EGS Biweekly Global Business Newsletter Issue 50, Tuesday, February 22, 2022

Edited and curated by: William (Bill) Edwards, CFE, CEO of Edwards Global Services, Inc. (EGS)

Trends in this issue:

Lots of unusual global brand news in this, our 50th edition. The Big Mac Index is updated. 62% of the world’s population has received at least one vaccination shot. The United Kingdom ends COVID restrictions. Canada’s labor force is ahead of 2019. Fast food chains in Asia are running out of French fires. You will soon be able to order a Big Mac virtually in the metaverse.

First, A Few Words of Wisdom

“Run when you can, walk if you have to, crawl if you must, just never give up.”, Winston Churchill

“The ladder of success is never crowded at the top.”, Napoleon Hill

“Someone is sitting in the shade today because someone planted a tree a long time ago.”, Warren Buffett

Highlights in issue #50:

- Brand Global News Section: Grill’d®, McDonalds®, Pret-A-Manger®, Starbucks®, Taco Bell®, YUM Brands® and White Castle®

Interesting Data and Studies

“The Big Mac Index: A Measure of Purchasing Power Parity – The Big Mac was created in 1967 by Jim Delligati, a McDonald’s franchise owner in Pennsylvania. It was launched throughout the U.S. the following year, and today you can buy one in more than 70 countries. However, the price you pay will vary based on where you are, as evidenced by the Big Mac Index.”, The Economist and Visual Capitalist, February 16, 2022

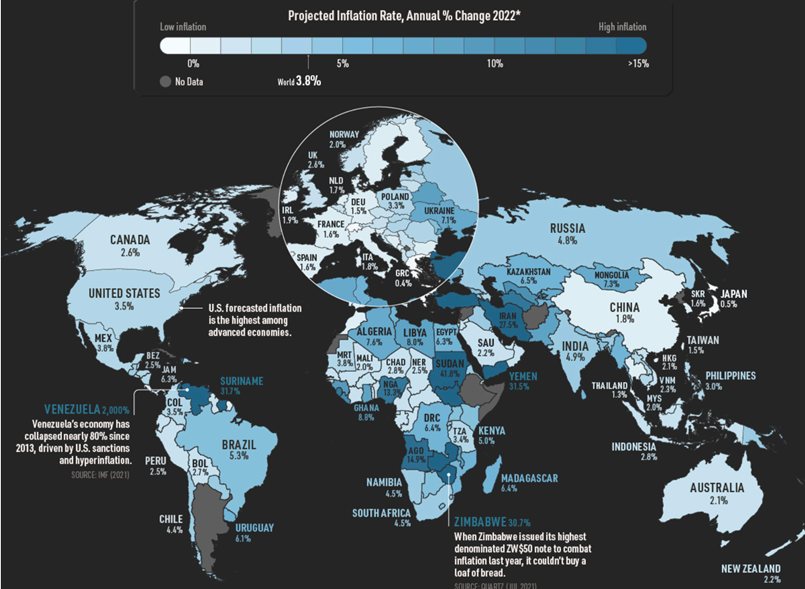

“Mapped: Inflation Forecasts by Country in 2022 – Today, this is a question on many investors’ minds. Across several countries, inflation has hit its highest level in decades. Supply shortages and massive monetary stimulus have contributed to increasing consumer prices. Asset prices, including houses, have also risen significantly. In this Markets in a Minute from New York Life Investments we show inflation by country in 2022 according to IMF projections.”, Visual Capitalist, February 10, 2022

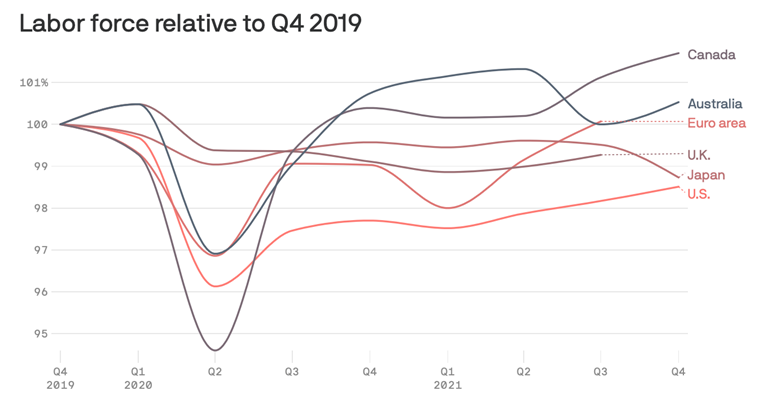

“Labor markets rebound – “Labor markets in advanced economies bounced back super-fast relative to pre-pandemic levels, but the U.S. is slightly behind. Why it matters: Consider it took years for jobs to come back after the 2008 financial crisis. This is like no other economic recovery in history, said Claire Li, an assistant vice president at Moody’s who helped put together this data. The United Kingdom and Euro area are ahead partly because of the way they headed off job losses at the start of COVID, using fiscal relief to keep workers attached to the job market — instead of paying unemployment benefits to workers.”, Axios, February 10, 2022

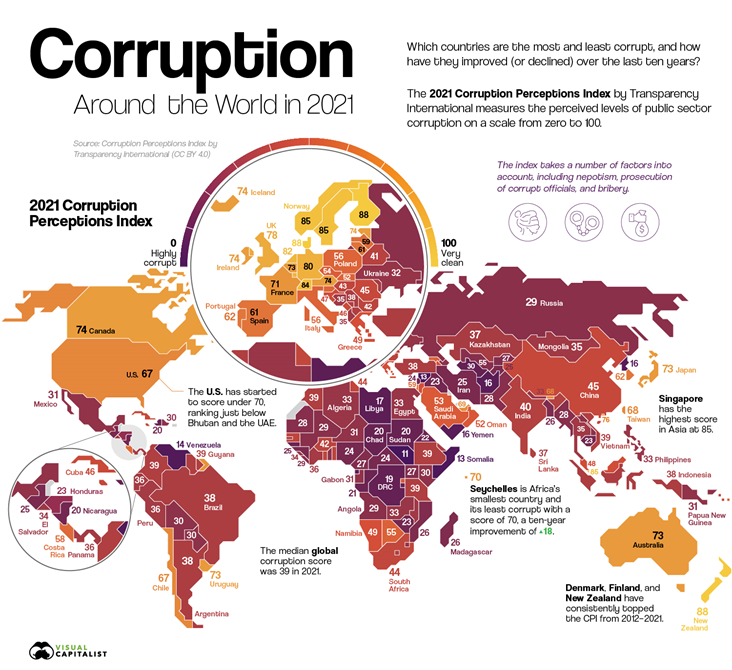

“Mapped: Corruption Around the World – For more than a decade, the Corruption Perceptions Index (CPI) by Transparency International has been the world’s most widely-used metric for scoring corruption. This infographic uses the 2021 CPI to visualize corruption in countries around the world, and the biggest 10-year changes.”, Visual Capitalist and Transparency International, February 10, 2022

“A Global Risk Assessment of 2022 and Beyond – Since the start of the global pandemic, we’ve been navigating through tumultuous waters, and this year is expected to be as unpredictable as ever. In the latest annual edition of the Global Risks Report by the World Economic Forum (WEF), it was found that a majority of global leaders feel worried or concerned about the outlook of the world, and only 3.7% feel optimistic.”, Visual Capitalist and World Economic Forum, January 31, 2022

