EGS Biweekly Global Business Newsletter Issue 106, Tuesday, April 16, 2024

Edited and curated by: William (Bill) Edwards, CFE, CEO of Edwards Global Services, Inc. (EGS)

Some Introductory Comments For This 106th Issue: A definition of artificial intelligence (AI). Brazil will require bank statement to get a visa next year. An awesome quote from Yoda! The size of the rapidly growing global senior population. China’s Foreign Direct Investment is drying up. Global tourism continues to recover, but….Who runs the ‘Global South’? U.S. consumers are growing pessimistic about their economy while U.S. CEO are more optimistic (??). Private equity investment is about to massively change the U.S. franchise industry.

Edited and curated by: William (Bill) Edwards, CEO & Global Advisor, Edwards Global Services, Inc. (EGS), Irvine, California, USA. Contact Bill with any questions, comments and contributions.

Bedwards@edwardsglobal.com, +1 949 375 1896

The mission of this newsletter is to use trusted global and regional information sources plus our network of 20+ in-country Associates to update our global readers on key global and local trends that can impact the success of their businesses at home and abroad. We subscribe to about 40 international information sources to keep our readers up to date on the world’s business.

Some of the information sources that we provide links to require a paid subscription for our readers to access. This means that some of the links to articles may not work if the reader does not have a subscription to that service. We maintain a paid subscription to ~30 information sources to be able to bring the reader the latest in global business trends.

First, A Few Words of Wisdom From Others For These Times

“Do or Do Not, There Is No Try.” – Yoda

“Do not squander time for that is the stuff life is made of.” – Benjamin Franklin

“The way to get started is to quit talking and begin doing.” – Walt Disney

Highlights in issue #106:

- Brand Global News Section: Body Fit®, Body Shop®, Jessey Mikes®, Little Chef® and Subway®

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Interesting Data, Articles and Studies

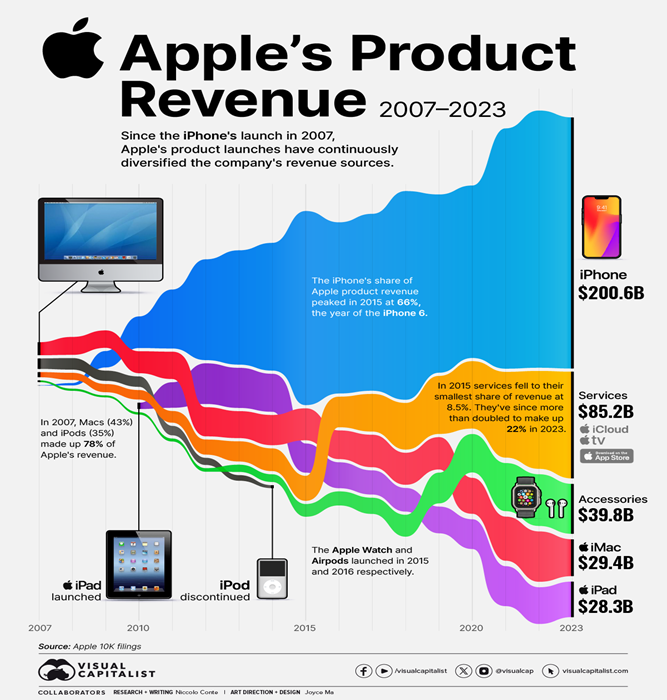

Global Smartphone Market Share: Apple Steals the Crown by Less than 1%. Apple and Samsung nearly tied. The two companies are the dominant names in the global market, holding a 20.1% and 19.4% market share. In terms of growth from 2022, though, Apple managed +3.7%, while Samsung shrank by -13.6%. Chinese firms round out the top five.”, Visual Capitalist and International Data Corporation’s (IDC), April 10, 2024

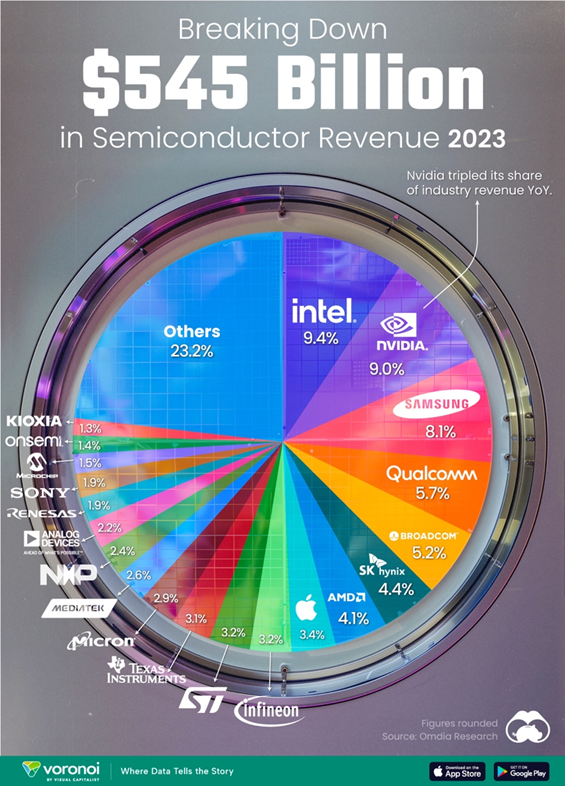

“Semiconductor Companies by Industry Revenue Share – Did you know that some computer chips are now retailing for the price of a new BMW? As computers invade nearly every sphere of life, so too have the chips that power them, raising the revenues of the businesses dedicated to designing them. But how did various chipmakers measure against each other last year? We rank the biggest semiconductor companies by their percentage share of the industry’s revenues in 2023, using data from Omdia research.”, Visual Capitalist and Omdia Research, April 9, 2024

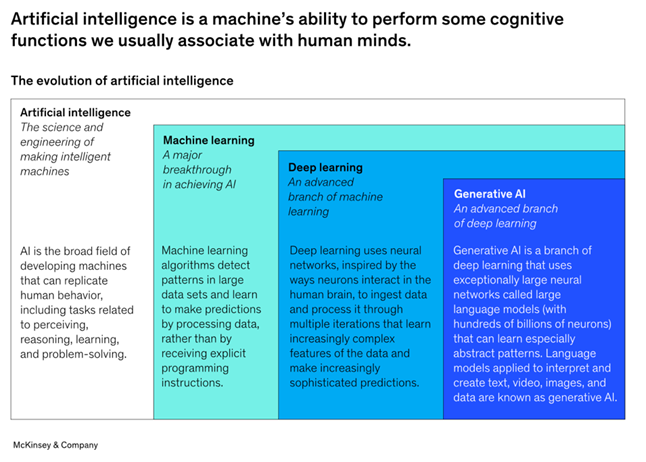

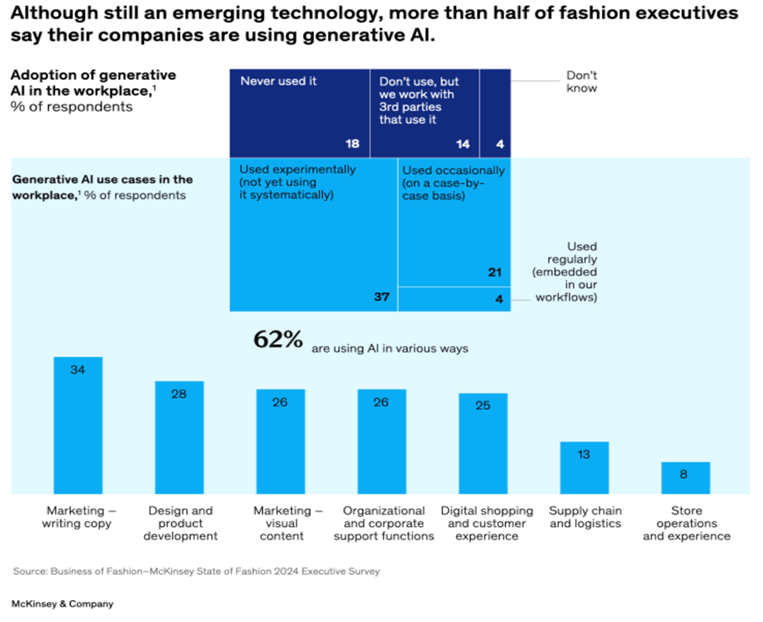

“What is AI (artificial intelligence)? – Artificial intelligence is a machine’s ability to perform some cognitive functions we usually associate with human minds. AI is a machine’s ability to perform the cognitive functions we associate with human minds, such as perceiving, reasoning, learning, interacting with the environment, problem-solving, and even exercising creativity. Machine learning is a form of artificial intelligence that can adapt to a wide range of inputs, including large sets of historical data, synthesized data, or human inputs.”, McKinsey & Co., April 3, 2024

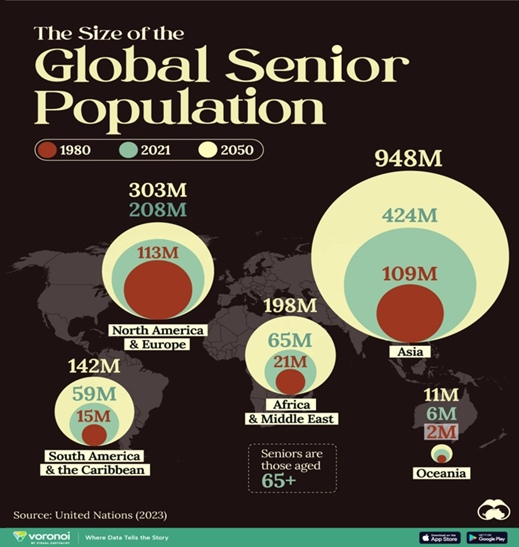

“Visualizing the Size of the Global Senior Population – The growth of the senior population is a consequence of the demographic transition towards longer and healthier lives. Population aging, however, can pose economic and social challenges. The data is from the World Social Report 2023 by the United Nations. Currently, population aging is most advanced in Europe, Northern America, Australia, New Zealand, and parts (of) Eastern and Southeastern Asia.”, Visual Capitalist and United Nations, April 4, 2024

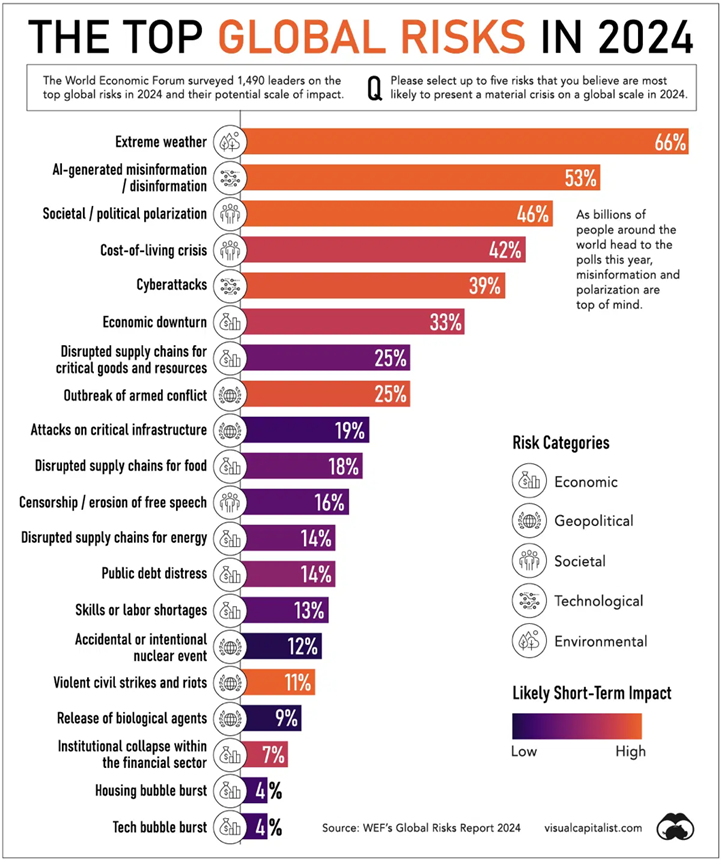

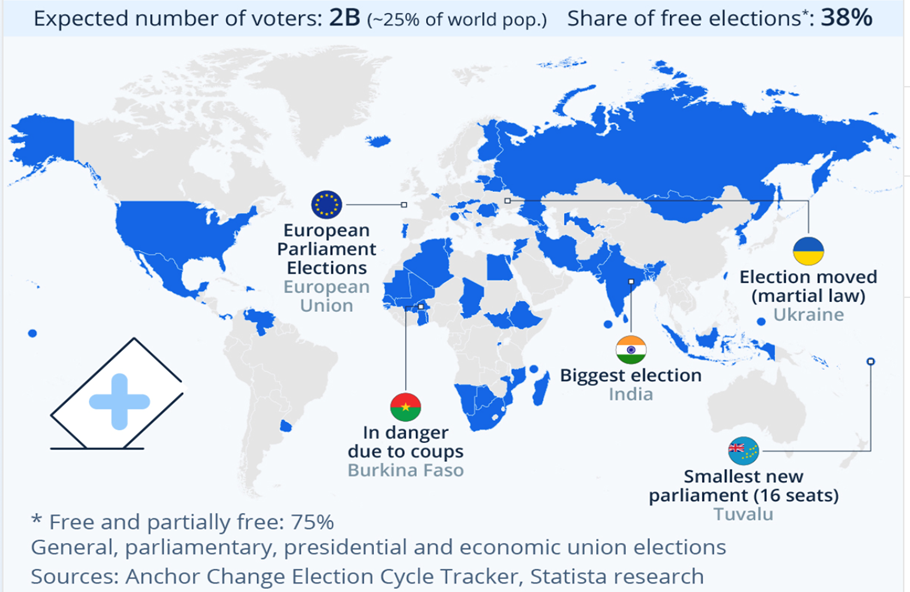

“Economic conditions outlook, March 2024 – Executives’ latest views on the global economy and their countries’ economies lean much more positive than they did at the end of 2023. In the latest McKinsey Global Survey on economic conditions, the outlook on domestic conditions in most regions has become more hopeful, despite ongoing shared concerns about geopolitical instability and conflicts. In a year brimming with national elections, respondents increasingly see transitions of political leadership as a primary hazard to the global economy, particularly in Asia–Pacific, Europe, and North America. Furthermore, respondents now view policy and regulatory changes as a top threat to their companies’ performance, and they offer more muted optimism than in December about their companies’ prospects.”, McKinsey & Co., March 29, 2024

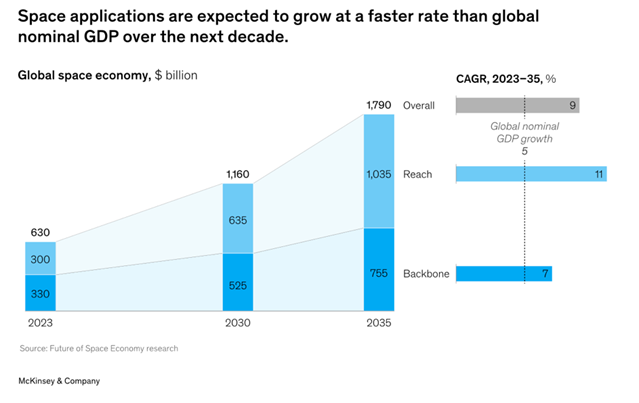

“Space: The $1.8 trillion opportunity for global economic growth – The space industry is approaching the next frontier, with each week bringing news of a major development somewhere in the world. Be it a test of a new rocket system, the launch of an innovative satellite, or a robotic exploration mission safely landing on the moon, activity in space is accelerating. We estimate that the global space economy will be worth $1.8 trillion by 2035 (accounting for inflation), up from $630 billion in 2023.”, McKinsey & Co., April 8, 2024

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global Supply Chain, Energy, Commodities, Inflation, Taxes & Trade Issues

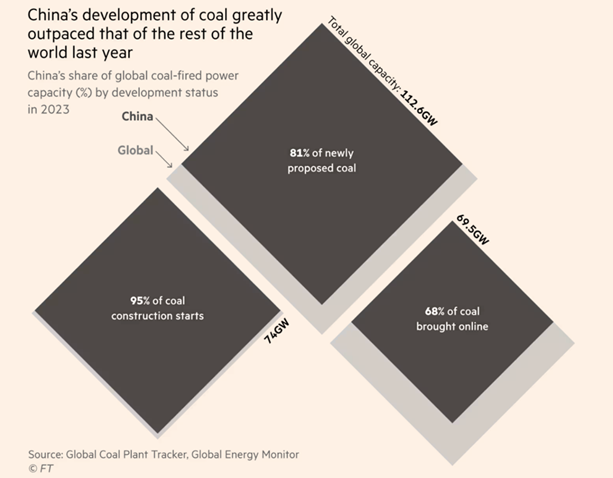

“World coal capacity growth jeopardises peak emissions forecasts – Global fleet increases in 2023 as China brings on new plants and the pace of closures slows in EU and US. The global coal fleet grew by 2 per cent last year, mainly driven by new capacity additions in China and a slow down of closures in the EU and the US, the latest data shows. The new data found that coal capacity outside of China increased for the first time since 2019, according to the non-profit research group Global Energy Monitor, as less coal power was retired than in any single year of the past decade. Outside of China, new coal power was brought online in Indonesia, India, Vietnam, Japan, Bangladesh, Pakistan, South Korea, Greece, and Zimbabwe.”, The Financial Times, April 11, 2024

