EGS Biweekly Global Business Newsletter Issue 63, Tuesday, August 23, 2022

Edited and curated by: William (Bill) Edwards, CFE, CEO of Edwards Global Services, Inc. (EGS)

Lots of individual country and brand updates in this issue. Plus, mixed signals on global oil & gas demand, inflation and economic growth. And, as you know if you travel a lot like me, the ease of travel is not back to 2019 when ‘ease’ was not the right word either!

To receive this biweekly newsletter that is read by 1,450 people in 20 countries, click here : https://bit.ly/geowizardsignup

First, A Few Words of Wisdom From Others

“Not everything that counts can be counted, and not everything that can be counted counts.”, William Bruce Cameron

“Life is what happens when you’re busy making other plans.”, John Lennon

“You never really learn much from hearing yourself speak.”, George Clooney

Highlights in issue #63:

- Brand Global News Section: Aqua-Tots®, Dutch Bros.®, F45®, Jollibee”s®, Krispy Kreme®, Marco’s Pizza®, McDonalds®, Popeyes®, Tom Hortons® and Wendy’s®

NOTE: Bolded headlines in this newsletter are live links where the article is freely available

Interesting Data and Studies

“Brands Play A Role In Happiness Even When The World Is In Crisis – Happiness is currently getting a lot of attention and it should. It’s a vital element to a healthy balanced life and in the current climate it feels in short supply. During times of turmoil, like now, it can seem wrong to be focused on something so individual when bigger problems fill our thoughts and news feeds. Research is showing that it’s more helpful to think of happiness as an active noun and complex concept that requires regular review and updating. To make happiness part of life we need to reframe our understanding of it to encompass a wider emotional and intellectual range. Brands can help with that.”, Forbes, August 11, 2022

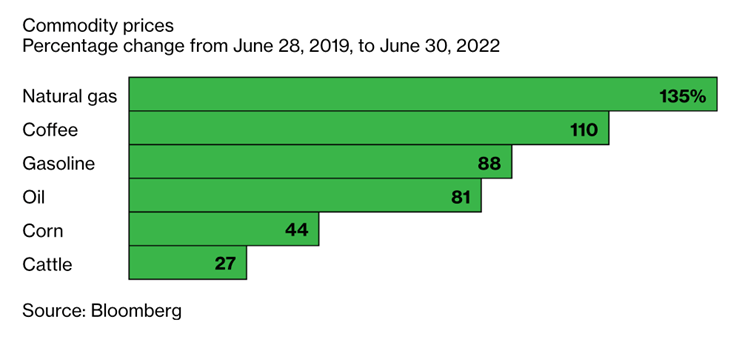

Global Supply Chain, Energy, Commodities, Inflation & Trade Issues

“Inflation Rates Are Rising Unevenly Around the World – Prices are rising all over the world at a pace that hasn’t been seen in decades, and central banks have responded by lifting rates. Here, we provide a snapshot of global and US data that help explain what’s happening. The war in Ukraine, the pandemic, and supply chain stress are all playing a role. Larger economies in Europe and the Americas, particularly Brazil, have seen a more dramatic upswing in consumer prices in the past few years than countries in Asia, where inflation gains in Japan and China have been muted.”, Bloomberg, August 12, 2022

“Oil Demand Accelerates as Gas Crisis Spurs Switch, IEA Says – Consumption growth boosted by 380,000 b/d to 2.1 million b/d Oil market spared squeeze as stockpiles seen accumulating. World oil consumption will now increase by 2.1 million barrels a day this year, or about 2%, up 380,000 a day from the previous forecast, the Paris-based agency said in its latest monthly report. The extra demand that prompted the revision is “overwhelmingly concentrated” in the Middle East and Europe.”, Bloomberg, August 11, 2022

“OPEC Cuts Oil-Demand Forecasts as Economic Growth Slows – Oil supply and demand were close to balanced in second quarter. OPEC’s revisions come as oil prices have eased significantly from the highs they hit in the wake of Russia’s invasion of Ukraine. Fears about slowing economic growth and signs of respite from a global energy crisis have undercut oil prices, which this month fell to their lowest level since February. While OPEC lowered its forecast for global economic growth this year and next, it said demand for oil—while more modest—would still be robust.”, The Wall Street Journal, August 11, 2022

