EGS Biweekly Global Business Newsletter Issue 49, Tuesday, February 8, 2022

Trends in this issue:

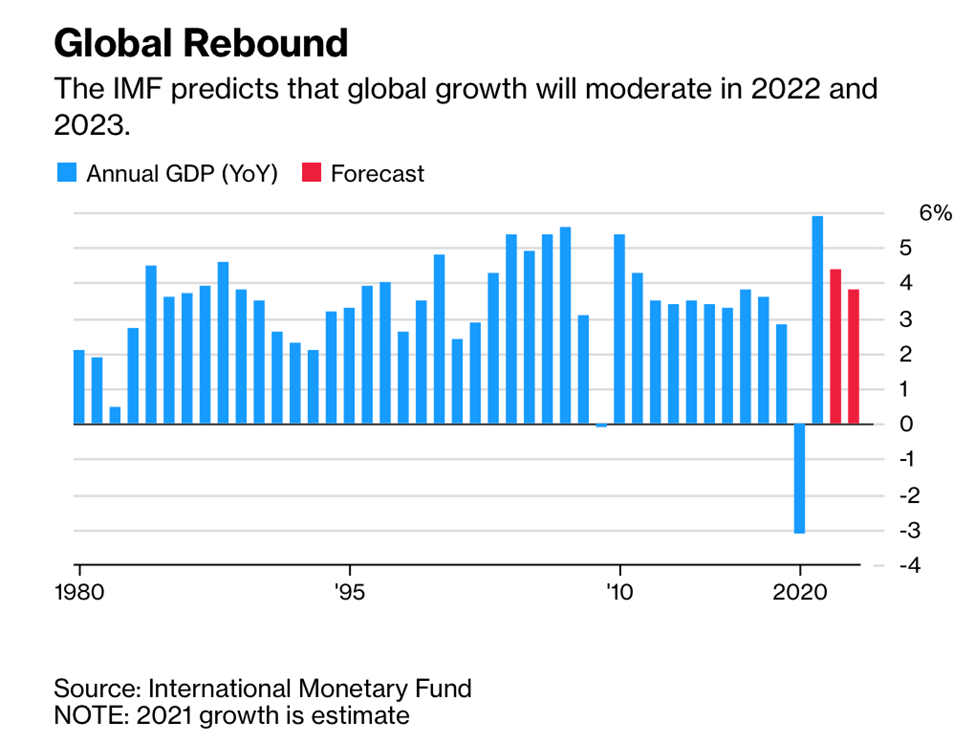

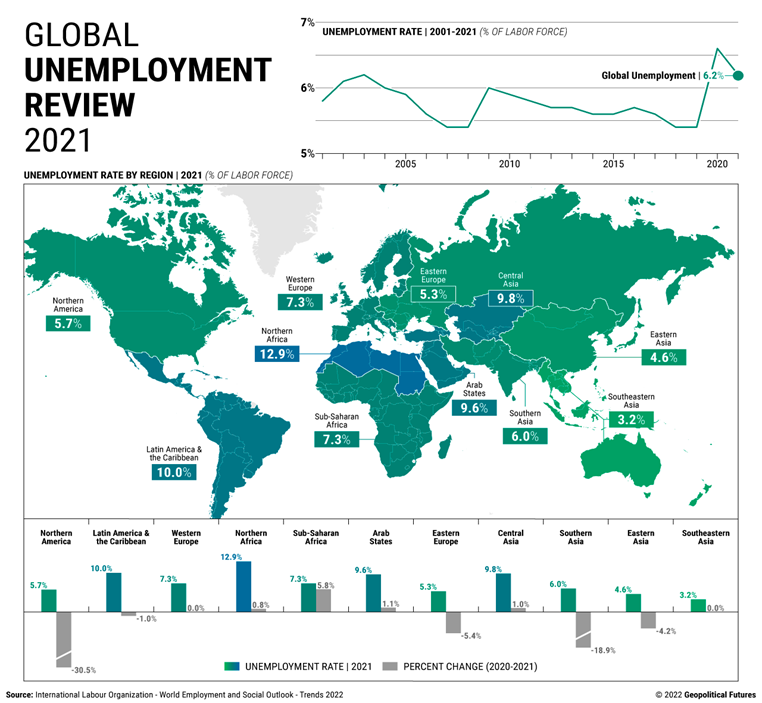

Australia and New Zealand reopen, the European Union sees declining COVID cases, global supply chain continues to be a mixed situation, the IMF sees a global GDP rebound in 2022 but global unemployment is highly variable across the world.

