale – The company also said it plans to open 2,000 net new stores in the U.S. by 2025, with an emphasis on meeting the growing demand for new types of service, including drive-thru, mobile ordering and delivery. Starbucks — ringing up record sales but struggling with low employee morale — plans to spend $450 million next year to make its North American stores more efficient and less complex.”, Chicago Sun Times, September 16, 2022

“TGI Fridays signs historic deal to expand chain to South and Southeast Asia – The development agreement is for 75 new restaurants over the next 10 years. The casual restaurant company said Friday that it expects the 10-year deal with Singapore-based Universal Success Enterprises Ltd. to boost its annual revenue by $500 million.”, Dallas Morning News, September 16, 2022

“Cartesian Capital Pushes Massive Growth of Tim Hortons China – Zero to 450. Less than four years after opening its first store in Shanghai, Tim Hortons China crossed the 450-unit mark this summer with plans to continue its dizzying development push on the way to 2,750 stores by 2026. It’s a pace necessary to compete in a consumer market that Peter Yu, chairman of Tim Hortons China, called the most compelling in the world.”, Franchise Times, August 29, 2022. Compliments of Paul Jones, Jones & Co., Toronto

“US burger chain Wendy’s is coming to Australia – The US Wendy’s burgers brand is heading to Australia and is on the hunt for a master franchisee. The iconic brand is reportedly the world’s third largest quick service restaurant burger chain, with about 7000 outlets worldwide….Now the chain is readying to hit the market Down Under, with consultancy firm DC Strategy tasked with recruiting master franchisees.”, Smart Company AU, September 15, 2022

Articles & Studies For Today And Tomorrow

“Franchising Isn’t for Entrepreneurs, It’s for Systempreneurs – First determine if you can follow a system, then find the right system for you. The franchise model leverages a system and business approach to help entrepreneurs start and run their own businesses. But a franchisee is really more of a systempreneur than an entrepreneur. True entrepreneurs invent a business from scratch and develop everything from the ground up. Systempreneurs use leverage of all types — debt, an existing operating system, best practices and information — to build their business.”, Entrepreneur Magazine, September 12, 2022

“These are the top 10 healthiest countries for digital nomads – Lemon.io, a marketplace of software developers, analyzed data from the 2022 Global Health Security Index by the Economist Intelligence Unit to determine the healthiest countries for digital nomads. The study ranked 195 countries based on their preparedness for epidemics and pandemics.”, CNBC, September 18, 2022

To receive this biweekly newsletter, click here : https://bit.ly/geowizardsignup

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, economic development and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing environment. Our GlobalTeam™ covering 40 countries provides us with updates about what is happening in their specific countries.

To sign up for our biweekly newsletter click here: https://bit.ly/geowizardsignup

William (Bill) Edwards has a four-decade career successfully accelerating the international growth of more than 40 brands worldwide. He has directed projects on-site in Alaska, Asia, Europe and the Middle and Near East and has lived in China, the Czech Republic, Hong Kong, Indonesia, Iran and Turkey. Edwards Global Services, Inc. (EGS) provides a complete International solution for companies Going Global. From initial global market research and country prioritization, to developing new international markets, providing in-country operations support and problem solving around the world. EGS has twice received the U.S. President’s Award for Export Excellence. For advice on doing business successfully across 40+ countries, contact Bill Edwards at bedwards@edwardsglobal.com or +1 949 224 3896.

Download our latest chart ranking 40+ countries as places to do business at this link:

Our latest GlobalVue™ 40 country ranking

EGS Biweekly Global Business Newsletter Issue 64, Tuesday, September 6, 2022

Edited and curated by: William (Bill) Edwards, CFE, CEO of Edwards Global Services, Inc. (EGS)

A new Prime Minister for the UK. A timely quote from Albert Einstein. There are up to 8,755 commercial flights in the air at any given time of day. Indonesia is a pleasant surprise among emerging markets. Japan turns back to nuclear power. Energy prices continue to rise to rise. And a must read 2022 Member survey from the U.S. China Business Council to know what is happening in China.

