EGS Biweekly Global Business Newsletter Issue 57, Tuesday, May 30, 2022

Edited and curated by: William (Bill) Edwards, CFE, CEO of Edwards Global Services, Inc. (EGS)

Shanghai will reopen this week. Is global inflation beginning to slow and maybe even drop slowly? Global travel for the Northern Hemisphere will be beyond 2019 levels. Globalization of trade remains strong. More global brands depart Russia. And those QR codes are for more than just menus

To receive this biweekly newsletter, click on this link:

https://bit.ly/geowizardsignup

First, A Few Words of Wisdom From Others

“Success isn’t always about greatness. It’s about consistency. Consistent hard work leads to success. Greatness will come.”, Dwayne Johnson

“There is nothing impossible to they who will try.”, Alexander the Great

“No matter what people tell you, words and ideas can change the world.”, Robin Williams

Highlights in issue #57:

- Brand Global News Section: Focus Brands, McDonald’s®, Nike®, Starbucks® and Wendy’s®

Interesting Data and Studies

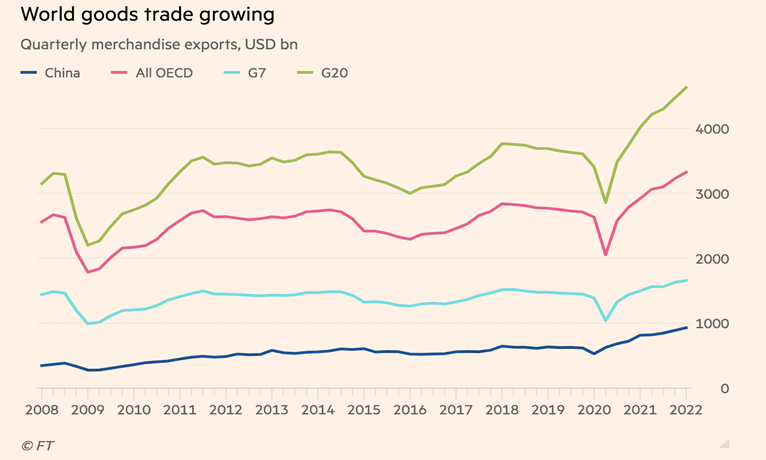

“The death of globalisation has been greatly exaggerated – So far, slowdown in cross-border activity reflects slowdown in growth. The global elite gathered at Davos this week for what by all accounts has been a gloomy affair. Among business leaders the talk is all about globalisation going into reverse. As the chart below shows, until the first quarter of this year merchandise trade gave little indication of deglobalisation for rich countries, China, or the 20 biggest economies (advanced and emerging) taken together. Indeed the IMF’s own research shows that the world now trades more than it had projected three years ago.”, The Financial Times,

