EGS Biweekly Global Business Newsletter Issue 41, Monday, October 18, 2021

Edited and curated by: William (Bill) Edwards, CFE, CEO of Edwards Global Services, Inc. (EGS)

Inflation, supply chains, vaccination levels, air travel remain the major trends for this issue of our newsletter: “Wages are surging across the rich world”, “Ikea warns stock shortages likely to last another year”, “where are the world’s worst port delays?”, Thailand and the USA to reopen to vaccinated tourists, “India faces electricity crisis as coal supplies run critically low”, “UK job vacancies hit record amid Brexit and Covid staff shortages”, “Nearly all major (USA) airlines mandate COVID vaccine for employees”, “There is no quick fix for Europe’s self-manufactured energy crisis”, etc.

Words of Wisdom from Others

“If you are not willing to learn, no one can help you. If you are determined to learn, no one can stop you.”, Zig Ziglar

“Success is the sum of small efforts, repeated day in and day out.”, R. Collier

“The secret of change is to focus all of your energy not on fighting the old, but building on the new.”, Socrates

Highlights in issue #41:

- What matters most? Five priorities for CEOs in the next normal (McKinsey)

- The US reopens to international travelers on November 8 — what you need to know.

- Covid Australia: Sydney celebrates end of 107-day lockdown

- China GDP: economic recovery stalls, growth slows to 4.9 per cent in third quarter

- Why Tropical Smoothie Cafe is Bucking the Ghost Kitchen Trend

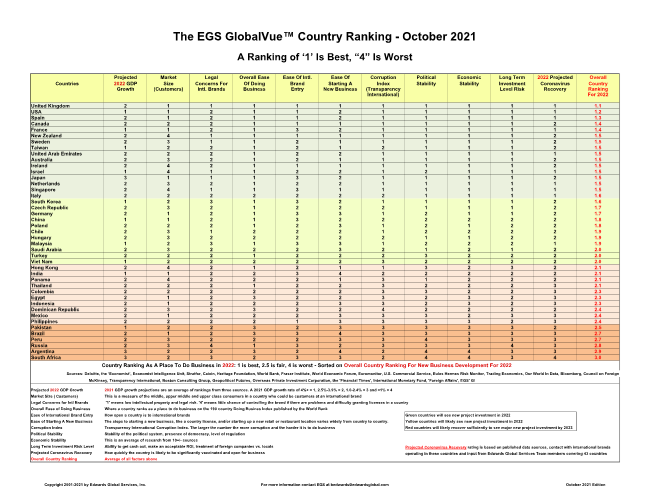

- Download the October EGS GlobalVue™ 40+ country ranking chart

- Brand News Section: Burger-Fi®, Carl’s Jr®, Denny’s®, Dominos®, Home Instead®, KFC® Russia, Tropical Smoothie®

Our Mission and Information Sources

Bolded article titles are live links, available without subscription

Our biweekly global business update newsletter focuses on what is happening around the world that impacts new trends, health, consumer spending, business investment, economic development and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing environment. Our GlobalTeam™ on the ground in 27 countries covers 43 countries and provides us with updates about what is happening in their specific countries. Please feel free to send us your input and sources of information. Our contact information is at the bottom of this newsletter.

Interesting Data and Studies

Our latest GlobalVue™ country ranking chart as places to do business in 2022 can be downloaded at this link: https://edwardsglobal.com/globalvue/

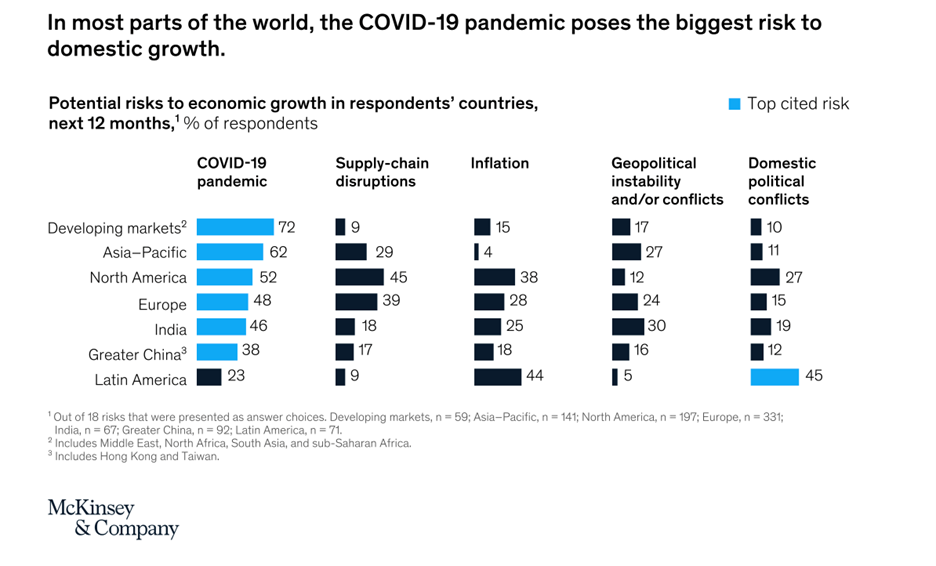

“The coronavirus effect on global economic sentiment – Eighteen months into the COVID-19 pandemic, executives’ responses to our latest McKinsey Global Survey suggest that they believe the economy is on track toward a recovery. 1 Throughout 2021, their views have, on average, been consistently positive. And they continue to report largely positive expectations: 71 percent of respondents predict that conditions in the global economy will improve in the next six months, down from an all-time high of 81 percent who said so last quarter.”, McKinsey, September 29, 2021