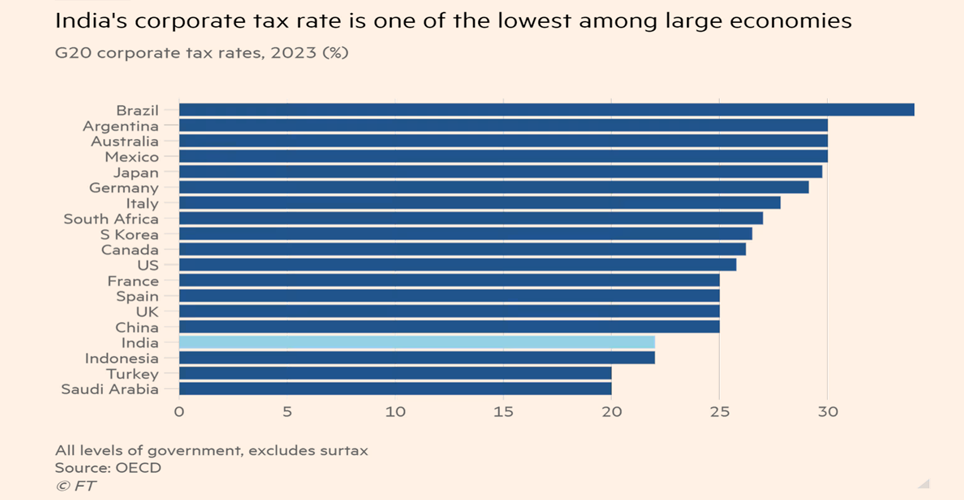

“Businesses bank on Narendra Modi election win to ease India’s bottlenecks – World’s most populous country is emerging as key market for investors but many companies remain tangled in red tape. But in private many businesses still complain about India’s complex tax regulation, difficulties in acquiring land, rigid labour laws, weak intellectual property enforcement and clogged courts. It takes almost four years to enforce contracts in business disputes, among the slowest globally, according to the World Bank. “Is the country better managed than it was decades ago? Undoubtedly so,” said a London-based executive with business in India. “Modi is a great marketer, but the ease of doing business is still not that easy at all.”, The Financial Times, April 15, 2024

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global & Regional Travel

“Travel and Tourism Industry Poised to Break Records This Year – The World Travel & Tourism Council (WTTC) is predicting that 2024 will be a record-breaking year for the global travel industry, with an all-time high in global economic contribution and employment. The industry is expected to generate one in every 10 dollars worldwide, contributing $11.1 trillion to the global economy, according to WTTC’s 2024 Economic Impact Research. That’s $770 billion higher than its previous record.”, Travel Pulse, April 4, 2024

“This country will require Americans to show their bank statements to visit – If you want to travel to Brazil next year, you’ll need to share your bank statements with the South American nation first. Travelers from the U.S., Canada, and Australia will need to obtain a visa before entering the country, beginning April 10, 2025, according to a Brazilian government-authorized website. To complete the visa application, visitors must provide proof of income for travel by showing their last three checking or savings account statements or their six previous pay stubs.”, The Hill, April 14, 2024

“The World’s Top Flight Routes, by Revenue – In 2024, a record 4.7 billion people are projected to travel by air—200 million more than in 2019. While revenues surged to an estimated $896 billion globally last year, airlines face extremely slim margins. On average, they made just $5.44 in net profit per passenger in 2023. Today, the industry faces pressures from high interest rates, supply chain woes, and steep infrastructure costs. This graphic shows the highest earning flight routes worldwide, based on data from OAG.”, Visual Capitalist and OAG, April 9, 2024

“Global tourism is recovering, but for Asia it’s a mixed bag at best – Talk to the UN world tourism organisation – since January rebranded as UN Tourism – and the message is that international tourism is well on the road to recovery from the Covid-19 pandemic. But talk to tourism officials in Hong Kong, South Korea, mainland China or Thailand and the story is: not so fast. According to the UN’s Tourism Recovery Tracker, global tourism last year recovered to within 12 per cent of the pre-Covid level, and is forecast to fully recover this year. In Europe, by far the world’s largest tourism market, it is a story of strong recovery. Across Asia, the story is anaemic at best. And it is a story of new tourism markets and travel patterns, with much excitement focused on Saudi Arabia, the United Arab Emirates (UAE) and other Gulf economies.”, South China Morning Post, April 6, 2024

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Country & Regional Updates

Australia

“RBA won’t cut interest rates until 2025 – Australia is expected to be almost the last major advanced economy to deliver an interest rate cut, after hot US inflation caused professional investors to push out bets for a local monetary easing until early next year. The deferral of an expected rate reduction until February is later than the Albanese government had hoped as a federal election approaches.”, Australian Financial Review, April 12, 2024

Canada

“Canada Unveils Billions for Artificial Intelligence – Canadian Prime Minister Justin Trudeau on Sunday said his government would spend nearly $2 billion to help fuel growth in the country’s domestic artificial-intelligence sector, the latest in a series of multibillion-dollar announcements the Canadian leader has vowed won’t stoke a fresh round of inflation…..Trudeau said Canada would spend C$2.4 billion that would, among other things, help build data centers and servers and ensure access to the computer power required to conduct research in the AI field. A report from consulting firm Deloitte & Touche’s Canadian unit said venture-capital investment in Canada’s AI sector reached C$8.6 billion in 2023, adding Canada ranks third among Group of Seven countries in terms of per capita venture-capital AI investments, trailing the U.S. and U.K.”, The Wall Street Journal, April 7, 2024

China

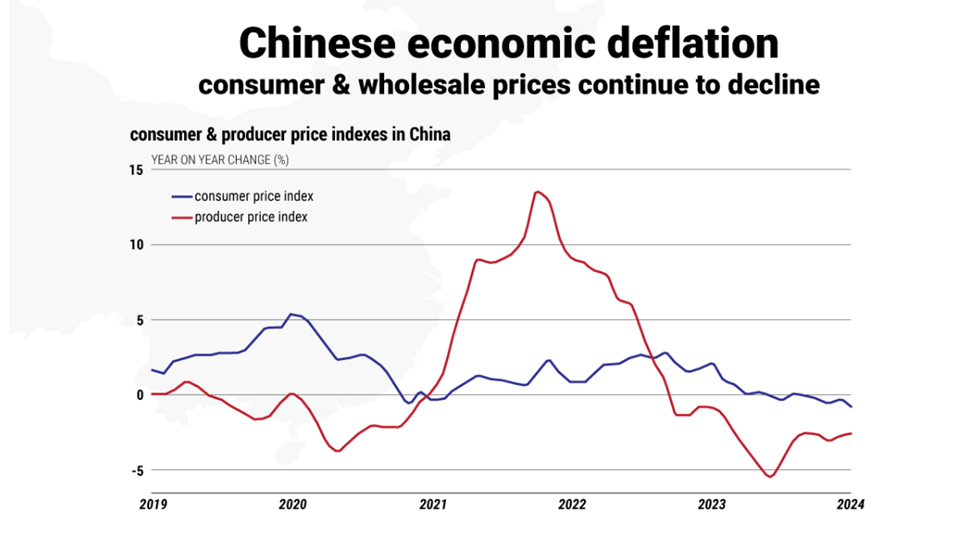

“China Regrets Fitch’s Downward Revision of Its Outlook – The revision from stable to negative — regarding the rating outlook on China as a long-term foreign-currency debt issuer — was based on rising risks to the country’s public finances amid economic uncertainties and ‘a transition away from property-reliant growth to what the government views as a more sustainable growth model,’ Fitch said in a Tuesday commentary. ‘Wide fiscal deficits and rising government debt in recent years have eroded fiscal buffers from a ratings perspective,’ Fitch said. It maintained an ‘A+’ rating for China as a long-term debt issuer.”, Caixin Global, April 10, 2024

“China’s Mammoth Effort to Help Foreigners Spend, Spend, Spend – Regulators have been pushing banks and nonbank payment platforms, such as Alipay, owned by Ant Group Co. Ltd., and WeChat Pay, operated by Tencent Holdings Ltd.’s Tenpay Payment Technology Co. Ltd., to improve services for international visitors and make it easier for them to spend money. The campaign is part of a broader strategy to boost China’s attraction as a destination for overseas visitors and reverse a slump in foreign investment.”, Caixin Global, April 9, 2024

Southern Europe

“Southern Europe is the continent’s new economic growth engine – Southern European economies that were long sneered at by their richer northern neighbors have turned the tables as they cement their role as growth drivers in the sputtering euro area.Business surveys by S&P Global released this week showed Spain and Italy beat economists’ expectations with faster expansion in March. A manufacturing gauge for Greece indicated a similar trend. A tourism surge since the pandemic, booming exports, and lower energy prices thanks to renewables and limited reliance on Russian gas, have given so-called periphery countries on the Mediterranean the edge in the euro area. But the region’s relatively strong growth is mainly due to the fact that after many years, southern European countries have ‘corrected their imbalances, so now they are developing at a healthy rate without macroeconomic imbalances.’”, Fortune, April 9, 2024

Global South

“Who’s the big boss of the global south? In a dog-eat-dog world, competition is fierce. The simplest working definition (of Global South) is that it refers to most, but not quite all, non-Western countries. Its use also denotes how emerging economies want more power over global affairs and often have a critical view of Western policy. Narendra Modi has suggested India could be its “voice”. Luiz Inácio Lula da Silva (known as Lula), the president of Brazil, reckons his country could be, too. Our conclusion is, counterintuitively, that America still has more influence than any other country over the global south, but that within the grouping itself China has become the most powerful member—giving Mr Xi the strongest claim to leadership.”, The Economist, April 8, 2024

India

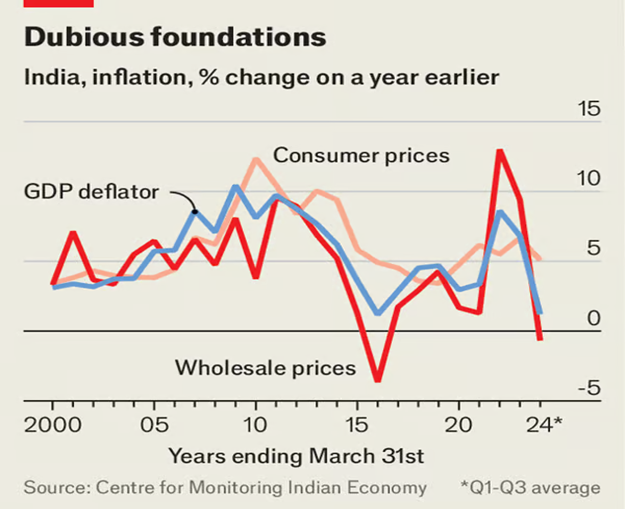

“How fast is India’s economy really growing? – Statisticians take the country’s figures with a pinch of salt. Today India again appears to be at the start of an upswing. In the year to the fourth quarter of 2023, GDP growth roared at 8.4%. But such figures tend to be treated with a pinch of salt. Economists inside and outside the government are debating just how fast the economy is growing—a question that has particular piquancy ahead of a general election that begins on April 19th. Since December 2019, real GDP has grown by 4.2% at an average annual rate, meaning that India, like many other countries, has not recovered to its pre-pandemic trend. Corporate and foreign investment remain weak.”, The Economist, April 11, 2024

United States

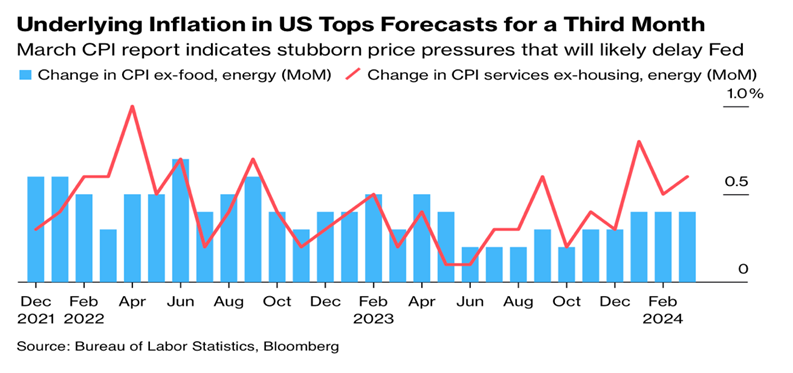

“US Inflation Refuses to Bend, Fanning Fears It Will Stick – Consumer prices rose in March amid stronger services inflation. Report reorders bets on Fed easing, dashing hopes for June cut. A key US price gauge topped forecasts for a third straight month on gains in rents and transportation costs, spurring concerns that inflation is becoming entrenched and likely further delaying Federal Reserve interest-rate cuts., Bloomberg, April 10, 2024

“Consumers are getting more pessimistic as inflation refuses to fall – Consumer sentiment about the U.S. economy has ticked down but remains near a recent high, with Americans’ outlook largely unchanged this year.The University of Michigan’s consumer sentiment index, released Friday in a preliminary version, slipped to 77.9 this month, down from March’s figure of 79.4. Sentiment is about halfway between its all-time low, reached in June 2022 when inflation peaked, and its pre-pandemic averages. The survey has been conducted since 1980. ‘Consumers are reserving judgment about the economy in light of the upcoming election, which, in the view of many consumers, could have a substantial impact on the trajectory of the economy,’ said Joanne Hsu, director of the consumer survey.”, Fortune, April 12, 2024

“87% of CEOs confident in the U.S. economy, says KPMG – After years of uncertainty facing the economy, from the pandemic to supply-chain challenges to multiple wars, America’s CEOs feel confident in the country’s economy. And chief executives are basking in the sunshine, overjoyed to be out from under the black clouds of economic uncertainty. The survey featured responses from 100 CEOs from companies with at least $500 million in revenue and 70% of which had at least $1 billion.”, Fortune, April 11, 2024

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Brand & Franchising News

“Body Fit Training Opens Studio in Spain – Body Fit Training (BFT) announced today the opening of its 300th global studio in Barcelona, Spain. The Barcelona studio opening expands the brand’s presence in countries around the world, including its birthplace of Australia, along with New Zealand, Singapore, the U.K., the U.S., and Hong Kong, among others, as the demand for group strength training workouts continues to surge.”, Franchising.com, April 4, 2024

“Little Chefs: What happened to roadside diner chain – With 439 restaurants on major routes across the UK, Little Chef once enjoyed a near monopoly on roadside dining. So, why did the restaurant chain disappear? Little Chef was started in 1958 by catering boss Peter Merchant and caravan manufacturer Sam Alper. The business’ decline was “gradual” according to Becky Parr-Phillips who started working for Little Chef as a waitress in the 1990s, rising through the managerial ranks to become head of operations around 15 years later. The owners were keen to reduce costs and maximise profits as the chain still enjoyed something of a monopoly on roadside dining. ‘There were closures, the prices were hiked, you know the guests did start to call it Little Thief rather than Little Chef’, says Becky.”, BBC News, April 12, 2024

“The Future of The Body Shop and its International Franchisee Network – In February of this year, skincare and cosmetics retailer The Body Shop began appointing administrators across its operations in the UK and certain European territories. The Body Shop Canada and USA have since followed suit. While the future of one of the UK’s most well-known high street brands remains uncertain, we consider what went wrong, what impact this may have on The Body Shop’s international franchise network and intellectual property rights portfolio, and the potential impacts on the Asia-Pacific market….In mainland China, The Body Shop is still selling through cross-border e-commerce platforms but does not have any bricks and mortar stores.”, Bird & Bird, April 10, 2024. Compliments of Paul Jones, Jones & Co., Toronto

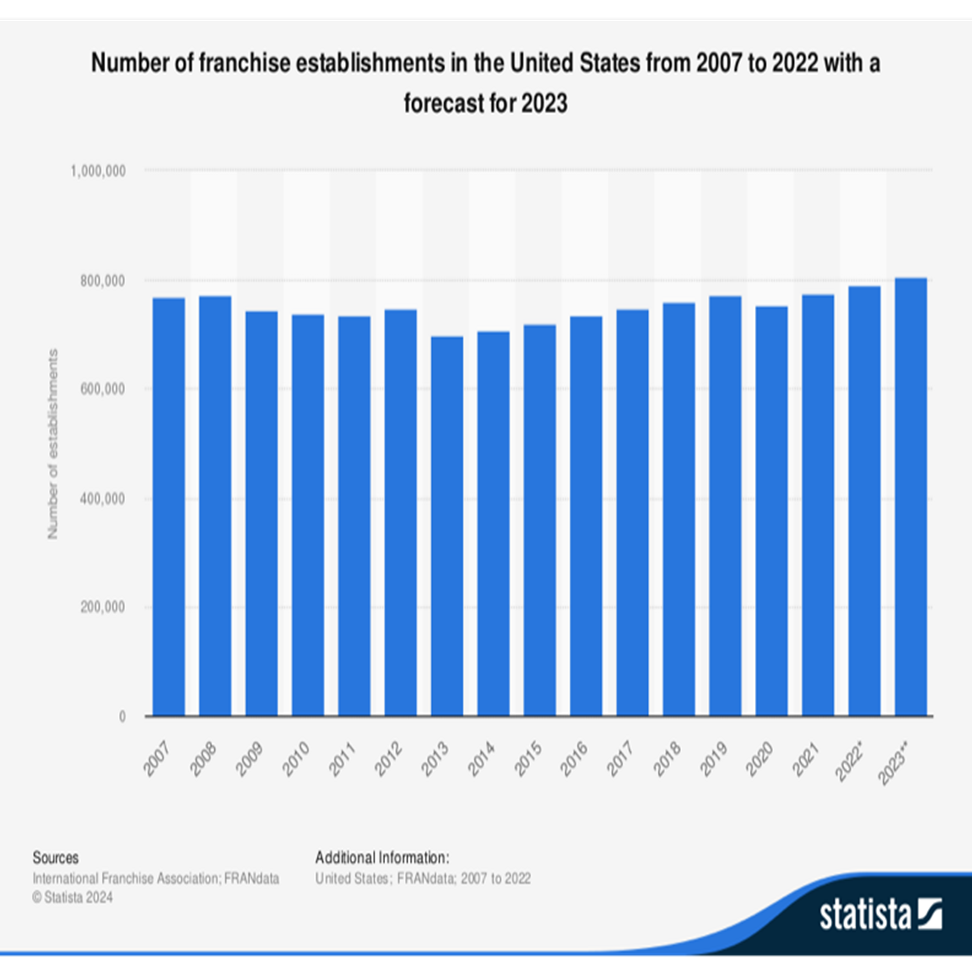

“The Franchise Industry is on The Verge of Massive Change With Private Equity’s Potential $8 Billion Acquisition of Jersey Mike’s. Two iconic brands, Subway and Jersey Mike’s, may sell to private equity after years of being closely held. Heavyweight PE firms are an increasing force within the franchising sector, marking a strategic shift and altering the industry landscape. Private equity has successfully cherry-picked most top franchise brands with enough scale to attract professional investors. Jersey Mike’s and Subway are two high-profile holdouts.” Entrepreneur, April 11, 2024

