EGS Biweekly Global Business Newsletter Issue 46, Monday, December 27, 2021

Edited and curated by: William (Bill) Edwards, CFE, CEO of Edwards Global Services, Inc. (EGS)

The world economy is predicted to top US$100 trillion for the first time in 2022: As we come to the end of 2021 and prepare to start 2022, the Year of the Tiger, this special issue focuses on predictions for the coming year.

And we also look back at how 2021 predictions turned out.

First, please click on this link to go to my latest article in ‘Global Trade’ magazine:

“5 Strategies To Expand Your Business Globally, Even in Trying Times”

Global Business Predictions for 2022, Year of the Tiger

“World economy to top $100 trillion in 2022 for first time – The world’s economic output will exceed $100 trillion for the first time next year and it will take China a little longer than previously thought to overtake the United States as the No.1 economy, a report showed on Sunday.”, Reuters, December 25, 2021

“2022 Market Outlook: More Upside For Stocks, Economic Growth To Rebound – ‘Our view is that 2022 will be the year of a full global recovery, an end of the global pandemic and a return to normal conditions we had prior to the COVID-19 outbreak. We believe this will produce a strong cyclical recovery, a return of global mobility and strong growth in consumer and corporate spending, within the backdrop of still-easy monetary policy. For this reason, we remain positive on equities, commodities and emerging markets and negative on bonds.’”, J.P. Morgan, December 15, 2021

“Corporate predictions for 2022: what the business schools say – Academics share their thoughts on what’s to come — and how to thrive. With demand and supply in many sectors pitching like ships in a hurricane so that the twain hardly ever seem to meet, leaders need resilient people and systems that can cope with the oscillation and not become prostrated by organisational seasickness. Julian Birkinshaw, professor of strategy and entrepreneurship at London Business School, identified the three key areas — finance, people and operations — where that resilience lies.”, The Times of London, December 22, 2021

“2022 Annual Forecast: A Global Overview – The global economy will continue its uneven recovery amid progress in COVID-19 vaccinations in most developed countries, lagging vaccinations in much of the rest of the world and the threat of new outbreaks. While global growth will be relatively strong, it is likely to slow from 2021 due to setbacks from the pandemic, persistent supply chain disruptions, higher inflation and tightening financial conditions, as well as constraints on public spending in many countries as they cope with high levels of debt and increased interest rates.”, Stratfor Worldview, December 20, 2021

“Five areas will shape the global operating environment for business in 2022 – Embedded in this year’s predictions are increased demand for virtual healthcare, continued pressures on the availability of critical raw materials and advanced manufacturing products, and lingering social and economic pressures. All have been magnified by the festering pandemic.”, Kearney Global Business Policy Council, December 2021

“Wall Street’s 2022 Outlook – New Challenges And Opportunities – Growth through easy money and deficit spending is being replaced by realistic expectations, planning and actions. Add in the Federal Reserve move to market-determined interest rates, and the 2022 outlook necessarily includes shifts in the financial markets. Among the shifts will be serious valuation adjustments of all assets, not just bonds.”, Forbes, December 22, 2021

“Global Airline Capacity Is Seen Rising in 2022, Along With Fares – Carriers poised to return to 2015 level, U.K. consultancy says Ticket prices to be affected by labor, debt, other factors. Bloomberg, December 22, 2-21

“Japan govt weighs raising FY22 growth forecast to +3.0% or more – The projection would be an upgrade from a forecast for 2.2% real GDP growth for the fiscal year starting in April 2022 released at a mid-year review in July. ‘The projected growth figure is not that overly bullish, considering the continued growth thanks to eased restrictions and a high vaccination rate,’ said Saisuke Sakai, senior economist at Mizuho Research and Technologies.”, Reuters, December 20, 2021

“What to Expect of China’s Economy in 2022 – After a bumpy ride in 2021, China enters a politically important year ahead…..one thing that’s certain is that growth will become the top priority in 2022. The readout from the Central Economic Work Conference (CEWC) that concluded on Dec. 10 became the most widely dissected document of this economically turbulent year. ‘Stability,’ mentioned 25 times in the CEWC readout this time, is the paramount goal before the party’s 20th National Congress later in 2022.”, Caixing Global, December 23, 2021

“Wall Street’s 2022 Outlook – New Challenges And Opportunities – Growth through easy money and deficit spending is being replaced by realistic expectations, planning and actions. Add in the Federal Reserve move to market-determined interest rates, and the 2022 outlook necessarily includes shifts in the financial markets. Among the shifts will be serious valuation adjustments of all assets, not just bonds.”, Forbes, December 22, 2021

“2022 Projected to Be Another Record Year For New Business Starts – A recent survey reveals that almost three out of five U.S. employees (57%) want to start a business and one in five (20%) will make the leap in 2022. After two record-breaking years of new business creation, there’s no sign of the trend slowing down as QuickBooks projects as many as 17 million new small businesses could be set up in 2022. The prediction comes from a recent survey of 8,000 U.S. employees, commissioned by QuickBooks in November 2021.”, The Street, December 22, 2021

“The business builders – The more new businesses you build, the better you get at building them. That’s the lesson from the companies that do it best. Business building helps companies diversify their revenues and keep pace with shifting customers and markets.” McKinsey & Co., December 25, 2021

