EGS Biweekly Global Business Newsletter Issue 61, Tuesday, July 26, 2022

Edited and curated by: William (Bill) Edwards, CFE, CEO of Edwards Global Services, Inc. (EGS)

As a 40 year China Hand, I find the “Foreign enterprises in China a decade of opportunities and transformation” article one of the most important in years as to how it for foreign brand to do business in China. We may be close to the top of the inflation curve. Will grain exports begin again soon to the Africa and the Middle East?

The U.S. trade gap narrows. A strong dollar makes this a good time for U.S. tourist in Europe. Africa and Egypt are becoming new tech start-up centers and who knew there were 13 distinct styles of fried chicken around the world?

As of this issue, 1,450 people in 20 countries receive this newsletter.

To receive this biweekly newsletter, click here : https://bit.ly/geowizardsignup

First, A Few Words of Wisdom From Others

“If you are not willing to learn, no one can help you. If you are determined to learn, no one can stop you.” Zig Ziglar

“Keep your eyes on the stars and your feet on the ground.”, Theodore Roosevelt

“Life is like and ocean, it goes up and down.”, Vanessa Paradis

Highlights in issue #61:

- Brand Global News Section: Five Guys®, Habit Burger®, Starbucks®, Subway® and Tom Horton’s®

NOTE: Bolded headlines in this newsletter are live links to published articles where the article is freely available

Interesting Data and Studies

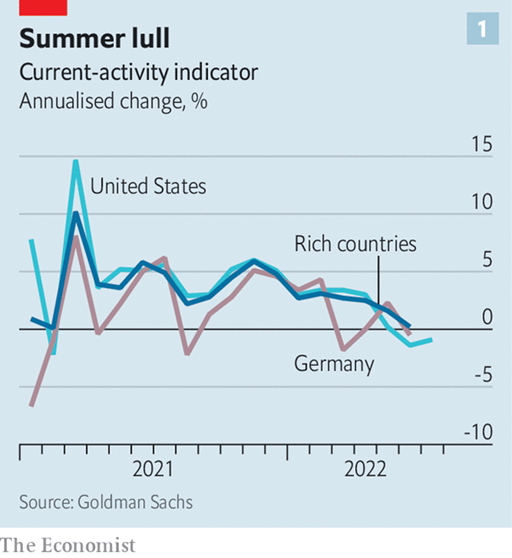

“Why it is too early to say the world economy is in recession – Growth in the rich world is slowing, but has not crashed to a halt. It is clear that central banks have to take the proverbial punchbowl away from the party. Wage growth in the rich world is far too strong given weak productivity growth. The few remaining optimists point to the strength of households and firms. Moreover, surveys suggest that people seem more confident about their personal finances than about the state of the economy. Across the eu as a whole, households are about one-third more likely to be positive about their own finances than they have been, on average, since the data began in the mid-1980s.

, The Economist, July 24, 2022

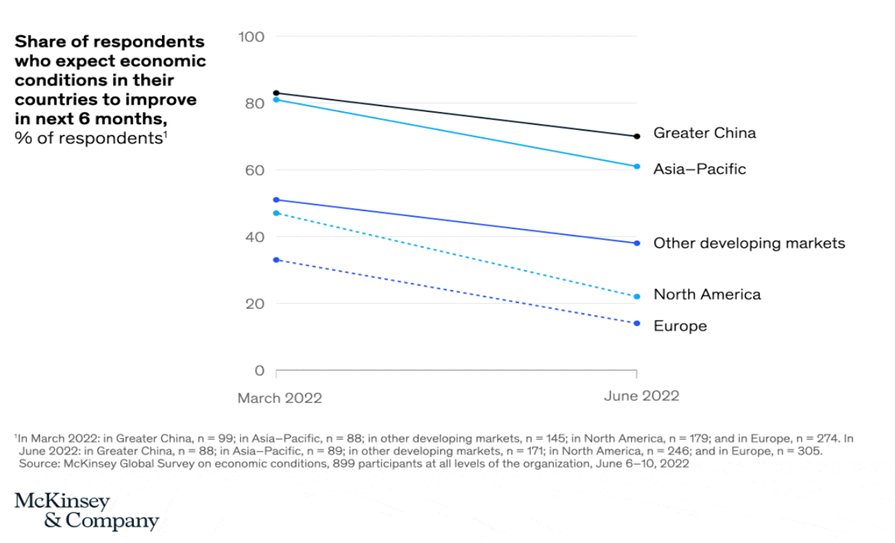

“According to a recent McKinsey survey, most Asia–Pacific and Greater China respondents are optimistic their economies will improve through 2022—although overall optimism has declined—whereas those in Europe and North America are more pessimistic, bracing for the worst.”, McKinsey, July 15, 2022

Global Supply Chain, Energy, Commodities, Inflation & Trade Issues

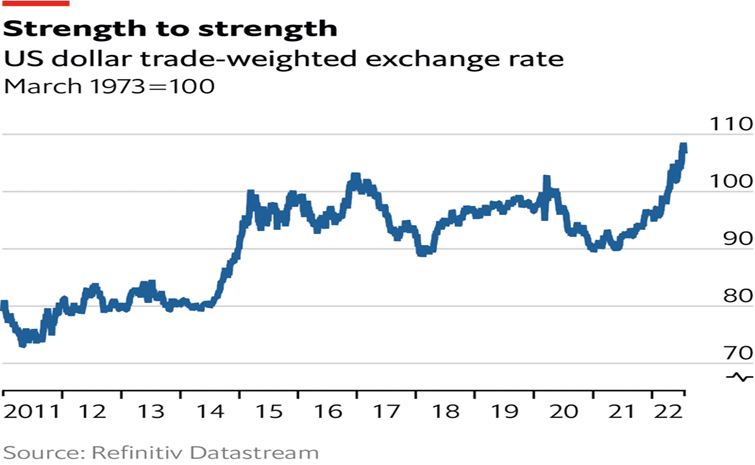

“Why the dollar is so strong – It is a good time to be an American tourist in Europe. Earlier this month the euro briefly dipped below parity with the dollar for the first time in two decades. The greenback is up by nearly 20% against that basket of currencies compared with June last year. It has climbed to heights last scaled in 2002. That is in large part because of the Federal Reserve’s hawkish shift. Determined to rein in inflation, it has increased interest rates by 1.5 percentage points since March.”, The Economist, July 20, 2022

