EGS Biweekly Global Business Newsletter Issue 54, Tuesday, April 19,2022

Edited and curated by: William (Bill) Edwards, CFE, CEO of Edwards Global Services, Inc. (EGS)

Trends in this issue:

As I return from a two week business trip to them Middle East and Central Europe, the 54th issue of our newsletter focuses on energy, globalization, global trade, inflation, rapidly opening global travel, social media a fully automated Pizza Hut® restaurant in Israel. A truly eclectic sample of global business trends today including the first automated Pizza Hut® restaurant in the world in Israel.

To receive our biweekly newsletter, click on this link: https://bit.ly/geowizardsignup

First, A Few Words of Wisdom From Others

“In the midst of chaos, there is also opportunity” – Sun Tzu

“The test of a first-rate intelligence is the ability to hold two opposed ideas in the mind at the same time, and still retain the ability to function,” F. Scott Fitzgerald.

“Opportunities come infrequently. When it rains gold, put out the bucket, not the thimble.”, Warren Buffett, Yahoo Finance

Highlights in issue #54:

Brand Global News Section: California Pizza Kitchen®, Chipotle®, Dairy Queen®, Lawn Rite® (New Zealand), McDonalds®, Pizza Hut® and QC Kinetix®

Interesting Data and Studies

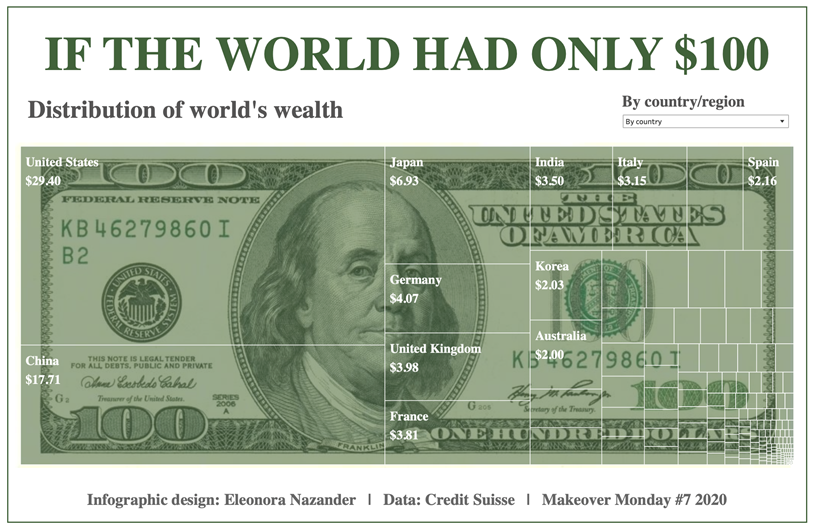

“Visualizing the Distribution of Household Wealth, By Country – A majority of the world’s wealth is concentrated in just a few countries. In fact, almost a third of household wealth is held by Americans, while China’s population accounts for nearly a fifth. Using data from Credit Suisse, this graphic by Eleonora Nazander shows the distribution of household wealth worldwide, highlighting the wealth gap that exists across regions. To help simplify things, this graphic shows how much household wealth each country would have if the world only had $100.”, Visual Capitalist, April 13, 2022

Global Energy

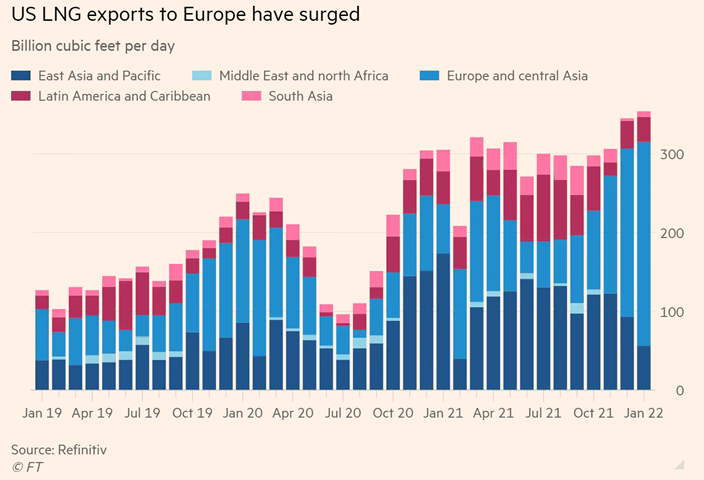

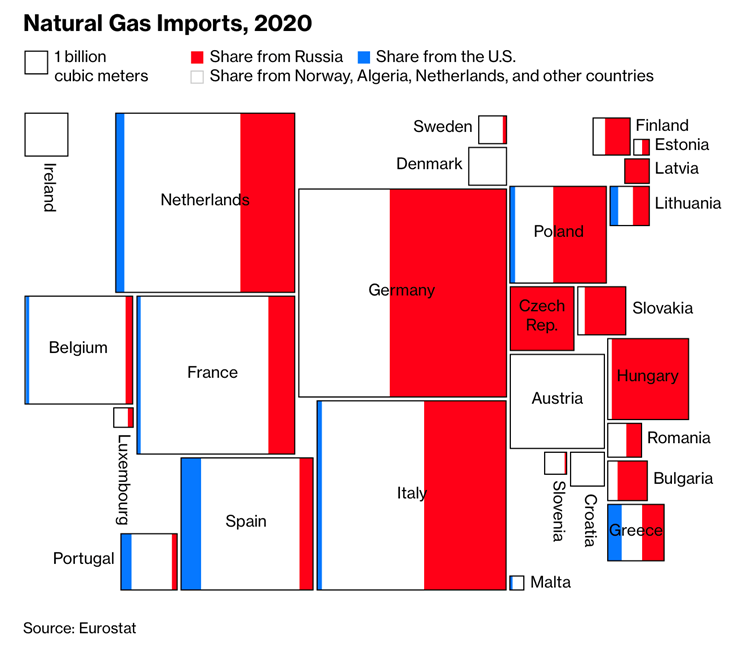

“US natural gas export fever tempered by costs and climate concerns – Suppliers must weigh Europe’s demand for LNG with its long-term goal to reduce fossil fuel use. European Commission president Ursula von der Leyen announced a deal with US president Joe Biden last month under which the EU would guarantee long-term demand for another 50 bcm (billion cubic meters) a year of LNG. The volumes would offset some of the 155 bcm of gas the EU imported from Russia last year.”, The Financial Times, April 17, 2022