“What major themes will we see in global media in 2022? What should we see more of? 0McKinsey Global Publishing’s Raju Narisetti asked dozens of journalists and media leaders around the world for their own perspectives on what’s to come—their personal lens on what’s likely to be covered heavily in 2022, and what issues might fly under the radar.”, McKinsey & Co., December 26, 2021

“Technomic Releases 2022 Foodservice Predictions – 2022 Global Restaurant Trends Forecast…….read ahead for Technomic’s take on six major trends poised to make a global impact on foodservice in 2022, plus some up-and-comers likely to break out.”, Technomic, via Franchising.com, December 21, 2021

“India Is on a Tear – Massive modernization presents opportunities for investors. ‘Adventures do occur, but not punctually,’ writes E.M. Forster in A Passage to India. In other words, exciting things happen in India, but a little patience is required. In recent years, however, it seems events have sped up in the Asian subcontinent, and that’s fueling a stock market rally.”, Kiplinger.com, December 21, 2021

“Global demand for coal could hit all-time high in 2022 – Electricity from coal plants has risen by 9% this year to fuel economic recovery from Covid, says watchdog. Coal power is on track to hit a new global record this year after an economic rebound that could drive worldwide coal demand to an all-time high in 2022, according to the International Energy Agency.”, The London Guardian, December 17, 2021

“2022 Global Public Real Estate Outlook – We expect 2022 to be another solid year for the global economy with consensus forecasts calling for global real GDP growth of +4.4%. Job growth is anticipated to be strong in 2022. Segments we believe are exceptionally well positioned to outperform in 2022 include: Industrial Facilities in North America; Data Centers in Asia; U.S. Residential Sector; European Office REITs; and Cell Towers.”, Hazelview Securities Inc., December 2021

A Look Back at 2021 Predictions

“Who Got It Right? A Look Back at Expert Predictions For 2021 – Last year, the editorial team at Visual Capitalist scoured through 200+ reports, articles, podcasts, and more, to create our 2021 Prediction Consensus—a big picture and aggregated look at the key trends that experts predict for the year ahead. If 2021 taught us anything, it’s that things can change at the drop of the hat. Amidst all this uncertainty, how many of the highlighted predictions came to fruition, and which ones didn’t pan out exactly as expected?”, Visual Capitalist, December 13, 2021

“2021: The year in (McKinsey & Co.) charts – While the quick arrival of vaccines buoyed optimism, the persistence of COVID-19 and the rise of variants continue to pose stumbling blocks toward achieving herd immunity. In this new normal, people are learning to live with an endemic disease. The future of work is at a pivotal crossroad—with many workers reassessing their options. During the pandemic, people grappled with finding meaning and purpose in their work. Will the future of work be hybrid, purposeful, inclusive, and built for balance?”, McKinsey & Co., December 17, 2021

“What Happened to Supply Chains in 2021? Pandemic-related disruptions threw a wrench into global supply chains this year, causing shortages of goods. Significantly, the pandemic-induced increase in demand for goods persisted even as demand for services (such as dining out, entertainment, and travel) largely returned to pre-pandemic levels.”, Council on Foreign Relations, December 13, 2021

“How 2021 became the year of ESG investing – Investors concerned about climate change and social justice had a bumper year in 2021, successfully pushing companies and regulators to make changes amid record inflows to funds focused on environmental, social and corporate governance (ESG) issues.”, Reuters, December 23, 2021

Our Information Sources & Who We Are

We constantly monitor 30+ countries, 40+ international information sources and ten business sectors to keep up with what is going on in this ever-changing environment. Our GlobalTeam™ on the ground covers 43 countries and provides us with updates about what is happening in their specific countries. Please feel free to send us your input and sources of information. Our contact information is at the bottom of this newsletter.

William (Bill) Edwards, CFE and CEO and Global Advisor, Edwards Global Services, Inc. (EGS) has 4 decades of international operations, development, executive and entrepreneurial experience and has lived in 7 countries. Over the years, Bill has solved global challenges in the franchise, oil and gas, information technology and management consulting sectors. Along the way, he has directed projects on-site in Alaska, Asia, Europe and the Middle and Near East. Mr. Edwards advises a wide range of companies on early to long term global development of their brands.

Edwards Global Services, Inc. (EGS) provides a complete International solution for companies Going Global. From initial global market research and country prioritization, to developing new international markets, providing in-country operations support and problem solving around the world. Our U.S. based executive team has experience living and working around the world. Our Team on the ground overseas covers 40+ countries. EGS has twice received the U.S. President’s Award for Export Excellence.