Global Energy

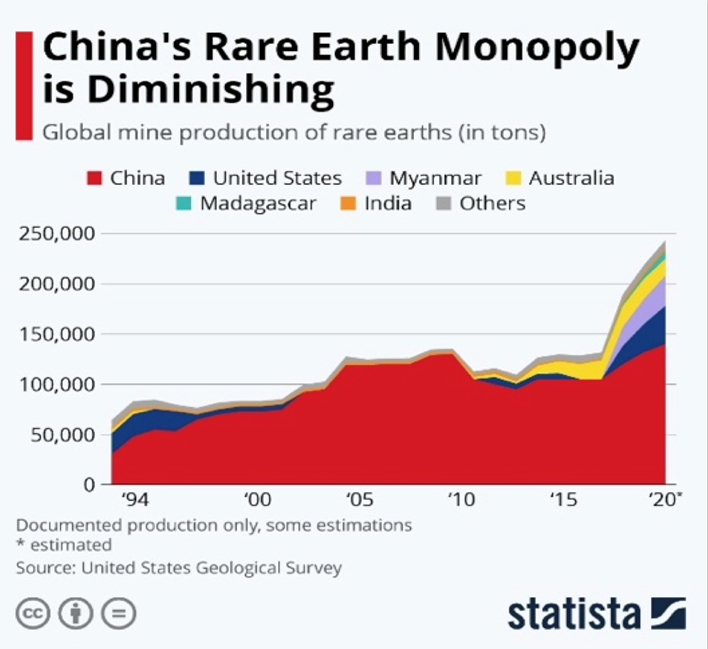

“China’s Reliance on Foreign Oil Declines for First Time in 20 Years – China’s crude oil imports and reliance on foreign oil declined for the first time in two decades, reflecting rising global petroleum prices, expanding domestic production and strengthened supervision of local refiners.”, Caixing Global, February 18, 2022

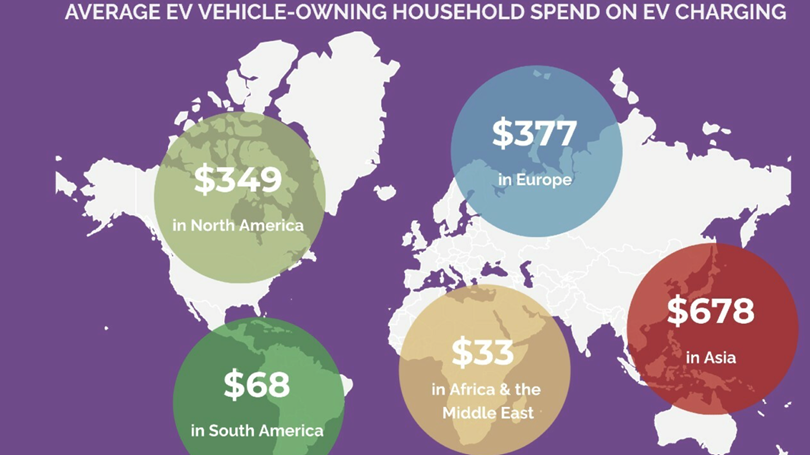

“Here’s How Much You’ll Be Spending to Charge Your Electric Car by 2026 – Expect a 390% growth in electric-vehicle spending globally over the next five years. According to Juniper Research, the lower cost and convenience associated with home charging will lead to a 390% increase in global spend over the next five years. This means the $3.4 billion that was spent on EV charging at home in 2021 will rise to $16 billion by 2026.”, PC Magazine, February 18, 2022

“Battery Swapping Boosts Appeal for New-Energy Heavy Trucks – Almost every new-energy heavy truck sold in China last month had a swappable battery, in a sign Chinese fleet operators are embracing the technology to beat the traditional limits of electric vehicles and reduce their operating costs. All but 20 of the 2,283 new-energy heavy vehicles sold in January were equipped with a power replenishing system capable of replacing the exhausted battery with a fully charged one in just a few minutes.”, Caixing Global, February 21, 2022

Global Supply Chain & Trade Update

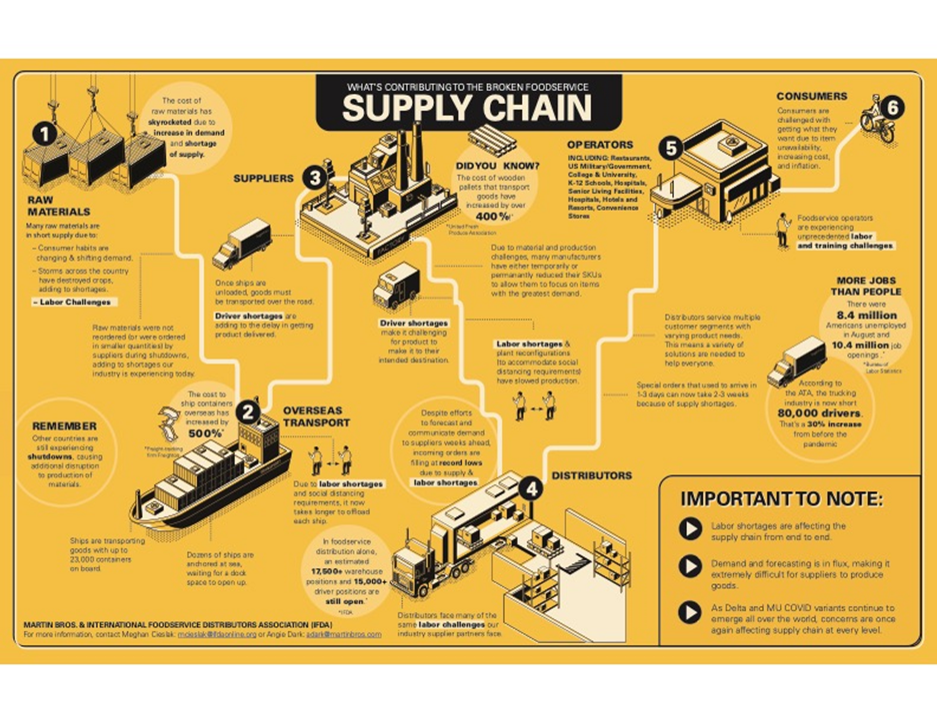

“Fast food chains in Southeast Asia are running out of french fries – Signs at some of Yum! Brands Inc.’s KFC outlets in Singapore informed customers that the company would replace side orders of fries with potato waffles due to a “global supply disruption.” McDonald’s Corp. stores in Malaysia and Indonesia halted sales of large-size portions of fries late last month for the same reason, according to company notices posted on Twitter.”, Fortune, February 18, 2022

“Asia rethinks ‘just-in-time’ strategy as pandemic upends logistics industry – Pandemic-era disruptions have upended distribution networks and exposed vulnerabilities in supply chains from Hong Kong to Singapore to Australia. Businesses are starting to stockpile more and diversify their suppliers, as regional governments look to shore up supplies of raw materials and essential goods.” South China Morning Post, February 19, 2022

“How Supply Chain Issues Continue To Impact The Restaurant Industry – As more independents and franchised QSR’s, Fast Casual and full service restaurants reopen to standard capacity, increasing supply chain issues and problems have made it challenging for business owners, dealers, and operators in the industry……In addition, did you know that continued demand for takeout has exacerbated shortages of items, such as coffee cups, plastic straws, and to-go containers?”, Forbes, February 14, 2022

Global, Regional & Local Travel Updates

“12 things to consider for international business travel – To help you prepare for an international business trip, we asked business leaders and travel professionals this question for their best insights. From updating your vaccinations to securing your devices, there are several considerations that may help you best prepare for your international business travels.”, AZ Big Media, February 20, 2022

“Australia’s border reopens to international visitors – Australia has reopened its international border for the first time in nearly two years, bringing joyful family reunions and a boost to tourism. The country imposed some of the world’s strictest travel bans after shutting itself off in March 2020 due to Covid.”, BBC News, February 19, 2022

“Air France to Introduce 200 New Direct Flights From the U.S. to Paris This Summer – Air France is restoring several flights between the U.S. and Paris this summer, the airline announced recently, as Europe heads into what the World Health Organization described as a “long period of tranquility” in the ongoing COVID-19 pandemic.”, Travel & Leisure, February 14, 2022