First, A Few Words of Wisdom

“If you don’t ask, the answer is always no.”, Nora Roberts

“Please think about your legacy, because you’re writing it every day.”, Gary Vaynerchuk

“Success usually comes to those who are too busy to be looking for it.”, Henry David Thoreau

Highlights in issue #49:

- Australia and New Zealand finally reopening for travel

- Brand Global News Section: Dunkin’ Donuts®, KFC®, Restaurant Brands NZ, Wingstop®

Interesting Data and Studies

“The global labor market faces a deficit of 52 million full-time jobs, and unemployment affects 207 million people. The global unemployment rate of 6.2 percent is the second highest since 2003 and isn’t expected to return to pre-pandemic levels this year.”, Geopolitical Futures, January 28, 2022

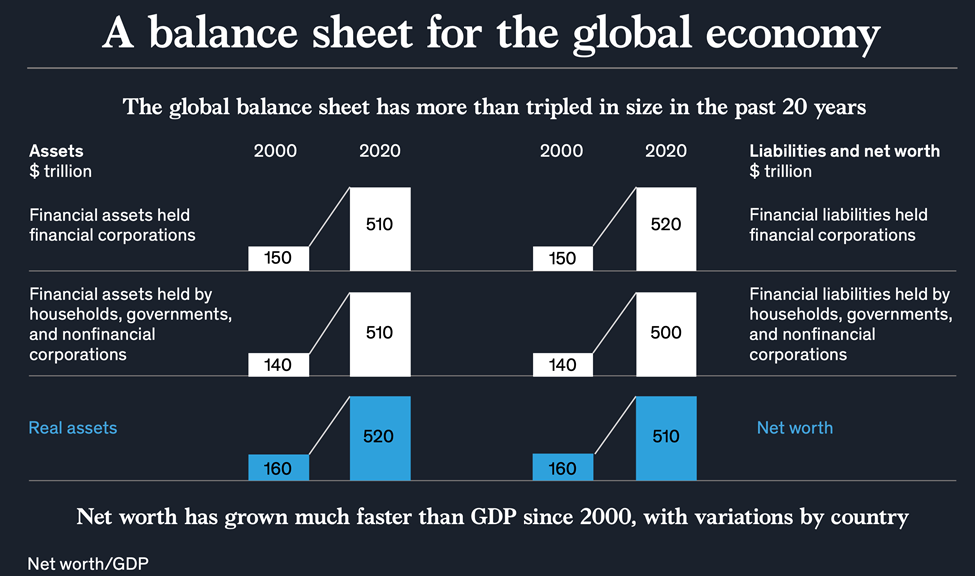

“The rise and rise of the global balance sheet – The market value of the global balance sheet tripled in the first two decades of this century. The world has never been wealthier, with large variations across countries, sectors, and households.”, McKinsey, November 2021