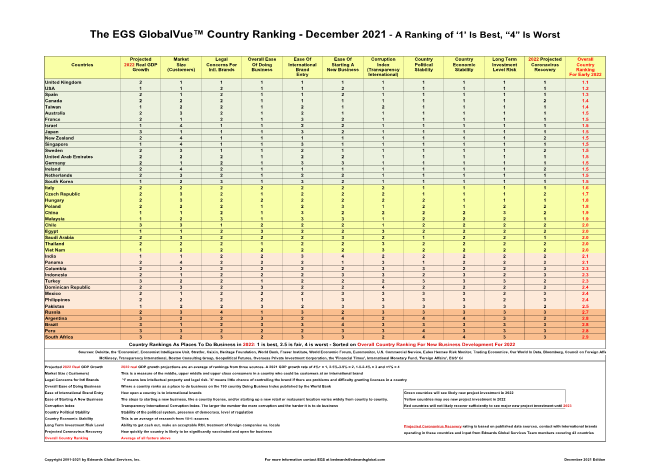

Download our December 2021 chart ranking 40+ countries as places to do business at this link:

Our Latest GlobalVue™ Country Ranking

Our global business update blog can be found at:

For global market research, operations and development support across 40 countries, contact Mr. Edwards at bedwards@edwardsglobal.com or +1 949 224 3896.

https://calendly.com/geowizard/30min Click here to schedule a call with Bill Edwards to discuss how to solve challenges as you grow your company around the world.

EGS Biweekly Global Business Newsletter Issue 45, Monday, December 13, 2021

Edited and curated by: William (Bill) Edwards, CFE, CEO of Edwards Global Services, Inc. (EGS)

A Major Change in our newsletter: We are changing the format of our biweekly newsletter. As of today, this email will include a summary of the global business trends and happenings over the past two weeks. We hope this will make it easier for our readers to catch up on the top global business trends.

A more detailed look at the world today for each section of our newsletter is on our blog at www.staging.geowizard.biz if you wish to click through.

All of us at EGS wish all of our readers Happy Holidays and a prosperous and healthy 2022. Our next issue will come out on Monday, January 10, 2022.

First, Some Words of Wisdom

“Kindness is like snow. It beautifies everything it covers.” – Kahlil Gibran

“Cheers to a new year and another chance for us to get it right.” – Oprah Winfrey

“Last year’s words belong to last year’s language. And next year’s words await another voice.” – T.S. Eliot

Highlights in issue #45:

- Brand Global News Section: 9Round®, Chipotle®, Del Taco®, Jack In The Box®, The Melting Pot®, Nathan’s Famous®, Shake Shack®

Our Mission and Information Sources

Bolded article titles are live links if the article is available without subscription. Specifically, articles from the ‘Economist’ and the ‘Financial Times’ do not have direct links to the article.

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, economic development and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing environment. Our GlobalTeam™ covers 43 countries and provides us with updates about what is happening in their specific countries. Please feel free to send us your input and sources of information. Our contact information is at the bottom of this newsletter.

To sign up for this free newsletter click on this link: https://lnkd.in/d_XkTGN.

Interesting Data and Studies

Our company has released our last 2021 GlobalVue™ countries as a place to do business in 2022 ranking analysis. Countries going up in the ranking include Egypt, Germany and Taiwan. Countries dropping in the ranking include Ireland, Italy, New Zealand. Hong Kong has been dropped as it is no longer considered separate from Mainland China. A major factor continues to be how well business in a country is recovering from the COVID-19 pandemic.

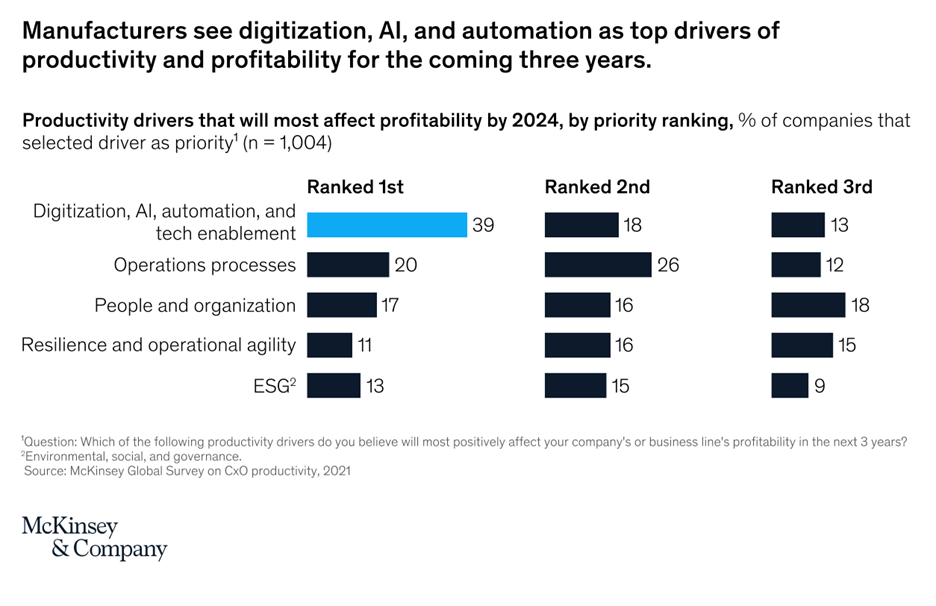

“If you could say anything positive about the COVID-19 pandemic—and its latest twist, the Omicron variant—it might be that it forced a lot of people to get better at accepting and acting upon the need for change. This week, we looked at three ways in which business leaders are transforming their organizations, as well as changes reshaping mortgages, infrastructure, healthcare, and the workplace.”, McKinsey, December 8, 2021