“IMF Revises Down Projected 2021 Growth – On Oct. 12, the International Monetary Fund announced a marginal revision down of its 2021 forecast for the global economy to 5.9%, though the adjustment does not reflect large changes for some countries. The IMF’s 2022 projection is unchanged at 4.9%…. The World Economic Outlook cited “dangerous divergence” across countries as a result of the “great vaccine divide” and differences in policy support by governments. Emerging market and developing countries face tighter financing conditions and the risk of “de-anchoring” inflation expectations, with the group’s output remaining 5.5% below pre-pandemic levels in 2024 amid deteriorating living standards. Supply bottlenecks, coupled with the release of pent-up demand, are also contributing to inflation.”, Stratfor, October 12, 2021

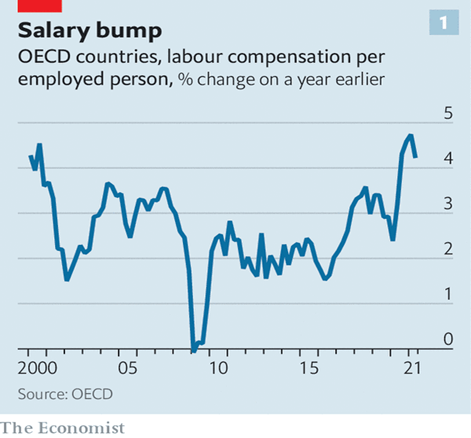

“Wages are surging across the rich world – When lockdowns were imposed poorly paid people in service jobs dropped out of the workforce, for instance, which had the effect of raising average pay as measured by statisticians. Even so, wage growth seems to have been stronger than the scale of the economic downturn alone would have suggested. Goldman Sachs, a bank, has created a “tracker” that corrects for pandemic-related distortions. Underlying wage growth, at about 2.5% across the (G)10 group of large economies, is as fast as it was in 2018.”, The Economist, October 16, 2021

“Coal Shortages in China and India – China’s attempts to resolve its ongoing power crunch hit a new snag. New flooding in the central Shanxi province over the weekend shut down a number of coal mines, hitting China’s plans to offset the loss of coal imports with a surge in domestic output. Several Indian states are reporting shortages of coal and warning of possible power cuts. Tamil Nadu and Kerala are running low on supplies, while Andhra Pradesh and Maharashtra have shut down power generation units because of coal shortages.” Geopolitical Futures, October 11, 2021

Supply Chain & Energy – Worldwide Issues

“Port Gridlock Stretches Supply Lines Thin in Blow for Economies – Delays may get worse before improving, several experts warn. Christmas gifts are sitting on the dock of a bay, wasting time. Global ports are growing more gridlocked as the pandemic era’s supply shocks intensify, threatening to spoil the holiday shopping season, erode corporate profits and drive up consumer prices.”, Bloomberg, October 16, 2021

“The waiting game: where are the world’s worst port delays? From Shenzhen to Los Angeles, storms, Covid and labour shortages are causing disruption. The nearly 100 ships waiting on the horizon to berth at the Hong Kong and Shenzhen container ports are just the latest sign of the problems to have snarled global supply chains, pushed up consumer prices in Europe and the US, and led to shortages of goods ranging from Christmas toys to furniture…..Globally, there are now 584 container ships stuck outside ports, nearly double the number at the start of the year, according to real-time data from Kuehne+Nagel, one of the world’s largest freight forwarders.”, The Financial Times, October 15, 2021

“Dubai to restrict cargo imports into airport to clear shipment backlog – Cargo logjam at regional trade and financial hub blamed on labour shortages. Dubai will restrict imports of cargo into its international airport for six days from Tuesday to clear a backlog caused by “extraordinarily high” volumes of inbound shipments. Dnata, the cargo handling arm of government-owned airline group Emirates, said the restrictions would also include transit cargo en route to other destinations in the United Arab Emirates. Certain categories of essential freight would be exempted.”, The Financial Times, October 15, 2021

“Stranded at sea with the cargo – Unvaccinated crews growing desperate to get off ships….Some 300,000 of these migrant merchant sailors have been stranded on vessels at sea or in ports around the world, according to the International Transport Workers’ Federation, a London-based trade union that is among the maritime agencies lobbying governments to address what’s been labeled the ‘crew-change crisis.’ They endure unbroken monotony and growing desperation. Their unions and charity groups describe exhaustion, despair, suicide and violence at sea, including at least one alleged murder on a cargo ship headed to Los Angeles.”, The Los Angeles Times, October 2021. Compliments of Guy Fox, Chairman of the Board, International Seafarers Center, Ports of Long Beach & Los Angeles