To receive this biweekly newsletter that is read by 1,450 people in 20 countries, click here : https://bit.ly/geowizardsignup

First, A Few Words of Wisdom From Others

“The world as we have created it isa process of our thin king. It cannot be changed without changing our thinking.”, Albert Einstein

“The ones who are crazy enough to think that they can change the world are the ones who do.”, Steve Jobs.

“There’s no shortage of remarkable ideas, what’s missing is the will to execute them.” – Seth Godin

Highlights in issue #64:

- Brand Global News Section: Bonchon®, Denny’s®, Dominos®, Hardees®, Marco’s Pizza®, Pret A Manger®, Planet Smoothie® and Red Rooster®

NOTE: Bolded headlines in this newsletter are live links where the article is freely available

Interesting Data and Studies

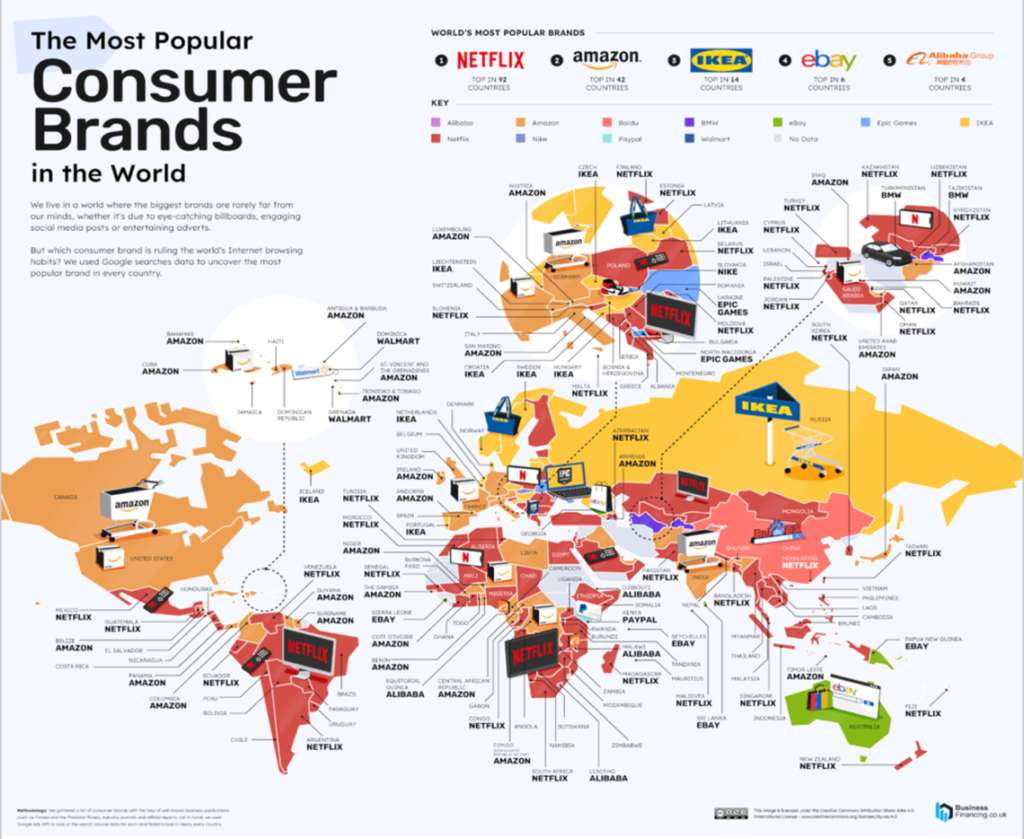

“The Most Searched Consumer Brands in 2022 – In today’s fast-paced world, a strong brand is a powerful asset that helps a business stand out in a sea of competition. What are some of the most popular brands around the world? One way to gauge this is by looking at Google searches to see what consumers are searching for online (and therefore, what brands they’re paying the most attention to). This graphic by BusinessFinancing.co.uk uses data from Google Keyword Planner to show the world’s most searched consumer brands in the twelve months leading up to March 2022.”, Visual Capitalist / Business/Finance, September 4, 2022