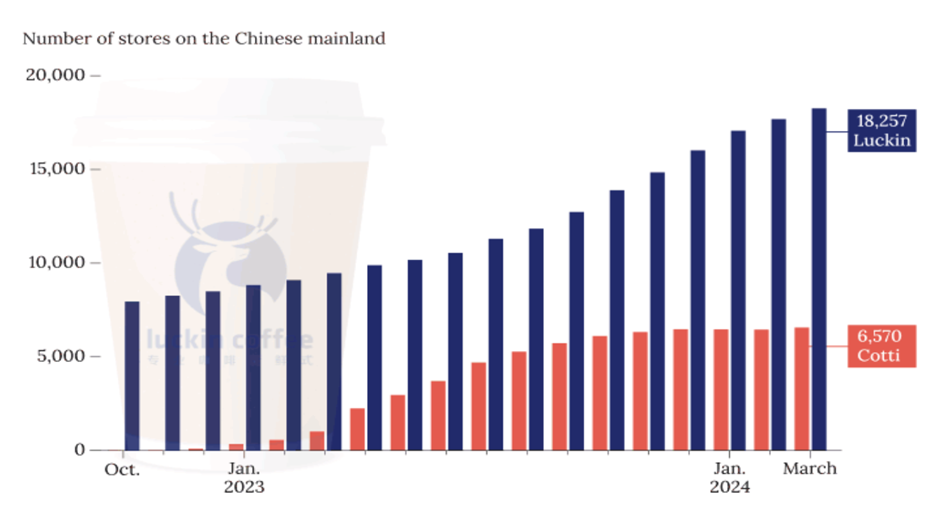

“Luckin Challenger Pushes China’s Coffee Price War Toward Boiling Point – China’s coffee market is in the midst of a price war, and it’s showing no sign of abating as the country’s leading affordable brand Luckin Coffee Inc. faces down challenger Cotti Coffee, the upstart launched by Luckin’s disgraced co-founders Lu Zhengyao and Qian Zhiya. Forced out of Luckin for their role in perpetrating a $300 million fraud, Lu and Qian returned in late 2022 with a new venture and promptly went to battle with their former brainchild. They adopted the same low-price strategy, at one point undercutting Luckin’s best discount. As of early March, Luckin had opened over 17,800 stores in China — significantly outstripping Starbucks’ 7,770 locations and Cotti’s close to 6,800, according to food and beverage industry information provider Canyan Data.”, Caixin Global, April 2, 2024. Compliments of Paul Jones, Jones & Co., Toronto

To receive our biweekly newsletter in your email every other Tuesday, click here – https://insider.edwardsglobal.com

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, the franchise sector, economic development, and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing environment. And our GlobalTeam™ on the ground covering 25+ countries provides us with updates about what is actually happening in their specific countries.

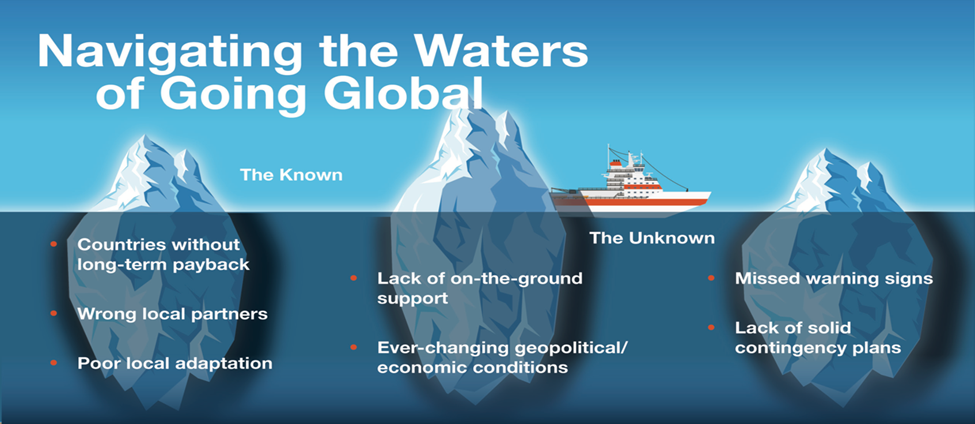

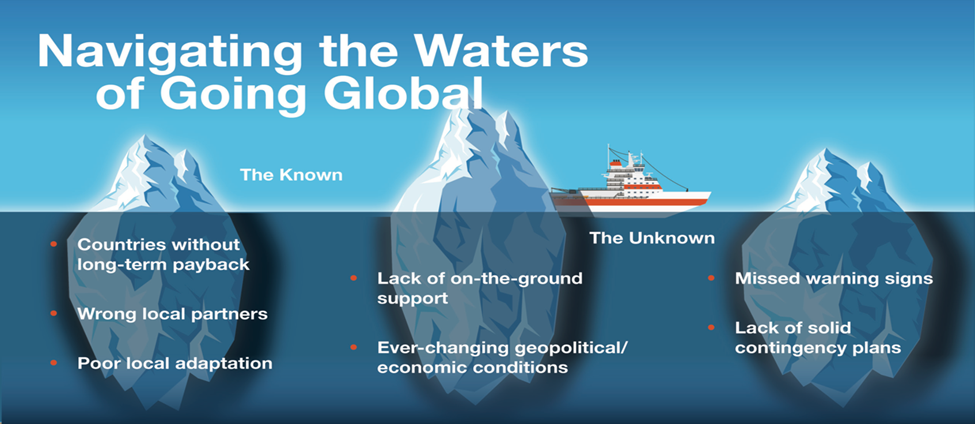

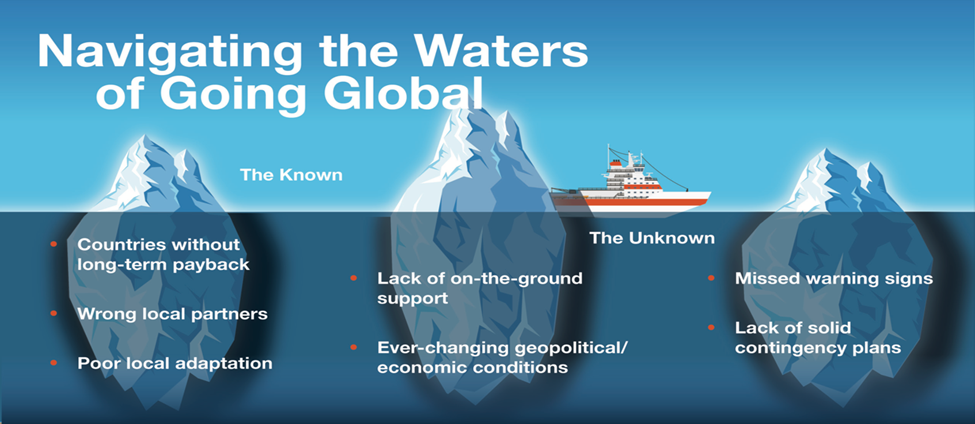

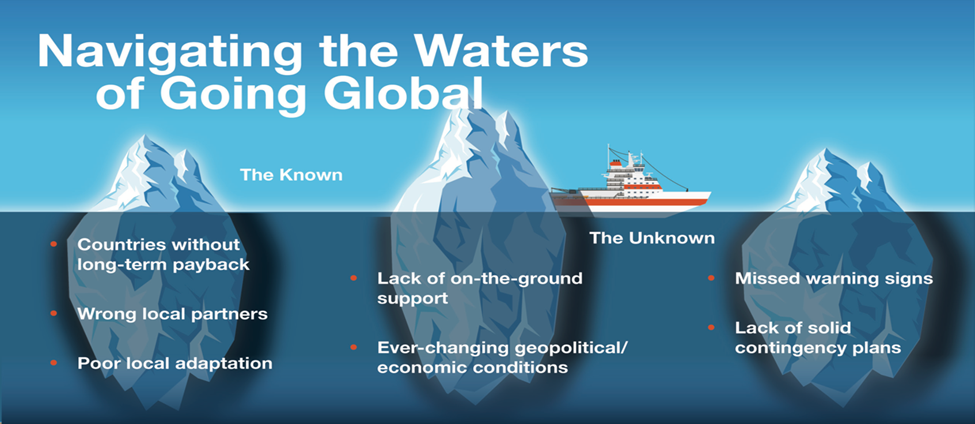

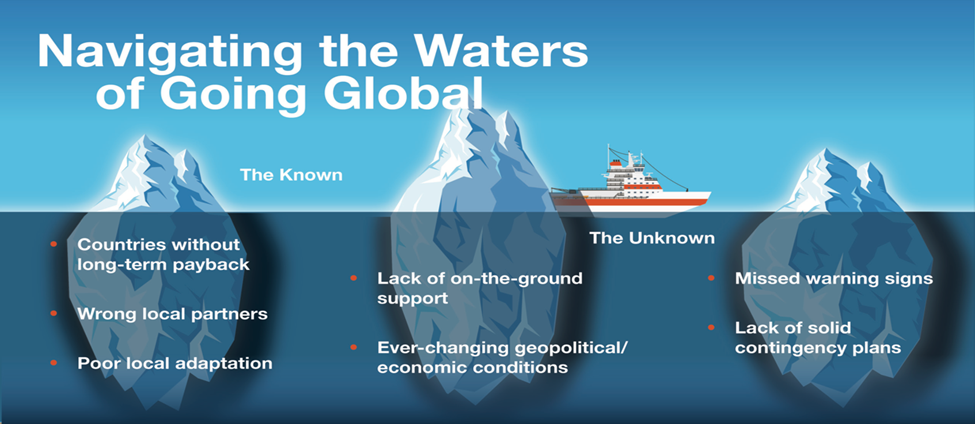

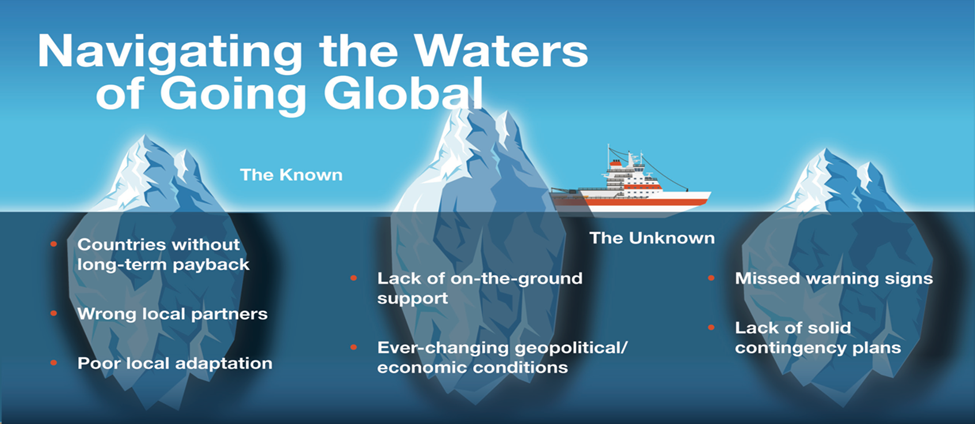

William “Bill” Edwards: Global Advisor Is Uniquely Qualified to Steer Sr. Executives Successfully Through the Complex Waters of Going Global. With four decades of successful international business experience spanning virtually every corner of the world and many business sectors, Bill Edwards understands the global business landscape like no other. He has been a County Master Franchisee in five countries in Asia, Europe and the Middle East; the Senior VP for a franchisor operating in 15 countries and a full-service consultant since 2001 taking 40+ franchisors global.

For a complimentary 30-minute consultation on how to take your business global successfully, click on the QR code or contact Bill Edwards at bedwards@edwardsglobal.com or +1 949 224 3896.

And download our latest chart ranking 40+ countries as places to do business at this link:

Our latest GlobalVue™ 40 country ranking

EGS Biweekly Global Business Newsletter Issue 105, Tuesday, April 2, 2024

Edited and curated by: William (Bill) Edwards, CFE, CEO of Edwards Global Services, Inc. (EGS)

Introduction: Coca-Cola worldwide comsumption. Consumer sentiment is rising, inflation is falling, countries in Latin America are dropping interest rates, the first-ever call on a mobile phone was made 50 years ago. ‘Friendshoring’ is growing away from China. But China does finally remove the Australian wine boycott. China relaxes control of the flow of data in and out of country due to business pressure. And we look at the 12 most spoken languages in the world.

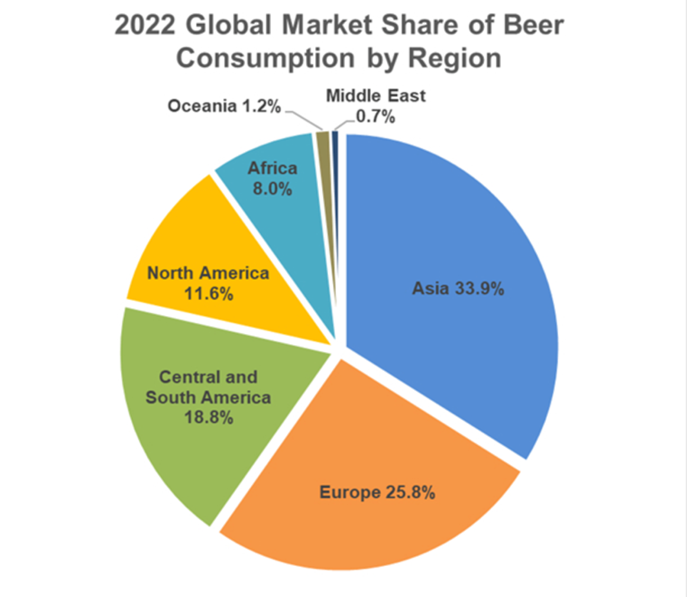

This year chocolate easter eggs were subject to ‘shrinkflation’. Egypt got another financial bailout. Starbucks® is now the second largest food brand in the world after McDonalds®, taking over from Subway®. Big tech increasingly has challenges finding energy to power their data centers. Global beer consumption explained. And AI data centers are spurring the use of more natural gas.

Edited and curated by: William (Bill) Edwards, CEO & Global Advisor, Edwards Global Services, Inc. (EGS), Irvine, California, USA

Bedwards@edwardsglobal.com, +1 949 375 1896

The mission of this newsletter is to use trusted global and regional information sources plus our network of 20+ in-country Associates to update our global readers on key global and local trends that can impact the success of their businesses at home and abroad. We subscribe to about 40 international information sources to keep our readers up to date on the world’s business.

Some of the information sources that we provide links to require a paid subscription for our readers to access. This means that some of the links to articles may not work if the reader does not have a subscription to that service. We maintain a paid subscription to ~30 information sources to be able to bring the reader the latest in global business trends.

First, A Few Words of Wisdom From Others For These Times

“Your time on earth is limited. Don’t try to ‘age with grace’, age with mischief, audacity, and a good story to tell.”, Compliments of Doug Bruhnke, Founder of the Global Chamber

“The secret of change is to focus all your energy not on fighting the old but on building the new.”, Socrates, father of Western philosophy

“Ideas are easy. Implementation is hard.”, Guy Kawasaki

Highlights in issue #105:

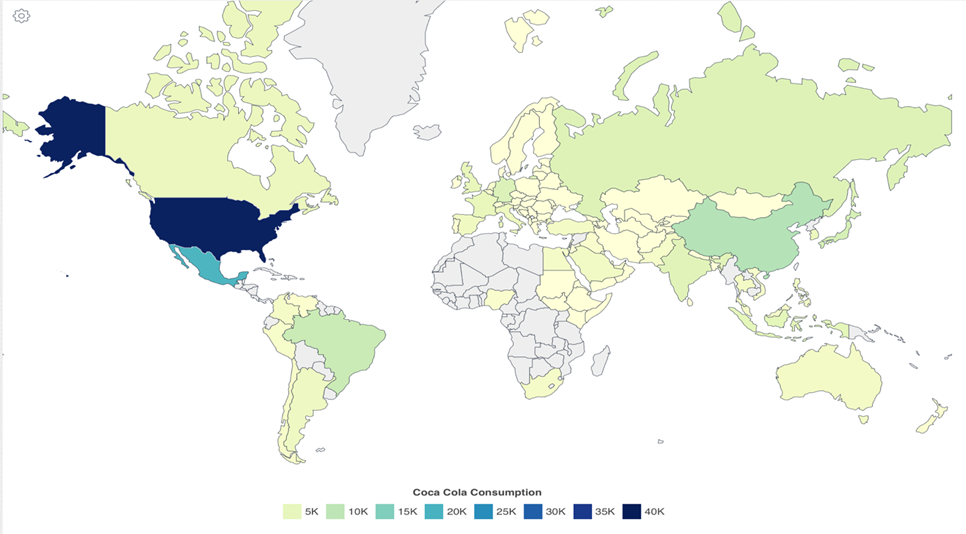

Coca Cola Consumption by Country 2024

China Loosens Cross-Border Data Rules on Business Pressure

U.S. Economic Growth Remains Robust, No Matter How You Slice It

Mexico becomes the latest major Latin American economy to cut rates

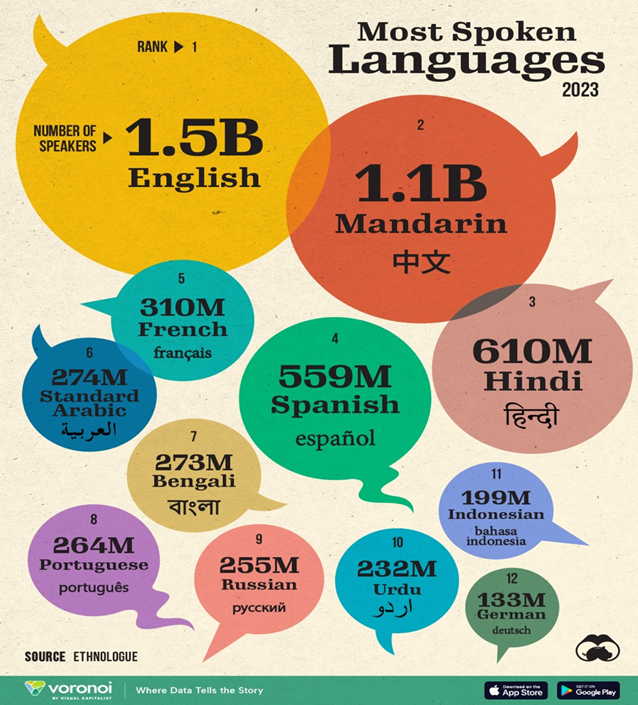

The 12 Most Spoken Languages In the World

Brand Global News Section: Anytime Fitness®, Dominos®, Olive Garden®, Orangetheory Fitness®, McDonalds®, and Starbucks®

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Interesting Data, Articles and Studies

“Coca Cola Consumption by Country 2024 – In 1971, the Coca-Cola Company released a TV commercial that promoted quite lofty goals for a soft-drink company. At a tense time globally, “I’d Like to Teach the World to Sing” invited everyone on our planet to put aside their differences and come together to enjoy friendly music and a friendly beverage. Looking at total consumption figures by country, the number varies from year to year, but Mexico holds the honor as of 2023, with an average of 634 8-ounce servings consumed per year by the 128 million residents, slightly down from 665 reported in 2016.