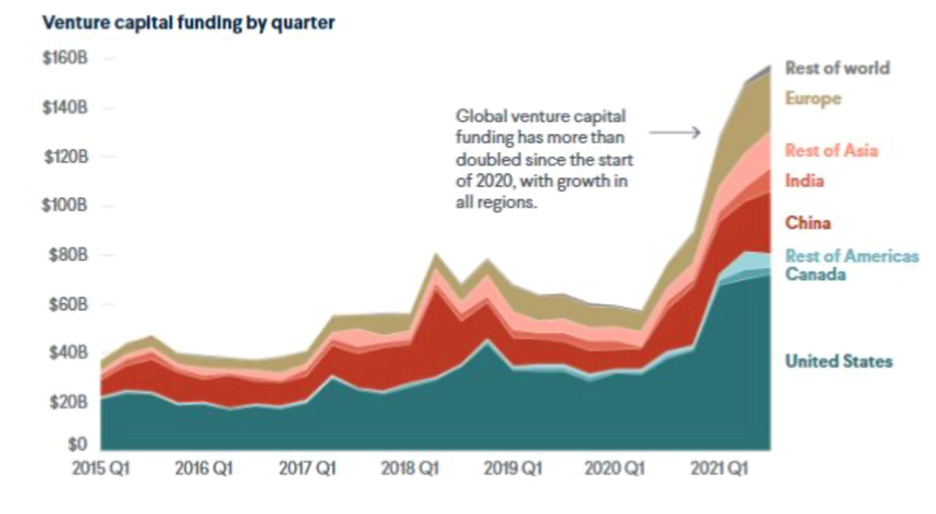

“During the pandemic, venture funding has boomed globally. The United States has retained its lead, accounting for roughly half of total venture dollars invested worldwide. China comes second, reflecting its status as the world’s second-largest economy. The striking change is that other regions are catching up: the rest of Asia has grown fast, and so too has Europe.”, Council on Foreign Relations, December 6, 2021

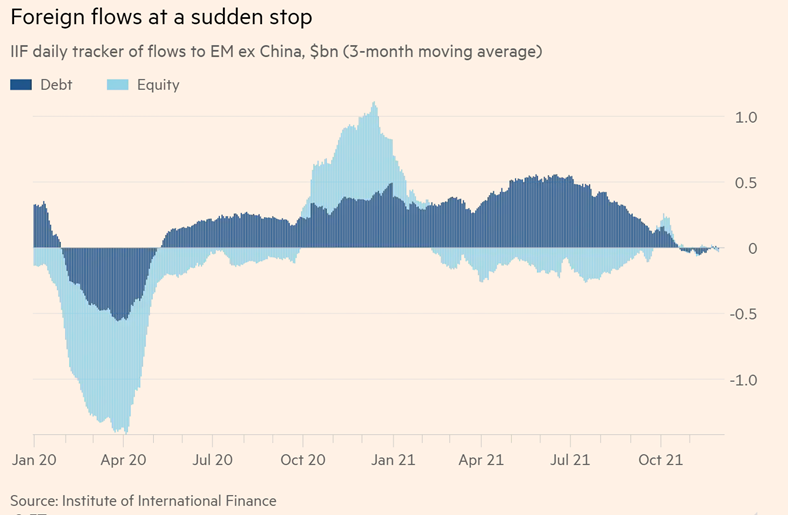

“Emerging markets hit by abrupt slowdown in new foreign investment – Flows into asset class ‘dry up’ on worries over US monetary policy and Omicron. Foreign investment in emerging market stocks and bonds outside China has come to an abrupt halt over fears that many economies will not recover from the pandemic next year, their prospects worsened by the Omicron coronavirus variant and expectations of higher US interest rates.”, Financial Times, December 8, 2021

“What comes after the Great Resignation? 4 workplace predictions for 2022? 4 workplace predictions for 2022. Daniel Zhao, senior economist and lead data scientist at employer review aggregator Glassdoor, thinks 2022 will be defined by the new normal and skyrocketing employee power within a historically tight labor market. The companies to find success in the new year will be the ones who ‘embrace the opportunities to rethink old ways of hiring, employee engagement, and how business is done.’”, Fortune, December 9, 2021

“J.P. Morgan says 2022 will be a great year: COVID’s impact will diminish and the economy will fully recover. In its annual global economic outlook, the U.S. investment bank optimistically predicted that 2022 will mark a huge improvement from the past two years. ‘Our view is that 2022 will be the year of a full global recovery,’ Marko Kolanovic, J.P. Morgan’s chief global markets strategist, wrote in a note to clients this week.”, Fortune, December 9, 2021

Global Supply Chain & Trade Update

“When Shipping Containers Are Abandoned, the Cargo Becomes a Mystery Prize –

Supply chain carnage creates opportunities for companies willing to take a chance on random goods, from cheese to used cars—and maybe even pumpkin seeds…… JS Cargo & Freight Disposal, acquires containers filled with abandoned goods that shipping lines want to get rid of. And business is booming in his line of work. Snarls in the global supply chain have left an estimated 3 million containers idling on ships queued up at ports around the world, according to Niels Larsen, president of Air & Sea North America at DSV, a global transport and logistics company.”, Bloomberg, November 29, 2021

“Toy sellers ponder reliance on China as supply problems bite – Companies hit by delays and soaring shipping costs are rethinking production options. The global supply chain crunch has led retailers from grocers to toy stores to warn of product shortages and higher prices. Recent manufacturing delays in China have added to the pressure, leading some in the $95bn global toy market to reconsider their reliance on the country.”, The Financial Times, December 11, 2021

