EGS Biweekly Global Business Newsletter Issue 59, Tuesday, June 28, 2022

Edited and curated by: William (Bill) Edwards, CFE, CEO of Edwards Global Services, Inc. (EGS)

How interest rate hikes around the world tie to inflation rates. Asia Pacific air travel begins to recover. How the pandemic impacted the rule of law worldwide. Lego’s® to be made once again in the USA. The top wheat, corn and sunflower oil exporters. And breaking down the world’s population by age group.

To receive this biweekly newsletter, click here : https://bit.ly/geowizardsignup

First, A Few Words of Wisdom From Others

“Good judgement comes from experience, and experience comes from bad judgement.”, Rita Mae Brown

“Experience is the teacher of all things.”, Julius Caesar

“The only source of knowledge is experience.”, Albert Einstein

Highlights in issue #59:

- Brand Global News Section: Lego’s®, Little Caesar’s®, McDonald’s®, Pizza Hut®, Popeyes®, Wendy’s® and Wingstop®

Interesting Data and Studies

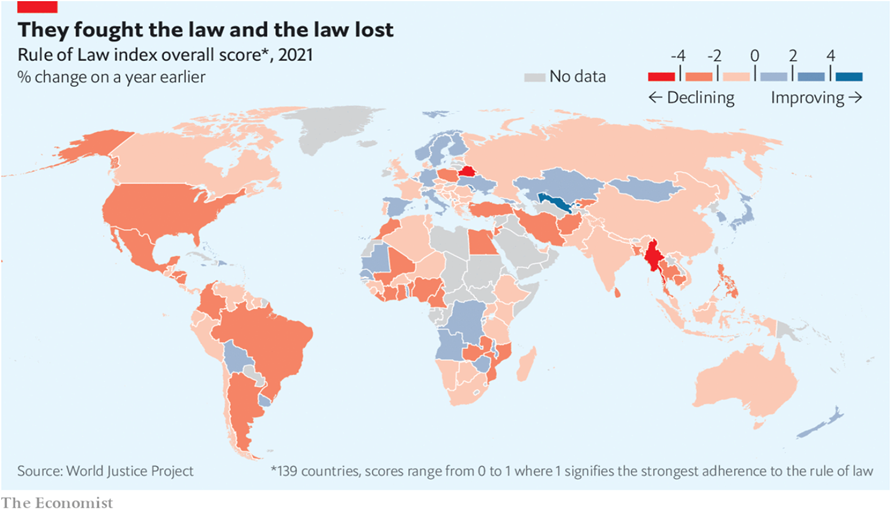

“The pandemic has accelerated a global decline in the rule of law – But it has also brought some needed change to the way justice is administered. Compiled by the World Justice Project (wjp), a Washington-based charity, the Rule of Law index, published annually since 2009 and now covering 140 countries, draws on tens of thousands of responses from households, legal practitioners and experts. It asks about people’s experience of the justice systems in their countries, and produces scores based on factors such as the constraints on government power, corruption, regulatory implementation, order and security, and the enforcement of civil and criminal law.”, The Economist, June 7, 2022

Global Energy & Commodities

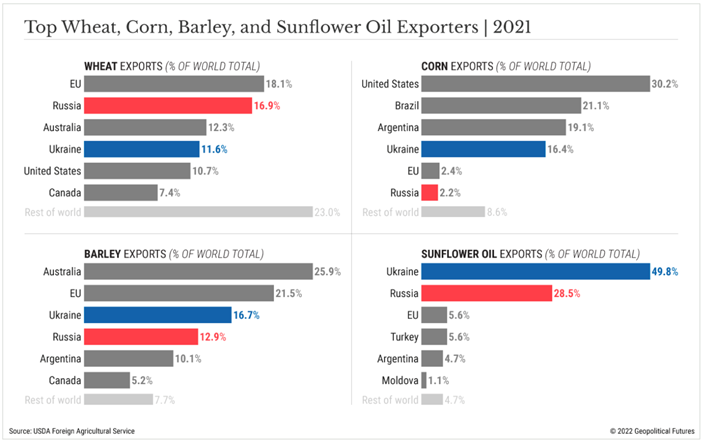

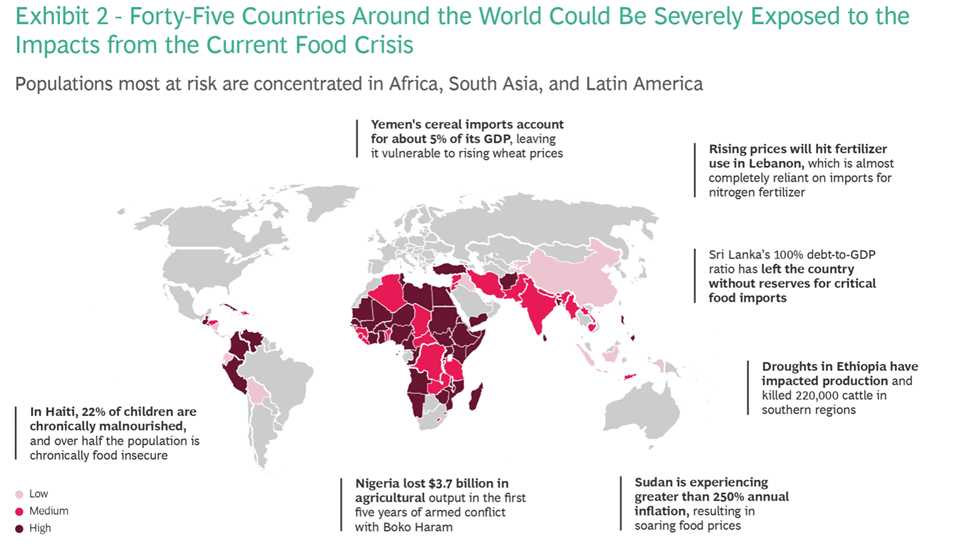

“The Global Economy: Commodities Crisis – The war in Ukraine is exacerbating pre- existing problems with global grain supplies and prices. Although higher prices will be felt by all, North African and Middle Eastern countries along the Mediterranean will be more directly and severely affected. Sudden spikes in food prices are directly linked to increased social unrest and conflict. Further, instability in this region could put fertilizer supplies at risk, which would put only more upward pressure on food prices.”, Geopolitical Futures, June 2022