With three exceptions – Cuba, North Korea, and Russia — Coca-Cola is everywhere.”, Our World In Data, March 2024

“The 12 Most Spoken Languages In the World – The top languages spoken in the world reflect economic trends, populated countries, and even colonial history. These are the most spoken languages around the world as of 2023. These figures come from Ethnologue, which publishes a list of the largest languages every year. English was born in the United Kingdom but today belongs to the modern world as the main international language of business and politics. That’s why it’s not very surprising to find English as the world’s most spoken language, with 1.5 billion speakers as of 2023.”, Visual Capitalist and Ethnologue, February 29, 2024

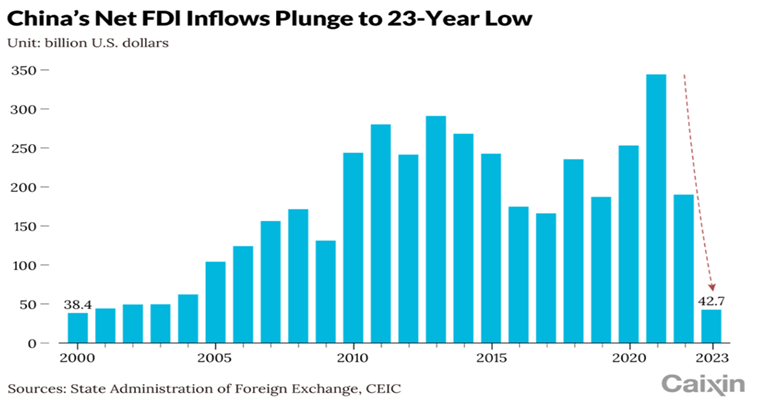

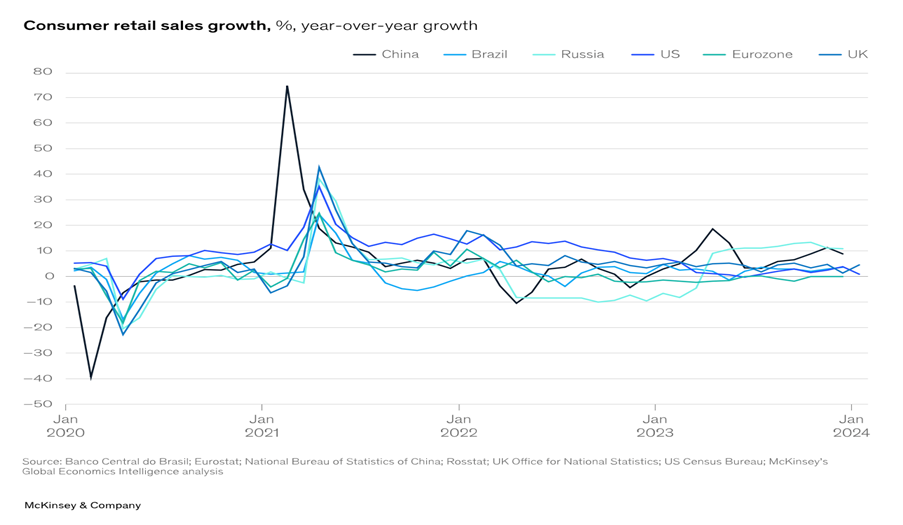

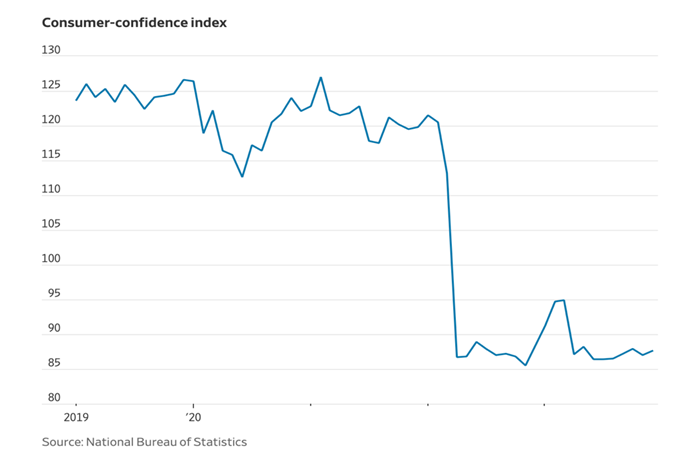

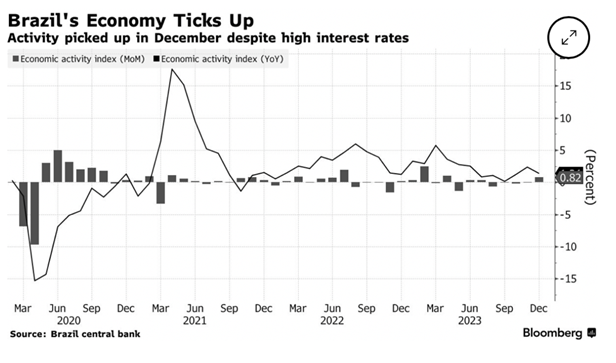

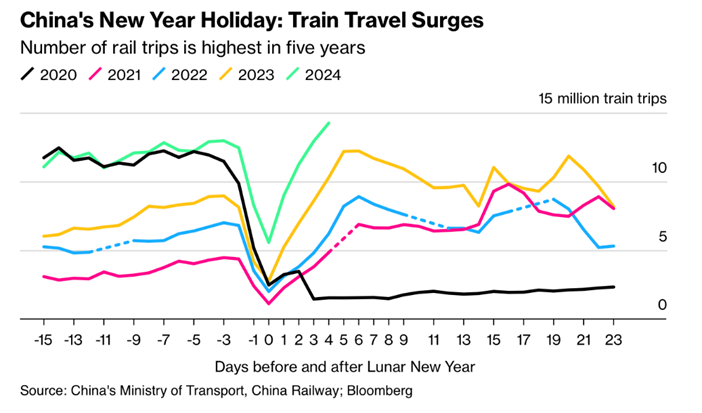

“(Global) Consumers Remain Upbeat – (In February 2024)Global economic uncertainty elevated but consumers upbeat; China faces deflation, real estate problems, and FDI decline; EU growth stagnant; high US interest rates affecting households and companies. Consumers remain upbeat as retail sales in the main economies show steady growth, despite elevated prices (Exhibit 1). Growing sentiment in the US saw the Consumer Confidence Index (Conference Board) rise to 114.8 in January, up from a revised 108.0 in December. By contrast, consumer confidence in Brazil dropped to its lowest level since May 2023 but is still 5.0 points higher than in January 2023. Automobile sales in India (which are a proxy for consumer sales) grew by 37.3% to 393,074 units (286,390 in December). Passenger vehicles saw their highest-ever sales in January, posting a growth of around 14% compared with the previous year. Meanwhile, official news from China was that consumption during the 2024 Spring Festival holiday underwent a notable increase.”, McKinsey & Co., March 20, 2024

“Global Beer Consumption by Country in 2022 – Global beer consumption exceeded 2019, showing a return to scale to pre-COVID levels despite unstable global conditions. China was the largest overall consumer for the 20th straight year, with Asia the leading region. The Czech Republic remained the top per-capita consumer for the 30th consecutive year.”, Kirin Holdings, December 22, 2023

“Replicating the Mobile Revolution – On April 3, 1973, Martin Cooper, an engineer from Motorola, made the first-ever call on a mobile phone to another engineer at a telecommunications rival company. Fifty years later, the mobile phone is arguably the most transformational invention in recent human history. In just 50 years, the number of people using the device went from zero to more than 7.1 billion as of 2021. Over 91 percent of the world owns a mobile phone, and 90 percent of the world is covered by a commercial wireless signal.”, The Center for Strategic & International Studies, March 19, 2024

“10 Conflicts to Watch in 2024 – More leaders are pursuing their ends militarily. More believe they can get away with it. 2024 begins with wars burning in Gaza, Sudan and Ukraine and peacemaking in crisis. Worldwide, diplomatic efforts to end fighting are failing. Gaza, Wider Middle East War, Sudan, Ukraine, Myanmar, Ethiopia, The Sahel, Haiti, Armenia-Azerbaijan and U.S.-China are the conflicts to watch this year.”, The International Crisis Group, January 1, 2024

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global Supply Chain, Energy, Commodities, Inflation & Trade Issues

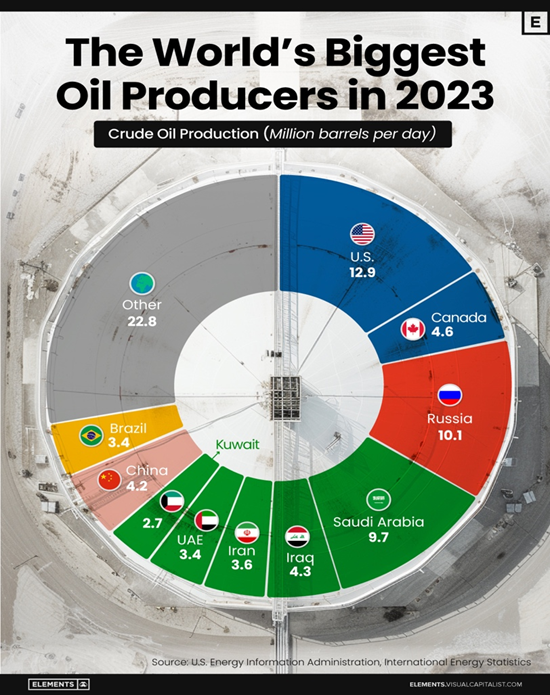

“Three Countries Accounted for One-Third of Global Oil Production in 2023 – Despite efforts to decarbonize the global economy, oil still remains one of the world’s most important resources. It’s also produced by a fairly limited group of countries, which can be a source of economic and political leverage. This graphic illustrates global crude oil production in 2023, measured in million barrels per day, sourced from the U.S. Energy Information Administration (EIA). In 2023, the United States, Russia, and Saudi Arabia collectively contributed 32.8 million barrels per day to global oil production. In 2024, analysts forecast that the U.S. will maintain its position as the top oil producer.”, Visual Capitalist and the U.S. Energy Information Administration (EIA), March 26, 2024

“Big Tech’s Latest Obsession Is Finding Enough Energy – The AI boom is fueling an insatiable appetite for electricity, which is creating risks to the grid and the transition to cleaner energy sources. It isn’t clear just how much electricity will be required to power an exponential increase in data centers worldwide. But most everyone agreed the data centers needed to advance AI will require so much power they could strain the power grid and stymie the transition to cleaner energy sources. After a long period of stagnant demand for electricity, utilities are dialing up forecasts by astonishing amounts. The five-year projection of U.S. electricity demand growth has doubled from a year ago, according to a report from consulting firm Grid Strategies.”, The Wall Street Journal, March 24, 2024

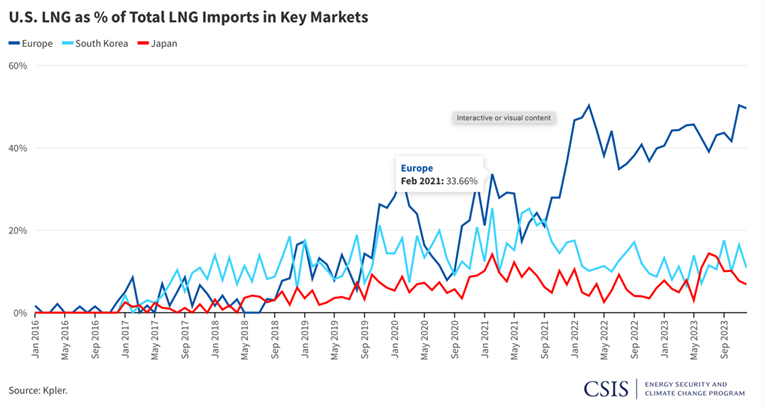

“AI revolution will be boon for natural gas, say fossil fuel bosses – Data centres’ need for reliable power supply set to soar. A surge in demand for electricity to feed data centres and to power an artificial intelligence revolution will usher in a golden era for natural gas, producers say. AI’s soaring energy needs will rise well beyond what renewable energy and batteries can deliver, executives argue, making more planet-warming fossil fuel supplies crucial even as governments vow to slash their use.”, The Financial Times, April 1, 2024

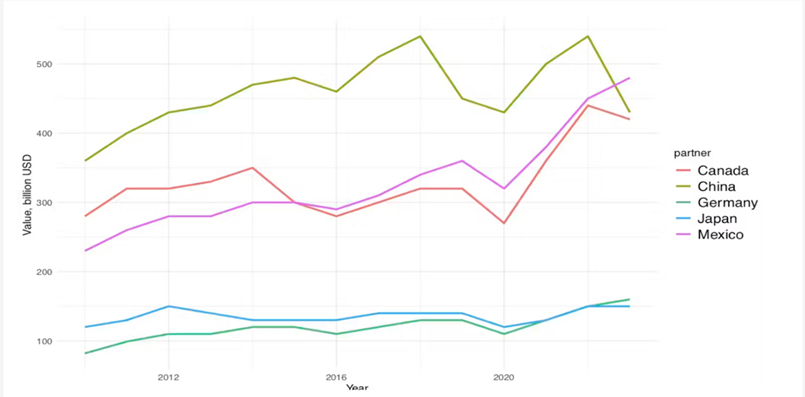

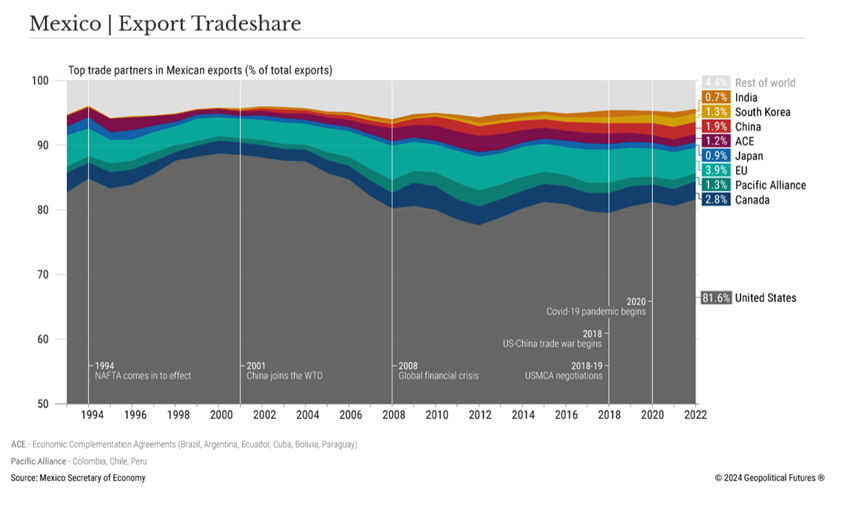

“Friend-shoring having the desired anti-China effect – Biden’s drive to trade more with allies and less with rivals has seen Canada and Mexico supplant China as America’s largest trading partners. One of the most high-profile results of a friend-shoring policy is that Canada and Mexico have recently replaced China as America’s largest trading partners by total trade, while Mexico has overtaken China as America’s top importer.”, AsiaTimes, March 21, 2024