“China’s energy crisis threatens lengthy disruption to global supply chain – Buyers in Europe and US must wait longer for supplies as factories are forced to slash operating capacity. Factory owners in China and their customers worldwide have been told to prepare for power supply disruptions becoming part of life as President Xi Jinping doggedly weans the world’s second-biggest economy off its dependence on coal.”, The Financial Times, October 16, 2021

“Don’t expect supply chain challenges to end anytime soon – Port backups are delaying equipment deliveries for months. Here’s why it’s happening, and how long it will last. Shipping delays can be expected to last until late next year. Restaurants looking to replace old fryers or build new locations have found it can sometimes take months to get equipment in the door, thanks to a backlog of imports that has left two dozen or more container ships waiting outside of U.S. ports. Such waits are likely to continue to be a problem for the foreseeable future.”, Restaurant Business Online, September 24, 2021

“(The commissioner of the Federal Maritime Commission), Carl Bentzel, discusses State of US Ports at International Forum – The shipping challenges the nation is currently experiencing are, he says, “the largest meltdown since World War II.” It is the first time since WWII that cargo shipments are not getting into the U.S. at a time when people want shipments. There are two primary factors behind this meltdown. The first reason is the dislocation of products and closures brought about by the COVID-19 pandemic. In California alone, cargo decreased by 20%–30% for a three-month period. The second factor is the resumption of activity after the COVID-19 closures, which led to an almost 30% surge in cargo. So, the industry quickly saw a swing of 60% in volume, he explains.”, California Chamber of Commerce, October 12, 2021

“Ikea warns stock shortages likely to last another year – World’s largest furniture retailer faces supply chain struggles but pandemic has shifted sales online. Ikea has become the latest retailer to warn on supply chain problems, saying on Thursday that stock shortages were likely to last another year…..Reporting its annual results, the world’s largest furniture retailer also said the pandemic had helped its business and sped up its transformation.”, The Financial Times, October 14, 2021

Global, Regional & Local Travel Updates

“The US reopens to international travelers on November 8 — what you need to know. Although we now have a confirmed date of Nov. 8, some questions remain regarding acceptable proof of vaccinations and what the entire process will look like. Here’s what we know so far about the U.S. reopening.”, The Points Guy, October 15, 2021

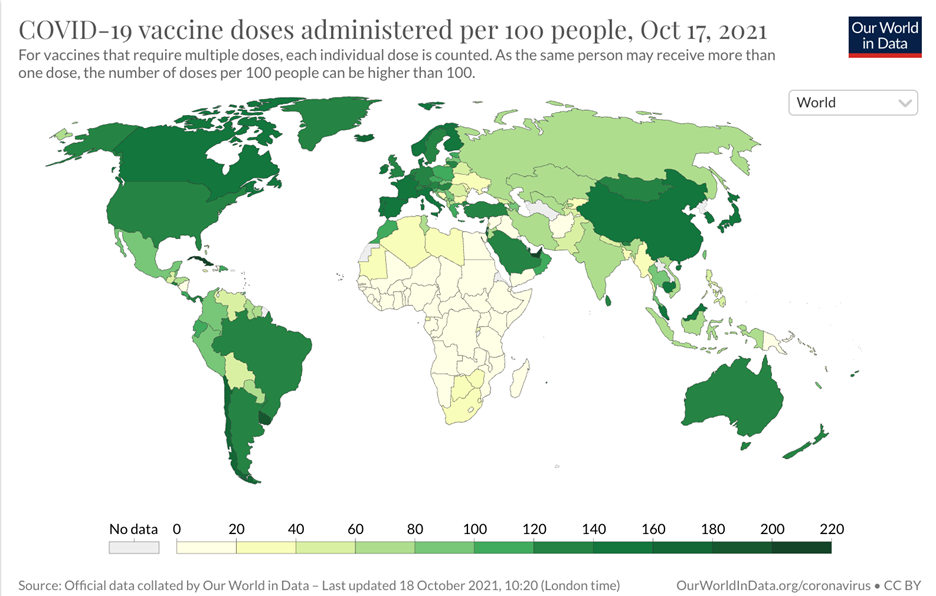

“European Cities Top Travel Openness Ratings in New Analysis – U.S. lags behind; Asian cities dominate bottom of Bloomberg’s ranking. European finance and tourism capitals dominate a Bloomberg ranking of 70 global cities most open to travelers, based on vaccination rates, local public health rules and Covid-19 travel restrictions.”, Bloomberg, October 10, 2021

“Nearly all major (USA) airlines mandate COVID vaccine for employees….. the largest pilots association and most major carriers — United Airlines, American Airlines, Southwest Airlines, JetBlue, Alaska Airlines and Hawaiian Airlines — confirm they will follow President Biden’s executive order requiring workers to get the shots.”, CBS News, October 12, 2021