“Vietnam to Lift Curbs on Tourists March 15 – International tourists must have proof of being vaccinated or recovery from COVID-19 with a negative test result ahead of departure under the current plan, the website reported. They would be required purchase Covid-19 medical insurance coverage worth $10,000.”, Bloomberg, February 16, 2022

Global COVID & Vaccine Update

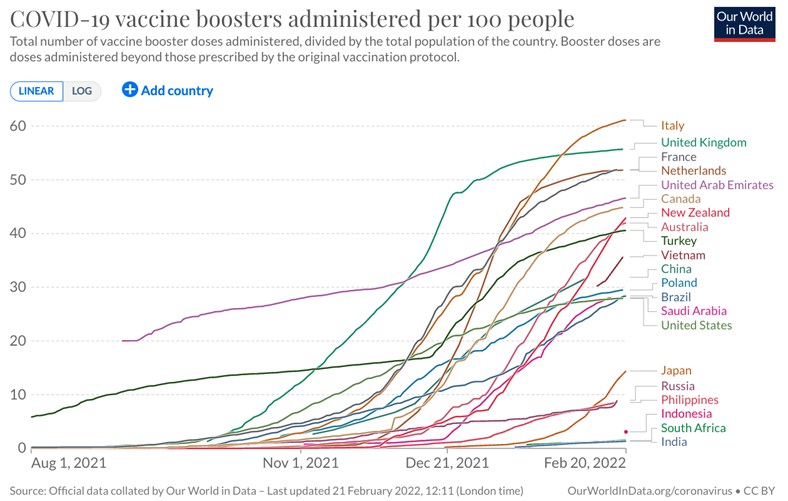

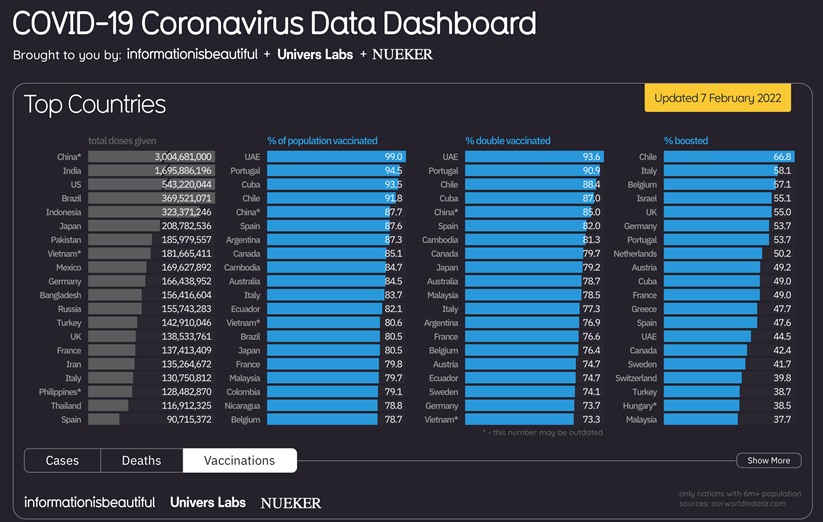

“62.3% of the world population has received at least one dose of a COVID-19 vaccine. 10.57 billion doses have been administered globally, and 31.82 million are now administered each day. Only 11.4% of people in low-income countries have received at least one dose.”, Our World In Data, February 20, 2022

Country & Regional Updates

European Union

“Eurozone economic activity rises at fastest pace since September – February PMI shows strong momentum in manufacturing and services while signalling concern over rising prices. The flash purchasing managers’ composite index for the eurozone, an important measure of the health of the manufacturing and services sectors, rose to 55.8 in February, up from 52.3 in January and the highest since September.”, The Financial Times, February 20, 2022

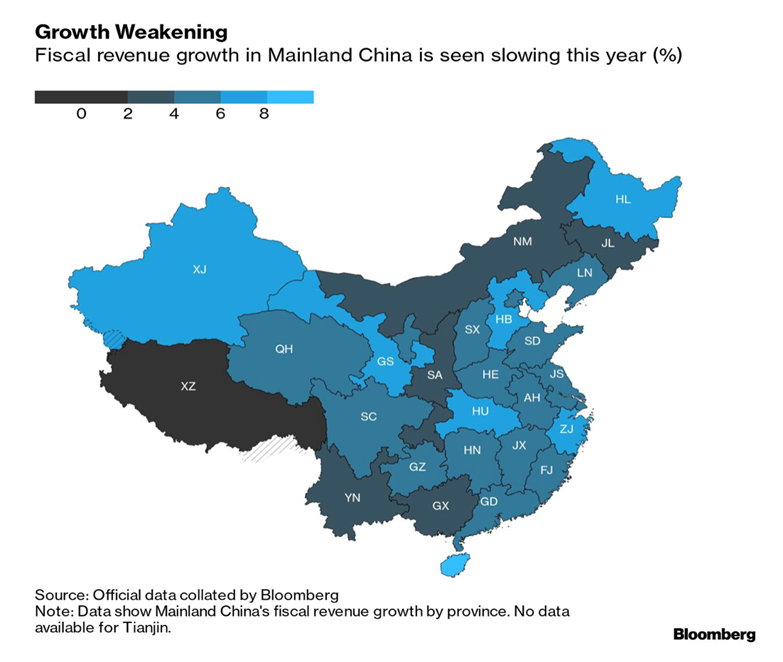

China

“China Tries a Balancing Act as Economy Hits Cross-Currents – As China’s property slump slows its economy, there’s increasing focus on how the central bank and government are going to support growth. As for government spending, that hasn’t ramped up as quickly as some had been expecting. While authorities have emphasized infrastructure investment, their actual spending hasn’t matched the rhetoric.”, Bloomberg, February 21, 2022

“Hershey officially denies withdrawing from China saying it is working with dealers to resolve supply issues – On February 11, in response to the rumors of withdrawing from the Chinese market, Hershey told Caijing.com today that China has always been one of the important markets for Hershey Company, and Hershey Company will still maintain an operation team . Continue to invest in the Chinese market and lead the continuous business promotion of distributors in China.”, Caijing (Chinese), February 11, 2022. Compliments of Paul Jones, Jones & Co., Toronto

Japan

“Japan’s Economy Recovered in Fourth Quarter – GDP expanded at annualized rate of 5.4% after Covid-19 restrictions were lifted, but the new year has brought a surge in infections. The growth was due largely to private spending, which increased 2.7% from the previous quarter. Spending on services recovered solidly after a state of emergency in Tokyo and other cities was lifted on Sept. 30. About 80% of the nation’s population was vaccinated by the end of 2021, making people feel safer to dine out or travel.”, The Wall Street Journal, February 14, 2022

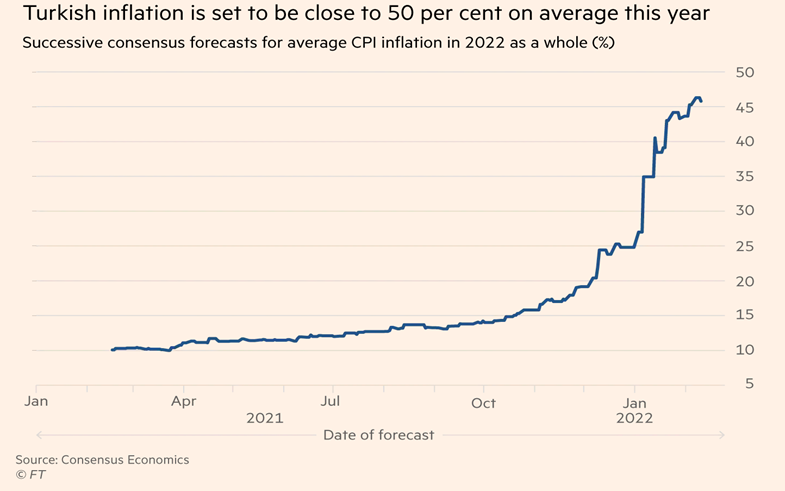

Turkey

“Can Erdogan’s gamble keep the Turkish lira steady? Erdogan argues that his “new economic model” will attract foreign direct investment that will bring hard currency into the country. Even with rock bottom valuations, western investors who have traditionally been the strongest source of FDI into Turkey remain hesitant due to concerns about the country’s economic management and the rule of law.”, The Financial Times, February 19, 2022