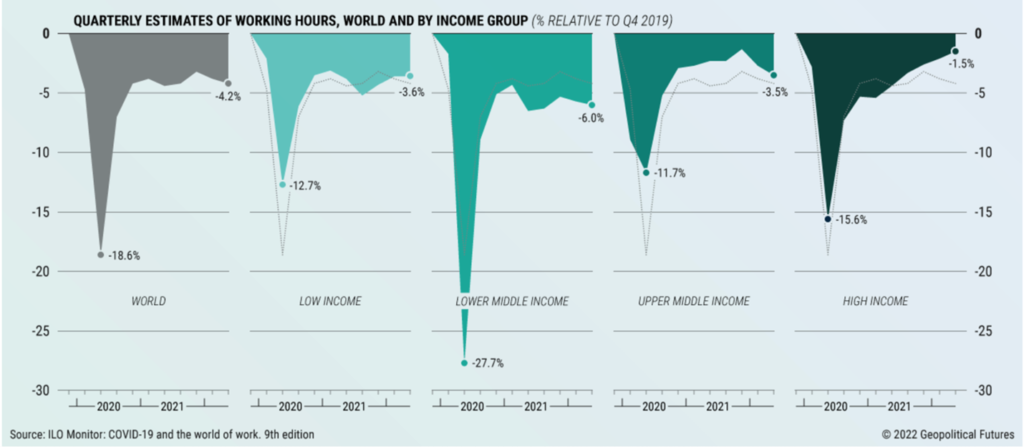

“How Work Has Changed Since COVID-19 – Labor markets everywhere are digging themselves out of a deep hole. The International Labor Organization predicts continued global labor market disruptions for at least the remainder of the year because of the war in Ukraine and China’s domestic economic problems. Predictably, problems are especially pronounced in low- and middle-income countries. When it comes to hours worked, high-income economies are again faring much better than the rest.”, Geopolitical Futures, August 26, 2022