““Biden’s Energy Marshall Plan for Europe Is No Quick Fix – Facilities to export and receive liquefied natural gas cost billions of dollars and take years to build. Six years after the first cargo of American shale gas sailed out of Cheniere Energy Inc.’s Louisiana terminal, the U.S. is vying with Qatar and Australia for the title of world’s top LNG exporter. (It’s a constantly shifting ranking, but the U.S. is currently in the lead.) Nevertheless, U.S. exports alone won’t be enough to wean Europe off Russian gas completely, at least in the short term.”, Bloomberg, March 30, 2022

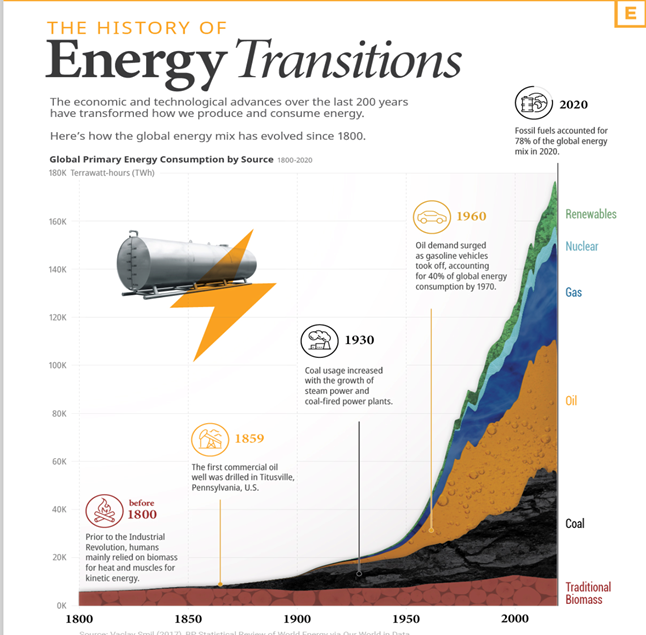

“The History of Energy Transitions – Over the last 200 years, how we’ve gotten our energy has changed drastically. These changes were driven by innovations like the steam engine, oil lamps, internal combustion engines, and the wide-scale use of electricity. The shift from a primarily agrarian global economy to an industrial one called for new sources to provide more efficient energy inputs. The current energy transition is powered by the realization that avoiding the catastrophic effects of climate change requires a reduction in greenhouse gas emissions. This infographic provides historical context for the ongoing shift away from fossil fuels using data from Our World in Data and scientist Vaclav Smil.”, Visual Capitalist and Our World in Data, April 8, 2022

Global Supply Chain & Trade Update

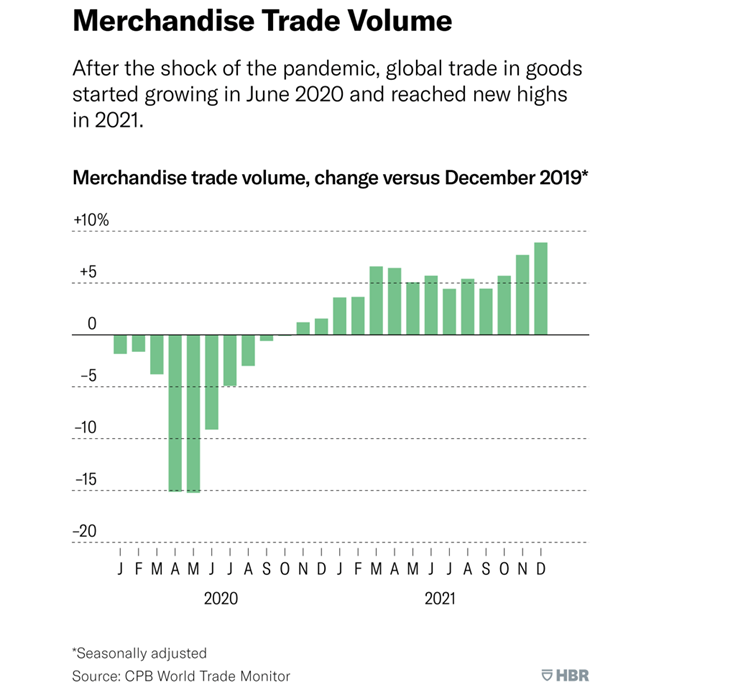

“The State of Globalization in 2022 – The DHL Global Connectedness Index, which our team develops at the NYU Stern Center for the Future of Management, measures globalization based on international flows of trade, capital, information, and people. We look here at the latest trends across those four categories of flows — and consider early signals of how the war might alter their trajectories moving forward.”, Harvard Business Review, April 12, 2022