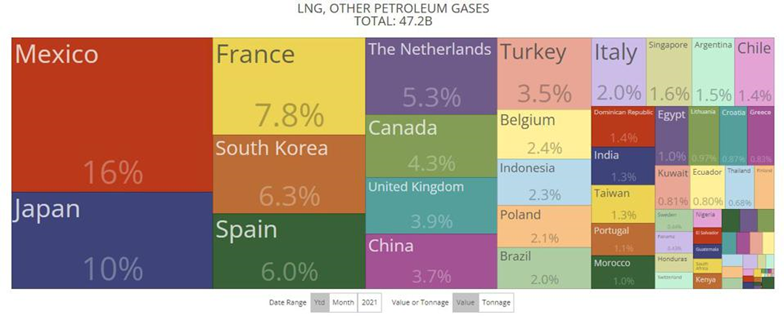

“LNG, Fastest-Growing U.S. Export Since Covid-19, Heading To Europe – The fastest-growing top 100 U.S. export from pre-pandemic 2019 is LNLN 0.0%G and other natural gases, up almost 10 times as much in value as the overall average. This year, the fastest-growing markets for the United States’ No. 3-ranked export are in Western Europe, when compared to the comparable first six months of last year. According to the latest U.S. Census Bureau data, overall U.S. exports topped $1 billion through June for the first time.”, Forbes, August 13, 2022

“Key European Power Price Doubles in Two Months as Crisis Deepens – German and UK day-ahead prices also soar to record highs Governments are under pressure to ease burden on households. Next-year electricity rates in Germany advanced as much as 3.7% to 477.50 euros ($487) a megawatt-hour on the European Energy Exchange AG. That’s almost six times as much as this time last year, with the price doubling in the past two months alone.”, Bloomberg, August 15, 2022

Global & Regional Travel Updates

“Forget 2022: Travel isn’t expected to improve until next year – As predicted, the summer 2022 travel season turned out to be unlike any summer in recent memory. After a trickle of COVID-19 restrictions eased over many months, travelers flooded airports and tourist destinations at rates not seen in three years and with a fervor not seen in even longer than that. It’s safe to say it did not all go according to plan. While hours-long waits and piles of luggage proved nightmarish for travelers overseas, flight disruptions in the U.S. surpassed ordinary frustration.”, The Points Guy, August 19, 2022

Country & Regional Updates

Australia

“A third of Aussie workers would trade a small pay cut for better work-life balance: LinkedIn – One in four workers would also take lower pay in exchange for a stronger chance to grow in the role, more flexibility to work onsite or remote, more inspiring company leadership, and a greater focus on their whole self at work, according to the index released this week. Cayla Dengate, LinkedIn Careers Expert, said a focus on workplace flexibility may be driven by many Aussies taking stock of what’s most important in their life following two years of disruption.”, Smart Company AU, August 5, 2022. Compliments of Jason Gehrke, Franchise Advisory Centre, Brisbane

Brazil

“Brazil’s central bank chief predicts end of credit cards – Brazil’s central bank chief Roberto Campos Neto on Friday said he believes credit cards will cease to exist soon due to the growth of the open finance system, through which clients authorize financial data sharing with different institutions. Open finance is a central bank project that has been implemented in phases since 2021. Speaking at an event about cryptocurrencies, Campos Neto projected that, through the system, users will control all aspects of their financial life in one “integrator” on their mobile, rather than having many apps from different banks.” Reuters, August 12, 2022

Canada

“Metro shoppers ‘trading down’ as inflation weighs, executives say retailer absorbing some cost increases – Grocery store owner Metro Inc. executives say they are not passing on all of their cost increases to shoppers, even as prices in stores have increased and the company reported a 9-per-cent jump in third-quarter profit. ‘Our costs have gone up significantly. We are absorbing some of those costs’, chief executive officer Eric La Flèche said on a call with analysts Wednesday to discuss the financial results. The Montreal-based retailer reported that its food basket inflation was 8.5 per cent. According to Statscan, grocery prices across the country rose by 9.4 per cent in June compared to a year earlier, slowing from a 9.7-per-cent jump in May.”, The Globe and Mail, August 11, 2022

“The Great Resignation has arrived in Canada – It took a while for a version of the Great Resignation to take hold in Canada, but now it’s here. It has taken the form of a retirement wave – and its arrival further clouds the outlook for an already murky economy. Last week’s July employment report from Statistics Canada revealed that a record 300,000 Canadians have retired over the past 12 months. That’s up nearly 30 per cent from the same time last year, and nearly 15 per cent from the months leading up to the pandemic in early 2020.”, The Globe and Mail, August 11, 2022