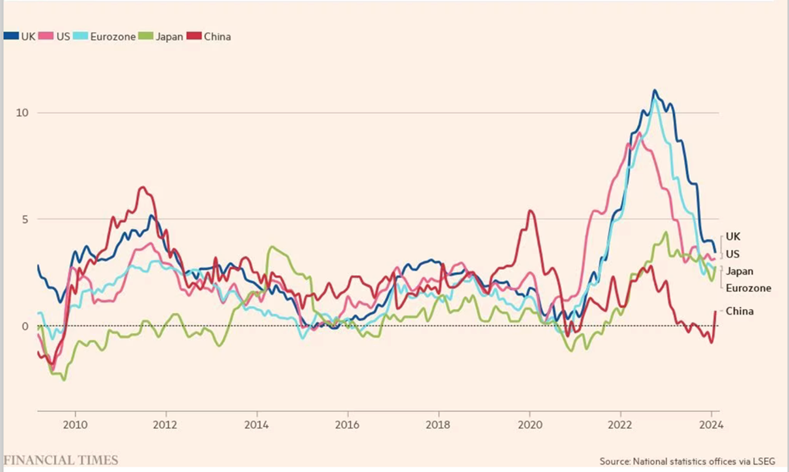

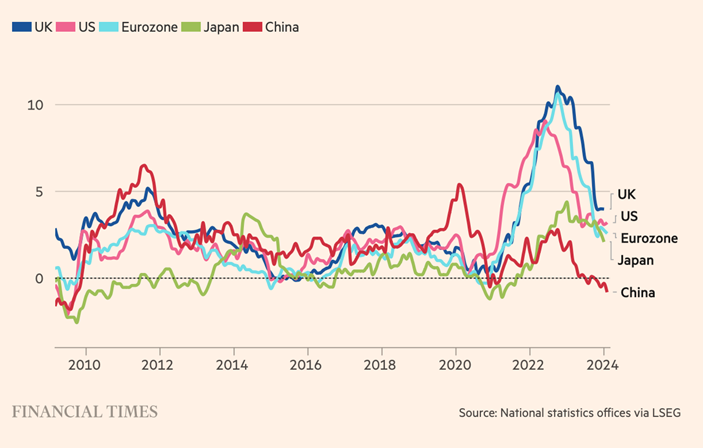

“Which country will be last to escape inflation? A new dividing line in the global fight. In January prices across the rich world rose by 5.7% year on year, down from a peak in late 2022 of 10.7%. This conceals wide variation, however. Some countries have slain the inflation beast. Others are still in the fight of their lives. Countries in the eu and Asia perform well; in the English-speaking world, inflation is taking longer to fade. Australia tops the ranking. Britain and Canada are not far behind. America is doing better, but even there inflation remains entrenched.”, The Economist, March 27, 2024

“‘Shrinkflation’ is coming for your Easter egg – Higher prices for smaller products are drawing the ire of politicians on both sides of the Atlantic. Last year, a Maltesers truffles luxury Easter egg could be snapped up in Waitrose for £8. Now it costs £13, according to UK consumer group Which? A Terry’s chocolate orange Easter egg with mini eggs has shrunk by 30g and a large Mars milk chocolate egg has dropped from 252g to 201g. It’s not just Easter eggs that are getting smaller and more expensive. So-called shrinkflation is hitting economies and consumers across the world and drawing the ire of politicians on both sides of the Atlantic.”, The Financial Times, March 28, 2024

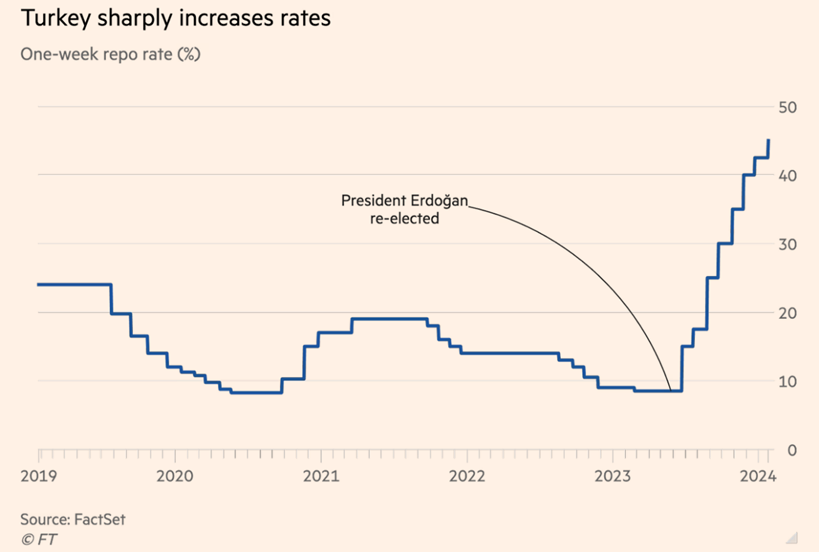

“Global inflation and interest rates tracker – Inflationary pressures are beginning to wane but not all central banks have taken action yet. Central banks around the world are expected to lower borrowing costs as global inflation eases from the multi-decade highs reached in many countries over the past two years.”, The Financial Times, March 28, 2024

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Country & Regional Updates

Australia

“China removes punishing tariffs on Australian wine trade – China is removing punishing tariffs on Australian wine imposed more than three years ago, restrictions that have all but destroyed a $1.2 billion export market for hundreds of local wineries. The Chinese Ministry of Commerce, late on Thursday, said the tariffs would be removed on Friday. They were imposed in late 2020.”, The Australian Financial Review, March 28, 2024

China

“China Loosens Cross-Border Data Rules on Business Pressure – More information will be exempt, top internet regulator says Foreign businesses have complained about the data rules. China relaxed rules governing cross-border data flows, addressing a key concern of foreign businesses that had complained previous regulations were disrupting their operations. Data collected in international trade, cross-border travel, manufacturing, academic research, and marketing that don’t contain either personal information or “important” information will be exempt from security evaluations when transfered out of the country, China’s top internet regulator said in a statement Friday.”, Bloomberg, March 22, 2024

“Tim Cook opens Asia s biggest Apple Store – People flocked to the Jing’an Temple area in Shanghai for the opening of Asia’s biggest Apple Store on Thursday night, and to see Apple’s chief executive Tim Cook. Shanghai now has eight Apple Stores, compared to six in Hong Kong and five in Beijing. New York city has seven. Since its first store in Shanghai – Apple Pudong – opened in July 2010, more than 163 million people have visited Apple’s seven retail locations in the city.”, Shine.cn, March 21, 2024. Compliments of Paul Jones, Jones & Co., Toronto

Egypt

“After pushing its economy to the brink, Egypt gets a bail-out – But a record-setting investment from the UAE will not fix its chronic problems. On February 23rd Egypt and the United Arab Emirates (UAE) signed a $35bn deal to develop Ras el-Hekma, a wedge of land jutting off Egypt’s Mediterranean coast. Within weeks of the announcement, the IMF more than doubled the $3bn loan it promised Egypt in December 2022, to $8bn. The European Union (EU) announced a €7.4bn ($8bn) aid package, and the World Bank stumped up another $6bn. All told, Egypt hauled in more than $50bn, a sum that dwarfs the central bank’s $35bn in foreign reserves.”, The Economist, March 27, 2024

Japan

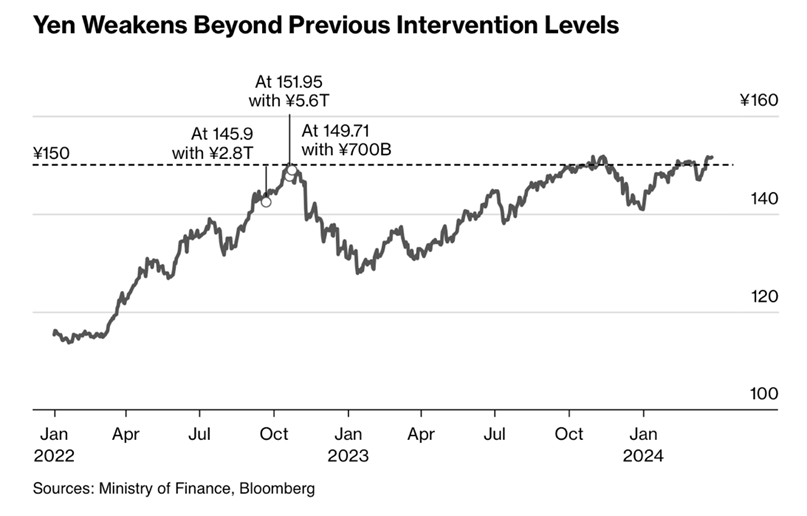

“Japan Steps Closer to Intervention as Yen Hits Lowest Since 1990 – Finance Minister Suzuki ramps up forex intervention threat. Yen may quicken drop if 152 barrier broken, say traders. The yen dipped to 151.97 versus the dollar early on Wednesday in Tokyo, before recovering after comments from Finance Minister Shunichi Suzuki, and his top currency official Masato Kanda indicating that Japan was ready to act.

South Korea

“South Korea prepares financial support for small businesses, builders – The government, together with commercial banks, plans to provide 40.6 trillion won ($30.3 billion) of financial support for small and medium-sized companies through loan guarantees and lower interest rates from April, the Financial Services Commission (FSC) said in a statement. The ministry in charge of financial policies also said it would continue to expand its joint scheme with commercial banks that returns interest income to small businesses and self-employed people who have taken out loans.”, Reuters, March 26, 2024

Mexico

“Mexico becomes the latest major Latin American economy to cut rates – Region has already begun unwinding its response to soaring inflation that has affected monetary policy around the world. The decision by the Bank of Mexico on Thursday to cut rates by 25 basis points to 11 per cent comes as most central banks in developed countries have yet to loosen monetary policy. Latin American central bankers’ swift response to soaring inflation after the coronavirus pandemic has transformed their credibility as they emerge from the most serious wave of price pressures in decades.”, The Financial Times, March 21, 2024

United Kingdom

“UK inflation falls to 3.4% as Bank of England mulls interest rate cut – Inflation slid faster than expected to its lowest level in two and a half years in February, strengthening hopes that the Bank of England will cut interest rates in the coming months, official figures showed. Inflation is now running at its slowest pace since September 2021. City analysts and the Bank of England had anticipated the rate to decline to 3.5 per cent. Inflation peaked at 11.1 per cent in October 2022, lifted by higher energy prices after Russia’s invasion of Ukraine.”, The Times of London, March 21, 2024

“UK Restaurants and Bars Cut Hours as Costs Soar by £3.4 Billion – Hospitality sector is facing higher wages and business rates Sites are reducing shifts and opening hours to cope with costs. Restaurants and bars across Britain are having to slash staff working hours to cushion the blow of a £3.4 billion ($4.3 billion) spike in annual costs, according to the head of the sector’s trade body. Kate Nicholls, chief executive officer of UKHospitality, said sites were also cutting back their opening hours to deal with a ‘tsunami of costs.’”, Bloomberg, April 1, 2024

“Domestic energy production falls to lowest level on record – Britain imported a net 41.1 per cent of its energy last year, up from 37.3 per cent in 2022, primarily from Norway and America. North Sea oil production last year fell to the weakest level since records began in 1948 and gas output was the second lowest, according to figures from the Department for Energy Security and Net Zero. A rise in wind, solar and hydroelectric output failed to offset the fall in more carbon-intensive fuels, which meant that total UK energy production was 9 per cent lower than in 2022 and down by more than two thirds on 1999, when domestic production peaked. Maintenance outages and plant closures meant that nuclear output was also at a fresh low.”, The Times of London, March 29, 2024

United States

“U.S. Economic Growth Remains Robust, No Matter How You Slice It – The Bureau of Economic Analysis said real gross domestic product grew 3.4% in the last three months of 2023, an upward revision from its previous estimate of 3.2%. That was driven by the fact that government spending, particularly at the local and state level, was higher than originally estimated. After trailing GDP dramatically throughout 2023, real gross domestic income jumped by 4.8% in the fourth quarter. It was the first quarter that GDI outpaced GDP growth since the third quarter of 2022.”, Barrons, March 28, 2024

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Brand & Franchising News

“Anytime Fitness to Expand into United Arab Emirates – High-profile financier Mark Mobius leads an investment group that will bring Anytime Fitness® to the United Arab Emirates, according to a news release from the gym brand’s parent, Self Esteem Brands. The umbrella franchisor owns a portfolio of diverse health and wellness brands. With the expansion into the UAE, Self Esteem Brands will have Anytime Fitness clubs operating 24/7/365 in more than 40 countries and territories around the world. Anytime Fitness is a fast-growing brand that serves nearly 5 million members at more than 5,200 clubs globally.”, FranchiseWire, March 24, 2024

“3 Important Considerations in Adapting Your Restaurant Menu for Global Success – If you want to expand your restaurant franchise and reach a global audience, you must adapt your menu accordingly. Updating your menu items when you open locations in other countries is essential for your restaurant’s long-term stability and success. Recognize cultural sensitivities. Evaluate profit margins and cost considerations. Retain brand consistency while adapting.”, Franchising.com, March 29, 2024

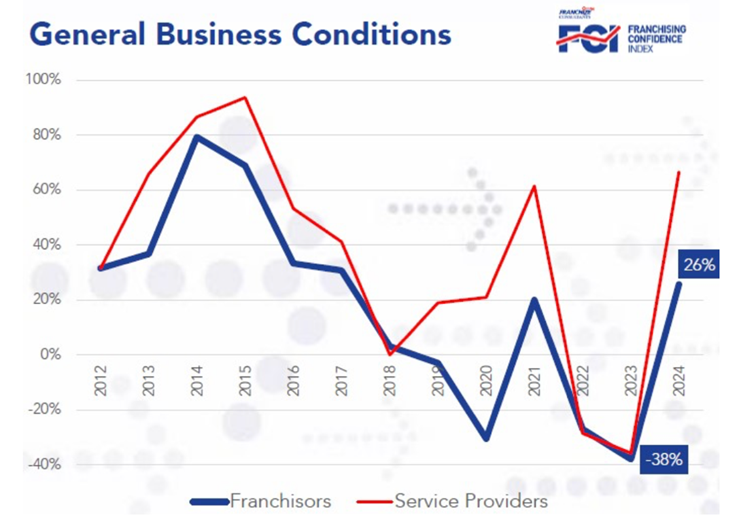

“International Growth Session Highlights from the 2024 Multi-Unit Franchising Conference – A high-level panel discussion at last week’s 2024 Multi-Unit Franchising Conference (“How Franchise Brands Grow Outside Their Home Country”) provided advice—both encouraging and cautionary—for franchise brand attendees looking to expand outside of their national borders. Whether U.S. brands eyeing overseas growth, or international brands looking to expand into the U.S., the expert panel had something for everyone. Franchising, March 27, 2024

“Domino’s China Franchisee Expands in Smaller Cities For Growth – The Chinese franchisee of Domino’s Pizza Inc. is accelerating store expansions as consumers outside the country’s top cities show a bigger appetite for western food.The pizza chain wants to tap demand for fast food among residents in less prominent Chinese cities and towns that aspire to the lifestyle of glitzy megacities, Aileen Wang, chief executive officer of DPC Dash Ltd, also known as Domino’s Pizza China, told Bloomberg in an interview in Shanghai Thursday. Bloomberg, March 28, 2024

“Quebec franchisees sue Tim Hortons, claiming declining profits – Nearly a dozen Quebec franchisees are suing Tim Hortons QSR-T, claiming their profits have declined by millions of dollars in recent years. The store owners say the gap has narrowed between their own costs for supplies and menu prices, both of which are controlled by the company. Tim Hortons currently has more than 3,900 locations in Canada, approximately 615 of which are in Quebec. The company has acknowledged that franchisee profits fell during that time: The average Tim Hortons location made $320,000 in earnings before interest, taxes, depreciation and amortization (EBITDA) in 2018, a number that declined to $220,000 by 2022.”, The Globe and Mail, March 29, 2024

“Olive Garden’s earnings just pulled back the curtain on the economy: The rich are dining out while the poor are falling back. ‘We’re clearly seeing consumer behavior shifts,’ Darden CEO Rick Cardenas said in a third-quarter earnings call on Thursday. ‘Transactions from incomes below $75,000 were much lower than last year. And at every brand, transactions fell from incomes below $50,000.’ Meanwhile, transactions for higher-income individuals were higher than last year, according to the earnings call, so households earning at least $150,000 were dining out more.”, Fortune, March 22, 2024

“Second-biggest restaurant chain in the world behind McDonald’s will surprise you – The burger chain is the biggest-restaurant chain in the world by unit, according to a Restaurant Business report, a publication focused on the foodservice industry. Hot on the heels in the No. 2 slot this year is a newcomer. For the first time, coffee giant Starbucks pushed past Subway to become the second-largest restaurant chain in the world. The Seattle-based coffee brand added 3,000 new locations in 2023, bringing the total number globally to 38,587, according to data from Technomic, an industry research and consulting firm. Starbucks operates 2,000 more locations than Subway, which once was the largest chain in the world by total unit count.”, Penn Live, March 23, 2024

“Orangetheory Fitness and Self Esteem Brands Announce Intent to Merge as Equals, Creating a New Company Representing One of the Largest Footprints of Fitness, Health and Wellness Services……the new company will represent $3.5 billion in systemwide sales and approximately 7,000 franchise locations across 50 countries and territories on all seven continents. The merger will result in significant international scale for the new company, with continued investments in leading-edge data and analytics, technology, products and services that help franchisees across its brands outpace growing consumer demands for holistic health and wellness services.”, PR Newswire, February 29, 2024

“18 International Starbucks Bakery Items You Need To Know About……the drink selection — and even more noticeably, the bakery options — tend to differ drastically at Starbucks locations outside the U.S. This makes sense, of course. The retailer operates stores in a staggering 80 countries as of March 2024, after all, and has made a conscious effort to adapt to the local culinary culture in each market. Here are 18 international Starbucks bakery items you need to know about.”, The Tasting Table, March 23, 2024

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

To receive our biweekly newsletter in your email every other Tuesday, click here – https://insider.edwardsglobal.com

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, the franchise sector, economic development, and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing environment. And our GlobalTeam™ on the ground covering 25+ countries provides us with updates about what is actually happening in their specific countries.

William “Bill” Edwards: Global Advisor Is Uniquely Qualified to Steer Sr. Executives Successfully Through the Complex Waters of Going Global. With four decades of successful international business experience spanning virtually every corner of the world and many business sectors, Bill Edwards understands the global business landscape like no other. He has been a County Master Franchisee in five countries in Asia, Europe and the Middle East; the Senior VP for a franchisor operating in 15 countries and a full-service consultant since 2001 taking 40+ franchisors global.