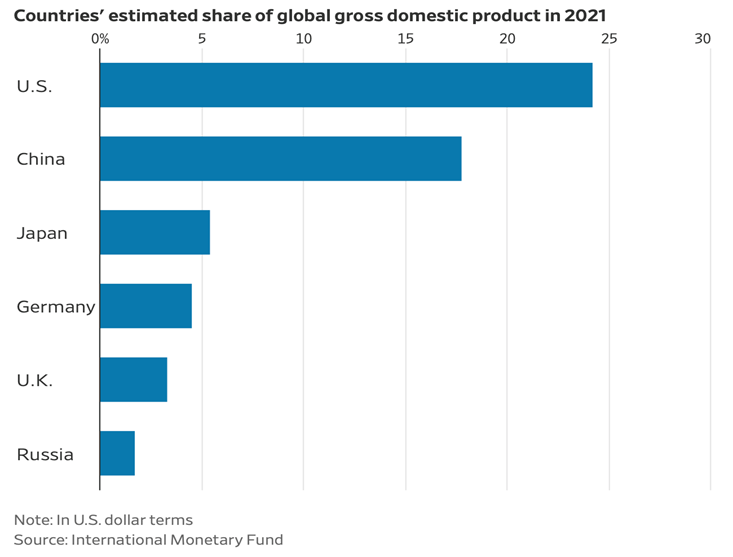

“Globalization Isn’t Unraveling. It’s Changing – The flow of trade, people and ideas among countries isn’t inevitably headed toward decline following Russia’s invasion of Ukraine. But it could be reshaped. Adjusting for the differing costs of goods and services across countries, Germany’s economy in 1913 accounted for 8.7% of global GDP, according to estimates by economic historian Angus Maddison. Russia’s share of global GDP last year was just 3.1% on that basis, estimates the International Monetary Fund, and an even smaller 1.7% in dollar terms.”, The Wall Street Journal, April 15, 2022

“World food prices hit new record on impact from Ukraine war – Global food prices have struck a new high, soaring at the fastest monthly rate in 14 years after the war in Ukraine hit the supply of grains and vegetable oils, in a shift likely to do the greatest harm in poorer countries around the world. March’s food price index from the UN Food and Agriculture Organization rose to its third record high in a row, jumping 34 per cent from the same time last year, after the war shut down supply lines from Ukraine and Russia.”, The Financial Times, April 8, 2022

Global, Regional & Local Travel Updates

“Delta sees ‘meaningful’ profit as travel demand hits ‘historic’ levels – The company said robust consumer demand not only translated into a ‘solid’ profit in March, but is also allowing it to offset soaring fuel costs with higher fares. ‘The demand environment that we have today is at a historic high,’ Chief Executive Officer Ed Bastian told Reuters in an interview. ‘The last five weeks have been the strongest period of bookings that Delta has ever seen in our history.’”, Reuters, April 13, 2022

“The Latest Covid-19 Travel Requirements For Central America, Including Belize And Costa Rica – Countries in Central America have been easing their travel restrictions in recent months, making them even easier destinations for Americans to plan visits to during the busy spring summer travel seasons. Still, each country has its own sets of rules and restrictions, and what’s acceptable in one destination may not work for another. Here are the latest travel requirements and restrictions in Central American countries, according to the Central America Tourism Agency.”, Forbes, April 18, 2022

Country & Regional Updates

South East Asia

“Why Southeast Asia Will See Stronger Growth in 2022 – Tourism is finally on the rebound. Increasing vaccination numbers are helping the private sector gain momentum. A revitalized private sector means improved supply chains. Increased energy demands mean innovation and jobs.”, Entrepreneur Magazine, April 9, 2022

Australia

“Sydney Harbour turns on sunshine as first cruise liner returns since March 2020 – CLIA Australasia’s managing director, Joel Katz, said more than a million Australians a year took an ocean cruise before the pandemic. ‘We now have an opportunity to return to sailing and revive an industry that was worth more than $5bn annually to the Australian economy,’ he said.”, The Guardian, April 18, 2022

China

“China GDP: economy grew by 4.8 per cent in first quarter despite ‘complicated, uncertain’ headwinds – Retail sales fell by 3.5 per cent in March from a year earlier, while industrial production grew by 5 per cent last month. But China’s economy slowed sharply in March due to the Covid outbreaks in many cities. The unemployment rate for those aged 16 to 24 rose to 16 per cent in March, up from 15.3 per cent in combined figures for January and February.:, South China Morning Post, April 18, 2022

India

“India’s annual wholesale inflation rate accelerated to 14.55% in March, completing a year in double-digit territory as firms grapple with rising input costs and pass on higher prices to consumers. Rising input costs for products such as fuel, metals and chemicals have pushed up wholesale prices, a proxy for producer prices. This is adding to pressure on retail prices, economists said. Headline retail inflation accelerated to 6.95% in March, its highest in 17 months and above the upper limit of the central bank’s tolerance band for a third straight month, putting pressure on the bank to raise interest rates.”, Reuters, April 18, 2022

Israel

“First Automated Pizza Hut Now Open in Israel – From afar, the restaurant looks like a shipping container, but the 40-foot rectangular unit is packed with all manner of robotics arms, conveyor belts and other gizmos that add toppings and cook the pizza. It’s operated with input 120 sensors, 20 AI-powered cameras and it’s plugged into the location’s ordering and digital infrastructure. To keep it clean, the kitchen floods with ozone-infused water every 40 minutes. The output is a fully cooked, boxed pizza in a drawer, ready for delivery or pickup.”, Franchise Times, February 4, 2022

New Zealand

“Why a (New Zealand) lawn mowing company is ditching petrol power for battery power – A swap to solar was a no-brainer for Troy Hillard. Over the past six months as the managing director for the Rite Group franchise, he decided it was time to take the lawn mowing business ‘off grid’. The Waikato-based group has since switched to battery-powered mowing equipment.” Stuff.co.nz, March 28, 2022. Compliments of Jason Gehrke, Founder and Director, Franchise Advisory Centre.