“There are 4 possible recession scenarios, UBS says, including one where the S&P 500 rises 16% by the end of 2023 – UBS’ economic models show just a 40% chance of a recession in the U.S. over the next year. Still, the UBS team acknowledged that “the economy is flying quite low to the ground and looks vulnerable to turbulence.” The team laid out four potential recession scenarios, including one with good news for investors: an S&P 500 rebound by the end of 2023.”, Fortune, July 18, 2022

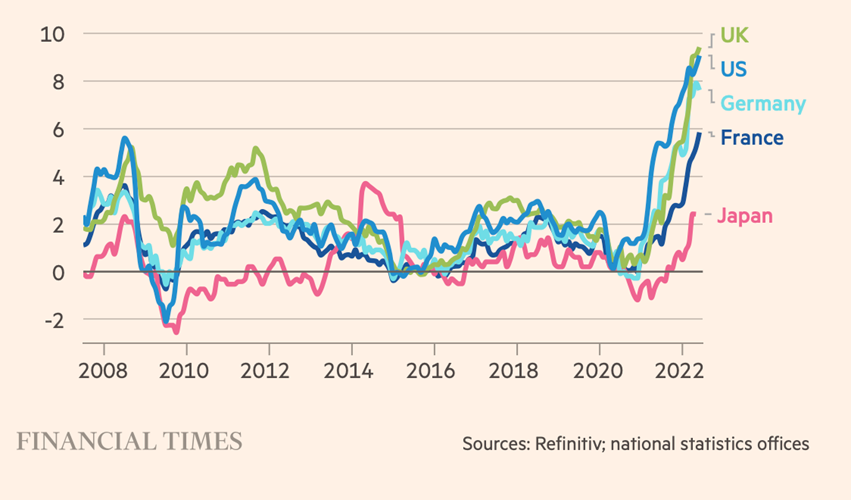

Consumer price inflation – % Annual change – The Financial Times, July 20, 2022

“When Will Inflation Subside? – We clearly are seeing the impact of inflation as it increases operating costs across supply and labor inputs in 2022. Is there relief coming from this profit-eroding upward pressure? What should we expect next year?”, Darrell Johnson, FRANdata, Franchising.com, July 22, 2022

Global, Regional & Local Travel Updates

“AirlineRatings picks best carriers in the world – 1. Qatar Airways. 2. Air New Zealand, 3. Etihad Airways. 4. Korean Air, 5. Singapore Airlines, 6. Qantas, 7. Virgin Australia, 8. EVA Air, 9. Turkish Airlines, 10. All Nippon Airways, 11. Cathay Pacific Airways, 12. Virgin Atlantic, 13. Japan Air Lines, 14. JetBlue, 15. Finnair, 16. Emirates, 17. Hawaiian Airlines, 18. Air France/ KLM, 19. Alaska Airlines and 20. British Airways”, NZ Herald, July 13, 2022

“Singapore Hotel Room Rates Hit Six-Year High as Tourism Recovers – Singapore in April became one of the first major regional economies to announce it would end all testing for incoming vaccinated travelers as the government furthered efforts for living with Covid-19. A revival of conferences and major events have also attracted visitors, and STB data showed a nearly 12-fold increase in arrivals in the first half of 2022 compared with the same period a year ago.”, Bloomberg, July 23, 2022

“Toronto Airport Is World’s Worst For Delays Amid Current Travel Chaos – Pearson International has won top honors for airport service for years, but now is at the epicenter of a global air-travel meltdown. Over 53% of flights departing Toronto Pearson between June 1 and July 18 arrived late at their destinations, according to flight-data specialist FlightAware. That was the highest rate among the world’s top 100 airports by number of flights.”, Wall Street Journal, July 24, 2022

Country & Regional Updates

Africa

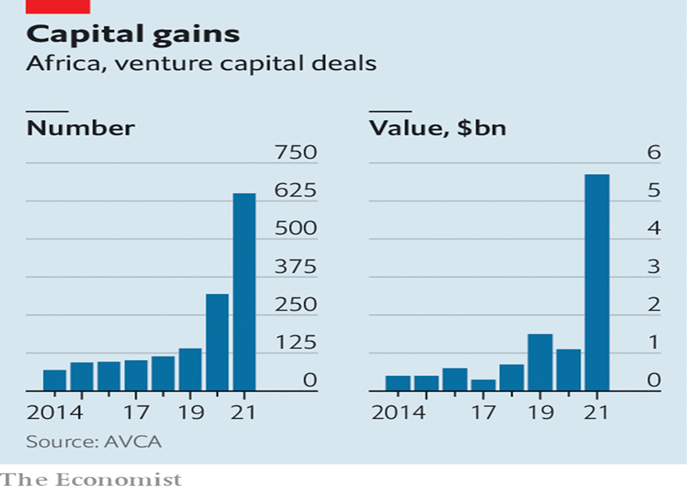

“African startups are raising unprecedented amounts. What next? The continent is the only region in the world not suffering from a slowdown in venture capital. Last year 604 African startups raised a total of $5.2bn, according to the African Private Equity and Venture Capital Association (avca), an industry group. This was more than the total invested in the seven preceding years. Five of Africa’s seven “unicorns” (startups valued at more than $1bn) won their horns last year. American investors led the charge, with 357 involved in deals last year, compared with 268 in total in 2014-20.”, The Economist, July 21, 2022

Australia

“Australia’s near-record low unemployment stokes staffing crisis – Labor government discusses work visas with Pacific Island leaders to alleviate worker shortage. The unemployment rate dropped to 3.5 per cent in June, lower than the 3.8 per cent predicted by economists. In 1974, the jobless rate fell to 2.7 per cent. Data released on Thursday revealed that 88,000 more people were employed in June from the previous month and that the workforce participation rate hit an all-time high of 66.8 per cent.”, The Financial Times, July 13, 2022

“Gig economy: Workers and customers are exiting the sector. How can we make it better? The gig economy is in trouble. Rideshare drivers are cancelling in droves. Wait times for food delivery are ballooning out and driver shortages are leading to food waste.”, Smart Company Australia, July 14, 2022