Global Supply Chain, Commodities, Inflation & Trade Update

“2022 Third-Quarter Forecast – During the third quarter of 2022, the combination of high energy and food prices, supply chain bottlenecks, geopolitical uncertainty and the tightening of monetary policy by central banks will slow economic activity in most parts of the world. While the drivers of slowing growth will be similar, the consequences will change from region to region.” Stratfor Worldview, June 27, 2022

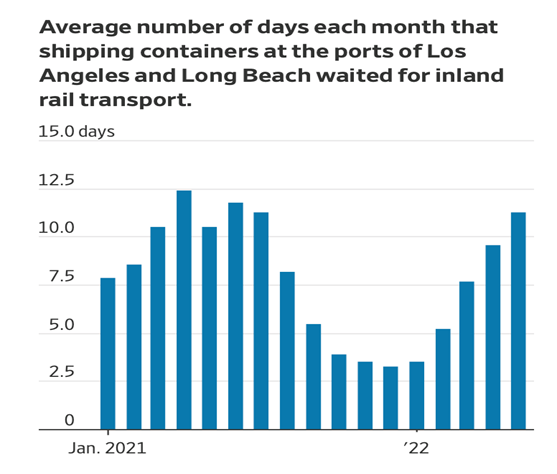

“U.S. Port Backups Are Extending Into Freight Rail Supply Chains – The congestion is raising costs and adding complications for importers managing the flow of goods in a fragile U.S. economy.

Some retailers are waiting weeks to move cargo by train out of Southern California’s ports of Los Angeles and Long Beach, while others are giving up on the railroads and shifting shipments of furniture, apparel and other consumer goods to trucks for long inland journeys on highways.” Wall Street Journal, June 24, 2022

Global, Regional & Local Travel Updates

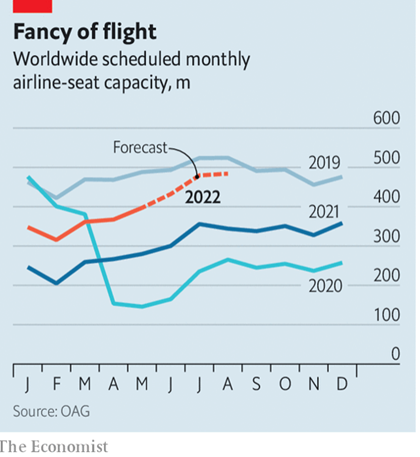

“Pent-up demand for travel is becoming un-pent,’ says Andrew Charlton of Aviation Advocacy, a consultancy.

The number of seats available on European airlines in the week commencing June 6th was only 9% below the same week in 2019. In North America it was just 5.6% down, according to oag, another consultancy…..up to September sales for international routes are at 72% of their level in 2019 and those on domestic ones are at 66%, according to iata, an industry body.”, The London Economist, June 9, 2022

“Air New Zealand Relaunches International Routes to Meet Travel Demand – Air New Zealand has announced the recommencement of 14 international routes over a 16-day period in July. According to the New Zealand Herald, the airline will relaunch services from Auckland to destinations such as Tahiti, Honolulu and Houston that have not seen service for just over 800 days.” , Air Geeks, June 24, 2022

Country & Regional Updates

Australia

“Minimum wage increase: Bosses slam Fair Work Commission’s pay boost – On Wednesday morning, the Fair Work Commission announced the national minimum wage would rise by 5.2 per cent to $21.38 per hour or $812.60 per week, representing an increase of $40 per week. Modern award minimum rates will also go up 4.6 per cent “subject to a minimum increase of $40 per week”, and both increases will come into effect from July 1 for most workers.”, News.com.au, June 16, 2022. Compliments of Jason Gehrke, Managing Director, The Franchise Advisory Centre, Brisbane

China

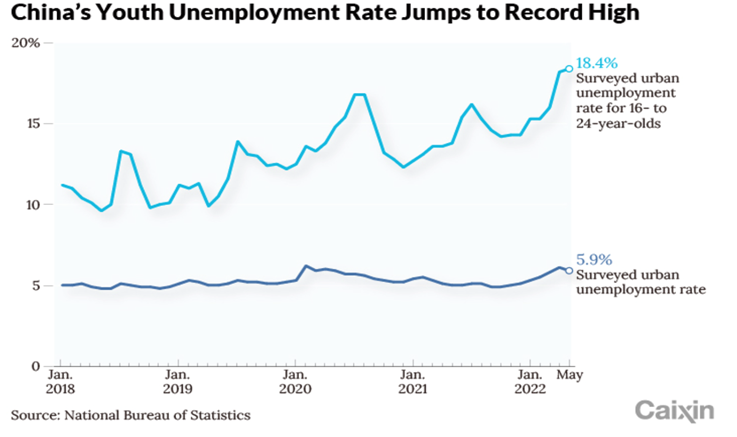

“China’s Record High Youth Unemployment Rate – China’s youth unemployment rate in urban areas in May was the highest since records began in 2018 as Covid-19 lockdowns restricted mobility and weighed on the labor market, with the government warning the situation could get worse as millions of fresh graduates start looking for work. The surveyed urban unemployment rate among workers aged 16 to 24 — which captures graduates from high school and college — climbed to 18.4% in May from 18.2% in April….”, Caixing Global, June 15, 2022