China

“China’s Youth Unemployment Rate Rises to Another Record – China’s urban youth unemployment rate reached 19.9% in July, the highest level since record keeping began in January 2018, according to National Bureau of Statistics (NBS) data released on Monday. It’s the fourth consecutive month of record high unemployment among urbanites from 16 to 24 years old, with the rate increasing 0.6 percentage points from June. Fu Linghui, a spokesperson for NBS, cited the slow recovery of the service industry, hampered by Covid-19, and the large cohort of graduates entering the job market during the graduating season around July and August, as reasons for the heightened youth joblessness.”, Caixing Global, August 15, 2022

“Shanghai Schools to Reopen After Classes Suspended in March – Shanghai will reopen kindergartens, primary and secondary schools in September, almost six months after in-person classes were suspended, with strict measures in place to avoid the spread of Covid-19. Students and teachers must be in Shanghai for two weeks before schools start on Sept. 1, and take two nucleic acid, or PCR, Covid tests within three days before returning to campuses, the city’s education authority said in a statement on Sunday. They will also need to produce a negative test result everyday to attend classes as China continues to pursue a Covid Zero policy.”, Bloomberg, August 13, 2022

Euro Zone Countries

“Economists Say a Euro-Zone Recession Is Now More Likely Than Not – Respondents in survey see 60% chance of downturn in next year……The risk of a euro-area recession has reached the highest level since November 2020 as energy shortages threaten to drive already record inflation higher still, according to economists polled by Bloomberg.”, Bloomberg, August 14, 2022

Germany

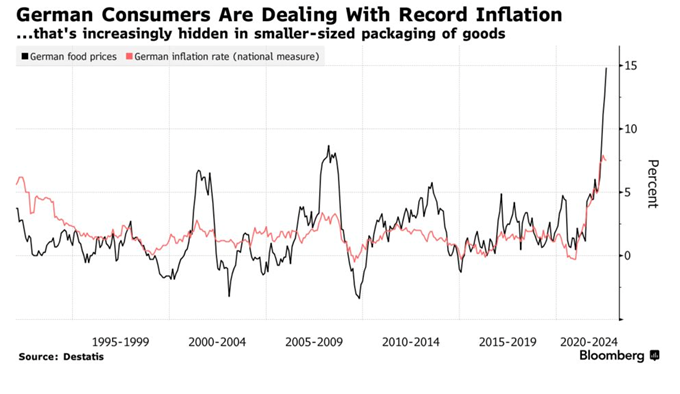

“Forget Inflation. Shrinkflation Is Sparking Fury in Germany – Packages of goods are getting smaller as prices hold firm Shoppers are inundating consumer authorities with complaints. German shoppers are getting increasingly angry at attempts to hike goods prices by stealth. While so-called shrinkflation — where the cost of a product stays the same though its size declines — isn’t a new phenomenon, consumer-protection authorities in Europe’s top economy are being inundated by complaints. Food prices are the biggest driver of German inflation after energy, rising at an annual pace of 14% in July — almost twice as much as the overall index.”, Bloomberg, August 12, 2022

Indonesia

“Shiny EVs in Sight, Indonesia Mulls Nickel Export Tax – The biggest producer of the EV battery metal, which is also used to make stainless steel, Indonesia is looking to add more value locally in a bid to boost revenues and jobs, President Joko Widodo told Bloomberg Editor-in-Chief John Micklethwait in a wide-ranging interview in Jakarta. The potential move, which was flagged earlier this year by another official, is one step on a path that could ultimately mean a ban on exports of all raw materials.”, Bloomberg, August 19, 2022

Israel

“Israel inflation rate jumps to new 14-year high of 5.2% y/y in July…..the most since October 2008 and following a 4.4% rate in June, as more aggressive interest rate hikes loom and keep the soaring cost of living centre stage ahead of an election in November. A Reuters poll of analysts had projected an inflation rate of 4.6%. CPI rose 1.1% in July from June, led by gains in transport, housing rentals and fresh fruit, the Central Bureau of Statistics said on Monday.”, Reuters, August 15, 2022