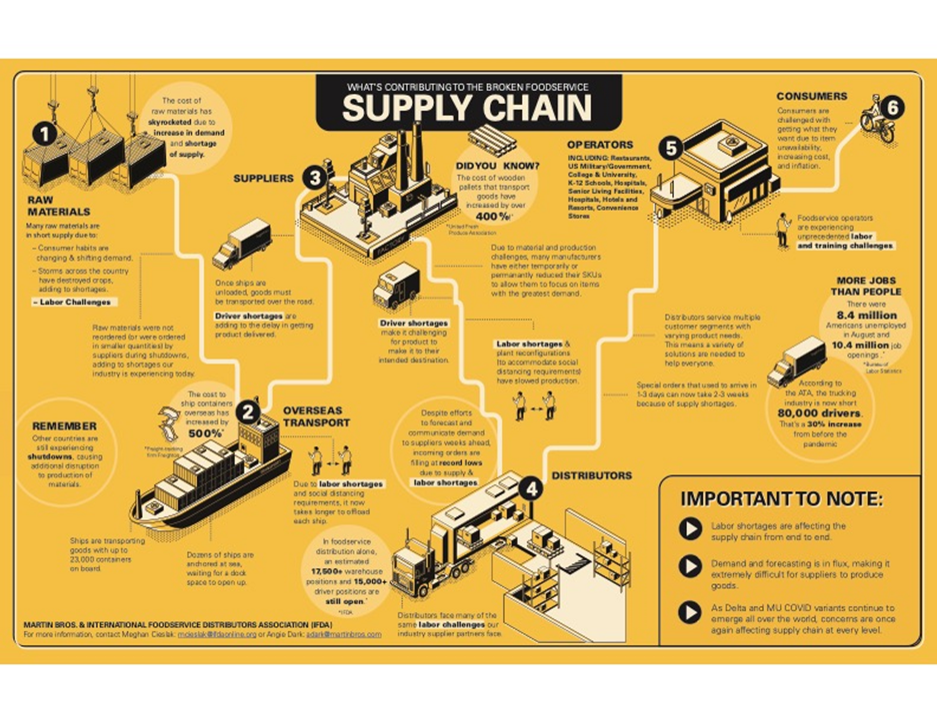

Global Supply Chain & Trade Update

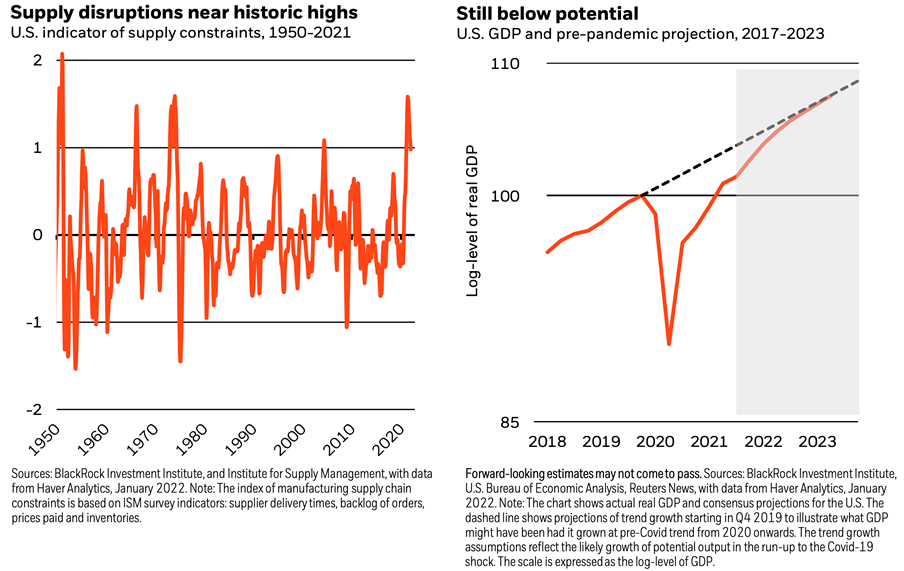

“A world shaped by supply – We’ve entered an era where supply constraints are the driving force of inflation, rather than excess demand. This will likely bring more macro volatility and force policymakers to live with higher inflation. We are in a new and unusual market regime, underpinned by a new macro landscape where inflation is shaped by supply constraints.”, Blackrock, January 2022 study

“Why supply-chain problems aren’t going away – Results season shows the financial effects of supply-chain snarl-ups on industrial firms. Supply chains have seldom featured in companies’ earnings reports over the three decades since globalisation took off in earnest, save for the occasional mention of the benefits of low costs and lean inventories. This earnings season, though, covid-induced shortages are among the first problems mentioned by many firms.”, The Economist, January 29, 2022

“World Food Prices Are Climbing Closer Toward a Record High – UN’s index of global food costs advanced 1.1% last month Unfavorable weather, energy crisis threaten further increase. The United Nations’ index of prices rose 1.1% in January, pushed up by more expensive vegetable oils and dairy. The gauge is edging closer to 2011’s all-time high, and unfavorable weather for crops and the fallout from an energy crisis threaten to keep prices high going forward. Inflation has been running rampant across the globe, and the latest leg higher in the UN’s food index could further stretch household budgets.”, Bloomberg, February 3, 2022

From a Private Director’s Association webinar, “Supply Chain Structure: Future Risks and Opportunities”, January 27, 2022

“Supply Chain Surges & Shortages, Exiger Trends Report, January 2022

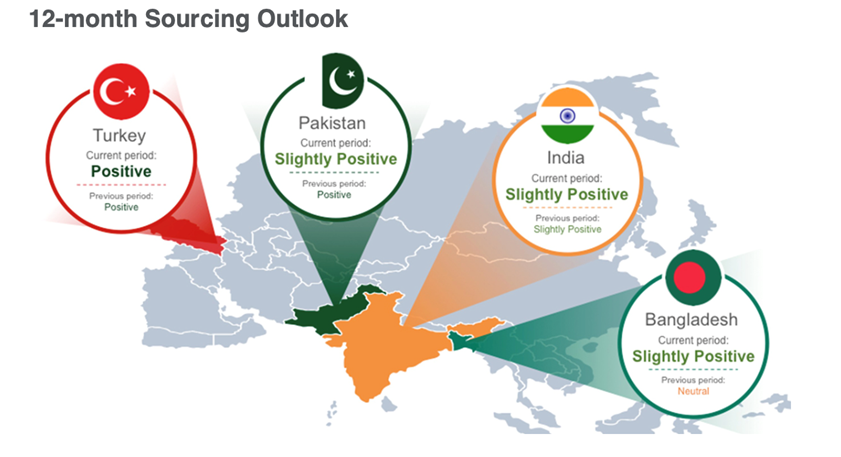

““Asia Sourcing Update – South and West Asia – Bangladesh, India, Pakistan and Turkey.”, FUNG Business Intelligence, January 30, 2022