United Kingdom

“U.K.’s Boris Johnson Ends Covid Rules in England in Major Policy Shift – U.K. premier says Covid restrictions in England to be lifted Plan welcome by ruling Tories key to his political survival. Boris Johnson said the U.K. must learn to live with coronavirus as he ended pandemic rules in England, becoming the first major Western government to do so even as his scientific advisers warned infections will rise.”, Bloomberg, February 20, 2022

“The (UK) economy has shaken off the effects of Omicron restrictions at the start of the year to rebound this month. The flash IHS Markit/CIPS composite purchasing managers’ index rose to 60.2 in February, from 54.2 in January, well above the consensus, 55.3. A figure above 50 indicates growth. A strong recovery in consumer spending on travel, leisure and entertainment boosted services companies. The flash services PMI increased to 60.8, from 54.1. Meanwhile, manufacturing PMI held steady at 57.3 as weaker employment growth offset a rise in the output balance.”, The Times of London, February 20, 2022

United States

“U.S. Retail Sales Rise Most in 10 Months in Broad-Based Rebound. Total value of receipts jumps 3.8% after dropping in December. Non-store retailers, furniture and autos among biggest gains. The value of overall purchases rose 3.8% in January after a downwardly revised 2.5% drop in the prior month, Commerce Department figures showed Wednesday. The advance was nearly double the median estimate of 2%.”, Bloomberg, February 16, 2022

Brand News

“Why Grill’d next move could put some customers off – Customers will have to shell out more money for some of their favourite items as burger chain Grill’d flagged increasing prices in the coming months. Grill’d co-founder and managing director Simon Crowe blamed rising supply chain costs and inflationary pressures as the reason for the rises, noting he hadn’t seen this level of pricing pressures from all angles for over 10 years. It’s turned two of its restaurants entirely plant-based, renaming the new venues which are based in Darlinghurst in Sydney and Collingwood in Melbourne, as Impossibly Grill’d.”, News.com.au, February 9, 2022. Compliments of Jason Gehrke, President, the Franchise Advisory Centre, Brisbane

“Get Ready to Order Your Big Mac from a Virtual McDonald’s in the Metaverse – Earlier this week, trademark attorney Josh Gerben reported that McDonald’s had filed 10 new trademark applications indicating that it is planning to open a virtual restaurant in the online metaverse.”, Food and Wine, February 11, 2022

“Why Pret-A-Manger’s UK Customers Are Seeing Red Over Its Coffee – It must have sounded like a good idea at the time for British chain Pret-a-Manger to offer guests five daily handcrafted beverages, covering choices that included “up to five organic coffees, teas, lattes, hot chocolates and more every day” if they paid a flat fee of 20 GBP ($27.22) monthly (via Pret-a-Manger). But things don’t always go according to plan.”, Mashed, February 19, 2022

“Can Starbucks China s Price Increase for Some Products Win the Future? Starbucks has already taken the lead in raising prices in the US domestic market. CEO Kevin Johnson said at the earnings conference that some product price hikes were aimed at countering the impact on profits from wage hikes and other cost increases.”, Caixin.com (Chinese), February 2, 2022. Compliments of Paul Jones, Jones & Co., Toronto

“Taco Bell sets sights on reaching 1,000 units outside the U.S. – The brand’s largest international market surpassed the 100-unit milestone and others are soon to follow. As a member of the Yum portfolio, Taco Bell’s strength has come from domestic growth over the past few years. But now Taco Bell is standing out for its success with international locations. The Irvine, Calif.-based chain ended the year with 7,791 units, of which 789 were international — and that growth outside the U.S. is a 25% increase from the roughly 600 international units at the beginning of 2021.”, Nation’s Restaurant News, February 15, 2022

“White Castle to hire 100 robots to flip burgers – The robotics program will take place in nearly one-third of the company’s locations. The hamburger chain announced plans this week to install Miso Robotics’ “Flippy 2” in 100 locations. The Ohio-based chain has been experimenting with the robotic fry cook since September 2020, when the original “Flippy” was installed in a Chicago area restaurant.”, Today.com, February 18, 2022

“Yum China’s fourth quarter 2021 net profit drops 93 percent, plans to add 1,000 stores in 2022. Affected by the epidemic, same-store sales, an important indicator of chain restaurants, fell further in the fourth quarter of 2021, down 11% year-on-year, with KFC and Pizza Hut down 12% and 8% respectively.”, Caixin (Chinese), February 9, 2022. Compliments of Paul Jones, Jones & Co., Toronto

This Issue’s Cartoon

Articles & Studies For Today And Tomorrow

“2022 Franchising Outlook – Franchising had an exceptional year in 2021, and 2022 looks to be another strong year of recovery. Bolstered by both the strengthening labor market and steady consumer spending, franchising is expected to continue to expand, trending upwards with the United States’ overall economic progression, but the pace of the growth in 2022 is most likely to moderate, due to the current headwinds in the economy.”, The International Franchise Association and FRANdata, February 2022

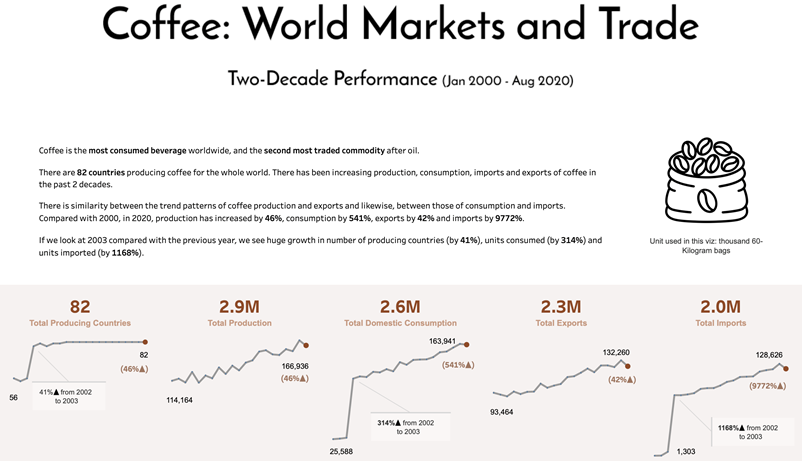

“Coffee production and consumption have been consistently on the rise in the past 2 decades. Interestingly, there are some periods that production were surpassed by domestic consumption. Top 10 producing countries provide 83% of world coffee beans. Top 10 markets consumes 81% of world beans. Top market is European Union which consumes 40% of the world beans. United States as a single country consumes 22% of the world beans.”, Tableau Public, 2021

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, economic development and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing environment. Our GlobalTeam™ covers 43 countries and provides us with updates about what is happening in their specific countries. Please feel free to send us your input for the biweekly report. bedwards@edwardsglobal.com

To sign up for our biweekly newsletter click on this link: https://lnkd.in/d_XkTGN.

William (Bill) Edwards, Your Newsletter Editor, has a four-decade career successfully accelerating the international growth of more than 40 brands. Bill Edwards has a four-decade career successfully accelerating the international growth of more than 40 brands. Bill is known as an international Problem Solver and Advisor. Over the years, Bill has made and/or seen most of the mistakes companies make when going global. In Bill’s role as a Global Advisor to ‘C’ level executives, his objective is to impart the wisdom he has learned over time to help them minimize costly mistakes.

With experience in the franchise, oil and gas, information technology and management consulting sectors, he has directed projects on-site in Alaska, Asia, Europe and the Middle and Near East. He has lived in China, the Czech Republic, Hong Kong, Indonesia, Iran and Turkey and has worked on projects in over 50 countries.