Malaysia

“Malaysia’s GDP Growth to Quicken on Pent-Up Demand……Local demand, robust trade to help maintain momentum, FM says Government won’t boost borrowings to pay for subsidies. Malaysia’s economic growth will accelerate this quarter after expanding at the fastest pace in a year, driven by private consumption as activities resume, Finance Minister Zafrul Aziz said. ‘People are underestimating the strength of the pent-up demand,’ he said in an interview on Saturday. ‘Restaurants are packed, traffic jams have returned, the unemployment rate has fallen to below 4% and the first-half tax collections have been way above our estimate.’”, Bloomberg, August 13, 2022

The Philippines

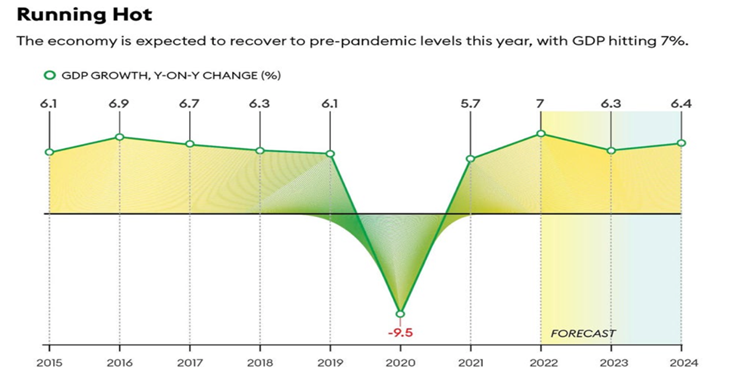

“Philippines Wealth Creation: Economic Recovery Gains Momentum In 2022 – The Philippines’ economy is expected to shrug off the impact of rate hikes and rising commodity prices to recover to pre-pandemic levels this year. GDP is forecast to hit 7%—thanks to returning tourists and a rise in household spending—before inflationary headwinds slow growth to 6.3% in 2023 and 6.4% in 2024. Even with the budget deficit running over 8% of GDP (the highest in Southeast Asia), the new administration of Ferdinand “Bongbong” Marcos Jr. is eyeing an expansionary fiscal policy as it tackles unemployment and poverty.”, Forbes, August 10, 2022

Thailand

“Tourists Pouring Back Into Thailand Underpin Outperforming Baht – Earlier this month, a government spokesman said the nation expects to attract 10 million international tourists this year, compared with the 6.1 million forecast in April. Visitors are seen rising to 30 million people next year, still shy of the 40 million who traveled to the country in the year before Covid spread. That rebound is important for Thailand, considering that the travel-related sector accounted for about a fifth of the nation’s economy before the pandemic.”, Bloomberg, August 14, 2022

Ukraine

“McDonald’s Charts Path to Reopen in Ukraine – McDonald’s Corp. plans to reopen some restaurants in Ukraine after shuttering them when Russia invaded the country in February. The world’s biggest fast-food chain will begin working with partners in the coming months to supply locations with products, prep the properties and bring employees back on site, the company said in a statement. McDonald’s didn’t provide a specific reopening date.”, Bloomberg, August 11, 2022

United Kingdom

“Workers going into office 1.5 days a week, survey suggests – UK workers are going into the office an average of 1.5 days a week, with only 13% coming in on a Friday, a survey suggests. Consultancy Advanced Workplace Associates surveyed 43 offices in the UK, representing nearly 50,000 people, in June and July. It suggests average attendance was 29%, with a peak of 39% mid-week. Pre-Covid, UK workers were going into the office an average of 3.8 days a week, according to the research which covered sectors including banking, energy, engineering, healthcare, insurance and tech.”, BBC News, August 15, 2022