United Kingdom

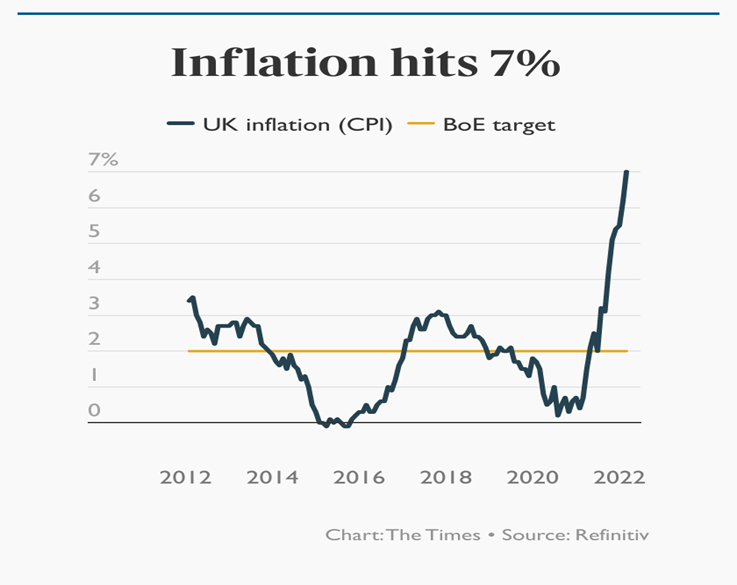

“The headline annual rate of CPI inflation rose to a higher-than-expected 7 per cent in March, according to the Office for National Statistics. City economists had forecast a rise of 6.7 per cent. Amid soaring inflation, traders are pricing as a dead-cert the Bank of England increasing the base rate next month. Money markets suggest that the probability of the base rate rising to 1 per cent, from the current 0.75 per cent, is 100 per cent.”, The Times of London, April 13, 2022

United States

“The huge service side of the U.S. economy speeds up in March, ISM finds – An ISM barometer of business conditions at service-oriented companies such as restaurants and theaters rose 1.8 points in March to 58.3%, signaling a faster expansion in the U.S. economy after an omicron-induced slowdown earlier in the year. Yet prices of oil, grains, metals and other supplies rose even faster and indicated little relief from high inflation. Ongoing supply-chain bottlenecks were also complicated by the Russian invasion of Ukraine. Numbers over 50% are viewed as positive for the economy and anything over 55% is considered exceptional.”, Market Watch, April 5, 2022

“New Study On How Labor Shortages Impact Franchising – The results were culled from responses from more than 200 franchise executives representing 197 brands and approximately 90,000 units. The results make it clear the availability of qualified labor is the number one challenge facing small businesses and franchisors are helping their franchisees address the shortage. ‘Four out of five franchise systems have experienced labor shortages in recent months,’ said FRANdata CEO Darrell Johnson.”, Franchising.com, April 2022

Brand News

“California Pizza Kitchen (US) Signs Two International Franchise Agreements – Recently signed international deals include agreements in Costa Rica and Chile, bringing the brand’s locations to approximately 50 overseas restaurants. Additionally, new locations are set to open in India, Chile, Costa Rica, Alberta, Canada, as well as in the Santiago, Chile and Costa Rica, San Jose airports.”, CISION PR Newswire, March 30, 2022. Compliments of World Franchise Associates

“Dairy Queen (US) Plans to Open 600 Locations in China – Dairy Queen on Thursday announced a deal with the investment firm FountainVest Partners to open 600 locations in the country by 2030, joining a rapidly growing number of U.S. brands making a bigger push in the fast-growing country. The agreement promises to further speed the growth of Minneapolis-based Dairy Queen, which already has 1,100 locations in China.”, Restaurant Business News, March 10, 2022. Compliments of World Franchise Associates

“Metaverse is restaurants’ new frontier – American restaurant chain Chipotle recently teamed up with online platform Roblox to have users create meals that earn credits for real food. When they began inviting people to join their restaurant in the metaverse and collect credits for their next Chipotle order by receiving special codes, more than 20,000 people were waiting to get in. McDonald’s recently announced that it intends to open restaurants in the metaverse. Wendy’s and Hooters have also made announcements in recent days. In Canada, Restaurants Canada launched a metaverse marketplace for its industry, a trend-hunter partnership to revive the food service industry. It will be launched in May.”, Winnipeg Free press, April 18, 2022

“What Makes McDonald’s France So Different From McDonald’s America – You may have heard the old saying: “if you’ve been to one, you’ve been to them all.” That same concept can apply to McDonald’s. No matter where you go, be the McDonald’s down the block or across the country, you’ll know exactly what to expect. In France, however, your trip to Mickey Dee’s may be a little more high-class than you were expecting. When you think of French cuisine, you’re probably thinking more along the lines of cheese and wine than anything resembling fast food. While this is a fair assumption, you’d be surprised to learn that McDonald’s in France are designed more around the food and the atmosphere than Playlands or drive-thru’s.”, Mashed, April 11, 2022

“Regenerative Medicine Group Celebrates 100th Clinic Opening – QC Kinetix, a regenerative medicine franchise that offers a cutting-edge, non-surgical alternative to joint and pain relief, recently celebrated its 100th clinic opening. On March 26, they celebrated their 100th clinic opening in Mishawaka, Indiana, near South Bend. To mark the milestone opening, the company’s top brass and founders hopped on a plane and made a surprise visit to Mishawaka to congratulate the new team and show their support on the clinic’s first day of business.”, Franchising.com, April 1, 2022

“How COVID Forever Changed the Future of Fast-Food Design – Across the U.S., quick-service brands are aggressively altering store designs to accommodate shifting consumer preferences, so many powered by the COVID-19 pandemic. In TD Bank’s 2021 Restaurant Franchise Pulse survey released earlier this year, 55 percent of restaurant operators said they planned to add more space for pickup orders, while 45 percent were plotting additional drive-thru locations, and another 43 percent were looking to add outdoor dining space. Those figures underscore the fast-changing world of restaurant design.”, QSR Magazine, April 2022. Compliments of Ron Rosenblat, Managing Partner at GlobalKoncepts, LLC