For a complimentary 30-minute consultation on how to take your business global successfully, click on the QR code or contact Bill Edwards at bedwards@edwardsglobal.com or +1 949 224 3896.

And download our latest chart ranking 40+ countries as places to do business at this link:

Our latest GlobalVue™ 40 country ranking

EGS Biweekly Global Business Newsletter Issue 104, Tuesday, March 19, 2024

Edited and curated by: William (Bill) Edwards, CFE, CEO of Edwards Global Services, Inc. (EGS)

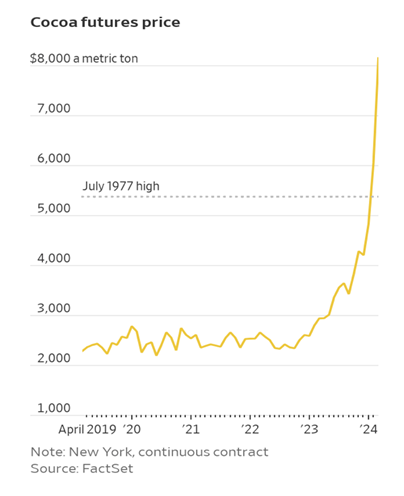

Introduction: Perhaps the most critical trend today is discussed in the “Regulate AI? How US, EU and China Are Going About It” article. Perhaps the second most important trend is McDonalds winning over French villages – seriously! Third is probably the fact that cocoa has surged to record prices and that means hot chocolate’s price will soar. The world’s economy has a growing chance of a soft landing and why inflation will drop in 2024. KFC surpasses 30,000 restaurants worldwide.

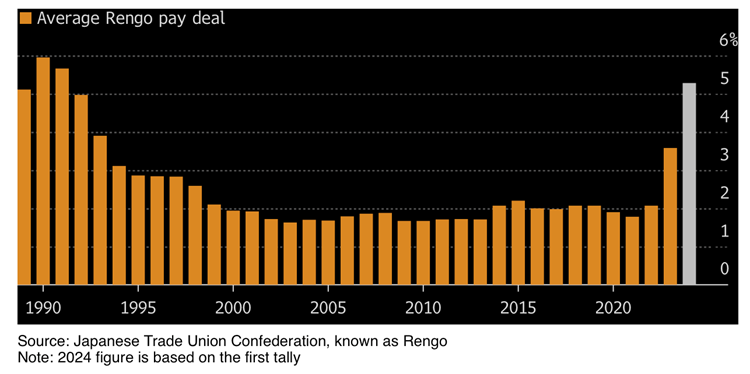

Reshoring, nearshoring, and friend shoring back into the United Kingdom. Chinese goods flow into Mexico to eventually enter the USA. The global sporting goods industry growth stand out for 2024 (pickleball??). Africa’s population to hit 2.5 billion by 2050. Better days for Australian wine exports ahead. Where are the obesity capitals of the world and why. Japan’s workers secure their highest annual pay raise in 30 years.

Edited and curated by: William (Bill) Edwards, CEO & Global Advisor, Edwards Global Services, Inc. (EGS), Irvine, California, USA

Bedwards@edwardsglobal.com, +1 949 375 1896

The mission of this newsletter is to use trusted global and regional information sources plus our network of 20+ in-country Associates to update our global readers on key global and local trends that can impact the success of their businesses at home and abroad. We subscribe to about 40 international information sources to keep our readers up to date on the world’s business.

Some of the information sources that we provide links to require a paid subscription for our readers to access.

First, A Few Words of Wisdom From Others For These Times

“The possibilities are numerous once we decide to act and not react”, George Bernard Shaw

“When opportunity comes, it is too late to prepare”, Coach John Wooden

“Whenever you see a successful business, someone once made a courageous decision.”, Peter F. Drucker

Highlights in issue #104:

- Brand Global News Section: Jollibees®, Haidilao®, KFC® and McDonalds®

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Interesting Data, Articles and Studies

“Regulate AI? How US, EU and China Are Going About It – Governments don’t have a great track record of keeping up with emerging technology. But the complex, rapidly evolving field of artificial intelligence raises legal, national security and civil rights concerns that can’t be ignored. The European Union passed a sweeping law that would put guardrails on the technology; in China, no company can produce an AI service without proper approvals. The US is still working on its regulatory approach. Already at work in products as diverse as toothbrushes and drones, systems based on AI have the potential to revolutionize industries from health care to logistics. But replacing human judgment with machine learning carries risks.”, Bloomberg, March 13, 2024

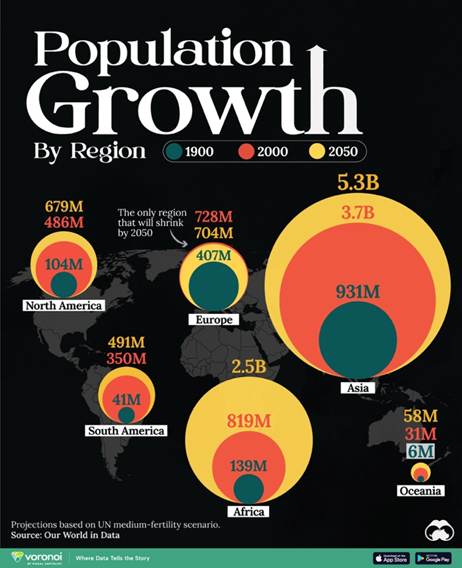

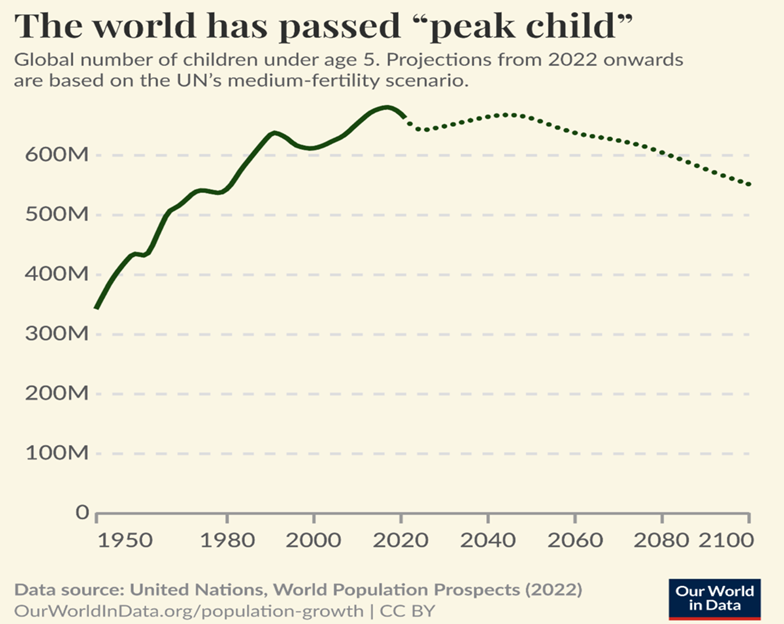

“Mapping Population Growth by Region (1900-2050F) – In fewer than 50 years, the world population has doubled in size, jumping from 4 to 8 billion. China was the main source of Asia’s population expansion, though its population growth has slowed in recent years. That’s why in 2023, India surpassed China to become the world’s most populous country. Southeast Asian countries like the Philippines and Indonesia have also been big drivers of Asia’s population boom to this point. Africa to hit 2.5 billion by 2050. Three countries—Nigeria, Ethiopia, and Egypt—will account for roughly 30% of that 2.5 billion population figure. A century ago, Europe’s population was close to 30% of the world total. Today, that figure stands at less than 10%.” Visual Capitalist and Our World In Data, March 10, 2024

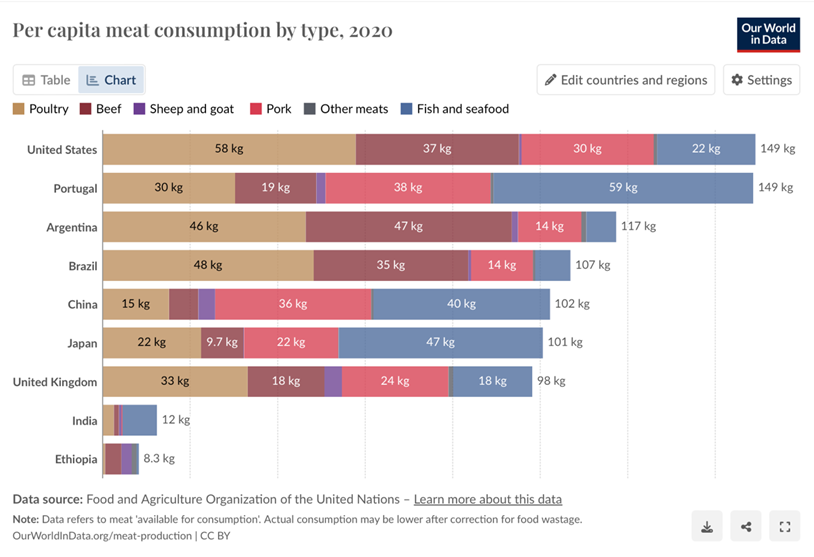

“What types of meat does the world consume? Here’s an approximate breakdown of the percentages of beef, fish, chicken, and pork consumed globally each year:

- Pork: 36% (Most consumed meat globally)

- Chicken: 35%

- Beef: 22%

- Fish: 7%”

Our World In Data, December 2023

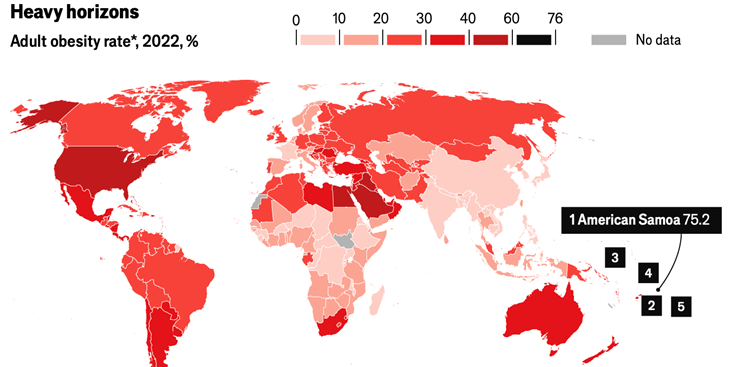

“The obesity capitals of the world – A new study shows that waistlines are widening almost everywhere. It was not that long ago that more of the world’s people had too little to eat than ate too much. Now the scales have tipped. A study published on February 29th in the Lancet, a medical journal, shows that more than 1bn people were classified as obese in 2022. The analysis finds higher obesity rates in low- and middle-income countries than in many high-income ones. More than 60% of adults in Polynesia and Micronesia were living with obesity in 2022—the highest rate in the world. This is likely to be a result of changing diets and a culture that puts a value on size.”, The London Economist, March 1, 2024

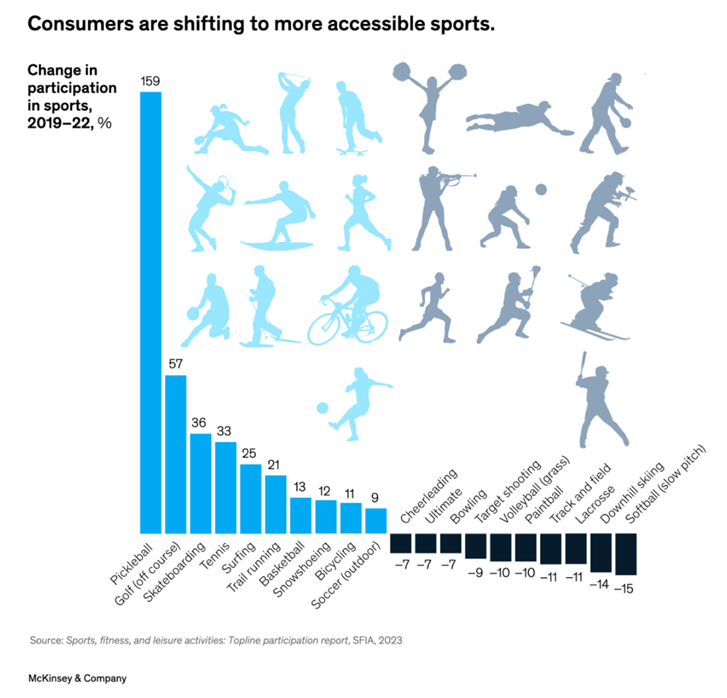

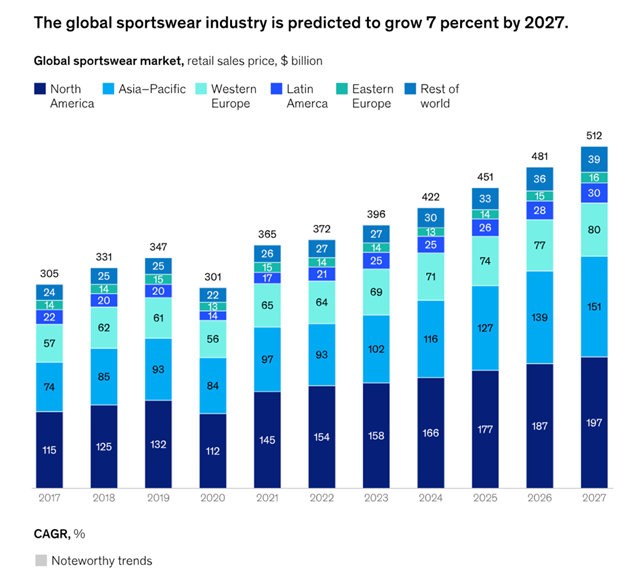

“Sporting goods industry trends for 2024 – As the world continued its uneven progress in 2023, the sporting goods industry faced familiar challenges. Economic headwinds, persistent inflation, and regional conflicts undermined consumer confidence, while companies continued to struggle with inventories—mainly overstocking, because anticipated demand failed to materialize. But the industry demonstrated its resilience again. Revenue growth in 2023 was 6 percent (compared with 2 percent in 2022) amid stronger performance across geographies.As we begin 2024, this report highlights a renewed sense of optimism among industry leaders. This reflects opportunities arising from an improving market environment and new consumer preferences. More people are choosing sports that are quicker to pick up, require less commitment, and are more social, rather than organized sports with fixed time commitments or requirements for teams or high levels of skill.”, McKinsey & Co., January 30, 2024

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global Supply Chain, Energy, Commodities, Inflation & Trade Issues

“World Economy Has Growing Chance of Soft Landing, G-20 Says – Finance ministers in Sao Paulo will finalize closing statement Draft cites ‘faster-than-expected disinflation’ as upside risk. The global economy has a growing chance of pulling off a soft landing, finance chiefs said in a draft of the G-20’s closing statement at this week’s meeting in Brazil, citing faster-than-expected disinflation as one of the upside risks. ‘We note that the likelihood of a soft landing in the global economy has increased,’ said the draft communique dated Feb. 23, seen by Bloomberg News. ‘Risks to the global economic outlook are more balanced. Upside risks include faster-than expected disinflation.’”, Bloomberg, February 27, 2024

“Global inflation and interest rates tracker – Central banks around the world are expected to lower borrowing costs as global inflation eases from the multi-decade highs reached in many countries over the past two years. Some institutions, particularly in emerging markets, have already started cutting rates, but many more are forecast to follow this year, including the US Federal Reserve, the European Central Bank and the Bank of England. The FT global inflation and interest rates tracker provides a regularly updated visual narrative of consumer price inflation and central bank policy rates around the world.”, The London Financial Times, March 12, 2024

“Your Sweet Tooth Is Getting Expensive – Prices for cocoa, the key ingredient in chocolate, have surged to records. Cocoa prices have climbed past a record set nearly a half-century ago, costing chocolate makers, bakers and aficionados alike. The sharp climb in price for chocolate’s main ingredient started with bad weather in West Africa, where much of the world’s cocoa is grown. Speculators piling into one of the hottest trades outside of artificial intelligence have added fuel to the rally.”, The Wall Street Journal, March 15, 2024

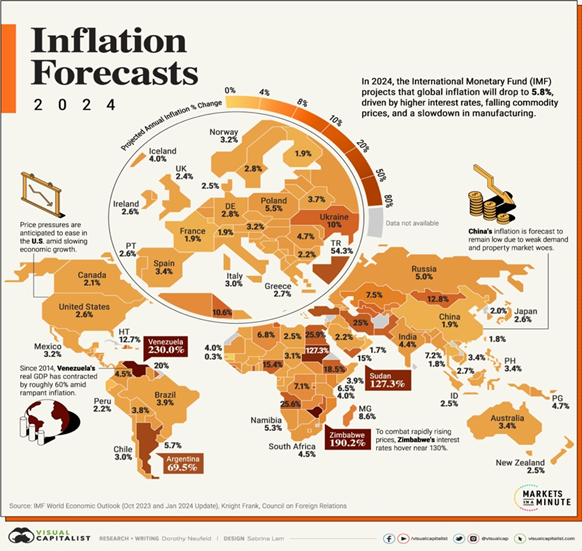

“Inflation Projections by Country, in 2024 – Global economic prospects hang on a delicate balance, largely hinging on the path of inflation. While inflation looks to be easing, there remains the risk of a second wave of price pressures driven by geopolitical conflicts and supply disruptions in the Red Sea. Adding to this, a stronger than expected labor market could drive consumer demand, pushing up higher prices. n 2024, global inflation is projected to decline to 5.8%, down from a 6.8% estimated annual average in 2023. Tighter monetary policy and falling energy prices are forecast to dampen price pressures alongside a cooling labor market.”, Visual Capitalist and the International Monetary Fund, February 28, 2024