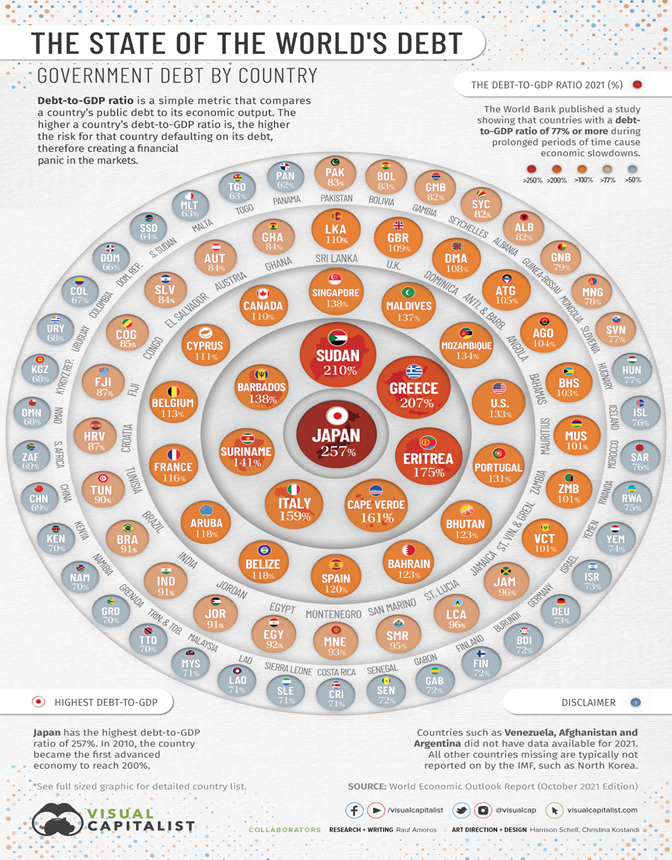

“Visualizing the State of Global Debt, by Country – Since COVID-19 started its spread around the world in 2020, the global economy has been put to the test with supply chain disruptions, price volatility for commodities, challenges in the job market, and declining income from tourism. To analyze the extent of global debt, we’ve compiled debt-to-GDP data by country from the most recent World Economic Outlook report by the IMF.”, Visual Capitalist and International Monetary Fund, February 1, 2022

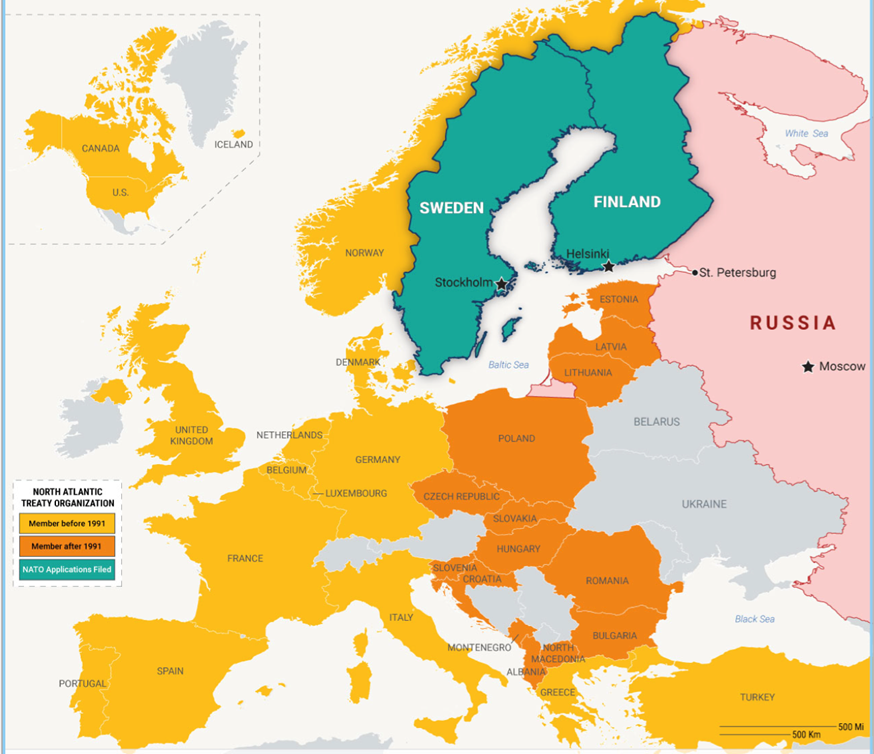

“War in Ukraine Is a Boon for NATO – The trans-Atlantic relationship has found renewed purpose since Russia’s invasion of its neighbor. Most of NATO’s expansion since the end of the Cold War in 1991 occurred from 1999 to 2004 and centered on former Warsaw Pact or Soviet states seeking to anchor themselves in the West and lock in security guarantees against Russia.”, Geopolitical Futures, May 20, 2022

Global Energy

“(UK) EV Rapid Charging Costs Soar 20% in Eight Months – Rapid charging an electric car has become a fifth more expensive in eight months due to soaring energy prices, new figures show. RAC analysis found that the average price of using a public rapid charger in Britain increased from 36.7p per kilowatt hour (kWh) in September last year to 44.6p per kWh this month……The RAC attributed the increase to a 65% spike in the wholesale cost of electricity, which was driven by surging gas prices.”, Bloomberg, May 26, 2022