China

“Foreign enterprises in China a decade of opportunities and transformation – In January 1999, Starbucks entered the Chinese mainland market by opening its first store in the China World Trade Center, Beijing’s most popular commercial center. But with a latte priced at around 20 yuan (about $2.4 back then) and the average monthly salary of Beijing residents just surpassing 1,000 yuan, coffee was a niche market at that time. It took several years for the U.S. coffee chain to get traction in the Chinese market. Since 2010, China has risen to become the largest overseas market for Starbucks. Over the past decade, the number of Starbucks stores jumped by about 9 times to over 5,700 across the country.”, Beijing Review, July 22, 2022. This important analysis was provided by Paul Jones, Jones & Co., Toronto

“China’s population expected to start to shrink before 2025 – China is battling to reverse a rapid shrinkage in natural population growth as many young people opt not to have children due to factors including the high cost and work pressure. A change in China’s laws last year to allow women to have three children has not helped, with many women saying the change comes too late and they have insufficient job security and gender equality.”, Reuters, July 24, 2022

Egypt

“Egypt’s booming startup scene is becoming the gateway to MENA – In the last few years, Egypt’s startup ecosystem has become one of the most vibrant on the continent, presenting rapid growth potential for the near future. According to a recent report by Startup Genome, Cairo, the country’s bustling capital, marked an overall increase of 60% in VC funding rounds over the past five years, and in 2021, saw a 156% increase in total VC funding rounds compared to 2020.”, The Next Web, July 25, 2022

Japan

“Japan Leaves Weak Yen Alone Despite Above-Target Inflation – Central bank sees core prices rising 2.3% this fiscal year as Japanese currency stands near 24-year low. The BOJ’s low interest rates have fueled the yen’s fall against the dollar. Last week, a dollar bought more than ¥139, the weakest level for the Japanese currency since 1998. On Thursday afternoon, the dollar was changing hands at ¥138.55.”, The Wall Street Journal, July 21, 2022

Ukraine

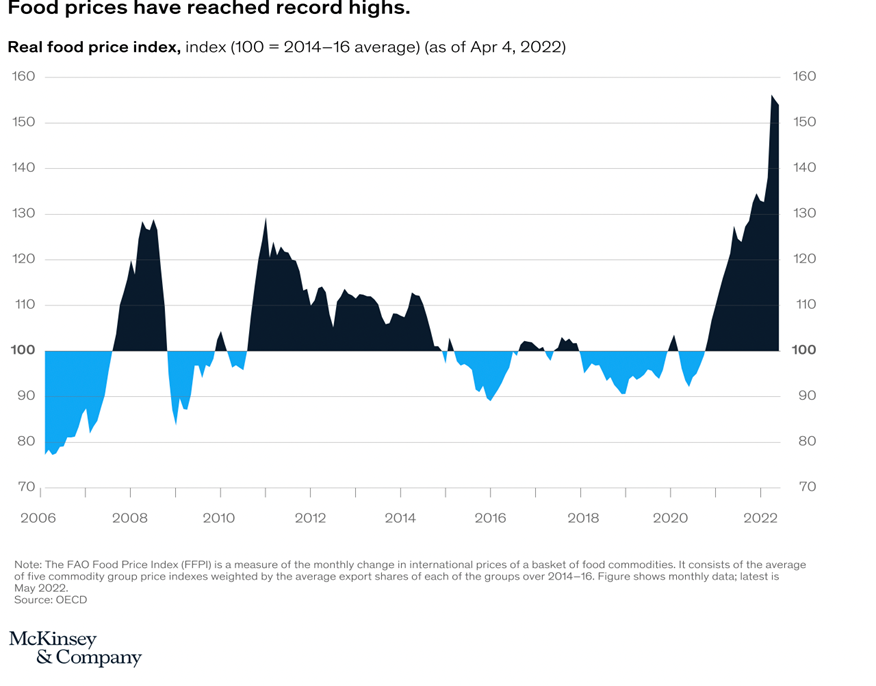

“First Ukraine Black Sea grain shipments could move in days – The agreement aims to allow safe passage for grain shipments in and out of Ukrainian ports, blockaded by Russia since its Feb. 24 invasion. Russia has blamed Ukraine for stalling shipments by mining the port waters. Russia and Ukraine are major global wheat suppliers, and Moscow’s invasion sent food prices soaring, stoking a global food crisis the World Food Programme says has pushed some 47 million people into ‘acute hunger’.”, Reuters, July 25, 2022

United Kingdom

“Aldi Staff Get Another Pay Rise as Brits Shift to Discounters – Aldi is giving its UK staff a pay rise for the second time this year as the German discount supermarket attracts more shoppers seeking to cope with the higher cost of living.”, Bloomberg, July 25, 2022

“Five Guys (UK) franchisee launches on-demand pay – Five Guys franchisee Life’s Food has introduced on-demand pay for its more than 200 employees, based across 23 locations in North Carolina, South Carolina and Tennessee. Through a partnership with on-demand salary provider DailyPay, Five Guys staff in Life’s Food-run locations have been given the option to access their pay immediately after finishing a shift, in a bid to provide greater flexibility and help staff manage their finances.”, Employee Benefits UK, July 22, 2022

“Starbucks explores UK business sale – Starbucks has been in the UK since 1998 and has about 1,000 outlets, of which about 70% are franchises while the remainder are owned by the firm. The company is also facing increased competition in the UK from rival coffee chains including Costa, Pret A Manger and Tim Hortons., The BBC, July 18, 2022

United States

“Survey Finds Majority of Companies Plan to Continue Hiring Despite Recession Worries – With the possibility of a recession on the horizon, 57% of American companies said they still plan to forge ahead with hiring, according to a new survey from The Harris Poll……more than half (51%) of U.S. companies think the next recession will happen within the next year. If a recession were to occur soon, more than 2 in 5 businesses (44%) feel their company won’t survive much longer. Nevertheless, companies don’t appear poised to pump the brakes on hiring like in previous recessions. 30% will continue hiring but cut back on the volume of workers, while 27% anticipate extending offers as planned.”, Franchising.com. July 22, 2022