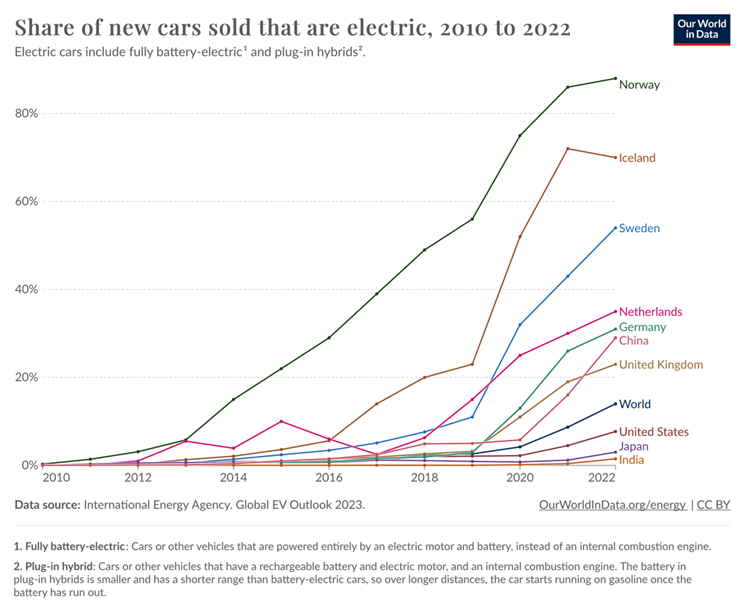

“Global BEV Market Share: Tesla Retains its #1 Spot for 2023 – Global BEV market share for the full year 2023, based on figures compiled by TrendForce. BEV refers to “battery electric vehicle”, also known as fully electric. This differs from PHEVs (plug-in hybrid electric vehicles), which still have a combustion engine. Analysts expect China’s BYD to surpass Tesla in BEV sales for 2024, given that BYD already outsold Tesla in the fourth quarter of 2023 (526,000 compared to 485,000).” ,Visual Capitalist, February 29, 2024

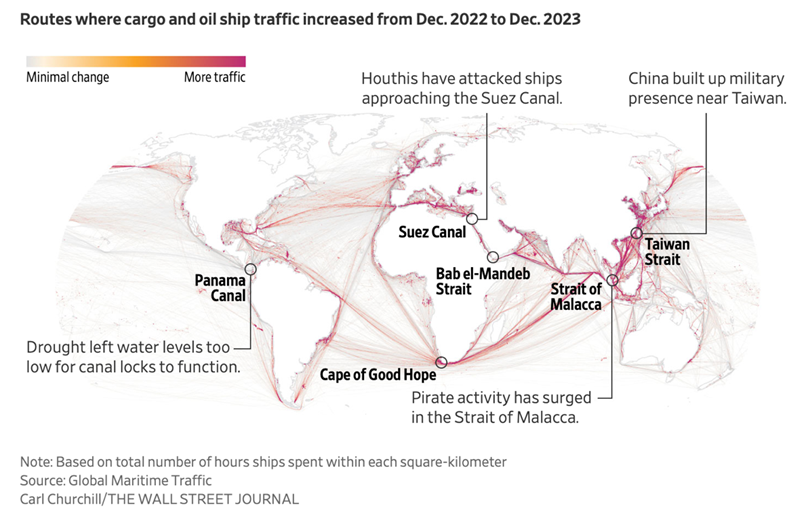

“Global Fuel Prices Are Surging With Supply Risks Ahead – US pump prices 60% higher than 2020, when Biden was elected. Global oil demand and refinery runs are both forecast to rise. US gasoline futures have jumped sharply in recent weeks and are now up by more than a fifth so far this year, while diesel in Europe has risen 10%. Disruptions on the world’s major trade routes, refinery closures and resurgent demand are pushing up global fuel prices and making forecasts difficult in the run-up to a US presidential election in which inflation will be a key issue. Interruptions to fuel production — a combination of scheduled work, unplanned outages and drone attacks on Russian facilities — have been lifting prices. They’ve come on top of higher shipping costs caused by Houthi attacks in the Red Sea and drought at the Panama Canal, as well as the supply-chain ructions spurred by Western sanctions on the Kremlin.”, Blomberg, March 12, 2024

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Country & Regional Updates

Australia

“China-Australia wine trade barriers seen falling as (Chinese) foreign minister Wang Yi confirms trip down under – Beijing is widely expected to reduce some trade barriers that were imposed in the past few years as relations deteriorated following Canberra’s call for an investigation into the origin of the coronavirus. Australia’s largest wine producer, Treasury Wine Estates, has been informed that the Chinese Ministry of Commerce had issued a draft interim decision outlining the cancellation of additional tariffs on Australian wine, according to a filing with the Australian Securities Exchange on Tuesday.”, South China Morning Post, March 14, 2024

Canada

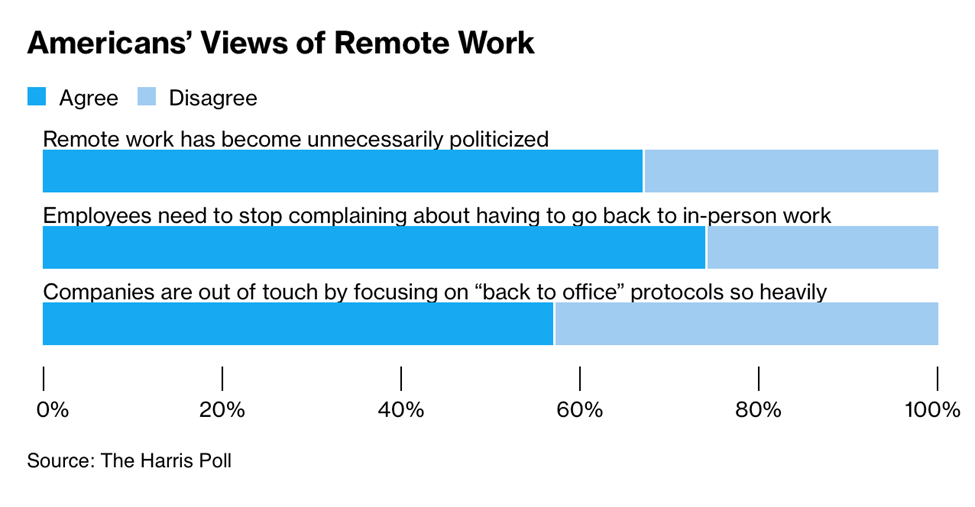

“Companies must design offices people want to come to – 76 per cent of Canadian companies are partially or fully mandating a return to the office. Offices are not currently designed to meet employees’ needs for collaboration. Companies can make thoughtful design updates that foster connection and support hybrid work so everyone wins. Data from Cisco Canada’s new Reimagining Workspaces Survey shows that there is a gap between what workers are looking for when they return to the office – collaboration – and what companies are currently offering – mostly solo work spaces.”, The Global and Mail, March 17, 2024

India

“On Eve of Elections, India Secures Pivotal $100bn Trade Agreement – India has successfully brokered a comprehensive free-trade pact with the European Free Trade Association (EFTA), consisting of Norway, Switzerland, Iceland, and Liechtenstein, injecting a staggering $100 billion investment into the Indian economy. The pact is designed with the objective of curtailing tariffs, simplifying investment frameworks, and enhancing the trade of goods and services. This move is expected to forge a dynamic economic alliance. Finalized after persistent negotiations spanning over a decade and a half, the deal entails India’s agreement to abrogate most import tariffs on industrial products from the EFTA countries, who, in turn, are set to make significant investments in Indian industries, including pharmaceuticals, machinery, and manufacturing, over the next 15 years.”, Intpolicydigest.org, March 12, 2024

Japan

“Japan’s Blowout Wage Result May Spur BOJ March Rate Increase – Japan’s workers secured the largest pay hike in more than 30 years. Largest union group says annual deals hit 5.28% in first tally Biggest gains in more than 30 years may prompt Bank Of Japan (BOJ) move. The stronger-than-expected result may be enough to convince the BOJ to end the world’s last negative rate on Tuesday instead of waiting until April. The central bank has long pursued a goal of achieving sustainable 2% inflation.”, Bloomberg, March 14, 2024

Latin America

“Catalysts of Change: How Entrepreneurs Are Transforming Latin America – In 2021, Latin America and the Caribbean (LAC) was the fastest-growing region in the world for venture capital (VC) investment, reaching an all-time high of $15.7 billion. At the close of that year, a total of 47 Latin American companies had secured the requisite valuation to be considered a unicorn. Of these 47 companies, a total of 10 had gone public or been acquired in 2022. The start-up ecosystem in LAC is having a considerable impact in the region, catalyzing a generation of innovators to increase competitiveness and economic growth.”, Center for Strategic & International Studies, March 8, 2024

Mexico

“China Goods Flood Into Mexico, Making It Top Global Trade Route – China-to-Mexico containers surged 60% in January, Xeneta says At that rate, Mexico volumes may pass US West Coast by 2031. Global goods trade is struggling to accelerate in most corners of the world economy this year — with one big exception: Chinese goods flowing into Mexico. After jumping almost 35% in 2023 from a year earlier, the number of containers shipped to Mexico from China surged 60% in January, according to a blog post Thursday by Oslo-based Xeneta, which analyzes ocean and air freight markets. ‘This is probably the strongest-growing trade in the world right now’, Xeneta chief analyst Peter Sand wrote. The reason, he suggested, has more to do with tariff avoidance than a growing demand from Mexican consumers and businesses to purchase Chinese products.”, Bloomberg, March 14, 2024

Singapore

“Singapore bumps up 2024 GDP forecast on manufacturing growth – lowers headline inflation outlook. GDP is expected to grow at 2.4% in 2024, up from 2.3% forecast in the previous survey, while CPI is estimated to be lower at 3.1%, compared with 3.4% expected earlier. The city-state’s economic growth is expected to increase to 2.5% in 2025. Singapore’s manufacturing sector — which makes up over 20% of the country’s GDP — is now expected to grow at 4% in 2024, up from 2.3%.”, CNBC, March 13, 2024

United Kingdom

“Why firms are bringing their manufacturing back home (to the UK) – Reshoring is when a company decides to stop getting its manufacturing done overseas, such as in China, and instead returns the work to its home country. More than half of UK manufacturers are now reshoring, according to one study at the start of this year. Other firms are “near shoring”, which means that while they are still getting their manufacturing done overseas, they are moving it to a nearer country. And then there is so-called “friend shoring”, whereby you keep your manufacturing abroad, but move it to a country that has friendlier relationships with your own.”, BBC, March 12, 2024

“Increase in UK Jobs for Window Cleaners, Gardeners and Authors – There has also been a growing demand for translators, fashion designers and data entry administrators. The biggest fall in vacancies included those for delivery drivers and couriers, optometrists and prison officers, said the Recruitment and Employment Confederation (REC).”, Bloomberg, March 16, 2024

United States

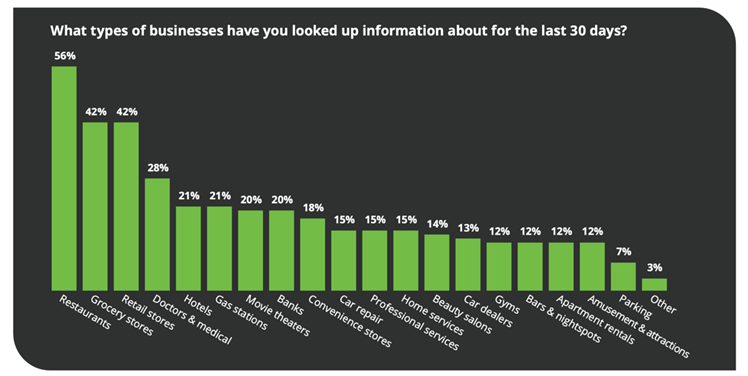

“SOCi’s 2024 Consumer Behavior Index – SOCi’s Consumer Behavior Index (CBI) asks U.S. consumers to weigh in on their practices and preferences when interacting on and offline with local businesses. The survey asked1,002 consumers across the U.S. about: The sites and apps they use to research and discover local businesses; The peer feedback about businesses that consumers both use and provide; The importance of open lines of communication between customers and local businesses; and Consumer feelings about AI in local marketing. Our U.S. consumers told us that they search online for local businesses online quite a bit, with 80% saying they do so at least once

a week and 32% searching every day or even multiple times a day.”, SOCI and the International Franchise Association, February 14, 2024

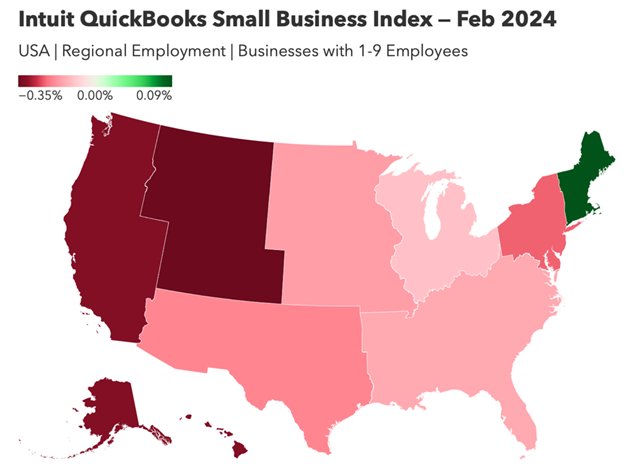

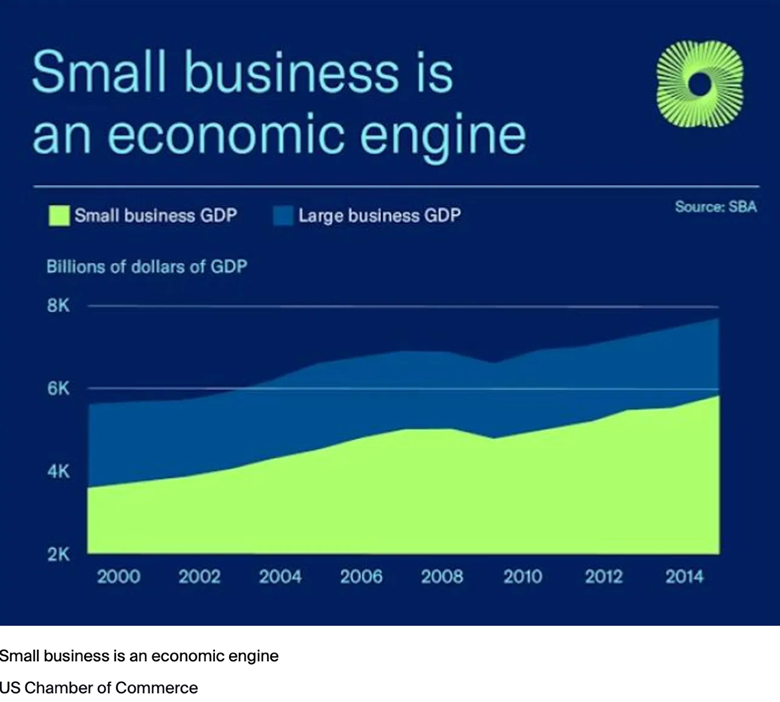

“Small businesses employment and job vacancy growth by region – Monthly employment growth rates and levels for small businesses with 1-9 employees (seasonally adjusted), showing the number of people employed in each region by businesses of this size and the monthly change in employment. National sample: almost 333,000 small businesses that run payroll with QuickBooks. The Index uses QuickBooks anonymized data to create aggregated data outputs which are normalized against official statistics to reflect the general population of small businesses, rather than the QuickBooks customer base. Regions are defined by the US Bureau of Economic Analysis.”, Intuit, February 2, 2024

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Brand & Franchising News

“KFC surpasses 30K restaurants globally – KFC is opening a new restaurant somewhere in the world every 3.5 hours on average. KFC’s newest restaurant in Rome, Italy, marks the company’s 30,000th global location. In 2023, KFC opened nearly 2,7000 restaurants across 96 countries, a 10% development pace and setting a brand development record. More than 80% of unit growth came from 15 publicly traded franchisees. KFC accounts for nearly 50% of parent company Yum Brands’ divisional operating growth.”, Nation’s Restaurant News, March 12, 2024

“Why has Haidilao opened its franchise business and catering chain franchises become so popular? In recent years, many catering brands have opened up franchises, and China’s catering chain process has accelerated. On March 4, Haidilao announced the opening of a franchise model to further expand. According to the company’s financial report, as of June 30, 2023, Haidilao had a total of 1,382 stores in Greater China, of which about 17% were located in first-tier cities, about 40% were opened in second-tier cities, and another 40% were opened in third-tier and below cities.”, Caixin, March 4, 2024. Compliments of Paul Jones, Jones & Co., Toronto.

“Why McDonald’s is winning over French villages – Despite years of protests the chain is expanding in rural France — and as traditional cafés close, young people are embracing the fast-food giant. The local café used to be a focus of social life in French villages, a place to enjoy a leisurely coffee, catch up on gossip or savour an aperitif after work. Some 70 per cent of village cafés have been forced to close, however, as rural populations have dwindled and habits have changed. Now, an unlikely newcomer may be replacing them as a place for young people to socialise in small communities: McDonald’s. Long popular in French towns and cities, McDonald’s is expanding into rural areas. Surprisingly perhaps, it appears to be welcome.”, The Sunday Times of London, March 14, 2024

“Jollibee Targets Exponential Growth in China to Triple Profit – Company allots up to 23 billion pesos (US$415,00,000) for capital spending It plans to sell preferred shares to raise 8 billion pesos. With 6,885 stores at the end of 2023, the company plans to open another 700 to 750 outlets this year and boost its network in multiple lower-tier cities in China as it ramps up franchising to expand globally. Aggressive expansion plans in China of the food chain known for its crispy fried chicken and sweet spaghetti comes as the Philippines’ assertive stance in the South China Sea has made some businesses cautious.”, Bloomberg, March 11, 2024

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

To receive this biweekly newsletter, click here – https://insider.edwardsglobal.com

Our Mission, Information Sources & Who We Are

Our biweekly global business update newsletter focuses on what is happening around the worldthat impacts new trends, health, consumer spending, business investment, the franchise sector, economic development, and travel. We daily monitor 30+ countries, 40+ international information sources and six business sectors to keep up with what is going on in this ever-changing environment. Our GlobalTeam™ on the ground covering 25+ countries provides us with updates about what is actually happening in their specific countries.