“Canada Announces Vaccine Mandate for Air, Rail and Cruise Travelers – The Canadian government announced Wednesday that domestic and international travelers arriving in the country via commercial flight, train or cruise ship must be fully vaccinated. According to the official website of Canada, Prime Minister Justin Trudeau revealed that all travelers 12 years of age and older entering or departing the country via federally regulated modes of transportation must be fully vaccinated by October 30.”, Travel Pulse, October 7, 2021

“LATAM Colombia Exceeds 2019 Passenger Numbers – LATAM Airlines Colombia exceeded the number of passengers moved during the third quarter of the year compared to the same period of 2019. The carrier transported a total of 1,742,988 passengers between its 15 destinations and 25 domestic routes handled in Colombia. With these results, the Colombian market remains one of the key countries in the LATAM Airlines Group’s strategy, with a trend that has continued to rise in recent months.”, Airline Geeks, October 12, 2021

“Phuket’s sandbox to Singapore’s travel corridors: as Asia wakes up to travel, destinations weigh risks and rewards – Thailand and Singapore are at the vanguard of Asia’s tourism reawakening and their moves will be eagerly watched by other destinations seeking an insight into what works and what doesn’t. Early data looks encouraging, but experts say such schemes are small steps. Increased costs, the risk of new variants emerging, and a lack of demand from Chinese tourists are all hurdles on the long road to full recovery.”, South China Morning Post, October 16, 2021

“Asian Destinations Are Finally Cracking Open For U.S. Travelers – In general, there are very few Asian destinations that an American leisure traveler can visit right now. A couple of destinations, including the Maldives and Sri Lanka, stand out as exceptions in welcoming tourists since early 2021. Yet slowly but surely, the tourism doors are starting to crack open, if ever so hesitantly and with many restrictions still in place. Here’s a tentative timeline for countries that have recently announced rolling out a conditional welcome mat for U.S. travelers.”, Forbes, October 11, 2021

“The Best Airports in the World: 2021 Readers’ Choice Awards – The airports you can’t wait to fly into again. 10. London Heathrow Airport (LHR), 9. Zurich Airport (ZRH), 8. Athens International Airport (ATH), 7. Marrakech Menara Airport (RAK), 6. Dubai International Airport (DXB), 5. Hamad International Airport (DOH), 4. Seoul Incheon International Airport (ICN), 3. Tokyo Narita International Airport (NRT), 2. Istanbul Airport (IST) and as usual 1. Singapore Changi Airport (SIN)”, CNN Traveler, October 8, 2021

Global Vaccine Update

“47.6% of the world population has received at least one dose of a COVID-19 vaccine. 6.67 billion doses have been administered globally, and 19.23 million are now administered each day. Only 2.7% of people in low-income countries have received at least one dose.”, Our World In Data, October 18, 2021

Country & Regional Updates

Australia

“Covid Australia: Sydney celebrates end of 107-day lockdown – Midnight rush for shops and pubs as Sydney reopens. Australia’s largest city, Sydney, has emerged from Covid lockdown after almost four months, with locals celebrating a range of new freedoms. People queued for pubs and shops that opened at midnight on Monday. Many others have been enjoying anticipated reunions with relatives and friends.”, BBC October 12, 2021

Brazil

“Brazil Comes Out of Pandemic and Hits the Next Hardship—Inflation – Prices of electricity and cooking gas are up 30% or more over the year, while meat prices are up 25%. Prices rose in September at the fastest pace for the month since 1994, while the 12-month figure reached 10.25%, returning Brazil to double-digit inflation for the first time in more than five years, the country’s national statistics agency, IBGE, said Friday.”, Wall Street Journal, October 8,2021

Canada

“A remarkable milestone’: Canadian employment jumps back to prepandemic levels – The country added 157,100 positions last month, building on a gain of 90,200 in August, Statistics Canada said Friday. Hiring was considerably stronger than the 60,000 positions that economists were expecting. The unemployment rate fell to 6.9 per cent from 7.1 per cent. In September, around 19.13 million people were employed – the same as in February, 2020, marking a significant milestone in the country’s recovery from the pandemic.”, The Global and Mail, October 8, 2021

China

“China GDP: economic recovery stalls, growth slows to 4.9 per cent in third quarter – China’s economy grew by 4.9 per cent in the third quarter of 2021 compared with a year earlier, down from the 7.9 per cent growth seen in the second quarter. Retail sales and industrial production rose by 4.4 per cent and 3.1 per cent, respectively, in September from a year earlier.”, South China Morning Post, October 18, 2021

“China goes back to coal to combat power crisis ahead of Cop26 – China has ordered coalmines to increase production by tens of millions of tonnes before the end of the year as President Xi prioritises a nationwide power crisis over reducing Beijing’s dependence on fossil fuels…..The power shortage and rationing of electricity has seen factories halt assembly lines in the manufacturing hubs of Zhejiang, Jiangsu and Guangdong provinces.”, The Times of London, October 10, 2021

“China inflation: factory-gate prices rise at fastest pace on record due to surging coal costs amid power crisis – China’s official producer price index (PPI) rose by 10.7 per cent in September from a year earlier, compared with 9.5 per cent in August. The consumer price index (CPI) rose by 0.7 per cent in September from a year earlier, compared with a 0.8 per cent rise in August.”, South China Morning Post, October 14, 2021