Articles & Studies For Today And Tomorrow

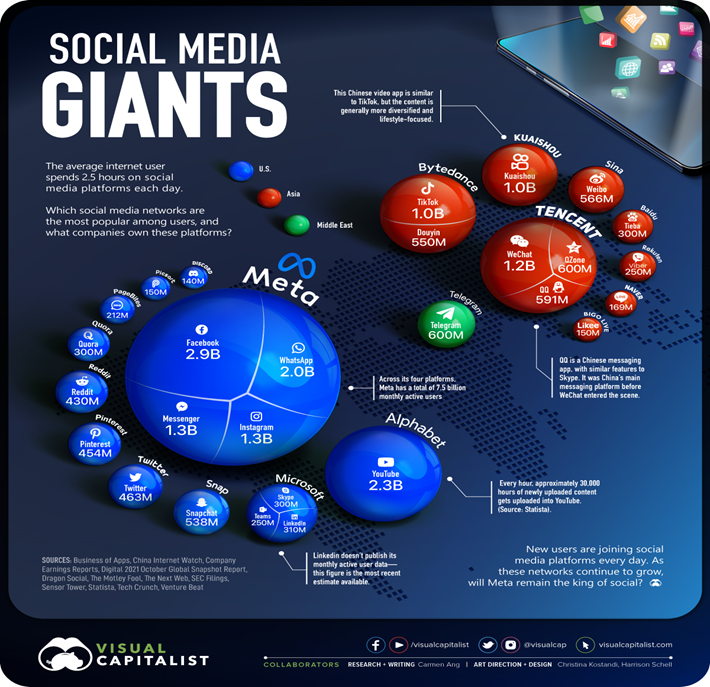

“Currently, there are over 4.5 billion people around the world who use some form of social media—about 57% of the global population. Yet, while social media’s audience is widespread and diverse, just a handful of companies control a majority of the world’s most popular social media platforms. Meta, the tech giant formerly known as Facebook, owns four of the five most widely used platforms.”. Visual Capitalist, December 6, 2021

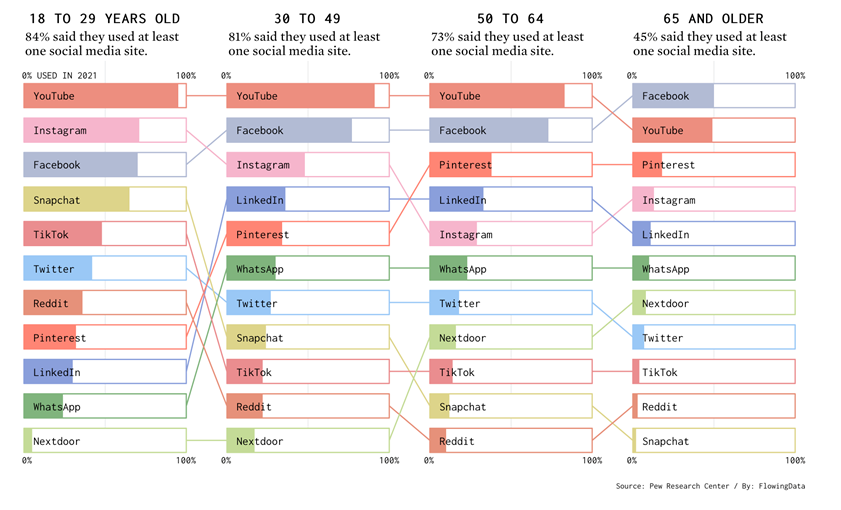

“(U.S.) Social Media Usage by Age – Social media apps are on a lot of phones these days, but some tend towards a younger audience and others an older. Some are common across the population. Here’s the breakdown by age for American adults in 2021, based on data from Pew Research Center. Snapchat, TikTok, and Reddit tend towards a younger audience, as you might expect. Facebook most common in the oldest group seems right. Nextdoor likely rises with home ownership, so that seems to make sense. LinkedIn relies on employment, so the bump up at middle age makes sense.”, Flowing Data, April 2022

To receive our biweekly newsletter, sign up here: https://bit.ly/geowizardsignup

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, economic development and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing environment. Our GlobalTeam™ covers 43 countries and provides us with updates about what is happening in their specific countries. Please feel free to send us your input for the biweekly report. bedwards@edwardsglobal.com

To sign up for our biweekly newsletter click here: https://bit.ly/geowizardsignup

William (Bill) Edwards, Your Newsletter Editor, has a four-decade career successfully accelerating the international growth of more than 40 brands. Bill Edwards has a four-decade career successfully accelerating the international growth of more than 40 brands. Over the years, Bill has made and/or seen most of the mistakes companies make when going global. In Bill’s role as a Global Advisor to ‘C’ level executives, his objective is to impart the wisdom he has learned over time to help them minimize costly mistakes. With experience in the franchise, oil and gas, information technology and management consulting sectors, he has directed projects on-site in Alaska, Asia, Europe and the Middle and Near East. He has lived in China, the Czech Republic, Hong Kong, Indonesia, Iran and Turkey and has worked on projects in over 50 countries.

Edwards Global Services, Inc. (EGS) provides a complete International solution for companies Going Global. From initial global market research and country prioritization, to developing new international markets, providing in-country operations support and problem solving around the world. Our U.S. based executive team has experience living and working around the world. Our Team on the ground overseas covers 40+ countries. EGS has twice received the U.S. President’s Award for Export Excellence.

Download our latest chart ranking 40+ countries as places to do business at this link:

Our latest GlobalVue™ 40 country ranking

For advice on doing business successfully across 40+ countries, contact Bill Edwards at bedwards@edwardsglobal.com or +1 949 224 3896.

EGS Biweekly Global Business Newsletter Issue 53, Tuesday, April 5,2022

Edited and curated by: William (Bill) Edwards, CFE, CEO of Edwards Global Services, Inc. (EGS)

Trends in this issue:

Inflation is up but so is international travel. The impact of the war in the Ukraine continues to cause major economic, political and policy changes in Europe and much of the rest of the world.