Global Supply Chain, Commodities & Trade Update

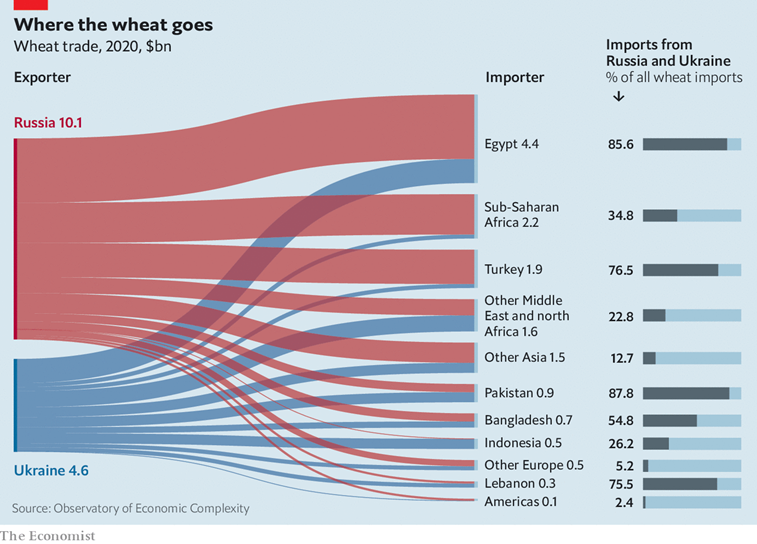

“In 2021 Russia and Ukraine were the world’s first and fifth biggest exporters of wheat, shipping 39m tonnes and 17m tonnes respectively—28% of the world market. They also grow a lot of grain used to feed animals, such as maize and barley, and are the number one (Ukraine) and number two (Russia) producers of sunflower seeds, which means they have 11.5% of the vegetable-oil market. All told, they provide almost an eighth of the calories traded worldwide.”, The Economist, May 19, 2022

Global, Regional & Local Travel Updates

“Tourism in Asia is bouncing back, but can the rebound survive a global recession? From Singapore and Malaysia to Indonesia, Thailand and Japan, inbound travel protocols are being relaxed and international visitors welcomed back. But the region’s tourism rebound risks being grounded by the combined effects of soaring food prices, runaway inflation and global supply chain disruptions. The sigh of relief was palpable across Asia as countries began lifting strict Covid-19 movement restrictions to allow in foreign travellers after two years of living in the shadow of the coronavirus.”, South China Morning Post, May 28, 2022

“Paris Tourism Rebounds as Europeans and Americans Return – Hotel prices in late April up 17% from 2019, according to MKG Jump comes as most Covid restrictions dropped, dollar rises. The city is the second-most sought-after destination worldwide this year, behind London, according to booking website aggregator Trivago. That has steadily pushed up hotel room rates and occupancy since the beginning of the year.”, Bloomberg, May 23, 2022

“Singapore Air Says Business Travel Is Climbing Its Way Back – Airline said Wednesday its net loss narrowed in second half Sees strong passenger growth this year as travel curbs eased. ‘Since April of this year, when Singapore fully opened its borders, we have seen a strong rebound in corporate travel,’ the carrier’s executive vice president of commercial operations, Lee Lik Hsin, said at a briefing Thursday.”, Bloomberg, May 19, 2022

Country & Regional Updates

Australia

“Unemployment rate falls to lowest level in 50 years – That is the lowest level since 1974 and the sixth consecutive monthly gain in employment. ‘In April, we saw employment rise by 4000 people and unemployment fall by 11,000 people,’ ABS head of labour statistics Bjorn Jarvis said on Thursday. ‘As a result, the unemployment rate decreased slightly in April, though remained level, in rounded terms, with the revised March rate of 3.9 per cent.’”, News.com.au, May 19, 2022

Canada

“Seismic reinvention of shopping malls accelerates in COVID’s wake – Reports of a ‘retail apocalypse’ don’t tell the whole story about what’s happening in Canadian shopping malls. The truth is more complex, with wins and losses leading to a revolution in retail. While e-commerce has been a catalyst for change, it hasn’t meant the end of retail stores. Customers are using malls for curbside pickups and inspirational window shopping to get ideas about what they want to buy online. And more online retailers could be opening return centres in retail complexes to make it more convenient for customers to send back merchandise.”, The Globe and Mail, May 17, 2022

China

“Shanghai will exit two months of COVID lockdowns on Wednesday. The hard part will be restarting the city’s economy. China’s economy is currently in a slump not seen since early 2020, with retail sales down 11% and industrial output down 3% in April compared to the same period last year. But the downturn in Shanghai, which implemented the strongest COVID controls of all Chinese cities battling Omicron outbreaks this year, is significantly greater.”, Fortune, May 30, 2022