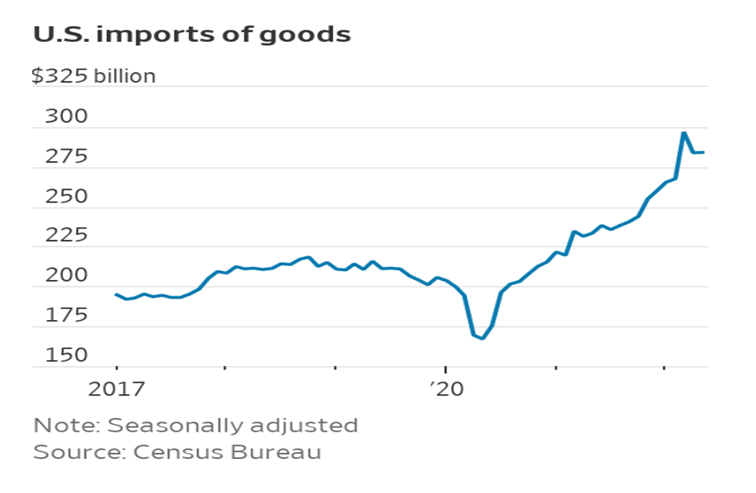

“U.S. Trade Gap Narrowed in May as Imports of Goods Slowed – American companies, meanwhile, exported more oil and natural gas as the Ukraine crisis deepened. The U.S. trade deficit narrowed for the second consecutive month in May as imports were held down by lower goods spending by American households and exports jumped on energy shipments. The trade gap in goods and services shrank 1.3% in May from the previous month to $85.5 billion, the Commerce Department said Thursday, down from April’s revised $86.7 billion.”, Wall Street Journal, July 7, 2022

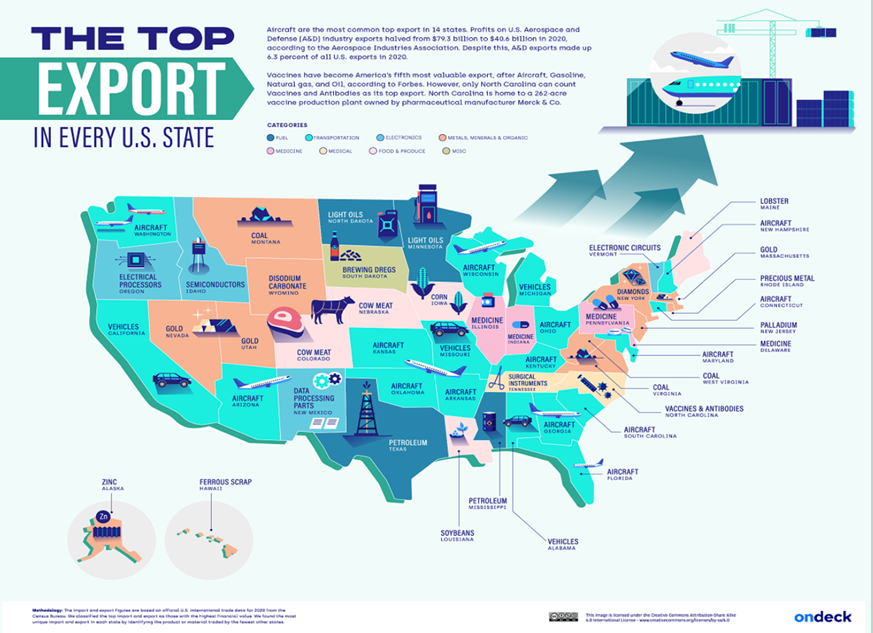

“The Top U.S. Exports by State – The U.S. exported over $1.3 trillion in goods in 2020, the second-highest amount worldwide. While refined petroleum was the top export overall at $58.4 billion, aircraft exports were actually the highest across 14 states—more than any other form of export. This infographic from OnDeck shows America’s top exports by state, using January 2022 data from the U.S. Census Bureau.” Visual Capitalist, July 19, 2022

Brand News

“The Habit Burger’s 2,000-Unit Journey Takes Shape – On the fifth page of its franchise brochure, The Habit Burger Grill quickly lets prospective operators know what type of track it’s on—more than 2,000 locations in the U.S. As it stands now, the fast casual has 330-unit restaurants in more than a dozen states. The long-term growth objective is steep, but John Phillips, chief global brand partnerships officer, has little doubt in The Habit Burger’s aims.”, QSR Magazine, July 18, 2022

“Subway is Ready to Crack its International Growth Potential – Among three biggest restaurant players in the U.S. in terms of footprint—Subway, McDonald’s, and Starbucks—the sandwich chain is the only one with a bigger domestic footprint than international. The brand believes there’s potential to double its international footprint. Subway has more than 37,000 stores worldwide, including roughly 21,000 in the U.S.”, QSR Magazine, July 15, 2022

“Tim Hortons first drive-thru-only stores will open later this summer! The unit will be just 900 square feet and will feature a mobile pickup shelf along with mobile order parking spots. This is a great model for the brand as they aim to maximize efficiency’s and cut costs while not compromising the guest experience.” LinkedIn, June 2022

Articles & Studies For Today And Tomorrow

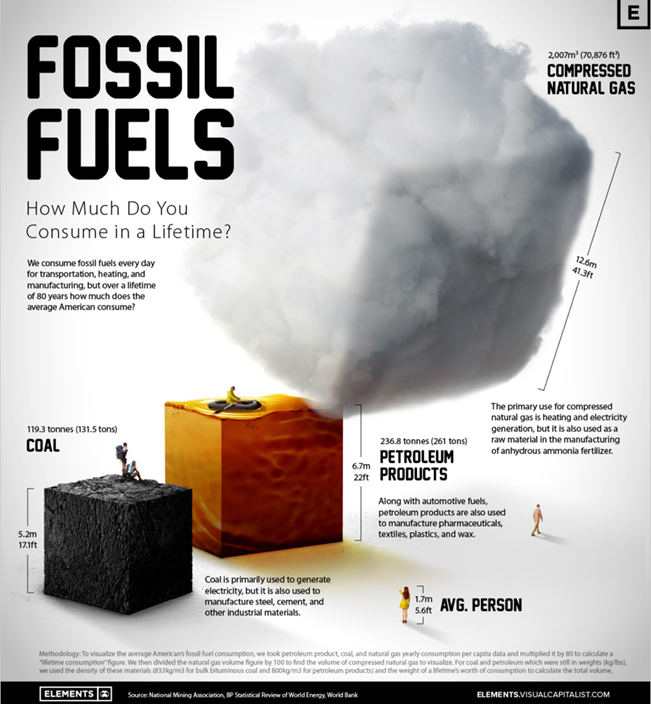

“A Lifetime’s Consumption of Fossil Fuels, Visualized – From burning natural gas to heat our homes to the petroleum-based materials found in everyday products like pharmaceuticals and plastics, we all consume fossil fuels in one form or another. In 2021, the world consumed nearly 490 exajoules of fossil fuels, an unfathomable figure of epic proportions. To put fossil fuel consumption into perspective on a more individual basis, this graphic visualizes the average person’s fossil fuel use over a lifetime of 80 years using data from the National Mining Association and Worldometer.”, Visual Capitalist, July 22, 2022