For a look at the impact of the war on franchising, listen to my podcast with Larry Weinberg, a truly global franchise attorney at the link below.

First, A Few Words of Wisdom From Others

“There is no sin punished more implacably by nature, then the sin of resistance to change.”, Anne Morrow Lindbergh. Compliments of Beth Adkisson

“What you can do today can improve all your tomorrows.”, Ralph Marston

“Play by the rules, but be ferocious.” – Phil Knight.

Highlights in issue #52:• Seven Themes to Define Europe• Russian invasion of Ukraine forces China-Europe rail transit to sea.• China Manufacturing Activity Slumps to Two-Year Low, Caixin PMI Shows• After 73% Collapse, Latin American Stocks Finally Start to Soar• Understanding International Franchising: Ukraine and Russia – a podcast• No one asked for a hamburger vending machine, and RoboBurger answered• 7 Mistakes That Make or Break Small Businesses• What Makes A Quality Franchise?• Brand Global News Section: Dairy Queen®, KFC® and Texas Roadhouse®

Interesting Data and Studies

“Geopolitical instability is now cited as the top risk to both global and domestic economies in our latest McKinsey Global Survey on economic conditions.That’s the consensus among executives worldwide, who have cited the COVID-19 pandemic as a leading risk to growth for the past two years.

Our quarterly survey was launched four days after the invasion of Ukraine, and executives express uncertainty and concern about its impact on the economy. About three-quarters of respondents cite geopolitical conflicts as a top risk to global growth in the near term, up from one-third who said so in the previous quarter. Meanwhile, the share of respondents citing the pandemic as a top risk fell from 57 to 12 percent, as much larger percentages now identify energy prices and inflation as threats to the global economy.”, McKinsey, March 30,2022

“The European member states are countries mainly in Europe, and three outside, that are part of one or more of the four major treaty groups, namely the European Union (EU), NATO, Schengen, and eurozone. Beginning with six countries in 1958, the European Economic Community has since added 21 more countries (the UK left the EU in 2020), with a primary focus on single or internal markets.”, Visual Capitalist, March 7, 2022

Global Energy

“U.S. liquefied natural gas exports rise 16%, to new record – U.S. LNG is in high demand as European countries try to cut gas imports from Russia following its invasion of Ukraine while also looking to rebuild low inventories. U.S. LNG exports to all destinations were about 7.43 million tonnes (MT) last month, according to Refinitiv, up from 6.4 MT in February and topping the prior record of 7.25 MT in January. Europe was the top importer of U.S. LNG for a fourth straight month, taking about 65% of U.S. exports. About 12% of exports went to Asia, and 3% to Latin America, the data showed. About 20 vessels responsible for 20% of volumes had not signaled a destination.”, Reuters, April 1, 2022

Global Supply Chain & Trade Update

“Russian invasion of Ukraine forces China-Europe rail transit to sea. Over 1 million containers scheduled to go by train between Europe and China via Russia must now find alternate routes. Exporters and logistics firms transporting goods between China and Europe are now looking to avoid land routes passing through Russia or the conflict zone in Ukraine, putting additional pressure on ports already struggling because of COVID-19.”, ExigerTrends Report, March 2022

“Stratfor 2022 Second-Quarter Forecast – During the second quarter, the world will continue to feel the impact of the war in Ukraine, high inflation, energy crunches, supply chain bottlenecks and a weakening — but still present — COVID-19 pandemic. Even if negotiations between Moscow and Kyiv make progress, the West will keep most of its sanctions against Russia in place, which will result in prolonged political and economic uncertainty. In the meantime, high energy prices will slow economic growth worldwide, negatively impacting households’ cost of living and businesses’ operating costs. Food and energy inflation will be particularly problematic because it will keep the risk of social unrest high, especially in emerging and developing countries where governments have less fiscal room to mitigate its impact.”, Stratfor, March 28, 2022

“Russia’s war on Ukraine has adversely affected the Arab region, which heavily depends on wheat imports, including from these two countries. The fallout from the war varies from country to country, but it has hurt one Arab nation more than the others: Egypt. In Egypt, wheat shortages have further exacerbated supply issues precipitated by poor government planning and the country’s rapid population growth. Since the war began last month, food prices have increased 25-50 percent and are likely to keep rising.”, Geopolitical Futures, March 31, 2022

Global, Regional & Local Travel Updates

“What it’s like to travel to Australia right now – Four weeks after the country opened to vaccinated visitors, international flight bookings are nearly half (49%) of pre-pandemic levels, according to the travel technology company Travelport. On average, fewer than 500 weekly international flights landed in Australia in March — down from 2,000 in March 2019 — according to Tourism Australia. However, international flights are expected to double in the next three months, mainly from Singapore, New Zealand, Indonesia and Hong Kong, according to Tourism Australia.”, CNBC, March 28, 2022

“Traveling to France? Here’s what to know about booster and testing requirements – In the eyes of the French government, American travelers age 12 and older must fulfill two vaccine-related requirements to be treated as fully vaccinated. The first is that you must show proof of receipt of either two doses of the Pfizer, Moderna or AstraZeneca vaccine or one dose of the J&J vaccine.Regardless of whether you received a single- or double-dose vaccine, if nine months or more have elapsed since your final dose, you must also show proof of a booster in order to maintain a full vaccination status.”, The Points Guy, April 2, 2022

“India has finally reopened its borders to international visitors – Even those countries that took a rather cautious approach to the pandemic are finally reopening their borders. New Zealand has started allowing travellers in again, South Korea is reopening next month and Thailand is scaling back its strict testing requirements. Now, after two years cut off from the world, India is also reopening to travellers. Until this week the country had only been letting in chartered flights, meaning it was essentially off-limits to most international visitors. But as of this weekend, 66 airlines from 41 countries – including the UK, US and Australia – will be allowed to fly a limited number of weekly flights to the country.”, Timeout.com, March 29, 2022

Country & Regional Updates

China

“China changes audit secrecy rules in bid to stop US delistings – Watchdog will allow foreign regulators to access sensitive financial information on overseas-listed companies. Beijing has revised its audit secrecy laws in a bid to stop around 270 Chinese companies from being delisted from US exchanges, in a significant concession to pressure from Washington.