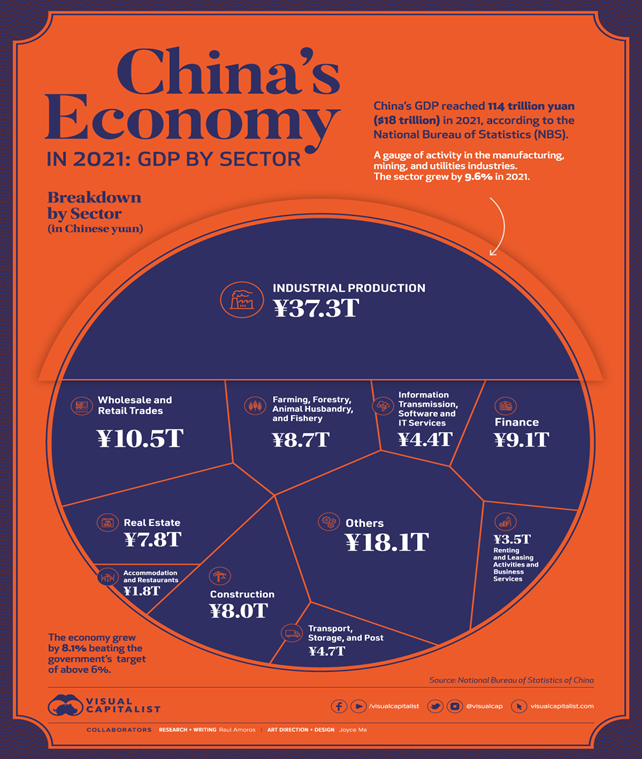

“Visualizing China’s $18 Trillion Economy in One Chart – China is the world’s second largest economy after the U.S., and it is expected to eventually climb into the number one position in the coming decades. While China’s economy has had a much rockier start this year due to zero-tolerance COVID-19 lockdowns and supply chain issues, our visualization covers a full year of data for 2021—a year in which most economies recovered after the initial chaos of the pandemic.”, Visual Capitalist and National Bureau of Statics of China, May 18, 2022

Germany

“German business morale rises in May on buoyant services sector – German business morale rose unexpectedly in May thanks to a pick up in the services sector in Europe’s largest economy that helped offset the impact of high inflation, supply chain problems and the war in Ukraine, a survey showed on Monday. ‘The German economy is showing resilience,’ Ifo economist Klaus Wohlrabe told Reuters, adding that service providers were benefiting from the easing of COVID-19 restrictions – especially in the tourism and hospitality sector. The situation in the industrial sector was more difficult.”, Reuters, May 23, 2022

India

“India Inflation Fight, Monsoon May Take Pressure Off RBI, Former Deputy Governor Says – Repo rate can rise 50 bps in June, and another 25 bps by March. Government-RBI steps may cool inflation within target of 6%. India’s coordinated fiscal and monetary efforts to tame inflation, plus a good agricultural production outlook, may take pressure off the central bank to aggressively raise interest rates later in the year, according to a former Reserve Bank of India official.”, Bloomberg, May 30, 2022

Mexico

“Mexico’s Economy Rebounded in First Quarter on US Demand – Output climbs 1% in first quarter, above initial 0.9% print Export-based economy relies on US demand, No. 1 trade partner. ‘It would be desirable for us to grow more, but it’s not bad growth,’ said Janneth Quiroz Zamora, vice president of economic research at Monex Casa de Bolsa. ‘There was an impact of Omicron, but it wasn’t as strong or as pronounced as was expected.’”, Bloomberg, May 25, 2022

Russia

“McDonald’s on Pushkinskaya will open under a new name on June 12 – Moscow Mayor Sergei Sobyanin said that after the name change, McDonald’s will remain the same menu. According to him, the authorities will support the resumption of the company under a new brand. The mayor noted that the departure of McDonald’s from Russia was discussed as “a huge loss and disaster”, but it turned out that 95-98% of the products used by the network are Russian.”, www.gazeta.ru, May 26, 2022. Compliments of Paul Jones, Jones & Co., Toronto

“Nike Is Reportedly Leaving Russia After Not Renewing Main Franchise Contract – U.S. sporting heavyweight Nike is exiting Russia after suspending operations in March, according to news reports on Wednesday, another symbolic departure of a major American brand as multinational firms including McDonald’s and Starbucks sever ties with Moscow for invading Ukraine.”, Forbes, May 25, 2022