Global, Regional & Local Travel Updates

“Travel & Tourism’s Contribution to Global Economy Could Reach $8.6 Trillion in 2022 – In 2019 the travel and tourism industry’s contribution to the global economy was almost $9.2 trillion, it said. The institution added that the sector’s contribution to global employment could reach over 330 million jobs, just 1% below pre-pandemic levels and 22% above 2020.”, The Wall Street Journal, February 2, 2022

“Chinese State-Owned Airlines Took Heavy Losses in 2021 – Over the past year, the aviation market in China has still been heavily impacted by the pandemic. The authority maintained the zero-tolerance policy against the virus, and one of the consequences was low travel demands from both domestic and international markets. All three airlines attributed the main reasons for heavy losses to the influence of the pandemic. During the traditional peak travel seasons in China, heavy restrictions were put in place to reduce traffic, especially in and out of areas that had Covid-19 cases.”, Airline Geeks, February 3, 2022

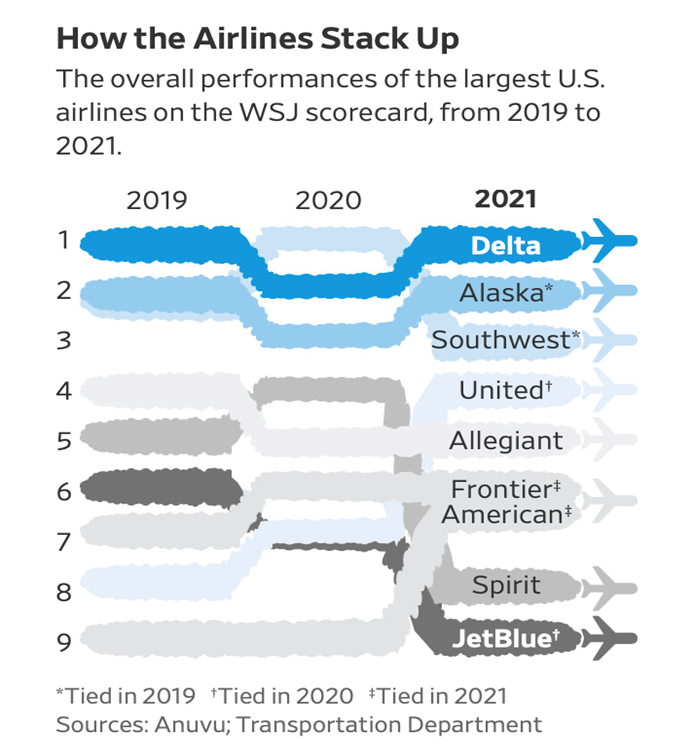

“The Best and Worst U.S. Airlines of 2021 – As Omicron infections and weather challenges hampered operations, some carriers struggled more than others to return to some version of pre-pandemic normal. The good news: Flying is more like it used to be. The bad news: Flying is more like it used to be. Leisure travel came roaring back in 2021. So did cancellations, delays and other flight problems. Airlines began to resemble their pre-pandemic selves, even if they still flew less overall than they did in 2019.”, The Wall Street Journal, January 28, 2022

Global COVID & Vaccine Update

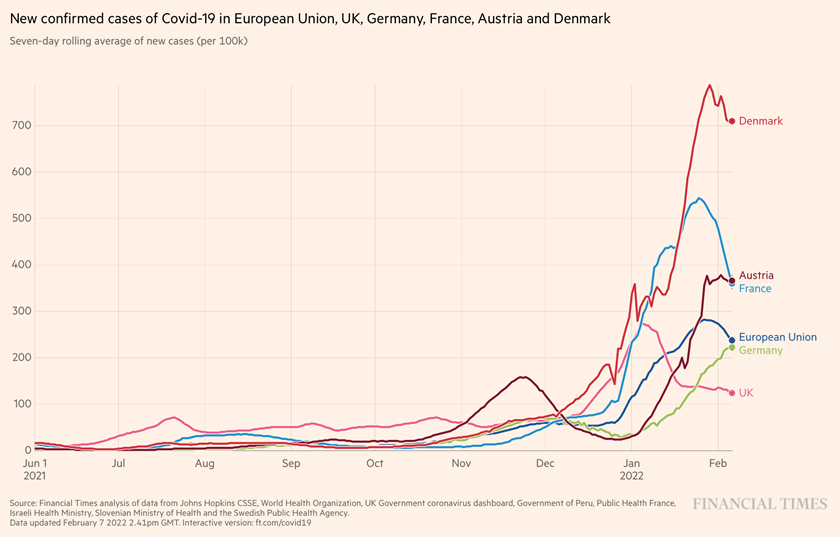

“Europe entering Covid pandemic ‘ceasefire’, says WHO – The World Health Organization’s (WHO) Europe director says the continent could soon enter a ‘long period of tranquillity’ in the Covid-19 pandemic. Dr Hans Kluge cited high vaccination rates, the end of winter and the less severe nature of the Omicron variant. It comes as a number of European nations end Covid-19 restrictions. Speaking to reporters, he said: ‘This period of higher protection should be seen as a ‘ceasefire’ that could bring us enduring peace.’”, BBC News, February 3, 2022