“13 Styles Of Fried Chicken Around The Globe – Across the globe, unique styles of fried chicken can be found in street corner stalls, fast food takeaways, and family dinner tables. Thankfully, there are home cooks, expat chefs, and even entire restaurant franchises devoted to the crispy poultry sharing both traditional and modern styles of the beloved dish across regions and borders. With so many ways to marinate and season, each country’s signature style of fried chicken has evolved to reflect its distinct history, culture, and tastes.”, Tasting Table, July 25, 2022

“The 12 Covenants of Success – True success is developed and built in a multimodal fashion. There is never one sure path to any goal, or one sure path to any climb up the mountain. Success, however, can be built upon following certain covenants or formulas that have been passed down throughout history for us to utilize in our own unique ways. If you follow these covenants, success is sure to follow.”, Entrepreneur, May 19, 2022

To receive this biweekly newsletter, click here : https://bit.ly/geowizardsignup

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the world that impacts new trends, health, consumer spending, business investment, economic development and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing environment. Our GlobalTeam™ covering 43 countries provides us with updates about what is happening in their specific countries.

To sign up for our biweekly newsletter click here: https://bit.ly/geowizardsignup

William (Bill) Edwards has a four-decade career successfully accelerating the international growth of more than 40 brands. He has directed projects on-site in Alaska, Asia, Europe and the Middle and Near East and has lived in China, the Czech Republic, Hong Kong, Indonesia, Iran and Turkey. Edwards Global Services, Inc. (EGS) provides a complete International solution for companies Going Global. From initial global market research and country prioritization, to developing new international markets, providing in-country operations support and problem solving around the world. EGS has twice received the U.S. President’s Award for Export Excellence. For advice on doing business successfully across 40+ countries, contact Bill Edwards at bedwards@edwardsglobal.com or +1 949 224 3896.

Download our latest chart ranking 40+ countries as places to do business at this link:

Our latest GlobalVue™ 40 country ranking

EGS Biweekly Global Business Newsletter Issue 60, Tuesday, July 12, 2022

Edited and curated by: William (Bill) Edwards, CFE, CEO of Edwards Global Services, Inc. (EGS)

I am on a two week business trip to Australia and New Zealand which are fast coming out of two years of pandemic lockdown. This issue we look at where China’s economy is going for the rest of 2022, more foreign brands fully exit Russia, the cost of living around the world, the COVID-19 pandemic impact on global executive sentiment and beating supply chain challenges for food brands. And my favorite airplane – the Airbus 380 – has returned to service. And India will surpass China’s population next year.

To receive this biweekly newsletter, click here : https://bit.ly/geowizardsignup

First, A Few Words of Wisdom From Others

“ Change something by even the smallest percentage and your outcomes will be different.”, Elaine Harrison

“Adapting does not mean permanent changes, it just means making small, quick adjustments.” Hany Kubba, The Teaching Blueprint

“Disruption is the new order. The only constant is change.”, Rob Moore

Highlights in issue #60:

- Brand Global News Section: Checkers & Rallys®, Dominos®, Holiday Inns®, KFC®, McDonalds®, PoolWerx®, Restaurant Brands, Starbucks®, YUM Brands,

NOTE: Bolded headlines are live links to published articles where the article is freely available

Interesting Data and Studies

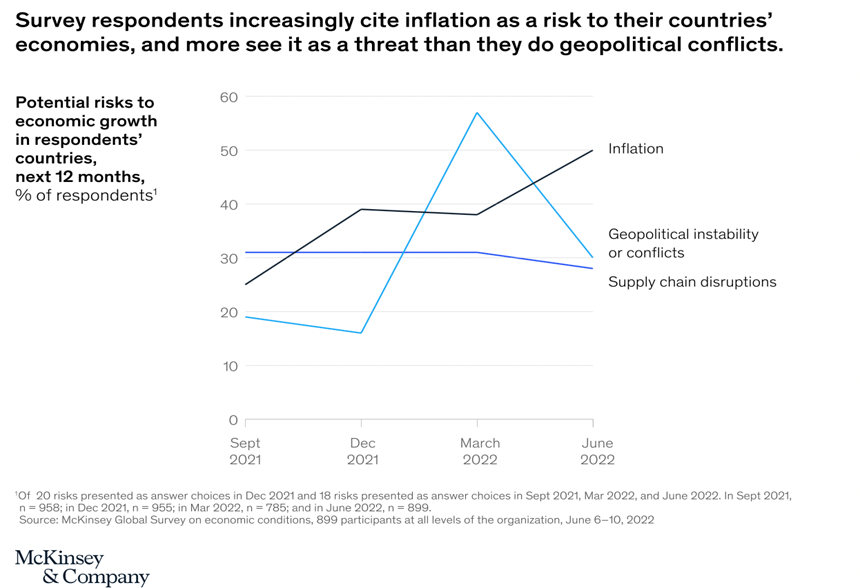

“The coronavirus effect on global economic sentiment – Just one quarter after geopolitical conflicts and instability overtook the COVID-19 pandemic as the leading risk to economic growth, (global executive) survey respondents’ concerns over inflation now exceed their worries about the effects of geopolitical issues on their countries’ economies. In the latest McKinsey Global Survey on economic conditions, respondents most often cite inflation as a risk over the next year.”, McKinsey & Co., June 29, 2022