The China Securities Regulatory Commission, Beijing’s top financial watchdog, said on Saturday it would change confidentiality laws that prevent its overseas-listed companies from providing sensitive financial information to foreign regulators.”, The Financial Times, April 2, 2022

“China Manufacturing Activity Slumps to Two-Year Low, Caixin PMI Shows – Activity in China’s manufacturing sector contracted at the steepest pace in 25 months in March, a Caixin-sponsored survey showed Friday, as restrictions aimed at containing a fresh wave of Covid-19 outbreaks hit supply and demand, while the war in Ukraine hurt export orders. The Caixin China General Manufacturing Purchasing Managers’ Index (PMI), which gives an independent snapshot of the country’s manufacturing sector, fell to 48.1 from 50.4 in February.”, Caixin Global, April 1, 2022

Europe

“Seven Themes to Define Europe – The Russia-Ukraine conflict will have far-reaching effects that look set to redefine many megatrends in Europe. We believe it is one of those rare events in history that will reshape geopolitics, societies and markets. Europe will transition to be more independent and redefine many of its sectors and economic paradigms. The consequences will range from the development of new industries, the acceleration of existing ones, additional infrastructure and technologies, while reaching independence and leadership for some.”, Bank Of America Study, March 22, 2022. Compliments of Steve Kwang, Vice President, Senior Financial Advisor, Merrill, Lynch Wealth Management

“European Inflation Soars to Record – Euro-zone inflation surged to a record 7.5% in March from a year ago as Russia’s war in Ukraine further boosted already soaring energy costs. While that’ll cost consumers about 230 billion euros ($254 billion) this year, household savings should help cushion the blow.”, Bloomberg, April 2, 2022

Latin America

“After 73% Collapse, Latin American Stocks Finally Start to Soar – Commodity rally is boosting exports and buoying weak economies Morgan Stanley favors Brazil and Chile despite political risks. The spark is the same today as it was then: a boom in global demand for the region’s exports of oil, copper, soybeans, corn and iron ore. Russia’s invasion of Ukraine only further squeezed global supplies of key commodities, pushing up prices more and generating a steady stream of dollars that is breathing life into long-stagnant economies from Mexico to Brazil. The result: The MSCI’s regional index, known as MXLA, has jumped 26% in the first quarter, its best start to a year since the early 1990s.”, Bloomberg, March 31, 2022

India

“Cost of Living Rises in India as Companies Pass on Higher Prices – Inflation spike risks denting disposable incomes, consumption RBI to decide on rates April 8 amid above-target inflation. Bloomberg, April 4, 2022

Israel

“Why Israel Drew 28 Times More Venture Capital Per Capita Than the U.S. – Despite the flourishing of work from anywhere during the pandemic, it still matters where a startup is located….This comes to mind in considering the flow of venture capital around the world in 2021. A striking conclusion is that on a per capita basis, capital flows into Israel were a whopping 28 times more than those in the U.S. To be sure, 2021 venture capital flow into the U.S. was way larger – up at 154 percent in 2021 to $330 billion – than to Israel – 136 percent higher to $25.4 billion, according to ‘NoCamels’. But Israel’s population of about nine million is a fraction of the U.S.’s 330 million people. Hence, Israel’s $28,000 in venture capital invested per capita in 2021 is far above the U.S.’s $1,000.”, Inc., March 29, 2022

Italy

““Italy’s Factories Feel the Economic Shocks of Ukraine War – Russia accounts for just 1.6% of Italy’s exports but in some sectors the proportion is much higher. And that’s without taking into account the impact of higher gas and power costs on energy-intensive sectors such as steel making, paper manufacturing or ceramics. Overall, according to a study by the Fim-Cisl union, more than 25,000 workers have already been affected by the economic fallout of the fighting, mostly in the highly industrial regions in the northeast of the country.”, Bloomberg, March 29, 2022

Russia

“Bloomberg logs off at Moscow terminals – The parent company of Bloomberg News has suspended its operations in Russia and Belarus after President Putin’s invasion of Ukraine. Customers in the two countries will be unable to access financial products including the terminal, data licence, data feed and electronic trading platforms, the company said. Trading functions for a range of Russian securities also have been disabled in accordance with international sanctions, Bloomberg said.”, The Times of London, March 30, 2022

Singapore

“Singapore Restaurants See Surge as Pandemic Early Closing Ends – At 10:31 p.m. on Tuesday, cheers went up from the crowds who had flocked to Singapore’s bars and restaurants. It wasn’t a World Cup match or the Super Bowl, but simply the first time in ages that people could still be drinking alcoholic beverages past 10:30 p.m. at food-and-beverage establishments in the city-state. The 10:30 limit, put in place as a pandemic restriction mainstay, has finally been lifted as Singapore slowly works its way back to normal.”, Bloomberg, April 1, 2022

Turkey

“Turkish Inflation’s Rush Toward a New 20-Year High Leaves Lira Vulnerable – A three-month policy pause by the central bank means Turkey’s interest rates — already the world’s lowest when adjusted for prices — are set to reach new depths as the cost of everything from food to energy surges. Data due Monday will show inflation climbed to an annual 61.5% in March from 54.4% a month earlier, according to the median of 19 estimates in a Bloomberg survey.”, Bloomberg, April 4, 2022

United Kingdom

“City talent hunt drives rise in visa sponsorship – Finance firms in rush for overseas recruits. City firms are sponsoring overseas recruits to come to work for them in the UK at the fastest rate since before Britain left the European Union, according to Home Office figures. About 200 foreign-based workers a week are being hired by British banks, fund managers, insurers and other City firms as the search for talent intensifies and as visa rules are relaxed.”, The Times of London, April 4, 2022

United States

“The (March 2022) Future Of Everything Report – Keys to Surviving and Thriving in Post COVID-19 and BeyondWe discuss the economy, the markets, and megatrends that disrupt everything including our careers, our money, and our lifestyle”, Brian Connors, NPB Financial Group, March 30, 2022. Editor’s Note: At the start of each monthwe will include a link to this timely and comprehensive report.