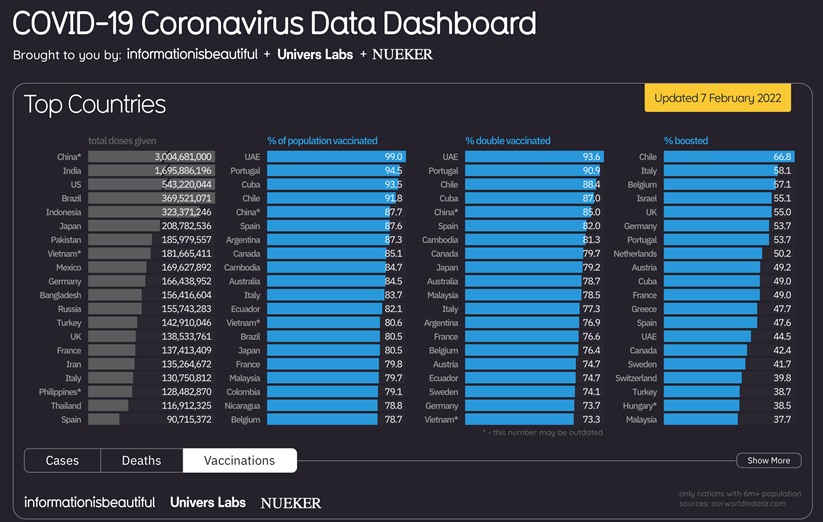

“Information is beautiful chart, February 7, 2022

New cases of COVID-19 begin to decline in most of the European Union countries and in the United Kingdom coming out of the latest variant. The Financial times, February 7, 2022

Country & Regional Updates

European Union

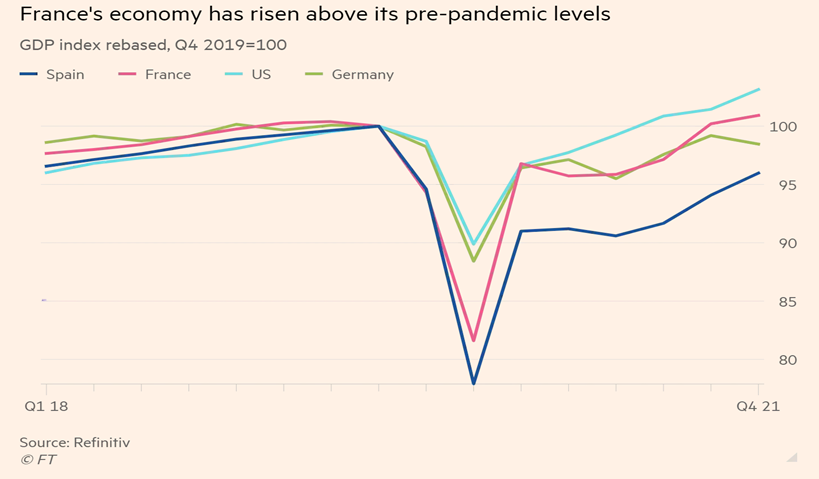

“The French national statistics office said average growth in 2021 was its fastest rate since 1969, at the peak of the postwar period known as “les trente glorieuses”. The economy has bounced back sharply from its 8 per cent contraction in 2020. The eurozone’s second-largest economy returned to its pre-pandemic level of GDP in the third quarter, it said.”, The Financial Times, January 28, 2022