United States

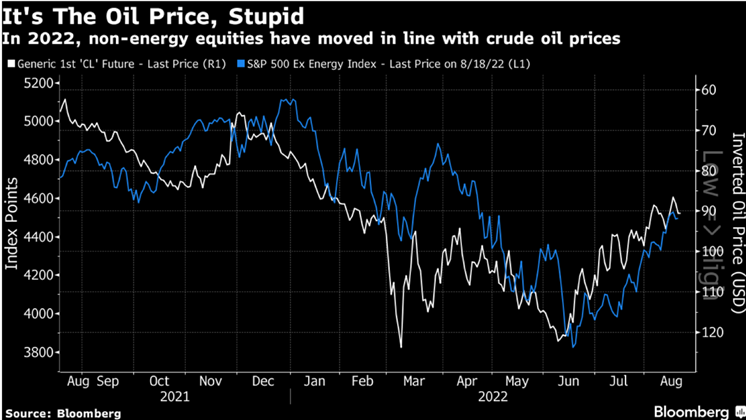

“If the Economy Is Shrinking, Why Is Everything Going Gangbusters? Economists are struggling to explain the global outlook. Maybe it’s better to ask someone in oil. A lot of recent data doesn’t sit well with the prevailing economic narrative. The US economy has shrunk for two consecutive quarters, yet the labor market is still going gangbusters, inflation looks increasingly subdued and retail sales for July beat expectations. But this is not a conventional business cycle, argues Jared Dillian. The damage wrought on supply chains by the pandemic, unprecedented fiscal stimulus and years of negative real interest rates have made soothsaying particularly troublesome. ‘But just because the data doesn’t fit Wall Street’s longstanding models that worked in the pre-pandemic era doesn’t mean that it’s “noise,”’ writes Jared. ‘It probably means the models are in dire need of updating.’”, Bloomberg, August 19, 2022

“U.S. Companies on Pace to Bring Home Record Number of Overseas Jobs – After Covid-19 pandemic upended supply chains, American companies are shifting jobs and processes to the U.S. U.S. companies are bringing workforces and supply chains home at a historic pace. American companies are on pace to reshore, or return to the U.S., nearly 350,000 jobs this year, according to a report expected Friday from the Reshoring Initiative. That would be the highest number on record since the group began tracking the data in 2010.”, The Wall Street Journal, August 20, 2022

Brand News

“Aqua-Tots Dives Deeper into Mexico with New Tijuana Location – Aqua-Tots Swim Schools has been renowned for its work teaching children across the United States how to swim for more than 30 years. Now, that same opportunity is available to more families south of the U.S. border in Baja California! Aqua-Tots opened its second location in Mexico – and 22nd international site – on July 18, just miles from the California border in Tijuana.”, Franchising.com, July 29, 2022

“Dutch Bros. on track for 130 new stores in 2022; Q2 revenue jumps – The fast-growing coffee opened 65 stores during the second quarter — including its 600th location — and is on track for at least 130 openings for the full year. Dutch Bros., which is celebrating its 30th anniversary this year, currently operates 603 locations across 14 states. ‘Our newest shops are exhibiting predictable and consistent sales and upward margin progression, while our 2020 and 2021 classes are generating annualized volumes that are 10% higher than our system average,’ said Joth Ricci, CEO and president, Dutch Bros.”, Chain Store Age, August 11, 2022

“How F45’s cash-draining celebrity deals left it gasping for air – Embattled Aussie fitness franchise F45 has had to overcome some significant hurdles in its rise to prominence and more recently, its fight for survival. And that includes multi-million dollar payments to the celebrities who were brought in to turbocharge its now-abandoned global expansion plans. F45’s US-listed shares plunged following a July 26 market update stating it had lost the financing underpinning its franchise sales. The update also revealed the company’s plans to slash staff and downgrade earnings and revenue forecasts for this year.”, Brisbane Times, August 19, 2022. Compliments of Jason Gehrke, Franchise Advisory Centre, Brisbane

“Jollibee’s Profit Nearly Triples as System-Wide Sales Hit Record – Jollibee Foods Corp., the largest Philippine restaurant operator, saw its profit jump by nearly 200% in the second quarter as diners returned with the easing of Covid restrictions. ‘We are encouraged to see further improvement in dine-in sales while at the same time sustaining growth in our delivery business,’ chief executive officer Ernesto Tanmantiong said in a statement Thursday. Sales were better than expected and have returned to pre-pandemic levels, he said.”, Bloomberg, August 10, 2022

“Why Krispy Kreme Isn’t Doing As Well As You Think – Although Krispy Kreme performed well in 2021 and predicted strong growth due to the implementation of its Hub and Spoke business model, unexpected economic circumstances have caused issues for the brand in 2022. According to Restaurant Business Online, the company’s shares dropped 15% earlier this week due to projected revenues not living up to expectations. Krispy Kreme’s international stores helped drive revenue growth in 2021, but in 2022, the company is taking a hit from its U.K. stores. According to CNN, operating costs for businesses are up across the board in the U.K.”, Mashed, August 19, 2022

“Marco’s Pizza Reaches 1,100 Stores and $1B in Annual Sales – These achievements come on the heels of aggressive franchise expansion with more than 200 stores in development, alongside record-breaking growth that has helped catapult its strong performance as America’s No. 5 pizza brand in systemwide sales. Multi-unit growth continues to play a strategic role in Marco’s rapid expansion, with nearly half of its current franchise network made up of multi-unit operators.”, Franchising.com, August 10, 2022