Global Supply Chain, Energy, Commodities, Inflation & Trade Issues

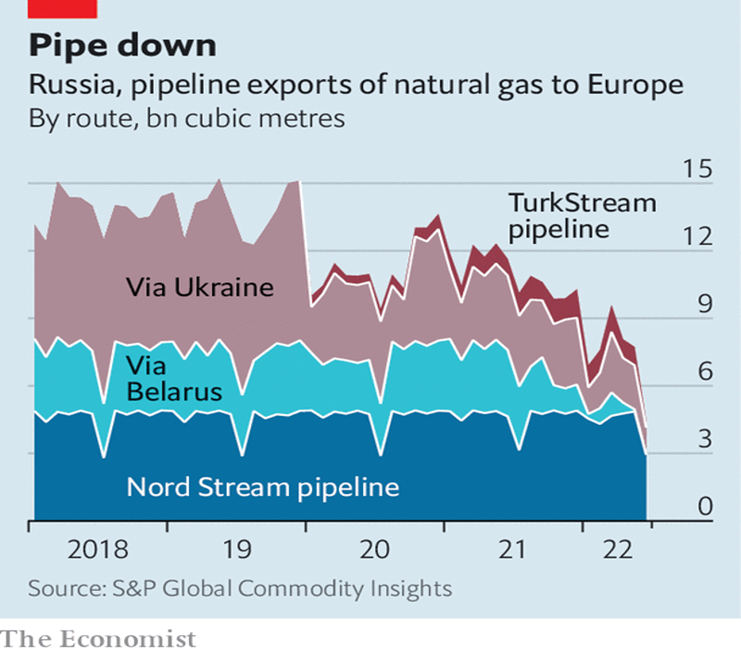

“Europe is preparing for Russian gas to be cut off this winter – An EU-wide plan is needed to cope. Gazprom, Russia’s state-controlled gas goliath, has been squeezing the Europeans for months. s&p Global, a research firm, reckons that in June Russia piped just 4.7bn cubic metres (bcm) to Europe, barely a third of the level in early 2021. Now Russia is squeezing even harder. On June 16th it slashed exports via ns1 to 40% of capacity, citing technical snags. On the morning of July 11th Russia shut down all gas exports via ns1 for about ten days of maintenance.”, The Economist, July 11, 2022

“There’s a massive pile-up of car, furniture exports bound for U.S. and it’s spreading across European ports – Labor slowdowns and strikes at the German and Netherland ports are creating a massive pile-up of export containers bound for the U.S. that will take months to clear out. “U.S. importers need to look four to five weeks in advance to see if there is a vessel available,” said Andreas Braun, Europe, Middle East, and Africa ocean product director of Crane Worldwide Logistics. “This is not normal. Also, if you are lucky to book a slot on a vessel you then have to locate an empty container which can be in the hinterland.”, CNBC, July 1, 2022

“How inflation is flipping the economic script – The liftoff in fertilizer prices, along with other fallout from the war in Ukraine, has pushed prices for basic foods much higher. Since 2021, food prices have risen to their highest level since the United Nations’ Food & Agriculture Office began its index. And the war in Ukraine has lifted food prices to an entirely new level.”, McKinsey & Co., July 6, 2022

“How to fight supply chain issues in food service – When asked what issues plague operators the most, among the answers are supply chain disruptions, which affect suppliers and distributors, too, said Brian Warrener, an associate professor at Johnson and Wales University, at the National Restaurant Association in May. Warrener teaches food & beverage hospitality and management. Warrener said that food costs are up 13%, industry wages are up 11% and industry prices are up 8%. When it comes to food costs, beef is up 23%, eggs 31%, chicken 27% and cooking oil 44%. He said 96% of operators report delays in the supply chains.”, QSRweb.com, June 29, 2022

Global, Regional & Local Travel Updates

“Three British bosses plot a ‘golden age of air travel’ in the Gulf – The chief executives of Emirates, Etihad and Dubai airport have different plans for luring passengers, going green — and making money. These three British chief executives handle more long-haul international passengers than the bosses of any other airlines or airports. As rival operators, notably British Airways and Heathrow and Manchester airports struggle to cope with rising demand, they want to cash in and “create a new golden age of travel,” as Griffiths puts it.”, The Sunday Times of London, July 10, 2022

“Swiss travel retailer Dufry to acquire Italy’s Autogrill – Duty-free retailer Dufry said on Monday it would acquire Italian airport and motorway caterer Autogrill expanding the Swiss company’s growth opportunities in international markets as travel rebounds. Basel-based Dufry operates around 2,200 shops at airports, cruise liners, seaports and other tourist locations worldwide. Autogrill runs bars, cafes and restaurants at 139 airports internationally, including 80 in North America, as well as on motorways in Europe. Dufry said the combined company will cater to 2.3 billion passengers in more than 75 countries….”, Reuters, July 11, 2022

“A380 Superjumbo Makes Return as Travel Demand Skyrockets – Qantas, who parked all 12 of its A380s in the California desert, said when the pandemic began that it wouldn’t need any of them for at least three years and now, just over two years later, the carrier says it will begin to return to service. British Airways has already begun to fly the A380 again and plans to ramp up service over the coming months. Asiana Airlines announced it would bring back its A380s within a month and Lufthansa announced on Monday that its A380s would make a return to service in 2023.”, AirlineGeeks, June 28, 2022

“Flying will become more expensive for passengers’, warns former British Airways boss – Flying will become more expensive because of soaring oil prices, the former head of British Airways has warned. Willie Walsh, the former chief executive of the airline, also said passengers are set to face problems at UK airports as they try to go away this summer…..The aviation industry is suffering major disruption as a surge in demand for travel coincides with staff shortages across roles such as airline crew, ground handlers, airport security staff and air traffic controllers.”, Yahoo! News, July 11, 2022

Country & Regional Updates

Canada

“Canada’s unemployment rate fell to record low in June, despite losing 43,000 jobs – Financial analysts were expecting a gain of 22,500 positions. The job losses were concentrated among the self-employed and those 55 and older. Hiring conditions remain challenging in Canada, and at last count employers were recruiting for about one million positions – far higher than job-vacancy levels before the pandemic.”, The Globe and Mail, July 8, 2022

China

“Where Analysts Think China’s Economy Is Going This Year – In late May, policymakers rolled out a stimulus package containing 33 measures, including tax and fee cuts, favorable loans for certain sectors and accelerated local government bond issuances for infrastructure investment…..It’s possible that there will be further regional outbreaks and lockdowns due to the harder-to-contain omicron variant, while low confidence is likely to be more persistent, they said.”, Caixing Global, June 24, 2022

“Record 274 Companies Apply for IPOs in Last Week of June – A record number of companies are rushing to submit applications for initial public offerings (IPOs) on China’s A-share market even as a rising number of others are withdrawing flotation plans. In the last week of June, 247 companies submitted IPO applications, the highest weekly number on record. A total of 921 companies are in line to raise money by selling shares on the Shanghai, Shenzhen and Beijing stock exchanges.”, Caixing Global, July 7, 2022