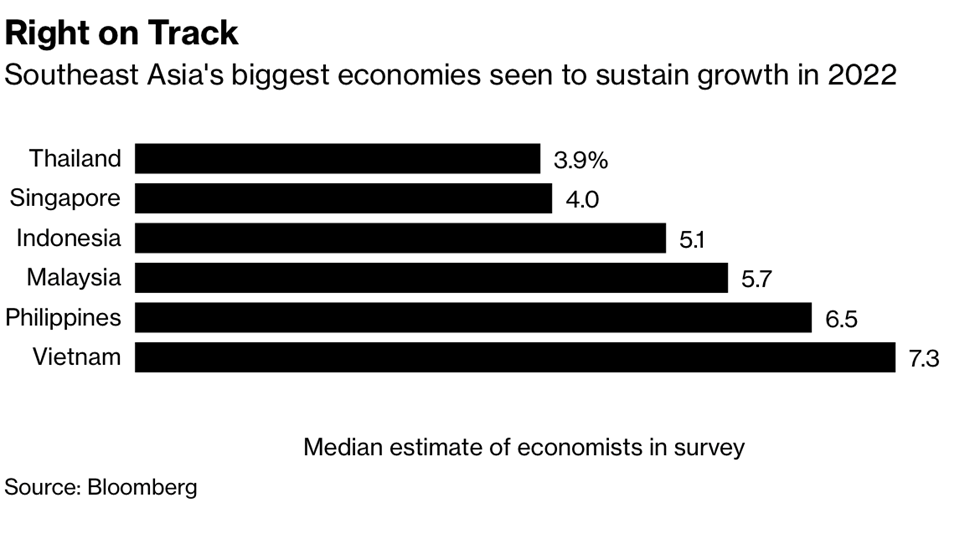

Southeast Asia

Australia

“After two years of closed borders, Australia welcomes the world back – Australia said on Monday it will reopen its borders to vaccinated travellers this month, ending two years of misery for the tourism sector, reviving migration and injecting billions of dollars into the world No. 13 economy. The move effectively calls time on the last main component of Australia’s response to the COVID-19 pandemic, which it has attributed to relatively low death and infection rates.”, Reuters, February 7, 2022

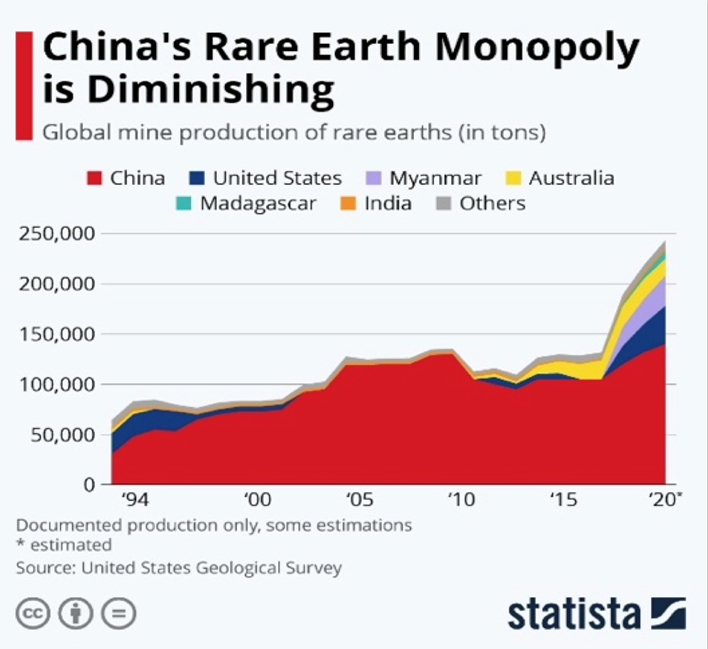

China

“It was in China, specifically the city of Wuhan, where the first cases of COVID-19 were detected in early 2020 before quickly spreading worldwide. China is now pushing a zero COVID policy using contact tracing, mass testing, a special app and lockdowns to try to eliminate the virus completely. Similar strategies have been adopted in other countries but were eventually abandoned in the recognition that COVID-19 is here to stay. But China is holding firm, imposing regulations very similar to the ones adopted at the beginning of the outbreak”, Geopolitical Futures, February 5, 2022

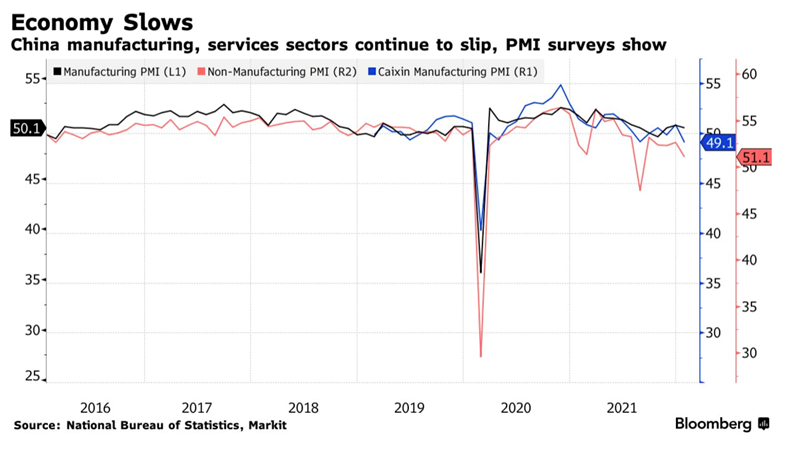

“China Manufacturing Slips in Latest Sign of Slowing Economy – PMI surveys signal slowdown in factories, services sector. Small businesses under pressure, Caixin survey shows. The official purchasing managers’ surveys released on Sunday showed a moderation in factory production and services in January. Small businesses bore the brunt of the pain, with a separate private index dropping to its lowest in almost two years.”, Bloomberg, January 30, 2022