“Only two Popeyes outlets now open in Shanghai – Only two restaurants of the American fried chicken chain Popeyes Louisiana Kitchen remain operational in Shanghai, according to local restaurant review and booking site Dianping. The two outlets are the Popeyes flagship store on Huaihai Road and another at the Shinmay Union Square in the Pudong New Area. The four other stores, however, have closed. Popeyes China is operated by PLK APAC Pte Ltd, a subsidiary of Restaurant Brands International Inc, and it’s not yet clear whether the remaining two stores will stay operational.”, Shina.cn, August 9, 2022. Compliments of Paul Jones, Jones & Co., Toronto

“Tim Hortons officially launches in India today with unique menu items – The iconic Canadian chain is becoming well known across the world for its signature coffee, iconic beverages, delicious food, and the specialty items that are unique to each location. India is no different, introducing several brand new menu options we’ve never seen before, like Chole Kulcha Flatbread, Chicken Makhani Ravioli Pasta, and Paneer Tikka Wraps. The Chilli Cheese Toast, Chicken Tikka Croissant Sandwich, and Lamb Kebab Wrap are just three more tasty-sounding items we really wish we had here in Canada.”, The Daily Hive, August 11, 2022

“America’s Second-Largest Burger Chain Walks Back Major Expansion Plans – To the delight of Frosty and Baconator lovers across the globe, Wendy’s announced an ambitious expansion plan last year, which would add 1,200 locations to its roster by 2025. More than half of these new locations—around 700 to be exact—were planned as delivery-only ghost kitchens to be operated and staffed through a collaboration with Reef Kitchens. But, it appears the burger chain may have bitten off more than it could chew, and is now drastically pulling back on its ghost kitchen strategy. Wendy’s announced it is cutting down the number of Reef locations it will open from 700 to just 100 to 150, with a significant decrease in units specifically within the U.S.”, Eat This, Not That¡, August 11, 2022

Articles & Studies For Today And Tomorrow

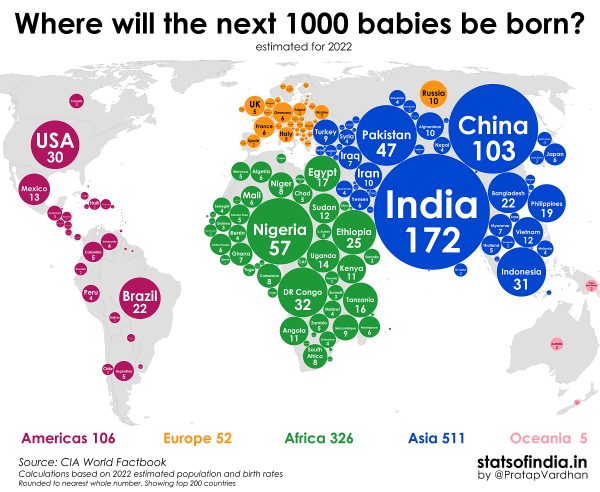

“Where will the world’s next 1,000 babies be born? Every four minutes, approximately 1,000 babies are born across the globe. But in which countries are these babies the most statistically likely to come from? Using data from the CIA World Factbook, this graphic by Pratap Vardhan (Stats of India) paints a picture of the world’s demographics, showing which countries are most likely to welcome the next 1,000 babies based on population and birth rates as of 2022 estimates.”, Visual Capitalist, August 19, 2022

To receive this biweekly newsletter, click here : https://bit.ly/geowizardsignup

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, economic development and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing environment. Our GlobalTeam™ covering 43 countries provides us with updates about what is happening in their specific countries.

To sign up for our biweekly newsletter click here: https://bit.ly/geowizardsignup

William (Bill) Edwards has a four-decade career successfully accelerating the international growth of more than 40 brands. He has directed projects on-site in Alaska, Asia, Europe and the Middle and Near East and has lived in China, the Czech Republic, Hong Kong, Indonesia, Iran and Turkey. Edwards Global Services, Inc. (EGS) provides a complete International solution for companies Going Global. From initial global market research and country prioritization, to developing new international markets, providing in-country operations support and problem solving around the world. EGS has twice received the U.S. President’s Award for Export Excellence. For advice on doing business successfully across 40+ countries, contact Bill Edwards at bedwards@edwardsglobal.com or +1 949 224 3896.

Download our latest chart ranking 40+ countries as places to do business at this link: