EGS Biweekly Global Business Newsletter Issue 48, Tuesday, January 25, 2022

Trends in this issue:

The reinvention of company culture, an explosion of new small businesses, venture capital grew 111% worldwide in 2021, falling shipping rates may mean an end to the global supply chain crisis, working from to be a permanent part of how jobs are done. And a zoom cartoon to reduce stress!

First, A Few Words of Wisdom

“Try to be a rainbow in someone’s cloud.”, Maya Angelou

“Your success in life isn’t based on your ability to simply change. It is based on your ability to change faster than your competition, customers and business.”, Mark Sanborn

“People begin to be successful the minute they decide to be.”, Harvey Mackay

Highlights in issue #48:

- Brand Global News Section: Checkers & Rally’s®, Denny’s®, KFC China, McDonalds®, Phenix Salon Suites®, Starbucks®, TGI Friday’s®, Tropical Smoothie®

Bolded article titles are live links, if the article is available without subscription

Interesting Data and Studies

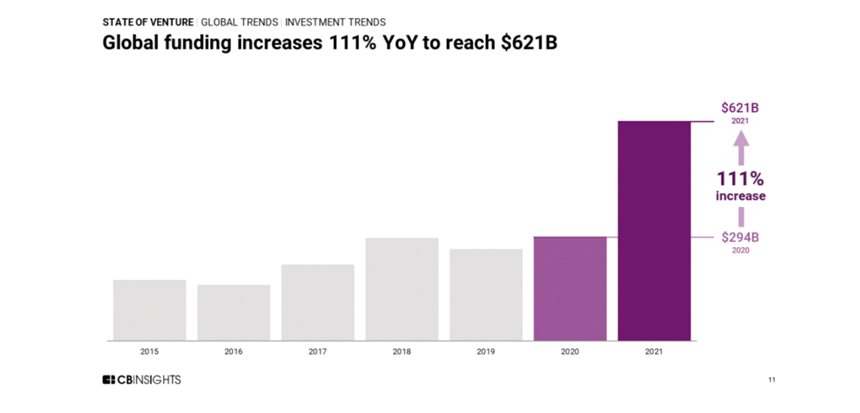

“State Of Venture 2021 Report – It was a record year for global & US venture funding, exits, unicorns, and more. Global venture deals and dollars reached record highs in 2021. Funding more than doubled year-over-year as startup investment soared across sectors and geographies.”, CB Insights, January 12, 2022

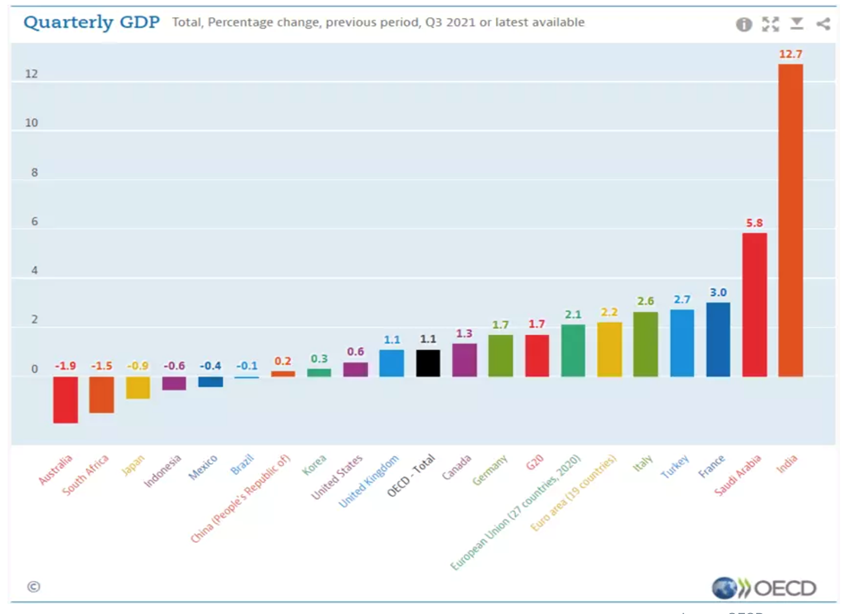

“GDP is growing fastest in these countries – what it means – Countries including India and Turkey saw strong GDP growth in the third quarter of 2021. While other countries, including China, Australia and Japan, saw their GDP slow or fall. The OECD says GDP growth in half the G20 major economies is still below pre-pandemic levels.”, World Economic Forum, January 17, 2022

“Inflation: Seven reasons the cost of living is going up around the world – From buying groceries to heating our homes, the cost of living is rising sharply – not just in the UK but around the world. Global inflation – the rate at which prices rise – is at its highest since 2008. Here are some of the reasons why.”, BBC News, January 20, 2022

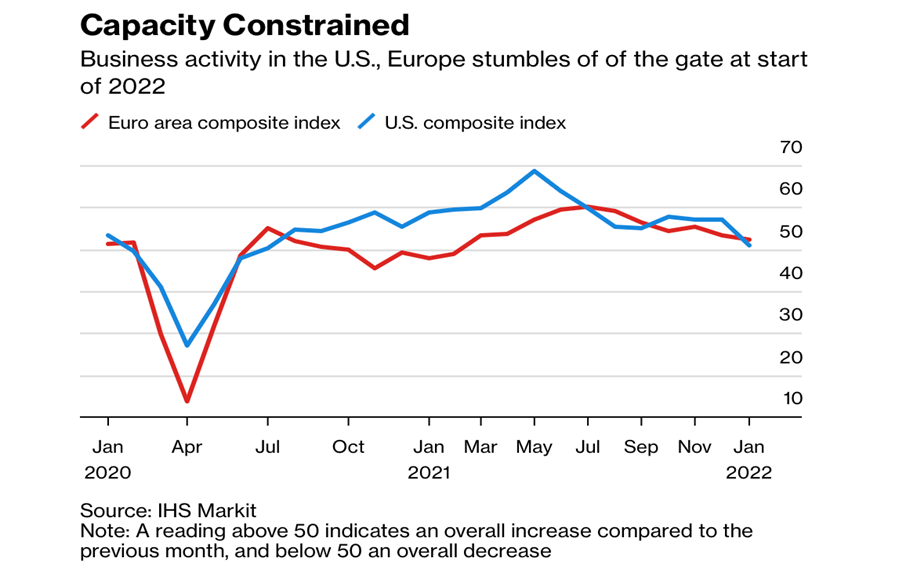

“The knot around the global economy from intractable supply networks is still holding tight at the start of the new year as the omicron variant complicates recovery efforts. According to fresh IHS Markit data, U.S. supplier delivery times lengthened slightly in early January. Still, there’s reason for optimism. Europe’s factories were able to lift output as shipping delays and materials shortages eased somewhat. German businesses expectations for the coming months improved recently. In the U.S., the ISM’s index of future manufacturing output climbed to the highest level in more than a year.”, Bloomberg, January 25, 2022

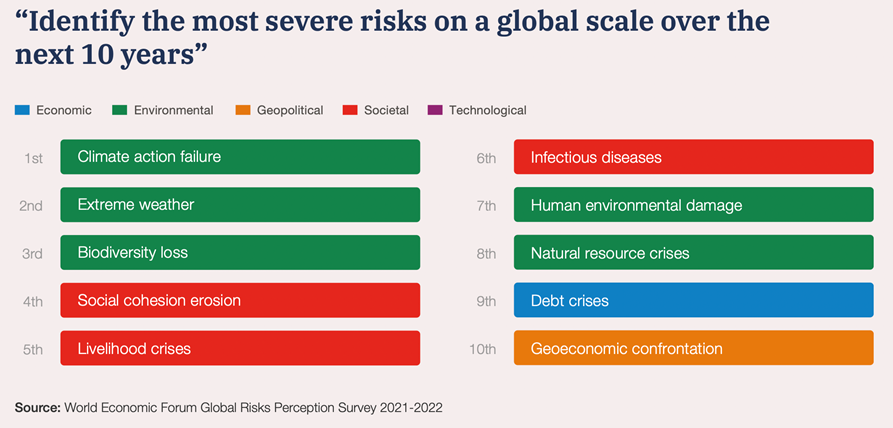

“The Global Risks Report 2022, 17th Edition – In some societies, rapid progress on vaccination, leaps forward on digitalization and a return to pre-pandemic growth rates herald better prospects for 2022 and beyond. Others could be weighed down for years by struggles to apply even initial vaccine doses, combat digital divides and find new sources of economic growth.”, World Economic Forum, January 2022

Global Supply Chain & Trade Update

“Omicron, Supply-Chain Troubles to Slow Growth, World Bank Says – Bank forecasts 4.1% growth in 2022, down from 5.5% last year. The global economy is poised to slow down in 2022, the World Bank forecast Tuesday, citing the effects of the Omicron variant, supply-chain disruptions, labor shortages and the winding down of government economic support. Japan, Indonesia, Thailand, Malaysia and Vietnam are among countries expected to strengthen in 2022. The report projects growth to slow further, to 3.2%, in 2023.”, Wall Street Journal, January 11, 2022

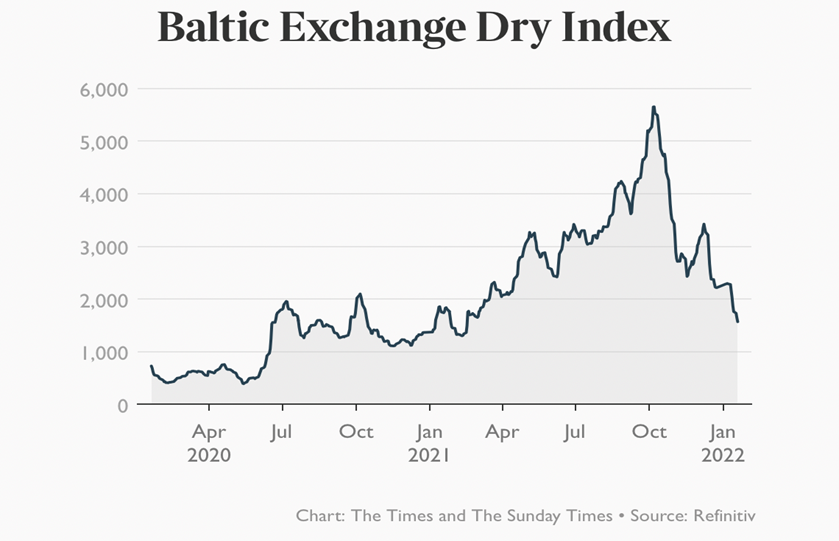

“Falling shipping rates point to end of the great supply chain crisis – The Baltic Dry Index……….measures the price of shipping bulk materials around the world and as such is used as a proxy to measure the stability and efficiency of worldwide supply chains. In times of market dislocation, it rises sharply to reflect the difficulties in transporting goods — and during the pandemic it has done little else but rise, peaking at more than 5,700. That peak in the Baltic Dry was hit on October 7. Since then, the index has fallen sharply, halving within a month. Though it jumped in the run-up to Christmas, it has dropped back again since. Yesterday it fell further, its tenth consecutive daily decline, to 1,570.”, The Times of London, January 21, 2022

“ Race to Measure Supply Chain Snarls Draws a Crowded Field – Jumping in this month were logistics giant Kuehne+Nagel, economists at Citigroup and Morgan Stanley, and researchers at the New York Fed. Analysts at Bloomberg, Flexport and the White House have already launched such data points and are making refinements as the crisis drags on.”, Bloomberg, January 24, 2022

“Challenges at ports, bad weather conditions or vessel issues can impact your shipments and cause disruptions in your supply chain. Currently, more than 561 vessels of the major carriers are anchored off ports, as many ports on every continent are facing disruptions in their operations.”, Sea Explorer, January 25, 2022

“Canada Faces Empty Shelves as Trucking Snarls Hit Food Supplies – About $45 billion worth of goods crosses the border every month, and Canada is the top export market for 32 U.S. states, according to the Department of Commerce. Most trade between Canada and the U.S. travels by truck.”, Bloomberg, January 21, 2022

Global Energy

“Europe’s Energy Shock Rattles Consumers – Wholesale gas prices are up almost 300% in the past year because of unusually low storage levels, increased demand from economies emerging from the pandemic and capped flows from Russia. That has driven inflation higher, and analysts at Bank of America estimate that household energy costs will rise 50% this year, and aid from governments to shield households will only offset about a quarter of that.”, Bloomberg, January 12, 2022

Global, Regional & Local Travel Updates

“A Brighter Outlook For Airlines In 2022? – Airlines are on the cusp of facing their third year dealing with the Coronavirus pandemic. The challenges have continued relentlessly, ranging from new variants of the virus, to shifting government policies on travel restrictions and testing. The impact on customer confidence and on airlines’ ability to plan and operate predictable schedules has hit revenues and finances severely. However, compared with the outlook when I reviewed the landscape 12 months ago, there are reasons for cautious optimism for 2022.”, Forbes, January 23, 2022

“When will international travel return? A country-by-country guide to coronavirus recovery. The emergence of the omicron variant of the COVID-19 virus created upheaval on an international scale……Many countries also changed their entry requirements over the last weeks of 2021, with some decreasing the number of days allowed for pre-travel testing and others once again requiring fully vaccinated travelers to present pre-travel negative test results.”, The Points Guy, January 22, 2022

“The biggest travel trend of 2022: Go big, spend big – If 2021 was about domestic travel, 2022 may be the year of the ‘bucket list’ trip. This is one of the biggest trends that travel insiders expect this year, despite 2022’s tumultuous start as the omicron Covid-19 variant snarled the industry.”, CNBC, January 20, 2022

“How China’s Zero-COVID Goal Is Impacting The Aviation Industry – Inbound international flights to China are operating at a fraction of comparable 2020 numbers and don’t look like recovering any time soon. If anything, capacity may further tighten. Among many industries, the aviation industry is a casualty of China’s zero-COVID policy. China closed its international borders to nearly all foreigners in March 2020, shutting down the inbound tourism and business markets. China has not relaxed that policy since. If anything, they’ve become tougher on who they award the few visas they grant to.”, Simple Flying, January 14, 2022

Global COVID & Vaccine Update

“Europe Slowly Starts to Consider Treating Covid Like the Flu – New metrics are needed as Covid becomes endemic, Spain PM says Hospitalization rates remain manageable despite surging cases. Spain is calling for Covid-19 to be treated as an endemic disease, like the flu, becoming the first major European nation to explicitly suggest that people live with it.”, Bloomberg, January 11, 2022

Country & Regional Updates

Australia

“Chicken shortage to continue for weeks to come, Australian Chicken Meat Federation warns – The continued supply chain strain of Omicron and a national shortage means Australia’s most popular protein will remain off the menu for weeks yet to come.”, News.com.au, January 20, 2022

Canada

“Ontario restaurants take pragmatic approach as they come out of yet another lockdown – As restaurants in Ontario prepare to reopen from the fifth wave of the pandemic, business owners say they’re going to be more cautious this time by bringing in measures such as smaller menus and limited operating hours to ensure they don’t suffer large losses in the case of another lockdown.”, The Globe and Mail, January 23, 2022

China

“Beijing Winter Olympics Will Spotlight a Richer, More Confident China – The country is richer, more confident, and more assertive than it was when the 2008 Summer Games were held in Beijing.”, Bloomberg, January 21, 2022

“Starbucks to widen online reach in China through new alliance with Meituan ending coffeehouse chains partnership with Alibaba – Seattle-based Starbucks said the collaboration with Meituan, which operates China’s largest online food delivery platform, will enable more consumers across the mainland to make reservations at its stores and get their coffee delivered, according to a statement published on Tuesday on the American firm’s official WeChat account.”, South China Morning Post, January 19, 2022. Compliments of Paul Jones, Jones & Co., Toronto

The Philippines

“Philippines Sets Vaccination Mandate For Unrestricted Air Travel – As of January 17th, only fully vaccinated individuals will be allowed to take public transportation to, from, and within the national capital region of the Philippines. While there are exceptions to this policy provided, the blanket policy will apply to air travel as well, which would appear to cover a large portion of flights since Manilla is the country’s largest air hub.”, Simple Flying, January 15, 2022

Poland

“Poland’s Biggest Convenience Chain Overtakes Amazon In European Race For Autonomous Stores – Using contactless, AI-powered computer vision technology from U.S. tech player AiFi—a system similar to Amazon’s Just Walk Out set-up—the concept enables shopping to be checkout-free and fast.”, Forbes, January 18, 2022

Spain

“Spain’s tourist sector seen reaching 88% of pre-pandemic size in 2022 – Spain was the world’s second most visited country before the pandemic. Holidaymakers flocked to its beaches and historic buildings while trendy cities like Barcelona and Madrid were popular for short breaks. Industry association Exceltur expects Spain’s tourism gross domestic product to be worth 135 billion euros ($155 billion) in 2022, 88% of pre-pandemic levels, versus 57% in 2021, when a partial recovery of domestic tourism didn’t offset a contraction in international travellers.”, Reuters, January 13, 2022

United Kingdom

“Britain ‘will be among first’ to emerge from Covid pandemic – Hospital admissions have stopped rising across most of England. The northeast and Yorkshire is the only part of England where admissions are still clearly rising, with London seeing falls and the rest of the country broadly level or starting to decline, adding to confidence in weathering the Omicron wave.”, The Times of London, January 11, 2022

United States

“How Much Are You Willing to Pay for a Burrito? The pandemic has led to the largest price spikes at fast-food restaurants in two decades. The pandemic has led to price spikes in everything from pizza slices in Manhattan to sides of beef in Colorado. And it has led to more expensive items on the menus at fast-food chains, traditionally establishments where people are used to grabbing a quick bite that doesn’t hurt their wallet.”, New York Times, January 21, 2022

“The flip side of the ‘great resignation’ — a small-business boom. From January through November, just under 5 million new businesses were launched, a jump of 55 percent over the same period in 2019. “This time has been really fertile. We’ve seen a huge increase in new businesses since the pandemic started,” said Julia Pollak, the chief economist at ZipRecruiter. ‘There are more opportunities out there.’”, NBC News, December 30, 2022

“Starbucks, McDonald’s, more are cutting hours due to staffing shortages – Starbucks reached out to customers about shortened hours, halt on features and products as omicron cases surge; McDonald’s also announces shorter hours. With a double whammy of surging omicron cases and continued labor shortages, several major restaurant chains are cutting back on hours and services to deal with the challenges, including Starbucks, and Chipotle.”, Nation’s Restaurant News, January 14, 2022

Brand News

“2021 Reflections, 2022 Predictions for Franchising – Naturally, hiring and retention will be crucial in 2022, as will all relationship “soft skills,” from development teams nurturing candidates to FBCs supporting franchisees to being attuned to customer desires. So what else does the future hold for 2022? See what these franchising pros are predicting.”, Franchising.com, January 2022

“Checkers and Rally’s hope to serve up turnaround and debt refinancing – Checkers and Rally’s, backed by private equity firm Oak Hill Capital Partners, “hopes” to refinance its debt within a year, conditioned upon stable markets, CEO Frances Allen told Axios. Why it matters: The beleaguered burger chain is making headway under Allen, who was brought in to turn around the business in early 2020.”, Axios, January 13, 2022

“Denny’s Fuels Growth with Innovative Development Initiatives – The chain is rolling out an upfront cash incentive development program to help domestic franchisees capitalize on market opportunities. The incentive ranges from $50,000 to $400,000, with more money going toward underpenetrated markets.”, FSR Magazine, January 14, 2022

“Phenix Salon Suites Signs 8-Unit Development Deal in Sweden – Phenix Salon Suites, the nation’s leading salon suite brand turned international trailblazer, has announced another global development deal. Randa Shebly-Cobb, who opened the brand’s 300th salon location in Atlanta earlier this year, will soon bring Phenix Salon Suites’ brand to Sweden.”, Franchising.com, January 22, 2022

“TGI Fridays launching new format – TGI Fridays is launching Fridays on the Fly, a small-format restaurant concept that is designed to meet rising consumer demand for delivery and takeout. At approximately 2,500-sq. ft., the new format will be focused on filling delivery and takeout orders. It will also offer in-door dining, but with a smaller dining space than a traditional TGI Fridays.”, Chain Store Age, January 21, 2022

“Tropical Smoothie Cafe Considers Going Public – Coming off a record year, Tropical Smoothie Cafe is reportedly planning to go public later in 2022, according to Bloomberg. The red-hot fast casual could be valued at at least $1 billion, sourced told the media outlet. Tropical Smoothie is said to be working with Morgan Stanley and Jefferies Financial Group.”, QSR Magazine, January 11, 2022

Cartoon Of The Week: Recent Zoom Call!

Articles & Studies For Today And Tomorrow

“European sales of electric cars overtake diesel models for first time – Switch to battery-powered vehicles enjoys record growth on back of government subsidies and emissions regulations. More than a fifth of new cars sold across 18 European markets, including the UK, were powered exclusively by batteries, according to data compiled for the Financial Times by independent auto analyst Matthias Schmidt, while diesel cars, including diesel hybrids, accounted for less than 19 per cent of sales.”, The Financial Times, January 16, 2022

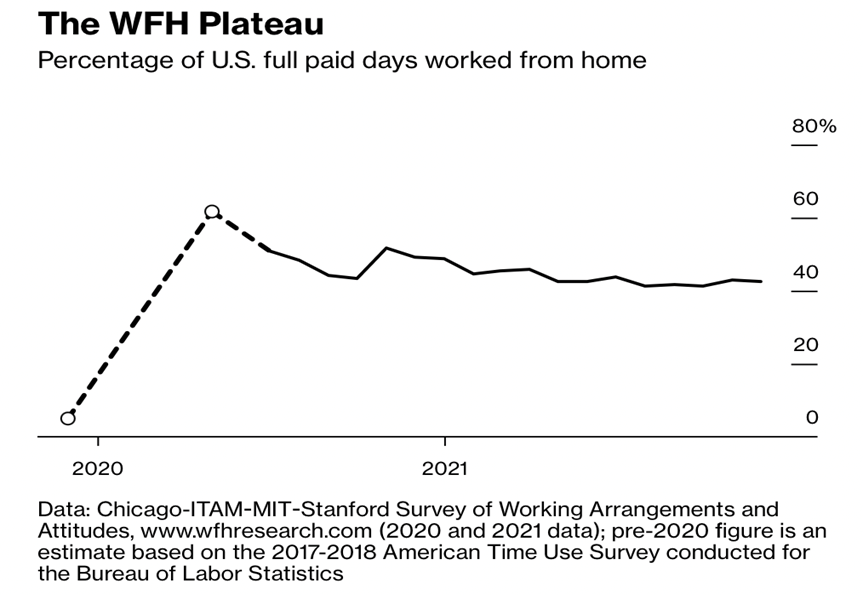

“Work From Home Is Becoming a Permanent Part of How Jobs Are Done – Data show we can expect 30% to 40% of workdays to be remote, long after the pandemic is over. In the second-to-last week of December, 42.4% of U.S. workdays were worked from home. Before the pandemic, WFH accounted for about 5% of U.S. paid full workdays.”, Bloomberg, January 18, 2022

“79% of baby boomers want to keep working, but with more flexibility. Is this the end of retirement? Baby boomers nearing retirement age don’t want to kick up their feet and relax through their sunset years. Instead, most of them want to continue working, but just fewer hours or in less demanding roles, according to a new survey.”, Fortune, January 12, 2022

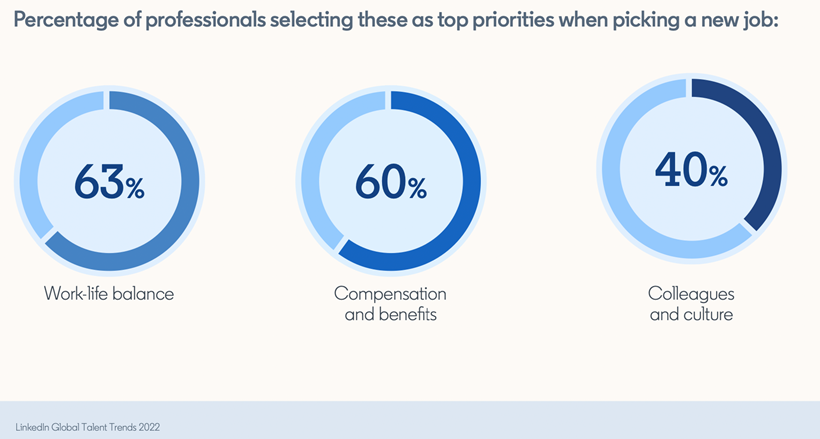

“2022 Global Talent Trends – The Reinvention of Company Culture. Because of the pandemic, employees are rethinking their priorities and their relationships with employers. They’re seeking flexible work arrangements and more work-life balance. They want to work for employers who value their physical and emotional well-being. And they’re ready to walk away from those who don’t.”, LinkedIn Talent Solutions, January 2022

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the world that impacts new trends, health, consumer spending, business investment, economic development and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing environment. Our GlobalTeam™ covers 43 countries and provides us with updates about what is happening in their specific countries. Please feel free to send us your input for the biweekly report. bedwards@edwardsglobal.com

To sign up for our biweekly newsletter click on this link: https://lnkd.in/d_XkTGN.

William (Bill) Edwards, Your Newsletter Editor, has a four-decade career successfully accelerating the international growth of more than 40 brands. Bill Edwards has a four-decade career successfully accelerating the international growth of more than 40 brands. Bill is known as an international Problem Solver and Advisor. Over the years, Bill has made and/or seen most of the mistakes companies make when going global. In Bill’s role as a Global Advisor to ‘C’ level executives, his objective is to impart the wisdom he has learned over time to help them minimize costly mistakes.

With experience in the franchise, oil and gas, information technology and management consulting sectors, he has directed projects on-site in Alaska, Asia, Europe and the Middle and Near East. He has lived in China, the Czech Republic, Hong Kong, Indonesia, Iran and Turkey and has worked on projects in over 50 countries.

Edwards Global Services, Inc. (EGS) provides a complete International solution for companies Going Global. From initial global market research and country prioritization, to developing new international markets, providing in-country operations support and problem solving around the world. Our U.S. based executive team has experience living and working around the world. Our Team on the ground overseas covers 40+ countries. EGS has twice received the U.S. President’s Award for Export Excellence.

Download our latest chart ranking 40+ countries as places to do business at this link:

Our Latest GlobalVue™ Country Ranking

For advice on doing business successfully across 40+ countries, contact Bill Edwards at bedwards@edwardsglobal.com or +1 949 224 3896.

https://calendly.com/geowizard/30min Click here to schedule a call with Bill Edwards to discuss how to solve challenges as you grow your company around the world.