Global Supply Chain, Energy, Commodities, Inflation & Trade Issues

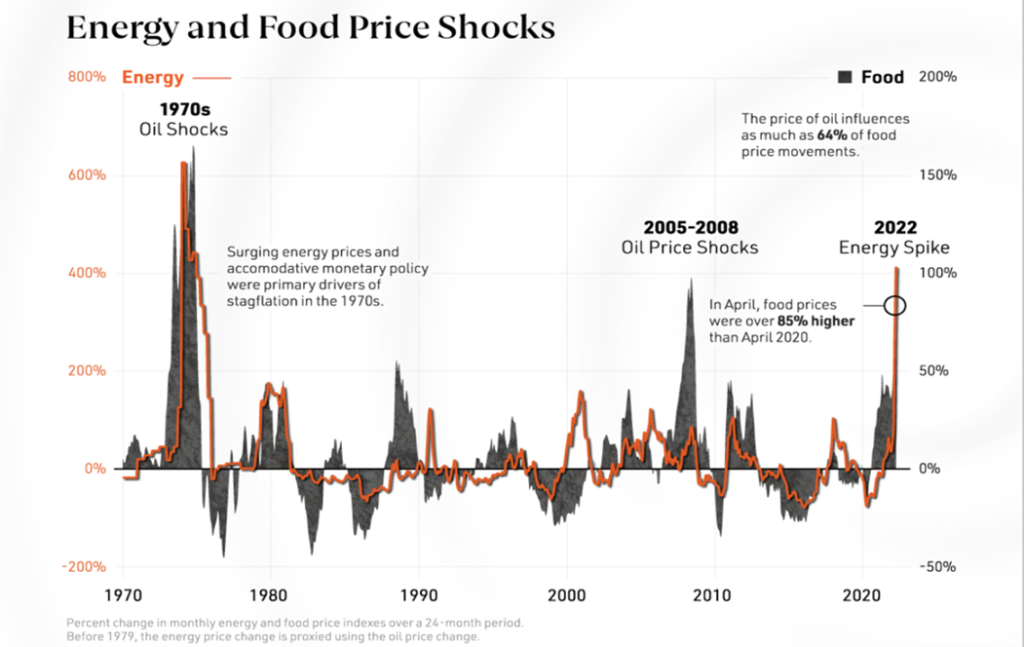

“How Rising Food and Energy Prices Impact the Economy – Since Russia’s invasion of Ukraine, the effects of energy supply disruptions are cascading across everything from food prices to electricity to consumer sentiment. In response to soaring prices, many OECD countries are tapping into their strategic petroleum reserves. In fact, since March, the U.S. has sold a record one million barrels of oil per day from these reserves. This, among other factors, has led gasoline prices to fall more recently—yet deficits could follow into 2023, causing prices to increase. With data from the World Bank, the above infographic charts energy shocks over the last half century and what this means for the global economy looking ahead.”, Visual Capitalist / World Bank, September 1, 2022

Global & Regional Travel Updates

“Ryanair passenger numbers hit new all-time high in August – Ryanair (RYA.I) in August flew a record number of passengers for the fourth month in a row as it continued to consolidate its position as Europe’s largest airline by passenger numbers. The Irish low-cost carrier, which unlike many airlines made a point of keeping its pilots and crew up-to-date with their flying hours during the pandemic, flew 16.9 million passengers in August compared to a pre-COVID peak of 14.9 million in August 2019.”, Reuters, September 1, 2022

“Mapping Airways: The World’s Flight Paths and Airports – There are up to 8,755 commercial flights in the air at any given time of day. These flights transport thousands of people (and millions of dollars worth of goods) around the world. But where are these people and goods headed? This map from Adam Symington uses historical data from OpenFlights to visualize the world’s flight paths. The graphic shows a comprehensive data set encompassing 67,663 different routes that connect 10,000 different airports across the globe. Visual Capitalist / OpenFlights, September 2, 2022

Country & Regional Updates

Asia

“Relief in sight for cheese lovers as Domino’s expands in Asia – Australia’s largest pizza chain, Domino’s Pizza Enterprises, says there are early signs that price pressures for key ingredients such as wheat and cheese are starting to flatten, but the company will still have to lift some product prices to combat inflation. The company also stepped up its expansion in Asia with the acquisition of 287 stores in Malaysia, Singapore and Cambodia in a deal with an upfront price of $214 million, in what is the biggest acquisition in the company’s history. It aims to grow to 600 stores in total across the three countries.”, The Australia Financial Review, August 24, 2022

China

“U.S.-China Business Council 2022 Member Survey – The US-China Business Council’s 2022 Member Survey was conducted in June 2022, shortly after a period of widespread COVID-19 lockdowns across China, most prominently in Shanghai. This report is based on responses from 117 member companies, a similar participation rate to past years. Most respondents are large, US-headquartered multinational companies that have operated in China for more than 20 years. China’s COVID-19 policies are the top challenge. Bilateral tensions continue to hurt American companies. Trajectory of commercial relations at another inflection point.”, U.S-China Business Council, August 29, 2022

“China Was One of the Best Places for Private Equity. Not Anymore. The number of Investments by U.S. PE and venture-capital firms in that country declined by about 31% in the second quarter this year, while their value plunged 79%, according to data from S&P Global Market Intelligence. Concerns about the country’s macroeconomic picture spurred the drop, S&P said.”, Barron’s, September 5, 2022

India

“India overtakes former colonial ruler UK to become 5th largest world economy – According to the calculation, based on US dollars, India overtook the U.K. in the final three months of 2021 and extended its lead into the first quarter. Nirmala Sitharaman, Minister of Finance and Corporate Affairs noted that a decade ago, India ranked 11th among the largest economies, while the U.K. was the 5th. The news came just after the country celebrated its 75th anniversary of independence from the U.K., which it achieved after nearly 100 years of direct rule. ”, Fox Business, September 4, 2022