Japan

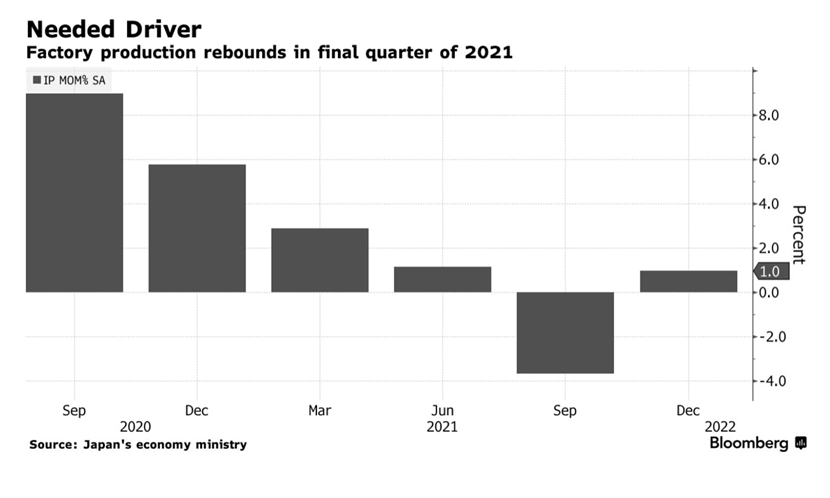

“Japan Quarterly Output Gain Signals Growth Return Before Omicron – Auto production led fourth quarter rebound in manufacturing Supply chain problems persist and omicron now clouds outlook. Japan’s industrial production rebounded last quarter, with the recovery in manufacturing likely helping restore economic growth at the end of 2021 before the omicron variant started its rapid spread.”, Bloomberg, January 30, 2022

New Zealand

“New Zealand will finally start to reopen its borders this month – New Zealand is putting an end to its quarantine requirements for incoming travelers and will start reopening its borders with a five-phase plan in March. The island nation, which has implemented some of the toughest border restrictions in the world since the start of the COVID-19 pandemic, announced Thursday it’s going to begin a phased reopening of its borders, the AP reported. New Zealand is putting an end to its quarantine requirements for incoming travelers and will start reopening its borders with a five-phase plan in March.”, The Points Guy, February 3, 2022

United States

“A Record 50% of U.S. Small Businesses Raised Wages in January to Lure Workers – A record 50% of U.S. small-business owners said they raised compensation in January amid still-elevated job openings, the National Federation of Independent Business said Thursday. With some 47% of small businesses reporting job openings last month that they could not fill, employers have been raising wages to attract skilled candidates — a trend that doesn’t appear to be reversing any time soon.”, Bloomberg, February 3, 2022

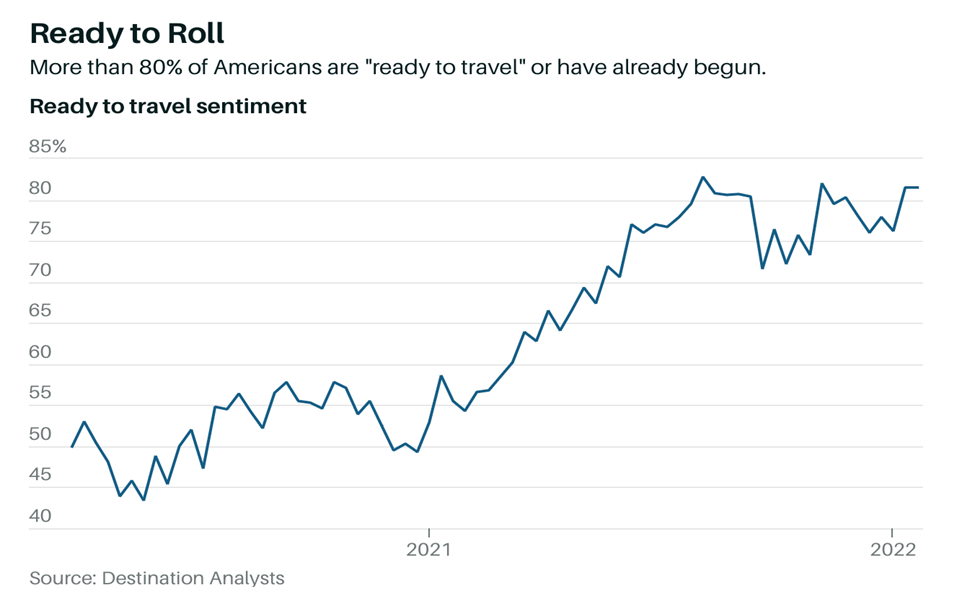

“With Omicron Waning, Americans Are Ready for the Reopening – A transition to a new pandemic normal holds major implications for the U.S. economy, and particularly for the hard-hit services sector, where recovery so far has been stunted even as spending elsewhere has soared. Even the perception of a pandemic lull this time around could have a significant effect. “People are going to, I think, have an even more euphoric attitude toward this if we do feel like this is really the actual end of the pandemic,” says Jefferies economist Tom Simons. ‘That will feel like a boom.’”, Barron’s, February 7, 2022