“Supply Chain Woes Force Murata to Ship Lithium Batteries by Air – ‘We are being forced to use airfreight to deliver our batteries because ships are unavailable, and that costs an outrageous amount of money. If we were able to use sea routes, we should be able to make a profit.’ (President Norio Nakajima said in an interview.) On top of inflated base cargo fees fueled by high demand, batteries shipped via air incur extra handling charges because they’re a fire hazard.”, Bloomberg, December 9, 2021

“Vanishing Ships Underscore Supply Woe: Crisis Peak Is a Mirage – A line of more than 80 container ships waiting to dock at the ports of Los Angeles and Long Beach, California, was cut in half in late November — or so it seemed. Turns out the vessels disappearing from the queue were merely hiding from it, loitering in the Pacific out of reach of the official count. The actual bottleneck at midweek stood at 96 ships. In a recurring theme in economies from Germany to the U.S., progress repairing this supply snarl proved to be a mirage.”, Bloomberg, December 9, 2021

“Shipping container lines on track make a record-breaking $150 billion this year from the supply chain breakdown – Container shipping pre-tax profit for 2021 and 2022 could be as high as $300 billion, according to Drewry, an independent maritime research consultancy. In 2021, the industry is forecast to make $150 billion. That’s a new record. In 2020, the industry brought in $25.4 billion, according to The Journal of Commerce. And even though 2021 has been a banner year, Drewry expects the industry to make even more in 2022.”, Fortune, December 3, 2021

“China shipping to Southeast Asia sees prices surge tenfold as reopening demand picks up – Already taxed by the coronavirus pandemic, intra-Asian shipping routes have entered their traditional peak season. Reopening and work resumption in Southeast Asia, as well as ongoing disruptions in the global logistics network, have contributed to record high prices. A 20-foot container, shipped from Shenzhen to Southeast Asia, cost about US$100 to US$200 before the pandemic, but the price has since surged tenfold, from US$1,000 to US$2,000, said Yan Zhiyang, a manager with a logistics company based in Guangdong province.”, South China Morning Post, December 10, 2021

Global, Regional & Local Travel Updates

“Qantas reopens Singapore, London lounges – Qantas’ Singapore and London business class lounges are once again open as the airline prepares to ramp up flights for the December/January holiday season. Along with the rest of Qantas’ international lounges, these were shuttered in March 2020 as the sweeping scope of the Covid pandemic became clear.”, Executive Traveller, December 11, 2021

“China’s domestic air traffic recovery faltering due to zero-COVID policy – China’s domestic air traffic, once the world’s envy after a fast rebound during the pandemic, is faltering due to a zero-COVID policy that has led to tighter travel rules in Beijing and weaker consumer confidence after repeated small outbreaks. The outlook for the fourth quarter, normally a popular time for southerners to head north for winter breaks and northerners to head south for warmer weather, is dimming due to COVID-19 related disruptions at a time when international traffic is negligible.”, Reuters, December 9, 2021

“International passenger flights will not resume till January 31, says India’s aviation regulator – The restrictions will not apply to flights specifically approved by the Directorate General of Civil Aviation and international all-cargo operations. International passenger flights to and from India will remain suspended till January 31, the Directorate General of Civil Aviation announced on Thursday, amid concerns about the spread of the Omicron variant of Covid-19.”, Scroll, December 9, 2021

“Big Airline Orders Moving Ahead Despite Variant, Executive Says – Airlines are moving forward to finalize big commercial aircraft orders despite the newly discovered coronavirus variant and a fresh wave of travel restrictions to contain its spread, Pratt & Whitney’s top sales executive said. ‘The campaign activity is as high as I’ve seen, maybe ever,’ said Rick Deurloo, chief commercial officer of Pratt & Whitney, a unit of Raytheon Technologies Corp.”, Bloomberg, December 3, 2021

Global COVID & Vaccine Update

“COVID-19 cases are plummeting in Asia, and scientists aren’t 100% sure why – After recording nearly 200,000 cases per day on Sept. 1, the region is recording 43,000 cases per day as of Thursday, according to the United Nations Office for the Coordination of Humanitarian Affairs, meaning the entire continent is logging roughly a third of the daily cases in the United States……Asia’s COVID-19 decline comes as Delta-driven waves are fueling surges elsewhere.”, Fortune, December 9, 2021

“Covid-19 booster jab results raise hopes of beating Omicron (UK) – Third dose gives immune system a massive lift. A third dose not only increased antibody levels thirtyfold, but roughly tripled levels of T-cells, a part of the immune system that experts believe could be the critical weapon against the heavily mutated Omicron strain.”, The Times of London, December 2, 2021

Country & Regional Updates

Africa

“African Startup Inflows Seen Hitting Record $5 Billion This Year – The jump partly reflects greater interest in Africa from investors in the U.S. and China as well as institutional bankers, according to Nina Triantis, global telecoms and media head at Standard Bank Plc, who spoke at the Africa Tech Summit in London this week.”, Bloomberg, December 8, 2021