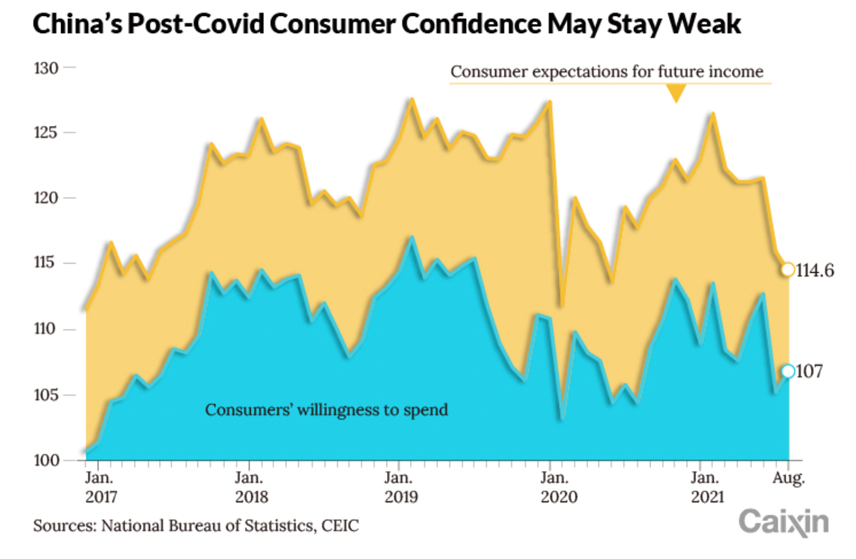

“China’s Consumer Spending May Suffer ‘Long Covid’ Contraction, Economists Warn – Surely one of the most commonly asked questions by people in China and indeed all over the world is: when will the Covid-19 pandemic end and life finally return to normal? Unfortunately, the answer from experts appears increasingly that it remains some time off.”, Caixing Global, October 7, 2021

European Union

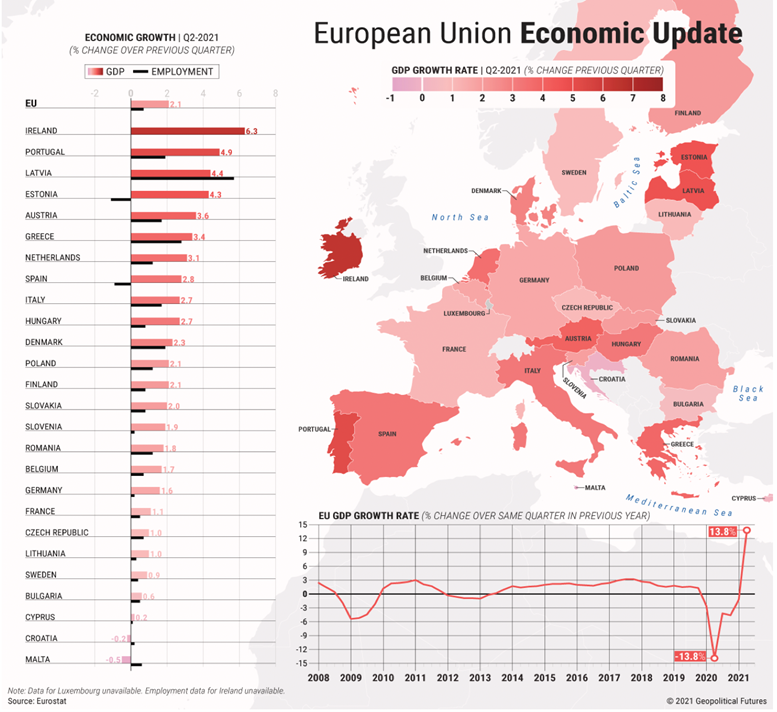

“Europe’s Faltering Economy (???) – As the COVID-19 vaccination campaign proceeds, the pandemic seems almost under control in Europe….But like the rest of the world, European supply chains can’t keep pace with demand. Industrial production in some states is faltering due to supply shortages…..Supply issues are also evident in the energy sector, where gas and electricity prices are hitting record highs, causing energy firms across the continent to shut down and putting upward pressure on inflation – a particularly sensitive issue in the eurozone….Put it all together and the supply bottlenecks, rising energy prices and inflationary pressures are headwinds that could hamper the European economic recovery.”, Geopolitical Futures, October 15, 2021

“There is no quick fix for Europe’s self-manufactured energy crisis – A bit more than a decade ago, a concerted effort was launched within the European Union countries and a few others on the continent to phase out their coal-fired generating plants to clean the skies and slow the pace of global warming. That’s the good news. The bad is that the Europeans are guilty of spectacularly bad planning. What was lost – coal-fired plants and their ability to meet peak demand fairly quickly – was never adequately replaced. Yes, loads of solar and wind power came on stream, but not enough. And – surprise! – solar and wind power became utterly useless when the sun did not shine and the wind did not blow.”, The Global and Mail, October 8, 2021