Indonesia

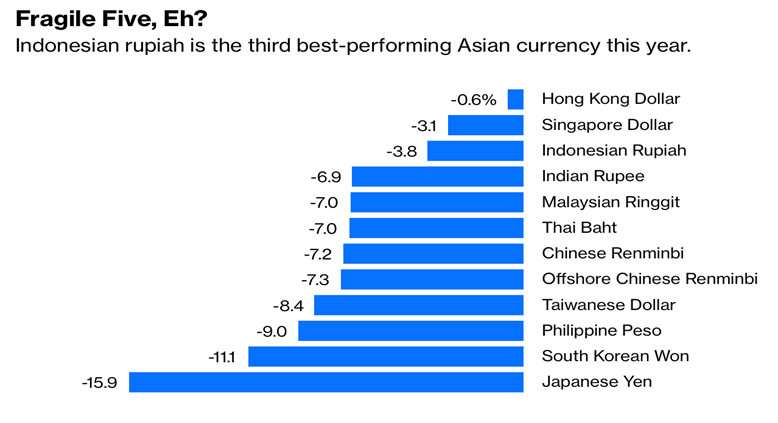

“A Surprise Winner as Emerging Markets Crumble – President Joko Widodo wants Indonesia to be more than a source of commodities, and investors are buying it. Developing nations are reeling from the double whammy of Federal Reserve interest-rate hikes and China’s economic slowdown. They are burning through foreign reserves at the fastest pace since the 2008, to defend their currencies and cover higher import bills for food and fuel. Indonesia, which was singled out as a Fragile Five less than a decade ago for its vulnerable currency and reliance on hot foreign money, has been a haven of relative calm.”, Bloomberg, August 25, 2022

Italy

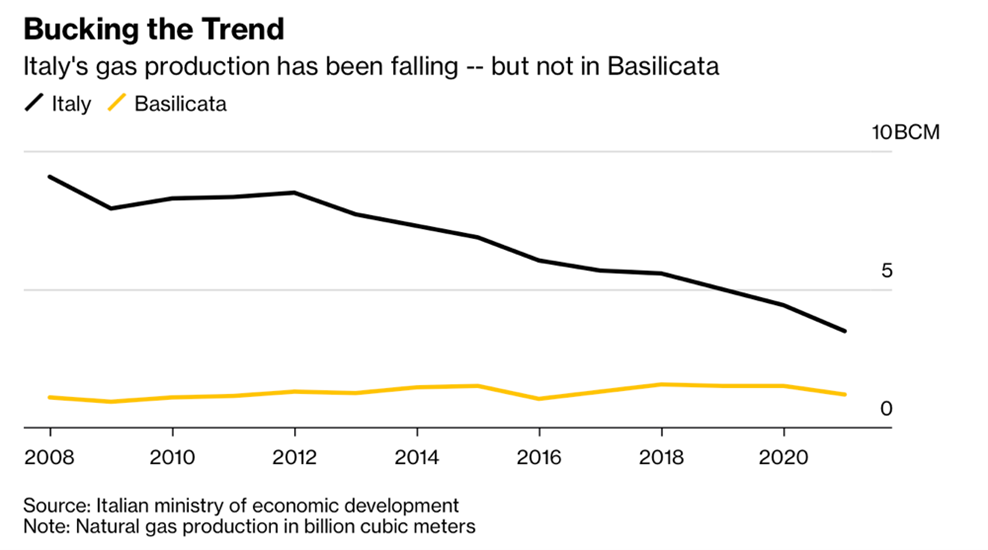

“An Italian Region Is Cutting Gas Bills as Prices Soar Elsewhere – Basilicata residents are due to get free gas from Shell, Eni – Southern region has bucked trend of reducing gas production. A small region in Italy’s impoverished south is about to enjoy a discount on gas bills of as much as 50% just as prices keep breaking records across Europe. Basilicata is reaping the benefits of a controversial decision to continue exploiting its vast gas reserves even as the rest of Italy reduced or halted production, largely over environmental concerns. Expanding domestic oil and gas production has become a divisive issue ahead of elections next month.”, Bloomberg, August 26, 2022