Edwards Global Services, Inc. (EGS) provides a complete International solution for companies Going Global. From initial global market research and country prioritization, to developing new international markets, providing in-country operations support and problem solving around the world. Our U.S. based executive team has experience living and working around the world. Our Team on the ground overseas covers 40+ countries. EGS has twice received the U.S. President’s Award for Export Excellence.

Download our latest chart ranking 40+ countries as places to do business at this link:

Our Latest GlobalVue™ Country Ranking

For advice on doing business successfully across 40+ countries, contact Bill Edwards at bedwards@edwardsglobal.com or +1 949 224 3896.

EGS Biweekly Global Business Newsletter Issue 49, Tuesday, February 8, 2022

Trends in this issue:

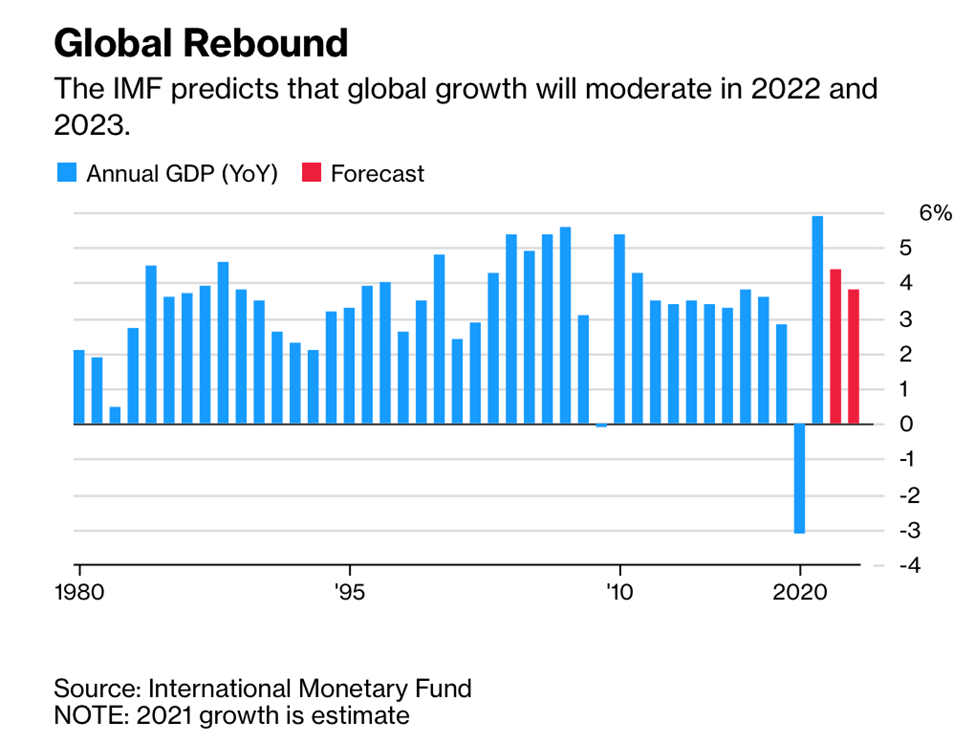

Australia and New Zealand reopen, the European Union sees declining COVID cases, global supply chain continues to be a mixed situation, the IMF sees a global GDP rebound in 2022 but global unemployment is highly variable across the world.

First, A Few Words of Wisdom

“If you don’t ask, the answer is always no.”, Nora Roberts

“Please think about your legacy, because you’re writing it every day.”, Gary Vaynerchuk

“Success usually comes to those who are too busy to be looking for it.”, Henry David Thoreau

Highlights in issue #49:

- Australia and New Zealand finally reopening for travel

- Brand Global News Section: Dunkin’ Donuts®, KFC®, Restaurant Brands NZ, Wingstop®

Interesting Data and Studies

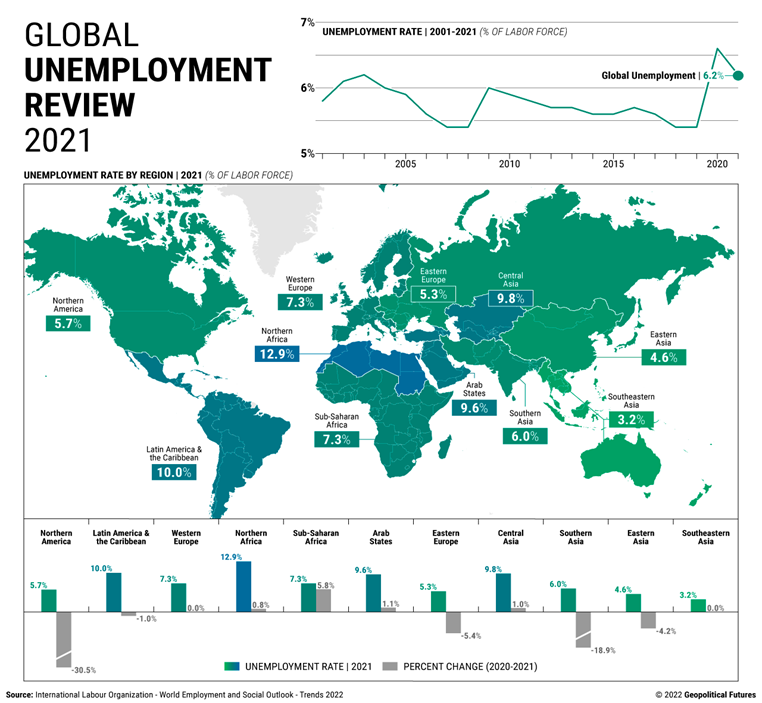

“The global labor market faces a deficit of 52 million full-time jobs, and unemployment affects 207 million people. The global unemployment rate of 6.2 percent is the second highest since 2003 and isn’t expected to return to pre-pandemic levels this year.”, Geopolitical Futures, January 28, 2022

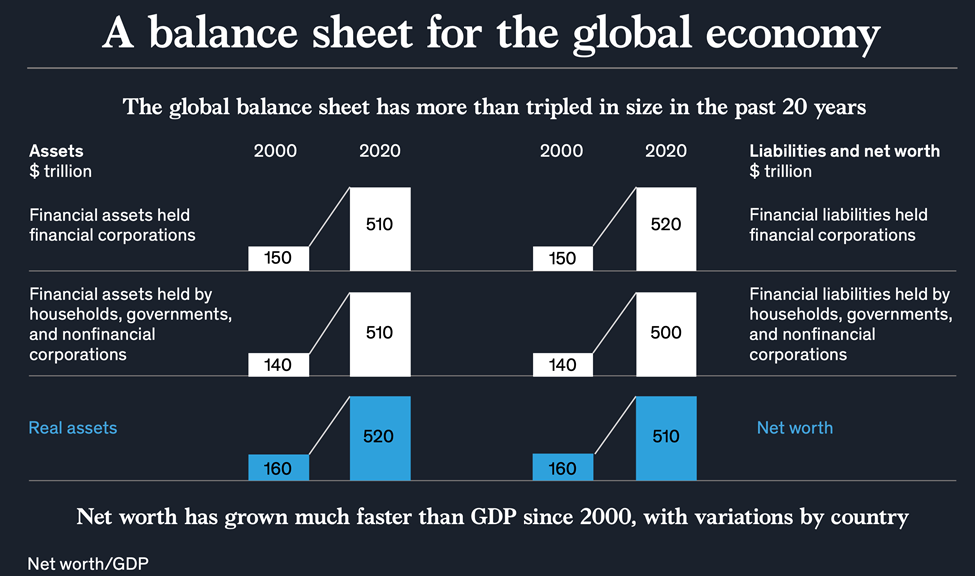

“The rise and rise of the global balance sheet – The market value of the global balance sheet tripled in the first two decades of this century. The world has never been wealthier, with large variations across countries, sectors, and households.”, McKinsey, November 2021

Global Supply Chain & Trade Update

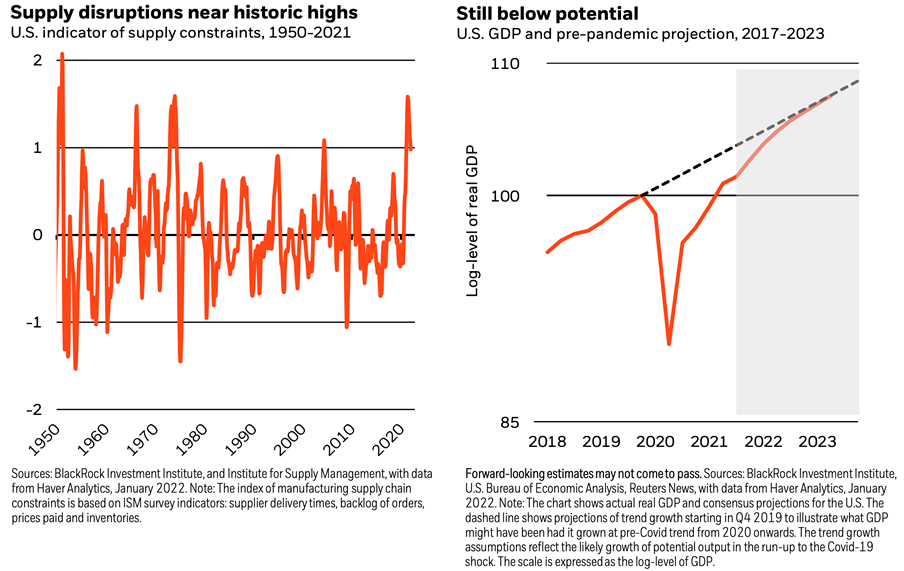

“A world shaped by supply – We’ve entered an era where supply constraints are the driving force of inflation, rather than excess demand. This will likely bring more macro volatility and force policymakers to live with higher inflation. We are in a new and unusual market regime, underpinned by a new macro landscape where inflation is shaped by supply constraints.”, Blackrock, January 2022 study

“Why supply-chain problems aren’t going away – Results season shows the financial effects of supply-chain snarl-ups on industrial firms. Supply chains have seldom featured in companies’ earnings reports over the three decades since globalisation took off in earnest, save for the occasional mention of the benefits of low costs and lean inventories. This earnings season, though, covid-induced shortages are among the first problems mentioned by many firms.”, The Economist, January 29, 2022

“World Food Prices Are Climbing Closer Toward a Record High – UN’s index of global food costs advanced 1.1% last month Unfavorable weather, energy crisis threaten further increase. The United Nations’ index of prices rose 1.1% in January, pushed up by more expensive vegetable oils and dairy. The gauge is edging closer to 2011’s all-time high, and unfavorable weather for crops and the fallout from an energy crisis threaten to keep prices high going forward. Inflation has been running rampant across the globe, and the latest leg higher in the UN’s food index could further stretch household budgets.”, Bloomberg, February 3, 2022

From a Private Director’s Association webinar, “Supply Chain Structure: Future Risks and Opportunities”, January 27, 2022

“Supply Chain Surges & Shortages, Exiger Trends Report, January 2022

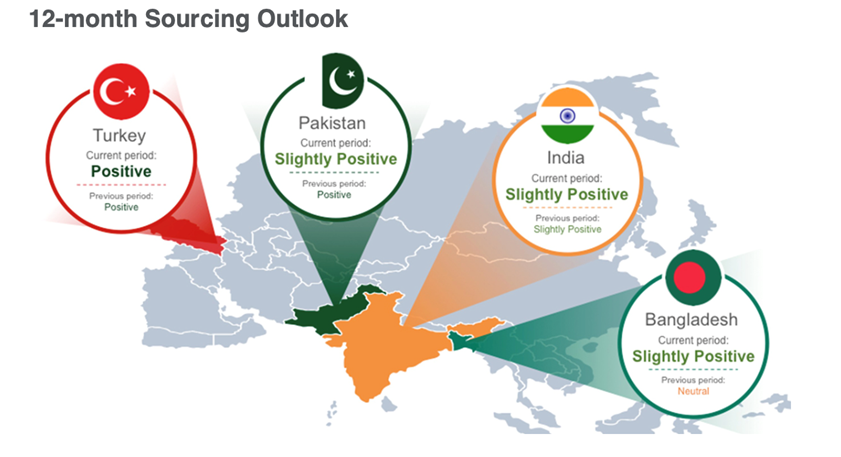

““Asia Sourcing Update – South and West Asia – Bangladesh, India, Pakistan and Turkey.”, FUNG Business Intelligence, January 30, 2022

Global, Regional & Local Travel Updates

“Travel & Tourism’s Contribution to Global Economy Could Reach $8.6 Trillion in 2022 – In 2019 the travel and tourism industry’s contribution to the global economy was almost $9.2 trillion, it said. The institution added that the sector’s contribution to global employment could reach over 330 million jobs, just 1% below pre-pandemic levels and 22% above 2020.”, The Wall Street Journal, February 2, 2022

“Chinese State-Owned Airlines Took Heavy Losses in 2021 – Over the past year, the aviation market in China has still been heavily impacted by the pandemic. The authority maintained the zero-tolerance policy against the virus, and one of the consequences was low travel demands from both domestic and international markets. All three airlines attributed the main reasons for heavy losses to the influence of the pandemic. During the traditional peak travel seasons in China, heavy restrictions were put in place to reduce traffic, especially in and out of areas that had Covid-19 cases.”, Airline Geeks, February 3, 2022

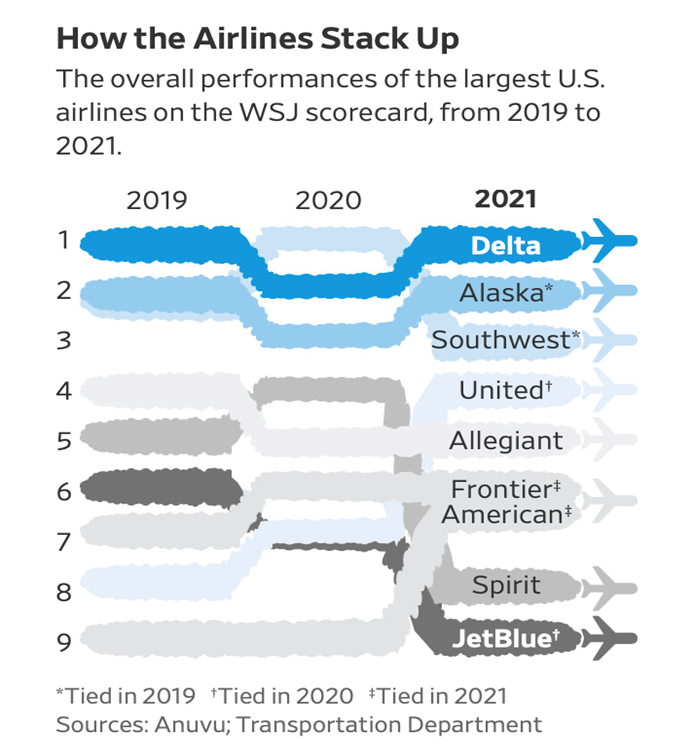

“The Best and Worst U.S. Airlines of 2021 – As Omicron infections and weather challenges hampered operations, some carriers struggled more than others to return to some version of pre-pandemic normal. The good news: Flying is more like it used to be. The bad news: Flying is more like it used to be. Leisure travel came roaring back in 2021. So did cancellations, delays and other flight problems. Airlines began to resemble their pre-pandemic selves, even if they still flew less overall than they did in 2019.”, The Wall Street Journal, January 28, 2022

Global COVID & Vaccine Update

“Europe entering Covid pandemic ‘ceasefire’, says WHO – The World Health Organization’s (WHO) Europe director says the continent could soon enter a ‘long period of tranquillity’ in the Covid-19 pandemic. Dr Hans Kluge cited high vaccination rates, the end of winter and the less severe nature of the Omicron variant. It comes as a number of European nations end Covid-19 restrictions. Speaking to reporters, he said: ‘This period of higher protection should be seen as a ‘ceasefire’ that could bring us enduring peace.’”, BBC News, February 3, 2022

“Information is beautiful chart, February 7, 2022

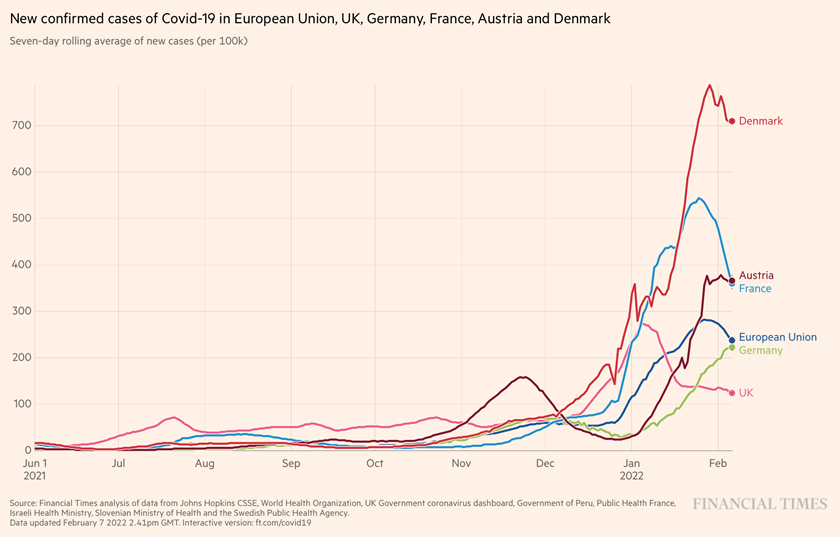

New cases of COVID-19 begin to decline in most of the European Union countries and in the United Kingdom coming out of the latest variant. The Financial times, February 7, 2022

Country & Regional Updates

European Union

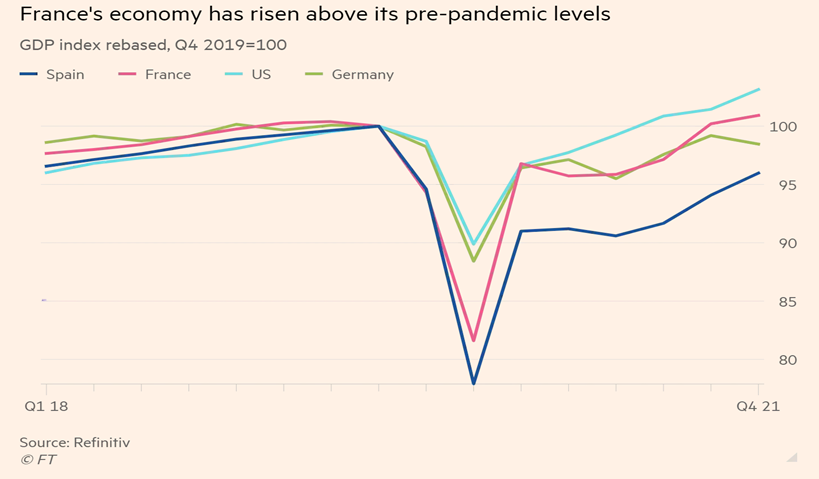

“The French national statistics office said average growth in 2021 was its fastest rate since 1969, at the peak of the postwar period known as “les trente glorieuses”. The economy has bounced back sharply from its 8 per cent contraction in 2020. The eurozone’s second-largest economy returned to its pre-pandemic level of GDP in the third quarter, it said.”, The Financial Times, January 28, 2022

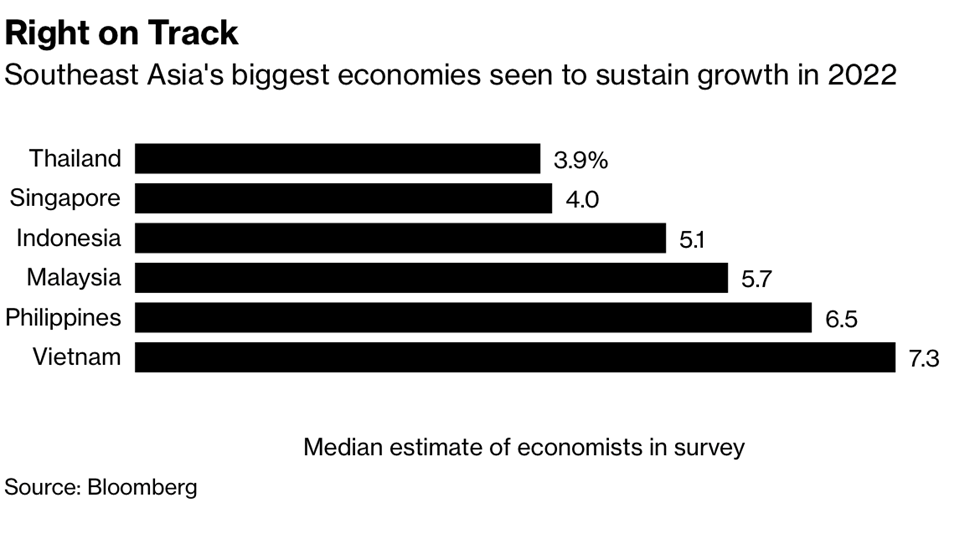

Southeast Asia

Australia

“After two years of closed borders, Australia welcomes the world back – Australia said on Monday it will reopen its borders to vaccinated travellers this month, ending two years of misery for the tourism sector, reviving migration and injecting billions of dollars into the world No. 13 economy. The move effectively calls time on the last main component of Australia’s response to the COVID-19 pandemic, which it has attributed to relatively low death and infection rates.”, Reuters, February 7, 2022

China

“It was in China, specifically the city of Wuhan, where the first cases of COVID-19 were detected in early 2020 before quickly spreading worldwide. China is now pushing a zero COVID policy using contact tracing, mass testing, a special app and lockdowns to try to eliminate the virus completely. Similar strategies have been adopted in other countries but were eventually abandoned in the recognition that COVID-19 is here to stay. But China is holding firm, imposing regulations very similar to the ones adopted at the beginning of the outbreak”, Geopolitical Futures, February 5, 2022

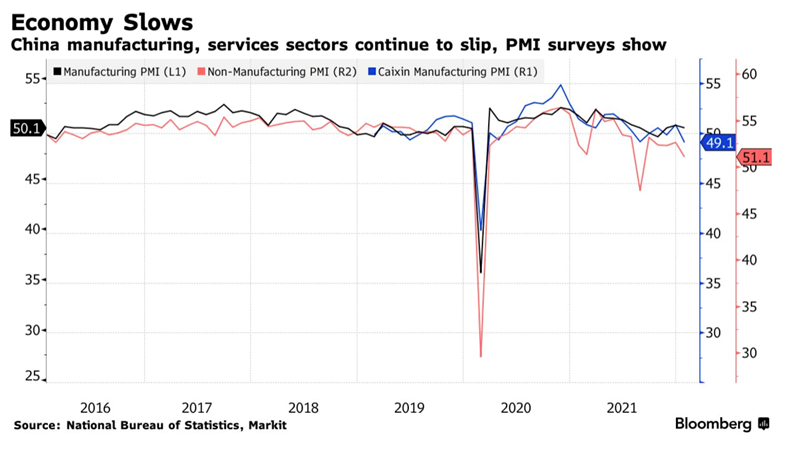

“China Manufacturing Slips in Latest Sign of Slowing Economy – PMI surveys signal slowdown in factories, services sector. Small businesses under pressure, Caixin survey shows. The official purchasing managers’ surveys released on Sunday showed a moderation in factory production and services in January. Small businesses bore the brunt of the pain, with a separate private index dropping to its lowest in almost two years.”, Bloomberg, January 30, 2022

Japan

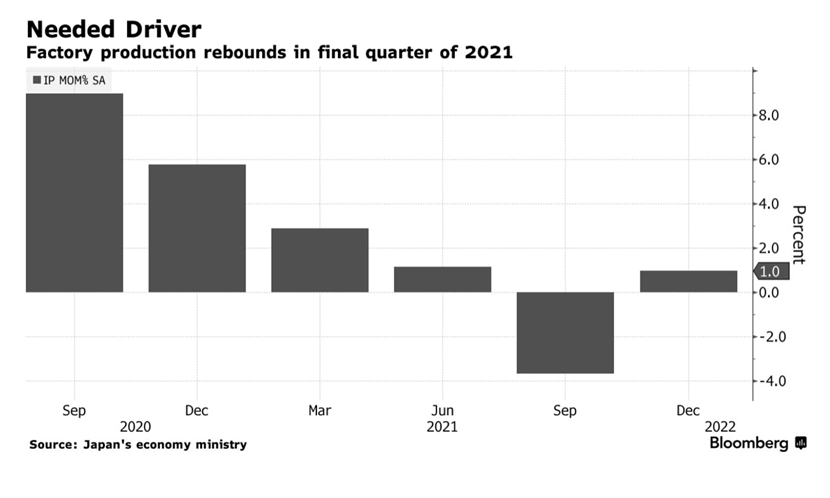

“Japan Quarterly Output Gain Signals Growth Return Before Omicron – Auto production led fourth quarter rebound in manufacturing Supply chain problems persist and omicron now clouds outlook. Japan’s industrial production rebounded last quarter, with the recovery in manufacturing likely helping restore economic growth at the end of 2021 before the omicron variant started its rapid spread.”, Bloomberg, January 30, 2022

New Zealand

“New Zealand will finally start to reopen its borders this month – New Zealand is putting an end to its quarantine requirements for incoming travelers and will start reopening its borders with a five-phase plan in March. The island nation, which has implemented some of the toughest border restrictions in the world since the start of the COVID-19 pandemic, announced Thursday it’s going to begin a phased reopening of its borders, the AP reported. New Zealand is putting an end to its quarantine requirements for incoming travelers and will start reopening its borders with a five-phase plan in March.”, The Points Guy, February 3, 2022

United States

“A Record 50% of U.S. Small Businesses Raised Wages in January to Lure Workers – A record 50% of U.S. small-business owners said they raised compensation in January amid still-elevated job openings, the National Federation of Independent Business said Thursday. With some 47% of small businesses reporting job openings last month that they could not fill, employers have been raising wages to attract skilled candidates — a trend that doesn’t appear to be reversing any time soon.”, Bloomberg, February 3, 2022

“With Omicron Waning, Americans Are Ready for the Reopening – A transition to a new pandemic normal holds major implications for the U.S. economy, and particularly for the hard-hit services sector, where recovery so far has been stunted even as spending elsewhere has soared. Even the perception of a pandemic lull this time around could have a significant effect. “People are going to, I think, have an even more euphoric attitude toward this if we do feel like this is really the actual end of the pandemic,” says Jefferies economist Tom Simons. ‘That will feel like a boom.’”, Barron’s, February 7, 2022

“California finally reopens: Mammoth and Tahoe ski resorts reopen lodgings after rollback of state’s COVID order. Mammoth and Lake Tahoe area ski resorts and mountain towns are reopening hotels and lodges to leisure visitors after California’s governor on Monday lifted statewide regional orders that had closed lodging to most travelers.”, Los Angeles Times, January 25, 2022

Brand News

“New research shows 84% of franchise companies report revenues are now equal to or higher than pre-pandemic levels – Franchise Business Review today announced the release of its 2022 Franchising Outlook Report. The report is based on research from over 31,000 franchise owners across 350 brands, 6,000 employees at both the corporate office and unit-level, and 200 franchise executives.”, Franchise Business Review, February 2, 2022

“How Dunkin’ Changed Franchising Forever – The first Dunkin’ was opened back in 1948, in Quincy, Massachusetts, after William Rosenberg had the idea to start selling donuts and coffee for just $0.05 and $0.10 each, respectively. Because of his dream and drive to make it a reality, Rosenberg remains a key pioneer of the fast food industry. In 2000, The LA Times reports, he was honored by the Nation’s Restaurant News as one of the top 100 people who ‘changed retailing and food service in the 20th century.’”, Mashed, January 30, 2022

“KFC Australia makes its drone delivery debut – CMO says the pilot of drone food delivery was prompted by dramatic changes to consumer behaviours during the pandemic. KFC Australia has teamed up with drone service provider, Wing, to pilot a delivery service of both hot and fresh menu items in Australia.”, CMO Australia, February 4, 2022

“Restaurant Brands lifts NZ sales by $51m; Covid closures cost it $26m – The fast-food company that owns the local franchises for KFC, Pizza Hut, Taco Bell and Carl’s Jr, made an extra $51 million in sales in New Zealand last year, but estimates it lost about $26m of sales as a result of Covid-19.”, Stuff New Zealand, January 27, 2022. Compliments of Jason Gehrke, Franchise Advisory Centre, Brisbane, Australia

“Wingstop creates digital-only, cashless storefront unit – Dallas prototype serves as testing ground for innovations — from sustainable uniforms and cashless transactions to a kitchen display system and grease extraction for bio-fuels. Wingstop Inc. in December opened a “Restaurant of the Future” in a Dallas strip mall, featuring cashless 100% digital transactions and serving as testing ground for new ideas, from new layouts and uniforms to a kitchen display system.”, Nation’s Restaurant News, February 3, 2022

Cartoon Of The Issue: Leadership!

Articles & Studies For Today And Tomorrow

“AI in Restaurants? The Possibilities are Limitless – The global AI market as a whole is expected to grow to a value of $190.61 billion by 2025. It looks like 2022 is shaping up to be a very interesting year in restaurant technology, especially in the quick-serve and fast-casual spaces. For example, we learned in December that TikTok was teaming up with a ghost-kitchen company to open 300 virtual kitchens in March, aiming to reach 1,000 by the end of the year. On the menu? Recipes that have gone viral on the video-sharing app.”, QSR Magazine, January 28, 2022

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, economic development and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing environment. Our GlobalTeam™ covers 43 countries and provides us with updates about what is happening in their specific countries. Please feel free to send us your input for the biweekly report. bedwards@edwardsglobal.com

To sign up for our biweekly newsletter click on this link: https://lnkd.in/d_XkTGN.

William (Bill) Edwards, Your Newsletter Editor, has a four-decade career successfully accelerating the international growth of more than 40 brands. Bill Edwards has a four-decade career successfully accelerating the international growth of more than 40 brands. Bill is known as an international Problem Solver and Advisor. Over the years, Bill has made and/or seen most of the mistakes companies make when going global. In Bill’s role as a Global Advisor to ‘C’ level executives, his objective is to impart the wisdom he has learned over time to help them minimize costly mistakes.

With experience in the franchise, oil and gas, information technology and management consulting sectors, he has directed projects on-site in Alaska, Asia, Europe and the Middle and Near East. He has lived in China, the Czech Republic, Hong Kong, Indonesia, Iran and Turkey and has worked on projects in over 50 countries.

Edwards Global Services, Inc. (EGS) provides a complete International solution for companies Going Global. From initial global market research and country prioritization, to developing new international markets, providing in-country operations support and problem solving around the world. Our U.S. based executive team has experience living and working around the world. Our Team on the ground overseas covers 40+ countries. EGS has twice received the U.S. President’s Award for Export Excellence.

Download our latest chart ranking 40+ countries as places to do business at this link:

Our Latest GlobalVue™ Country RankingFor advice on doing business successfully across 40+ countries, contact Bill Edwards at bedwards@edwardsglobal.com or +1 949 224 3896.