India

“India faces electricity crisis as coal supplies run critically low – Eight in 10 thermal power stations within days of running out as state blackouts spark protests. States across India have issued panicked warnings that coal supplies to thermal power plants, which convert heat from coal to electricity, are running perilously low.”, The Guardian, October 12, 2021

The Philippines

“Why the Philippines Became the Worst Place to Be in Covid – The Philippines fell to last place in Bloomberg’s Covid Resilience Ranking of the best and worst places to be amid the pandemic, capping a steady decline over the course of 2021. The monthly snapshot — which measures where the virus is being handled the most effectively with the least social and economic upheaval — ranks 53 major economies on 12 datapoints related to virus containment, the economy and opening up.”, Bloomberg, September 29, 2021

Thailand

“Thailand to reopen for some vaccinated tourists from November – Visitors from Britain and the US among those permitted as country seeks to boost its crucial tourism sector. Thailand plans to fully re-open to vaccinated tourists from countries deemed low risk from 1 November, the country’s leader said, citing the urgent need to save the kingdom’s ailing economy.”, The Guardian, October 12, 2021

United Kingdom

“UK job vacancies hit record amid Brexit and Covid staff shortages – Job vacancies soared to a record high of almost 1.2m in September, according to official figures, as employers hunted for staff to meet shortages brought on by Brexit and the pandemic. The Office for National Statistics (ONS) figures also showed a 207,000 increase in the number of people on payrolls to a record 29.2 million – 120,000 above pre-pandemic levels.”, The Guardian, October 12, 2021

“Containers of Christmas gifts turned away as Felixstowe port hits capacity – The problem was described yesterday as a “perfect storm” caused by a shortage of lorry drivers to move the containers, restrictions at ports because of Covid, and a surge in imports. One shipping boss said: ‘I don’t want to sound like a Grinch but there are going to be gaps on shelves this Christmas.’ The delay threatens to become the latest emergency to hit Britain after fuel shortages at the pumps and rising gas prices.”, The Times of London, October 13, 2021

“Warehouse space harder to find after online boom – Amid a desperate battle for space, several companies have agreed recently to pay 20 per cent above the asking price, CBRE said. ‘Supply levels are now critical, particularly in the northern belt that straddles the M62 motorway,’ Jonathan Compton, senior director for UK logistics at CBRE, said. Reflecting the change in shopping habits, of all the warehouse space taken in the most recent quarter, 39 per cent was leased by online retail companies.”, The Times of London, October 2, 2021

United States

“The ‘Great Resignation’ is likely to continue, as 55% of Americans anticipate looking for a new job – Most Americans expect to look for a new job as the pandemic continues. Some 55% of people in the workforce, meaning that they’re currently working or actively looking for employment, said they are likely to look for a new job in the next 12 months, according to Bankrate’s August jobseeker survey, published Monday. YouGov Plc conducted the survey of 2,452 adults for Bankrate from July 28 to July 30.”, CNBC, August 25, 2021

“Will Gen Z save malls and stores from their online rivals? Physical retailers have a rare chance to make shopping attractive again this holiday season. New US data from Accenture suggests 70 per cent of Gen Z customers plan to make most of their holiday purchases in store, while 54 per cent of Baby Boomers plan to buy largely online. Younger consumers are driven partly by fear of shortages — they would rather physically pick up items than risk shipping delays — but also by a desire to get out and do things with other people…..That means brands and malls that lost ground to online sales last year have a vital chance to fight back.”, The Financial Times, October 13, 2021

Brand News

“BurgerFi to acquire Anthony’s Coal Fired Pizza & Wings – Palm Beach, Fla.-based fast-casual burger chain BurgerFi International announced Monday the intention to acquire Anthony’s Coal Fired Pizza & Wings for $161.3 million from growth investment firm L Catterton. When the deal goes through, likely in the fourth quarter of 2021, L Catterton will become one of the largest shareholders of Burger Fi International.”, Nation’s Restaurant News, October 11, 2021

“US burger giant Carl’s Jr. states intention to enter the UK market – Popular US burger restaurant chain Carl’s Jr. is looking to enter the UK for the first time with plans to open restaurants in the capital and beyond. The brand, best known for its charbroiled burgers, is actively seeking companies to invest in franchises to open its first restaurants on UK soil. Founded in 1941, Carl’s Jr. is one of the most popular QSR chains in the world with more than 1,000 restaurants in 28 markets worldwide. The company already has a presence in Europe, with 79 restaurants across France, Denmark, Spain, Turkey and Russia and has just signed a 300-restaurant deal in Russia and is now targeting the UK as well as Germany for further expansion.”, Big Hospitality, October 7, 2021

“Denny’s Corporation: Catalyst Rich Third Quarter Likely To Deliver Strong Growth – Dine-in sales are likely to benefit significantly from pent-up customer demand. Additional growth is expected as 60% of the footprint that was operating with limited hours reverts back to the 24/7 schedule. The launch-to-date success of the virtual brands indicates a possible new leg of growth.”, Seeking Alpha, October 14, 2021