Germany

“Another strike at major German ports as pay negotiations break down again – As the RMT union leads UK rail workers in their second day of walkouts, new industrial action is also under way at German ports. Negotiations in Bremen between German trade union ver.di and the Central Association of German Seaport Companies (ZDS) broke down yesterday. Beginning at 6am, the strikes are affecting the ports of Bremerhaven, Hamburg and Wilhelmshaven – road, rail and sea cargo, Maersk said – and run until 6am tomorrow.”, The Loadstar, June 23, 2022. Compliments of Vince Iacopella, EVP Growth and Strategy, Alba Wheels Up International Inc.

Spain

“Amazon to add 2,000 jobs to its Spanish payroll in 2022 – U.S. online retailer plans to add 2,000 new jobs to its Spanish payroll in 2022, the company’s local unit said on Thursday, a move that will take the total number of employees in Spain to 20,000 by the end of the year. The new hirings include more than 500 jobs within high-demand sectors such as engineering, software development, data science and machine learning….”, Reuters, June 23, 2022

United Kingdom

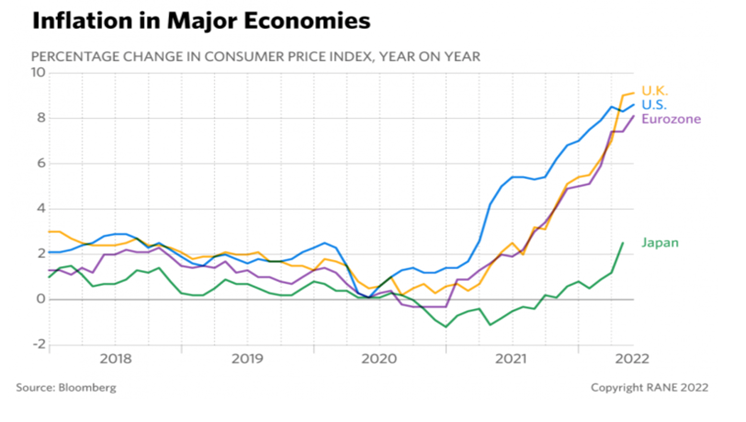

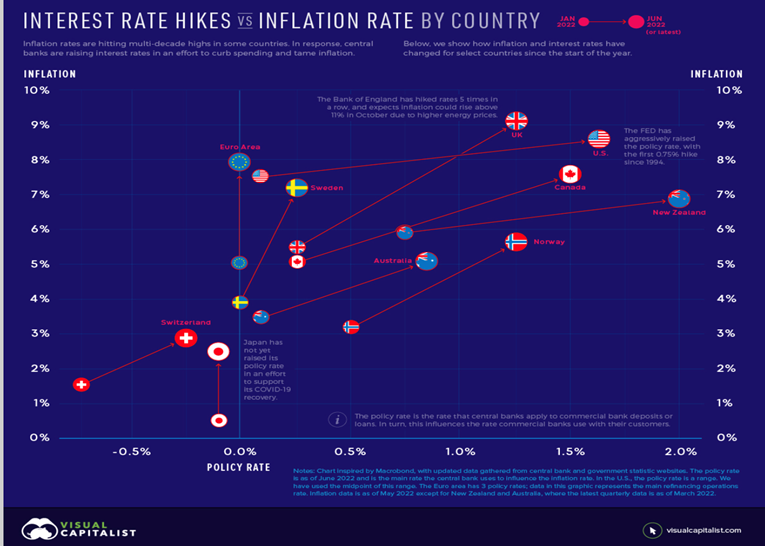

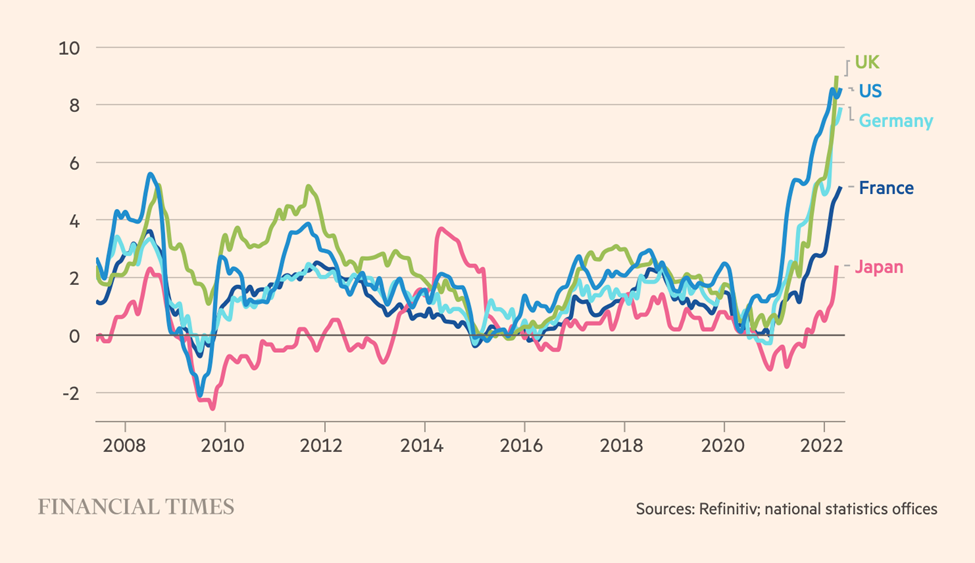

“Interest rates set to rise to 1.25% as Bank tries to curb inflation – Interest rates will rise today for the fifth time in a row to 1.25 per cent amid calls for Boris Johnson to level with the public about the cost of living crisis. The Bank of England is expected to increase rates by 0.25 percentage points from what was already a 13-year high as it seeks to rein in inflation. The Federal Reserve, America’s central bank, went further yesterday, increasing interest rates by 0.75 percentage points, the sharpest rise since 1994.”, The Times of London, June 15, 2022

United States

“Lego Brings Manufacturing Back To The U.S., 15 Years After Pulling Plug – The Denmark-based toy company, which makes the colorful plastic building blocks that kids have played with for nine decades, said on Wednesday that it plans to invest more than $1 billion in a new manufacturing plant in Virginia. The move will allow it to shorten the distance that its products have to travel to reach the U.S., one of its biggest markets, it said, and thereby avoid the global supply chain chaos that has resulted in major delays and increased costs during the pandemic.”, Forbes, June 15, 2022

Brand News

“This National Pizza Chain Just Announced Plans to Open 1,000 New Locations – In the mood for some pizza? Little Caesars is counting on it and making moves that will ensure every corner of the country has access to their hot-n-ready pies. The majority of Little Caesars franchises currently dominate the New York, New England, and Hawaii markets—but the brand recently expanded internationally in Russia, Spain, Columbia, and Barbados. It’s looking to also open more in Brazil, France, the Philippines, Malaysia, and the United Arab Emirates.”, Eat This, Not That, June 23, 2022

“The former McDonald s opened under the new brand Vkusno and that’s it – Big Mac and McFlurry will disappear from the menu, and prices will be higher. The first 15 restaurants of the former fast food chain McDonald’s opened last weekend under the new brand “Tasty – and that’s it.” By the end of the month, the number of open restaurants will increase to 200. The American corporation, which managed 718 restaurants in 45 regions, sold the Russian business at a significant discount, reserving the opportunity to buy it back within 15 years, the new owner of the chain, Alexander Govor, told Vedomosti in an interview.”, Vemdoosti.ru, June 13, 2022. Compliments of Paul Jones, Jones & Co., Toronto. (English translation available on Google)

“Allegro taps bankers to deliver Pizza Hut exit – Allegro Funds’ turnaround at Pizza Hut Australia looks just about complete, with the private equity firm preparing to hang up the for-sale sign and seek a growth-minded buyer. Six years after taking the reins, and after a lengthy restructure, it is understood Allegro Funds has hired Miles Advisory and had the firm’s dealmakers preparing potential buyers for a confidential auction.”, Australia Financial Review, June 13, 2022. Compliments of Jason Gehrke, Managing Director, The Franchise Advisory Centre, Brisbane

“US Fried-Chicken Chain Popeyes Expands in UK With Six New Sites….where its first location has become the brand’s best-performing restaurant globally since it launched last year. Popeyes, owned by Restaurant Brands International Inc., will roll out sites in Nottingham, Gateshead, Oxford, Reading, Brighton and Ealing. It currently runs delivery kitchens around London and a take-away restaurant in east London’s Stratford, now the best-performing of Popeyes’ 3,600 worldwide. The company also opened a sit-in restaurant in Chelmsford over the weekend.”, BBN Bloomberg, June 13, 2022

“Wendy’s New Zealand up for sale – The New Zealand arm of the well-known Wendy’s hamburger chain is on the market, including all 22 company-owned stores. Wendy’s NZ, the current master franchisee, owner and operator of all Wendy’s hamburger restaurants throughout New Zealand, is on the market for the first time in 34 years.:”, Franchise New Zealand magazine, June 23, 2022

“Wingstop opens its first restaurant in Canada – the company is opening a location this month in Toronto, one of 100 planned for the country as the chicken wing chain pushes international growth more aggressively…..The vast majority of the brand’s 1,800 locations are in the U.S., but a growing number of them are outside the country. Wingstop finished 2021 with just under 200 locations, up by 160% over the past five years, according to Technomic. The brand has found success in Mexico, Europe, Asia Pacific and the Middle East.”, Restaurant Business, June 20, 2022

Articles & Studies For Today And Tomorrow

“Interest Rate Hikes vs. Inflation Rate, by Country – Imagine today’s high inflation like a car speeding down a hill. In order to slow it down, you need to hit the brakes. In this case, the “brakes” are interest rate hikes intended to slow spending. However, some central banks are hitting the brakes faster than others. This graphic uses data from central banks and government websites to show how policy interest rates and inflation rates have changed since the start of the year. It was inspired by a chart created by Macrobond.”, Visual Capitalist, June 24, 2022

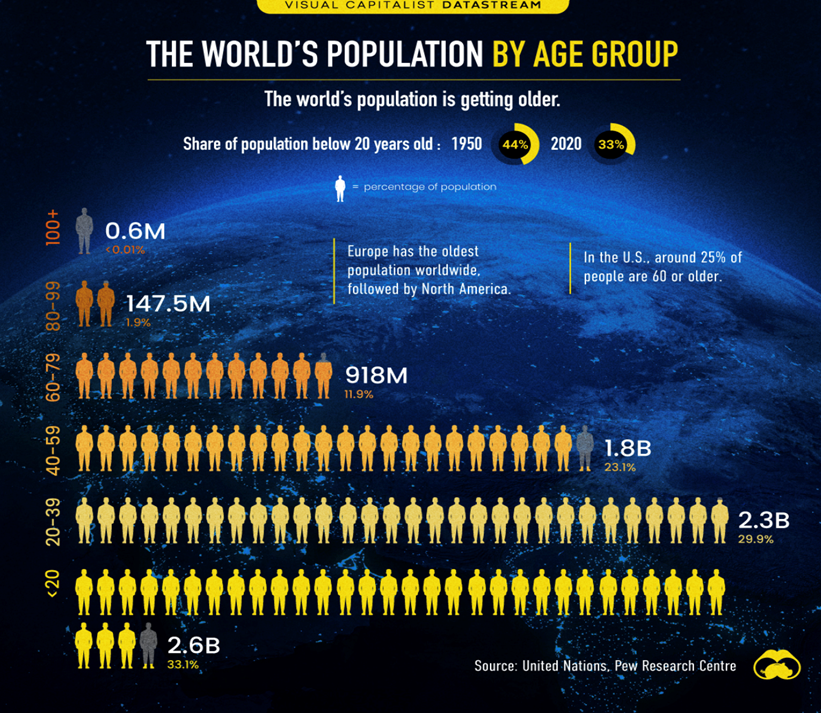

“Visualizing the World’s Population by Age Group – An aging population can have far-reaching consequences on a country’s economy. With this in mind, today’s graphic looks at the age composition of the global population in 2020, based on the latest figures from the United Nations. Our global population is getting older, largely because of increasing life expectancies and declining birth rates. In 2020, more than 147 million people around the world were between the ages of 80-99, accounting for 1.9% of the global population.”, United Nations, Pew Research Center, June 16, 2022

To receive this biweekly newsletter, click here : https://bit.ly/geowizardsignup

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the world that impacts new trends, health, consumer spending, business investment, economic development and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing environment. Our GlobalTeam™ covering 43 countries provides us with updates about what is happening in their specific countries.

To sign up for our biweekly newsletter click here: https://bit.ly/geowizardsignup

William (Bill) Edwards has a four-decade career successfully accelerating the international growth of more than 40 brands. He has directed projects on-site in Alaska, Asia, Europe and the Middle and Near East and has lived in China, the Czech Republic, Hong Kong, Indonesia, Iran and Turkey. Edwards Global Services, Inc. (EGS) provides a complete International solution for companies Going Global. From initial global market research and country prioritization, to developing new international markets, providing in-country operations support and problem solving around the world. EGS has twice received the U.S. President’s Award for Export Excellence. For advice on doing business successfully across 40+ countries, contact Bill Edwards at bedwards@edwardsglobal.com or +1 949 224 3896.

Download our latest chart ranking 40+ countries as places to do business at this link:

Our latest GlobalVue™ 40 country ranking

EGS Biweekly Global Business Newsletter Issue 58, Tuesday, June 14, 2022

Edited and curated by: William (Bill) Edwards, CFE, CEO of Edwards Global Services, Inc. (EGS)

Our company’s June 2022 quarterly EGS GlobalVue™country ranking chart is out. The U.S. stops requiring COVID tests to enter the country. Economic optimism in India and Indonesia. Premium gasoline is US$7/gallon in California. McDonald’s clones open in Moscow. China’s small businesses are the post-COVID focus.

To receive this biweekly newsletter, click here : https://bit.ly/geowizardsignup

First, A Few Words of Wisdom From Others

“Life is like a camera. Focus on what is important. Capture the good times. Develop from the negatives. And if things do not work out, take another shot!!”, Anonymous

“Yesterday is history. Tomorrow is a mystery. And today? Today is a gift. That’s why we call it the present.”, Babatunde Olatunji

“Happiness is not something ready made. It comes from your own actions.”, The Dalai Lama

Highlights in issue #58:

- Brand Global News Section: Denny’s®, KFC®, McDonald’s®, Panera Bread®, Subway®, Taco Bell®