Japan

“Japan turns back to nuclear power in post-Fukushima shift – Prime minister says government will step up reactor restarts and study construction of new plants. (Prime Minister Fumio) Kishida’s decision to throw his political weight behind the nuclear power sector is intended to rein in soaring energy costs for households and companies and to support Japan’s nuclear technology manufacturers.”, The Financial Times, August 24, 2022

Nigeria

“Nigeria Pays Part of Airline Dues Amid Flight Suspension Threats – Nigeria released some funds owed to international air carriers to try and avert a crisis in the aviation sector amid warnings of flight suspensions from operators including Dubai’s Emirates Airline. The Central Bank of Nigeria released $265 million to settle ticket sales owed to airline operators, it said late on Friday. Nigeria — Africa’s biggest economy — owes carriers $464 million, the International Air Transport Association said this month.”, Bloomberg, August 27, 2022

Portugal

“Foreign tourism to Portugal surpasses pre-COVID levels in July – The number of foreign tourists visiting Portugal slightly surpassed pre-pandemic levels in July for the first time since the end of most COVID-19 restrictions, data from the National Statistics Institute (INE) showed on Wednesday. More than 1.8 million foreigners stayed in Portuguese hotels last month, up from around 600,000 a year ago, when the country still had some restrictions in place, and slightly above 1.78 million in July of 2019, which was a record year for tourism.”, Reuters, August 31, 2022

Singapore

“Singapore Hotel Prices Hit 10-Year High as City Roars Back to Life – Arrivals accelerating as Covid-19 restrictions are eased. Pace expected to continue with F1 event, slew of concerts. Hotel rooms in Singapore are now the most expensive in almost a decade as the city-state seeks to position itself as the tourism and business destination in Asia with a slew of high-profile events lined up for the coming months.”, Bloomberg, September 4, 2022

United Kingdom

“Liz Truss vows to ‘deliver’ after winning race to be new prime minister – In her acceptance speech, Truss promised to cut taxes, deal with energy bills and fix the NHS, and appeared to rule out an early election, saying: ‘We will deliver a great victory for the Conservative Party in 2024’.”, The Time of London, September 5, 2022

“Britain heading for recession as business contracts – The likelihood of the British economy sliding into recession has risen after a closely-watched survey showed business activity contracted last month for the first time in a year and a half. The latest composite purchasing managers’ index (PMI), which encompasses the services and manufacturing sectors, has been revised down to 49.6 for August, from an initial flash reading of 50.9, S&P Global said. In a further sign of the faltering economy, the survey result for the services sector last month was also lowered from the preliminary flash reading of 52.5 to 50.9, which represented the weakest growth for 18 months.”, The Times of London, September 3, 2022

United States

“US Goods-Trade Gap Narrows to Least Since October as Imports Drop Again – (Value) of consumer-goods imports fell most since at least 1992 Overall imports declined 3.5% to $270 billion, Census says. The US merchandise-trade deficit narrowed in July to the smallest since October as imports fell for a fourth month, suggesting a tailwind for economic growth in the third quarter.”, Bloomberg, August 26, 2022

“KPMG to Cut Manhattan Office Space in Move to New U.S. Headquarters at Hudson Yards – Firm shrinking its New York office space by over 40% as it pursues hybrid-work strategy. The KPMG deal also highlights the harsh new reality for the office sector. Companies are still willing to spend big on modern office space with more amenities, outdoor space and energy efficiency. But they often want far less of it. That leaves landlords with increasingly large holes to fill, especially in older buildings.”, The Wall Street Journal, August 23, 2022

Vietnam

“Good morning Vietnam: the world’s new factory is emerging – Amid tensions with China, the nation’s manufacturing sector is booming. In 2021, Vietnam’s exports hit $336 billion (£282 billion) in value, up 19 per cent from 2020 despite the pandemic. Foreign-invested production dominates, with 73 per cent of last year’s export turnover generated by international firms.”, The Times Of London, August 28, 2022