Australia

“Australia GDP Falls Less Than Feared, Shows Signs of Resilience – Australia’s economy posted a smaller-than-forecast contraction, a result that’s likely to reinforce views the Reserve Bank will taper or potentially even scrap its bond buying program early next year. The result is “much stronger and consistent with the resilience theme,” said Su-Lin Ong at Royal Bank of Canada.”, Bloomberg, November 30, 2021

“Beer Shortage Is a Nightmare Before Christmas for Australians – The nation’s two biggest brewers — Lion and Carlton & United Breweries — have flagged protracted delays and lower production of some of the beer-loving country’s most popular brews due to supply chain problems. That’s sparked fears major retail chains might start imposing limits on booze purchases at the worst possible time, with millions of Australians only recently emerging from a series of bleak lockdowns and hoping for a summer holiday season resembling some kind of normality.”, Bloomberg, December 9, 2021

China

“Analysts Offer Clues for Where to Invest in Xi’s New China – Before the coronavirus struck, investing in luxury stocks and Chinese internet giants like Alibaba Group Holding Ltd. and Tencent Holdings Ltd. was a surefire way of tapping the world’s largest consumer base……But as investors are learning, Xi’s vision goes further than just reducing inequality. His speech also made clear that efforts to foster “common prosperity” would come amid a drive for “high-level development” of China’s economy.”, Bloomberg, December 11, 2021

“China’s vegetable prices surge 30.6% in November as food costs soar – The gains followed a 15.9% year-on-year rise in October, as floods and other extreme weather in recent months have hit farms. Although the bureau noted the supply of vegetables increased in November, prices were still up on a monthly basis by 6.8%. Investors have been watching for signs of whether rapidly rising prices and stagnant economic activity might further drag down growth.”, CNBC, December 8, 2021

European Union

“Few Europeans want a return to 9-5 at office after pandemic, survey shows – Only 14% of European workers want to return to the office 9-5, and more than half say they have become more productive as a result of working from home, which has boomed amid COVID-19 lockdowns and restrictions, a survey showed on Thursday. About 12% of employed people in the European Union usually worked from home in 2020, up from around 5% before the pandemic, according to data from Eurostat.”, Reuters, December 8, 2021

The Middle East

“In the Middle East, a New Era of Alliances Emerges – Middle Eastern relations as we’ve known them for decades are over. As ambitious states try to expand their influence throughout the region, interests, not ideology, are driving the creation of new alliances. Even ultra-religious movements are showing signs of pragmatism.”, Geopolitical Futures, December 2, 2021

New Zealand

“2021 Survey – FRANCHISING COUNTS – Highlights from Massey University’s latest survey show the resilience of franchising in difficult times. Sales through franchised units are estimated to be a massive $36.8 billion – equivalent to a remarkable 12 percent of our GDP – and this figure doesn’t include motor vehicle or fuel retail through franchised outlets. Add those in, and the total comes to $58.5 billion. The survey has also confirmed that New Zealand is still the most franchised country in the world.”, Franchise New Zealand Magazine, December 8, 2021. Compliments of Stewart Germann, Stewart Germann Law Office, and Simon Lord, Publisher, Franchise New Zealand Magazine

“After 108 Days Of Lockdown, New Zealand’s Largest City Reopens As Nation Shifts Away From ‘Zero Covid’ Approach – Restaurants, cafes, cinemas and other public venues reopened in Auckland on Friday as New Zealand’s largest city exited 108 days of Covid-19 lockdown, a move that comes as the highly vaccinated south Pacific nation moves forward with its plans to ease pandemic restrictions despite the emerging threat from the Omicron variant.”, Forbes, December 3, 2021

Peru

“Peru Lifts Key Rate to 2.5% as Economy Grows Most in Region – Peru raised interest rates for a fifth straight month as the economy grows at the fastest pace in Latin America and inflation exceeds the upper limit of its target range.”, Bloomberg, December 9, 2021

United Arab Emirates

“UAE to shift weekend and create shorter working week – Gulf state will introduce four-and-a-half day office week to boost economy and attract expats. The United Arab Emirates government is shifting the national weekend to Saturday and Sunday to synchronise with global markets, instituting a four-and-a-half day working week from January next year. Changes to the working week, which at present runs from Sunday to Thursday, are intended to “boost work-life balance and enhance social wellbeing, while increasing performance to advance the UAE’s economic competitiveness”, the government said in a statement.”, The Financial Times, December 7, 2021

United Kingdom

“U.K. Warned of ‘Unsustainable’ Shortage of Workers as Pay Soars – Survey by REC and KPMG shows no easing of labor market strains Starting-pay inflation hits record as firms try to fill roles. U.K. employers increased starting salaries at a record pace in November amid an ‘unsustainable’ shortage of workers, according to a survey published Thursday.”, Bloomberg, December 8, 2021

“Want to start a business? Next year could be a great time to do it – Among the positives, Covid-19 has had a significant impact on reducing costs inside companies, especially in areas such as business travel and property, and we are still seeing the beneficial effects of the enormous fiscal and monetary stimulus pumped into the economy by governments around the world in response to the pandemic. Unesco estimates the total stimulus at $16 trillion out of a global economy valued at $93 trillion.”, The Times of London, November 11, 2021

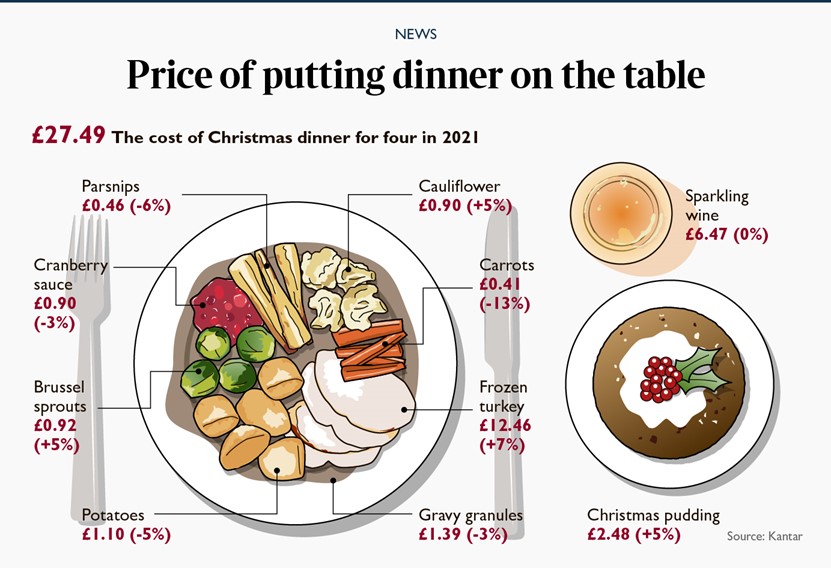

“Christmas lunch burns hole in pockets – The price of a Christmas dinner has risen by 3.4 per cent as food inflation reaches its highest level so far this year. The average price of a festive meal for four is £27.48 (US$36.48), with the price of a frozen turkey rising by 7 per cent and brussels sprouts and Christmas puddings 5 per cent more expensive than last year, according to figures from Kantar.”, The Times of London, December 7, 2021

United States

“Record Share of U.S. Small Businesses Raise Pay, NFIB Says – Forty-four percent of firms boosted pay, matching the largest share in monthly data back to 1986, according to the NFIB’s November survey. Those wage gains may be beginning to pay off. Some 48% of respondents reported having job openings they could not fill, and while still very high, it’s the second straight monthly decline.”, Bloomberg, December 2, 2021

“Disneyland employees vote for union contract, avoid strike – The tentative agreement endorsed by Master Services Council leadership raises minimum pay from $15.50 to $18.50 per hour — a 19% increase….The union coalition represents approximately 40% of the 25,000 Disneyland resort cast members — Disney parlance for employees.”, OC Register, December 4, 2021

Brand News

“13 restaurant prototypes unveiled in 2021, from Taco Bell to Denny’s – Restaurant chains unveiled plans for new prototypes in 2021, almost entirely catering to consumers’ evolving needs during the pandemic. Quick-service and fast-casual chains nationwide made plans to add drive-thrus and specific pickup areas for digital orders, with many shrinking or even eliminating dining rooms. Not every redesign came from limited-service chains, however. At least two family-dining restaurants joined in the trend.”, Nation’s Restaurant News, December 11, 2021

“As 2022 Arrives, The Restaurant of the Future Comes Into Focus – The pandemic brought a catalog of questions to restaurateurs’ tables. Nothing was revolutionary, necessarily. Notions like mobile ordering and loyalty. Finding ways to alleviate drive-thru capacity. Whether or not guests even needed a dining room. And just like early lockdown days, three vectors have driven evolution as operators approach 2022, according to new data from consulting giant Deloitte, which polled 1,000 consumers who dined in a restaurant within the past three months to field its latest “Restaurant of the Future Report.’”, QSR Magazine, December 8, 2021

“9Round finalizes South Korean expansion plans, expands Middle Eastern operations – “We are thrilled to welcome South Korea to our roster and to continue to expand our presence across the Middle East,” said 9Round founder and CEO Shannon Hudson.”, Upstate Business Journal, December 2, 2021

“America’s Most Popular Fast-Casual Chain Could Double Its Locations, CEO Says – Chipotle is on a meteoric rise, and according to CEO Brian Niccol, not afraid of the competition. While expressing cautious concern about the impact of the latest COVID-19 variant Omicron on the chain’s operations, Niccol was optimistic about Chipotle’s ability to continue its dominance of the fast-casual market in a recent interview with CNN.”, Eat This, Not That!, December 1, 2021

“Jack in the Box to acquire Del Taco for over $450 mln – Jack in the Box, which would now have over 2,800 restaurants spanning 25 states, said the deal would help the chain beef up its off-restaurant premise sales. About 99% of Del Taco restaurants feature a drive-thru.”, Reuters, December 5, 2021

“How the Melting Pot is re-emerging from COVID-19 stronger – The 100+-unit fondue chain is expanding its franchising footprint amid a menu overhaul. Moving forward, The Melting Pot is looking to expand franchising and add new franchisees to the team, with plans for the new Melting Pot Social spinoff: the “younger, hipper cousin” to the Melting Pot with shorter experience times (which originally could run up to 2-3 hours per table) and an emphasis on the bar program.”, Nation’s Restaurant News, December 1, 2021

“Nathan’s Famous (US) Expands to Saudi Arabia – Nathan’s Famous, Inc., the American tradition serving New York favorites for more than 100 years, announces a new expansion plan into Saudi Arabia. Nathan’s Famous will serve their world-famous hot dogs and fries in seven kiosks across Saudi Arabia, with plans to open three more in the coming weeks.”, World Franchise Associates, November 4, 2021