Interesting Data and Studies

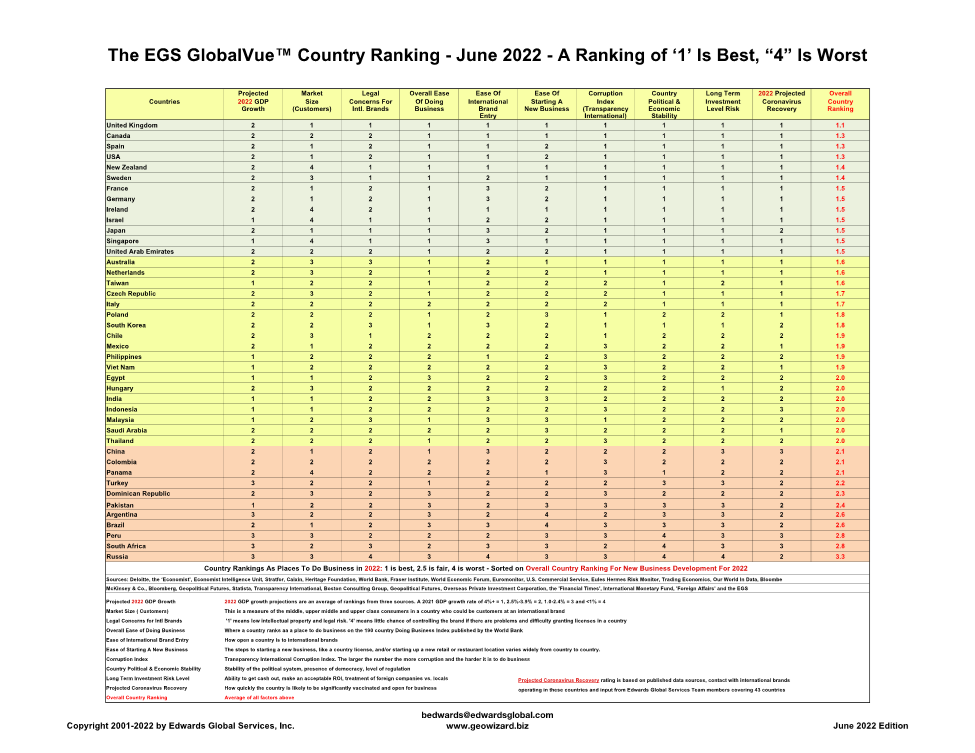

The EGS GlobalVue™ June 2022 Country Ranking Chart

In the June 2022, the EGS GlobalVue™ country ranking, Canada, Indonesia, Mexico, New Zealand and the Philippines have moved up since the March report and is primarily due to continued recovery from the COVID-19 pandemic. Russia moved down due to the Ukraine war cutting off its trade with other countries.

The EGS GlobalVue™ country ranking of places to do business was established in 2001 and is released 4x annually. The report contents are based on the latest economic and political trends in 40+ countries across the globe; feedback from EGS GlobalTeam™ members covering 43 countries; and our daily review of over 30 international vetted information sources.

Global Energy & Commodities

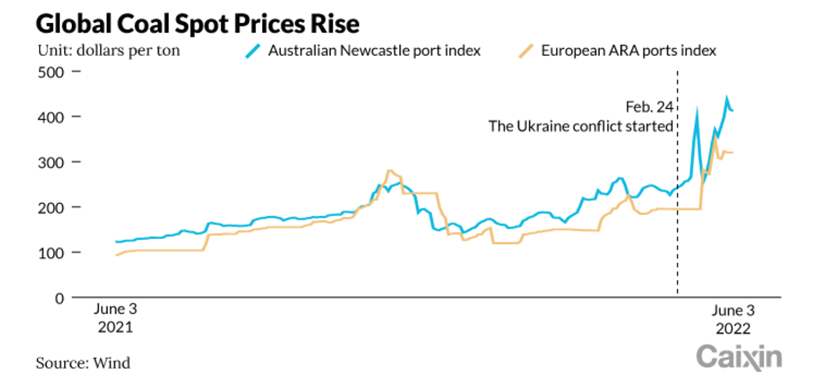

“China’s Never-Ending Coal Price Woes – Since the week of March 10, the price for a ton of the benchmark 5,500 kilocalorie per kilogram (kcal/kg) thermal coal has mostly been over 1,155 yuan ($173). Even after that figure was set as the cap for coal prices by the National Development and Reform Commission (NDRC) on May 7, prices remained well above that level. As of the week of May 26, the latest weekly report available, the price had reached 1,255 yuan, figures from the China Electricity Council (CEC) showed.”, Caixing Global, June 9, 2022

“UK ramps up gas and oil exports to EU amid Russia’s war in Ukraine – Britain’s goods exports to EU a record £16.4bn in April despite impact of Brexit. Reflecting the impact of the war in Ukraine as EU nations seek to diversify energy supplies away from Russia, the data suggests the UK is acting as a hub for liquified natural gas (LNG) imports from the rest of the world before pumping it through pipelines to the continent. UK fuel exports rose by £500m on the month, driven by gas and crude oil to the Netherlands and Ireland, in a sign of heightened demand on the continent to refill gas storage sites in the run-up to winter.”, The London Guardian, June 13, 2022

Global Supply Chain, Commodities, Inflation & Trade Update

“The War in Ukraine and the Rush to Feed the World – Russia’s invasion of Ukraine has led to a major humanitarian crisis, not just in Ukraine but also around the world. Given the region’s importance as a breadbasket to the world, the impact on key food commodities such as wheat and sunflower oil has been immediate, resulting in massive shortages and price shocks. What’s worse, Russia is a key producer of fertilizers and of the energy needed to distribute available food and to grow more. According to the World Bank, global food prices are on track to rise 23% this year, after having risen 31% in 2021, and the cost of the inputs and fuel required to produce and move the food that the world will need tomorrow is also rising.”, Boston Consulting Group, May 17, 2022

“Financial Times Data explorer: consumer price inflation – Annual % change in consumer price index. The latest figures for most of the world’s largest economies make for worrying reading, with price pressures surging to the highest level in many decades.”, Financial Times, June 13, 2022

Global, Regional & Local Travel Updates

“Airline travel to take off after COVID testing drops for international trips – The Biden administration will stop requiring air travelers to take Covid-19 tests in order to fly to the U.S. starting on Sunday, said federal officials, ending one of the last vestiges of travel restrictions employed during the pandemic to try to stem the spread of the disease. The Centers for Disease Control and Prevention said it has determined that people flying to the U.S. from abroad no longer need to test negative a day before their departures, based on available science and data, ending a requirement that has been in place since last year. The testing requirement is set to end on June 12 at 12:01 a.m. (Eastern time).”, The Wall Street Journal, June 10, 2022

“Singapore Changi Airport to Reopen Terminals to Meet Demand – Terminal 4 and rest of Terminal 2 to reopen in coming months Transport minister expects the growth trajectory to continue. Terminal 4 will reopen in September and departure operations in the southern wing of Terminal 2 will restart from October, Changi Airport Group (Singapore) Pte said in a statement Friday. The added capacity will allow the airport to better cope with an influx of passengers in the northern hemisphere winter.”, Bloomberg, June 10, 2022

“Thailand Ready to Scrap Last of Pandemic-Era Curbs on Tourists – Tourism ministry to propose ending pre-travel registrations Visa-on-arrival expansion planned to attract foreign visitors. Thailand plans to end mandatory pre-travel registration for foreigners, rolling back the last of the pandemic-era curbs, as the tourism-reliant nation bets on global visitors to power its economic recovery. The move would go into effect next month and has the backing of the Health Ministry, he said.”, Bloomberg, June 9, 2022

Country & Regional Updates

Australia

“Endota buys in NZ to try to replicate Aussie success – Australian spas and wellness products company Endota has acquired New Zealand’s largest day spa group Forme Spa to try to put a rocket under its international expansion plans. Endota operates 120 spas and distributes products to 11 countries including Canada, Thailand, Malaysia, and China with a group turnover of approximately $170 million. The Forme acquisition adds nine locations around New Zealand to Endota’s studio chain.”, Franchise Advisory Centre, Brisbane, June 10, 2022

Canada

“Nutrien plans major potash production hike as war in Ukraine exerts relentless pressure on global supplies. Nutrien Ltd. is planning a major ramp up in potash production, as the war in Ukraine exerts relentless pressure on global supplies of the key fertilizer. The world’s biggest fertilizer producer, based in Saskatoon, said on Thursday that it intends to boost its annual potash production to 18 million tonnes by 2025 – about 21.5 per cent higher than current levels. This year, Nutrien expects to produce about 14.8 million tonnes, a figure that had already been revised upward.”, The Globe & Mail, June 9, 2022

China

“China’s struggling private firms tasked with lifting nation out of economic doldrums – Call to action comes at annual gathering of China’s business leaders that serves as an influential idea-exchange forum. China’s private firms have taken an especially hard economic hit over the past year, whereas state-owned enterprises have remained mostly intact or even thrived. With China’s economic headwinds intensifying amid rising internal and external uncertainties, the country’s private sector has been tasked with rebooting the economy, despite having borne most of the pain of the current economic downturn.”, South China Morning Post, June 13, 2022

“Uncertainty Weighs on British Businesses in China Amid Lockdowns, Chamber Says – A majority of British companies in China have forecast falling revenues for 2022 as they expect the country’s current wave of Covid-19 outbreaks and the resulting government response to take a serious toll on business this year. That’s according to an annual business sentiment survey conducted by the British Chamber of Commerce in China, which says “increasing uncertainty” threatens to undermine what many foreign companies see as a major strength of doing business in the country.”, Caixing Global, May 31, 2022

India

“India’s Factory Output Expands to Eight-Month High in April – Index of industrial production rises 7.1%, versus 5% estimate Increasing commodity prices could hurt nascent recovery. Domestic demand is powering the Indian economy from the pandemic-induced slump but geopolitical tensions threaten to thwart the nation’s nascent recovery. Rising commodity prices and supply chain disruptions have further fueled inflationary concerns forcing the country’s central bank to cumulatively raise rates by 90 basis points this year to tame prices.”, Bloomberg, June 10, 2022

Indonesia

“Optimism in Indonesia as youth prospects improve amid economic recovery – Experts say nation ‘on track to recovery’ post Covid and doing better than other countries, with controlled inflation and subsidies to poorest citizens. Adhi Saputro, a senior economist at Prospera Indonesia, a partnership between Australia and Indonesia to support the latter’s economy, said Indonesia was “on track to recovery” and faring “better relative to other countries” particularly with inflation under control and windfall profits from commodity price surges.”, South China Morning Post, June 13, 2022

Russia

“Russian-owned successor of McDonald’s opens in Moscow – Fifteen of the former McDonald’s were set to reopen in Moscow on Sunday. It wasn’t until a couple of hours before the Pushkin Square restaurant opened that the Russian chain’s new name was announced: Vkusno-i Tochka (Tasty-period). The logo is different, but still evokes the golden arches: a circle and two yellow oblongs — representing a beef patty and french fries — configured into a stylized M.”, NBC News, June 12, 2022

United States

“(U.S.) Inflationary Pressure Shows Signs of Easing in 2023 – What should we expect next year? As I see it, there are two forces at work, one global and one domestic, that provide solid clues. Holding aside the international actions taken purely for political reasons (Russia in particular), most of the global supply input flows were a consequence of Covid, and we are starting to see economic forces bringing stability back to those flows.”, Darrell Johnson, FRANdata, franchising.com, June 9, 2022

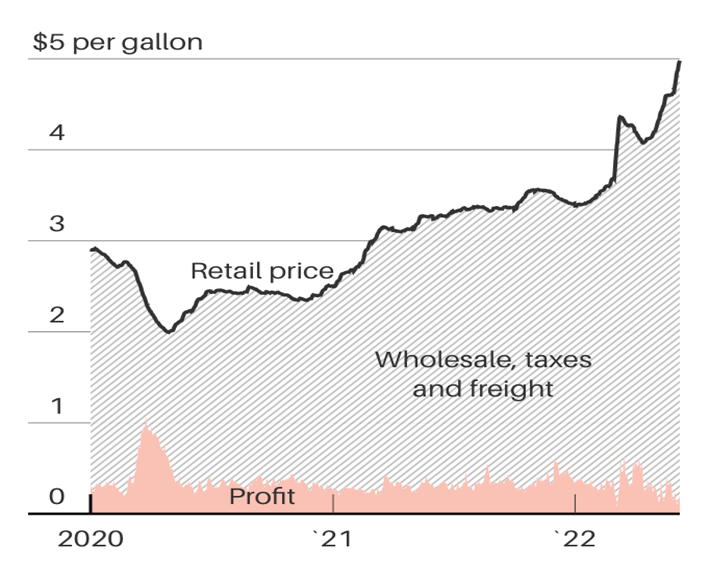

“Gas Prices Soar to Records, but Exclusive Data Show Gas Stations Aren’t the Problem – Profits earned by gas stations are small compared to the recent rise in retail prices. The average service station reaped a $28,676 profit from gasoline in April. When gas prices spiked in May, they saw their profit fall to an average of $16,424. Once they paid their rent and made payroll, most gas stations were hardly rolling in profits.”, Barron’s, June 12, 2022