Brand News

“American chain Planet Smoothie opens its first two Australian stores – Kahala Brands, the franchisor and owner of the Planet Smoothie brand, has collaborated with the Docklands-based Smoothie Group to expand into Australia. The company plans to open an additional location in the second quarter of next year.”, Insideretail.com.au, August 24, 2022. Compliments of Jason Gehrke, Franchise Advisory Centre, Brisbane

“Bonchon is Crunching the Competition with Record Sales Numbers – The Korean fried chicken brand is on fire and outperforming the industry average as it leads the fast-casual and casual dining segments, according to mid-year data from research firm Black Box Intelligence™. Bonchon has experienced a year-over-year sales increase of 12 percent and the brand’s AUV has increased by 24.7% to $1.57 million since VIG Partners invested in the company in 2018. It’s full-steam ahead for the second half of the year, with plans to grow by 20 percent before the end of the year.”, Franchising.com, September 5,l 2022

Denny’s hires presidents for both its brands – Denny’s has promoted John Dillon, chief brand officer, to president of Denny’s effective Sept. 1, the company announced Thursday. David Schmidt, who recently served as CFO at Red Lobster, has been hired as president for Keke’s Breakfast Cafe, effective Sept. 12. These appointments come a month after Denny’s closed its $82.5 million acquisition of Keke’s Breakfast Cafe, which will operate independently of Denny’s.”, Restaurant Dive, August 26, 2022

“Hardee’s Has Teamed Up With A Nashville Brewery To Create A Beer That Includes The Chain’s Signature Biscuits – Hardee’s announced today it is working with Nashville-based Southern Grist Brewing Co. to turn its famous biscuits into a Strawberry Biscuit Ale. Specifically, the brewer has figured out a way to infuse Hardee’s biscuits into a full-bodied, cream ale that incorporates hints of strawberry jam and buttermilk.”, Forbes, August 30, 2022

“Top Pizza Franchise Becomes Billion-Dollar Brand – Marco’s Pizza, the nation’s fastest-growing pizza brand*, recently crossing the $1B annual systemwide sales mark and opening its 1,100th store. Marco’s expects greater expansion of its geographic footprint with more than 230 stores currently in development. Multi-unit franchisees play a huge part in the continuous growth of the brand. In fact, nearly half of Marco’s current franchise network is made up of multi-unit operators……”, Franchising.com, September 5, 2022

“Overweight in the coffee market McDonald’s (China) plans to add about 1 000 McCafé stores in 2023 – On August 31, McCafé, a professional handcrafted coffee brand owned by McDonald’s, announced the launch of the “Milk Iron Series”. This product is a brand-new milk coffee product developed by McCafe on the basis of understanding the coffee taste of Chinese consumers. “Milk Iron” will be sold in nearly 2,500 McAfee stores nationwide as an exclusive star product of McAfee. As a result, McCafe also announced the latest plan. It is expected that about 1,000 new stores will be added in 2023, mainly in third-tier cities.”, Beijing Business Daily, September 2, 2022. Compliments of Paul Jones, Jones & Co., Toronto

“American chain Planet Smoothie opens its first two Australian stores – Kahala Brands, the franchisor and owner of the Planet Smoothie brand, has collaborated with the Docklands-based Smoothie Group to expand into Australia. The company plans to open an additional location in the second quarter of next year.”, Insideretail.com.au, August 24, 2022. Compliments of Jason Gehrke, Franchise Advisory Centre, Brisbane

“PRET-flation! How lunchtime and pub favourites have soared in price amid cost-of-living crisis – with Pret A Manger tuna sandwich up 50p to £3.80. It comes after fast-food chain McDonalds last month raised the price of its iconic – and once seemingly inflation-beating – 99p cheeseburger to £1.19. It was the first time the burger’s price had been increased in more than 14 years. It comes as all restaurants and grab and go spots face a double whammy of increasing costs. Ingredients such as flour and cooking oils have all gone up in price as a knock on from Russia’s invasion of Ukraine, while shops, cafes and restaurants are also feeling the pinch due to spiraling gas prices.”, DailyMail.com, September 3, 2022