“Domino’s Pizza Enterprises Ltd celebrates official 3000th store opening – – in Dresden, Germany. In 2021 the Company has opened 206 new stores and has acquired its 10th market Taiwan and over the next 3-5 years plans to open new stores at a rate of 9-11% of the network annually.”, Dominos Australia, October 7, 2021. Compliments of Jason Gehrke, Managing Director, The Franchise Advisory Centre, Brisbane

“Why Founders Sold $2.1B Home Instead After Resisting for Years – ‘It’s different, that’s for sure,’ said co-founder Paul Hogan when reached in late September, about his life after selling Home Instead to Honor Technology in August. How hard was it to decide to sell the homecare franchise that he and his wife, Lori, built from zero in 1994 to $2.1 billion in systemwide sales in 2020? ‘It was like this Olympic wrestling match with this decision.’”, Franchise Times, September 30, 2021

“KFC will go Straight” – The (Russia) network launched its own delivery – High rates of food delivery aggregators are forcing large fast food chains to develop their sales channels. KFC, five years after an unsuccessful attempt to create such a service, again decided to launch its own delivery. KFC has launched its own delivery in Moscow and St. Petersburg, the company itself told Kommersant. They added that in the near future the service will work in other cities with a population of over one million, which ‘will increase the volume of orders by 15-20%.’”, Kommersant.ru, October 10, 2021. Compliments of Paul Jones, Jones & Co., Toronto

“Why Tropical Smoothie Cafe is Bucking the Ghost Kitchen Trend – The 1,000-unit brand is letting franchisees dictate the path forward…… Ghost kitchens? CEO Charles Watson says they are not a part of the chain’s sizable growth plans. For Watson, it comes down to the brand’s roots as a franchisee-led organization. Since operators haven’t expressed overwhelming interest to jump in, it’s likely not in the company’s path forward. But the reasons go beyond that.”, QSR Magazine, October 6, 2021

Articles, Podcasts & Studies For Today And Tomorrow

I was featured in a Global Chamber podcast last week which can be heard at this link: Globinar Featuring Bill Edwards on “Global Business Recovery from the Trenches”

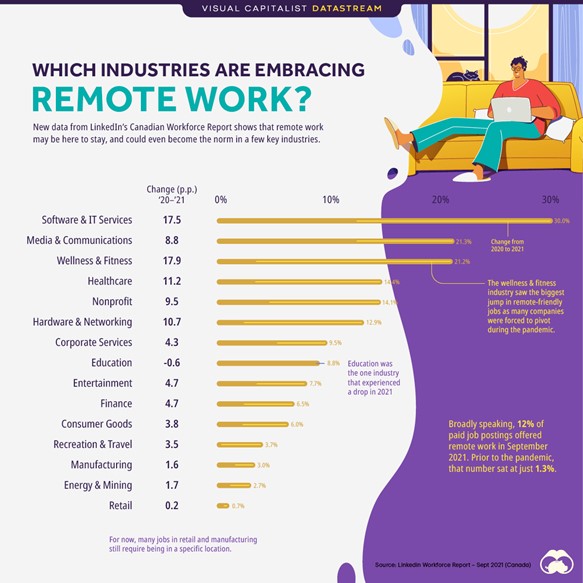

“Charting the Continued Rise of Remote Jobs – When the pandemic first took hold in 2020, and many workplaces around the world closed their doors, a grand experiment in work-from-home began. Today, well over a year after the first lockdown measures were put in place, there are still lingering questions about whether remote work would now become a commonplace option, or whether things would generally return to the status quo in offices around the world.”, LinkedIn Work Force Report, September 2021

“What matters most? Five priorities for CEOs in the next normal – The pandemic has both revealed and accelerated a number of trends that will play a substantial role in the shape of the future global economy. In our conversations with global executives, they have identified five priorities. Companies will want to adopt these five priorities as their North Star while they navigate the trends that are molding the future.”, McKinsey, September 8, 2021

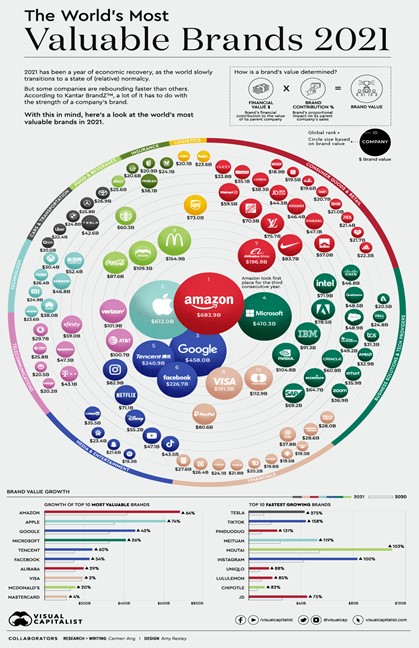

“The World’s 100 Most Valuable Brands in 2021 – In 2020, the global economy experienced one of the worst declines since the Great Depression. Yet, while the ripple effects of COVID-19 have thrown many businesses into disarray, some companies have not only managed to stay afloat amidst the chaos—they’ve thrived. Using data from Kantar BrandZ, this graphic looks at the top 100 most valuable brands of 2021.”, Visual Capitalist, October 6, 2021

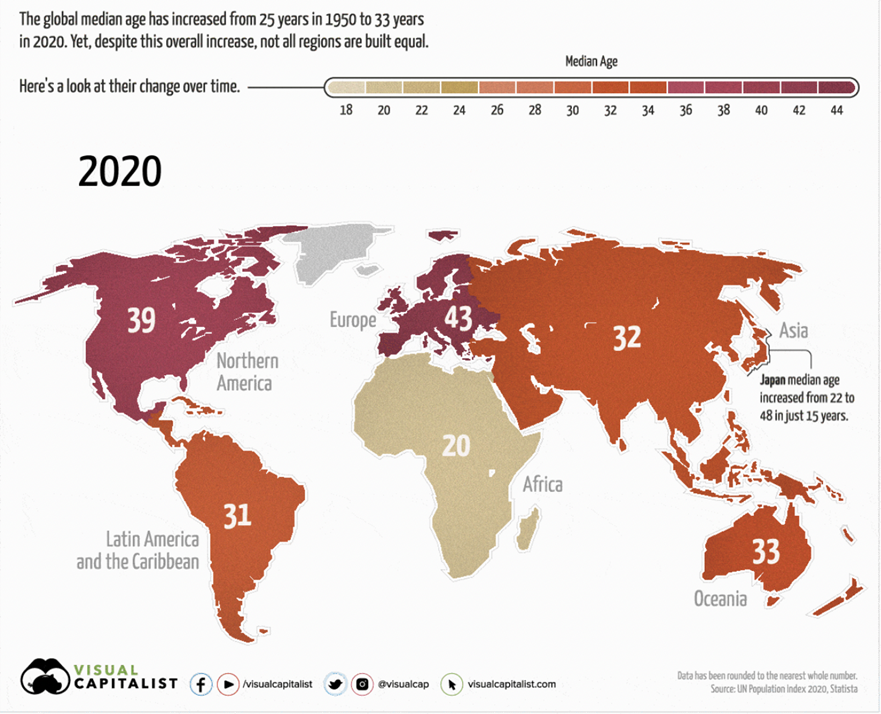

“Over the last 70 years, the global population has gotten older. Since 1950, the worldwide median age has gone from 25 years to 33 years. Yet, despite an overall increase globally, not all regions have aged at the same rate. For instance, Europe’s median age has grown by 14 years, while Africa’s has only increased by 1 year. Today’s animated map uses data from the UN Population Index to highlight the changes in median age over the last 70 years, and to visualize the differences between each region. We also explain why some regions skew older than others.”, Visual Capitalist / UN Population Index / Statista, July 10, 2020

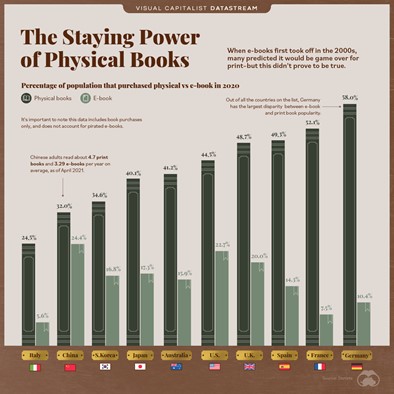

“E-books are certainly not a new phenomenon. In fact, they’ve been around longer than the internet. Yet, while the emergence of e-books dates back to the early 1970s, they didn’t hit the mainstream until the 2000s, when big companies began launching their own e-book readers, and digital libraries started to become more accessible to the public. Around this time, sales for e-books started to soar, and by 2013, e-book sales made up 20%of all books sales in America. Many wondered if this was the end for print books. But fast forward to 2021, and e-books haven’t made print books obsolete. At least, not yet.”, Statista / Visual Capitalism, October 2021

William (Bill) Edwards, CFE, is CEO and Global Advisor of Edwards Global Services (EGS). He has 4 decades of international operations, development, executive and entrepreneurial experience and has lived in 7 countries. With experience in the franchise, oil and gas, information technology and management consulting sectors, he has directed projects on-site in Alaska, Asia, Europe and the Middle and Near East. Mr. Edwards advises a wide range of companies on early to long term global development of their brands.

Bill recently was published on Franchising.com in an article about how global franchise supply chain management is critical for international success. Read the full article here: https://bit.ly/3io0BuK

Edwards Global Services, Inc. (EGS) provides a complete International solution for companies Going Global. From initial global market research and country prioritization, to developing new international markets, providing in-country operations support and problem solving around the world. Our U.S. based executive team has experience living and working in many countries. Our Associate network on the ground overseas covers 40+ countries. EGS has twice received the U.S. President’s Award for Export Excellence.

Download our latest 40 country ranking chart at this link:

July 2021 GlobalVue™ Country Ranking Chart

For global market research, operations and development support across 40 countries, contact Mr. Edwards at bedwards@edwardsglobal.com or +1 949 224 3896.

https://calendly.com/geowizard/30min Click here to schedule a call with Bill Edwards to discuss how to succeed in developing your company around the world.