Brand News

“How The Denny’s Grand Slam Got Its Name – Denny’s has long been a staple of the American breakfast scene, offering an oasis of pancakes and hearty plates of eggs no matter how late or early it may be. The breakfast-oriented diner has been around since 1953 when it first opened as a donut shop in California, growing into what it calls “America’s diner” with over 1,400 locations across the United States. One of the chain’s most famous entrees is the Grand Slam — a veritable breakfast buffet of two buttermilk pancakes, two eggs, bacon, and sausage.”, Mashed, June 7, 2022

“(Washington) DC will get one of first digital-only Panera Bread stores – Panera Bread is going where the customers are, and D.C. will be among first markets to get a digital-only Panera store. Panera just opened its first take-out and delivery-only store in Chicago, with plans to open two more this year in California and the District. Panera said as of the end of 2021, 81% of its sales were via off-premise channels, including delivery, pickup, drive-thru and catering.”, WTOP News, June 10, 2022

Both KFC and Subway will use cabbage or a cabbage/lettuce blend in their burgers and sandwiches in lieu of lettuce which is selling for up to $12 a head in independent stores. Growers have reportedly been receiving between $80 and $100 per box of lettuce, compared with the usual $14 to $16 per box, after extreme rainfall events in Queensland’s Lockyer Valley wiped out crops.”, Franchise Advisory Centre, Brisbane, June 10, 2022

“Taco Bell Opens New Futuristic Drive-Thru, Guarantees You’ll Feel Fast-Food Regret Even Faster – The new venue referred to as “Taco Bell Defy” opened this week in a Minneapolis suburb. It doesn’t even have a dining room and the kitchen is elevated above the drive-thru. Also, instead of one or two, it has four drive-thru lanes. The lanes each have a different designation. One is for delivery drivers, one is for Taco Bell app users, and the others are for traditional orders.”, Mandatory, June 10, 2022

Articles & Studies For Today And Tomorrow

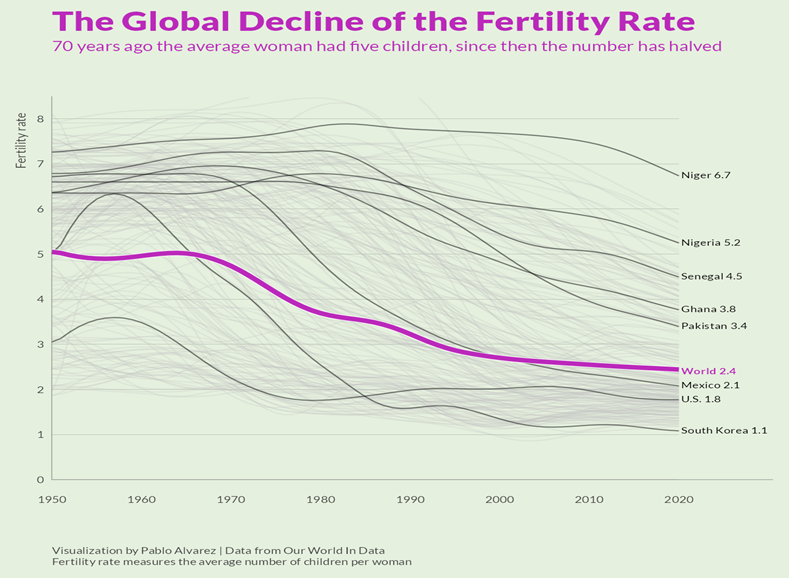

“The Global Decline of Fertility Rates – Over the last 50 years, fertility rates have dropped drastically around the world. In 1952, the average global family had five children—now, they have less than three. Not including immigration, a given area needs an overall total fertility rate of 2.1 to keep a stable population.”, Our World In Data, June 10, 2022

To receive this biweekly newsletter, click here : https://bit.ly/geowizardsignup

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, economic development and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing environment. Our GlobalTeam™ covering 43 countries provides us with updates about what is happening in their specific countries.

To sign up for our biweekly newsletter click here: https://bit.ly/geowizardsignup

William (Bill) Edwards has a four-decade career successfully accelerating the international growth of more than 40 brands. He has directed projects on-site in Alaska, Asia, Europe and the Middle and Near East and has lived in China, the Czech Republic, Hong Kong, Indonesia, Iran and Turkey.

Edwards Global Services, Inc. (EGS) provides a complete International solution for companies Going Global. From initial global market research and country prioritization, to developing new international markets, providing in-country operations support and problem solving around the world. EGS has twice received the U.S. President’s Award for Export Excellence.

Download our latest chart ranking 40+ countries as places to do business at this link:

Our latest GlobalVue™ 40 country ranking

For advice on doing business successfully across 40+ countries, contact Bill Edwards at bedwards@edwardsglobal.com or +1 949 224 3896.