“Shake Shack expands into drive-thru industry – In 2022, Shake Shack plans to open 45 to 50 new restaurants, including up to 10 drive-thru locations….In addition to ordering directly in Shack and at drive-thru lanes, guests will have the option of placing orders ahead of time for pickup via the Shack app and online at order.shakeshack.com., Fox Business, December 7, 2021

Articles & Studies For Today And Tomorrow

“The Year In Franchising: Reflecting On 2021, And Anticipating 2022 – Over the past two years, the world has changed in ways it never has before, and the franchise industry is no exception. It has taken a while, but following the challenges of the Covid-19 pandemic, 2022 is positioned to be a massive year for franchise development and sales growth.”, Forbes, November 30, 2021

“The digital transformation market size is expected to grow from $521.5 billion as of this year to $1.25 trillion by 2026. Corporations need to create bionic capabilities so that they can harness the potential of disruptive technologies and integrate them into new processes, business models, and ways of working. Evidence shows that successful digital transformation drives performance and competitive advantage and directs companies towards becoming bionic. In the short term, digital technology improves productivity and customer experiences. Longer term, it opens up new growth opportunities and sets up companies for sustained success.”, NMS Consulting, December 2021

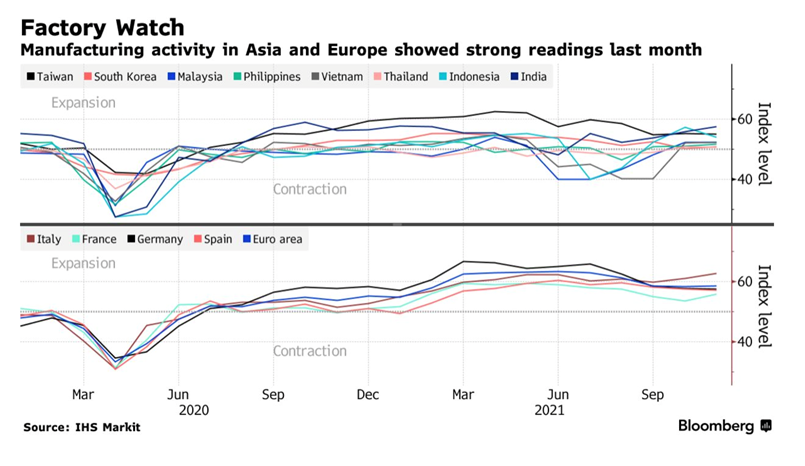

“Global Factory Output Stabilizes But New Threat of Omicron Lurks – Euro-area PMI ends four-month slowdown from record expansion. Asia benefits from looser lockdown and border restrictions. Factories across Southeast Asia had been on a recovery path as loosened movement restrictions allowed output to catch up before the crucial year-end holiday season.”, Bloomberg, November 30, 2021

“How Technology is Evolving to Make Companies More Productive – What’s one of the biggest goals of most small businesses? Efficiency. Emerging technology is helping to make companies more productive. When operations are fast, effective, and accurate, the company can do more with less. Though the dream of full-on productivity might not be entirely feasible, many professional teams are making headway.”, Entrepreneur Magazine, December 9, 2021

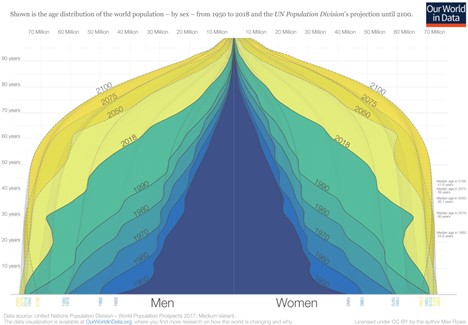

“Back in the 1960s, global population growth peaked at a 2.1% annual rate, but since then it has been on a historic downtrend. In fact, according to the most commonly cited United Nations projection, which is based on a medium fertility rate scenario, it’s expected that annual population growth could drop all the way to 0.1% by the end of the 21st century.”, Visual Capitalist and Our World In Data, December 2, 2021

William (Bill) Edwards, CFE and CEO and Global Advisor, Edwards Global Services, Inc. (EGS) has 4 decades of international operations, development, executive and entrepreneurial experience and has lived in 7 countries. With experience in the franchise, oil and gas, information technology and management consulting sectors, he has directed projects on-site in Alaska, Asia, Europe and the Middle and Near East. Mr. Edwards advises a wide range of companies on early to long term global development of their brands.

Our Latest GlobalVue™ Country Ranking

Edwards Global Services, Inc. (EGS) provides a complete International solution for companies Going Global. From initial global market research and country prioritization, to developing new international markets, providing in-country operations support and problem solving around the world. Our U.S. based executive team has experience living and working in many countries. Our Associate network on the ground overseas covers 40+ countries. EGS has twice received the U.S. President’s Award for Export Excellence.

For global market research, operations and development support across 40 countries, contact Mr. Edwards at bedwards@edwardsglobal.com or +1 949 224 3896.

https://calendly.com/geowizard/30min Click here to schedule a call with Bill Edwards to discuss how to successfully grow your company around the world.