“Red Rooster (Australia) celebrates 50 years of Red – Red Rooster is celebrating 50 years of serving as Australia’s chicken shop through promotions such as limited merchandise collection and a chance to win 50,000 Red Royalty Dollars. The chicken shop is ‘painting the town Red’ by offering various initiatives to more than 360 Red Rooster restaurants.”, Qsrmedia.com.au, August 22, 2022. Compliments of Jason Gehrke, Franchise Advisory Centre, Brisbane

Articles & Studies For Today And Tomorrow

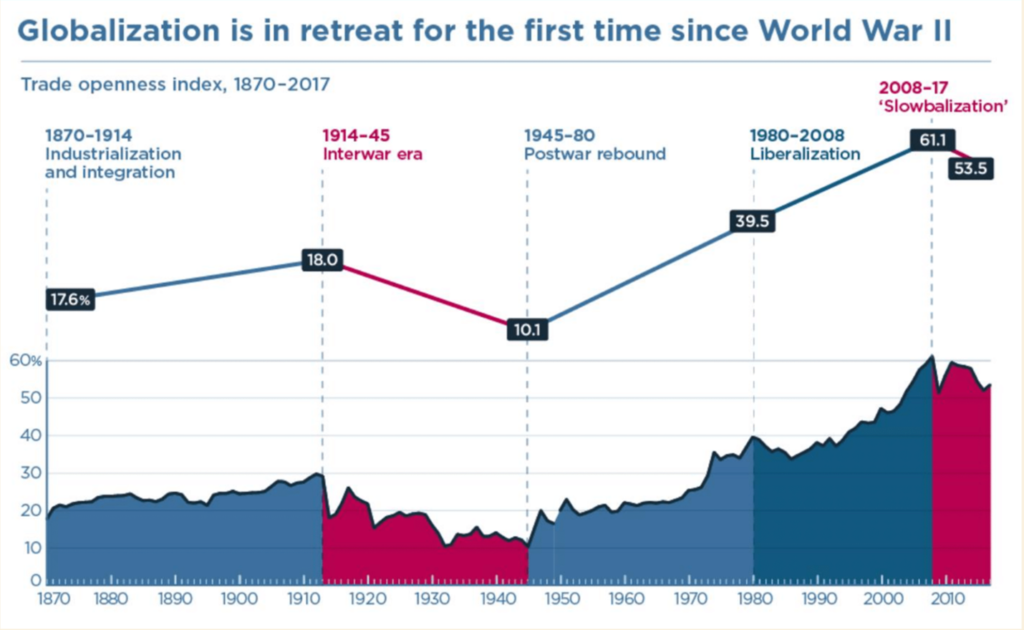

“Slowbalization – This chart is from “Globalization ’22 – What Will The Future Hold”, a presentation made by Team 4 in the Executive MBA 23 course at the University of Southern California, Irvine led by Dr. Leonard Lane. Bill Edwards was asked to monitor and contribute to the final course team presentations. https://bit.ly/3D2ba1y

To receive this biweekly newsletter, click here : https://bit.ly/geowizardsignup

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, economic development and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing environment. Our GlobalTeam™ covering 43 countries provides us with updates about what is happening in their specific countries.

To sign up for our biweekly newsletter click here: https://bit.ly/geowizardsignup

William (Bill) Edwards has a four-decade career successfully accelerating the international growth of more than 40 brands. He has directed projects on-site in Alaska, Asia, Europe and the Middle and Near East and has lived in China, the Czech Republic, Hong Kong, Indonesia, Iran and Turkey. Edwards Global Services, Inc. (EGS) provides a complete International solution for companies Going Global. From initial global market research and country prioritization, to developing new international markets, providing in-country operations support and problem solving around the world. EGS has twice received the U.S. President’s Award for Export Excellence. For advice on doing business successfully across 40+ countries, contact Bill Edwards at bedwards@edwardsglobal.com or +1 949 224 3896.

Download our latest chart ranking 40+ countries as places to do business at this link:

Our latest GlobalVue™ 40 country ranking