William “Bill” Edwards: Global Advisor Is Uniquely Qualified to Steer Sr. Executives Successfully Through the Complex Waters of Going Global. With four decades of successful international business experience spanning virtually every corner of the world and many business sectors, Bill Edwards understands the global business landscape like no other. He has been a County Master Franchisee in five countries in Asia, Europe and the Middle East; the Senior VP for a franchisor operating in 15 countries and a full-service consultant since 2001 taking 40+ franchisors global.

For a complimentary 30-minute consultation on how to take your business global successfully, contact Bill Edwards at bedwards@edwardsglobal.com or +1 949 224 3896.

And download our latest chart ranking 40+ countries as places to do business at this link:

Our latest GlobalVue™ 40 country ranking

EGS Biweekly Global Business Newsletter Issue 103, Tuesday, March 5, 2024

Edited and curated by: William (Bill) Edwards, CFE, CEO of Edwards Global Services, Inc. (EGS)

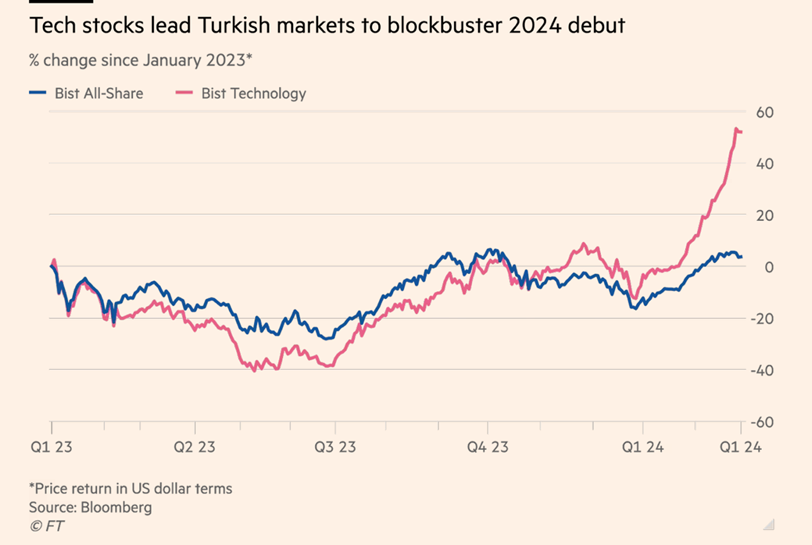

Introduction: This is one of the largest issues of our newsletter ever. Trends from Argentina, Brazil, Canada, China, India, Ireland, Japan, South Korea, Turkey, the United Kingdom, the USA and Vietnam. Chocolate, coffee, marketing, EVs, GDP growth, pickleball, unemployment, freedom and consumers. Applebee’s®, Athlete’s Foot®, Buffalo Wild Wings®, Dairy Queen®, IHOP®, KFC® and Sprinkles®. Eclectic!!!!

To receive this currently free biweekly newsletter every other Tuesday in your email, click here: https://bit.ly/geowizardsignup

The mission of this newsletter is to use trusted global and regional information sources to update our global readers on key global and local trends that can impact the success of their businesses at home and abroad.

NOTE: We subscribe to about 40 international information sources to keep our readers up to date on the world’s business. Some of the information sources that we provide links to require a paid subscription for our readers to access.

First, A Few Words of Wisdom From Others For These Times

“I’m a great believer in luck, and I find the harder I work, the more I have of it.” – Thomas Jefferson

“It’s not what you don’t know that gets you in trouble but what you know that just ain’t so!” – Mark Twain

“Opportunities multiply as they are seized.” – Sun Tzu, 544 BC-496 BC

==================================================================

Highlights in issue #103:

- (U.S.) Small Business Owners’ Optimism Reaches A 22-Year High

- Brand Global News Section: Applebee’s®, Athlete’s Foot®, Buffalo Wild Wings®, Dairy Queen®, IHOP®, KFC® and Sprinkles®

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Interesting Data, Articles and Studies

But, first……

“Global Savings Glut’s Demise Threatens Higher Borrowing Costs – Aging populations, economic fragmentation to push yields up Draghi sees reversal of era of falling global interest rates. Ben Bernanke’s global savings glut is drying up. Long-term interest rates worldwide may be heading higher as a result. Aging populations, an embattled Chinese economy and an increasingly fragmented global one are among the factors threatening to turn the surplus of savings the former Federal Reserve chair identified almost 20 years ago into a shortfall. The result, according to some economists: A reversal of the decades-long trend toward lower interest rates as borrowers from Washington on down are forced to pay up for a dwindling supply of excess cash.”, Bloomberg, February 28, 2024

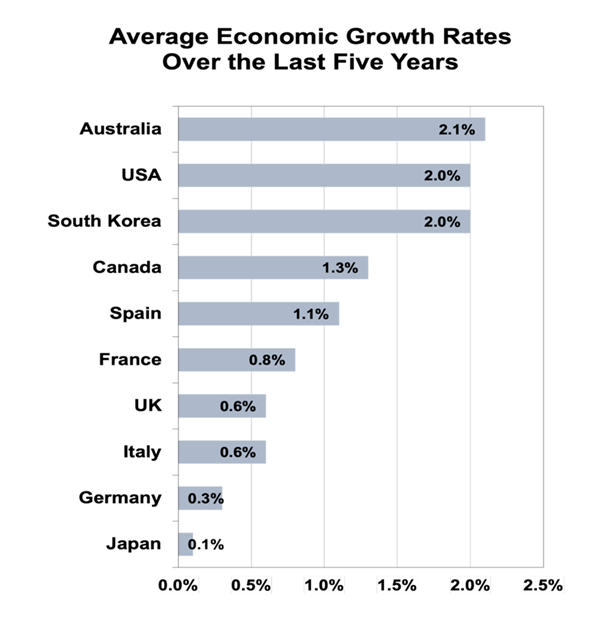

“The US Economy is Outperforming Much of the Rest of the World – For much of the world, the past few years, including last year, have been particularly difficult from an economic standpoint. However, for the United States economy, 2023 proved to be a surprisingly strong year, despite lingering inflationary pressures, high interest rates and persistent labor shortages. Moreover, while economic sentiment among the US public has risen, it still low enough to suggest that the US economy has been performing poorly. However, it has not, especially when it is compared to its contemporaries around the world.”, LinkedIn, February 26, 2024

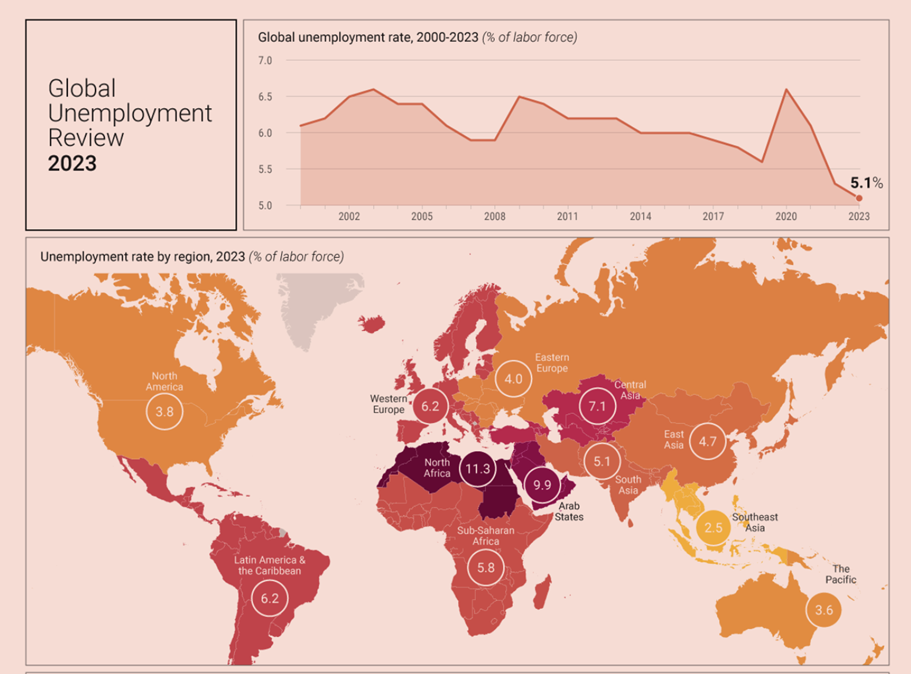

“Employment Returns to Pre-Pandemic Levels – But the data hide major weaknesses in the labor market. Global employment rates have returned to pre-pandemic levels despite 2023’s macroeconomic downturns. Yet, multiple indicators reveal underlying fragility in the labor market. The Ukraine war, Gaza conflict, U.S.-China trade tensions and other geopolitical conflicts continue to inject uncertainty, driving central banks to aggressive actions. Consequently, global economic growth has decelerated. Labor market imbalances persist in advanced and some emerging economies.”, Geopolitical Futures, March 3, 2024

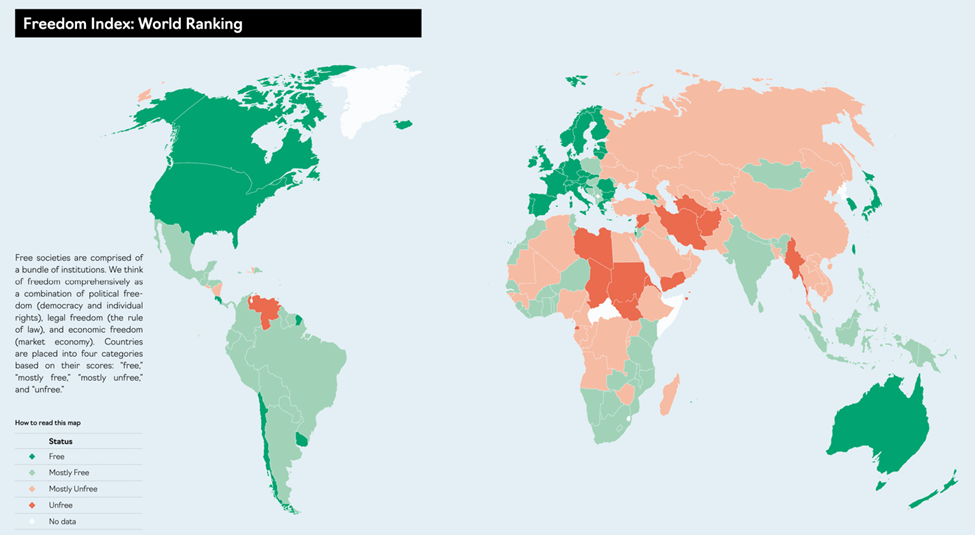

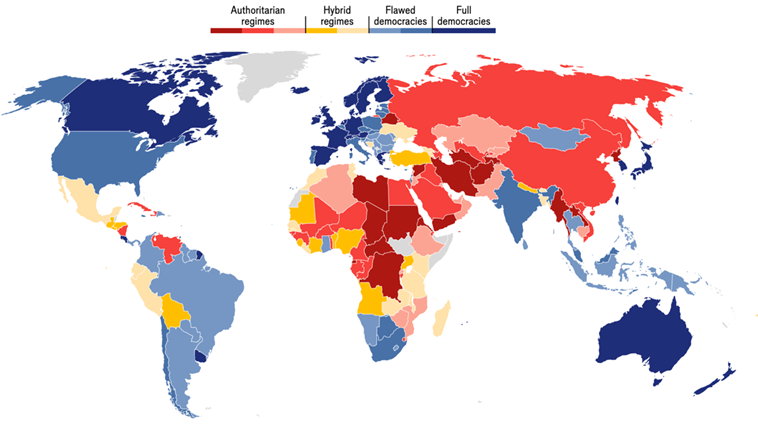

“2024 Atlas Freedom and Prosperity Around the World – Democracy and freedom are in crisis. Freedom House reports that democracy around the world has been in constant retreat for seventeen con- secutive years.1 In 2021, sixty countries experienced declines in their democracy score, while only twenty-five showed improvement. Today, the world is less democratic than it has been at any time since 1997. Concurrently, there has been a steep decline in support for democracy. In international surveys, 60 percent of respondents reported a positive view of democracy in the mid-1990s; the number now stands at 50 percent.”, Atlantic Council Freedom and Prosperity Center, Early 2024

“Four Marketing Trends to Elevate Brand Loyalty in 2024 – Getting ahead of the curve in marketing will be essential for organizations in 2024 — and beyond. AI and technology are impacting nearly every aspect of how marketers create, collaborate and operate. It’s never been more important (or difficult) to cut through the noise and innovate your brand while remaining relevant. (Here) are four trends that we anticipate will shape the marketing landscape in 2024: Understanding these will help keep your customers loyal and you competitive in the year ahead.”, Compliments of Steve Dobbins, theDobbins Group, February 2024

“Pickleball nets fans – The sporting goods sector has shown resilience despite subdued consumer confidence in recent years. Although participation in organized sports has declined, senior partner Gemma D’Auria and coauthors note, consumers instead are favoring more accessible activities. Pickleball participation has shot up 159 percent from 2019 to 2022, and off-course golf grew 57 percent during that span.”, McKinsey & Co., March 1, 2024

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Global Supply Chain, Energy, Commodities, Inflation & Trade Issues

“Tracking global data on electric vehicles – Explore data on electric car sales and stocks worldwide. Globally, around 1-in-7 new cars sold was electric in 2022. (the preliminary estimate for 2023 is around 1-in-5). In Norway, the share was well over 4-in-5, and in China, it was around 1-in-3.”, Our World In Data, February 26, 2024

“Chocolate Makers Try a New Recipe: Less Chocolate – The soaring cost of cocoa has made candy manufacturers crank out new treats with less of the expensive ingredient—or none at all. Cocoa prices have climbed to record highs, and market participants don’t expect any near-term relief. Prices have skyrocketed as the world’s biggest producers in West Africa grapple with drought and disease as well as structural problems that could linger for years to come.”, Bloomberg, February 29, 2024

“Coffee powerhouses Indonesia and Vietnam are sourcing beans from Brazil to meet surging demand at home – Some of Asia’s biggest coffee-producing nations are finding it more challenging to satisfy the caffeine cravings in their home markets.From the streets of Ho Chi Minh City to the cafes of Jakarta, consumers are rapidly developing a taste for coffee, and that’s transforming Asian producers into large buyers. While Vietnam and Indonesia still rank as major shippers, they are increasingly sourcing coffee from agriculture powerhouse Brazil to meet the consumption boom. Both Indonesia and Vietnam, big growers of the bitter robusta variety favored to make espresso and instant drinks, prefer to export their coffee production while importing for domestic consumption — their own beans are more expensive than Brazil’s. Coffee’s cool factor at home is a good indication that the imports will continue, especially after extreme weather and insufficient yields over the past years have weighed on global production.”, Fortune, March 2, 2024

“Marigold Releases Its 2024 Global Consumer Trends Index – The 2024 Global Consumer Trends Index is an annual research study designed to provide brands with consumer data and insights critical to developing effective relationship marketing strategies. For the 2024 iteration, Marigold, in conjunction with Econsultancy, surveyed a total of 10,394 consumers from the following regions: Australia and New Zealand, the Benelux Region, Denmark, France, Germany, Japan, Spain, Sweden, the United Kingdom, and the United States. The survey was conducted from September to November 2023.”, Franchising.com, February 29, 2024

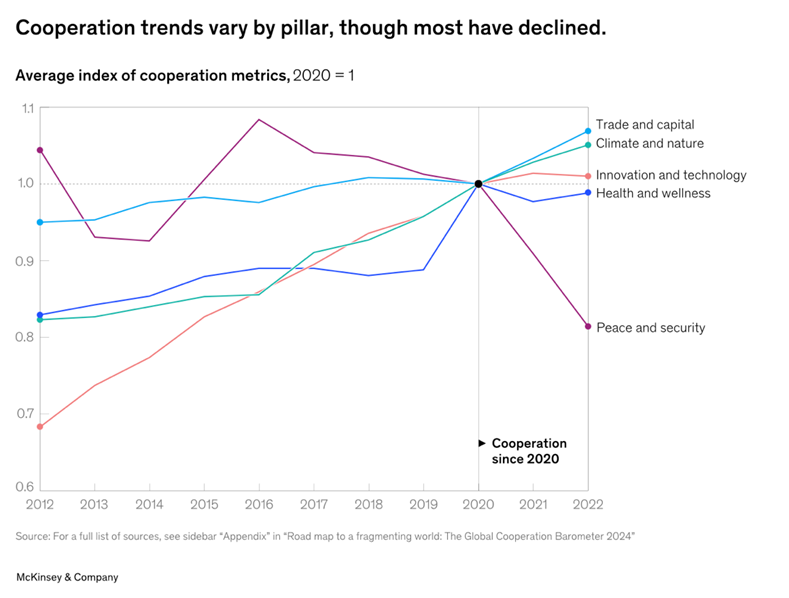

“Strengthening fraying ties: The Global Cooperation Barometer 2024 – Global cooperation is key to better human lives. Our new barometer, developed with the World Economic Forum, can help leaders track trends, monitor critical outcomes, and act to increase cooperation. The barometer takes the pulse of five pillars of global cooperation—trade and capital flows, innovation and technology, climate and natural capital, health and wellness, and peace and security. The world is at an inflection point. The barometer indicates that global cooperation has stalled, after trending positively for much of the past decade.”, McKinsey & Co., February 27, 2024

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Country & Regional Updates

Argentina