“Starbucks joins McDonald’s in pulling out of Russia – The giant coffee chain, which had already suspended all business activity in Russia in March, said it had now decided ‘to exit and no longer have a brand presence in the market’. Starbucks does not have any cafés in Ukraine but in Russia it has 130 outlets that are wholly owned and operated by a licensed partner, Alshaya Group, of Kuwait, which has 2,000 so-called ‘green apron partners’.”, The Times of London, May 24, 200

Saudi Arabia

“Saudi Arabia steps into the Davos limelight – Flush with oil revenue, the kingdom and its Gulf neighbours are a rare economic bright spot. Despite a dire human rights record, the Gulf country wants the world to focus on its economic story: the world’s top oil exporter is one of the few bright spots in an otherwise shaky global economy wracked by Russia’s invasion of Ukraine, and surging inflation.”, The Financial Times, May 27, 2022

United Kingdom

“Food and drink sales in Britain’s cities back in growth as workers and visitors return – The Top Cities Vibrancy report reveals buoyant Spring sales for restaurants, pubs and bars as Bristol is ranked Britain’s most vibrant city, while northern hubs bounce back…… nine of the ten cities recorded higher sales over the four-week period than in the same period in 2019. Bristol tops the list of most vibrant cities, and sales growth was also above 8% in Manchester, Birmingham and Glasgow.:”, CGA Strategy, May 7, 2022

“Why chicken is getting more and more expensive – The price of chicks is up 14% in a year. Chicken feed is up 50% over 2 years. Packaging, diesel and wages are up double digits…..Prices from the farm gate have already risen by almost 50% in a year.”, BBC News, May 24, 2022

United States

“US Economic Data Signals Firmer Growth That May Ease by Yearend – Consumer spending off to a solid start early in second quarter. Manufacturing gauges soften, while housing market stumbles. Firmer consumer spending and a decisive narrowing of the merchandise trade deficit show the US economy is emerging in short order from a first-quarter pothole. Sustaining that momentum later this year is more of a question mark as manufacturing and housing soften along with employment and wage growth.”, Bloomberg, May 28, 2022

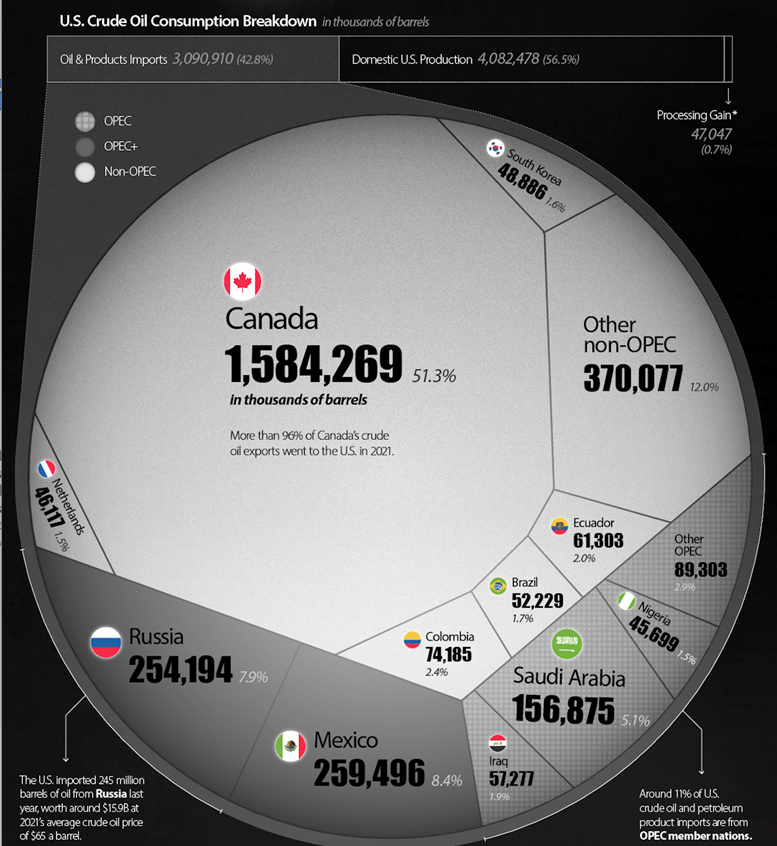

“Visualizing U.S. Crude Oil and Petroleum Product Imports in 2021 – Despite being the world’s largest oil producer, in 2021 the U.S. still imported more than 3 billion barrels of crude oil and petroleum products, equal to 43% of the country’s consumption. This visualization uses data from the Energy Information Administration (EIA) to compare U.S. crude oil and refined product imports with domestic crude oil production, and breaks down which countries the U.S. imported its oil from in 2021.”, Visual Capitalist, May 16, 2022