“Coffee is fragrant again about 800 Starbucks Shanghai stores resume dine in – On June 29, 2022, the first day that Shanghai opened its dine-in restaurants in an orderly manner, the long-awaited coffee shop also opened its doors to welcome guests. On the same day, about 800 Starbucks Shanghai stores took the lead in fully resuming dine-in.”, Yical, June 29, 2022. Compliments of Paul Jones, Jones & Co., Toronto

Germany

“The German Trade Deficit Is No Cause for Alarm – Germans have long placed too much emphasis on the importance of a surplus to their country’s prosperity. In May, for the first time in more than three decades, Germany’s storied trade surplus disappeared. Not only is imported natural gas more expensive, but demand in China is falling — neither of which is good news for Germany. Nevertheless, the fallout will be more manageable than many people expect, the Germans included.”, Bloomberg, July 7, 2022

Greece

“Greek Tourism Boom Means Growth May Top 3.2%, Stournaras Says – The Greek economy may grow more than expected as tourists return to the country in greater numbers, according to the central bank chief. The country also is in a better situation than some of its euro-area peers in regard to the threat of Russia cutting off energy deliveries. Greece will likely avoid a recession should shipments halt completely, Stournaras said.”, Bloomberg, July 10, 2022

India

“India to Surpass China as Most-Populous Nation in 2023 – UN had previously estimated India to cross milestone by 2027 Report pegs global population growth at 8.5 billion by 2030. The UN expects global population to hit 8 billion on Nov. 15 and grow to 8.5 billion by 2030. More than half the projected rise between now and 2050 is expected to be in just eight countries: Congo, Egypt, Ethiopia, India, Nigeria, Pakistan, the Philippines and Tanzania….”, Bloomberg, July 12, 2022

Japan

“Why most overseas visitors to Japan are on business trips, with the country opening up cautiously. Japan is allowing in overseas visitors on official tour groups, but most arrivals are there on business trips and fitting in some sightseeing. Some of these ‘bleisure’ travellers said they had no problem getting into Japan, while others complained of having to jump through too many hoops.”, South China Morning Post, July 11, 2022

Russia

“Russians served mouldy burgers in McDonald’s replacement restaurants – Now diners at the new Vkusno & Tochka outlets (translated from Russian as “tasty and that’s it”) posted photos of their food on social media, New York Post reports. The disturbing images show mould on the hamburger buns. Other customers have reported finding insect legs in the meat patties, according to the Daily Mail.”, News.com.au, July 6, 2022. Compliments of Jason Gehrke, Publisher & Editor, Franchise Advisory Centre, Brisbane

“McDonald’s simplifies franchising policies to attract more diverse candidates – Starting in 2023, the fast-food giant will evaluate every potential new operator equally. In the past, the spouses and children of current franchisees have been given preferential treatment. The company recently came under pressure for a plan to roll out a new grading system early next year that rankled some franchisees, who have concerns about potentially alienating workers.”, CNBC, June 23, 2022

“Starbucks found a buyer for the Russian business – Restaurateur Anton Pinsky will most likely become the new owner of the chain. The deal can be closed as early as the 20th of July, it will include lease rights to all areas of Starbucks coffee shops with renovation (but without the possibility of using Starbucks products and technologies), as well as premises in the Pushkino Park shopping center, which is located at the company owned, say the interlocutors of Vedomosti. The new owner of the network will also have to rebrand it, as happened with McDonald’s earlier (renamed to “Tasty – and that’s it!”)…”, Vedomosti, July 7, 2022. Compliments of Paul Jones, Jones & Co., Toronto

“Fast Food Giant Yum Brands Announces Plans to Leave Russia With KFC Sale – One of the world’s largest restaurant companies, Yum Brands Inc, announced Tuesday it is “in advanced talks” to sell its KFC restaurants and franchise in Russia. The American company plans to fully exit the Russian market after selling the brand to a local buyer, state-run news agency Interfax reported. The company has already sold its Pizza Hut business to a Russian company Noi-M.”, The Moscow Times, July 5, 2022. Compliments of Paul Jones, Jones & Co., Toronto

“IHG Hotels and Resorts To Cease All Operations in Russia – On April 8, the company shared it was in discussions with the owners of its 28 IHG-branded hotels in Russia “regarding the complex, long-term management and franchise contracts under which these hotels operate,” according to the statement. The InterContinental Moscow – Tverskaya opened in 2011 and is the company’s highest-profile branded hotel in the country. Crowne Plaza and Holiday Inn hotels are prevalent across the country, and a Staybridge Suites and a Hotel Indigo round out the company’s portfolio there.”, Hotel News Now / Costar, June 27, 2022. Compliments of Paul Jones, Jones & Co., Toronto

Singapore

“Singapore’s Sky-High Car Prices Are Warning for Global Cities – City-state’s taxes have pushed car prices to as much as a flat Government restricts sales to prevent congestion, pollution. Singapore media professional Ellie Lim gave up her plan to buy a new Volvo SUV to ferry her newborn baby when she realized it was going to cost her more than S$200,000 ($142,000). ‘I was quite shocked,’ said Lim, 34. Coupled with high interest rates on car loans, fuel prices and maintenance fees, buying a new car is ‘a financially unsound decision,’ she said.”, Bloomberg, July 6, 2022

Turkey

“Turkey hit with soaring prices as inflation nears 80% – Growth in annual prices rose from 73.5% in May to 78.6% in June, but real rate could be double official figure. The growth in annual prices rose from 73.5% in May to 78.6% in June, according to the Turkish statistics agency. However, opposition parties and economists said recent hikes in oil and gas prices meant the real rate of inflation was almost double the official figure.”, The Guardian, July 4, 2022

United Kingdom

“UK Tax Cuts Feature at Heart of Race to Replace Johnson – The contest to succeed Boris Johnson as UK prime minister is likely to become a battle over hand-outs for households, with limited interest in fiscal restraint. Tax cuts and aid for families struggling with a surge in the cost of living are already at the heart of the political debate, and pressures for largess from the Treasury will only increase during the next few weeks. By September, when the ruling Conservative Party aims to install a new leader, the government is likely to face strike threats from public sector workers demanding higher pay.”, Bloomberg, July 10, 2022

United States

“Supply Chain Taking Toll on US Business – More than a third of US retailers are just two months away from running out of cash, according to a new survey from Brightpearl. There’s more. The study of 500 retailers also found 80 percent have been hit with supply problems in the last year; 52 percent have experienced stockouts, resulting in a loss of sales; and the supply crisis has added 23 percent to retailers’ costs over the last year, with 51% saying they have increased prices as a result.”, Franchising.com, July 2022