“California finally reopens: Mammoth and Tahoe ski resorts reopen lodgings after rollback of state’s COVID order. Mammoth and Lake Tahoe area ski resorts and mountain towns are reopening hotels and lodges to leisure visitors after California’s governor on Monday lifted statewide regional orders that had closed lodging to most travelers.”, Los Angeles Times, January 25, 2022

Brand News

“New research shows 84% of franchise companies report revenues are now equal to or higher than pre-pandemic levels – Franchise Business Review today announced the release of its 2022 Franchising Outlook Report. The report is based on research from over 31,000 franchise owners across 350 brands, 6,000 employees at both the corporate office and unit-level, and 200 franchise executives.”, Franchise Business Review, February 2, 2022

“How Dunkin’ Changed Franchising Forever – The first Dunkin’ was opened back in 1948, in Quincy, Massachusetts, after William Rosenberg had the idea to start selling donuts and coffee for just $0.05 and $0.10 each, respectively. Because of his dream and drive to make it a reality, Rosenberg remains a key pioneer of the fast food industry. In 2000, The LA Times reports, he was honored by the Nation’s Restaurant News as one of the top 100 people who ‘changed retailing and food service in the 20th century.’”, Mashed, January 30, 2022

“KFC Australia makes its drone delivery debut – CMO says the pilot of drone food delivery was prompted by dramatic changes to consumer behaviours during the pandemic. KFC Australia has teamed up with drone service provider, Wing, to pilot a delivery service of both hot and fresh menu items in Australia.”, CMO Australia, February 4, 2022

“Restaurant Brands lifts NZ sales by $51m; Covid closures cost it $26m – The fast-food company that owns the local franchises for KFC, Pizza Hut, Taco Bell and Carl’s Jr, made an extra $51 million in sales in New Zealand last year, but estimates it lost about $26m of sales as a result of Covid-19.”, Stuff New Zealand, January 27, 2022. Compliments of Jason Gehrke, Franchise Advisory Centre, Brisbane, Australia

“Wingstop creates digital-only, cashless storefront unit – Dallas prototype serves as testing ground for innovations — from sustainable uniforms and cashless transactions to a kitchen display system and grease extraction for bio-fuels. Wingstop Inc. in December opened a “Restaurant of the Future” in a Dallas strip mall, featuring cashless 100% digital transactions and serving as testing ground for new ideas, from new layouts and uniforms to a kitchen display system.”, Nation’s Restaurant News, February 3, 2022

Cartoon Of The Issue: Leadership!

Articles & Studies For Today And Tomorrow

“AI in Restaurants? The Possibilities are Limitless – The global AI market as a whole is expected to grow to a value of $190.61 billion by 2025. It looks like 2022 is shaping up to be a very interesting year in restaurant technology, especially in the quick-serve and fast-casual spaces. For example, we learned in December that TikTok was teaming up with a ghost-kitchen company to open 300 virtual kitchens in March, aiming to reach 1,000 by the end of the year. On the menu? Recipes that have gone viral on the video-sharing app.”, QSR Magazine, January 28, 2022

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, economic development and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing environment. Our GlobalTeam™ covers 43 countries and provides us with updates about what is happening in their specific countries. Please feel free to send us your input for the biweekly report. bedwards@edwardsglobal.com

To sign up for our biweekly newsletter click on this link: https://lnkd.in/d_XkTGN.

William (Bill) Edwards, Your Newsletter Editor, has a four-decade career successfully accelerating the international growth of more than 40 brands. Bill Edwards has a four-decade career successfully accelerating the international growth of more than 40 brands. Bill is known as an international Problem Solver and Advisor. Over the years, Bill has made and/or seen most of the mistakes companies make when going global. In Bill’s role as a Global Advisor to ‘C’ level executives, his objective is to impart the wisdom he has learned over time to help them minimize costly mistakes.

With experience in the franchise, oil and gas, information technology and management consulting sectors, he has directed projects on-site in Alaska, Asia, Europe and the Middle and Near East. He has lived in China, the Czech Republic, Hong Kong, Indonesia, Iran and Turkey and has worked on projects in over 50 countries.

Edwards Global Services, Inc. (EGS) provides a complete International solution for companies Going Global. From initial global market research and country prioritization, to developing new international markets, providing in-country operations support and problem solving around the world. Our U.S. based executive team has experience living and working around the world. Our Team on the ground overseas covers 40+ countries. EGS has twice received the U.S. President’s Award for Export Excellence.

Download our latest chart ranking 40+ countries as places to do business at this link:

Our Latest GlobalVue™ Country RankingFor advice on doing business successfully across 40+ countries, contact Bill Edwards at bedwards@edwardsglobal.com or +1 949 224 3896.