Brand News

“Focus Brands announces first (international) franchise operations support center – The center will see Focus Brands provide high-quality coaching to improve customer service. The Customer Experience Center of Excellence (CECE) will be located in Heredia, Costa Rica. CECE’s job will be to provide an affordable and effective means to deliver world-class customer service and ultimately, improve the performance of all franchisees.”, Global Franchise, May 24, 2022

“What McDonald’s In Other Countries Is Really Like – McDonald’s is in over 100 countries around the globe, practically all of which have adapted the menu to reflect local cultural tastes while still maintaining some of the signature American items that the restaurant is known for. But what are some of those differences? For those whose curiosity is piqued, this is what McDonald’s is like in other countries.”, Mashed, May 27, 2022

“One of America’s Favorite Burger Chains May Soon Have a New Owner – Wendy’s largest shareholder is exploring moves that would improve the chain’s shareholder value. Trian Fund Management, a majority shareholder of Wendy’s, announced Tuesday that it is looking into a potential acquisition of the burger chain, in hopes of making the company more profitable. A recent SEC filing confirms that Trian, which owns a 19.4% stake in Wendy’s, is currently ‘explor[ing]…a potential transaction…to enhance shareholder value’—one which could involve a third party, and include an acquisition, merger, or other deal that would transfer control of Wendy’s.”, Eat this. Not That!, May 25, 2022

Articles & Studies For Today And Tomorrow

“Did You Really Think We’d Stop Shaking Hands? Humans are meant to be together, especially when it comes to conducting business. We yearn to see each other’s faces in person. And we want to touch and shake hands. The act of shaking hands dates back to medieval times when the world was a more dangerous place. It was a way to ensure your arms were free of anything intended to harm another. Millenia later, the Covid pandemic hit and we found ourselves anxiously disinfecting everything in sight, from packages of potato chips to our own kids.”, Skift, May 13, 2022

“QR Codes Are More Than Digital Menus – Several trending articles over the last year have cropped up maligning the ubiquity of QR codes, most prominently by Erin Woo the New York Times….The little black punctuated squares almost seemed self-replicating with their proliferation in an era of pandemic and its accompanying collective aversion to fomites and non-sanitized contact surfaces. From restaurant menus to payment portals, they have become a mainstay, almost necessitating a smartphone for everyday interactions.”, Forbes, May 30, 2022

To receive our biweekly newsletter, sign up here: https://bit.ly/geowizardsignup

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the world that impacts new trends, health, consumer spending, business investment, economic development and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing environment. Our GlobalTeam™ covers 43 countries and provides us with updates about what is happening in their specific countries. Please feel free to send us your input for the biweekly report. bedwards@edwardsglobal.com

To sign up for our biweekly newsletter click here: https://bit.ly/geowizardsignup

William (Bill) Edwards, Your Newsletter Editor, has a four-decade career successfully accelerating the international growth of more than 40 brands. With experience in the franchise, oil and gas, information technology and management consulting sectors, he has directed projects on-site in Alaska, Asia, Europe and the Middle and Near East. He has lived in China, the Czech Republic, Hong Kong, Indonesia, Iran and Turkey and has worked on projects in over 50 countries.

Edwards Global Services, Inc. (EGS) provides a complete International solution for companies Going Global. From initial global market research and country prioritization, to developing new international markets, providing in-country operations support and problem solving around the world. Our U.S. based executive team has experience living and working around the world. EGS has twice received the U.S. President’s Award for Export Excellence.

Download our latest chart ranking 40+ countries as places to do business at this link:

Our latest GlobalVue™ 40 country ranking

For advice on doing business successfully across 40+ countries, contact Bill Edwards at bedwards@edwardsglobal.com or +1 949 224 3896.