“No one asked for a hamburger vending machine, and RoboBurger answered – If a startup from New Jersey has its way, the next Ray Kroc will be a robot. In the last week, a company called RoboBurger installed an autonomous burger chef in Jersey City’s Newport Centre Mall. Over on its website, RoboBurger breathlessly describes its vending machine as the ‘biggest innovation in hot food vending since the invention of the microwave.’”, Engadget, March 29, 2022

Brand News

“Dairy Queen Just Made Its Biggest Menu Change In Over 20 Years – The restaurant chain now plans to shake up its entire menu with the biggest revamp that the chain has seen in about 20 years. TODAY reports that Dairy Queen plans to make diners think about burgers when they walk through the door with a new line of Stackburgersthat come in five different topping combinations.”, Mashed, March 29, 2022

“KFC’s first fine dining restaurant includes a gravy candle that melts into chicken fat – KFC opened its doors to an innovative fine-dining experience for one weekend only, taking their famed crunchy chicken to a whole new level. Over 200,000 people applied for tickets, but only 180 of them successfully got a place at the exclusive experience in Sydney (Australia). Luckily, TikTokuser Samantha (@samantha.khater) provided the platform with all the juicy details.”, Indy 100, April 3, 2022

“Texas Roadhouse Is Growing Impressively – In 2021, the company’s sales growth and operating profitability was better than pre-covid levels…..Louisville, Kentucky based Texas Roadhouse opened its first restaurant in 1993 and since then has expanded to over 667 restaurants in 49 states and ten countries. The company’s business approach is to position each of its restaurants as a local favorite for a wide range of customers looking for quality, low-cost meals provided with a friendly, attentive service. As of December 28, 2021, the company employed around 73,300 people.”, Seeking Alpha, April 1, 2022

“These Restaurant Chains Are Raising Their Prices – Be it Starbucks or Taco Bell, Dunkin’ or Domino’s, every chain seems to have felt the burn of red hot inflation, and is turning to customers to cool it down. But as we know, there is little that’s more exasperating than seeing your favorite restaurant ask you to pay more. Here’s a run-down of restaurant chains that are unfortunately asking you to do exactly that.”, The Mashed, April 1, 2022

Articles & Studies For Today And Tomorrow

“Understanding International Franchising: Ukraine and Russia – In this episode (of the Franchise Voice podcast), we are discussing the impact of the war in Ukraine on franchised businesses and the decision of many to cease operations in Russia, as highly reported in the media. We will dive in to how all of this works, answer frequent questions, and address common misperceptions about the franchise business model. We have two international franchise experts who will help set the record straight about how franchising works and what this means for businesses with units in these areas.

William Edwards, CEO & Global Advisor to Senior Executives, Edwards Global Services, Inc., Larry Weinberg, Partner, Cassels, Jack Monson, Host and Bill Meierling, Host

“What Makes A Quality Franchise? – The cover story of this issues ‘Franchise New Zealand’ magazine describes the ingredients that successful franchises have in common., Franchise New Zealand Autumn 2022 issue

“7 Mistakes That Make or Break Small Businesses – Launching a new business is risky — learn from other’s mistakes and set yourself up for success. It is arguable that the mistakes that make or break small businesses are similar across industries and geography. Whether it’s focusing attention on places that don’t produce income or build relationships, not setting boundaries or ignoring their online reputation, I’ve watched small businesses make these mistakes that make or break them.” Entrepreneur magazine, March 31, 2022

To receive our biweekly newsletter, sign up here: https://bit.ly/geowizardsignup

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the world that impacts new trends, health, consumer spending, business investment, economic development and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing environment. Our GlobalTeam™ covers 43 countries and provides us with updates about what is happening in their specific countries. Please feel free to send us your input for the biweekly report. bedwards@edwardsglobal.com

To receive our biweekly newsletter click on this link: https://bit.ly/geowizardsignup

William (Bill) Edwards, Your Newsletter Editor, has a four-decade career successfully accelerating the international growth of more than 40 brands. Bill Edwards has a four-decade career successfully accelerating the international growth of more than 40 brands. Bill is known as an international Problem Solver and Advisor. Over the years, Bill has made and/or seen most of the mistakes companies make when going global. In Bill’s role as a Global Advisor to ‘C’ level executives, his objective is to impart the wisdom he has learned over time to help them minimize costly mistakes.

With experience in the franchise, oil and gas, information technology and management consulting sectors, he has directed projects on-site in Alaska, Asia, Europe and the Middle and Near East. He has lived in China, the Czech Republic, Hong Kong, Indonesia, Iran and Turkey and has worked on projects in over 50 countries.

Edwards Global Services, Inc. (EGS) provides a complete International solution for companies Going Global. From initial global market research and country prioritization, to developing new international markets, providing in-country operations support and problem solving around the world. Our U.S. based executive team has experience living and working around the world. Our Team on the ground overseas covers 40+ countries. EGS has twice received the U.S. President’s Award for Export Excellence.

Download our latest chart ranking 40+ countries as places to do business at this link:

Our latest GlobalVue™ 40 country ranking

For advice on doing business successfully across 40+countries, contact Bill Edwards at bedwards@edwardsglobal.com or +1 949 224 3896.