“Workers in America’s biggest cities are defying their bosses and avoiding the office – In-office visits in San Francisco, New York City, and Chicago still aren’t as frequent as they were before the pandemic, according to new research from locational analysis software Placer.ai that analyzed foot traffic data in nearly 200 office buildings in all three cities. If any trend has emerged from the Great Resignation and the past two years of remote work, it’s that white-collar employees generally like workplace flexibility. What they don’t like as much—the office. Research from McKinsey & Co. found that 58% of Americans have the option to work remotely at least one day a week.”, Fortune, July 2, 2022

“A Small Business Hiring Surge – Owners fear recession but are still adding workers. The owners of small U.S. firms went on a hiring binge last month and continue to raise compensation to attract and retain scarce workers. That’s according to the latest monthly employment survey from the National Federation of Independent Business, due out later today. What makes this strong desire to hire especially odd is that it is occurring even as the owners of small firms are more pessimistic about future business conditions than they’ve been in at least 48 years, according to NFIB.”, The Wall Street Journal, July 7, 2022

Brand News

“Checkers & Rally’s Taking a Big Bite Out of Franchise Fees and Royalties – In 2022, the brand is offering incentives of as little as 2% royalties for the first year for franchisees opening one or two restaurants on schedule, to 0 percent royalties for franchisees who open three restaurants on schedule and within a set time period. Beyond those enticing incentives, there is also a reduction in franchise fees for veterans and women entrepreneurs interested in franchising with the Tampa, Florida-based brand.”, Franchising.com, July 2022

“Domino’s (Australia) adds pizza delivery charges as costs bite fast food sector – Pizza chain Domino’s has introduced a 6 percent delivery fee for online orders as rising food and fuel costs begin to bite across Australia’s fast food industry. The ASX-listed pizza maker told The Sydney Morning Herald and The Age it had introduced the fee to cover the increasing costs of doing business.”, Brisbane Times, July 5, 2022

Global investment firm Norwest invests in Poolwerx pool and spa franchise network – US-based global venture and growth equity investment firm Norwest has invested a substantial amount in Poolwerx to support the franchisor’s plans for ambitious growth. Poolwerx founder and CEO John O’Brien says the investment will bring additional expertise and opportunities to enable Poolwerx to grow bigger and faster in Australia, New Zealand and the US.”, Splash Magazine (Australia), July 7, 2022

“Restaurant Brands International – Second Quarter Results Likely To Beat Expectations On Strong Business Momentum. The opening up of Canada and the firm’s international markets was possibly a continued predominant tailwind for sales. Digital, delivery, and increased dine-in sales which drove upside over the first quarter, probably delivered during the second quarter as well. Burger King U.S. likely continued to recapture market share due to turnaround efforts.”, Seeking Alpha, June 30, 2022

“Yum Brands is completely exiting Russia – After Yum completes the transfer of ownership of all KFC restaurants in Russia to a local operator, the process of exiting the contentious country will be complete.”, Nation’s Restaurant News, July 5, 2022

Articles & Studies For Today And Tomorrow

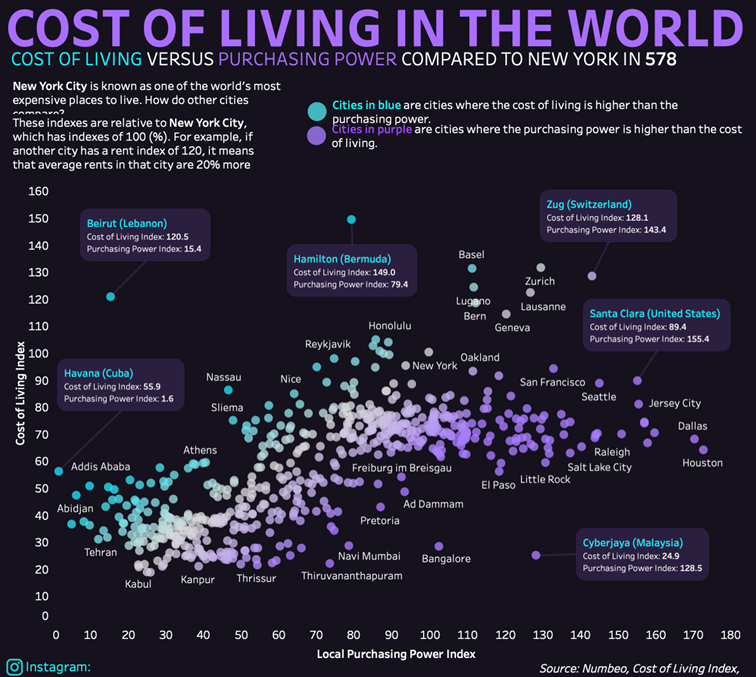

“Comparing the Cost of Living Around the World – The amount of money that’s needed to pay for day-to-day expenses like housing and food varies greatly from city to city. And some cities, like New York City, are known as especially expensive places to live. This graphic by Victor Dépré (hypntic.data) uses 2022 data from Numbeo to compare the cost of living and purchasing power in 578 different cities around the world, using New York City as a benchmark for comparison.”, Visual Capitalist / Numbeo, July 8, 2022 NOTE: The graphic at the link is interactive for the 578 cities.

To receive this biweekly newsletter, click here : https://bit.ly/geowizardsignup

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the world that impacts new trends, health, consumer spending, business investment, economic development and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing environment. Our GlobalTeam™ covering 43 countries provides us with updates about what is happening in their specific countries.

To sign up for our biweekly newsletter click here: https://bit.ly/geowizardsignup

William (Bill) Edwards has a four-decade career successfully accelerating the international growth of more than 40 brands. He has directed projects on-site in Alaska, Asia, Europe and the Middle and Near East and has lived in China, the Czech Republic, Hong Kong, Indonesia, Iran and Turkey. Edwards Global Services, Inc. (EGS) provides a complete International solution for companies Going Global. From initial global market research and country prioritization, to developing new international markets, providing in-country operations support and problem solving around the world. EGS has twice received the U.S. President’s Award for Export Excellence. For advice on doing business successfully across 40+ countries, contact Bill Edwards at bedwards@edwardsglobal.com or +1 949 224 3896.

Download our latest chart ranking 40+ countries as places to do business at this link:

Our latest GlobalVue™ 40 country ranking